0001267238false00012672382023-11-092023-11-090001267238us-gaap:CommonStockMember2023-11-092023-11-090001267238us-gaap:SeniorSubordinatedNotesMember2023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 15, 2023 (November 9, 2023)

Assurant, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-31978 | | 39-1126612 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

260 Interstate North Circle SE

Atlanta, Georgia 30339

(770) 763-1000

(Address, including zip code, and telephone number, including area code, of Registrant's Principal Executive Offices)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 Par Value | AIZ | New York Stock Exchange |

| 5.25% Subordinated Notes due 2061 | AIZN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 15, 2023, Assurant, Inc. (the “Company”) announced the appointment of Keith R. Meier to serve as Executive Vice President, Chief Financial Officer, and Francesca L. Luthi to serve as Executive Vice President, Chief Operating Officer, each effective immediately. Mr. Meier, 53, most recently served as Executive Vice President, Chief Operating Officer since January 2022. Prior to that, Mr. Meier served as Executive Vice President and President, International from June 2016 to December 2021, and has held various executive positions since joining the Company in 1998. Ms. Luthi, 47, most recently served as Executive Vice President, Chief Administrative Officer since July 2020, a position that has been eliminated. Prior to that, Ms. Luthi served as Executive Vice President, Chief Communication and Marketing Officer from September 2015 to July 2020, and has held various senior positions since joining the Company in 2012.

On November 15, 2023, the Company concurrently announced that Richard S. Dziadzio ceased serving as Executive Vice President, Chief Financial Officer, effective immediately, and will depart from the Company on March 18, 2024 (the “Separation Date”). In connection with his departure, the Company and Mr. Dziadzio entered into a separation agreement on November 14, 2023 (the “Separation Agreement”), providing for: (i) a cash payment equal to Mr. Dziadzio’s base salary at the rate in effect immediately prior to the Separation Date plus his 2023 target annual performance bonus payable in monthly installments for the twelve month period following the Separation Date (the “Relevant Period”); (ii) payment of Mr. Dziadzio’s 2023 annual performance bonus in March 2024 in accordance with the Amended and Restated Assurant, Inc. Executive Short Term Incentive Plan; and (iii) payment for the Company’s contributions for Mr. Dziadzio’s health insurance coverage for the Relevant Period. Following the Separation Date, the unvested portions of Mr. Dziadzio’s equity awards will vest on a prorated basis pursuant to their respective terms and the Assurant, Inc. 2017 Long Term Equity Incentive Plan, as amended and restated (the “ALTEIP”). Mr. Dziadzio will be subject to non-compete and non-solicitation restrictions for the Relevant Period. The foregoing description of the Separation Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Separation Agreement, a copy of which will be filed as an exhibit to the Company’s annual report on Form 10-K for the year ending December 31, 2023.

In connection with Mr. Meier’s appointment as Executive Vice President, Chief Financial Officer, he will receive the following compensation: (i) annual base salary of $730,000; (ii) new 2023 target annual performance bonus opportunity of 120% of his applicable annual base salary on a pro-rated basis from time of appointment; and (iii) target 2024 long-term incentive opportunity of 330% of his adjusted annual base salary. Mr. Meier will also receive a one-time equity award on March 16, 2024 with a grant date value of approximately $1,000,000, with 25% of such amount in the form of restricted stock units (“RSUs”) and 75% of such amount in the form of performance stock units (“PSUs”) under the ALTEIP.

In connection with Ms. Luthi’s appointment as Executive Vice President, Chief Operating Officer, she will receive the following compensation: (i) annual base salary of $625,000; (ii) 2023 target annual performance bonus opportunity of 100% of her applicable annual base salary; and (iii) target 2024 long-term incentive opportunity of 280% of her adjusted annual base salary. Ms. Luthi will also receive a one-time equity award on March 16, 2024 with a grant date value of approximately $750,000, with 25% of such amount in the form of RSUs and 75% of such amount in the form of PSUs under the ALTEIP.

Other than as set forth above, Mr. Meier and Ms. Luthi will continue to participate in the Company’s compensation and benefits programs in the manner described in the Company’s 2023 Proxy Statement filed on March 23, 2023.

Item 7.01. Regulation FD Disclosure.

A copy of the Company’s news release is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item 7.01. The information being furnished pursuant to this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in any such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Exhibit |

| |

| |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ASSURANT, INC. |

| | |

Date: November 15, 2023 | By: | | /s/ Mariana Wisk |

| | | Name: Mariana Wisk |

| | | Title: Senior Vice President and Corporate Secretary |

Exhibit 99.1

Assurant Realigns Executive Team to Support Global Growth Strategy

Keith Meier Named Chief Financial Officer

Francesca Luthi Appointed Chief Operating Officer

ATLANTA, Nov. 15, 2023 – Assurant, Inc. (NYSE: AIZ), a leading global business services company that supports, protects, and connects major consumer purchases, today announced the realignment of its executive team to support its global growth strategy and sustain business momentum by appointing Keith Meier as chief financial officer and Francesca Luthi as chief operating officer, effective immediately.

