Vericel Corporation (NASDAQ:VCEL), a leader in advanced therapies

for the sports medicine and severe burn care markets, today

reported financial results and business highlights for the second

quarter ended June 30, 2024.

Second Quarter 2024 Financial Highlights

- Total net revenue of $52.7 million

- MACI® net revenue growth of 21% to $44.1 million

- Burn Care net revenue of $8.5 million, consisting of $7.8

million of Epicel® revenue and $0.8 million of NexoBrid®

revenue

- Gross margin of 70%, an increase of 430 basis points versus the

prior year

- Net loss of $4.7 million, or $0.10 per diluted share

- Non-GAAP adjusted EBITDA increased 42% to $6.3 million,

representing adjusted EBITDA margin of 12%, an increase of

approximately 230 basis points versus the prior year

- Operating cash flow of approximately $18.5 million

- As of June 30, 2024, the Company had approximately $154 million

in cash, restricted cash and investments, and no debt

First Half 2024 Financial Highlights

- Total net revenue increased 20% to $103.9 million

- MACI net revenue growth of 20% to $84.3 million

- Burn Care net revenue growth of 20% to $19.6 million

- Gross margin of 69%, an increase of approximately 430 basis

points versus the prior year

- Net loss of $8.5 million, or $0.18 per diluted share

- Non-GAAP adjusted EBITDA increased 120% to $13.5 million,

representing adjusted EBITDA margin of 13%, an increase of

approximately 600 basis points versus the prior year

- Operating cash flow of approximately $26 million

Business Highlights and Updates

- Record second quarter total revenue and MACI revenue

- Second highest number of MACI biopsies and surgeons taking

biopsies in a quarter since launch, including the highest number of

biopsies in any month since launch

- Commercial plans progressing for MACI Arthro™ in advance of

anticipated launch later this quarter

- NexoBrid launch progressing with approximately 70 Pharmacy and

Therapeutics (P&T) committee submissions, more than 40 burn

centers obtaining approval and approximately 40 centers placing

initial orders

- FDA approval of pediatric indication for NexoBrid expected in

the third quarter of 2024

“The Company had another strong quarter as we generated record

second quarter revenue, highlighted by continued high growth for

MACI and solid progression in NexoBrid demand, and delivered

another quarter of significant margin expansion as our growth in

profitability continues to outpace our high revenue growth,” said

Nick Colangelo, President and CEO of Vericel. “In light of the

strong performance of our core portfolio in the first half of the

year, with both MACI and the Burn Care franchise delivering 20%

growth, and with the expected contributions from new product

launches, we believe that the Company is very well-positioned for

continued high revenue and profit growth in 2024 and beyond.”

2024 Financial Guidance

- Reaffirmed total net revenue

guidance of $238 to $242 million, or 20% to 23% growth

- Profitability guidance raised to 71%

gross margin and 21% adjusted EBITDA margin, compared to the

previous guidance of 70% and 20%, respectively

Second Quarter 2024 ResultsTotal net revenue

for the quarter ended June 30, 2024 increased 15% to $52.7 million,

compared to $45.9 million in the second quarter of 2023. Total net

product revenue for the quarter included $44.1 million of MACI

(autologous cultured chondrocytes on porcine collagen membrane) net

revenue, $7.8 million of Epicel (cultured epidermal autografts) net

revenue, and $0.8 million of NexoBrid (anacaulase-bcdb) net

revenue, compared to $36.3 million of MACI net revenue and $9.6

million of Epicel net revenue, respectively, in the second quarter

of 2023.

Gross profit for the quarter ended June 30, 2024 was $36.6

million, or 70% of net revenue, compared to $29.9 million, or 65%

of net revenue, for the second quarter of 2023.

Total operating expenses for the quarter ended June 30, 2024

were $42.6 million, compared to $35.9 million for the same period

in 2023. The increase in operating expenses was primarily due to

development and pre-launch activities for MACI Arthro, increased

headcount and related employee expenses, and lease expense

associated with the Company’s new facility that is under

construction.

