Chegg, Inc. (NYSE:CHGG), the leading student-first connected

learning platform, today reported financial results for the three

months ended September 30, 2024.

“While the global education industry continues to experience

tremendous change, in Q3, we showed early progress against our

strategic plan and delivered better-than-expected revenue and

adjusted EBITDA. However, recent technology shifts and generative

AI have created significant headwinds, and as a result, we are

undertaking an additional restructuring,” said Nathan Schultz,

Chief Executive Officer & President of Chegg, Inc. “There

continues to be a market of students looking for the high-quality,

proven, and differentiated learning expertise Chegg provides, and

we believe our brand and product experience are resilient and will

endure.”

In November 2024, our Board of Directors approved a $300.0

million increase to our existing securities repurchase program

authorizing the repurchase of our common stock and/or convertible

notes, through open market purchases, block trades, and/or

privately negotiated transactions or pursuant to Rule 10b5-1 plans,

in compliance with applicable securities laws and other legal

requirements. The timing, volume, and nature of the repurchases

will be determined by management based on the capital needs of the

business, market conditions, applicable legal requirements, and

other factors. After the November 2024 increase, we have $303.7

million remaining under the securities repurchase program, which

has no expiration date and will continue until otherwise suspended,

terminated or modified at any time for any reason by our board of

directors.

Third Quarter 2024

Highlights

- Total Net Revenues of $136.6 million, a decrease of 13%

year-over-year

- Subscription Services Revenues of $119.8 million, a

decrease of 14% year-over-year

- Gross Margin of 68%

- Non-GAAP Gross Margin of 70%

- Net Loss was $212.6 million

- Non-GAAP Net Income was $9.8 million

- Adjusted EBITDA was $22.3 million

- 3.8 million Subscription Services subscribers, a

decrease of 13% year-over-year

Total net revenues include revenues from Subscription Services

and Skills and Other. Subscription Services includes revenues from

our Chegg Study Pack, Chegg Study, Chegg Writing, Chegg Math, and

Busuu offerings. Skills and Other includes revenues from Chegg

Skills, Advertising, and any other revenues not included in

Subscription Services.

For more information about non-GAAP net income, non-GAAP gross

margin and adjusted EBITDA, and a reconciliation of non-GAAP net

income to net (loss) income, gross margin to non-GAAP gross margin

and adjusted EBITDA to net (loss) income, see the sections of this

press release titled, “Use of Non-GAAP Measures,” “Reconciliation

of Net (Loss) Income to EBITDA and Adjusted EBITDA,” and

“Reconciliation of GAAP to Non-GAAP Financial Measures.”

Business Outlook

Fourth Quarter 2024

- Total Net Revenues in the range of $141 million to $143

million

- Subscription Services Revenues in the range of $126

million to $128 million

- Gross Margin between 67% and 68%

- Adjusted EBITDA in the range of $32 million to $34

million

For more information about the use of forward-looking non-GAAP

measures, a reconciliation of forward-looking net loss to EBITDA

and adjusted EBITDA for the fourth quarter 2024, see the below

sections of the press release titled “Use of Non-GAAP Measures,”

and “Reconciliation of Forward-Looking Net Loss to EBITDA and

Adjusted EBITDA.”

An updated investor presentation and an investor data sheet can

be found on Chegg’s Investor Relations website

https://investor.chegg.com.

Prepared Remarks - Nathan Schultz, CEO

& President Chegg, Inc.

Thank you, Tracey. Hello everyone and thank you for joining

Chegg’s third-quarter earnings call. I’ll start today by walking

you through our Q3 results, and then discuss important shifts in

our competitive landscape and what they mean for our business going

forward.

In Q3, while the global education industry continues to

experience tremendous change, we have shown early progress against

the strategic plan we outlined in June. As a result of this work,

in Q3 we delivered better-than-expected revenue of $137 million and

$22 million in adjusted EBITDA. Engagement remained high with the

number of questions asked in the quarter up 79% year-over-year and

our Q3 Chegg Study and Study Pack monthly retention rate increased

30 basis points year-over-year.

However, technology shifts have created headwinds for our

industry and Chegg’s business specifically. Recent advancements in

the AI search experience and the adoption of free and paid

generative AI services by students, have resulted in challenges for

Chegg. These factors are adversely affecting our business outlook

and are requiring us to refocus and adjust the size of our

business.

