Bio-Rad Laboratories, Inc. (NYSE: BIO and BIO.B), a global

leader in life science research and clinical diagnostics products,

today announced financial results for the first quarter ended March

31, 2024.

First-quarter 2024 total net sales were $610.8 million, a

decrease of 9.8 percent compared to $676.8 million reported for the

first quarter of 2023. On a currency-neutral basis, quarterly sales

decreased 9.6 percent compared to the same period in 2023.

Life Science segment net sales for the first quarter were $241.7

million, a decrease of 25.3 percent compared to the same period in

2023. On a currency-neutral basis, Life Science segment sales

decreased by 25.2 percent compared to the same quarter in 2023. The

currency-neutral year-over-year sales decrease was broad-based and

was primarily driven by ongoing weakness in the biotech and

biopharma end-markets and the economic environment in China.

Clinical Diagnostics segment net sales for the first quarter

were $368.6 million, an increase of 4.7 percent compared to the

same period in 2023. On a currency-neutral basis, net sales

increased 4.8 percent versus the same quarter last year. The

currency-neutral year-over-year sales increase was primarily driven

by an increased demand for quality control, blood typing, and

diabetes products.

First-quarter gross margin was 53.4 percent compared to 53.5

percent during the first quarter of 2023.

Income from operations during the first quarter of 2024 was

$44.7 million versus $61.9 million during the same quarter last

year.

Net income for the first quarter of 2024 was $383.9 million, or

$13.45 per share, on a diluted basis, versus net income of $69.0

million, or $2.32 per share, on a diluted basis, during the same

period in 2023. Net income amounts for the first quarter of 2024

and 2023 were primarily impacted by the recognition of changes in

the fair market value of equity securities related to the holdings

of the company’s investment in Sartorius AG.

The effective tax rate for the first quarter of 2024 was 21.8

percent, compared to 18.7 percent for the same period in 2023. The

effective tax rate reported in these periods was primarily affected

by the accounting treatment of our equity securities.

“Our first quarter results were largely in line with

expectations,” said Norman Schwartz, Bio-Rad’s President and Chief

Executive Officer. “The ongoing weakness in the biotech and

biopharma markets impacted sales of our life science research

products while increased demand for our clinical diagnostics

products drove year-over-year growth for this business. We are

cautiously optimistic about a gradual biopharma market recovery in

the second half of the year and remain confident in our overall

strategy and long-term market opportunities.”

The non-GAAP financial measures discussed below exclude certain

items detailed later in this press release under the heading “Use

of Non-GAAP and Currency-Neutral Reporting.” A reconciliation

between historical GAAP operating results and non-GAAP operating

results is provided following the financial statements that are

part of this press release.

Non-GAAP gross margin of 54.2 percent for the first quarter of

2024 was unchanged compared to 54.2 percent during the first

quarter of 2023.

Non-GAAP income from operations during the first quarter of 2024

was $59.0 million versus $84.2 million during the comparable

prior-year period.

Non-GAAP net income for the first quarter of 2024 was $65.2

million, or $2.29 per share, on a diluted basis, compared to $99.4

million, or $3.34 per share, on a diluted basis, during the same

period in 2023.

The non-GAAP effective tax rate for the first quarter of 2024

was 22.3 percent, compared to 20.9 percent for the same period in

2023. The higher rate in 2024 was driven by geographical mix of

earnings and change in valuation allowance related to our deferred

tax assets.

GAAP Results

Q1 2024

Q1 2023

Revenue (millions)

$610.8

$676.8

Gross margin

53.4%

53.5%

Operating margin

7.3%

9.1%

Net income (millions)

$383.9

$69.0

Income per diluted share

$13.45

$2.32

Non-GAAP Results

Q1 2024

Q1 2023

Revenue (millions)

$610.8

$676.8

Gross margin

54.2%

54.2%

Operating margin

9.7%

12.4%

Net income (millions)

$65.2

$99.4

Income per diluted share

$2.29

$3.34

A reconciliation between historical GAAP operating results and

non-GAAP operating results is provided following the financial

statements that are part of this press release. We do not provide a

reconciliation of our non-GAAP financial expectations to

expectations for the most comparable GAAP measure because the

amount and timing of many future charges that impact these measures

(such as amortization of future acquisition-related intangible

assets, future acquisition-related expenses and benefits, future

restructuring charges, future asset impairment charges, future

valuation changes of equity-owned securities, future gains and

losses on equity-method investments or future legal charges or

benefits), which could be material, are variable, uncertain, or out

of our control and therefore cannot be reasonably predicted without

unreasonable effort, if at all.

