0001327811FALSE00013278112023-11-302023-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 30, 2023

WORKDAY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35680 | 20-2480422 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

6110 Stoneridge Mall Road

Pleasanton, California 94588

(Address of principal executive offices)

Registrant’s telephone number, including area code: (925) 951-9000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 | WDAY | The Nasdaq Stock Market LLC |

| | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 - Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On November 30, 2023, the Board of Directors (the “Board”) of Workday, Inc. (“Workday”) adopted the Workday, Inc. Executive Severance and Change in Control Policy (the “Policy”), which amends and restates the Workday, Inc. Change in Control Policy that was adopted by the Board on April 22, 2021 (the “Prior Policy”). The purpose of the amendments to the Policy is to provide certain of the Company’s senior management employees with compensation and benefits in the event of a termination of employment by Workday without Cause outside of a Change in Control Period (as such terms are defined in the Policy). The compensation and benefits provided under the Policy to a participant in the event of a termination of employment without Cause or resignation for Good Reason within a Change in Control Period are described below and are substantially the same as provided in the Prior Policy.

Under the Policy, in the event of a termination of a participant’s employment without Cause outside of a Change in Control Period (referred to as a “Non-CIC Qualifying Termination” in the Policy), an eligible participant will be entitled to receive:

(i)a lump sum cash payment in an amount equal to one (1) times the participant’s annual base salary;

(ii)a lump sum cash payment in an amount equal to (a) one (1) times the participant’s Target Bonus (as defined in the Policy) for the prior fiscal year, minus any portion of the annual bonus paid to the participant for the prior fiscal year, if the Non-CIC Qualifying Termination occurs in the first fiscal quarter of any fiscal year, or (b) one (1) times the participant’s Target Bonus for the fiscal year in which the Non-CIC Qualifying Termination occurs, pro rata based on the date of the Non-CIC Qualifying Termination, minus any portion of the annual bonus paid to the participant for the fiscal year in which the Non-CIC Qualifying Termination occurs, if the Non-CIC Qualifying Termination occurs after the first quarter of any fiscal year;

(iii)acceleration of time-based vesting provisions of outstanding equity awards (other than performance-based awards, which will accelerate, if at all, as provided under the applicable award agreement) that would have vested within twelve (12) months following the Non-CIC Qualifying Termination, other than any equity awards granted within the twelve (12) months immediately prior to the Non-CIC Qualifying Termination; and

(iv)a lump sum cash payment of the estimated aggregate premiums for continuation coverage for twelve (12) months under COBRA.

In addition, if the participant was serving as Chief Executive Officer of Workday immediately prior to the Non-CIC Qualifying Termination, the participant is eligible to receive an additional lump sum cash payment in an amount equal to one (1) times the participant’s Target Bonus for the fiscal year in which the Non-CIC Qualifying Termination occurs.

Under the Policy, in the event of a termination of a participant’s employment without Cause or participant’s resignation for Good Reason, in each case within a Change in Control Period (referred to as a “CIC Qualifying Termination” in the Policy), an eligible participant will be entitled to receive:

(i)a lump sum cash payment in an amount equal to one (1) times the participant’s annual base salary as in effect immediately prior to the CIC Qualifying Termination (or at the rate in effect immediately prior to a reduction in the base salary that gave rise to Good Reason) or the Change in Control, whichever is greater;

(ii)a lump sum cash payment in an amount equal to one (1) times the participant’s Target Bonus for the fiscal year in which the CIC Qualifying Termination occurs;

(iii)100% acceleration of time-based vesting provisions of outstanding equity awards (other than performance-based awards, which will accelerate, if at all, as provided under the applicable award agreement); and

(iv)a lump sum cash payment of the estimated aggregate premiums for continuation coverage for twelve (12) months under COBRA for twelve (12) months.

In addition, if the participant was serving as Chief Executive Officer of Workday immediately prior to the CIC Qualifying Termination, the amounts set forth in subsections (i) and (ii) above shall be two (2) times (instead of one (1) times) and the continuation coverage set forth in subsection (iv) shall be for twenty-four (24) months.

In each case, receipt of any compensation or benefits under the Policy is subject to the participant’s execution of a separation and release agreement. A participant is eligible to receive the greater of (i) the payments and benefits set forth under the Policy, or (ii) the aggregate payments and benefits provided for under an arrangement entered into by the participant and Workday prior to the effective date of the Policy.

