0001393584false00013935842024-12-172024-12-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 17, 2024 |

American Well Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39515 |

20-5009396 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

75 State Street 26th Floor |

|

Boston, Massachusetts |

|

02109 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 617 204-3500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock, $0.01 Par Value |

|

AMWL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Amendment to Employment Agreement with Mark Hirschhorn

On December 17, 2024, American Well Corporation (the “Company”) appointed its current Chief Financial Officer, Mark Hirschhorn, age 60, to also serve as its Chief Operating Officer. Mr. Hirschhorn is a healthcare technology industry leader, with over three decades of experience in financial and strategic operations, having served in senior executive positions for both public and private companies. Prior to his appointment as the Company’s Chief Financial Officer, from January 2022 to September 2024, he served as chief executive officer of TapestryHealth. Prior to that, he spent seven years at Teladoc Health where he held key roles as chief financial officer and chief operating officer from October 2012 to January 2019, and Talkspace where he contributed to strong growth and strategic repositioning efforts as president and COO from February 2020 to November 2021. Mr. Hirschhorn does not have any family relationships with any executive officer or director of the Company. Mr. Hirschhorn is not a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

In connection with that appointment, the Company entered into an amendment (the “Hirschhorn Amendment”) to the existing Employment Agreement, dated as of October 14, 2024, with Mr. Hirschhorn. The Hirschhorn Amendment provides that (i) effective immediately Mr. Hirschhorn (a) shall be appointed Chief Financial Officer and Chief Operating Officer, and (b) receive an increase in his base salary to $575,000, and (iii) beginning in the 2025 fiscal year, receive an increase in his target annual bonus to 125% of his base salary. The Hirschhorn Amendment provides that for the fiscal 2024 year, Mr. Hirschhorn will receive an annual bonus of $500,000.

Separation Agreement with Kathy Weiler

On December 17, 2024, the Company entered into a separation agreement (“Weiler Agreement”) with Kathy Weiler (Chief Commercial & Growth Officer). The Weiler Agreement provides that Ms. Weiler’s employment with the Company will end on December 31, 2024. In addition, Ms. Weiler will receive the benefits outlined in Section 8(c) of her Employment Agreement with the Company, dated April 17, 2023, as amended (“Weiler Employment Agreement”), with the following modifications: (i) she will receive payment of her target bonus for 2024 on January 24, 2025 in lieu of a payment of her 2024 annual bonus based on actual results, and (ii) in lieu of the salary continuation payments to which Ms. Weiler is entitled under Section 8(c) of the Weiler Employment Agreement such that all such payments are made in in a single lump sum on January 24, 2025.

The foregoing summary descriptions of the Hirschhorn Amendment and the Weiler Agreement are not complete and are subject to, and qualified in its entirety by reference to, the full text of the Hirschhorn Amendment and the Weiler Agreement, respectively, which are filed as Exhibits 10.1 and 10.2 to this Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is being filed herewith:

|

|

|

10.1 |

|

Amendment to Employment Agreement between American Well Corporation and Mark Hirschhorn, dated December 17, 2024 |

10.2 |

|

Separation Agreement between American Well Corporation and Kathy Weiler, dated December 17, 2024 |

99.1 |

|

Press Release, dated December 18, 2024, issued by American Well Corporation |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

AMERICAN WELL CORPORATION |

|

|

|

|

Date: |

December 18, 2024 |

By: |

/s/ Bradford Gay |

|

|

|

Bradford Gay

Senior Vice President, General Counsel |

AMERICAN WELL CORPORATION

AMENDMENT TO EMPLOYMENT AGREEMENT

THIS AMENDMENT TO EMPLOYMENT AGREEMENT (the “Amendment”), effective as of December 17, 2024 (the “Effective Date”), is made to that certain Employment Agreement (“Agreement”), dated October 14, 2024, by and between American Well Corporation, a Delaware corporation (the “Company”), and Mark Hirschhorn, an individual (the “Executive”) (hereinafter collectively referred to as “the parties”), as amended. Where the context requires, references to the Company shall include the Company’s subsidiaries and affiliates.

RECITALS

WHEREAS, Company and Executive desire to revise the commercial terms of the Agreement.

NOW, THEREFORE, in consideration of the respective agreements of the parties contained herein, it is agreed as follows:

1.Section 2(a) of the Agreement is hereby deleted in its entirety and replace with the following:

“(a) Executive shall be employed as Executive Vice President, Chief Financial Officer and Chief Operating Officer of the Company, reporting to the CEO. Executive shall perform the duties, undertake the responsibilities and exercise the authority customarily performed, undertaken and exercised by persons situated in similar executive capacities.”