Full-Year 2024 Financial Outlook

Bio-Rad is maintaining its financial outlook for the full year

2024. The company continues to expect non-GAAP, currency-neutral

revenue growth of approximately 1.0 to 2.5 percent and an estimated

non-GAAP operating margin of approximately 13.5 to 14.0

percent.

Conference Call and Webcast

Management will discuss the company’s first quarter 2024 results

and financial outlook in a conference call scheduled for 2 PM

Pacific Time (5 PM Eastern Time) on May 7, 2024. To participate,

dial 800-274-8461 within the U.S., or (+1) 203-518-9814 from

outside the U.S., and provide access code: BIORAD.

A live webcast of the conference call will also be available in

the "Investor Relations" section of the company’s website under

"Events & Presentations" at investors.bio-rad.com. A replay of

the webcast will be available for up to a year.

Use of Non-GAAP and Currency-Neutral Reporting

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), we use

certain non-GAAP financial measures, including non-GAAP net income

and non-GAAP EPS, which exclude amortization of acquisition-related

intangible assets, certain acquisition-related expenses and

benefits, restructuring charges, asset impairment charges, gains

and losses from change in fair market value of equity securities

and loan receivable, gains and losses on equity-method investments,

and significant legal-related charges or benefits and associated

legal costs. Non-GAAP net income and non-GAAP EPS also exclude

certain other gains and losses that are either isolated or cannot

be expected to occur again with any predictability, tax

provisions/benefits related to the previous items, and significant

discrete tax events. We exclude the above items because they are

outside of our normal operations and/or, in certain cases, are

difficult to forecast accurately for future periods.

We utilize a number of different financial measures, both GAAP

and non-GAAP, in analyzing and assessing the overall performance of

our business, in making operating decisions, forecasting and

planning for future periods, and determining payments under

compensation programs. We consider the use of the non-GAAP measures

to be helpful in assessing the performance of the ongoing operation

of our business. We believe that disclosing non-GAAP financial

measures provides useful supplemental data that, while not a

substitute for financial measures prepared in accordance with GAAP,

allows for greater transparency in the review of our financial and

operational performance. We also believe that disclosing non-GAAP

financial measures provides useful information to investors and

others in understanding and evaluating our operating results and

future prospects in the same manner as management and in comparing

financial results across accounting periods and to those of peer

companies. More specifically, management adjusts for the excluded

items for the following reasons:

Amortization of purchased intangible assets: we do not acquire

businesses and assets on a predictable cycle. The amount of

purchase price allocated to purchased intangible assets and the

term of amortization can vary significantly and are unique to each

acquisition or purchase. We believe that excluding amortization of

purchased intangible assets allows the users of our financial

statements to better review and understand the historic and current

results of our operations, and also facilitates comparisons to peer

companies.

Acquisition-related expenses and benefits: we incur expenses or

benefits with respect to certain items associated with our

acquisitions, such as transaction costs, professional fees for

assistance with the transaction; valuation or integration costs;

changes in the fair value of contingent consideration, gain or loss

on settlement of pre-existing relationships with the acquired

entity; or adjustments to purchase price. We exclude such expenses

or benefits as they are related to acquisitions and have no direct

correlation to the operation of our on-going business.

Restructuring, impairment charges, and gains and losses from

change in fair market value of equity securities and loan

receivable, and gains and losses on equity-method investments: we

incur restructuring and impairment charges on individual or groups

of employed assets and charges and benefits arising from gains and

losses from change in fair market value of equity securities and

loan receivable, and gains and losses (including impairments) on

equity-method investments, which arise from unforeseen

circumstances and/or often occur outside of the ordinary course of

our on-going business. Although these events are reflected in our

GAAP financials, these unique transactions may limit the

comparability of our on-going operations with prior and future

periods.

