-- Sales of $6.8 billion, at high-end of

guidance range --

-- Third-Quarter Earnings Per Diluted Share

of $1.88; Non-GAAP Earnings Per Diluted Share of $2.38 --

Arrow Electronics, Inc. (NYSE:ARW) today announced financial

results for its third quarter of 2024.

“In the third quarter, the company continued to execute well in

a challenging environment. While the cyclical correction continues

in our global components business, we saw enterprise IT spending

gain momentum,” said Sean Kerins, Arrow’s president and chief

executive officer. “I am pleased that we delivered revenue above

the midpoint of our guidance range and non-GAAP earnings per

diluted share ahead of our expectations,” said Mr. Kerins.

Arrow Consolidated

Quarter Ended

Nine Months Ended

September 28,

September 30,

September 28,

September 30,

(in millions except per share

data)

2024

2023

2024

2023

Consolidated sales

$

6,823

$

8,007

$

20,640

$

25,258

Net income attributable to

shareholders

101

199

293

709

Net income per diluted share

1.88

3.53

5.42

12.28

Non-GAAP net income attributable to

shareholders (1)

128

233

410

757

Non-GAAP net income per diluted share

2.38

4.14

7.59

13.12

In the third quarter of 2024, sales decreased 15 percent year

over year. Changes in foreign currencies had a positive impact on

growth of approximately $37 million on sales and $0.02 on earnings

per share on a diluted basis compared to the third quarter of

2023.

Global Components

“In our global components business, the broader ecosystem

inventory correction persists. Given the market environment, we

remain focused on our suppliers and customers while managing the

operational factors within our control,” said Mr. Kerins.

Global Components

Quarter Ended

Nine Months Ended

September 28,

September 30,

September 28,

September 30,

(in millions)

2024

2023

2024

2023

Global components sales

$

4,946

$

6,245

$

15,170

$

19,784

Global components operating income

189

379

624

1,178

Global components non-GAAP operating

income

193

386

654

1,198

In the third quarter of 2024, global components sales decreased

21 percent year over year. Americas components third-quarter sales

decreased 12 percent year over year. EMEA components third-quarter

sales decreased 35 percent year over year and decreased 36 percent

year over year on a constant currency basis. Asia-Pacific

components third-quarter sales decreased 15 percent year over

year.

Global Enterprise Computing

Solutions

“We saw better momentum and strong sales growth in our global

ECS business, highlighted by a healthy market for hybrid cloud

solutions, steady market dynamics in Europe, and an improving

trajectory for us in North America,” said Mr. Kerins.

Global Enterprise Computing

Solutions (ECS)

Quarter Ended

Nine Months Ended

September 28,

September 30,

September 28,

September 30,

(in millions)

2024

2023

2024

2023

Global ECS sales

$

1,877

$

1,762

$

5,471

$

5,474

Global ECS operating income

76

55

250

222

Global ECS non-GAAP operating income

77

56

253

226

In the third quarter of 2024, global ECS sales increased 7

percent year over year and increased 6 percent year over year on a

constant currency basis. EMEA ECS third-quarter sales increased 13

percent year over year and increased 11 percent year over year on a

constant currency basis. Americas ECS third-quarter sales increased

2 percent year over year.

Other Financial

Information

“In the third quarter, we reduced inventory levels by

approximately $125 million, or $1.3 billion over the last 12

months. We also generated $81 million in cash flow from operations

and repurchased $50 million of shares,” said Raj Agrawal, Arrow’s

senior vice president and chief financial officer.

“In line with our ongoing efforts to simplify our operations, we

are restructuring the business to drive additional cost savings,”

said Mr. Agrawal.

In addition to actions taken to date, the company estimates

total restructuring expenses over the next two years of $185

million, including costs of $135 million for efficiency

initiatives, as well as costs of approximately $50 million to exit

certain lines of non-core business. The company has identified

opportunities to reduce annual operating expenses by the end of

2026 by approximately $90 million to $100 million, primarily

related to reorganizing and consolidating certain areas of the

company’s operations.