Even in the face of adversity, there continues to be a large

market of students looking for the high-quality, proven learning

experience that Chegg provides. We will continue to

enthusiastically serve this audience, and I remain optimistic in

the outlook for us to extend our brand, individualize our product

and weather these challenges.

The first impact I’d like to discuss is Google’s broad rollout

of its AI Overviews search experience, or AIO, which displays

AI-generated content at the top of a search results page. This

experience keeps users on Google’s search results page instead of

leading them onto third-party sites such as Chegg. This rollout has

been rapid, and while we’ve been monitoring the development of AIO

all year, it was not until mid-August that this search experience

significantly expanded. It’s our belief that the prevalence of AIO

will only continue to increase, and that Google, in its attempt to

maintain market share, is shifting from being a search origination

point to the destination, disintermediating content sites like

Chegg.

Second, across our industry, there has been a continued increase

in the adoption of free and paid generative AI products. It has

been widely reported and substantiated in industry research, that

students are increasingly turning to generative AI for academic

support, such as homework and exams. This issue impacts the

education ecosystem at large, including universities and education

technology companies broadly where students see generative AI

products like Chat GPT as strong alternatives to vertically

specialized solutions for education, such as Chegg.

These factors, the speed and scale of Google’s AIO rollout and

student adoption of generative AI products, have negatively

impacted our industry and our business. We have seen a sharp

decline in overall traffic, and therefore, a decline in our outlook

on revenue. Global non-subscriber traffic to Chegg declined

year-over-year 8% in Q2, 19% in Q3, and we exited Q3 with trends

looking even more unfavorable, at negative 37% year-over-year for

the month of October.

We have taken all of this into account, and consequently, we do

not expect to meet our 2025 goals of 30% adjusted EBITDA margin and

$100 million in free cash flow.

Earlier this year, we undertook a strategic restructuring based

on the environment in which we were operating. Since then, these

new factors have come into play with immense speed and impact. As a

result, we are undertaking an additional restructuring to further

manage costs and align with the market.

Effective immediately, we are initiating a broad restructuring

that will impact all groups across the company:

- We will reduce headcount by an additional 21%.

- We anticipate that these actions, along with additional

operating expense savings, will result in annualized non-GAAP cost

savings of $60-$70 million in 2025.

- The cost savings from the restructuring announced in June,

coupled with the restructuring announced today, will result in a

combined non-GAAP savings of $100-$120 million in 2025.

Even with this, we remain optimistic that there is an audience

for Chegg. While it’s clear that some students will favor

generative AI options, we believe there is still a large market of

students who care about learning and are seeking products that

improve their competency and outcomes. In an August 2024

quantitative study, we found that over 75% of high school and

college students in North America show a high to medium willingness

to pay for online educational tools if they significantly improve

academic performance. Therefore, we believe there continues to be a

student audience that is looking for high-quality content and

proven learning expertise.

This is what differentiates Chegg from other generative AI tools

today and why millions of learners depend on Chegg to provide

meaningful learning experiences with the highest quality content

possible. Fifteen years of deep expertise in understanding

students, applying advanced learning science to the subjects and

topics students learn, providing an archive of 132 million

high-quality solutions, and human-supported output has created deep

trust and awareness for Chegg. That’s why students continue to come

directly to Chegg, even as the competitive environment evolves.

We have taken steps towards the strategic plan we laid out in

June. We remain committed to developing a verticalized and

individualized experience for education and supporting students

throughout their entire learning journey, starting with academic

support and eventually functional support.

Let me acknowledge the progress we have made on our strategic

plan in the third quarter:

- We launched our “Small steps, big wins” brand marketing

campaign, which is showing early signs of progress, with

year-over-year improvements in click-thru-rate and conversion rate

across many of our paid marketing channels.

- We introduced a content quality and satisfaction guarantee

differentiating our service against generative AI and building

trust and loyalty with our subscribers. While it is still early, it

is driving a lift in new subscriber conversion rate.

- We implemented an ‘AI Arena’ that allows us to evaluate and

introduce new frontier AI models in real-time to deliver the most

accurate solutions for students and integrate AI into the full

learning journey.

