UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or 15d-16

Under the Securities Exchange Act of 1934

For the Month of June, 2024

001-36000

(Commission File Number)

XTL Biopharmaceuticals Ltd.

(Exact name of Registrant as specified in its charter)

26 Ben-Gurion St.

Ramat Gan, Israel, 5112001

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

On June 12, 2024, XTL Biopharmaceuticals Ltd.

(the “Company”) announced that it will hold an Annual and Extraordinary General Meeting of Shareholders (the “Meeting”)

on July 22, 2024, at the offices of the Company’s attorneys, Doron Tikotzky Kantor Gutman & Amit Gross., 7 Metsada St., B.S.R

Tower 4, 33 Floor, Bnei Brak, Israel. In connection with the Meeting, the Company furnishes the following documents:

| 1. | A

copy of the Notice and Proxy Statement with respect to the Company’s Meeting describing the proposals to be voted upon at the Meeting,

the procedure for voting in person or by proxy at the Meeting and various other details related to the Meeting, attached hereto as Exhibit

99.1; |

| 2. | A

form of Proxy Card whereby holders of ordinary shares of the Company may vote at the Meeting without attending in person, attached hereto

as Exhibit 99.2; and |

| 3. | A

form of Voting Instruction Card whereby holders of American Depositary Shares of the Company may vote at the Meeting without attending

in person, attached hereto as Exhibit 99.3. |

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

XTL BIOPHARMACEUTICALS LTD. |

| |

|

| Date: June 12, 2024 |

/s/ Shlomo Shalev |

| |

Shlomo Shalev |

| |

Chief Executive Officer |

3

Exhibit 99.1

NOTICE OF

ANNUAL AND EXTRAORDINARY GENERAL MEETING OF

SHAREHOLDERS

TO BE HELD ON JULY 22, 2024

To the shareholders of XTL Biopharmaceuticals

Ltd.:

Notice is hereby given that an Annual and Extraordinary

General Meeting (the “Annual Meeting”) of the shareholders of XTL Biopharmaceuticals Ltd. (the “Company”)

will be held at the offices of the Company’s attorneys, Doron Tikotzky Kantor Gutman & Amit Gross, at 7 Metsada St., B.S.R Tower

4, Bnei Brak, Israel at 15:00 PM (Israel Time), on July 22, 2024.

The agenda of the Meeting will be as follows:

| |

1. |

To discuss the auditor’s report of our independent registered public accounting firm and audited financial statements for the year ended as of December 31, 2023. |

| |

|

|

| |

2. |

To re-appoint Somekh Chaikin, Certified Public Accountants in Israel and a member firm of KPMG as the Company’s independent auditors for the fiscal year ending December 31, 2024, and to authorize the Board of Directors, upon the recommendation of the Company’s audit committee (the “Audit Committee”), to determine the auditors’ remuneration to be fixed in accordance with the volume and nature of their services to the Company for such fiscal year. |

| |

|

|

| |

3. |

To re-elect Messrs. Alexander Rabinovitch, Shlomo Shalev, and Doron Turgeman to our Board of Directors, each for a term expiring at our next annual general meeting of shareholders (a separate vote for each director will be taken). Declaration of Directors Qualification is attached as Annex A hereto. |

| |

|

|

| |

4. |

To approve the terms and provisions of the acquisition of The Social Proxy Ltd. (“Social Proxy”), as further detailed in the Company’s Form 6-K dated June 5, 2024 (the “Transaction”) which includes (a) the issuance to the shareholders of Social Proxy such number of ADS’s of the Company which represent 44.6% of the issued and outstanding share capital of the Company and (b) the payment of US$430,000 in cash to the shareholders of Social Proxy. |

| |

|

|

| |

5. |

To approve that the Company shall enter into any and all agreement and other documents required in order to effect the Transaction and to authorize, empower and direct the Chief Executive Officer of the Company, in the name and on behalf of the Company, to take or cause to be taken any and all such further actions and to prepare, execute, deliver and file, or cause to be prepared, executed, delivered and filed any documents and such other reports, schedules, statements, consents, documents, agreements, certificates, undertakings in the name of and on behalf of the Company as he shall in his judgment, with the advice of counsel, determine to be necessary, proper or desirable to carry out fully the intent and purposes of the foregoing resolutions in order to consummate the transactions contemplated by the foregoing resolutions (the “Consummation”). |

| |

|

|

| |

6. |

To approve, conditional upon the Consummation of the Transaction, the election of Mr. Tal Klinger and Mr. Yair Redl to our Board of Directors each for a term expiring at our next annual general meeting of shareholders (a separate vote for each director will be taken). Declaration of Directors Qualification is attached as Annex B hereto. |

Only shareholders and holders of ordinary shares

represented by American Depositary Shares at the close of business on June 24, 2024 (the “Record Date”) are entitled

to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof. You are cordially invited to attend the

Annual Meeting in person.

If you are unable to attend the Meeting in person,

you are requested to complete, date and sign the enclosed proxy and to return it promptly in the pre-addressed envelope provided. Shareholders

who attend the Annual Meeting may revoke their proxies and vote their shares in person.

Beneficial owners who hold ordinary shares through

members of the Tel Aviv Stock Exchange, or the TASE, may either vote their shares in person at the Annual Meeting by presenting a certificate

signed by the TASE Clearing House member through which the shares are held, which complies with the Israel Companies Regulations (Proof

of Ownership for Voting in General Meetings)-2000 as proof of ownership of the shares on the record date, or send such certificate along

with a duly executed proxy (in the form filed by us on MAGNA, the distribution site of the Israeli Securities Authority, at www.magna.isa.gov.il),

to us at 26 Ben-Gurion Street, Ramat Gan 5112001, Israel, Attention: Chief Executive Officer.

| |

By Order of the Board of Directors |

| |

|

| |

/s/ Shlomo Shalev |

| |

Shlomo Shalev |

| |

Chief Executive Officer |

| |

Dated: June 12, 2024 |

5 Ben-Gurion St.

Ramat Gan, Israel, 5112001

PROXY STATEMENT

FOR ANNUAL AND EXTRAORDINARY GENERAL MEETING

OF SHAREHOLDERS

TO BE HELD ON JULY 22, 2024

This Proxy Statement is furnished

to our holders of ordinary shares, par value NIS 0.1 per share and holders of our ordinary shares that are represented by American Depository

Shares, or ADSs, in connection with Annual and Extraordinary General Meeting of Shareholders (the “Annual Meeting”),

to be held on July 22, 2024, at 15:00 PM Israel time at the offices of the Company’s attorneys, Doron Tikotzky Kantor Gutman &

Amit Gross, at 7 Metsada St., B.S.R Tower 4, Bnei Brak, Israel.

Throughout this Proxy Statement,

we use terms such as “XTL Biopharmaceuticals,” “XTL,” “we”, “us”, “our” and

the “Company” to refer XTL Biopharmaceuticals Ltd. and terms such as “you” and “your” to refer to

our shareholders and ADS holders.

Agenda Items

The agenda of the Annual Meeting

will be as follows:

1. To discuss the auditor’s

report of our independent registered public accounting firm and audited financial statements for the year ended December 31, 2023.

2. To appoint Somekh Chaikin,

Certified Public Accountants in Israel and a member firm of KPMG as the Company’s independent auditors for the fiscal year ending

December 31, 2024, and to authorize the Boad of Directors, upon the recommendation of the Audit Committee to determine the auditors’

remuneration to be fixed in accordance with the volume and nature of their services to the Company for such fiscal year.

3. To re-elect Mr. Alexander

Rabinovitch to our Board of Directors for a term expiring at our next annual general meeting of shareholders.

4. To re-elect Mr. Shlomo

Shalev to our Board of Directors for a term expiring at our next annual general meeting of shareholders.

5. To re-elect Mr. Doron Turgeman

to our Board of Directors for a term expiring at our next annual general meeting of shareholders.

6. To approve the terms and

provisions of the acquisition of The Social Proxy Ltd. (“Social Proxy”), as more fully detailed in the Company’s

Form 6-K dated June 5, 2024 (the “Transaction”) which includes (a) the issuance to the shareholders of Social Proxy

such number of ADS’s of the Company which represent 44.6% of the issued and outstanding share capital of the Company and (b) the

payment of US$430,000 in cash to the shareholders of Social Proxy.