1 A reconciliation of non-GAAP financial

measures to GAAP financial measures is presented in the

reconciliation tables included herein.

Fourth-Quarter 2024

Outlook

- Consolidated sales of $6.67 billion to $7.27 billion, with

global components sales of $4.50 billion to $4.90 billion, and

global enterprise computing solutions sales of $2.17 billion to

$2.37 billion

- Net income per share on a diluted basis of $1.35 to $1.55, and

non-GAAP net income per share on a diluted basis of $2.48 to

$2.68

- Average tax rate in the range of 23 to 25 percent

- Interest expense of approximately $60 million to $65

million

- Changes in foreign currencies to increase sales by

approximately $60 million, and earnings per share on a diluted

basis by $0.02 compared to the fourth quarter of 2023

- Changes in foreign currencies to have no impact on growth in

sales or earnings per share on a diluted basis compared to the

third quarter of 2024

Fourth-Quarter 2024 GAAP to

non-GAAP Outlook Reconciliation

NON-GAAP SALES RECONCILIATION

Quarter Ended

Quarter Ended

December 31,

December 31,

December 31,

September 28,

(in billions)

2024

2023

% Change

2024

2024

% Change

Global components sales, GAAP

$

4.50 - 4.90

$

5.64

(20%) - (13%)

$

4.50 - 4.90

$

4.95

(9%) - (1%)

Impact of changes in foreign

currencies

—

0.04

—

—

Global components sales, constant

currency

$

4.50 - 4.90

$

5.68

(21%) - (14%)

$

4.50 - 4.90

$

4.95

(9%) - (1%)

Global ECS sales, GAAP

$

2.17 - 2.37

$

2.21

(2%) - 7%

$

2.17 - 2.37

$

1.88

15% - 26%

Impact of changes in foreign

currencies

—

0.02

—

—

Global ECS sales, constant currency

$

2.17 - 2.37

$

2.23

(3%) - 6%

$

2.17 - 2.37

$

1.88

15% - 26%

NON-GAAP EARNINGS

RECONCILIATION

Reported GAAP measure

Intangible amortization

expense

Restructuring &

integration charges

Non-GAAP measure

Net income per diluted share

$1.35 to $1.55

$0.10

$1.03

$2.48 to $2.68

Earnings Presentation

Please refer to the earnings presentation, which can be found at

investor.arrow.com, as a supplement to the company’s earnings

release. The company uses its website as a tool to disclose

important information about the company and to comply with its

disclosure obligations under Regulation Fair Disclosure.

Webcast and Conference Call

Information

Arrow Electronics will host a conference call to discuss

third-quarter 2024 financial results on Oct. 31, 2024, at 1:00 PM

ET.

A live webcast of the conference call will be available via the

events section of investor.arrow.com or by accessing the webcast

link directly at https://events.q4inc.com/attendee/487434328.

Shortly after the conclusion of the conference call, a webcast

replay will be available on the Arrow website for one year.

About Arrow Electronics

Arrow Electronics (NYSE:ARW) sources and engineers technology

solutions for thousands of leading manufacturers and service

providers. With global 2023 sales of $33 billion, Arrow’s portfolio

enables technology across major industries and markets. Learn more

at arrow.com.