The above description of the Policy does not purport to be complete and is qualified in its entirety by reference to the full text of the Policy which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 9.01 – Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 1, 2023 | | | | | |

| | Workday, Inc. |

| | /s/ Richard H. Sauer |

| | Richard H. Sauer |

| Chief Legal Officer, Head of Corporate Affairs, and Corporate Secretary |

Exhibit 10.1

Workday, Inc.

Executive Severance and Change in Control Policy

| | | | | |

PURPOSE; EFFECTIVE DATE | This Executive Severance and Change in Control Policy (this “Policy”) was adopted by the Board of Directors (the “Board”) of Workday, Inc., a Delaware corporation (the “Workday”) on November 30, 2023 (the “Effective Date”). This Policy sets forth the separation benefits for eligible executives upon certain terminations of their employment with Workday under the conditions set forth herein. |

ELIGIBILITY | Executive officers for purposes of Section 16 of the Exchange Act of 1934, as amended (“Section 16 Officers”), other Executive Vice Presidents, and other employees as designated by the Board or the Compensation Committee of the Board (the “Committee”) are eligible to participate in this Policy (each, a “Participant”). A Participant shall cease to be a Participant under this Policy upon the earlier of (i) the date Participant’s employment with Workday terminates for a reason other than a Non-CIC Qualifying Termination or a CIC Qualifying Termination (as each is defined below), (ii) unless otherwise determined by the Board or the Committee in its sole discretion, the date on which Participant is no longer either a Section 16 Officer or an Executive Vice President, or (iii) confirmation by the Board or the Committee, upon the recommendation of the Chief Executive Officer or Co-Chief Executive Officer (referred to herein as “CEO”) or the Chief People Officer; provided, that, in the event of a Change in Control (as defined below), Participant’s participation in this Policy may not be terminated pursuant to (ii) or (iii) above. For the avoidance of doubt, in no event shall a Participant receive payment under both the section entitled Benefits upon a Non-CIC Qualifying Termination and the section entitled Benefits upon a CIC Qualifying Termination. |

| | | | | |

BENEFITS UPON A NON-CIC QUALIFYING TERMINATION | Under this Policy, in the event of a Non-CIC Qualifying Termination, and contingent upon the Participant’s execution and non-revocation of a binding separation and release agreement in a form acceptable to Workday (a “Release”) within sixty (60) days following the Non-CIC Qualifying Termination, the Participant will be entitled to receive: (i)If the Participant was serving as CEO immediately prior to the Non-CIC Qualifying Termination: a.A lump sum cash payment in an amount equal to one times such Participant’s annual base salary as in effect immediately prior to the Non-CIC Qualifying Termination, plus one times such Participant’s Target Bonus for the fiscal year in which the Non-CIC Qualifying Termination occurs, less applicable withholding taxes; b.A lump sum cash payment in an amount equal to the following: i.If the Non-CIC Qualifying Termination occurs in the first fiscal quarter of any fiscal year, one times the Participant’s Target Bonus for the prior fiscal year, minus any portion of the annual bonus paid to the Participant for the prior fiscal year, less applicable withholding taxes; or ii.If the Non-CIC Qualifying Termination occurs in the second, third, or fourth quarter of any fiscal year, one times such Participant’s Target Bonus for the fiscal year in which the Non-CIC Qualifying Termination occurs, pro rata based on the date of the Non-CIC Qualifying Termination, minus any portion of the annual bonus paid to the Participant for the fiscal year in which the Non-CIC Qualifying Termination occurs, less applicable withholding taxes; c.Accelerated vesting of the portion of Participant’s unvested equity awards that would otherwise vest in the twelve (12) months following the Non-CIC Qualifying Termination (excluding Performance Awards (as defined below)); provided that any equity awards granted within the twelve (12) months immediately prior to the date of the Non-CIC Qualifying Termination shall not be eligible for accelerated vesting. With respect to awards that would otherwise vest only upon satisfaction of performance criteria (“Performance Awards”), vesting will accelerate, if at all, as set forth in the terms of the applicable performance-based award agreement; and d.A lump sum cash payment in an amount equal to an estimate of the aggregate premiums for continuation coverage for twelve (12) months pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), less applicable withholding taxes. (ii)If the Participant was serving in a role other than CEO immediately prior to the Non-CIC Qualifying Termination: a.A lump sum cash payment in an amount equal to one times such Participant’s annual base salary as in effect immediately prior to the Non-CIC Qualifying Termination, less applicable withholding taxes; |