- We upgraded our QnA experience to align with our drive towards

providing an individualized and adaptive learning solution. This

effort has already shown an improvement in user engagement and

retention.

- We launched an app on Discord as well as an Extension on Chrome

to reach students where they are already spending time. These

efforts connect students' study activities across sites, engage

them with our product, create new pathways for product-driven

growth, which we expect will reduce our reliance on SEO.

- We moved to a new vendor-based commerce platform, which will

reduce our costs, provide flexibility and allow us to move faster

as we continue to evolve our pricing and packaging programs.

- And finally, we launched four direct-to-institution

partnerships, providing access to Chegg Study paid for by the

institutional partner. These pilots allow us to gather valuable

insights on how Chegg can enhance classroom learning, supporting

our goal to diversify our customer acquisition and revenue streams,

while strengthening Chegg's role in improving student learning

outcomes.

As we head into the spring semester, you will continue to see

our commitment to building and generating momentum with our brand,

traffic, and product capabilities:

- We will continue to raise brand awareness with a new spring

brand campaign. Our creative strategy builds on Chegg's long legacy

of empowering students and our unique caring approach. The plan

will activate across the full funnel, which we believe will bring

new users in, create strong consideration and connection, and

ultimately drive conversion. Based on what we learned this fall

from Small Steps Big Wins, we believe this strategy will bring both

audience expansion and acquisition efficiency.

- On the product front, we will continue delivering

individualized learning solutions, specifically focusing on

expanding into two of the most highly relevant use cases: practice

and solution comparison. These are durable needs and core learner

behaviors that support learning.

While we acknowledge the significance of the headwinds we

covered earlier, Chegg has a deep legacy of serving students and we

believe our brand and product experiences are resilient. We remain

optimistic and will continue to be there for the students who have

grown to rely on us. As you’ve heard, we are already taking steps

to strengthen our experience and increase efficiency across the

business.

This is a multi-year plan that will require patience, and we

will continue to manage our expenses prudently as the competitive

landscape evolves. We will keep focused on doing the right thing

for our investors, our team, and the students we serve.

Before I end, I want to thank our employees around the world for

their hard work and dedication. Their efforts and talents have

helped support students and bring learning to life, and while this

is a trying time for us all, I am confident that we will get

through it.

With that, I’ll turn it over to David.

Prepared Remarks - David Longo, CFO

Chegg, Inc.

Thank you, Nathan and good afternoon.

Today, I will present our financial performance for the third

quarter of 2024 and the company’s outlook for Q4.

We delivered a solid third quarter. During the quarter, we

remained focused on executing our strategic plan to deliver our

AI-driven experience to students around the world, while we

continued to prudently manage our expenses. We exceeded our Q3

guidance on both revenue and adjusted EBITDA, and our balance sheet

remains healthy.

In the third quarter, total revenue was $137 million, down 13%

year-over-year, including Subscription Services revenue of $120

million, which was down 14% year-over-year. We had 3.8 million

subscribers in the quarter, representing a decline of 13%.

Subscription Services ARPU was down 2% year-over-year, a one-point

improvement from Q2 2024. Overall monthly retention for Chegg Study

and Study Pack remained strong and was up 30 basis points

year-over-year. Skills and Other revenue was $17 million, a

decrease of 6% year-over-year. And we delivered adjusted EBITDA of

$22 million which represented a margin of 16%.

We had two notable items this quarter. First, we recorded an

impairment charge against our goodwill. As a result of continued

industry pressure and declines in our market capitalization, and as

required by accounting rules, we completed an impairment test on

our goodwill which resulted in a $196 million non-cash impairment

charge that was excluded from our Q3 adjusted EBITDA. Second, we

reached a settlement agreement to resolve the Leventhal class

action securities lawsuit. We recorded $55 million for the

estimated contingent liability for the loss, along with a $55

million receivable for the insurance proceeds we expect to receive.

These amounts had no impact on our Q3 adjusted EBITDA. While we

strongly disagree with the premise of the case and deny all

allegations of wrongdoing, the decision to settle the lawsuit was

driven by the cost and burden of ongoing protracted class action

litigation and the monetary costs of defending the case. We are

happy to have this matter resolved.

Free cash flow was $24 million in the third quarter. Capital

expenditures were $15.8 million in the quarter, down 32%

year-over-year, of which $10 million were content costs. As we

harness the power of AI, CapEx content costs were down 28%

year-over-year, while the number of questions asked increased

79%.