Information Relating to Forward-Looking

Statements

This press release includes “forward-looking” statements, as the

term is defined under the federal securities laws, including but

not limited to statements regarding: Arrow’s future financial

performance, including its outlook on financial results for the

fourth quarter of fiscal 2024 such as sales, net income per diluted

share, non-GAAP net income per diluted share, average tax rate,

interest and other expense, impact to sales due to changes in

foreign currencies, intangible amortization expense per diluted

share, restructuring & integration charges per diluted share,

the timing of the completion of the Operating Expense Efficiency

Plan (the “Plan”) and Arrow’s estimated costs and expected

operating expense reductions from the Plan, industry trends and

expectations regarding market demand and conditions and shareholder

returns. These and other forward-looking statements are subject to

numerous assumptions, risks, and uncertainties, which could cause

actual results or facts to differ materially from such statements

for a variety of reasons, including, but not limited to: the

incurrence of additional charges not currently contemplated and

failure to realize contemplated cost savings due to unanticipated

events that may occur, including in connection with the

implementation of the Plan; unfavorable economic conditions;

disruptions or inefficiencies in the supply chain; political

instability and changes; impacts of military conflict and

sanctions; industry conditions; changes in product supply, pricing

and customer demand; competition; other vagaries in the global

components and the global ECS markets; deteriorating economic

conditions, including economic recession, inflation, tax rates,

foreign currency exchange rates, or the availability of capital;

the effects of natural or man-made catastrophic events; changes in

relationships with key suppliers; increased profit margin pressure;

changes in legal and regulatory matters; non-compliance with

certain regulations, such as export, antitrust, and anti-corruption

laws; foreign tax and other loss contingencies; breaches of

security or privacy of business information and information system

failures, including related to current or future implementations,

integrations and upgrades; outbreaks, epidemics, pandemics, or

public health crises; restructuring activities and impacts thereof;

and the company's ability to generate positive cash flow. For a

further discussion of these and other factors that could cause the

company's future results to differ materially from any

forward-looking statements, see the section entitled “Risk Factors”

in the company's most recent Quarterly Report on Form 10-Q and the

company's most recent Annual Report on Form 10-K, as well as in

other filings the company makes with the Securities and Exchange

Commission. Shareholders and other readers are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date on which they are made. The company

undertakes no obligation to update publicly or revise any of the

forward-looking statements.

Certain Non-GAAP Financial

Information

In addition to disclosing financial results that are determined

in accordance with accounting principles generally accepted in the

United States (“GAAP”), the company also provides certain non-GAAP

financial information. The company provides the following non-GAAP

metrics: sales, operating income (including by business segment),

income before income taxes, provision for income taxes,

consolidated net income, noncontrolling interest, net income

attributable to shareholders, effective tax rate and net income per

share on a diluted basis. The foregoing non-GAAP measures are

adjusted by certain of the following, as applicable: impact of

changes in foreign currencies (referred to as “changes in foreign

currencies” or “on a constant currency basis”) by re-translating

prior-period results at current period foreign exchange rates;

identifiable intangible asset amortization, restructuring,

integration, and other charges; net gains and losses on

investments; write downs (reversals) to inventory related to the

wind down of a business within the global components reportable

segment (“impact of wind down”); loss on extinguishment of debt;

and impact of tax legislation changes. Management believes that

providing this additional information is useful to the reader to

better assess and understand the company’s operating performance

and future prospects in the same manner as management, especially

when comparing results with previous periods. Management typically

monitors the business as adjusted for these items, in addition to

GAAP results, to understand and compare operating results across

accounting periods, for internal budgeting purposes, for short- and

long-term operating plans, and to evaluate the company's financial

performance. However, analysis of results on a non-GAAP basis

should be used as a complement to, in conjunction with, and not as

a substitute for, data presented in accordance with GAAP. For

further discussion of our non-GAAP measures and related

adjustments, refer to the section entitled “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in

the company's most recent Quarterly Report on Form 10-Q and the

company's most recent Annual Report on Form 10-K.

ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands except per share

data)

(Unaudited)

Quarter Ended

Nine Months Ended

September 28, 2024

September 30, 2023

September 28, 2024

September 30, 2023

Sales

$

6,823,319

$

8,007,019

$

20,640,447

$

25,257,963

Cost of sales

6,038,491

7,027,422

18,151,349

22,098,495

Gross profit

784,828

979,597

2,489,098

3,159,468

Operating expenses:

Selling, general, and administrative

534,508

563,150

1,670,429

1,822,783

Depreciation and amortization

40,592

45,005

123,356

137,948

Restructuring, integration, and other

34,466

31,359

121,859

44,252

609,566

639,514

1,915,644

2,004,983

Operating income

175,262

340,083

573,454

1,154,485

Equity in earnings of affiliated

companies

1,002

1,392

1,912

4,373

Gain (loss) on investments, net

3,757

(6,159

)

(760

)

4,649

Loss on extinguishment of debt

—

—

(1,657

)

—

Employee benefit plan expense, net

(979

)

(854

)

(2,892

)

(2,510

)

Interest and other financing expense,

net

(62,947

)

(82,180

)

(209,442

)

(246,672

)

Income before income taxes

116,095

252,282

360,615

914,325

Provision for income taxes

15,198

52,241

66,996

201,168

Consolidated net income

100,897

200,041

293,619

713,157

Noncontrolling interests

330

1,382

753

4,189

Net income attributable to

shareholders

$

100,567

$

198,659

$

292,866

$

708,968

Net income per share:

Basic

$

1.90

$

3.57

$

5.48

$

12.43

Diluted

$

1.88

$

3.53

$

5.42

$

12.28

Weighted-average shares outstanding:

Basic

53,010

55,597

53,476

57,021

Diluted

53,475

56,298

53,999

57,715

ARROW ELECTRONICS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands except par

value)

(Unaudited)

September 28, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

248,000

$

218,053

Accounts receivable, net

11,726,601

12,238,073

Inventories

4,529,655

5,187,225

Other current assets

1,022,620

684,126

Total current assets

17,526,876

18,327,477

Property, plant, and equipment, at

cost:

Land

5,691

5,691

Buildings and improvements

193,315

195,579

Machinery and equipment

1,648,708

1,632,606

1,847,714

1,833,876

Less: Accumulated depreciation and

amortization

(1,354,179

)

(1,303,136

)

Property, plant, and equipment, net

493,535

530,740

Investments in affiliated companies

61,506

62,741

Intangible assets, net

105,313

127,440

Goodwill

2,084,160

2,050,426

Other assets

663,259

627,344

Total assets

$

20,934,649

$

21,726,168

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

9,392,389

$

10,070,015

Accrued expenses

1,668,633

1,463,915

Short-term borrowings, including current

portion of long-term debt

909,826

1,653,954

Total current liabilities

11,970,848

13,187,884

Long-term debt

2,363,241

2,153,553

Other liabilities

564,483

507,424

Equity:

Shareholders’ equity:

Common stock, par value $1:

Authorized - 160,000 shares in both 2024

and 2023

Issued - 58,059 and 57,691 shares in 2024

and 2023, respectively

58,059

57,691

Capital in excess of par value

582,572

553,340

Treasury stock (5,472 and 3,880 shares in

2024 and 2023, respectively), at cost

(506,157

)

(297,745

)

Retained earnings

6,083,083

5,790,217

Accumulated other comprehensive loss

(254,460

)

(298,039

)

Total shareholders’ equity

5,963,097

5,805,464

Noncontrolling interests

72,980

71,843

Total equity

6,036,077

5,877,307

Total liabilities and equity

$

20,934,649

$

21,726,168

ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In thousands)

(Unaudited)

Quarter Ended

September 28, 2024

September 30, 2023

Cash flows from operating activities:

Consolidated net income

$

100,897

$

200,041

Adjustments to reconcile consolidated net

income to net cash provided by operations:

Depreciation and amortization

40,592

45,005

Amortization of stock-based

compensation

8,487

6,519

Equity in earnings of affiliated

companies

(1,002

)

(1,392

)

Deferred income taxes

(12,889

)

(19,639

)

Loss (gain) on investments, net

(3,686

)

6,159

Other

(670

)

1,092

Change in assets and liabilities, net of

effects of acquired businesses:

