Form S-8 - Securities to be offered to employees in employee benefit plans

19 Septiembre 2023 - 3:30PM

Edgar (US Regulatory)

As filed with the US Securities and Exchange Commission on September 19, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

BURFORD CAPITAL LIMITED

(Exact name of registrant as specified in its charter)

Bailiwick of Guernsey

(State or other jurisdiction of incorporation or organization) | N/A

(I.R.S. Employer Identification No.) |

____________________

Oak House, Hirzel Street

St. Peter Port

Bailiwick of Guernsey

GY1 2NP

(Address of Principal Executive Offices, including Zip Code)

____________________

BURFORD CAPITAL 2016 LONG TERM INCENTIVE PLAN

(Full title of the plan)

____________________

Puglisi & Associates

850 Library Avenue

Suite 204

Newark, Delaware 19711

(Name and address of agent for service)

(302) 738-6680

(Telephone number, including area code, of agent for service)

____________________

Copies to:

Mark N. Klein

General Counsel and Chief Administrative Officer

350 Madison Avenue

New York, New York 10017

Telephone: (212) 235-6820

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ |

Smaller reporting company ¨ | Emerging growth company ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY NOTE

This registration statement on Form S-8 (this “Registration Statement”) is filed by Burford Capital Limited (the “Registrant”) pursuant to General Instruction E to Form S-8. The contents of the registration statement on Form S-8 previously filed on October 5, 2020 (Registration No. 333-249328) are incorporated by reference into, and made a part of, this Registration Statement, except as supplemented, amended or superseded by the information set forth in this Registration Statement. This Registration Statement is filed by the Registrant to register an additional 10,000,000 ordinary shares, no par value per share, of the Registrant that may become issuable under the Burford Capital 2016 Long Term Incentive Plan, as amended and renewed on May 13, 2020.

ITEM 6. INDEMNIFICATION OF DIRECTORS AND OFFICERS.

Except as described below, there is no provision of the Registrant’s articles of incorporation (the “Articles of Incorporation”) or the Registrant’s memorandum of incorporation (the “Memorandum of Incorporation”) or any contract, arrangement or statute, under which any director or officer of the Registrant is insured or indemnified in any manner against any liability which he or she may incur in his or her capacity as such.

In summary, Article 37 of the Articles of Incorporation provides that:

| (a) | to the extent permitted by the Companies (Guernsey) Law, 2008, as amended (the “Companies Law”), any director, alternate director, secretary, resident agent, other officer or auditor of the Registrant, and their respective heirs and executors (each, an “Indemnified Person”), shall be fully indemnified in so far as the Companies Law allows out of the assets and profits of the Registrant from and against all actions, suits, proceedings, expenses and liabilities (collectively, “Indemnification Matters”) which they or their respective heirs or executors may incur by reason of any contract entered into or any act or omission in or about the execution of their respective offices or trusts (including, without prejudice to the generality of the foregoing, against any costs, charges, expenses, losses or liabilities suffered or incurred by such persons in respect of any act or omission in the actual or purported execution and/or discharge of their duties and/or the exercise or purported exercise of their powers and discretions and/or otherwise in relation to or in connection with their duties, powers or offices in relation to the Registrant), except such (if any) as would otherwise attach to them in connection with any negligence, default, breach of duty or breach of trust in relation to the Registrant, and none of them shall be answerable for the acts, receipts, neglects or defaults of the others of them or for joining in any receipt for the sake of conformity or for any bankers or other person with whom any moneys or assets of the Registrant may be lodged or deposited for safe custody or for any bankers or other persons into whose hands any money or assets of the Registrant may come or for any defects of title of the Registrant to any property purchased or for insufficiency or deficiency of, or defect in, title of the Registrant to any security upon which any moneys of the Registrant shall be placed out or invested or for any loss, misfortune or damage resulting from any such cause as aforesaid or which may happen in or about the execution of their respective offices or trusts except should the same happen by or through their own negligence, default, breach of duty or breach of trust in relation to the Registrant, provided that Article 37 of the Articles of Incorporation shall be deemed not to provide for, or entitle any person to, indemnification to the extent that it would cause Article 37 of the Articles of Incorporation, or any part of it, to be treated as void under the Companies Law; |

| (b) | the Registrant shall pay the expenses (including lawyers’ fees) actually and reasonably incurred by an Indemnified Person in defending any Indemnification Matter in advance of its final disposition upon receipt of a written undertaking by or on behalf of such person to promptly repay all amounts advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal that such person is not entitled to be indemnified for such expenses under paragraph (a) above or otherwise. Payment of such expenses actually and reasonably incurred by such person may be made by the Registrant, subject to such terms and conditions as the directors in their discretion deem appropriate; and |