Significant litigation charges or benefits and legal costs: we

may incur charges or benefits as well as legal costs in connection

with litigation and other contingencies unrelated to our core

operations. We exclude these charges or benefits, when significant,

as well as legal costs associated with significant legal matters,

because we do not believe they are reflective of on-going business

and operating results.

Income tax expense: we estimate the tax effect of the excluded

items identified above to determine a non-GAAP annual effective tax

rate applied to the pretax amount in order to calculate the

non-GAAP provision for income taxes. We also adjust for items for

which the nature and/or tax jurisdiction requires the application

of a specific tax rate or treatment.

From time to time in the future, there may be other items

excluded if we believe that doing so is consistent with the goal of

providing useful information to investors and management.

Percentage sales growth in currency neutral amounts are

calculated by translating prior period sales in each local currency

using the current period’s monthly average foreign exchange rates

for that currency and comparing that to current period sales.

There are limitations in using non-GAAP financial measures

because the non-GAAP financial measures are not prepared in

accordance with generally accepted accounting principles and may be

different from non-GAAP financial measures used by other companies.

The non-GAAP financial measures are limited in value because they

exclude certain items that may have a material impact on our

reported financial results. The presentation of this additional

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with GAAP in the United States. Investors should

review the reconciliation of the non-GAAP financial measures to

their most directly comparable GAAP financial measures as provided

in the tables accompanying this press release.

BIO-RAD is a trademark of Bio-Rad Laboratories, Inc. in certain

jurisdictions.

About Bio-Rad

Bio-Rad Laboratories, Inc. (NYSE: BIO and BIO.B) is a leader in

developing, manufacturing, and marketing a broad range of products

for the life science research and clinical diagnostics markets.

Based in Hercules, California, Bio-Rad operates a global network of

research, development, manufacturing, and sales operations with

approximately 8,000 employees and $2.7 billion in revenues in 2023.

Our customers include universities, research institutions,

hospitals, food safety and environmental quality laboratories, and

biopharmaceutical companies. Together, we develop innovative,

high-quality products that advance science and save lives. To learn

more, visit bio-rad.com.

Forward-Looking Statements

This release may be deemed to contain certain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include,

without limitation, statements we make regarding estimated future

financial performance or results; being cautiously optimistic about

a gradual biopharma market recovery in the second half of the year

and remaining confident in our overall strategy and long-term

market opportunities; and for the full-year 2024: continuing to

expect non-GAAP, currency-neutral revenue growth of approximately

1.0 to 2.5 percent and an estimated non-GAAP operating margin of

approximately 13.5 to 14.0 percent. Forward-looking statements

generally can be identified by the use of forward-looking

terminology such as, "expect,” "estimate," "continue,"

"anticipate," “target,” "believe," "will," "project," "assume,"

"may," "intend," or similar expressions or the negative of those

terms or expressions, although not all forward-looking statements

contain these words. Such statements involve risks and

uncertainties, which could cause actual results to vary materially

from those expressed in or indicated by the forward-looking

statements. These risks and uncertainties include reductions in

government funding or capital spending of our customers, global

economic and geopolitical conditions, the uncertain pace of the

biopharma sector’s recovery, the challenging macroeconomic

environment in China, supply chain issues, international legal and

regulatory risks, our ability to develop and market new or improved

products, our ability to compete effectively, foreign currency

exchange fluctuations, product quality and liability issues, our

ability to integrate acquired companies, products or technologies

into our company successfully, changes in the healthcare industry,

and natural disasters and other catastrophic events beyond our

control. For further information regarding the Company's risks and

uncertainties, please refer to the "Risk Factors" and "Management’s

Discussion and Analysis of Financial Condition and Results of

Operations" in the Company's public reports filed with the

Securities and Exchange Commission (the "SEC"), including the

Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, and its Quarterly Report on Form 10-Q for the

quarter ended March 31, 2024 to be filed with the SEC. The Company

cautions you not to place undue reliance on forward-looking

statements, which reflect an analysis only and speak only as of the

date hereof. Bio-Rad Laboratories, Inc. disclaims any obligation to

update these forward-looking statements.