Accounts receivable, net

(701,168

)

260,749

Inventories

169,211

(383,647

)

Accounts payable

550,797

157,482

Accrued expenses

(83,506

)

127,235

Other assets and liabilities

13,495

(77,897

)

Net cash provided by operating

activities

80,558

321,707

Cash flows from investing activities:

Acquisition of property, plant, and

equipment

(18,519

)

(20,670

)

Other

10,677

—

Net cash used for investing activities

(7,842

)

(20,670

)

Cash flows from financing activities:

Change in short-term and other

borrowings

549,451

603,693

Proceeds from (repayments of) long-term

bank borrowings, net

(613,449

)

(557,308

)

Net proceeds from note offering

494,886

—

Redemption of notes

(500,000

)

—

Proceeds from exercise of stock

options

585

443

Repurchases of common stock

(51,051

)

(203,491

)

Other

(899

)

—

Net cash used for financing activities

(120,477

)

(156,663

)

Effect of exchange rate changes on

cash

82,752

(51,462

)

Net increase in cash and cash

equivalents

34,991

92,912

Cash and cash equivalents at beginning of

period

213,009

240,382

Cash and cash equivalents at end of

period

$

248,000

$

333,294

ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In thousands)

(Unaudited)

Nine Months Ended

September 28, 2024

September 30, 2023

Cash flows from operating activities:

Consolidated net income

$

293,619

$

713,157

Adjustments to reconcile consolidated net

income to net cash provided by operations:

Depreciation and amortization

123,356

137,948

Amortization of stock-based

compensation

30,187

34,868

Equity in earnings of affiliated

companies

(1,912

)

(4,373

)

Deferred income taxes

(20,287

)

(53,038

)

Loss on extinguishment of debt

1,657

—

Loss (gain) on investments, net

1,077

(4,649

)

Other

4,194

4,078

Change in assets and liabilities, net of

effects of acquired businesses:

Accounts receivable, net

512,394

1,585,521

Inventories

662,685

(525,020

)

Accounts payable

(687,015

)

(1,355,777

)

Accrued expenses

189,537

(88,348

)

Other assets and liabilities

(305,543

)

(25,660

)

Net cash provided by operating

activities

803,949

418,707

Cash flows from investing activities:

Acquisition of property, plant, and

equipment

(70,155

)

(57,775

)

Other

17,129

10,962

Net cash used for investing activities

(53,026

)

(46,813

)

Cash flows from financing activities:

Change in short-term and other

borrowings

(595,069

)

802,032

Proceeds from (repayments of) long-term

bank borrowings, net

60,158

(566,734

)

Net proceeds from note offering

989,564

496,268

Redemption of notes

(1,000,000

)

(300,000

)

Proceeds from exercise of stock

options

5,353

16,824

Repurchases of common stock

(214,352

)

(719,708

)

Settlement of forward-starting interest

rate swap

—

56,711

Other

(1,040

)

(142

)

Net cash used for financing activities

(755,386

)

(214,749

)

Effect of exchange rate changes on

cash

34,410

(766

)

Net increase in cash and cash

equivalents

29,947

156,379

Cash and cash equivalents at beginning of

period

218,053

176,915

Cash and cash equivalents at end of

period

$

248,000

$

333,294

ARROW ELECTRONICS, INC.