2.Sections 3(a) and (b) of the Agreement are hereby deleted in their entirety and replaced with the following:

“(a) Base Salary. Beginning effective as of December 17, 2024, during the Employment Term, Executive shall be paid an annual base salary of US $575,000 (as in effect from time to time, “Base Salary”). The Base Salary shall be payable in accordance with the Company’s regular payroll practices as then in effect.

(a)Annual Bonus. Subject to the terms of the Company’s annual cash bonus program as in effect from time to time and the provisions hereof, for each fiscal year of the Company ending during the Employment Term (commencing with the 2025 fiscal year), Executive shall be eligible to receive a target annual cash bonus of 125% of Base Salary (such target bonus, as may hereafter be increased, the “Target Bonus”). For the 2024 fiscal year, Executive shall receive an annual bonus equal to $500,000. Annual bonuses, if any, will be payable after the close of the applicable fiscal year, but in any event prior to March 15 of the following calendar year. The criteria for, and attainment of, Executive’s annual bonus will be at the sole discretion of the compensation committee (the “Committee”) of the Board of Directors of the Company (the “Board”) and may be based on the achievement of both corporate and personal performance objectives.”

3.No Other Modification. Except as modified and amended herein, all other terms and provisions of the Agreement will remain in full force and effect.

4.Counterparts. This Agreement may be executed in separate counterparts, any one of which need not contain signatures of more than one party, but all of which taken together will constitute one and the same Agreement. Signatures transmitted via facsimile or PDF will be deemed the equivalent of originals.

[Remainder of page left intentionally blank]

IN WITNESS WHEREOF, the parties have executed this Employment Agreement as of the day and year first above written, to be effective as of the Effective Date.

AMERICAN WELL CORPORATION

By: /s/ Brad Gay

Name: Brad Gay

Title: General Counsel

EXECUTIVE

By: /s/ Mark Hirschhorn

Name: Mark Hirschhorn

December 17, 2024

Dear Kathy:

1. Separation of Employment. Your employment with American Well Corporation (the “Company”) will end on December 31, 2024 (the “Separation Date”). You acknowledge that from and after the Separation Date, you shall have no authority to, and shall not, represent yourself as an employee or agent of the Company.

2. Final Pay Check and Retention Amount. On the Separation Date, you will be paid your Accrued Compensation as defined in Section 8 of your American Well Corporation Employment Agreement dated April 17, 2023 (as amended by the amendments to such Employment Agreement effective as of August 14, 2024 and August 16, 2024, collectively, the “Employment Agreement”) and (ii) the Retention Amount (as defined in the Retention Agreement, as defined below) of Five Hundred Thousand Dollars and Zero cents ($500,000) as provided in the Retention Agreement entered into as of July 1, 2024 (the “Retention Agreement”). You acknowledge that other than the payments and benefits as provided under this Letter Agreement, upon signing this Letter Agreement you are not entitled to any other compensation including, without limitation, wages, bonuses, retention payments, equity acceleration, commissions, earned paid sick leave, holiday pay or any other form of compensation or benefit.

Except as otherwise provided in the Employment Agreement, all employment-related benefits, including all accident and health insurance benefits, will terminate on the last day of the month during which the Separation Date occurs, in this case December 31, 2024, except that any benefits for which you elect COBRA continuation coverage will continue until the date applicable pursuant to COBRA.

3. Termination Payments and Benefits. Provided you timely sign and not revoke the Release, in exchange for the promises and release of claims contained herein (and subject to such release becoming effective and irrevocable) the Company agrees to provide you with the following payments and benefits (the “Termination Benefits”) at the times, and subject to the conditions, set forth below:

i.The Company shall pay you as severance pay, Four Hundred Eighty Five Thousand Dollars and Zero cents ($485,000.00), which is equal to one (1) times your current Base Salary (as defined in the Employment Agreement), less all customary and required taxes and employment-related deductions. Payment of the severance pay shall be made on January 24, 2025;

ii.If you are participating in the Company’s group health insurance plans on your Separation Date, and you timely elect and remain eligible for continued coverage under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”) or if applicable, state or local insurance laws, the Company shall pay that portion of your premiums that the Company was paying prior to the Separation Date for the period of twelve (12) months following your Separation Date, or for the continuation period for which you are eligible, whichever is shorter;

iii.In lieu of any other bonus otherwise payable to you in respect of the 2024 fiscal year, the Company shall pay you a Target Bonus (as defined in the Employment Agreement) for the 2024 fiscal year in the amount of Four Hundred Eighty Five Thousand Dollars and Zero cents ($485,000.00) less all customary and required

taxes and employment-related deductions. Payment of the Target Bonus shall be made on January 24, 2025;

iv.With respect to each unvested equity award held by you as of your Separation Date, notwithstanding anything in the award agreement or applicable plan governing each such equity award to the contrary, such equity award shall vest as to the portion that would have vested had you remained employed through the first anniversary of your Separation Date and shall otherwise be governed by the terms of the applicable plan and/or award agreement; and

v.Section 12 of the Employment Agreement shall be deleted in its entirety and replaced with the provisions set forth on Exhibit A hereto.