7. To approve the consummation

of the Transaction by the Company and to authorize, empower and direct the Chief Executive Officer of the Company, in the name and on

behalf of the Company, to take or cause to be taken any and all such further actions he deems necessary for the completion of such consummation.

8. To approve, conditional

upon the consummation of the Transaction, the election of Mr. Tal Klinger to our Board of Directors for a term expiring at our next annual

general meeting of shareholders

9. To approve,

conditional upon the consummation of the Transaction, the election of Mr. Yair Redl to our Board of Directors for a term expiring at

our next annual general meeting of shareholders.

We currently are unaware of

any other matters that may be raised at the Annual Meeting. Should any other matters be properly raised at the Annual Meeting, the persons

designated as proxies shall vote according to their own judgment on those matters.

Board Recommendation

Our Board of Directors

unanimously recommends that you vote “FOR” each of agenda items 2 to 9.

Who Can Vote

Only shareholders and ADS

holders at the close of business on June 24, 2024 shall be entitled to receive notice of and to vote at the Annual Meeting.

How You Can Vote

You can vote your ordinary

shares by attending the Annual Meeting. If you do not plan to attend the Annual Meeting, the method of voting will differ for shares held

as a record holder, shares held in “street name” (through a Tel Aviv Stock Exchange, or TASE, member) and shares underlying

ADSs that you hold. Record holders of shares will receive proxy cards. Holders of shares in “street name” through a TASE member

will also vote via a proxy card, but through a different procedure (as described below). Holders of ADSs (whether registered in their

name or in “street name”) will receive voting instruction cards in order to instruct their banks, brokers or other nominees

on how to vote.

Shareholders of Record

If you are a shareholder of

record, you can submit your vote by completing, signing and submitting a proxy card, which has been published at www.magna.isa.gov.il,

to the Company’s office at 5 Ben-Gurion Street, Ramat Gan 5112001, Israel.

Please follow the instructions

on the proxy card.

Shareholders Holding in

“Street Name” through the TASE

If you hold ordinary shares

in “street name,” that is, through a bank, broker or other nominee that is admitted as a member of the TASE, your shares will

only be voted if you provide instructions to the bank, broker or other nominee as to how to vote, or if you attend the Annual Meeting

in person.

If voting by mail, you must

sign and date a proxy card in the form to be filed by us on MAGNA on June 13, 2024 and attach to it a certificate signed by the TASE Clearing

House member through which the shares are held, which complies with the Israel Companies Regulations (Proof of Ownership for Voting in

General Meetings)-2000 as proof of ownership of the shares on the record date, and return the proxy card, along with the proof of ownership

certificate, to the offices of our attorneys, Doron Tikotzky Kantor Gutman & Amit Gross. (Attention: Ronen Kantor, Adv.) located at

7 Metsada St., B.S.R Tower 4, Bnei Brak, Israel, as described in the instructions available on MAGNA.

If you choose to attend the

Annual Meeting (where ballots will be provided), you must bring the proof of ownership certificate from the TASE’s Clearing House

member through which the shares are held, indicating that you were the beneficial owner of the shares on the record date.

Holders of ADSs

Under the terms of the Deposit

Agreement between the Company, The Bank of New York Mellon, as depositary, or BNY Mellon, and the holders of our ADSs, BNY Mellon shall

endeavor (insofar as is practicable) to vote or cause to be voted the number of shares represented by ADSs in accordance with the instructions

provided by the holders of ADSs to BNY Mellon. For ADSs that are held in “street name”, through a bank, broker or other nominee,

the voting process will be based on the underlying beneficial holder of the ADSs directing the bank, broker or other nominee to arrange

for BNY Mellon to vote the ordinary shares represented by the ADSs in accordance with the beneficial holder’s voting instructions.

If no instructions are received by BNY Mellon from any holder of ADSs (whether held directly by a beneficial holder or in “street

name”) with respect to any of the shares represented by the ADSs on or before the date established by BNY Mellon for such purpose,

BNY Mellon shall not vote or attempt to vote the shares represented by such ADSs.

Multiple Record Shareholders

or Accounts

You may receive more than

one set of voting materials, including multiple copies of this document and multiple proxy cards or voting instruction cards. For example,

shareholders who hold ADSs in more than one brokerage account will receive a separate voting instruction card for each brokerage account

in which ADSs are held. Shareholders of record whose shares are registered in more than one name will receive more than one proxy card.

You should complete, sign, date and return each proxy card and voting instruction card you receive.

Our Board of Directors urges

you to vote your shares so that they will be counted at the Annual Meeting or at any postponements or adjournments of the Annual Meeting.

Solicitation of Proxies

By appointing “proxies”,

shareholders and ADS holders may vote at the Annual Meeting whether or not they attend. If a properly executed proxy in the attached form

is received by us at least 48 hours prior to the Annual Meeting (and received by BNY Mellon no later than the date indicated on the voting

instruction card, in the case of ADS holders), all of the shares represented by the proxy shall be voted as indicated on the form or,

if no preference is noted, shall be voted in favor of the matter described above, and in such manner as the holder of the proxy may determine

with respect to any other business as may come before the Annual Meeting or any adjournment thereof. Shareholders and ADS holders may

revoke their proxies at any time before the deadline for receipt of proxies by filing with us (in the case of holders of ordinary shares)

or with BNY Mellon (in the case of holders of ADSs), a written notice of revocation or duly executed proxy bearing a later date.

Proxies are being distributed

to shareholders and to ADS holders on or about June 13, 2024. Certain officers, directors, employees, and agents of ours, none of whom

will receive additional compensation therefor, may solicit proxies by telephone, emails, or other personal contact. We will bear the cost

for the solicitation of the proxies, including postage, printing, and handling, and will reimburse the reasonable expenses of brokerage

firms and others for forwarding material to beneficial owners of shares and ADSs.

To the extent you would like

to submit a position statement with respect to any of the Proposals described in this proxy statement pursuant to the Israeli Companies

Law 5759-1999 (the “Companies Law”), you may do so by delivery of appropriate notice to the offices of our attorneys,

Doron Tikotzky Kantor Gutman & Amit Gross. (Attention: Ronen Kantor, Adv.) located at 7 Metsada St., B.S.R Tower 4, Bnei Brak, Israel,

not later than ten days before the convening of the Annual Meeting. Response of the Board of Directors to the position statement may be

submitted not later than five days after the deadline for sending the position statement.

Quorum

At the close of business of

June 11, 2024, we had outstanding 544,906,149 ordinary shares, of which 290,048,900 were represented by ADSs. Each ordinary share (including

ordinary shares represented by ADSs) outstanding as of the close of business on the record date is entitled to one vote upon each of the

matters to be voted on at the Annual Meeting.

The quorum required to hold

the Annual Meeting consists of at least two shareholders present in person or by proxy who hold or represent between them at least one-third

of the voting rights in the Company. If the Meeting is adjourned for lack of a quorum it will be held on the same day in the following

week at the same time and place (with no need for any notice to the shareholders) or until such other later time if we serve notice to

the shareholders no less than seven days before the date fixed for the such adjourned Meeting (the “Deferred Meeting”).

If at a Deferred Meeting there is no quorum present half an hour after the time set for the Meeting, any number participating in the Deferred

Meeting shall represent a quorum and shall be entitled to discuss the matters set down on the agenda for the original Annual Meeting.

Vote Required for Each Proposal

Proposals 2, 3, 4, 5, 8, and

9 to be presented at the Annual Meeting require the affirmative vote of holders of at least a majority of the voting power represented

and voting on such proposal in person or by proxy on the matter presented for passage.

The approval of Proposals

6 and 7 is subject to the affirmative vote of the holders of a majority of the voting power represented and voting on such proposal in

person or by proxy. In addition, the shareholders’ approval must either include at least a majority of the ordinary shares voted

by shareholders who are not controlling shareholders nor are they shareholders who have a personal interest in the approval of the proposal

(excluding a personal interest that is not related to a relationship with the controlling shareholders), or the total ordinary shares

of noncontrolling shareholders and non-interested shareholders voted against the proposal must not represent more than 2% of the outstanding

ordinary shares.