Bio-Rad Laboratories,

Inc.

Condensed Consolidated

Statements of Income (Loss)

(In thousands, except per share

data)

(Unaudited)

Three Months Ended

March 31,

2024

2023

Net sales

$

610,820

$

676,844

Cost of goods sold

284,854

314,427

Gross profit

325,966

362,417

Selling, general and administrative

expense

214,883

225,553

Research and development expense

66,375

74,951

Income from operations

44,708

61,913

Interest expense

12,277

12,337

Foreign currency exchange gains, net

(1,954

)

(2,347

)

(Gains) losses from change in fair market

value of equity securities and loan receivable

(422,177

)

17,525

Other income, net

(34,516

)

(50,431

)

Income before income taxes

491,078

84,829

Provision for income taxes

(107,162

)

(15,867

)

Net income

$

383,916

$

68,962

Basic earnings per share:

Net income per basic share

$

13.46

$

2.33

Weighted average common shares - basic

28,518

29,596

Diluted earnings per share:

Net income per diluted share

$

13.45

$

2.32

Weighted average common shares -

diluted

28,537

29,747

Bio-Rad Laboratories,

Inc.

Condensed Consolidated Balance Sheets (In thousands)

March 31, December 31,

2024

2023

(Unaudited) Current assets: Cash and cash equivalents

$

433,280

$

403,815

Short-term investments

1,217,954

1,208,887

Accounts receivable, net

444,809

489,017

Inventories, net

783,369

780,517

Other current assets

181,524

166,094

Total current assets

3,060,936

3,048,330

Property, plant and equipment, net

522,364

529,007

Operating lease right-of-use assets

188,918

194,730

Goodwill, net

412,817

413,569

Purchased intangibles, net

313,602

320,514

Other investments

8,018,383

7,698,070

Other assets

92,873

94,850

Total assets

$

12,609,893

$

12,299,070

Current liabilities: Accounts payable, accrued payroll and

employee benefits

$

249,241

$

284,554

Current maturities of long-term debt

487

486

Income and other taxes payable

33,961

35,759

Other current liabilities

182,465

202,000

Total current liabilities

466,154

522,799

Long-term debt, net of current maturities

1,199,381

1,199,052

Other long-term liabilities

1,893,224

1,836,086

Total liabilities

3,558,759

3,557,937

Total stockholders' equity

9,051,134

8,741,133

Total liabilities and stockholders' equity

$

12,609,893

$

12,299,070

Bio-Rad Laboratories, Inc. Condensed Consolidated

Statements of Cash Flows (In thousands) (Unaudited)

Three Months Ended March 31,

2024

2023

Cash flows from operating activities: Cash received from

customers

$

638,324

$

677,522

Cash paid to suppliers and employees

(560,316

)

(552,990

)

Interest paid, net

(22,425

)

(22,482

)

Income tax payments, net

(3,835

)

(13,283

)

Other operating activities

18,044

9,352

Net cash provided by operating activities

69,792

98,119

Cash flows from investing activities: Payments for purchases

of marketable securities and investments

(406,458

)

(203,588

)

Proceeds from sales and maturities of marketable securities and

investments

403,515

168,840

Other investing activities

(40,150

)

(35,725

)

Net cash used in investing activities

(43,093

)

(70,473

)

Cash flows from financing activities: Payments on long-term

borrowings

(118

)

(115

)

Other financing activities

139

4,424

Net cash provided by financing activities

21

4,309

Effect of foreign exchange rate changes on cash

2,663

(1,996

)

Net increase in cash, cash equivalents and restricted cash

29,383

29,959

Cash, cash equivalents and restricted cash at beginning of period

404,369

434,544

Cash, cash equivalents and restricted cash at end of period

$

433,752

$

464,503

Reconciliation of net income to net cash provided by

operating activities: Net income

$

383,916

$

68,962

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

37,091

35,587

Reduction in the carrying amount of right-of-use assets

10,676

9,999

(Gains) losses from change in fair market value of equity

securities and loan receivable

(422,177

)

17,525

Changes in working capital

(40,551

)

(38,830

)

Other

100,837

4,876

Net cash provided by operating activities

$

69,792

$

98,119

Bio-Rad Laboratories, Inc.