| (c) | the directors of the Registrant are empowered to purchase and maintain insurance (including, subject to applicable law, from an associated company or any of the Registrant’s subsidiary undertakings from time to time) for the benefit of a person who is or was a director, alternate director, secretary, resident agent, other officer or auditor of the Registrant or of a company which is or was a subsidiary undertaking of the Registrant or in which the Registrant has or had an interest (whether direct or indirect), indemnifying such persons |

| | against liability for negligence, default, breach of duty or breach of trust or other liability which may lawfully be insured against by the Registrant (including, without prejudice to the generality of the foregoing, insurance against any costs, charges, expenses, losses or liabilities suffered or incurred by such persons in respect of any act or omission in the actual or purported execution and/or discharge of their duties and/or the exercise or purported exercise of their powers and discretions and/or otherwise in relation to or in connection with their duties, powers or offices in relation to the Registrant or any such other body). |

In summary, the Companies Law provides that:

| (a) | pursuant to section 157(1) of the Companies Law, any provision that purports to exempt a director from any liability in connection with any negligence, default, breach of duty or breach of trust in relation to a Guernsey company is void; |

| (b) | pursuant to section 157(2) of the Companies Law, any provision by which a company directly or indirectly provides an indemnity (to any extent) for a director of the company or an associated company, or a body corporate which is an overseas company and a subsidiary of the company, against any liability attaching to such director in connection with any negligence, default, breach of duty or breach of trust in relation to the company of which he or she is a director is void, except that section 157(2) of the Companies Law: |

| ● | does not prevent a Guernsey company from purchasing and maintaining for a director of the company, or any associated company, insurance against any such liability (see section 158 of the Companies Law); and |

| ● | does not apply to a qualifying third-party indemnity provision (see section 159 of the Companies Law). Section 159(2) of the Companies Law provides that “third party indemnity provision” means provision for indemnity against liability incurred by a director to a person other than the company or an associated company, and such provision does not provide any indemnity against: (i) any liability of the director to pay (A) a fine imposed in criminal proceedings, (B) a sum payable to a regulatory authority by way of a penalty in respect of non-compliance with any requirement of a regulatory nature (however arising); or (ii) any liability incurred by the director (A) in defending criminal proceedings in which he or she is convicted, (B) in defending civil proceedings brought by the company, or an associated company, in which judgment is given against him or her, or (C) in connection with an application for relief under section 522 of the Companies Law in which the Royal Court of Guernsey refuses to grant him or her relief. |

ITEM 8. EXHIBITS.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended (the “Securities Act”), the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Luzern, Switzerland on September 19, 2023.

| | |

BURFORD CAPITAL LIMITED |

| |

By: | | /s/ Christopher Halmy |

| | Name: Christopher Halmy |

| | Title: Authorized Person |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS that each person whose signature appears below hereby severally and individually constitutes and appoints Mark N. Klein his or her true and lawful attorney-in-fact and agent with full powers of substitution to sign on his or her behalf, individually and in any and all capacities (including the capacities stated below), any and all amendments (including post-effective amendments) to this Registration Statement and any subsequent registration statement filed by the Registrant pursuant to Rule 462(b) of the Securities Act or Instruction E to Form S-8, in each case which relates to this Registration Statement, and all instruments or documents necessary or advisable in connection therewith and to file the same, with all exhibits thereto, and other instruments and documents in connection therewith, with the US Securities and Exchange Commission, granting to said attorney-in-fact and agent, full power and authority to perform each and every act and thing whatsoever necessary or advisable to be done in and about the premises, as fully and to all intents and purposes as any of the undersigned might or could do in person, hereby ratifying and confirming everything that said attorney-in-fact and agent, or his substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

Name and Signature | | Title | | Date |

| | | | |

/s/ Christopher Bogart Christopher Bogart | | Chief Executive Officer and Director (Principal Executive Officer) | | September 19, 2023 |

| | |

/s/ Jordan Licht Jordan Licht | | Chief Financial Officer (Principal Financial Officer) | | September 19, 2023 |

| | |

/s/ Charles Utley Charles Utley | | Chief Accounting Officer (Principal Accounting Officer) | | September 19, 2023 |

| | |

/s/ Hugh Steven Wilson | | Chairman of the Board of Directors | | September 19, 2023 |