Under the Israeli Companies

Law, in general, you will be deemed to be a controlling shareholder if you have the power to direct our activities, otherwise than by

reason of being a director or other office holder of ours, if you hold 25% or more of the voting rights in our Company or have the right

to appoint the majority of the directors of the Company or its chief executive officer, and you are deemed to have a personal interest

if any member of your immediate family or their spouse has a personal interest in the adoption of the proposal. In addition, you are deemed

to have a personal interest if a company, other than XTL, that is affiliated to you has a personal interest in the adoption of the proposal.

Such company is a company in which you or a member of your immediate family serves as a director or chief executive officer, has the right

to appoint a director or the chief executive officer, or owns 5% or more of the outstanding shares. However, you are not deemed to have

a personal interest in the adoption of the proposal if your interest in such proposal arises solely from your ownership of our shares,

or to a matter that is not related to a relationship with a controlling shareholder.

In the proxy card and voting

instruction card attached to the proxy statement you will be asked to indicate whether you have a personal interest with respect to the

proposal. If any shareholder casting a vote in connection hereto does not notify us whether or not they have a personal interest with

respect to the proposal, their vote with respect to the proposal will be disqualified.

If you provide specific instructions

(mark boxes) with regard to certain Proposals, your shares will be voted as you instruct. If you sign and return your proxy card or voting

instruction form without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board of

Directors. The proxy holders will vote in their discretion on any other matters that properly come before the Annual Meeting.

If you are a shareholder of

record and do not return your proxy card, your shares will not be voted. If you hold shares (or ADSs representing shares) beneficially

in street name, your shares will also not be voted at the Annual Meeting if you do not return your proxy card or voting instruction card

to instruct your broker or BNY Mellon how to vote. For all proposals, a broker (and BNY Mellon) may only vote in accordance with instructions

from a beneficial owner of shares or ADSs. This will be true even for a routine matter, such as Proposal 2 (the approval of the re-appointment

of our independent registered public accounting firm and authorization of our Board of Directors to fix such accounting firm’s annual

compensation), as your broker and BNY Mellon will not be permitted to vote your shares in their discretion on any proposal at the Annual

Meeting. For all proposals, a broker (and BNY Mellon) may only vote in accordance with instructions from a beneficial owner of shares

or ADSs.

Availability of Proxy Materials

Copies of the proxy card and

voting instruction card, the Notice of the Annual Meeting and this Proxy Statement are available at the “Investor Information”

portion of our website, http://www.xtlbio.com/. The contents of that website are not a part of this Proxy Statement.

Reporting Requirements

We are subject to the information

reporting requirements of the Securities Exchange Act of 1934, as amended, or Exchange Act, applicable to foreign private issuers. We

fulfill these requirements by filing reports with the Securities and Exchange Commission (the “Commission”). Our filings

with the Commission may be inspected without charge at the Commission’s Public Reference Room at 100 F Street, N.E., Washington,

D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the Commission at 1-800-SEC-0330. Our

filings are also available to the public on the Commission’s website at http://www.sec.gov.

As a foreign private issuer,

we are exempt from the rules under the Securities Exchange Act, or Exchange Act of 1934, as amended, related to the furnishing and content

of proxy statements. The circulation of this notice and proxy statement should not be taken as an admission that we are subject to the

proxy rules under the Exchange Act.

PROPOSAL 1:

REVIEW AND DISCUSSION OF AUDITOR’S REPORT

AND CONSOLIDATED FINANCIAL STATEMENTS

At the Annual Meeting, in

accordance with the requirements of the Companies Law, our auditor’s report, annual report and consolidated financial statements

for the year ended as of December 31, 2023 will be presented. We will furthermore hold a discussion with respect to such financial statements

at the Annual Meeting. This item will not involve a vote of the shareholders.

The

foregoing auditor’s report and the audited consolidated financial statements, as well as our Annual Report on Form 20-F for the

year ended as of December 31, 2023 (filed with the Securities and Exchange Commission on April 30, 2024), may be reviewed at through the

EDGAR website of the Securities and Exchange Commission at www.sec.gov, through the Israeli Securities Authority’s electronic filing

system at: http://www.magna.isa.gov.il, or through the website of the Tel-Aviv Stock Exchange Ltd. at: http://maya.tase.co.il. None of

the auditor’s report, audited consolidated financial statements, Form 20-F and its amendments or the contents of our website form

part of the proxy solicitation material.

PROPOSAL 2:

APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTANTS AND

AUTHORIZATION OF THE BOARD, UPON THE RECOMMENDATION

OF THE AUDIT COMMITTEE, TO DETERMINE THE AUDITORS’ REMUNERATION TO BE FIXED IN ACCORDANCE WITH THE VOLUME AND NATURE OF THEIR SERVICES

TO THE COMPANY FOR SUCH FISCAL YEAR

Background

It is proposed to re-appoint

Somekh Chaikin, Certified Public Accountants in Israel and a member firm of KPMG as the Company’s independent auditors (the “Proposed

Auditors”) for the fiscal year ending December 31, 2024, until our next annual general Meeting of shareholders and to authorize

our Board of Directors, upon recommendation of the Audit Committee to determine KPMG’s remuneration to be fixed in accordance with

the volume and nature of their services to the Company for such fiscal year.

The following table sets forth

for the year ended 2023, the fees billed by the Company’s independent registered public firm.

| Service

Rendered | |

Year

ended December 31, 2023 | |

| Audit (1) | |

US$ |

80,000 | |

| Audit related services (2) | |

| |

| Tax | |

US$ |

5,000 | |

| All other fees | |

| |

| Total | |

US$ |

85,000 | |

| (1) | Audit fees consist of services that would normally be provided

in connection with statutory and regulatory filings or engagements, including services that generally only the independent accountant

can reasonably provide. |

| (2) | Audit related services consist of services that were reasonably

related to the performance of the audit or reviews of our financial statements and not included under “Audit Fees” above,

including, principally, providing consents for registration statement filings. |

Proposed Resolution

It is proposed that at the

Annual Meeting the following resolution shall be adopted:

“RESOLVED, that the

appointment of Somekh Chaikin, Certified Public Accountants in Israel and a member firm of KPMG, as the Company’s independent auditors

for the fiscal year ending December 31, 2024, until our next annual general Meeting of shareholders and the same hereby is, approved,

and that the Company’s Board of Directors be, and the same hereby is, authorized, subject to the approval of the Audit Committee,

to determine their fees, as presented to the shareholders, be and the same hereby are, approved.”

Required Vote

Under the Israeli Companies

Law, the affirmative vote of the holders of a majority of the voting power represented and voting on this Proposal in person or by proxy

is necessary to approve the resolution to approve the appointment of our independent auditors and authorize the Audit Committee to fix

the independent auditors’ renumeration.

Board Recommendation

Our Board of Directors recommends

a vote FOR the foregoing resolution approving the appointment of our independent auditors and authorization of our Audit Committee or

Board of Directors to fix the independent auditors’ compensation.

PROPOSALS 3-5:

RE-ELECTION OF DIRECTORS

Background

Under the Companies Law and

our articles of association, the management of our business is vested in our Board of Directors. The Board of Directors may exercise all

powers and may take all actions that are not specifically granted to our shareholders.

Our Board of Directors currently

consists of seven directors, including two external directors. Our directors, excluding the external directors, are elected at each annual

general meeting of shareholders. All of the members of our Board of Directors, other than the external directors, may be re-elected for

an unlimited number of terms upon completion of their then-current term of office.

Each of the nominees, whose

professional background is provided below, has advised us that he or she are willing, able and ready to serve as a director if elected

or re-elected as the case may be.

Alexander Rabinovich

joined our Board of Directors in April 2017. He has significant public company experience with both NASDAQ and TASE listed companies.

Mr. Rabinovich is currently the Chief Executive Officer and director of Green Forest Holdings Ltd., a fully owned company engaged in capital

investments and of Intercure Ltd. (TASE, NASDAQ) In addition, he serves as a director and CEO of Green Fileds Capital Ltd. (TASE). Mr.

Rabinovich served as director in Pilat Media Global PLC, public company listed on TASE and on the Alternative Investment Market of the

London Stock Exchange and several other private companies such as Visuality Systems Ltd. Mr. Rabinovich holds a B.A. degree in Economics

and Accounting from the University of Haifa.

