Bally’s Stockholders to Receive $18.25 per

Share in Cash, Representing a 71% Premium to the Company’s 30-day

Volume Weighted Average Price Prior to the Initial Standard General

Proposal

Bally’s Special Committee Unanimously

Recommended and Board of Directors Approved the Transactions and

the Per Share Cash Merger Consideration

In Lieu of Receiving the Per Share Cash

Merger Consideration, Bally’s Stockholders Can Elect to Remain

Invested in the Company via Rollover Election

Bally’s to be Combined with The Queen Casino

& Entertainment

Bally’s Corporation (“Bally’s” or the “Company”) (NYSE: BALY)

announced today that it has entered into a definitive merger

agreement (the “Merger”) pursuant to which Standard General L.P.

(“Standard General”), the Company’s largest common stockholder,

will acquire the Company’s outstanding shares for $18.25 per

Bally’s share (the “Cash Consideration”). The price represents a

71% premium over the Company’s 30-day volume weighted average price

per share as of March 8, 2024, the last trading day before the

public disclosure of Standard General’s initial cash acquisition

proposal of $15.00 per share. In lieu of receiving the Cash

Consideration, Bally’s stockholders may elect to retain all or a

portion of their Bally’s stock by means of a rollover election.

Bally’s stockholders electing to retain all or a portion of their

Bally’s investment will continue as stockholders of the Combined

Company (as defined below). The transaction values Bally’s at

approximately $4.6 billion in enterprise value. The Combined

Company will remain a publicly traded registrant under the

Securities Act of 1934.

Pursuant to the Merger, Bally’s will combine with The Queen

Casino & Entertainment Inc. (“QC&E”), a regional casino

operator majority-owned by funds managed by Standard General

(together, the “Combined Company”). QC&E is a regional gaming,

hospitality and entertainment company that currently owns and

operates four casinos across three states, including DraftKings at

Casino Queen in East St. Louis, IL, the Queen Marquette in

Marquette, IA, and the Queen Baton Rouge and the Belle of Baton

Rouge in Baton Rouge, LA. QC&E is in the process of executing

on transformational redevelopment projects at two of its four

properties which are expected to be completed in 2025 and generate

meaningful organic growth. The combination will expand the

Company’s Casino & Resorts segment to 19 gaming, entertainment

and hospitality facilities across 11 U.S. states and enhance the

Company’s development pipeline with several exciting projects.

Jaymin Patel, Chairman of the Special Committee, said, “After a

detailed consideration by the Special Committee, with the

assistance of our outside financial and legal advisors, it was

determined that the Cash Consideration from Standard General

delivers a meaningful and immediate value to stockholders. We look

forward to working with the team at Standard General and QC&E

as we move through the process to complete the merger.”

Robeson Reeves, Bally’s Chief Executive Officer, said, “Our team

is well positioned to continue to execute on our initiatives to

drive growth across all our segments including in our International

Interactive business, North America Interactive and our Casinos

& Resorts (“C&R”) segments, while proceeding with our

development pipeline, including construction of our permanent

casino resort in Chicago, for which we recently announced a

comprehensive financing plan. The addition of four complementary

properties through this merger to our existing 15 domestic casino

properties will add further geographic and market diversity to our

portfolio. With QC&E’s development pipeline recently completed

or already well underway, we see a path toward additional revenue

and EBITDAR growth and value accretion as those projects are

completed in 2025. We look forward to bringing our ultimate vision

to bear and to working closely with the Standard General team to

execute on that vision.”

Soo Kim, Managing Partner of Standard General, said, “The

Transaction provides Bally’s stockholders with a significant cash

premium along with certainty of value for their investment or, if

they elect to retain their shares, the opportunity to participate

in the longer-term growth prospects of our expanded portfolio and

significant development pipeline. The addition of the complementary

QC&E assets builds upon the Company’s attractive growth

profile. We look forward to working with the Board of Directors and

the Company’s senior management team as they continue to execute on

their business plan.”

In connection with the transaction, in addition to Standard

General, Sinclair Broadcast Group, Inc. (“Sinclair”), and Noel

Hayden have committed to support the Merger and to make rollover

elections. As a result, at least 47% of Bally’s outstanding

fully-diluted equity interests will be rolled over into the

Combined Company.

