BREIT Appoints Wesley LePatner CEO

22 Agosto 2024 - 3:15PM

Business Wire

Frank Cohen to Retire at Year-End; Will

Remain Chairman of BREIT Board

Blackstone Real Estate Income Trust, Inc. (“BREIT”) today

announced that current Chief Operating Officer, Wesley LePatner,

will become BREIT’s Chief Executive Officer as of January 1, 2025.

She will succeed Frank Cohen, who, after nearly thirty years, plans

to retire from Blackstone at year-end. Mr. Cohen will remain

Chairman of BREIT’s Board of Directors.

Kathleen McCarthy and Nadeem Meghji, Global Co-Heads of

Blackstone Real Estate, said: “This announcement effectuates the

next stage of BREIT’s long-planned succession. We are incredibly

fortunate to have a colleague of Wesley’s caliber, who has been

intimately involved with BREIT since inception. Wesley will

seamlessly step in at a time when real estate values have begun to

recover. Frank has been a valuable partner and mentor to all of us

and we are incredibly grateful for his dedication to the

business.”

Jon Gray, President & COO of Blackstone, said: “For almost

30 years, Frank has been a friend, partner and enormous contributor

to the success of Blackstone Real Estate. We will all miss him. We

are quite pleased he will continue as Chairman of BREIT. We are

confident that Wesley will continue to drive exceptional

performance through her tremendous talent and sector expertise. We

couldn’t be prouder of how BREIT has delivered for investors since

inception seven and a half years ago.”

Ms. LePatner joined Blackstone in 2014 to spearhead the creation

of the Core+ business, including the launch of all three open-ended

Core+ strategies (U.S., Europe and Asia). Ms. LePatner has been

integral to the success of these strategies, having helped

conceive, build and operationalize BREIT as COO and a Board

member.

Since joining Blackstone in 1996, Mr. Cohen has held a number of

leadership positions in Blackstone Real Estate, including

overseeing Americas Acquisitions, Global Head of Core+ Real Estate

and Chairman and CEO of BREIT.

Ms. LePatner said: “I am honored to become CEO of BREIT. Its

portfolio is over 85% concentrated in data centers, industrial and

rental housing, sectors which are benefiting from megatrends and we

are well-positioned to capitalize on the highly compelling

opportunities in today’s market. It has been an honor to work

alongside Frank since I joined Blackstone ten years ago and I wish

him the best in his next chapter.”

Mr. Cohen said: “I want to express my deepest gratitude to

Steve, Jon and the entire Blackstone team for creating the culture

of excellence that has made this a first-rate place for our

employees and investors alike. Wesley is a phenomenal leader and I

look forward to seeing her continue to drive exceptional

performance for BREIT’s investors.”

Since inception over seven and a half years ago, BREIT has

delivered a 10% annualized net return on Class I, ~2x publicly

traded REITs. BREIT’s differentiated portfolio, which is

concentrated in high growth sectors including data centers,

warehouses and student housing, and in fast growing Sunbelt

markets, has driven this outperformance.

About Blackstone Real Estate Income Trust

Blackstone Real Estate Income Trust, Inc. (BREIT) is a

perpetual-life, institutional quality real estate investment

platform that brings private real estate to income focused

investors. BREIT invests primarily in stabilized, income-generating

U.S. commercial real estate across key property types and to a

lesser extent in real estate debt investments. BREIT is externally

managed by a subsidiary of Blackstone (NYSE: BX), a global leader

in real estate investing. Blackstone’s real estate business was

founded in 1991 and has approximately $336 billion in investor

capital under management. Further information is available at

www.breit.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the federal securities laws and the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by the use of forward-looking

terminology such as “outlook,” “indicator,” “believes,” “expects,”

“potential,” “continues,” “identified,” “may,” “will,” “should,”

“seeks,” “approximately,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates”, “confident,” “conviction” or other

similar words or the negatives thereof. These may include financial

estimates and their underlying assumptions, statements about plans,

objectives, intentions, and expectations with respect to

positioning, including the impact of macroeconomic trends and

market forces, future operations, repurchases, acquisitions, future

performance and statements regarding identified but not yet closed

acquisitions. Such forward-looking statements are inherently

subject to various risks and uncertainties. Accordingly, there are

or will be important factors that could cause actual outcomes or

results to differ materially from those indicated in such

statements. We believe these factors include but are not limited to

those described under the section entitled “Risk Factors” in

BREIT’s prospectus and annual report for the most recent fiscal

year, and any such updated factors included in BREIT’s periodic

filings with the SEC, which are accessible on the SEC’s website at

www.sec.gov. These factors should not be construed as exhaustive

and should be read in conjunction with the other cautionary

statements that are included in this document (or BREIT’s public

filings). Except as otherwise required by federal securities laws,

we undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future developments or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240822036714/en/

Jeffrey Kauth Jeffrey.Kauth@Blackstone.com (212) 583-5395

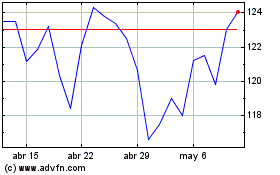

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024