You agree to promptly submit all outstanding expense reports for business expenses you incurred prior to the Separation Date. In the event that you do not submit expense reports within five (5) days of the Separation Date or do not have appropriate receipts for submitted expenses, then the Company will have no obligation to reimburse you for such expenses.

Your receipt and retention of the benefits described above is expressly conditioned upon your compliance with Section 12 of the Employment Agreement (as amended and restated as set forth on Exhibit A hereto) as well as your compliance in all material respects with Sections 11, 14 and 15 of the Employment Agreement. You and the Company agree that this Letter Agreement is entered into in connection with your separation from the Company and, therefore, not governed by the Massachusetts Noncompetition Agreement Act (MGL c.149, § 24L), as you are being given seven (7) business days during which you may rescind this Letter Agreement. In the event that a court of competent jurisdiction determines that Section 12 of the Employment Agreement (as amended and restated as set forth on Exhibit A hereto), which is expressly incorporated herein, is covered by the Massachusetts Noncompetition Agreement Act, you and the Company agree that this Letter Agreement is supported by mutually agreed-upon consideration under the Massachusetts Noncompetition Agreement Act (MGL c.149, § 24L) and agree and stipulate not to challenge the sufficiency of the agreed-upon consideration supporting this Letter Agreement. You further acknowledge and agree that: (a) the Company has advised you, in writing, that you have the right to consult with counsel prior to signing this Letter Agreement (and this document constitutes that writing); and (b) you have been given more than ten (10) business days to review this Letter Agreement prior to signing it.

4. Surviving Employment Agreement Obligations.

You expressly acknowledge and agree to the following:

(a) That you will abide by the Sections of the Employment Agreement that expressly survive the termination of your employment with the Company, which are incorporated by reference herein, and shall remain in effect and continuous following your Separation Date. Those Sections of the Employment Agreement are Section 9, Section 409A; Section 10, Employee Protection; Section 11, Records and Confidential Data; Section 12, Covenant Not to Solicit and Not to Compete, Non-Disparagement; Section 13, Remedies for Breach of Obligations under Sections 12 and 13 hereof; Section 14, Cooperation; Section 15, Inventions and Intellectual Property; Section 16, Miscellaneous; and Section 17, Indemnification.

(c) You understand that nothing in this Letter Agreement prohibits you from reporting possible violations of federal law or regulation to any governmental agency or entity, including but not limited to the Department of Justice, the Securities and Exchange Commission, the Congress, and any agency Inspector General, or making other disclosures that are protected under the whistleblower provisions of federal law or regulation. You understand that you do not need the prior authorization of the Company to make any such reports or disclosures and that you are not required to notify the Company that you have made such reports or disclosures.

(d) This Letter Agreement does not in any way restrict or impede you from disclosing the underlying facts or circumstances regarding conduct that you reasonably believe to be illegal discrimination, harassment, retaliation, a wage and hour violation, or sexual assault, or that is recognized as against a clear mandate of public policy, the existence of a settlement involving such conduct, or exercising protected rights to the extent that such rights cannot be waived by agreement or from complying with any applicable law or regulation or a valid order of a court of competent jurisdiction or an authorized government agency, provided that such compliance does not exceed that required by the law, regulation, or order.

5. Your Release of Claims.

(a) Release. In consideration of the covenants set forth herein, and more particularly the benefits provided to you, and other good and valuable consideration and except as provided in Section 5(b) below, you and your respective agents, heirs, legatees, successors and assigns (collectively hereinafter “you”), hereby unconditionally and irrevocably release, remise, and forever discharge the Company, persons acting by, though, under or in concert with the Company (including, without limitation, its affiliated, related, parent or subsidiary entities, and their present and former directors, officers, and employees) of and from any and all actions, causes of actions, suits, debts, charges, complaints, claims, liabilities, obligations, promises, agreements, controversies, damages, and expenses (including attorney fees and costs actually incurred), of any nature whatsoever, in law or equity (collectively “Claims”), which you had, now have, or hereafter may have against the Company from the beginning of time through the date on which you execute this Letter Agreement (the “Execution Date”), whether known or unknown to you. Without limiting the generality of the foregoing waiver and release of claims, you specifically waive and release the Company from any Claim arising from or related to your employment relationship with the Company or the termination thereof including, without limitation:

(i) Claims under any federal, state (including, without limitation, Massachusetts) or local discrimination, fair employment practices or other employment related statute, regulation or executive order (as they may have been amended through the Execution Date) prohibiting discrimination or harassment based upon any protected status including, without limitation, age, race, national origin, gender, marital status, disability, veteran status or sexual orientation. Without limitation, specifically included in this paragraph are any Claims arising under the federal Age Discrimination in Employment Act, the Older Workers Benefit Protection Act, the Civil Rights Acts of 1866 and 1871, Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1991, the Massachusetts Fair Employment Practices Act (also known as Chapter 151B), the Equal Pay Act, the Americans with Disabilities Act, the Worker Adjustment and Retraining Notification Act and any similar statute;

(ii) Claims under any other federal, state (including, without limitation, Massachusetts) or local employment-related statute, regulation or executive order (as they may have been amended through the Execution Date) relating to wages, hours or any other terms and conditions of employment, including, without limitation, the Massachusetts Payment of Wages

Law (Massachusetts General Laws Chapter 149, §§ 148, 150), Massachusetts General Laws Chapter 149 in its entirety and Massachusetts General Laws Chapter 151 in its entirety (including, without limitation, the sections concerning payment of wages, minimum wage and overtime), the Fair Labor Standards Act, the Family and Medical Leave Act of 1993, the National Labor Relations Act, the Employee Retirement Income Security Act of 1974, the Consolidated Omnibus Budget Reconciliation Act of 1985 and any similar statute. You specifically acknowledge that you are waiving any Claims for unpaid wages under these and other statutes, regulations and executive orders;

(iii) Claims under any federal, state (including, without limitation, Massachusetts) or local common law theory including, without limitation, wrongful discharge, breach of express or implied contract, promissory estoppel, unjust enrichment, breach of a covenant of good faith and fair dealing, violation of public policy, defamation, interference with contractual relations, intentional or negligent infliction of emotional distress, invasion of privacy, misrepresentation, deceit, fraud or negligence;

(iv) Claims under any federal, state (including, without limitation, Massachusetts) or local securities law, including, without limitation, the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and any similar statute; and

(v) Claims arising under the Massachusetts Civil Rights Act (Massachusetts General Laws Chapter 12, § 11); the Massachusetts Equal Rights Act (Massachusetts General Laws Chapter 93); the Massachusetts Small Necessities Act (Massachusetts General Laws Chapter 149 § 52D); the Massachusetts Privacy Statute (Massachusetts General Laws Chapter. 214, § 1B and C); the Massachusetts AIDS Testing Act (Massachusetts General Laws Chapter 111 § 70F); the Massachusetts Consumer Protection Act (Massachusetts General Laws Chapter 93A); the Massachusetts Equal Rights for the Elderly and Disabled Law (Massachusetts General Laws Chapter 93, § 103); the Massachusetts Anti-Sexual Harassment Statute (Massachusetts General Laws Chapter 151B, § 3A); or any comparable law in any other jurisdiction;

(vi) Claims arising under federal, state or local law.

(b) Release Limitations; Participation in Agency Proceedings.

(i)Notwithstanding anything to the contrary contained in this Letter Agreement, this release does not include and will not preclude: (1) any claims or rights which cannot be waived by law, including you right to accrued and unused vacation pay; (2) any claims for the payments and benefits due under this Letter Agreement or claims to enforce rights that accrue under this Letter Agreement following termination of your employment; (3) any claims or rights to any vested benefits or vested rights that you may have under the express terms of any employee benefit, retirement, pension or equity plans; (4) any rights and/or claims under COBRA to elect continued group health plan coverage; (6) claims for reimbursement of approved business expenses incurred prior to the Separation Date, subject to the terms of Section 3; (7) rights, if any, to defense and indemnification from the Company or its insurers pursuant to the Company’s articles of incorporation or bylaws, applicable law or any applicable directors and officers insurance policies or indemnification agreement of the Company; and (8) any rights and/or claims you may have as a shareholder of the Company to the extent arising after the Separation Date.