NON-GAAP SALES RECONCILIATION

(In thousands)

(Unaudited)

Quarter Ended

September 28, 2024

September 30, 2023

% Change

Consolidated sales, as reported

$

6,823,319

$

8,007,019

(14.8

)

%

Impact of changes in foreign

currencies

—

36,708

Consolidated sales, constant currency

$

6,823,319

$

8,043,727

(15.2

)

%

Global components sales, as reported

$

4,946,059

$

6,245,192

(20.8

)

%

Impact of changes in foreign

currencies

—

24,592

Global components sales, constant

currency

$

4,946,059

$

6,269,784

(21.1

)

%

Americas components sales, as reported

$

1,638,459

$

1,869,934

(12.4

)

%

Impact of changes in foreign

currencies

—

(809

)

Americas components sales, constant

currency

$

1,638,459

$

1,869,125

(12.3

)

%

Asia components sales, as reported

$

2,017,814

$

2,387,835

(15.5

)

%

Impact of changes in foreign

currencies

—

2,433

Asia components sales, constant

currency

$

2,017,814

$

2,390,268

(15.6

)

%

EMEA components sales, as reported

$

1,289,786

$

1,987,423

(35.1

)

%

Impact of changes in foreign

currencies

—

22,968

EMEA components sales, constant

currency

$

1,289,786

$

2,010,391

(35.8

)

%

Global ECS sales, as reported

$

1,877,260

$

1,761,827

6.6

%

Impact of changes in foreign

currencies

—

12,116

Global ECS sales, constant currency

$

1,877,260

$

1,773,943

5.8

%

Americas ECS sales, as reported

$

1,033,115

$

1,015,924

1.7

%

Impact of changes in foreign

currencies

—

(645

)

Americas ECS sales, constant currency

$

1,033,115

$

1,015,279

1.8

%

EMEA ECS sales, as reported

$

844,145

$

745,903

13.2

%

Impact of changes in foreign

currencies

—

12,761

EMEA ECS sales, constant currency

$

844,145

$

758,664

11.3

%

ARROW ELECTRONICS, INC.

NON-GAAP SALES RECONCILIATION

(In thousands)

(Unaudited)

Nine Months Ended

September 28, 2024

September 30, 2023

% Change

Consolidated sales, as reported

$

20,640,447

$

25,257,963

(18.3

)

%

Impact of changes in foreign

currencies

—

(6,154

)

Consolidated sales, constant currency

$

20,640,447

$

25,251,809

(18.3

)

%

Global components sales, as reported

$

15,169,507

$

19,783,867

(23.3

)

%

Impact of changes in foreign

currencies

—

(24,213

)

Global components sales, constant

currency

$

15,169,507

$

19,759,654

(23.2

)

%

Americas components sales, as reported

$

4,807,991

$

6,169,949

(22.1

)

%

Impact of changes in foreign

currencies

—

(2,994

)

Americas components sales, constant

currency

$

4,807,991

$

6,166,955

(22.0

)

%

Asia components sales, as reported

$

5,975,729

$

7,226,871

(17.3

)

%

Impact of changes in foreign

currencies

—

(39,533

)

Asia components sales, constant

currency

$

5,975,729

$

7,187,338

(16.9

)

%

EMEA components sales, as reported

$

4,385,787

$

6,387,047

(31.3

)

%

Impact of changes in foreign

currencies

—

18,314

EMEA components sales, constant

currency

$

4,385,787

$

6,405,361

(31.5

)

%

Global ECS sales, as reported

$

5,470,940

$

5,474,096

(0.1

)

%

Impact of changes in foreign

currencies

—

18,059

Global ECS sales, constant currency

$

5,470,940

$

5,492,155

(0.4

)

%

Americas ECS sales, as reported

$

2,904,933

$

3,014,544

(3.6

)

%

Impact of changes in foreign

currencies

—

(3,184

)

Americas ECS sales, constant currency

$

2,904,933

$

3,011,360

(3.5

)

%

EMEA ECS sales, as reported

$

2,566,007

$

2,459,552

4.3

%

Impact of changes in foreign

currencies

—

21,243

EMEA ECS sales, constant currency

$

2,566,007

$

2,480,795

3.4

%

ARROW ELECTRONICS, INC.