Shlomo Shalev joined

our Board of Directors in December 2014 and in August 2015 was appointed to serve as Chairman and served in such capacity until July 2018

and currently serves as the Company CEO. He most recently served as Chairman of the board of directors at Intercure and Micronet, both

TASE listed companies. In addition to serving as a Board member on a number of NASDAQ and TASE listed companies, such as Ophir Optronics,

Arel Communications and PowerDsine, Mr. Shalev was the Senior Vice President of Investments for Ampal. He has also worked on a number

of transactions in mergers and acquisitions and initial public offerings. With an educational background in economics, Mr. Shalev was

Israel’s Consul for Economic Affairs and the Economic Advisor to the Director General, Ministry of Industry and Trade. Mr. Shalev

holds an MBA from the University of San Francisco and a B.A. degree in Economics from the University of Ben Gurion, Beer Sheva, Israel.

Doron Turgeman joined

our Board of Directors in December 2014 and currently serve as Chairman. He has significant public company experience with both NASDAQ

and TASE listed companies. Mr. Turgeman is currently the Chief Executive Officer of Internet Gold (IGLD), and since 2011 until January

2019 also used to be the CEO of B Communications (BCOM), both of which are listed on the NASDAQ. Mr. Turgeman has gained considerable

experience in mergers and acquisitions involving both debt and equity, with, among other things, the purchase of the controlling interest

of Bezeq by B Communications. He is knowledgeable in capital markets in Israel, the U.S. and Europe as well as SEC and TASE reporting

standards. Mr. Turgeman holds a B.A. degree in Economics and Accounting from the Hebrew University of Jerusalem and is a certified public

accountant in Israel.

Proposed Resolutions

It is proposed that at the

Annual Meeting the following resolutions shall be adopted:

“RESOLVED, that the

re-election of Alexander Rabinovitch as a director of the Company, to serve until our next annual general meeting of shareholders be,

and hereby is, approved in all respects.”

“RESOLVED, that the

re-election of Shlomo Shalev as a director of the Company, to serve until our next annual general meeting of shareholders be, and hereby

is, approved in all respects.”

“RESOLVED, that the

re-election of Doron Turgeman as a director of the Company, to serve until our next annual general meeting of shareholders be, and hereby

is, approved in all respects.”

Required Vote

Under the Companies Law and

our articles of association, the affirmative vote of the holders of a majority of the ordinary shares represented at the Annual Meeting,

in person or by proxy, entitled to vote and voting on the matter, is required to re-elect as directors each of the nominees named above.

Board Recommendation

Our Board of Directors recommends

a vote FOR the re-election of the foregoing director nominees.

It is hereby clarified that

resolutions approving the re-election of each director shall be adopted separately.

PROPOSALS 6-7

TRANSACTION

AGREEMENT TERMS AND CONDITIONS AND TRANSACTION CONSUMMATION

Background

On March 20, 2024 the Company

announced that it entered into a binding term sheet with Social Proxy an artificial intelligence web data company, developing and powering

a unique ethical, intellectual property based, proxy and data extraction platform for artificial intelligence and BI applications at scale,

to acquire all of the issued and outstanding share capital of the Social Proxy on a fully diluted basis, subject to the approval of shareholders

of the Company and receipt of necessary government approvals, if required.

On

June 5, 2024, the Company entered into that certain share purchase agreement with

the current shareholders of Social Proxy (the “Purchase Agreement”). Pursuant to the Purchase Agreement,

the Company will acquire all of the issued and outstanding share capital of Social Proxy on a fully diluted basis in exchange for (a)

the issuance by the Company to the shareholders of Social Proxy, by way of a private placement, such number of ADSs of the Company, representing

immediately after such issuance, 44.6% of the issued and outstanding share capital of the Company and (b) the payment of US$430,000 to

the shareholders of Social Proxy.

In addition, as part of the Transaction, the shareholders

of Social Proxy will be issued additional warrants, which may only be exercised upon reaching certain financial measured milestones (the

“Milestones”) within a period of up to three (3) years from the closing of the Transaction, Social Proxy will operate

as fully owned subsidiary of the Company and its shareholders will be entitled to appoint two (2) representatives to the Company’s

board of directors out of a total of up to seven (7) directors.

The Purchase Agreement contains

customary representations and warranties, agreements and obligations and conditions to closing, all as are customary for transactions

of this nature, including, without limitation, the approval of the Transaction by the Company’s shareholders and receipt of necessary

government or third-party approvals, if required.

The Purchase Agreement also

provides that at the closing, the Company shall provide Social Proxy with evidence that it retains a certain Minimum Equity of Cash (as

defined therein) and that until the earlier of (i) the lapse of a six (6) months period commencing as of the closing of the Transaction

and (ii) the date of achievement of the first Milestone, the ADS’s to be issued pursuant the Purchase Agreement shall be held in

escrow with an independent escrow agent. During the escrow period, current shareholders of the Social Proxy shall be entitled to exercise

all of the rights that the ADSs would entitle the holder of such ADSs in the capital of the Company, excluding the right to attend and

vote at a general meeting of the Company.

Proposed Resolutions

It is proposed that at the Annual Meeting the following

resolutions be adopted:

“RESOLVED, to approve the Purchase Agreement

and their execution by the Company.”

“RESOLVED, to approve the issuance of ordinary

shares pursuant to the Purchase Agreement, as the case may be.”

“RESOLVED, to authorize, empower and direct

the Chairman of the Board/Chief Executive Officer of the Company, in the name and on behalf of the Company, to take or cause to be taken

any and all such further actions he deems necessary to consummate the Transaction.”

Required Vote

The affirmative vote of the

holders of a majority of the voting power represented and voting on this proposal in person or by proxy is necessary for the approval

of the resolution to approve the re-election of the external director. In addition, the shareholders’ approval must either include

at least a majority of the ordinary shares voted by shareholders who are not controlling shareholders nor are they shareholders who have

a personal interest in the approval of the re-election of the external director, or the total ordinary shares of non-controlling shareholders

and non-interested shareholders voted against this proposal must not represent more than 2% of the outstanding ordinary shares.

For this purpose, you are

asked to indicate on your proxy card or voting instruction card whether you have a personal interest in the approval of the Purchase Agreement.

Under the Israeli Companies Law, in general, you are deemed to have a personal interest if any member of your immediate family or their

spouse has a personal interest in the adoption of the proposal. In addition, you are deemed to have a personal interest if a company,

other than the Company, that is affiliated to you has a personal interest in the adoption of the proposal. Such company is a company in

which you or a member of your immediate family serves as a director or chief executive officer, has the right to appoint a director or

the chief executive officer, or owns 5% or more of the outstanding shares. However, you are not deemed to have a personal interest in

the adoption of the proposal if your interest in such proposal arises solely from your ownership of our shares, or to a matter that is

not related to a relationship with a controlling shareholder.

Board Recommendation

Our Board of Directors recommends

a vote FOR the approval of the forgoing resolutions.

PROPOSALS 8-9

ELECTION, CONDITIONAL UPON

THE CONSUMMATION OF THE TRANSACTION, OF DIRECTORS

Background

Pursuant to the provisions

of the Transaction, the Board of Directors of the Company will consist, conditional upon the consummation of the Transaction, of seven

(7) directors, five (5) serving as directors and two (2) serving as external directors. Prior to the closing of the Transaction, Social

Proxy will be entitled to appoint two (2) representatives to the Company’s Board of Directors out of a total of up to seven (7)

directors.

Each of the nominees, whose

professional background is provided below, has advised us that he or she are willing, able and ready, conditional upon the consummation

of the Transaction, to serve as a director if elected. We do not have any understanding or agreement with respect to the future election

of any of the nominees named.

Tal Klinger

is founder and CEO of Social Proxy and its subsidiaries. Prior to his founding of Social Proxy, Mr. Klinger was the Co-Founder and CEO

of the Lychee Digital Group. Mr. Klinger has an extensive career as CEO and Director of start-up and technological companies around the

world. Mr. Klinger graduated from the College of Law and Business with a Masters In international commercial transactions and bachelor

degrees in both Law and Administration and Management.