(ii) This Release does not prohibit you from challenging the validity of this release under federal law, from filing a charge or complaint of employment-related discrimination with the Equal Employment Opportunity Commission (“EEOC”) or similar state agency, or from participating in any investigation or proceeding conducted by the EEOC or similar state agency. Your waiver and release, however, are intended to be a complete bar to any recovery or personal benefit by or to you with respect to any such claim (except those which cannot be released under law), including those raised through a charge with the EEOC. Accordingly, nothing in this section shall be deemed to limit the Company’s right to seek immediate dismissal of such charge or complaint on the basis that your signing of this Letter Agreement constitutes a full release of any individual rights under the federal discrimination laws, or to seek restitution to the extent permitted by law of the economic benefits provided to you under this Letter Agreement in the event you successfully challenge the validity of this release and prevail in any claim under the federal discrimination laws.

(c) Acknowledgement; Covenant Not to Sue. You acknowledge and agree that, but for providing this waiver and release, you would not be receiving the payments or benefits provided to you under this Letter Agreement. You represent that you have not initiated, filed, or caused to be filed and agree not to initiate, file or cause to be filed any released Claims against any released parties with respect to any released Claim. You expressly covenant and warrant that you have not assigned or transferred to any person or entity any portion of any released Claims that are waived, released and/or discharged herein. If you nonetheless file, cause to be filed, or pursue any released Claims against one or more released party, you will pay to each such released party any costs or expenses (including attorneys’ fees and court costs) incurred by such released party in connection with such released Claim. The parties agree that each of the released persons referenced in Section 5(a) are expressly intended to be third-party beneficiaries of this Section 5 and will be entitled to enforce it as if they were a party to this Letter Agreement.

(d) OWBPA Review and Rescission Period. You explicitly acknowledge that, because you are over forty (40) years of age, you have specific rights under the Age Discrimination in Employment Act (“ADEA”) and Older Workers Benefits Protection Act (“OWBPA”), which prohibit discrimination on the basis of age. It is Company’s desire and intent to make certain that you fully understand the provisions and effects of this Letter Agreement, and specifically Section 5, which includes a release of claims under the ADEA and OWBPA. To that end, you have been encouraged and given the opportunity to consult with legal counsel for the purpose of reviewing the terms of this Letter Agreement, and have been provided certain additional information required by the ADEA and OWBPA. Consistent with the provisions of the ADEA and OWBPA, the Company also is providing you with at least twenty one (21) days in which to consider and accept the terms of the Release and this Letter Agreement by signing below and returning it to the Company. You agree that any changes to this Letter Agreement, whether or not material, shall not restart this twenty one (21) day period. In addition, you may rescind your assent to this Letter Agreement within seven business (7) days after you sign it. You understand that such rescission period is intended to satisfy the requirements of the ADEA and OWBPA, as well as the requirements of the Massachusetts Noncompetition Act Agreement. To do so, you must deliver a notice of rescission to the Company, addressed to General Counsel, Bradford Gay, hand delivered, via electronic mail to Bradford.Gay@amwell.com, or postmarked within the seven (7) day period and sent by certified mail, return receipt requested. This Letter Agreement will not be effective until the date upon which the revocation period has expired, which will be the eighth business day after the date that this Letter Agreement is signed by you provided that you do not revoke it (the “Release Effective Date”).

6. Taxation. Both you and the Company intend this Letter Agreement to be in compliance with Section 409A of the Internal Revenue Code of 1986 (as amended). You acknowledge and agree, however, that the Company does not guarantee the tax treatment or tax consequences associated with any payment or benefit arising under this Letter Agreement, including, without limitation, to consequences related to Section 409A, and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest, or other expenses that may be incurred by you on account of non-compliance with Section 409A. In the event any payments or benefits are deemed by the IRS to be non-compliant, this Letter Agreement, at your option, shall be modified to the extent practicable, so as to make it compliant by altering the payments or benefits, or the timing of their receipt, provided that no such modification shall increase the Company’s obligations hereunder.

7. Entire Agreement / Modification / Waiver / Choice of Law / Enforceability. You acknowledge and agree that with the exception of Sections 9 through 17 of your Employment Agreement, which remain in full force and effect, this Letter Agreement supersedes any and all other prior or contemporaneous oral and/or written agreements between you and the Company (including, without limitation, the Retention Agreement)1, and together sets forth the entire agreement between you and the Company. No variations or modifications hereof shall be deemed valid unless reduced to writing and signed by the parties hereto. The failure of either party to seek enforcement of any provision of this Letter Agreement in any instance or for any period of time shall not be construed as a waiver of such provision or of such party’s right to seek enforcement of such provision in the future. This Letter Agreement shall be deemed to have been made in Massachusetts, shall take effect as an instrument under seal within Massachusetts, and shall be governed by and construed in accordance with the laws of Massachusetts, without giving effect to conflict of law principles. You agree that any action, demand, claim or counterclaim relating to the terms and provisions of this Letter Agreement, or to its breach, shall be subject to arbitration in Massachusetts under Section 16(g) of the Employment Agreement. Both parties hereby waive and renounce in advance any right to a trial by jury in connection with such legal action. The provisions of this Letter Agreement are severable, and if for any reason any part hereof shall be found to be unenforceable, the remaining provisions shall be enforced in full.