NON-GAAP EARNINGS

RECONCILIATION

(In thousands except per share

data)

(Unaudited)

Three months ended September 28,

2024

Reported

Intangible

Restructuring,

Impact of

Non

GAAP

amortization

Integration

Wind

recurring

Non-GAAP

measure

expense

and other

Down(1)

tax items

Other(2)

measure

Operating income

$

175,262

$

7,308

$

34,466

$

(1,857

)

$

—

$

—

$

215,179

Income before income taxes

116,095

7,308

34,466

(1,857

)

—

(3,757

)

152,255

Provision for income taxes

15,198

1,819

8,592

(444

)

—

(902

)

24,263

Consolidated net income

100,897

5,489

25,874

(1,413

)

—

(2,855

)

127,992

Noncontrolling interests

330

136

—

—

—

—

466

Net income attributable to

shareholders

$

100,567

$

5,353

$

25,874

$

(1,413

)

$

—

$

(2,855

)

$

127,526

Net income per diluted share (4)

$

1.88

$

0.10

$

0.48

$

(0.03

)

$

—

$

(0.05

)

$

2.38

Effective tax rate (5)

13.1

%

15.9

%

Three months ended September 30,

2023

Reported

Intangible

Restructuring,

Impact of

Non

GAAP

amortization

Integration

Wind

recurring

Non-GAAP

measure

expense

and other

Down(1)

tax items

Other(2)

measure

Operating income

$

340,083

$

7,863

$

31,359

$

—

$

—

$

—

$

379,305

Income before income taxes

252,282

7,863

31,359

—

—

6,159

297,663

Provision for income taxes

52,241

1,959

7,321

—

—

1,476

62,997

Consolidated net income

200,041

5,904

24,038

—

—

4,683

234,666

Noncontrolling interests

1,382

138

—

—

—

—

1,520

Net income attributable to

shareholders

$

198,659

$

5,766

$

24,038

$

—

$

—

$

4,683

$

233,146

Net income per diluted share (4)

$

3.53

$

0.10

$

0.43

$

—

$

—

$

0.08

$

4.14

Effective tax rate (5)

20.7

%

21.2

%

ARROW ELECTRONICS, INC.

NON-GAAP EARNINGS

RECONCILIATION

(In thousands except per share

data)

(Unaudited)

Nine months ended September 28,

2024

Reported

Intangible

Restructuring,

Impact of

Non

GAAP

amortization

Integration

Wind

recurring

Non-GAAP

measure

expense

and other

Down(1)

tax items

Other(3)

measure

Operating income

$

573,454

$

22,310

$

121,859

$

10,229

$

—

$

—

$

727,852

Income before income taxes

360,615

22,310

121,859

10,229

—

2,417

517,430

Provision for income taxes

66,996

5,562

30,820

2,447

—

580

106,405

Consolidated net income

293,619

16,748

91,039

7,782

—

1,837

411,025

Noncontrolling interests

753

406

—

—

—

—

1,159

Net income attributable to

shareholders

$

292,866

$

16,342

$

91,039

$

7,782

$

—

$

1,837

$

409,866

Net income per diluted share (4)

$

5.42

$

0.30

$

1.69

$

0.14

$

—

$

0.03

$

7.59

Effective tax rate (5)

18.6

%

20.6

%

Nine months ended September 30,

2023

Reported

Intangible

Restructuring,

Impact of

Non

GAAP

amortization

Integration

Wind

recurring

Non-GAAP

measure

expense

and other

Down(1)

tax items

Other(2)

measure

Operating income

$

1,154,485

$

23,751

$

44,252

$

—

$

—

$

—

$

1,222,488

Income before income taxes

914,325

23,751

44,252

—

—

(4,649

)

977,679

Provision for income taxes

201,168

5,961

10,638

—

(942

)

(1,114

)

215,711

Consolidated net income

713,157

17,790

33,614

—

942

(3,535

)

761,968

Noncontrolling interests

4,189

408

—

—

—

—

4,597

Net income attributable to

shareholders

$

708,968

$

17,382

$

33,614

$

—

$

942

$

(3,535

)

$

757,371

Net income per diluted share (4)

$

12.28

$

0.30

$

0.58

$

—

$

0.02

$

(0.06

)

$

13.12

Effective tax rate (5)

22.0

%

22.1

%

______________________________

(1) Includes write downs (reversals) of inventory related to the

wind down of a business.