Net loss for the quarter ended June 30, 2024 was $4.7 million,

or $0.10 per diluted share, compared to $5.0 million, or $0.11 per

diluted share, for the second quarter of 2023.

Non-GAAP adjusted EBITDA for the quarter ended June 30, 2024 was

$6.3 million, or 12% of net revenue, compared to $4.4 million, or

10% of net revenue, for the second quarter of 2023. A table

reconciling non-GAAP measures is included in this press release for

reference.

As of June 30, 2024, the Company had approximately $154 million

in cash, restricted cash and investments, and no debt.

Conference Call Information Today’s conference

call will be available live at 8:30 a.m. Eastern Time and can be

accessed through the Investor Relations section of the Vericel

website at http://investors.vcel.com/events-presentations. A slide

presentation with highlights from today’s conference call will be

available on the webcast and in the Investor Relations section of

the Vericel website. Please access the site at least 15 minutes

prior to the scheduled start time in order to download the required

audio software, if necessary. To participate by telephone, please

register here to receive dial-in details and your personal

passcode. A replay of the webcast will be available on the Vericel

website until August 1, 2025.

About Vericel CorporationVericel is a leading

provider of advanced therapies for the sports medicine and severe

burn care markets. The Company combines innovations in biology

with medical technologies, resulting in a highly differentiated

portfolio of innovative cell therapies and specialty biologics that

repair injuries and restore lives. Vericel markets three products

in the United States. MACI (autologous cultured chondrocytes on

porcine collagen membrane) is an autologous cellularized scaffold

product indicated for the repair of symptomatic, single or multiple

full-thickness cartilage defects of the knee with or without bone

involvement in adults. Epicel (cultured epidermal autografts) is a

permanent skin replacement for the treatment of patients with deep

dermal or full thickness burns greater than or equal to 30% of

total body surface area. Vericel also holds an exclusive license

for North American rights to NexoBrid (anacaulase-bcdb), a

biological orphan product containing proteolytic enzymes, which is

indicated for the removal of eschar in adults with deep

partial-thickness and/or full-thickness burns. For more

information, please visit www.vcel.com.

GAAP v. Non-GAAP MeasuresVericel’s reported

earnings are prepared in accordance with generally accepted

accounting principles in the United States, or GAAP, and represent

earnings as reported to the Securities and Exchange Commission.

Vericel has provided in this release certain financial information

that has not been prepared in accordance with GAAP. Vericel’s

management believes that the non-GAAP adjusted EBITDA described in

this release, which includes adjustments for specific items that

are generally not indicative of our core operations, provides

additional information that is useful to investors in understanding

Vericel’s underlying performance, business and performance trends,

and helps facilitate period-to-period comparisons and comparisons

of its financial measures with other companies in Vericel’s

industry. However, the non-GAAP financial measures that Vericel

uses may differ from measures that other companies may use.

Non-GAAP financial measures are not required to be uniformly

applied, are not audited and should not be considered in isolation

or as substitutes for results prepared in accordance with GAAP.

Epicel® and MACI® are registered trademarks of Vericel

Corporation. NexoBrid® is a registered trademark of MediWound

Ltd. and is used under license to Vericel Corporation. © 2024

Vericel Corporation. All rights reserved.

Forward-Looking StatementsVericel cautions you

that all statements other than statements of historical fact

included in this press release that address activities, events or

developments that we expect, believe or anticipate will or may

occur in the future are forward-looking statements. Although we

believe that we have a reasonable basis for the forward-looking

statements contained herein, they are based on current expectations

about future events affecting us and are subject to risks,

assumptions, uncertainties and factors relating to our operations

and business environment, all of which are difficult to predict and

many of which are beyond our control. Our actual results may differ

materially from those expressed or implied by the forward-looking

statements in this press release. These statements are often, but

are not always, made through the use of words or phrases such as

“anticipates,” “intends,” “estimates,” “plans,” “expects,”

“continues,” “believe,” “guidance,” “outlook,” “target,” “future,”

“potential,” “goals” and similar words or phrases, or future or

conditional verbs such as “will,” “would,” “should,” “could,”

“may,” or similar expressions.