Yair Redl

was a partner and CEO at Deloitte and served as a senior manager and chief financial officer at several technology companies throughout

the years. Currently he is founder and Partner at A.Y. Augmented Management and a managing partner at Moore Management Consulting, while

serving as Chairman of the Board at Social Proxy and several other technology companies and startups. Mr. Redl graduated from Queens College

with a BA in Mathematics and Physics and from Columbia University with an MSc in operation research.

Proposed Resolutions

It is proposed that at the

Annual Meeting the following resolutions shall be adopted:

“RESOLVED, that, conditional

upon the consummation of the Transaction, the election of Tal Klinger as a director of the Company, to serve until our next annual general

meeting of shareholders be, and hereby is, approved in all respects.”

“RESOLVED, that, conditional

upon the consummation of the Transaction, the election of Yair Redl as a director of the Company, to serve until our next annual general

meeting of shareholders be, and hereby is, approved in all respects.”

Required Vote

Under the Companies Law and

our articles of association, the affirmative vote of the holders of a majority of the ordinary shares represented at the Annual Meeting,

in person or by proxy, entitled to vote and voting on the matter, is required to re-elect as directors each of the nominees named above.

Board Recommendation

Our Board of Directors recommends

a vote, conditional upon the consummation of the Transaction, FOR the election of the foregoing director nominees.

It is hereby clarified that

resolutions approving the election of each director shall be adopted separately.

OTHER BUSINESS

Other than as set forth above,

as of the mailing of this Proxy Statement, management knows of no business to be transacted at the Annual Meeting, but, if any other matters

are properly presented at the Annual Meeting, the persons named in the attached form of proxy will vote upon such matters in accordance

with their best judgment.

| |

By Order of the Board of Directors |

| |

|

| |

/s/ Shlomo Shalev |

| |

Shlomo Shalev

Chief Executive Officer |

| |

Dated: June 12, 2024 |

Annex A

To:

XTL BIOPHARMACEUTICALS LTD.

Declaration of Director’s Qualification

(Section 224(b) of the Israeli Companies’ Law -

1999 (the “Law”))

I, the undersigned, Alexander Rabinovich, I.D 014122568

hereby states, declares and undertakes to XTL BIOPHARMACEUTICALS Ltd. (the “Company”) as follows:

| 1. | I have the necessary qualifications and ability to devote

appropriate time to perform the position of a director in the Company, taking into account, among other things, the Company’s special

needs. |

| 2. | With accordance to paragraph 1 above, the following are details

regarding my skills: |

| 2.1 | Education-(Field of education, institution,

academic degree, certificate or professional license) |

B.A degree in Economics and Accounting from Haifa University

| 2.2 | Practice and Professional Experience- (Job description,

employer details, duration of service) |

February 2019 until today: CEO of Intercure Ltd.

2016 until today: CEO of Green Fields Capital Ltd.

2009 until today: CEO of Green Forest Holdings Ltd.

2013 until today: CEO of Green Forest Global

2009 until 2014: CEO of Eurocom Holdings and Investments Ltd.

& Eurocom Investments LP.

| 2.3 | Companies in which I serve or served as a director in the

past 5 years-(Job description, company’s name, duration of service) |

2018 until today: Intercure Ltd.

2018 until today: Canndoc Ltd.

2011 until today: Green Fields Capital Ltd.

2009 until today: Green Forest Holdings Ltd.

2013 until today: Green Forest Global

2013 until today: D.I.M Investments / D.I.M Risk

Management Ltd.

| 3. | I have not been convicted by a final judgment of one or more

offences specified under sections 290 to 297, 392, 415, 418 to 428 to the Israel Penal Law 5737-1997; or under sections 52C, 52D, 53(a)

and 54 to the Securities Law, 5728-1968 (“Securities Law”); and in any additional offences to those set forth above,

as prescribed by the Minister of Justice from time to time. |

| 4. | I have not been convicted by a final judgment in a court

outside of Israel for bribery, fraud, directors’ offenses involving misuse of inside information. |

| 5. | I have not been convicted by a final judgment of any other offense in which a court

determined that due to its nature, severely or circumstances I do not deserve the serve as director/director of a public company. |

| | | |

| 6. | I was not imposed by an administrative enforcement commission, appointed under

section 52(32)(a) of the Securities Law, with means of enforcement, as provided in section 52 of the Securities Law, or imposed under

Chapter H4 of the Securities Law, under Chapter G2 of the Regulation of Investment Counseling and Investment Portfolio Management Law,

1995 or under Chapter J1 to the Joint Investment Trust Law, 1994, as applicable. |

| | | |

| 7. | I am not a minor, incompetent, and was not declared insolvent. |

| | | |

| 8. | To this time, I maintain/do not maintain (Please delete the unnecessary) securities

of the company or of a subsidiary and/or related company of the company. |

Below are my stated Holdings:

| |

Quantity of | | |

The rate of Holdings | | |

The rate of Holdings (strong/full dilution) | |

| Name, type and series of Security | |

Securities | | |

Capital | | |

Vote | | |

Capital | | |

Vote | |

| ADR | |

| 661,394 | | |

| | | |

| | | |

| | | |

| | |

| Ordinary shares | |

| 62,149,487 | | |

| | | |

| | | |

| | | |

| | |

| Total: | |

| 128,288,887 | | |

| 23.54 | % | |

| 23.54 | % | |

| 22.31 | % | |

| 22.31 | % |

| 9. | I hereby declare that if any change shall apply in the above listed information

in a way that shall prevent the continuation of my service as director of the Company, I shall inform the company about the change immediately

and my service as a director shall terminate immediately. I am fully aware that the Company relied on the declaration of this statement

during the approval of my tenure as director of the Company. |

| 10. | I am aware that non-disclosure of information as mentioned above shall be considered

as a breach of my fiduciary duty to the Company. |

| 11. | I hereby declare that I shall meet all the law requirements regarding service as

a director of a public company, and serve for the benefit of the Company. |

| |

Signature: |

/s/ Alexander Rabinovich |

| |

|

|

| |

Date: June 6, 2024 |

To:

XTL

BIOPHARMACEUTICALS LTD.

Declaration of Director’s Qualification

(Section 224(b) of the Israeli Companies’ Law –

1999 (the “Law”))

I, the undersigned, Shlomo Shalev, I.D 057708422

hereby states, declares and undertakes to XTL BIOPHARMACEUTICALS Ltd. (the “Company”) as follows:

| 1. | I have the necessary qualifications and ability to devote appropriate time to perform the position of

a director in the Company, taking into account, among other things, the Company’s special needs. |

| 2. | With accordance to paragraph 1 above, the following are details regarding my skills: |

| 2.1 | Education- (Field of education, institution, academic degree, certificate or professional license) |

BA Ben Gurion University, Israel

MBA San Francisco University, CA USA

2.2. Practice and Professional Experience-

(Job description, employer details, duration of service)

Chairman

of the Board, GFC Green Fields Capital (TASE) 2015-Current

CEO GFC Green Fields Capital (TASE) 2014-2015

Active Chairman of the Board, Intercure

(TASE) 2015-2018

Active Chairman of the Board Micronet

(TASE) 2011-2013

Active Chairman of the Board NetformX

2007-2010

Senior VP Investments, Ampal (NASDAQ)

1998-2006

Consul for Economic Affairs, United States

Northwestern Region 1994-1998

Economic Advisor to the Director General,

Ministry of Industry and Trade

1992-1994

2.3. Companies in which I serve or

served as a Director in the past 5 years- (Job description, company’s name, duration of service)

GFC Green Fields Capital – 2015-current

Micronet 2017-2019

Intercure 2015-2018

Tigi Solar – 2021-Current

SaverOne – 2020 - Current

| 3. | I have not been convicted by a final judgment of one or more offences specified under sections 290 to

297, 392, 415, 418 to 428 to the Israel Penal Law 5737-1997; or under sections 52C, 52D, 53(a) and 54 to the Securities Law, 5728-1968

(“Securities Law”); and in any additional offences to those set forth above, as prescribed by the Minister of Justice

from time to time. |

| 4. | I have not been convicted by a final judgment in a court outside of Israel for bribery, fraud, directors’

offenses involving misuse of inside information. |

| 5. | I have not been convicted by a final judgment of any other offense in which a court determined that due

to its nature, severely or circumstances I do not deserve the serve as director/director of a public company. |

| 6. | I was not imposed by an administrative enforcement commission, appointed under section 52(32)(a) of the