By executing this Letter Agreement, you are acknowledging that you have been afforded sufficient time to understand the terms and effects of this Letter Agreement, that your agreements and obligations hereunder are made voluntarily, knowingly and without duress, and that neither the Company nor its agents or representatives have made any representations inconsistent with the provisions of this Letter Agreement.

The parties agree that the last act necessary to render this Letter Agreement effective is for the Company to sign the Agreement, and the Agreement may be signed by the parties on one or more copies (including through electronic signature, such as DocuSign), each of which when signed will be deemed to be an original, and all of which together will constitute one and the same Letter Agreement. Signatures transmitted via facsimile or PDF will be deemed the equivalent of originals.

If the foregoing correctly sets forth our understanding, please sign, date and return the enclosed copy of this Letter Agreement to Bradford Gay on or before December 17, 2024.

For: American Well Corporation

By: _/s/ Bradford Gay_______________

Bradford Gay

SVP & General Counsel

Dated: 12/16/2024

Confirmed, Agreed and Acknowledged:

/s/ Kathy Weiler___________________

Kathy Weiler

Dated: 12/13/2024

EXHIBIT A

Each capitalized term that is used but not defined in this Exhibit A shall have the meaning given to it in the Employment Agreement.

12. Covenant Not to Solicit and Not to Compete; Non-Disparagement

(a)Covenants Not to Solicit or to Interfere. To protect the Confidential Information, Company Intellectual Property and other trade secrets of the Company and its subsidiaries, Executive agrees, during the Employment Term and for a period of twelve (12) months after Executive’s cessation of employment with the Company, not to solicit, hire or participate in or assist in any way in the solicitation or hire of any employees of the Company or any of its subsidiaries (or any person who was an employee of the Company or any of its subsidiaries during the six-month period preceding such action) in any country. For purposes of this covenant, “solicit” or “solicitation” means directly or indirectly influencing or attempting to influence employees of the Company or any of its subsidiaries to become employed with any other person, partnership, firm, corporation, or other entity.

In addition, to protect the Confidential Information, Company Intellectual Property and other trade secrets of the Company and its subsidiaries, Executive agrees, during the Employment Term and for a period of twelve (12) months after Executive’s cessation of employment with the Company, not to (x) solicit any client or customer to receive services or to purchase any goods or services in competition with those provided by the Company or any of its subsidiaries or (y) interfere or attempt to interfere in any material respect with the relationship between the Company or any of its subsidiaries on one hand and any client, customer, supplier, investor, financing source or capital market intermediary on the other hand, in any country. For purposes of this covenant, “solicit” or “solicitation” means directly or indirectly influencing or attempting to influence clients or customers of the Company or any of its subsidiaries to accept the services or goods of any other person, partnership, firm, corporation or other entity in competition with those provided by the Company or any of its subsidiaries. Notwithstanding the foregoing, Executive’s engaging in activities described in clause (x) of this paragraph shall not constitute a violation of this paragraph if such activities are not Prohibited Activities, as defined in Section 12(b) below, taking into account the exclusions contained in the proviso thereto.

Executive agrees that the covenants contained in this Section 12(a) are reasonable and desirable to protect the Confidential Information and Company Intellectual Property of the Company and its subsidiaries; provided that solicitation through general advertising or the provision of references shall not constitute a breach of such obligations.

(b) Covenant Not to Compete. To protect the Confidential Information, Company Intellectual Property and other trade secrets of the Company and its subsidiaries, and in consideration of the payments and benefits provided in the Letter Agreement to which