Hugh Steven Wilson | | | | |

| | |

/s/ Rukia Baruti | | Non-Executive Director | | September 19, 2023 |

Rukia Baruti | | | | |

| | |

/s/ Robert Gillespie | | Non-Executive Director | | September 19, 2023 |

Robert Gillespie | | | | |

| | |

/s/ Christopher Halmy Christopher Halmy | | Non-Executive Director | | September 19, 2023 |

| | |

/s/ John Sievwright John Sievwright | | Non-Executive Director | | September 19, 2023 |

SIGNATURE OF AUTHORIZED REPRESENTATIVE OF THE REGISTRANT

Pursuant to the requirements of the Securities Act, the undersigned, the duly authorized representative in the United States of Burford Capital Limited, has signed this Registration Statement or amendment thereto in the State of Delaware on September 19, 2023.

| | |

PUGLISI & ASSOCIATES |

| |

By: | | /s/ Donald J. Puglisi |

| | Name: Donald J. Puglisi |

| | Title: Managing Director |

Burford Capital Limited (the Company) Oak House Hirzel Street

St Peter Port

Guernsey

GY1 2NP | | D +44 1481 752312 |

| | E bryon.rees@ogier.com |

| | |

| | Ref: BPR/CBR/156090.00046 |

| | 19 September 2023 |

Dear Sirs

Burford Capital 2016 Long Term Incentive Plan

| 1.1 | We have acted as Guernsey legal counsel to the Company in connection with the Company’s registration statement on Form S-8, including all amendments or supplements thereto (the Form S-8), as filed with the US Securities and Exchange Commission under the US Securities Act of 1933, as amended, on or about the date hereof. The Form S-8 relates to the Burford Capital 2016 Long Term Incentive Plan, as amended and renewed by resolution of a general meeting on 13 May 2020 (the 2016 LTIP), and a certain number of ordinary shares of no par value in the capital of the Company which may be issued in connection with the 2016 LTIP (each, an LTIP Share). |

| 1.2 | Unless otherwise defined, capitalised terms shall have the meanings given to them in the Rules (as defined below). References herein to a Schedule are references to a schedule to this opinion. |

| 2.1 | For the purposes of giving this opinion, we have examined the corporate and other documents listed in Part A of Schedule 1 and conducted the searches referred to in Part B of Schedule 1. |

| 2.2 | We have not made any searches or enquiries concerning, and have not examined any documents entered into by or affecting the Company or any other person, save for the searches, enquiries and examinations expressly referred to in Schedule 1. |

In giving this opinion we have relied upon the assumptions set forth in Schedule 2 without having carried out any independent investigation or verification in respect of such assumptions.

Ogier (Guernsey) LLP Redwood House St Julian's Avenue St Peter Port Guernsey GY1 1WA T +44 1481 721672 F +44 1481 721575 ogier.com | Partners Martyn Baudains Paul Chanter Tim Clipstone Simon Davies Bryan de Verneuil-Smith Gavin Ferguson Matthew Guthrie Alex Horsbrugh-Porter | Christopher Jones Marcus Leese Sandie Lyne Catherine Moore Mathew Newman Bryon Rees Richard Sharp | |

On the basis of the examinations and assumptions referred to above and subject to the qualifications set forth in Schedule 3 and the limitations set forth below, we are of the opinion that:

| (a) | the Company is validly existing as a non-cellular company limited by shares and in "good standing" under Guernsey law; and |

| (b) | each LTIP Share which is issued in accordance with the Rules of the 2016 LTIP pursuant to the valid vesting of any award which has not lapsed will be validly issued, fully paid and "non-assessable" provided that: |

| (i) | such LTIP Share is issued by the directors of the Company in accordance with the memorandum and articles of incorporation of the Company, the Companies (Guernsey) Law, 2008 (as amended) and the Rules; |

| (ii) | (where relevant) any subscription price is paid in full; and |

| (iii) | the name(s) of the relevant shareholder(s) or their respective nominee(s) are entered into the register of members of the Company in respect of such LTIP Share. |

| 5 | Limitations and interpretation |

| (a) | in relation to the laws of any jurisdiction other than Guernsey (and we have not made any investigation into such laws) and we express no opinion as to the meaning, validity or effect of references in the 2016 LTIP to statutes, rules, regulations, codes or judicial authority of any jurisdiction other than Guernsey; or |

| (b) | except to the extent that this opinion expressly provides otherwise, as to the terms of, or the validity, enforceability or effect of the Form S-8, the accuracy of representations, the fulfilment of warranties or conditions, the occurrence of events of default or terminating events or the existence of any conflicts or inconsistencies among the Form S-8 and any other agreements into which the Company may have entered or any other documents. |