Looking at the balance sheet, we ended the quarter with cash and

investments of $631 million and a net cash balance of $30

million.

Today, we announced that our Board of Directors has authorized

an increase of $300 million as part of our securities repurchase

program. The program will allow us to buy back our convertible

notes and/or common stock. Chegg had approximately $3.7 million

remaining from its previously announced program.

As Nathan discussed earlier, we are executing a restructuring

plan to better align our cost structure with recent industry

challenges and the negative impact on our business. While these

difficult decisions are essential for Chegg's future, we recognize

the unfortunate impact they may have on many of our employees and

their families.

Our restructuring will impact 319 employees, or approximately

21% of the company. In 2025, the company expects to realize

non-GAAP expense savings of $60-$70 million from these employee

departures, real estate savings, as well as other cost

rationalizations. Chegg expects to incur a $22-$26 million charge

related to the restructuring. Of this charge, $18-$22 million will

be incurred in cash representing mostly severance payments, with

the remaining amount representing non-cash charges. We expect that

a substantial portion of the cash and non-cash charges will be

incurred in the fourth quarter. We anticipate these activities and

substantially all charges will be completed by June 30, 2025. The

cost savings from the restructuring announced in June, coupled with

the restructuring announced today, will result in a combined

non-GAAP savings of $100-$120 million in 2025.

Moving on to Q4 guidance, we expect:

- Total revenue between $141 and $143 million, with Subscription

Services revenue between $126 and $128 million;

- Gross margin to be in the range of 67 to 68 percent;

- And adjusted EBITDA between $32 and $34 million.

In closing, while our business outlook has significantly

softened versus our prior expectations, and these numbers are not

where we want them to be, like many companies in the ed-tech space,

we are dealing with the challenges of a dynamically changing AI

landscape. We are working to expand our best-in-class verticalized

experience for students focused on improving their outcomes,

however, it will take time to adjust to the new opportunity and see

the benefits in our business results. In the meantime, we are

committed to maintaining transparency about the industry and our

business trends.

With that, I will turn the call over to the operator for your

questions.

Conference Call and Webcast

Information

To access the call, please dial 1-877-407-4018, or outside the

U.S. +1-201-689-8471, five minutes prior to 1:30 p.m. Pacific Time

(or 4:30 p.m. Eastern Time). A live webcast of the call will also

be available at https://investor.chegg.com under the Events &

Presentations menu. An audio replay will be available beginning at

4:30 p.m. Pacific Time (or 7:30 p.m. Eastern Time) on November 12,

2024, until 8:59 p.m. Pacific Time (or 11:59 p.m. Eastern Time) on

November 19, 2024, by calling 1-844-512-2921, or outside the U.S.

+1-412-317-6671, with Conference ID 13749504. An audio archive of

the call will also be available at https://investor.chegg.com.

Use of Investor Relations Website for

Regulation FD Purposes

Chegg also uses its media center website,

https://www.chegg.com/press, as a means of disclosing material

non-public information and for complying with its disclosure

obligations under Regulation FD. Accordingly, investors should

monitor https://www.chegg.com/press, in addition to following press

releases, Securities and Exchange Commission filings and public

conference calls and webcasts.

About Chegg

Chegg provides individualized learning support to students as

they pursue their educational journeys. Available on demand 24/7

and powered by over a decade of learning insights, the Chegg

platform offers students AI-powered academic support thoughtfully

designed for education coupled with access to a vast network of

subject matter experts who ensure quality. No matter the goal,

level, or style, Chegg helps millions of students around the world

learn with confidence by helping them build essential academic,

life, and job skills to achieve success. Chegg is a publicly held

company based in Santa Clara, California and trades on the NYSE

under the symbol CHGG. For more information, visit

www.chegg.com.