A special committee of independent and disinterested directors

(the “Special Committee”) of Bally’s Board of Directors, which has

been advised by its own independent financial and legal advisors in

evaluating the Merger and the Cash Consideration, determined that

the Merger is in the best interest of Bally’s and its stockholders

(aside from Standard General, Sinclair and Noel Hayden) and

unanimously recommended that the Company’s Board of Directors

approve the Merger. Acting upon the recommendation of the Special

Committee, Bally’s Board of Directors approved the Merger and

recommends that stockholders approve the Merger. The factors

considered by the Special Committee in arriving at its unanimous

decision will be outlined in public proxy filings to be made by

Bally’s. The Bally’s Special Committee and Board of Directors are

making recommendations with respect to the Cash Consideration and

are not making recommendations with respect to the rollover

election.

Financing Details and Approvals

Standard General has obtained $500 million of committed

financing (the “Financing”) to support the Merger (together, the

“Transaction”). The cash proceeds from the Financing, in connection

with the Company’s existing resources, will be used to effectuate

the Merger and fund the Cash Consideration to Bally’s

stockholders.

The Transaction is subject to receipt of regulatory approvals,

the approval by Bally’s stockholders (other than Standard General,

Sinclair and Noel Hayden), and satisfaction of other customary

closing conditions, and is expected to close in first half of

2025.

Advisors

Macquarie Capital is acting as financial advisor to the Special

Committee and Sullivan & Cromwell LLP and Potter Anderson &

Corroon LLP are acting as legal counsel to the Special Committee.

Nixon Peabody LLP is acting as legal counsel to Bally’s. Citizens

JMP Securities, LLC is acting as financial advisor to QC&E and

Fried, Frank, Harris, Shriver & Jacobson LLP and Richards,

Layton & Finger, PA are acting as its legal counsel.

2024 Second Quarter Results Announcement

Notwithstanding the proposed Transaction, Bally’s expects to

host its regular conference call in connection with the release of

its second quarter 2024 financial results but does not expect to

comment on the Transaction until it has filed preliminary proxy

materials with the Securities Exchange Commission, which is

anticipated to occur within 45 days from the signing of the

definitive merger agreement. The Company currently expects to issue

a press release which details results for the 2024 second quarter

on or before July 31, 2024, and will file its Form 10-Q shortly

thereafter.

About Bally’s Corporation

Bally's Corporation is a global casino-entertainment company

with a growing omni-channel presence. It currently owns and manages

15 casinos across 10 states, a golf course in New York, a horse

racetrack in Colorado, and has access to OSB licenses in 18 states.

It also owns Bally's Interactive International, formerly Gamesys

Group, a leading, global, online gaming operator, Bally Bet, a

first-in-class sports betting platform, and Bally Casino, a growing

iCasino platform.

With 10,600 employees, the Company's casino operations include

approximately 15,300 slot machines, 580 table games and 3,800 hotel

rooms. Upon completing the construction of a permanent casino

facility in Chicago, IL, and a land-based casino near the Nittany

Mall in State College, PA, Bally's will own and/or manage 16

casinos across 11 states. Bally’s also has rights to developable

land in Las Vegas post the closure of the Tropicana. Its shares

trade on the New York Stock Exchange under the ticker symbol

"BALY".

About The Queen Casino & Entertainment Inc.

The Queen Casino & Entertainment Inc. is a U.S. regional

gaming, hospitality and entertainment company that currently owns

and operates four casino properties across three states. QC&E

is also the largest shareholder in Intralot S.A. (ATSE: INLOT), a

global lottery management and services business, with ownership

interests valued in excess of $250 million based upon prevailing

market trading prices.

With over 900 employees, QC&E’s U.S. operations currently

include approximately 2,400 slot machines, 50 table games and 150

hotel rooms. QC&E operates four gaming facilities across three

states. It recently completed a land-side development and opened

the new Queen Baton Rouge gaming and entertainment complex in

August 2023. QC&E has also recently announced plans for a

land-side development of a nearby property in downtown Baton Rouge,

Belle of Baton Rouge. The Belle of Baton Rouge development will

feature a brand-new gaming, hospitality and entertainment complex,

including a boutique hotel scheduled to open in 2025, bringing much

needed hospitality capacity to the state capital and home to

Louisiana State University. Upon completing the development of this

project, QC&E will operate approximately 1,400 slot machines,

40 table games, 9 F&B concepts and 250 hotel rooms across the

two Baton Rouge properties. Separately, QC&E is also in the

process of completing a land-side conversion and expansion of its

Marquette riverboat gaming facility which is scheduled to open in

the spring of 2025. QC&E is privately-held and majority-owned

by funds managed by Standard General LP.