Reconciliation of GAAP financial measures to non-GAAP financial

measures

(In thousands, except per share data)

(Unaudited)

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), we use

certain non-GAAP financial measures, including non-GAAP net income

and non-GAAP diluted income per share (non-GAAP EPS), which exclude

amortization of acquisition-related intangible assets; certain

acquisition-related expenses and benefits; restructuring charges;

asset impairment charges; gains and losses from change in fair

market value of equity securities and loan receivable; gains and

losses on equity-method investments; and significant legal-related

charges or benefits and associated legal costs. Non-GAAP net income

and non-GAAP EPS also exclude certain other gains and losses that

are either isolated or cannot be expected to occur again with any

predictability, tax provisions/benefits related to the previous

items, and significant discrete tax events. We exclude the above

items because they are outside of our normal operations and/or, in

certain cases, are difficult to forecast accurately for future

periods.

We utilize a number of different financial measures, both GAAP

and non-GAAP, in analyzing and assessing the overall performance of

our business, in making operating decisions, forecasting and

planning for future periods, and determining payments under

compensation programs. We consider the use of the non-GAAP measures

to be helpful in assessing the performance of the ongoing operation

of our business. We believe that disclosing non-GAAP financial

measures provides useful supplemental data that, while not a

substitute for financial measures prepared in accordance with GAAP,

allows for greater transparency in the review of our financial and

operational performance. We also believe that disclosing non-GAAP

financial measures provides useful information to investors and

others in understanding and evaluating our operating results and

future prospects in the same manner as management and in comparing

financial results across accounting periods and to those of peer

companies.

Three MonthsEnded Three MonthsEnded March 31,

% of March 31, % of

2024

revenue

2023

revenue GAAP cost of goods sold

$

284,854

$

314,427

Amortization of purchased intangibles

(4,448

)

(4,288

)

Restructuring benefits (costs)

(518

)

(330

)

Non-GAAP cost of goods sold

$

279,888

$

309,809

GAAP gross profit

$

325,966

53.4%

$

362,417

53.5%

Amortization of purchased intangibles

4,448

4,288

Restructuring (benefits) costs

518

330

Non-GAAP gross profit

$

330,932

54.2%

$

367,035

54.2%

GAAP selling, general and administrative expense

$

214,883

$

225,553

Amortization of purchased intangibles

(1,044

)

(1,691

)

Acquisition related benefits (costs)

-

(800

)

Restructuring benefits (costs)

(4,427

)

(8,988

)

Other non-recurring items (2)

(1,498

)

(1,922

)

Non-GAAP selling, general and administrative expense

$

207,914

$

212,152

GAAP research and development expense

$

66,375

$

74,951

Acquisition related benefits (costs)

(200

)

-

Restructuring benefits (costs)

(2,164

)

(4,235

)

Non-GAAP research and development expense

$

64,011

$

70,716

GAAP income from operations

$

44,708

7.3%

$

61,913

9.1%

Amortization of purchased intangibles

5,492

5,979

Acquisition related (benefits) costs

200

800

Restructuring (benefits) costs

7,109

13,553

Other non-recurring items (2)

1,498

1,922

Non-GAAP income from operations

$

59,007

9.7%

$

84,167

12.4%

GAAP (gains) losses from change in fair market value of

equity securities and loan receivable

$

(422,177

)

$

17,525

Gains (losses) from change in fair market value of equity

securities and loan receivable

422,177

(17,525

)

Non-GAAP (gains) losses from change in fair market value of

equity securities and loan receivable

$

-

$

-

GAAP other (income) expense, net

$

(34,516

)

$

(50,431

)

Gains (losses) on equity-method investments

(783

)

(995

)

Non-GAAP other (income) expense, net

$

(35,299

)

$

(51,426

)