Use of Non-GAAP Measures

To supplement Chegg’s financial results presented in accordance

with generally accepted accounting principles in the United States

(GAAP), this press release and the accompanying tables and the

related earnings conference call contain non-GAAP financial

measures, including adjusted EBITDA, non-GAAP cost of revenues,

non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating

expenses, non-GAAP income from operations, non-GAAP net income,

non-GAAP weighted average shares, non-GAAP net income per share,

and free cash flow. For reconciliations of these non-GAAP financial

measures to the most directly comparable GAAP financial measures,

please see the section of the accompanying tables titled,

“Reconciliation of Net (Loss) Income to EBITDA and Adjusted

EBITDA,” “Reconciliation of GAAP to Non-GAAP Financial Measures,”

“Reconciliation of Net Cash Provided by Operating Activities to

Free Cash Flow,” and “Reconciliation of Forward-Looking Net Loss to

EBITDA and Adjusted EBITDA.”

The presentation of these non-GAAP financial measures is not

intended to be considered in isolation from, as a substitute for,

or superior to, the financial information prepared and presented in

accordance with GAAP, and may be different from non-GAAP financial

measures used by other companies. Chegg defines (1) adjusted EBITDA

as earnings before interest, taxes, depreciation and amortization

or EBITDA, adjusted for share-based compensation expense, other

income, net, acquisition-related compensation costs, impairment

expense, restructuring charges, content and related assets charge

and transitional logistic charges; (2) non-GAAP cost of revenues as

cost of revenues excluding amortization of intangible assets,

share-based compensation expense, acquisition-related compensation

costs, restructuring charges, content and related assets charge,

and transitional logistic charges; (3) non-GAAP gross profit as

gross profit excluding amortization of intangible assets,

share-based compensation expense, acquisition-related compensation

costs, restructuring charges, content and related assets charge,

and transitional logistic charges; (4) non-GAAP gross margin is

defined as non-GAAP gross profit divided by net revenues, (5)

non-GAAP operating expenses as operating expenses excluding

share-based compensation expense, amortization of intangible

assets, acquisition-related compensation costs, restructuring

charges, impairment expense, impairment of lease related assets,

and loss contingency; (6) non-GAAP income from operations as loss

from operations excluding share-based compensation expense,

amortization of intangible assets, acquisition-related compensation

costs, restructuring charges, impairment expense, content and

related assets charge, impairment of lease related assets, loss

contingency, and transitional logistic charges; (7) non-GAAP net

income as net (loss) income excluding share-based compensation

expense, amortization of intangible assets, acquisition-related

compensation costs, amortization of debt issuance costs, the income

tax effect of non-GAAP adjustments, restructuring charges,

impairment expense, content and related assets charge, impairment

of lease related assets, gain on sale of strategic equity

investment, gain on early extinguishment of debt, loss contingency

and transitional logistic charges; (8) non-GAAP weighted average

shares outstanding as weighted average shares outstanding adjusted

for the effect of shares for stock plan activity and shares related

to our convertible senior notes, to the extent such shares are not

already included in our weighted average shares outstanding; (9)

non-GAAP net income per share is defined as non-GAAP net income

divided by non-GAAP weighted average shares outstanding; and (10)

free cash flow as net cash provided by operating activities

adjusted for purchases of property and equipment. To the extent

additional significant non-recurring items arise in the future,

Chegg may consider whether to exclude such items in calculating the

non-GAAP financial measures it uses.

Chegg believes that these non-GAAP financial measures, when

taken together with the corresponding GAAP financial measures,

provide meaningful supplemental information regarding Chegg’s

performance by excluding items that may not be indicative of

Chegg’s core business, operating results or future outlook. Chegg

management uses these non-GAAP financial measures in assessing

Chegg’s operating results, as well as when planning, forecasting

and analyzing future periods and believes that such measures

enhance investors’ overall understanding of our current financial

performance. These non-GAAP financial measures also facilitate

comparisons of Chegg’s performance to prior periods.

As presented in the “Reconciliation of Net (Loss) Income to

EBITDA and Adjusted EBITDA,” “Reconciliation of GAAP to Non-GAAP

Financial Measures,” “Reconciliation of Forward-Looking Net Loss to

EBITDA and Adjusted EBITDA,” and “Reconciliation of Net Cash

Provided by Operating Activities to Free Cash Flow,” tables below,

each of the non-GAAP financial measures excludes or includes one or

more of the following items:

Share-based compensation expense.

