Barnes & Noble Education, Inc. (NYSE: BNED), a leading

solutions provider for the education industry, today announced

preliminary, unaudited results for the second quarter ended October

26, 2024. These unaudited GAAP results are from continuing

operations on a consolidated basis, unless noted otherwise, with

Adjusted EBITDA presented as a non-GAAP measure.

As BNED’s most significant quarter from a revenue perspective,

the second quarter includes the majority of the Fall back-to-school

period. Preliminary, unaudited results suggest that second quarter

fiscal year 2025 revenue is expected to be approximately flat year

over year (YoY), while operating 109 fewer physical and virtual

stores. Net Income for the quarter is expected to be in the mid to

high $40 million range, an anticipated increase by mid-70% to

mid-90% YoY, driven by comparable store top-line growth and

continued improvements in cost management. Adjusted EBITDA is also

expected to increase in the mid to high $10 million range to the

mid to high $60 million range.

Jonathan Shar, CEO, commented, “We are pleased with the

preliminary second quarter results during the important Fall

back-to-school period and the progress we have made to date

executing against our key strategic initiatives. From strong growth

in our First Day® affordable access programs, to outstanding retail

execution supporting our client institutions, and a disciplined

approach to cost management, we are excited about the momentum we

are building in our business transformation.”

The company is expecting to share final, unaudited second

quarter fiscal year 2025 financial results in the beginning of

December 2024 and will provide more detail and commentary at that

time, inclusive of full financial tables and a reconciliation of

non-GAAP measures.

The table below reflects the reconciliation of Adjusted EBITDA

to the most comparable GAAP financial metric, Net Income from

Continuing Operations:

| |

|

|

|

|

| |

$ in

thousands |

13 weeks ended - Q2 |

| |

|

Oct

26, |

|

Oct 28, |

| |

|

2024 |

|

|

2023 |

|

| |

Net income

from continuing operations |

$44,000-$49,000 |

|

$ |

24,854 |

|

| |

Add: |

|

|

|

| |

Depreciation

and amortization expense |

8,000 |

|

|

10,175 |

|

| |

Interest

expense, net |

5,000 |

|

|

10,664 |

|

| |

Income tax

expense |

1,000-2,000 |

|

|

314 |

|

| |

Restructuring and other charges |

1,000 |

|

|

4,274 |

|

| |

Stock-based

compensation expense (non-cash) |

2,000 |

|

|

799 |

|

| |

Adjusted

EBITDA (Non-GAAP) - Continuing Operations |

$61,000-$69,000 |

|

$ |

51,080 |

|

| |

|

|

|

|

ABOUT BARNES & NOBLE EDUCATION, INC.Barnes

& Noble Education, Inc. (NYSE: BNED) is a leading solutions

provider for the education industry, driving affordability, access

and achievement at hundreds of academic institutions nationwide and

ensuring millions of students are equipped for success in the

classroom and beyond. Through its family of brands, BNED offers

campus retail services and academic solutions, wholesale

capabilities and more. BNED is a company serving all who work to

elevate their lives through education, supporting students, faculty

and institutions as they make tomorrow a better and smarter world.

For more information, visit www.bned.com.

Use of Non-GAAP Financial Information - Adjusted

EBITDATo supplement the Company’s condensed consolidated

financial statements presented in accordance with generally

accepted accounting principles (“GAAP”) the Company has presented

the financial measure of Adjusted EBITDA, which is a non-GAAP

financial measure under Securities and Exchange Commission (the

"SEC") regulations. We define Adjusted EBITDA as net income (loss)

plus (1) depreciation and amortization; (2) interest expense and

(3) income taxes, (4) as adjusted for items that are subtracted

from or added to net income (loss).

This non-GAAP measure has been reconciled to the most comparable

financial measure presented in accordance with GAAP as follows: the

reconciliation of consolidated Adjusted EBITDA to consolidated net

income (loss). All of the items included in the reconciliation are

either (i) non-cash items or (ii) items that management does not

consider in assessing our on-going operating performance.