Among the factors that could cause actual results to differ

materially from those set forth in the forward-looking statements

include, but are not limited to, uncertainties associated with our

expectations regarding future revenue, growth in revenue, market

penetration for MACI, Epicel, and NexoBrid, growth in profit, gross

margins and operating margins, the ability to continue to scale our

manufacturing operations to meet the demand for our cell therapy

products, including the timely completion of a new headquarters and

manufacturing facility in Burlington, Massachusetts, the ability to

achieve or sustain profitability, contributions to adjusted EBITDA,

the expected target surgeon audience, potential fluctuations in

sales and volumes and our results of operations over the course of

the year, timing and conduct of clinical trial and product

development activities, timing and likelihood of the FDA’s

potential approval of the arthroscopic delivery of MACI to the knee

or the use of MACI to treat cartilage defects in the ankle, the

estimate of the commercial growth potential of our products and

product candidates, competitive developments, changes in

third-party coverage and reimbursement, physician and burn center

adoption of NexoBrid, supply chain disruptions or other events or

factors affecting MediWound’s ability to manufacture and supply

sufficient quantities of NexoBrid to meet customer demand,

including but not limited to the ongoing Israel-Hamas war or other

military conflicts in the Middle East, negative impacts on the

global economy and capital markets resulting from the conflict in

Ukraine and the Israel-Hamas war, adverse developments affecting

financial institutions, companies in the financial services

industry or the financial services industry generally, global

geopolitical tensions or record inflation and potential future

impacts on our business or the economy generally stemming from a

resurgence of COVID-19 or another similar public health

emergency.

These and other significant factors are discussed in greater

detail in Vericel’s Annual Report on Form 10-K for the year ended

December 31, 2023, filed with the Securities and Exchange

Commission (SEC) on February 29, 2024, Vericel’s Quarterly Report

on Form 10-Q for the quarter ended June 30, 2024, filed with the

SEC on August 1, 2024, and in other filings with the SEC. These

forward-looking statements reflect our views as of the date hereof

and Vericel does not assume and specifically disclaims any

obligation to update any of these forward-looking statements to

reflect a change in its views or events or circumstances that occur

after the date of this release except as required by law.

Investor Contact:Eric Burnsir@vcel.com+1 (734)

418-4411

Media Contact:Julie Downsmedia@vcel.com

|

VERICEL CORPORATIONCONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(in thousands, except per

share amounts - unaudited) |

| |

| |

Three Months Ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Product sales, net |

$ |

52,662 |

|

|

$ |

45,922 |

|

|

$ |

103,943 |

|

|

$ |

86,939 |

|

|

Total revenue |

|

52,662 |

|

|

|

45,922 |

|

|

|

103,943 |

|

|

|

86,939 |

|

|

Cost of product sales |

|

16,061 |

|

|

|

15,981 |

|

|

|

31,988 |

|

|

|

30,478 |

|

|

Gross profit |

|

36,601 |

|

|

|

29,941 |

|

|

|

71,955 |

|

|

|

56,461 |

|

|

Research and development |

|

7,363 |

|

|

|

5,253 |

|

|

|

13,781 |

|

|

|

10,465 |

|

|

Selling, general and administrative |

|

35,269 |

|

|

|

30,649 |

|

|

|

69,669 |

|

|

|

60,134 |

|

|

Total operating expenses |

|

42,632 |

|

|

|

35,902 |

|

|

|

83,450 |

|

|

|

70,599 |

|

| Loss from operations |

|

(6,031 |

) |

|

|

(5,961 |

) |

|

|

(11,495 |

) |

|

|

(14,138 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest income |

|

1,510 |

|

|

|

1,095 |

|

|

|

3,272 |

|

|

|

1,934 |

|

|

Interest expense |

|

(153 |

) |

|

|

(149 |

) |

|

|

(306 |

) |

|

|

(294 |

) |

|

Other expense |

|

(8 |

) |

|

|

(5 |

) |

|

|

(15 |

) |

|

|

(17 |

) |

|

Total other income |

|

1,349 |

|

|

|

941 |

|

|

|

2,951 |

|

|

|

1,623 |

|

| Net loss |

$ |

(4,682 |

) |

|

$ |

(5,020 |

) |

|

$ |

(8,544 |

) |

|

$ |

(12,515 |

) |

| Net loss per common

share: |

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.10 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.26 |