| | | | | |

| b.A lump sum cash payment in an amount equal to the following: i.If the Non-CIC Qualifying Termination occurs in the first fiscal quarter of any fiscal year, one times the Participant’s Target Bonus for the prior fiscal year, minus any portion of the annual bonus paid to the Participant for the prior fiscal year, less applicable withholding taxes; or ii.If the Non-CIC Qualifying Termination occurs in the second, third, or fourth quarter of any fiscal year, one times such Participant’s Target Bonus for the fiscal year in which the Non-CIC Qualifying Termination occurs, pro rata based on the date of the Non-CIC Qualifying Termination, minus any portion of the annual bonus paid to the Participant for the fiscal year in which the Non-CIC Qualifying Termination occurs, less applicable withholding taxes; c.Accelerated vesting of the portion of Participant’s unvested equity awards that would otherwise vest in the twelve (12) months following the Non-CIC Qualifying Termination (excluding Performance Awards (as defined below)); provided that any equity awards granted within the twelve (12) months immediately prior to the date of the Non-CIC Qualifying Termination shall not be eligible for accelerated vesting. Performance Awards will accelerate, if at all, only as set forth in the terms of the applicable performance-based award agreement; and d.A lump sum cash payment in an amount equal to an estimate of the aggregate premiums for continuation coverage for twelve (12) months pursuant to COBRA, less applicable withholding taxes. The foregoing benefits payable in cash will be provided on Workday’s first customary payroll date that is ten (10) or more business days following the sixty-first (61st) day following the Non-CIC Qualifying Termination, and in any event no later than March 15 of the year following the year in which the Non-CIC Qualifying Termination occurs. |

| | | | | |

BENEFITS UPON A CIC QUALIFYING TERMINATION | Under this Policy, in the event of a CIC Qualifying Termination, and contingent upon the Participant’s execution and non-revocation of a Release within sixty (60) days following the CIC Qualifying Termination, the Participant will be entitled to receive: (i)If the Participant was serving as CEO immediately prior to the Change in Control: a.A lump sum cash payment in an amount equal to two times such Participant’s annual base salary as in effect immediately prior to the CIC Qualifying Termination (or at the rate in effect immediately prior to a reduction in the base salary that gave rise to Good Reason) or the Change in Control, whichever is greater, less applicable withholding taxes; b.A lump sum cash payment in an amount equal to two times such Participant’s Target Bonus for the fiscal year in which the CIC Qualifying Termination occurs, less applicable withholding taxes; c.Accelerated vesting of 100% of the amount of Participant’s unvested equity awards (excluding Performance Awards) immediately prior to the CIC Qualifying Termination. With respect to Performance Awards, vesting will accelerate, if at all, as set forth in the terms of the applicable performance-based award agreement; and d.A lump sum cash payment in an amount equal to an estimate of the aggregate premiums for continuation coverage for twenty-four (24) months pursuant to COBRA, less applicable withholding taxes. (ii)If the Participant was serving in a role other than CEO immediately prior to the Change in Control: a.A lump sum cash payment in an amount equal to such Participant’s annual base salary as in effect immediately prior to the CIC Qualifying Termination (or at the rate in effect immediately prior to a reduction in the base salary that gave rise to Good Reason) or the Change in Control, whichever is greater, less applicable withholding taxes; b.A lump sum cash payment in an amount equal to such Participant’s Target Bonus for the fiscal year in which the CIC Qualifying Termination occurs, less applicable withholding taxes; c.Accelerated vesting of 100% of the amount of Participant’s unvested equity awards (excluding Performance Awards) immediately prior to the CIC Qualifying Termination. With respect to Performance Awards, vesting will accelerate, if at all, as set forth in the terms of the applicable performance-based award agreement; and d.A lump sum cash payment in an amount equal to an estimate of the aggregate premiums for continuation coverage for twelve (12) months pursuant to COBRA, less applicable withholding taxes. The foregoing benefits payable in cash will be provided on Workday’s first customary payroll date that is ten (10) or more business days following the sixty-first (61st) day following the CIC Qualifying Termination, and in any event no later than March 15 of the year following the year in which the CIC Qualifying Termination occurs. |