Securities Law, with means of enforcement, as provided in section 52 of the Securities Law, or imposed under Chapter H4 of the Securities

Law, under Chapter G2 of the Regulation of Investment Counseling and Investment Portfolio Management Law, 1995 or under Chapter J1 to

the Joint Investment Trust Law, 1994, as applicable. |

| 7. | I am not a minor, incompetent, and was not declared insolvent. |

| 8. | To this time, I maintain/do not maintain (Please delete the unnecessary) securities of the company or

of a subsidiary and/or related company of the company. |

Below are my stated Holdings:

| |

Quantity of | | |

Treasury | | |

The rate of Holdings | | |

The rate of Holdings

(strong/full dilution) | |

| Name, type and series of Security | |

Securities | | |

Securities | | |

Capital | | |

Vote | | |

Capital | | |

Vote | |

| Shares | |

| 3,019,309 | | |

| | | |

| | | |

| | | |

| | | |

| | |

| 9. | I hereby declare that if any change shall apply in the above listed information in a way that shall prevent

the continuation of my service as director of the Company, I shall inform the company about the change immediately and my service as a

director shall terminate immediately. I am fully aware that the Company relied on the declaration of this statement during the approval

of my tenure as director of the Company. |

| 10. | I am aware that non-disclosure of information as mentioned above shall be considered as a breach of my

fiduciary duty to the Company. |

| 11. | I hereby declare that I shall meet all the law requirements regarding service as a director of a public

company, and serve for the benefit of the Company. |

| |

Signature: |

/s/ Shlomo Shalev |

| |

|

| |

Date: June 5, 2024 |

To:

XTL

BIOPHARMACEUTICALS LTD.

Declaration of Director’s Qualification

(Section 224(b) of the Israeli Companies’ Law –

1999 (the “Law”))

I, the undersigned, Doron Turgeman, I.D

023568389 hereby states, declares and undertakes to XTL BIOPHARMACEUTICALS Ltd. (the “company”) as follows:

| 1. | I have the necessary qualifications and ability to devote appropriate time to perform the position of a director

in the Company, taking into account, among other things, the Company’s special needs. |

| 2. | With

accordance to paragraph

1 above, the following are details regarding my skills: |

| 2.1 | Education-(Field

of education, institution, academic degree, certificate or professional) |

B.A.

Economics and Accounting. Hebrew University of Jerusalem, Israel

| 2.2. | Practice

and Professional Experience-(Job description, employer details, duration of service) |

Since

2020 : Independent financial advisor that provide management services, debts restructuring consulting, and board services

to public companies in Israel. Currently serves as board member at 6 public companies which trade on TASE.

October 2011 - February 2021

(10 years): CEO of Internet Gold which is publicly-traded company dual-listed on Nasdaq and TASE.

From October 2011 until January

2019 I served in addition, as CEO of B Communications which is publicly-traded company dual-listed on Nasdaq and TASE.

2008-October 2011 (3 years):

Deputy CEO and CFO, Internet Gold. In tandem, VP of Eurocom Panasonic, the sole distributer of Panasonic in Israel and CFO of Eurocom

Communications between 2012-2015.

| 2.3. | Companies

in which I serve or served as a Director in the past 5 years- (Job description, company’s

name, duration of service) |

Since

November 2021: Board member of Effi Capital real estate, a public company which trade on TASE.

Since October 2019: Board member of

Alon Ribua Kahol, one of the largest Israeli holding companies.

Since February 2016: Board member

of The Klein International Group Limited, BVI company which raised bonds on TASE.

Since June 2020: Board member of M.V

Investments, Israeli real estate company which raised bonds on TASE.

Since September 2020: Board member

of Encore Group Limited, BVI company which raised bonds on TASE.

Between February 2018 until December

2019: Board member of BEZEQ, the largest Israeli telecoms company.

Between November 2021 until September

2022: Board member of Erica Carmel, which trade on TASE.

| 3. | I have not been convicted by a final judgment of one or more offences specified under sections 290 to

297, 392, 415, 418 to 428 to the Israel Penal Law 5737-1997; or under sections 52C, 52D, 53(a) and 54 to the Securities Law, 5728-1968

(“Securities Law”); and in any additional offences to those set forth above, as prescribed by the Minister of Justice

from time to time. |

| 4. | I have not been convicted by a final judgment in a court outside of Israel for bribery, fraud, directors’

offenses involving misuse of inside information. |

| 5. | I have not been convicted by a final judgment of any other offense in which a court determined that due

to its nature, severely or circumstances I do not deserve the serve as director/director of a public company. |

| 6. | I was not imposed by an administrative enforcement commission, appointed under section 52(32)(a) of the

Securities Law, with means of enforcement , as provided in section 52 of the Securities Law, or imposed under Chapter H4 of the Securities

Law, under Chapter G2 of the Regulation of Investment Counseling and Investment Portfolio Management Law, 1995 or under Chapter J1 to

the Joint Investment Trust Law, 1994, as applicable. |

| 7. | I am not a minor, incompetent, and was not declared insolvent. |

| 8. | To this time, I maintain/do not maintain (Please delete the unnecessary) securities of the company or

of a subsidiary and/or related company of the company. |

Below are my stated Holdings:

| Name, type and | |

No. of

Security on

the stock | | |

Quantity of | | |

Treasury | | |

The rate of Holdings | | |

The rate of Holdings (strong/full dilution) | |

| series of Security | |

exchange | | |

Securities | | |

Securities | | |

Capital | | |

Vote | | |

Capital | | |

Vote | |

| XTL ADR | |

| 3,400 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| 9. | I hereby declare that if any change shall apply in the above listed information in a way that shall prevent

the continuation of my service as director of the Company, I shall inform the company about the change immediately and my service as a

director shall terminate immediately. I am fully aware that the Company relied on the declaration of this statement during the approval

of my tenure as director of the Company. |

| 10. | I am aware that non-disclosure of information as mentioned above shall be considered as a breach of my

fiduciary duty to the Company. |

| 11. | I hereby declare that I shall meet all the law requirements regarding service as a director of a public

company, and serve for the benefit of the Company. |

| |

Signature: |

/s/ Doron Turgeman |

| |

|

|

| |

Date: June 5, 2024 |

Annex B

To:

XTL

BIOPHARMACEUTICALS LTD.

Declaration

of Director’s Qualification

(Section

224(b) of the Israeli Companies’ Law – 1999 (the “Law”))

I,

the undersigned, Tal Klinger, I.D 204008411 hereby states, declares and undertakes to XTL BIOPHARMACEUTICALS Ltd. (the

“Company”) as follows:

| 1. | I

have the necessary qualifications and ability to devote appropriate time to perform the position

of a director in the Company, taking into account, among other things, the Company’s special

needs. |

| 2. | With

accordance to paragraph 1 above, the following are details regarding my skills: |

| 2.1 | Education-

(Field of education, institution, academic degree, certificate or professional license) |

| ● | Master

of Laws – LLM, Specialty in international l commercial transaction from College of

Law and Business. |

| ● | Bachelor

of Laws – LLB, Law specialty in Commercial Law from College of Law and Business. |

| ● | Bachelor

Degree Business Administration and Management from College of Law and Business. |

| 2.2. | Practice

and Professional Experience-(Job description, employer details, duration of service) |

| ● | March

2023 until today: Manager, ALIGN TECHNOLOGIES AND DATA, UNIPESSOAL LDA. |

| ● | January

2020 until today: CEO, director and founder, “The Social Proxy Ltd”. |

| ● | April

2021 until today: CEO, director and president. “The Social Proxy Inc.” |

| ● | June

2019 until June 2021: Co-Founder and CEO at Lychee, Lychee Digital Group. |

| ● | April

2019 until September 2020: Growth Hacker, Adecco Middle East. |

| 2.3. | Companies in

which I serve or served as a Director in the past 5 years-(Job description, company’s name, duration of service) |

| ● | January

2020 until today: Director, The Social Proxy Ltd. |

| ● | April

2021 until today: Director, The Social Proxy Inc. |

| 3. | I

have not been convicted by a final judgment of one or more offences specified under sections