As chief financial officer (CFO), Keith Meier will have oversight of Assurant’s global finance and technology organizations and continue to report to Assurant president and CEO Keith Demmings. Meier started his career at Price Waterhouse LLP (now PricewaterhouseCoopers LLP), specializing in insurance. During his 25-year tenure at Assurant, he has held leadership roles within several of Assurant’s global businesses. As Head of International, he successfully improved the underlying performance of the company’s European operations and expanded its global footprint in key markets, including establishing a leadership position in Japan. Most recently, Meier served as chief operating officer during which he integrated the company’s operations and technology teams, driving technology innovation to reduce cost-to-serve while enhancing the customer experience for Assurant’s major lines of business.

“Keith’s appointment represents our ability to deploy our deep bench of talent from a position of strength, building on our strong momentum and accelerating long-term profitable growth,” said Demmings. “He brings a unique combination of financial, business, and commercial expertise and a commitment to drive shareholder value through strategic investments and disciplined capital allocation. His track record of delivering business growth and digital innovation will strengthen our competitive advantage in the market.”

As CFO, Meier will be responsible for leading Assurant’s global finance organization, including its business finance, accounting, actuarial, tax, treasury, asset management, internal audit, and investor relations functions. Additionally, he will maintain oversight of the company’s global technology organization to continue to foster innovation and efficiency in support of Assurant’s client growth strategies.

Meier succeeds Richard Dziadzio who, after seven years with the company, will be leaving Assurant. Demmings commented, "We thank Richard for his many contributions and dedication to excellence during his tenure with Assurant.” Dziadzio oversaw the implementation of the company’s global operating model in finance to support business transformation, while also advancing the company’s prudent capital management strategy. He will remain with Assurant until mid-March of 2024 to support an orderly transition.

The company also announced today that, effective immediately, Francesca Luthi has been named chief operating officer (COO), continuing to report to Keith Demmings. She will take responsibility for Assurant’s global operations and the company’s centers of excellence for customer experience, data analytics, and digital and artificial intelligence transformation. To further accelerate Assurant’s strategic priorities, Luthi will maintain oversight of the company’s people organization, communications, sustainability, diversity, equity and inclusion (DEI), global sourcing, and facilities functions.

According to Demmings, “With more than 7,000 employees across our global operations, Francesca’s appointment as COO will drive significant business value and advance our progress in connecting and delivering superior employee and customer experiences. She is a proven global change agent within Assurant, and a champion of our

culture, who will focus on accelerating value realization through the ongoing deployment of emerging technologies and a steadfast focus on operational excellence.”

As chief administrative officer and acting chief human resources officer, Luthi led a transformation of the People Organization to strengthen Assurant’s culture and empower its 13,700 employees worldwide to deliver on the company’s growth and innovation agenda. As part of this effort, she designed and executed Assurant’s “Future of Work” program, including resetting talent strategies, enabling flexible ways of working, and restructuring the company’s corporate real estate portfolio to evolve Assurant’s workplace environment and consistently increase employee engagement. Through the deployment of emerging technologies, she drove meaningful improvements to the employee experience while also driving scale efficiencies.

“Keith and Francesca exemplify the depth and breadth of our executive bench. I am confident that in these new roles they will accelerate growth for the benefit of our clients, employees and shareholders,” Demmings concluded.

About Assurant

Assurant, Inc. (NYSE: AIZ) is a leading global business services company that supports, protects and connects major consumer purchases. A Fortune 500 company with a presence in 21 countries, Assurant supports the advancement of the connected world by partnering with the world’s leading brands to develop innovative solutions and to deliver an enhanced customer experience through mobile device solutions, extended service contracts, vehicle protection services, renters insurance, lender-placed insurance products and other specialty products.

Learn more at assurant.com or on X (formerly Twitter) @Assurant.

###

Media Contact:

Stacie Sherer

Vice President, Corporate Communications

917.420.0980

stacie.sherer@assurant.com

Investor Relations Contact:

Sean Moshier

Vice President, Investor Relations

914.204.2253

sean.moshier@assurant.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeniorSubordinatedNotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

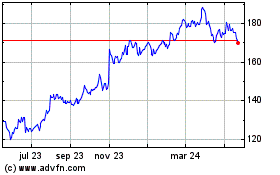

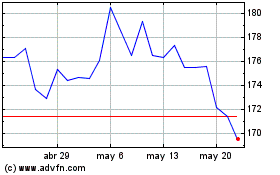

Assurant (NYSE:AIZ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Assurant (NYSE:AIZ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024