this Exhibit A is attached, Executive agrees, to the maximum extent permitted by applicable law, not to become involved with any entity that directly or indirectly engages in Prohibited Activities (as defined below) in any country in which the Company or any of its subsidiaries conducts such business, or plans to conduct such business during the Employment Term, during the period commencing with the Employment Term and ending twelve (12) months after Executive’s cessation of employment with the Company for any reason. For the purposes of this Agreement, the term “Prohibited Activities” means directly or indirectly owning any interest in, managing, participating in (whether as an employee, director, officer, consultant, partner, member, manager, representative or agent), consulting with or rendering services to any entity (including, without limitation, Doctor On Demand, MDLive, Teladoc, Epic Systems, Cerner or Zoom) in (A) the telehealth industry or (B) digital healthcare, that, in the case of clause (B), performs or plans to perform any of the services or manufactures or sells or plans to manufacture or sell any of the products planned, provided or offered by the Company or any of its subsidiaries or any products or services designed to perform the same function or achieve the same results as the products or services planned, provided or offered by the Company or any of its subsidiaries or performs or plans to perform any other services and/or engages or plans to engage in the development, production, manufacture, distribution or sale of any product similar to any planned or actual services performed or products developed, produced, manufactured, distributed or sold by the Company or any of its subsidiaries during the term of Executive’s employment with the Company and its subsidiaries, including, without limitation, any business activity that directly or indirectly provides the research, development, manufacture, marketing, selling or servicing of systems facilitating consumer communications with professional service providers in the digital healthcare field; provided that (i) Prohibited Activities shall not mean Executive’s investment in securities of a publicly-traded company (or a non-publicly traded entity through a passive investment) equal to less than five percent (5%) of such company’s outstanding voting securities, (ii) Prohibited Activities following cessation of Executive’s employment shall not include businesses of the Company or its subsidiaries which are reasonably projected, as of the termination date, to represent less than 5% of the consolidated revenues of the Company and its subsidiaries taken as a whole following the termination date, and (iii) Executive shall be permitted to provide services to an entity that has a unit, division, subsidiary or affiliate engaging in a Prohibited Activity so long as Executive does not provide services, directly or indirectly, to such unit, division, subsidiary or affiliate engaging in the Prohibited Activity. Executive agrees that the covenants contained in this Section 12(b) are (i) reasonable and desirable to protect the Confidential Information and Company Intellectual Property and other legitimate business interests of the Company and its subsidiaries; (ii) the area and time duration thereof are in all things reasonable and necessary to protect the goodwill and the operations and business of Company and its subsidiaries, and does not impose a greater restraint than is necessary to protect the goodwill or other business interests of the Company, and (iii) good and valuable consideration exists under the Agreement, for Executive's agreement to be bound thereby. Notwithstanding, if any of the restrictions set forth herein is found by a court having jurisdiction to be unreasonable or overly-broad

as to geographic area, scope or time or to be otherwise unenforceable, the parties hereto intend for the restrictions set forth herein to be reformed, modified and redefined by such court so as to be reasonable and enforceable and, as so modified by such court, to be fully enforced. Any reference to plans or planned activity in this paragraph shall be limited to plans or planned activities that are based upon material demonstrable actions. Following Executive’s cessation of employment, the prohibitions in this paragraph shall be limited to activities and planned activities (including locations) as of the date of Executive’s termination of employment.

(c)Non-Disparagement. Executive agrees not to make written or oral statements about the Company, its subsidiaries or affiliates, or its directors, executive officers or non-executive officer employees that are negative or disparaging, except as provided in Section 10 hereof or in the ordinary course of personnel performance reviews when making such statements is reasonable and appropriate. The Company, as represented by its directors and executive officers who are at the relevant time in service to the Company, shall not make written or oral statements about Executive that are negative or disparaging, except as provided in Section 10 hereof or in the ordinary course of personnel performance reviews when making such statements is reasonable and appropriate. Notwithstanding the foregoing, nothing in this Agreement or otherwise shall preclude Executive, the Company, its subsidiaries and affiliates, and the Company’s directors and executive officers from communicating or testifying truthfully to the extent required by law to any federal, state, provincial or local governmental agency or in response to a subpoena to testify issued by a court of competent jurisdiction or in connection with any litigation or arbitration between Executive and the Company or any of its affiliates or any of its directors, executive officers or non-executive officer employees. Either party may make truthful statements to the extent reasonably necessary to correct any inaccurate public statements made by the other party (including executives or directors of the Company) or in the normal course of permitted competitive actions.

(d)It is the intent and desire of Executive and the Company that the restrictive provisions of this Section 12 be enforced to the fullest extent permissible under the laws and public policies as applied in each jurisdiction in which enforcement is sought. If any particular provision of this Section 12 shall be determined to be invalid or unenforceable, such covenant shall be amended, without any action on the part of either party hereto, to delete therefrom the portion so determined to be invalid or unenforceable, such deletion to apply only with respect to the operation of such covenant in the particular jurisdiction in which such adjudication is made.