(2) Other includes loss (gain) on

investments, net.

(3) Other includes loss (gain) on

investments, net and loss on extinguishment of debt.

(4) The sum of the components for non-GAAP

diluted EPS, as adjusted may not agree to totals, as presented, due

to rounding.

(5) The items as shown in this table,

represent the reconciling items for the tax rate as reported and as

a non-GAAP measure.

ARROW ELECTRONICS, INC.

SEGMENT INFORMATION

(In thousands)

(Unaudited)

Quarter Ended

Nine Months Ended

September 28,

September 30,

September 28,

September 30,

2024

2023

2024

2023

Sales:

Global components

$

4,946,059

$

6,245,192

$

15,169,507

$

19,783,867

Global ECS

1,877,260

1,761,827

5,470,940

5,474,096

Consolidated

$

6,823,319

$

8,007,019

$

20,640,447

$

25,257,963

Operating income (loss):

Global components (a)

$

188,600

$

379,053

$

624,363

$

1,177,906

Global ECS (b)

75,614

54,624

249,654

221,951

Corporate (c)

(88,952

)

(93,594

)

(300,563

)

(245,372

)

Consolidated

$

175,262

$

340,083

$

573,454

$

1,154,485

(a)

Global components operating income

includes a reversal of $1.9 million and charges of $10.2 million in

inventory write downs related to the wind down of a business for

the third quarter and first nine months of 2024. Global components

operating income includes $62.2 million in settlement charges

recorded as a reduction to operating expense for the third quarter

and first nine months of 2023.

(b)

For the third quarter and first nine

months of 2023, global ECS operating income includes charges of

$21.9 million and $25.4 million, respectively, to increase the

allowance for credit losses related to one customer. For the first

nine months of 2024, global ECS operating income includes a

reversal of $20.0 million for aged receivables that were collected,

related to the same customer, which was taken during the second

quarter of 2024.

(c)

Corporate operating loss includes

restructuring, integration, and other charges of $34.5 million and

$121.9 million for the third quarter and first nine months of 2024,

respectively, and $31.4 million and $44.3 million for the third

quarter and first nine months of 2023, respectively.

NON-GAAP SEGMENT

RECONCILIATION

Quarter Ended

Nine Months Ended

September 28,

September 30,

September 28,

September 30,

2024

2023

2024

2023

Global components operating income, as

reported

$

188,600

$

379,053

$

624,363

$

1,177,906

Intangible assets amortization expense

6,247

6,640

19,134

20,064

Impact of wind down to inventory

(1,857

)

—

10,229

—

Global components non-GAAP operating

income

$

192,990

$

385,693

$

653,726

$

1,197,970

Global ECS operating income, as

reported

$

75,614

$

54,624

$

249,654

$

221,951

Intangible assets amortization expense

1,061

1,223

3,176

3,687

Global ECS non-GAAP operating income

$

76,675

$

55,847

$

252,830

$

225,638

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031098147/en/

Investors: Brad Windbigler, Treasurer and Vice President,

Investor Relations 720-654-9893 Media: John Hourigan, Vice

President, Public Affairs and Corporate Marketing 303-824-4586

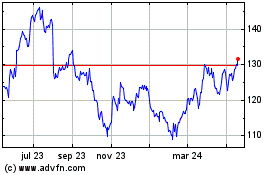

Arrow Electronics (NYSE:ARW)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

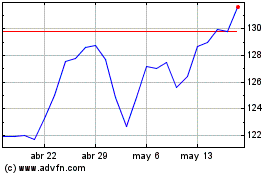

Arrow Electronics (NYSE:ARW)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024