| 5.2 | This opinion is limited to matters referred to herein and shall not be construed as extending to any other matter or document not referred to herein. |

| (a) | Good standing means that as at the date of this opinion, (i) the Company was duly incorporated on 11 September 2009 and is validly existing under Guernsey law; and (ii) a search of the Public Records (as defined below) on the date hereof revealed no evidence of any orders or resolutions for the winding up or dissolution of the Company and no evidence of the appointment of any administrator or liquidator in respect of the Company or any of its assets. |

| (b) | Non-assessable means, with respect to an LTIP Share, that the liability of the registered holder of an LTIP Share to the Company is limited to the amount unpaid on that LTIP Share. |

| 6 | Governing law and reliance |

| (a) | governed by and shall be construed in accordance with Guernsey law; |

| (b) | limited to the matters expressly stated herein; and |

| (c) | confined to and given on the basis of the laws and practice in Guernsey at the date hereof. |

| 6.2 | All references in this opinion to specific Guernsey legislation shall be to such legislation as amended to the date hereof. |

| 6.3 | We hereby consent to the filing of this opinion as Exhibit 5.1 to the Form S-8. |

| (a) | may be used only in connection with the Form S-8 while the 2016 LTIP is effective; and |

| (b) | is given for your benefit and, with the exception of disclosure on a non-reliance basis to (i) your professional advisers (acting in that capacity) and (ii) publicly filing on the Electronic Data Gathering, Analysis and Retrieval (EDGAR) system, it may not be disclosed to or relied upon by any person or used for any other purpose or referred to or made public in any way without our prior written consent. |

Yours faithfully

/s/ Ogier (Guernsey) LLP

Ogier (Guernsey) LLP

Documents examined

Part A

Corporate and other documents

| 1 | A certificate signed by a director of the Company dated on or about the date hereof (the Director's Certificate) relating to certain questions of fact together with true and complete copies of the documents referred to therein, including the rules of the 2016 LTIP, approved by resolution of a general meeting of the Company held on 15 December 2016 and further amended and renewed by resolution of a general meeting of the Company held on 13 May 2020 (the Rules). |

| 2 | The certificate of incorporation and any certificates of change of name of the Company appearing on the Public Records on the date of this opinion. |

| 3 | The memorandum of incorporation of the Company dated 11 September 2009 appearing on the Public Records on the date of this opinion. |

| 4 | The articles of incorporation of the Company dated 13 May 2020 appearing on the Public Records on the date of this opinion. |

Part B

Searches

The public records of or relating to the Company on file and available for inspection on or visible through the registers maintained by the Registrar of Companies (the Companies Registry) and the office of HM Greffier on the date hereof (the Public Records).

Schedule 2

Assumptions

| 1 | All original documents examined by us are authentic and complete. |

| 2 | All copy documents and counterparts of documents provided to us (whether in facsimile, electronic or other form) conform to the originals of such documents and those originals are authentic and complete. |

| 3 | The signatures, seals, dates, stamps and markings (whether on original or copy documents) are genuine. |

| 4 | A meeting of the Company’s board of directors (or a duly authorised committee thereof) will be duly and validly convened and held at which it will be resolved to authorise and issue any LTIP Share that has not been so authorised as of the date hereof (a Board Meeting). |

| 5 | In resolving that the Company issue an LTIP Share pursuant to the relevant resolution(s) in a Board Meeting or previous meeting of the Company's board of directors (or a duly authorised committee thereof): |

| (a) | each of the directors of the Company was, or will be, acting in good faith with a view to the best interests of the Company and was, or will be, exercising the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances; and |

| (b) | the directors of the Company were complying, or will comply, with all relevant Guernsey legal requirements, including the solvency test under the Companies (Guernsey) Law, 2008 (as amended), and in issuing any LTIP Share will comply, and will procure that the Company's registrar complies, with the memorandum and articles of incorporation of the Company and all relevant resolutions of the shareholders of the Company in force at the time of issue of such LTIP Share. |

| 6 | None of the opinions expressed in this opinion will be adversely affected by the laws or public policies of any jurisdiction other than Guernsey. In particular, but without limitation, there are no provisions of the laws of any jurisdiction other than Guernsey, or any judgments, orders or judicial decision in any jurisdiction other than Guernsey, which would render the issue of an LTIP Share illegal or ineffective. |

| 7 | The Director's Certificate and the documents referred to therein or attached thereto, and any factual statements made therein, are accurate and complete as at the date hereof. |

| 8 | The information and documents disclosed by our searches of the Public Records are accurate as at the date hereof and there is no information or document which has been delivered to the Companies Registry or the office of HM Greffier, or which is required by Guernsey law to be delivered, which was not included in the Public Records. |

| 9 | The Company has duly complied, remains compliant and at the time of admission of any LTIP Share will comply with all requirements of any relevant stock exchange and any other applicable laws, rules and regulations of any jurisdiction other than Guernsey. |