290 to 297, 392, 415, 418 to 428 to the Israel Penal Law 5737-1997; or under sections 52C,

52D, 53(a) and 54 to the Securities Law, 5728-1968 (“Securities Law”); and

in any additional offences to those set forth above, as prescribed by the Minister of Justice

from time to time. |

| 4. | I

have not been convicted by a final judgment in a court outside of Israel for bribery,

fraud, directors’ offenses involving misuse of inside information. |

| 5. | I

have not been convicted by a final judgment of any other offense in which a court determined

that due to its nature, severely or circumstances I do not deserve the serve as director/director

of a public company. |

| 6. | I

was not imposed by an administrative enforcement commission, appointed under section 52(32)(a)

of the Securities Law, with means of enforcement, as provided in section 52 of the Securities

Law, or imposed under Chapter H4 of the Securities Law, under Chapter G2 of the Regulation

of Investment Counseling and Investment Portfolio Management Law, 1995 or under Chapter J1

to the Joint Investment Trust Law, 1994, as applicable. |

| 7. | I

am not a minor, incompetent, and was not declared insolvent. |

| 8. | To

this time, I do not maintain securities of the company or of a subsidiary and/or related

company of the company. |

Below

are my stated Holdings:

| Name, type and series of | |

No. of

Security on the stock | |

| |

Treasury | |

The rate of Holdings | | |

The rate of Holdings (strong/full dilution) | |

| Security | |

exchange | |

Quantity of Securities | |

Securities | |

Capital | | |

Vote | | |

Capital | | |

Vote | |

| Shares | |

| |

Upon the consummation of the Transaction as detailed in Company’s Form 6-K, dated June 5, 2024, 258,687,265 represented by 2,586,873 ADS of the Company, | |

| |

| | | |

| | | |

| | | |

| | |

| 9. | I

hereby declare that if any change shall apply in the above listed information in a way that

shall prevent the continuation of my service as director of the Company, I shall inform the

company about the change immediately and my service as a director shall terminate immediately.

I am fully aware that the Company relied on the declaration of this statement during the

approval of my tenure as director of the Company. |

| 10. | I

am aware that non-disclosure of information as mentioned above shall be considered as a breach

of my fiduciary duty to the Company. |

| 11. | I

hereby declare that I shall meet all the law requirements regarding service as a director

of a public company, and serve for the benefit of the Company. |

| |

Signature: |

/s/ Tal Klinger |

| |

|

| |

Date: June 11, 2024 |

To:

XTL

BIOPHARMACEUTICALS LTD.

Declaration

of Director’s Qualification

(Section

224(b) of the Israeli Companies’ Law – 1999 (the “Law”))

I,

the undersigned, Yair Redl, Israeli I.D No. 0-5828652-7hereby states, declares and undertakes to XTL BIOPHARMACEUTICALS Ltd.

(the “Company”) as follows:

| 1. | I

have the necessary qualifications and ability to devote appropriate time to perform the position

of a director in the Company, taking into account, among other things, the Company’s special

needs. |

| 2. | With

accordance to paragraph 1 above, the following are details regarding my skills: |

BA

degree in Mathematics, minor Physics from Queens College

MSc

– operation research from Columbia University

| 2.2. | Practice

and Professional Experience-(Job description, employer details, duration of service) |

| ● | January

2019 until today: Managing Partner, owner, “Moore Management Consulting”. |

| ● | January

2023 until today: Chairman of the Board, “NRN Norm”. |

| ● | January

2022 until today: Chief financial officer and Chairman of the Board, “The Social Proxy

Ltd”. |

| ● | January

2019 until today: Chairman of the Board, “A.Y.Mavlet Technologies”. |

| ● | May

2008 until December 2018: Managing partner, “ICG -Integra Consulting Group”. |

| ● | June

2003 until December 2004: Director of immigration (Aliyah) Division at “The Jew Agency

for Israel” |

| ● | March

2003 until October 2005: Partner & CEO, Deloitte. |

| ● | March

2003 until October 2005: CIO, Director of Recovery Process, “Leumit Health Fund (HMO). |

| 2.3. | Companies

in which I serve or served as a Director in the past 5 years-(Job description, company’s

name, duration of service) |

| ● | January

2023 until today: Chairman of the Board - NRN Norm. |

| ● | January

2022 until today: Director - The Social Proxy Ltd. |

| ● | January

2024 until today: Director -The Social Proxy Inc. |

| 3. | I

have not been convicted by a final judgment of one or more offences specified under sections

290 to 297, 392, 415, 418 to 428 to the Israel Penal Law 5737-1997; or under sections 52C,

52D, 53(a) and 54 to the Securities Law, 5728-1968 (“Securities Law”); and

in any additional offences to those set forth above, as prescribed by the Minister of Justice

from time to time. |

| 4. | I

have not been convicted by a final judgment in a court outside of Israel for bribery,

fraud, directors’ offenses involving misuse of inside information. |

| 5. | I

have not been convicted by a final judgment of any other offense in which a court determined

that due to its nature, severely or circumstances I do not deserve the serve as director/director

of a public company. |

| 6. | I

was not imposed by an administrative enforcement commission, appointed under section 52(32)(a)

of the Securities Law, with means of enforcement, as provided in section 52 of the Securities

Law, or imposed under Chapter H4 of the Securities Law, under Chapter G2 of the Regulation

of Investment Counseling and Investment Portfolio Management Law, 1995 or under Chapter J1

to the Joint Investment Trust Law, 1994, as applicable. |

| 7. | I

am not a minor, incompetent, and was not declared insolvent. |

| 8. | To

this time, I do not maintain securities of the company or of a subsidiary and/or related

company of the Company. |

Below

are my stated Holdings:

| Name, type and series of | |

No. of

Security on the stock | |

| |

Treasury | |

The rate of Holdings | | |

The rate of Holdings (strong/full dilution) | |

| Security | |

exchange | |

Quantity of Securities | |

Securities | |

Capital | | |

Vote | | |

Capital | | |

Vote | |

| Shares | |

| |

Upon the consummation of the Transaction as detailed in Company’s Form 6-Kk dated June 5, 2024, 28,041,700 represented by 280,417 ADS of the Company, indirectly through A.Y Augmented Management | |

| |

| | | |

| | | |

| | | |

| | |

| 9. | I

hereby declare that if any change shall apply in the above listed information in a way that

shall prevent the continuation of my service as director of the Company, I shall inform the

company about the change immediately and my service as a director shall terminate immediately.

I am fully aware that the Company relied on the declaration of this statement during the

approval of my tenure as director of the Company. |

| 10. | I

am aware that non-disclosure of information as mentioned above shall be considered as a breach

of my fiduciary duty to the Company. |

| 11. | I

hereby declare that I shall meet all the law requirements regarding service as a director