) |

| Weighted-average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

48,686 |

|

|

|

47,572 |

|

|

|

48,413 |

|

|

|

47,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VERICEL CORPORATIONRECONCILIATION OF

REPORTED NET LOSS (GAAP) TO ADJUSTED EBITDA

(NON-GAAP MEASURE)(in thousands -

unaudited) |

| |

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss |

|

$ |

(4,682 |

) |

|

$ |

(5,020 |

) |

|

$ |

(8,544 |

) |

|

$ |

(12,515 |

) |

|

Stock-based compensation expense |

|

|

9,520 |

|

|

|

8,761 |

|

|

|

19,354 |

|

|

|

17,492 |

|

|

Depreciation and amortization |

|

|

1,323 |

|

|

|

1,171 |

|

|

|

2,701 |

|

|

|

2,329 |

|

|

Net interest income |

|

|

(1,357 |

) |

|

|

(946 |

) |

|

|

(2,966 |

) |

|

|

(1,640 |

) |

|

Pre-occupancy lease expense |

|

|

1,509 |

|

|

|

475 |

|

|

|

2,986 |

|

|

|

475 |

|

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

6,313 |

|

|

$ |

4,441 |

|

|

$ |

13,531 |

|

|

$ |

6,141 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VERICEL CORPORATIONCONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands - unaudited) |

| |

June 30, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

50,291 |

|

|

$ |

69,088 |

|

|

Restricted cash |

|

25,563 |

|

|

|

17,778 |

|

|

Short-term investments |

|

52,217 |

|

|

|

40,469 |

|

|

Accounts receivable (net of allowance for doubtful accounts of $10

and $43, respectively) |

|

47,996 |

|

|

|

58,356 |

|

|

Inventory |

|

14,887 |

|

|

|

13,087 |

|

|

Other current assets |

|

6,432 |

|

|

|

6,853 |

|

|

Total current assets |

|

197,386 |

|

|

|

205,631 |

|

|

Property and equipment, net |

|

73,086 |

|

|

|

41,635 |

|

|

Intangible assets, net |

|

6,563 |

|

|

|

6,875 |

|

|

Right-of-use assets |

|

73,020 |

|

|

|

73,462 |

|

|

Long-term investments |

|

26,120 |

|

|

|

25,283 |

|

|

Other long-term assets |

|

664 |

|

|

|

771 |

|

|

Total assets |

$ |

376,839 |

|

|

$ |

353,657 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

25,216 |

|

|

$ |

22,347 |

|

|

Accrued expenses |

|

12,856 |

|

|

|

17,215 |

|

|

Current portion of operating lease liabilities |

|

5,791 |

|

|

|

6,187 |

|

|

Total current liabilities |

|

43,863 |

|

|

|

45,749 |

|

|

Operating lease liabilities |

|

89,801 |

|

|

|

81,856 |

|

|

Other long-term liabilities |

|

198 |

|

|

|

100 |

|

|

Total liabilities |

$ |

133,862 |

|

|

$ |

127,705 |

|

|

Total shareholders’ equity |

|

242,977 |

|

|

|

225,952 |

|

|

Total liabilities and shareholders’ equity |

$ |

376,839 |

|

|

$ |

353,657 |

|

|

|

|

|

|

|

|

|

|

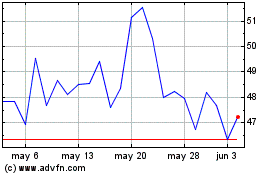

Vericel (NASDAQ:VCEL)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Vericel (NASDAQ:VCEL)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025