(e)Executive’s obligations under this Section 12 shall survive the termination of the Employment Term.

Amwell CFO Mark Hirschhorn Expands Leadership Role

Seasoned leader assumes responsibility for operations and sales as COO

BOSTON — Dec. 18, 2024 — Amwell® (NYSE: AMWL), a leader in digital care, has announced Chief Financial Officer (CFO) Mark Hirschhorn will take on an expanded role as chief operating officer, effective Jan. 1, 2025.

Hirschhorn will now oversee the company's operational and growth strategies, including the clinical, sales and marketing teams, while continuing his responsibilities as CFO. This move reflects Amwell’s commitment to scale its innovative solutions to meet the growing demand for digital healthcare.

"Since joining Amwell, Mark has proven himself to be a strong leader, and we’re thrilled to have him step into this expanded role," said Ido Schoenberg, M.D., CEO and chairman of Amwell. "Mark’s operational experience, coupled with his extensive financial acumen, will help us continue to streamline the Amwell portfolio of services and pursue core channels of profitable growth while powering the digital care aspirations of our clients. With these changes, we enable a higher level of focus on our mission of connecting and empowering providers, insurers, and innovators to deliver more accessible, affordable, high-quality care for the benefit of all stakeholders. We also solidify our confidence in our path to cash flow positive in 2026."

"I am eager to take on the additional responsibilities as COO," said Hirschhorn. "I look forward to working closely with our talented and streamlined leadership team to sharpen our operational focus on key priorities, drive greater efficiencies, optimize cash flow and deliver profitable growth while pursuing our mission to redefine healthcare delivery through technology-driven solutions."

As Amwell continues to streamline processes and drive alignment, two executives will leave the company. Chief Commercial and Growth Officer Kathy Weiler, and Chief Operating Officer Kurt Knight, will depart Amwell at the end of the year. Over her tenure, Weiler has contributed to meaningful cost initiatives while transforming the company’s growth organization. Knight has provided substantial leadership over his 14-year tenure, including key roles in strategy, M&A, the company’s IPO, rapidly scaling operations through the COVID-19 pandemic, and building and managing the company’s affiliated network of providers, Amwell Medical Group®, a strategic service for payer and provider organizations.

“Kathy’s leadership led to the creation of a formally structured and professionalized growth organization, which has had a meaningful and lasting impact on our business. Kurt is a foundational partner in Amwell. He has made an incredible contribution to our company over many years. He played a major role in transforming Amwell into the company it is today, and I am forever grateful. I thank both leaders for their contributions to Amwell,” said Schoenberg.

About Amwell

Amwell is a leading hybrid care, delivery enablement platform in the United States and globally, connecting and enabling providers, payers, patients, and innovators to deliver greater access to more affordable, higher quality care. Amwell believes that hybrid care delivery will transform healthcare. We offer a single, comprehensive platform to support all digital health needs from urgent to acute and post-acute care, as well as chronic care management and healthy living. With nearly two decades of experience, Amwell powers the digital care of more than 50 health plans, which collectively represent more than 100 million covered lives, and many of the nation’s largest health systems. For more information, please visit https://business.amwell.com/.

©2024 American Well Corporation. All rights reserved. Amwell®, SilverCloud®, Amwell ConvergeTM, CarepointTM , Amwell Medical Group®, and the Amwell Logo are registered trademarks or trademarks of American Well Corporation.

Media:

Angela Vogen

Press@amwell.com

Investors:

Sue Dooley

Sue.Dooley@amwell.com

Notice of Ownership

All materials contained herein are the property of American Well Corporation and are copyrighted under United States law and applicable international copyright laws and treaty provisions. The materials contained herein are not work product or "work for hire" on behalf of any third party. The materials contained herein constitute the confidential information of American Well Corporation, except for specific data elements provided by third parties, which are the confidential information of such third parties. The content contained herein results from the application of American Well proprietary processes, analytical frameworks, algorithms, business methods, solution construction aids and templates, all of which are and remain the property of American Well Corporation.

Trademark Notice

All of the trademarks, service marks and logos displayed on these materials (the "Trademark(s)") are registered and unregistered trademarks of American Well Corporation or third parties who have licensed their Trademarks to American Well Corporation. Except as expressly stated in these terms and conditions, you may not reproduce, display or otherwise use any Trademark without first obtaining American Well Corporation's written permission.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

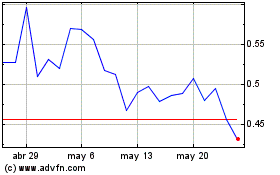

American Well (NYSE:AMWL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

American Well (NYSE:AMWL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025