Qualifications

| 1 | Information available in public registries in Guernsey is limited and, in particular, there is no publicly available record of charges or other security interests over the shares or assets of Guernsey companies (other than relating to real property situated in Guernsey, ships in respect of which title has been entered on the Registry of British Ships maintained in Guernsey and aircraft, aircraft engines and charges and priority notices related thereto, which have been entered in the Registers maintained in Guernsey pursuant to the Aviation Registry (Guernsey) Law, 2013). |

| 2 | The search of the Public Records referred to in this opinion is not conclusively capable of revealing whether or not an order or application has been made or a resolution passed for the winding up or dissolution of the Company or for the appointment of any administrator or liquidator in respect of the Company, as notice of these matters might not be filed with the Companies Registry or the office of HM Greffier immediately and, when filed, might not be available or visible immediately. In addition there is no officially approved litigation search which can be conducted. Records of matters which have gone through court depend entirely upon input by Greffe officials, so that there is a time lag which could also lead to an inaccurate report. Further, a search of the Public Records referred to above will not in any event indicate matters in respect of which a summons has been issued, but which has not had a hearing in either the Magistrate's Court or the Royal Court. |

| 3 | Where Public Records are available for inspection electronically we have not conducted a physical search of records held and have relied exclusively upon information and documents which were visible via such electronic inspection at the time of inspection. |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the Burford Capital 2016 Long Term Incentive Plan of our reports dated May 16, 2023, with respect to the consolidated financial statements of Burford Capital Limited and the effectiveness of internal control over financial reporting of Burford Capital Limited included in its Annual Report (Form 20-F) for the year ended December 31, 2022, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Guernsey, Channel Islands

September 19, 2023

Exhibit 107

CALCULATION OF FILING FEE TABLE

FORM S-8

(Form type)

____________________

BURFORD CAPITAL LIMITED

(Exact name of registrant as specified in its charter)

Table 1: Newly Registered Securities

| | | | | | | |

Security

Type | Security

Class Title | Fee

Calculation

Rule | Amount

Registered

(1), (2) | Proposed

Maximum

Offering

Price Per

Unit(3) | Maximum

Aggregate

Offering

Price(3) | Fee Rate | Amount of

Registration

Fee(4) |

Equity | Ordinary shares, no par value (“Ordinary Shares”) | Other | 10,000,000 | $15.00 | $150,000,000.00 | $110.20 per $1,000,000 | $16,530.00 |

Total Offering Amounts | | $150,000,000.00 | | $16,530.00 |

Total Fee Offsets | | | | — |

Net Fee Due | | | | $16,530.00 |

| (1) | This registration statement on Form S-8 (this “Registration Statement”) is being filed by Burford Capital Limited (the “Registrant”) with the US Securities and Exchange Commission (the “SEC”) to register an additional 10,000,000 Ordinary Shares which may be issued under the Burford Capital 2016 Long Term Incentive Plan, as amended and renewed on May 13, 2020 (as the same may be further amended or renewed from time to time, the “Plan”). |

| (2) | Pursuant to Rule 416(a) under the US Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers any additional Ordinary Shares that may become issuable under the Plan pursuant to this Registration Statement by reason of any stock dividend, stock split, recapitalization or any other similar transaction effected without receipt of consideration which results in an increase in the number of the Registrant’s outstanding Ordinary Shares. |

| (3) | Estimated, solely for the purpose of calculating the registration fee, pursuant to Rules 457(c) and 457(h)(1) promulgated under the Securities Act, based on the average of the high and low sales prices for the Ordinary Shares reported on the New York Stock Exchange on September 15, 2023. |

| (4) | Determined in accordance with Section 6(b) of the Securities Act at a rate equal to $110.20 per $1,000,000 of the proposed maximum aggregate offering price. |

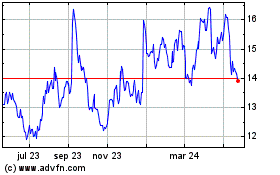

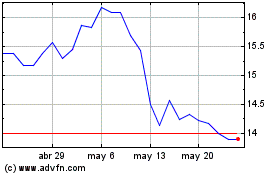

Burford Capital (NYSE:BUR)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Burford Capital (NYSE:BUR)

Gráfica de Acción Histórica

De May 2023 a May 2024