of a public company, and serve for the benefit of the Company. |

| |

Signature: |

/s/ Yair Redl |

| |

|

| |

Date: June 11, 2024 |

B-4

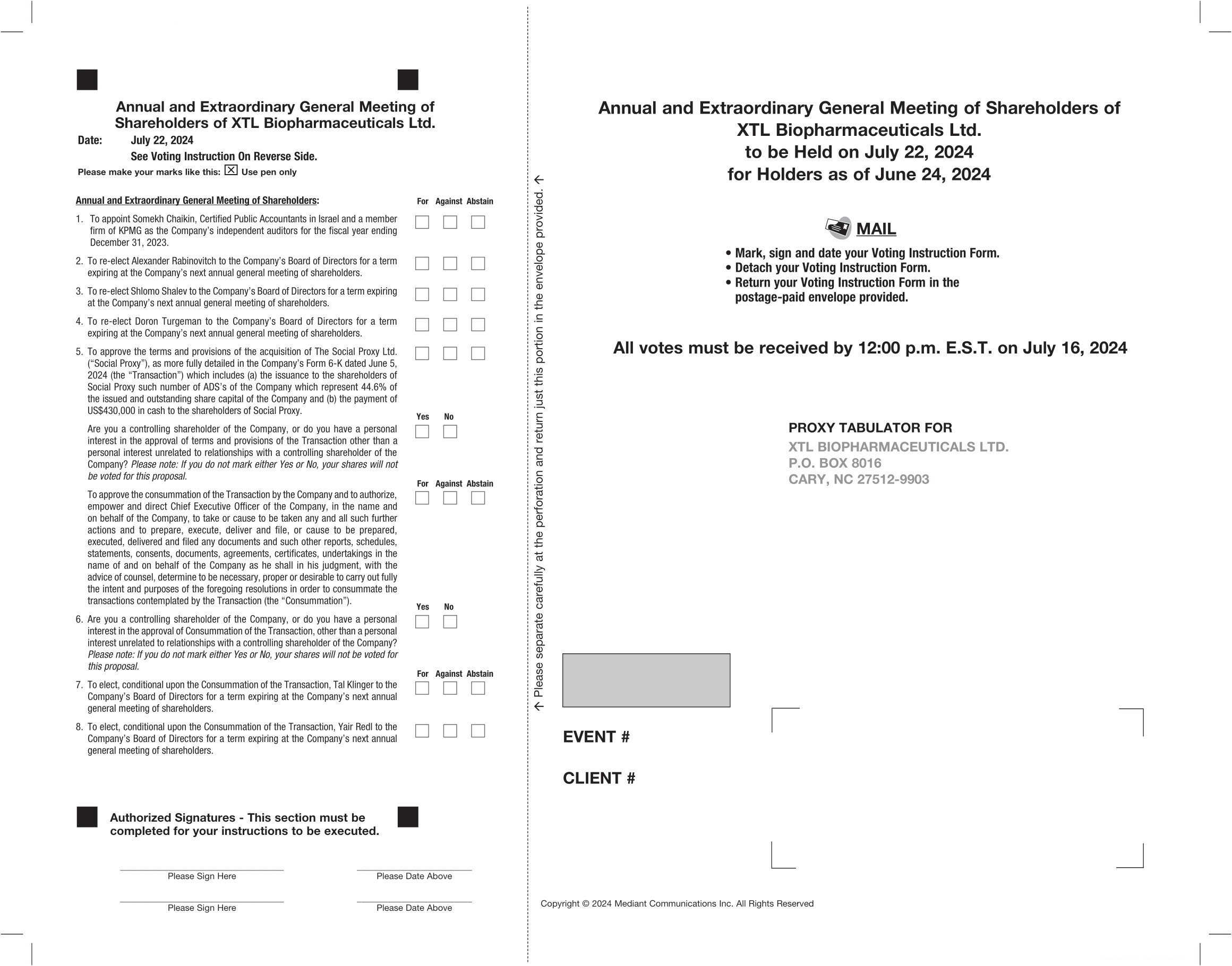

Exhibit 99.2

XTL Biopharmaceuticals Ltd.

PROXY FOR THE ANNUAL AND EXTRAORDINARY GENERAL

MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 22, 2024

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD

OF DIRECTORS.

The undersigned hereby appoints

Shlomo Shalev, Chief Executive Officer, attorney, agent and proxy of the undersigned, with full power of substitution to each of them,

to represent and to vote on behalf of the undersigned all the ordinary shares in XTL Biopharmaceuticals Ltd. (the “Company”)

which the undersigned is entitled to vote at the annual and extraordinary general meeting of shareholders (the “Annual Meeting”)

to be held at the offices of the Company’s attorneys, Doron Tikotzky Kantor Gutman & Amit Gross., at 7 Metsada St., B.S.R Tower

4, Bnei Brak, Israel, on July 22, 2024 at 15:00 PM (Israel time), and at any adjournments or postponements thereof, upon the following

matters, which are more fully described in the Notice of Annual and Extraordinary General Meeting of Shareholders (the “Notice”)

and proxy statement relating to the Annual Meeting (the “Proxy Statement”).

The undersigned acknowledges

receipt of the Notice and Proxy Statement of the Company relating to the Annual Meeting. All terms that are not defined in this Proxy

shall have the same meaning of such terms in the Notice and/or the Proxy Statement.

This Proxy, when properly

executed, will be voted in the manner directed herein by the undersigned. If no direction is made with respect to any matter, this Proxy

will be voted FOR such matter. Any and all proxies heretofore given by the undersigned are hereby revoked.

(Continued and to be signed on the reverse side)

ANNUAL AND EXTRAORDINARY GENERAL MEETING OF

SHAREHOLDERS OF

XTL BIOPHARMACEUTICALS LTD.

July 22, 2024, 15:00 p.m. (Israel time)

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

EACH OF THE PROPOSALS FOR THE MEETING

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE

ENCLOSED ENVELOPE.

PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS

SHOWN HERE ☒

| 1. | To

appoint Somekh Chaikin, Certified Public Accountants in Israel and a member firm of KPMG as the Company’s independent auditors

for the fiscal year ending December 31, 2023. |

| |

☐ |

for |

☐ |

against |

☐ |

abstain |

| 2. | To

re-elect Alexander Rabinovitch to the Company’s Board of Directors for a term expiring at the Company’s next annual general

meeting of shareholders. |

| |

☐ |

for |

☐ |

against |

☐ |

abstain |

| 3. | To

re-elect Shlomo Shalev to the Company’s Board of Directors for a term expiring at the Company’s next annual general meeting

of shareholders. |

| |

☐ |

for |

☐ |

against |

☐ |

abstain |

| 4. | To

re-elect Doron Turgeman to the Company’s Board of Directors for a term expiring at the Company’s next annual general meeting

of shareholders. |

| |

☐ |

for |

☐ |

against |

☐ |

abstain |

| 5. | To

approve the terms and provisions of the acquisition of The Social Proxy Ltd. (“Social Proxy”), as more fully detailed

in the Company’s Form 6-K dated June 5, 2024 (the “Transaction”) which includes (a) the issuance to the shareholders

of Social Proxy such number of ADS’s of the Company which represent 44.6% of the issued and outstanding share capital of the Company

and (b) the payment of US$430,000 in cash to the shareholders of Social Proxy. |

| |

☐ |

for |

☐ |

against |

☐ |

abstain |

Are you a controlling shareholder of the

Company, or do you have a personal interest in the approval of terms and provisions of the Transaction, other than a personal interest

unrelated to relationships with a controlling shareholder of the Company? Please note: If you do not mark either Yes or No, your shares

will not be voted for this proposal.

| 6. | To

approve the consummation of the Transaction by the Company and to authorize, empower and direct Chief Executive Officer of the Company,

in the name and on behalf of the Company, to take or cause to be taken any and all such further actions and to prepare, execute, deliver

and file, or cause to be prepared, executed, delivered and filed any documents and such other reports, schedules, statements, consents,

documents, agreements, certificates, undertakings in the name of and on behalf of the Company as he shall in his judgment, with the advice

of counsel, determine to be necessary, proper or desirable to carry out fully the intent and purposes of the foregoing resolutions in

order to consummate the transactions contemplated by the Transaction (the “Consummation”). |

| |

☐ |

for |

☐ |

against |

☐ |

abstain |

Are you a controlling shareholder of the

Company, or do you have a personal interest in the approval of Consummation of the Transaction, other than a personal interest unrelated

to relationships with a controlling shareholder of the Company? Please note: If you do not mark either Yes or No, your shares will

not be voted for this proposal.

| 7. | To

elect, conditional upon the Consummation of the Transaction, Tal Klinger to the Company’s Board of Directors for a term expiring

at the Company’s next annual general meeting of shareholders. |

| |

☐ |

for |

☐ |

against |

☐ |

abstain |

| 8. | To

elect, conditional upon the Consummation of the Transaction, Yair Redl to the Company’s Board of Directors for a term expiring

at the Company’s next annual general meeting of shareholders. |

|

|

☐ |

for |

☐ |

against |

☐ |

abstain |

In their discretion, the proxies

are authorized to vote upon such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof.

| |

|

Date: ________, 2024 |

|

|

|

Date_________, 2024 |

| SIGNATURE |

|

|

|

SIGNATURE |

|

|

Please sign exactly as your name appears on this

Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, trustee or guardian, please give

full title as such. If the signed is a corporation, please sign full corporate name by duly authorized officer, giving full title as such.

If signer is a partnership, please sign in partnership name by authorized person.

Exhibit 99.3

XTL Biopharmaceuticals (NASDAQ:XTLB)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

XTL Biopharmaceuticals (NASDAQ:XTLB)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024