| | | | | |

DEFINITIONS | A “Change in Control” shall be deemed to have occurred if any one of the following events shall have occurred: (i)any “person” (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934 (the “Exchange Act”)) other than Workday’s founders or a trust, foundation or other estate planning vehicle established by one of Workday’s founders, becomes the “beneficial owner” (as defined in Rule 13d-3 of the Exchange Act), directly or indirectly, of securities representing fifty percent (50%) or more of the total voting power represented by Workday’s then-outstanding voting securities; (ii)the consummation of the sale or disposition of all or substantially all of Workday’s assets; or (iii)the consummation of a merger or consolidation of Workday with any other corporation, other than a merger or consolidation which would result in Workday’s voting securities outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or its parent) at least fifty percent (50%) of the total voting power represented by our voting securities or such surviving entity or its parent outstanding immediately after such merger or consolidation. “Change in Control Period” means the period commencing upon a Change in Control and ending twelve (12) months following a Change in Control. “CIC Qualifying Termination” shall be (i) an involuntary termination of Participant’s employment other than for “Cause,” death, or disability or (ii) Participant’s voluntary resignation for “Good Reason”, in each case occurring within a Change in Control Period. “Cause” shall mean: (i)Gross negligence or misconduct in the performance of Participant’s duties; (ii)Participant’s conviction or a plea of “guilty” or “no contest” for (x) a felony or (y) any violent crime or crime involving theft, dishonesty, moral turpitude, or money laundering; (iii)Participant’s negligent or intentional act or omission which is, or is reasonably likely to be, materially injurious to the financial condition or reputation of Workday or its affiliates; (iv)Participant’s breach of Workday’s standard Proprietary Information and Inventions Agreement; or (v)Participants breach of Workday’s written policies and procedures, including without limitation a code of conduct, or any contract or agreement between Participant and Workday, in either case which is, or is reasonably likely to be, materially injurious to the financial condition or reputation of Workday or its affiliates. “Good Reason” shall mean: (i)any material reduction in Participant’s Base Salary or target bonus opportunity (excluding a reduction affecting substantially all similarly situated Participants or any change in the value of equity incentives); (ii)the relocation of the Participant’s primary work location such that Participant’s one-way commute is increased by more than fifty (50) miles; (iii)a material diminution to Participant’s duties and responsibilities as in effect immediately prior to a Change in Control; or |

| | | | | |

| (iv)a successor of Workday as set forth in the section “Successors” hereof does not assume this Policy; provided, that, any of the events described in clauses (i)-(iv) of this section shall constitute Good Reason only if Workday fails to cure such event within 30 days after receipt from Participant of written notice of the event which constitutes Good Reason and Participant resigns his or her employment within 30 days following expiration of such cure period; provided, further, that Good Reason shall cease to exist for an event on the 90th day following its initial occurrence, unless Participant has given Workday written notice thereof prior to such date. The notice provided by Participant to Workday must set forth in reasonable detail the specific conduct of Workday that constitutes Good Reason and the specific provision(s) of this definition on which the Participant is relying. The “Code” shall mean the Internal Revenue Code of 1986, as amended. “Non-CIC Qualifying Termination” shall be an involuntary termination of Participant’s employment other than for “Cause,” death, or disability occurring outside of a Change in Control Period. “Target Bonus” shall mean the Participant’s annual target bonus at the rate then in effect (a) immediately prior to the Non-CIC Qualifying Termination, in the event of Participant’s Non-CIC Qualifying Termination or (b) immediately prior to the CIC Qualifying Termination (ignoring any decrease in Target Bonus that forms the basis for Good Reason) or the Change in Control, whichever is greater, in the event of Participant’s CIC Qualifying Termination, as applicable. For purposes of this Policy, “Target Bonus” shall not include any other Company cash incentive payments for which Participant may be eligible (e.g., commission payments, sign-on bonus, etc.). |