GAAP income before income taxes

$

491,078

$

84,829

Amortization of purchased intangibles

5,492

5,979

Acquisition related (benefits) costs

200

800

Restructuring (benefits) costs

7,109

13,553

(Gains) losses from change in fair market value of equity

securities and loan receivable

(422,177

)

17,525

(Gains) losses on equity-method investments

783

995

Other non-recurring items (2)

1,498

1,922

Non-GAAP income before income taxes

$

83,983

$

125,603

GAAP provision for income taxes

$

(107,162

)

$

(15,867

)

Income tax effect of non-GAAP adjustments (1)

88,396

(10,376

)

Non-GAAP provision for income taxes

$

(18,766

)

$

(26,243

)

GAAP net income

$

383,916

62.9%

$

68,962

10.2%

Amortization of purchased intangibles

5,492

5,979

Acquisition related (benefits) costs

200

800

Restructuring (benefits) costs

7,109

13,553

(Gains) losses from change in fair market value of equity

securities and loan receivable

(422,177

)

17,525

(Gains) losses on equity-method investments

783

995

Other non-recurring items (2)

1,498

1,922

Income tax effect of non-GAAP adjustments (1)

88,396

(10,376

)

Non-GAAP net income

$

65,217

10.7%

$

99,360

14.7%

GAAP diluted income per share

$

13.45

$

2.32

Amortization of purchased intangibles

0.19

0.20

Acquisition related (benefits) costs

0.01

0.03

Restructuring (benefits) costs

0.25

0.46

(Gains) losses from change in fair market value of equity

securities and loan receivable

(14.79

)

0.59

(Gains) losses on equity-method investments

0.03

0.03

Other non-recurring items (2)

0.05

0.06

Income tax effect of non-GAAP adjustments (1)

3.10

(0.35

)

Non-GAAP diluted income per share

$

2.29

$

3.34

GAAP diluted weighted average shares used in per share

calculation

28,537

29,747

Shares included in non-GAAP net income per share, but excluded from

GAAP net loss per share as they would have been anti-dilutive

-

-

Non-GAAP diluted weighted average shares used in per share

calculation

28,537

29,747

Reconciliation of Net income to adjusted EBITDA:

GAAP net income

$

383,916

62.9%

$

68,962

10.2%

Interest expense

12,277

12,337

Provision for income taxes

107,162

15,867

Depreciation and amortization

37,091

35,587

Foreign currency exchange gains, net

(1,954

)

(2,347

)

Other income, net

(34,516

)

(50,431

)

(Gains) losses from change in fair market value of equity

securities and loan receivable

(422,177

)

17,525

Dividend from Sartorius AG

17,930

34,766

Acquisition related (benefits) costs

200

800

Restructuring (benefits) costs

7,109

13,553

Other non-recurring items (2)

1,498

1,922

Adjusted EBITDA

$

108,536

17.8%

$

148,541

21.9%

(1) Excluded items identified in the reconciliation schedule are

tax effected by application of a non-GAAP effective tax rate. The

non-GAAP tax provision is adjusted for items, the nature of which

and/or tax jurisdiction requires the application of a specific tax

rate or treatment. (2) Incremental costs to comply with the

European Union's In Vitro Diagnostics Regulation ("IVDR") for

previously approved products.

2024 Financial Outlook

Forecasted non-GAAP operating margin excludes 87 basis points

related to amortization of purchased intangibles. Forecasted

non-GAAP operating margin does not reflect future gains and charges

that are inherently difficult to predict and estimate due to their

unknown timing, effect and/or significance, such as foreign

currency fluctuations, future gains or losses associated with

certain legal matters, acquisitions and restructuring

activities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507008867/en/

Investor Contact: Edward Chung, Investor Relations

510-741-6104 ir@bio-rad.com

Media Contact: Anna Gralinska, Corporate Communications

510-741-6643 cc@bio-rad.com

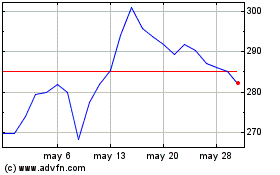

Bio Rad Laboratories (NYSE:BIO)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Bio Rad Laboratories (NYSE:BIO)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024