No Offer or Solicitation

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation

of any vote or approval.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements may be identified by the use of words such as

“anticipate,” “believe,” “expect,” “intend,” “plan” and “will” or,

in each case, their negative, or other variations or comparable

terminology. By their nature, forward-looking statements involve

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. As a result,

these statements are not guarantees of future performance and

actual events may differ materially from those expressed in or

suggested by the forward-looking statements. Any forward-looking

statement made by Bally’s in this press release, its reports filed

with the Securities and Exchange Commission (“SEC”) and other

public statements made from time-to-time speak only as of the date

made. New risks and uncertainties come up from time to time, and it

is impossible for Bally’s to predict or identify all such events or

how they may affect it. Bally’s has no obligation, and does not

intend, to update any forward-looking statements after the date

hereof, except as required by federal securities laws. Factors that

could cause these differences include, but are not limited to those

included in Bally’s Annual Report on Form 10-K, Quarterly Reports

on Form 10-Q and other reports filed by Bally’s with the SEC. These

statements constitute the Company’s cautionary statements under the

Private Securities Litigation Reform Act of 1995.

Additional Information and Where to Find It

This communication is being made in respect of the proposed

Transaction involving the Company, Standard General and QC&E.

In connection with the Transaction, (i) the Company intends to file

the relevant materials with the SEC, including a proxy statement on

Schedule 14A and (ii) certain participants in the Transaction

intend to jointly file with the SEC a Schedule 13E-3 Transaction

Statement, which will contain important information on the Company,

Standard General, QC&E and the Transaction, including the terms

and conditions of the proposed Transaction. Promptly after filing

its definitive proxy statement with the SEC, the Company will mail

the definitive proxy statement, the Schedule 13E-3 and a proxy card

to each stockholder of the Company entitled to vote at the Company

Stockholders Meeting. Prior to closing, the Company will distribute

election forms to its stockholders for use by stockholders to make

rollover elections with respect to all or a portion of their stock

in the Company. This communication is not a substitute for the

proxy statement, the Schedule 13E-3, the election form or any other

document that the Company may file with the SEC or send to its

stockholders in connection with the proposed Transaction. The

materials to be filed by the Company will be made available to the

Company’s investors and stockholders at no expense to them and

copies may be obtained free of charge on the Company’s website at

www.ballys.com. In addition, all of those materials will be

available at no charge on the SEC’s website at www.sec.gov.

Investors and stockholders of the Company are urged to read the

proxy statement, the Schedule 13E-3 and the other relevant

materials when they become available before making any voting or

investment decision with respect to the proposed Transaction

because they contain important information about the Company,

Standard General, QC&E and the proposed Transaction. This

communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation

of any vote or approval.

Stockholders of the Company are urged to read all relevant

documents filed with the SEC, including the proxy statement and the

Schedule 13E-3 Transaction Statement, as well as any amendments or

supplements to these documents, carefully when they become

available because they will contain important information about the

proposed Transaction.

Participants in the Proxy Solicitation

The Company and its directors, executive officers, other members

of its management and employees may be deemed to be participants in

the solicitation of proxies of the Company stockholders in

connection with the Transaction under SEC rules. Investors and

stockholders may obtain more detailed information regarding the

names, affiliations and interests of the Company’s executive

officers and directors in the solicitation by reading the Company’s

proxy statement on Schedule 14A filed with the SEC on April 5,

2024, in connection with its 2024 annual meeting of stockholders,

and the proxy statement, the Schedule 13E-3 Transaction Statement,

the election form and other relevant materials that will be filed

with the SEC in connection with the proposed Transaction when they

become available. Information concerning the interests of the

Company’s participants in the solicitation, which may, in some

cases, be different than those of the Company’s stockholders

generally, will be set forth in the proxy statement relating to the

proposed Transaction and the Schedule 13E-3 Transaction Statement

when they become available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724571083/en/

Media Diane Spiers (609) 377-4705 dspiers@ballys.com

Investor Marcus Glover Chief Financial Officer (401)

475-8564 ir@ballys.com

James Leahy, Joseph Jaffoni, Richard Land JCIR (212) 835-8500

baly@jcir.com

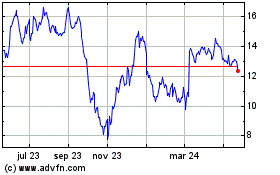

Ballys (NYSE:BALY)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

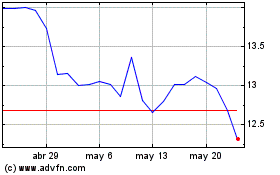

Ballys (NYSE:BALY)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025