POLICY EFFECTIVENESS; TERMINATION | This Policy is effective as of the Effective Date and replaces and supersedes in its entirety the Change in Control Policies which were effective as of September 3, 2020, and April 22, 2021, respectively, and any prior versions of this Policy. This Policy will be reviewed regularly by the Committee and may be amended or terminated by the Committee or Board. Notwithstanding anything herein to the contrary, in no event shall any amendment or termination adversely affect the rights of any Participant (i) during the Change in Control Period or (ii) who is then receiving or entitled to receive payments or benefits under this Policy, without the prior written consent of such Participant. |

SUCCESSORS | Workday shall require any successor (whether pursuant to a Change in Control, direct or indirect, and whether by purchase, merger, consolidation, liquidation or otherwise) to all or substantially all of the business and/or assets of Workday to expressly assume and agree to perform the obligations under this Policy in the same manner and to the same extent as Workday would be required to perform in the absence of such a succession of Workday. For all purposes of this Policy, the term “Workday” shall include any successor to Workday’s business and/or assets or which becomes bound by this Policy by operation of law. |

OTHER SEVERANCE ARRANGEMENTS | A Participant shall be entitled to receive the greatest of (a) the total payments, equity acceleration and benefits provided for under this Policy, subject to the applicable terms and conditions of this Policy or (b) the total payments, equity acceleration and benefits provided in the event of a change of control and/or qualifying termination of employment provided under arrangements entered into by and between Participant and Workday prior to the Effective Date of this Policy, subject to the applicable terms and conditions of such arrangements. For the purposes of this section, the value of (a) and (b) shall be calculated and determined by Workday at its discretion. |

| | | | | |

280G BEST-OF PROVISION | If the benefits described in this Policy constitute “parachute payments” within the meaning of the Code and would be subject to the excise tax imposed by Section 4999 of the Code, then at the Participant’s discretion, the benefits will be payable either (i) in full, or (ii) as to such lesser amount which would result in no portion of such benefits being subject to the excise tax under Section 4999 of the Code, whichever of the foregoing amounts (taking into consideration applicable taxes, including the excise tax under Section 4999) would result in the receipt by Participant on an after-tax basis of the greatest amount of benefits (even if some of such benefits are taxable under Section 4999). |

SECTION 409A | For purposes of this Policy, no payment will be made to any Participant upon termination of the Participant’s employment unless such termination constitutes a “separation from service” within the meaning of Section 409A of the Code. It is intended that the right of any Participant to receive installment payments pursuant to this Policy shall be treated as a right to receive a series of separate and distinct payments for purposes of Section 409A of the Code. It is further intended that all payments and benefits hereunder satisfy, to the greatest extent possible, the exemption from the application of Section 409A of the Code (and any state law of similar effect) provided under Treasury Regulation Section 1.409A-1(b)(4) (as a “short-term deferral”) and are otherwise exempt from or comply with Section 409A of the Code. Accordingly, to the maximum extent permitted, this Policy shall be interpreted in accordance with that intent. To the extent necessary to comply with Section 409A of the Code, if the designated payment period for any payment under this Policy begins in one taxable year and ends in the next taxable year, the payment will commence or otherwise be made in the later taxable year. For purposes of Section 409A of the Code, if Workday determines that a Participant is a “specified employee” under Section 409A(a)(2)(B)(i) of the Code at the time of his or her separation from service, then to the extent delayed commencement of any portion of the payments or benefits to which the Participant is entitled pursuant to this Policy is required in order to avoid a prohibited distribution under Section 409A(a)(2)(B)(i) of the Code, such portion shall not be provided to the Participant until the earlier (i) the expiration of the six-month period measured from the Participant’s separation from service or (ii) the date of the Participant’s death. As soon as administratively practicable following the expiration of the applicable Section 409A(2)(B)(i) period, all payments deferred pursuant to the preceding sentence shall paid in a lump-sum to the Participant and any remaining payments due pursuant to this Policy shall be paid as otherwise provided herein. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

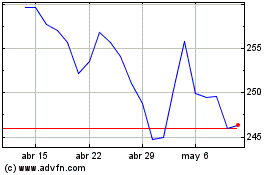

Workday (NASDAQ:WDAY)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Workday (NASDAQ:WDAY)

Gráfica de Acción Histórica

De May 2023 a May 2024