This non-GAAP financial measure is not intended as substitutes

for and should not be considered superior to measures of financial

performance prepared in accordance with GAAP. In addition, the

Company's use of this non-GAAP financial measure may be different

from similarly named measures used by other companies, limiting

their usefulness for comparison purposes.

We review this non-GAAP financial measure as an internal measure

to evaluate our performance at a consolidated level to manage our

operations. We believe that this measure is a useful performance

measure which is used by us to facilitate a comparison of our

on-going operating performance on a consistent basis from

period-to-period. We believe that this non-GAAP financial measure

provides for a more complete understanding of factors and trends

affecting our business than measures under GAAP can provide alone,

as they exclude certain items that management believes do not

reflect the ordinary performance of our operations in a particular

period. Our Board of Directors and management also use Adjusted

EBITDA at a consolidated level as one of the primary methods for

planning and forecasting expected performance, for evaluating on a

quarterly and annual basis actual results against such

expectations, and as a measure for performance incentive plans. We

believe that the inclusion of Adjusted EBITDA results provides

investors useful and important information regarding our operating

results, in a manner that is consistent with management’s

evaluation of business performance.

The Company urges investors to carefully review the GAAP

financial information included as part of the Company’s Form 10-K

dated April 27, 2024 filed with the SEC on July 1, 2024, which

includes consolidated financial statements for each of the three

years for the period ended April 27, 2024, April 29, 2023, and

April 30, 2022 (Fiscal 2024, Fiscal 2023, and Fiscal 2022,

respectively). The Company also urges investors to carefully review

the financial information included as part of the Company’s

Quarterly Report on Form 10-Q for the period ended July 27, 2024,

filed with the SEC on September 10, 2024.

Forward-Looking Statements This press release

contains certain “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995 and

information relating to us and our business that are based on the

beliefs of our management as well as assumptions made by and

information currently available to our management. When used in

this communication, the words “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “plan,” “will,” “forecasts,” “projections,” and

similar expressions, as they relate to us or our management,

identify forward-looking statements. Actual results could differ

materially from those projected in the forward-looking statements,

which include but are not limited to the anticipated financial

results for second quarter fiscal 2025 and the timing of the

Company full release of financial results for second quarter fiscal

2025. We caution you not to place undue reliance on these

forward-looking statements. Such statements reflect our current

views with respect to future events, the outcome of which is

subject to certain risks, including, but not limited to: the

completion of our quarterly review process for our financial

results for the second fiscal quarter of 2025, which could cause

the preliminary results reflect in this press release to change;

the amount of our indebtedness and ability to comply with covenants

contained in our credit agreement; and our ability to maintain

adequate liquidity levels to support ongoing inventory purchases

and related vendor payments in a timely manner. It is not possible

for our management to predict all risks, nor can we assess the

impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements we may make. For a more detailed discussion of these

factors, and other factors that could cause actual results to vary

materially, interested parties should review the risk factors

listed in the Company’s Annual Report on Form 10-K for the year

ended April 27, 2024 as filed with the SEC. Any forward-looking

statements made by us in this press release speak only as of the

date of this press release, and we do not intend to update these

forward-looking statements after the date of this press release,

except as required by law.

Media & Investor Contact:Judith BuckinghamManager, Corporate

Communicationsjbuckingham@bned.com

Source: Barnes & Noble Education

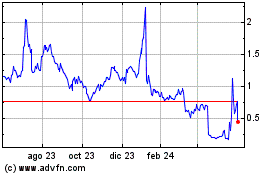

Barnes and Noble Education (NYSE:BNED)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

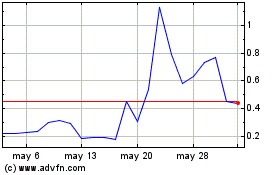

Barnes and Noble Education (NYSE:BNED)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024