Share-based compensation expense is a non-cash expense that

varies in amount from period to period and is dependent on market

forces that are often beyond Chegg's control. As a result,

management excludes this item from Chegg's internal operating

forecasts and models. Management believes that non-GAAP measures

adjusted for share-based compensation expense provide investors

with a basis to measure Chegg's core performance against the

performance of other companies without the variability created by

share-based compensation as a result of the variety of equity

awards used by other companies and the varying methodologies and

assumptions used.

Amortization of intangible assets.

Chegg amortizes intangible assets, including those that

contribute to generating revenues, that it acquires in conjunction

with acquisitions, which results in non‑cash expenses that may not

otherwise have been incurred. Chegg believes excluding the expense

associated with intangible assets from non-GAAP measures allows for

a more accurate assessment of its ongoing operations and provides

investors with a better comparison of period-over-period operating

results. No corresponding adjustments have been made related to

revenues generated from acquired intangible assets.

Acquisition-related compensation costs.

Acquisition-related compensation costs include compensation

expense resulting from the employment retention of certain key

employees established in accordance with the terms of the

acquisitions. In most cases, these acquisition-related compensation

costs are not factored into management's evaluation of potential

acquisitions or Chegg's performance after completion of

acquisitions, because they are not related to Chegg's core

operating performance. In addition, the frequency and amount of

such charges can vary significantly based on the size and timing of

acquisitions and the maturities of the businesses being acquired.

Excluding acquisition-related compensation costs from non-GAAP

measures provides investors with a basis to compare Chegg’s results

against those of other companies without the variability caused by

purchase accounting.

Amortization of debt issuance costs.

The difference between the effective interest expense and the

contractual interest expense are excluded from management's

assessment of our operating performance because management believes

that these non-cash expenses are not indicative of ongoing

operating performance. Chegg believes that the exclusion of the

non-cash interest expense provides investors with a better

comparison of period-over-period operating results.

Income tax effect of non-GAAP adjustments.

We utilize a non-GAAP effective tax rate for evaluating our

operating results, which is based on our current mid-term

projections. This non-GAAP tax rate could change for various

reasons including, but not limited to, significant changes

resulting from tax legislation, changes to our corporate structure

and other significant events. Chegg believes that the inclusion of

the income tax effect of non-GAAP adjustments provides investors

with a better comparison of period-over-period operating

results.

Restructuring charges.

Restructuring charges represent expenses incurred in conjunction

with a reduction in workforce. Chegg believes that it is

appropriate to exclude them from non-GAAP financial measures

because they are nonrecurring and the result of an event that is

not considered a core-operating activity. Chegg believes that it is

appropriate to exclude the restructuring charges from non-GAAP

financial measures because it provides investors with a better

comparison of period-over-period operating results.

Impairment expense.

Impairment expense represents the impairment of goodwill,

intangible assets, and property and equipment. Chegg believes that

it is appropriate to exclude them from non-GAAP financial measures

because they are the result of discrete events that are not

considered core-operating activities and are not indicative of our

ongoing operating performance. Chegg believes that it is

appropriate to exclude the impairment expense from non-GAAP

financial measures because it provides investors with a better

comparison of period-over-period operating results.

To conform with current quarter presentation, $3.6 million of

impairment expense included within content and related assets

charge during the three months and nine months ended September 30,

2023 has been reclassified to impairment expense. This change in

presentation does not affect previously reported results.

Impairment of lease related assets.

The impairment of lease related assets represents impairment

charge recorded on the ROU asset and leasehold improvements

associated with the closure of our offices. The impairment of lease

related assets is the result of an event that is not considered a

core-operating activity and we believe its exclusion provides

investors with a better comparison of period-over-period operating

results.

Content and related assets charge.

The content and related assets charge represents a write off of

certain content and related assets. The content and related assets

charge is excluded from non-GAAP financial measures because it is

the result of a discrete event that is not considered

core-operating activities. Chegg believes that it is appropriate to

exclude the content and related assets charge from non-GAAP

financial measures because it enables the comparison of

period-over-period operating results.

Gain on sale of strategic equity investment.

The gain on sale of strategic equity investment represents a

one-time event to record the sale of our equity investment in Sound

Ventures. We believe that it is appropriate to exclude the gain

from non-GAAP financial measure because it is the result of an

event that is not considered a core-operating activity and we

believe its exclusion provides investors with a better comparison

of period-over-period operating results.

Gain on early extinguishment of debt.

The difference between the carrying amount of early extinguished

debt and the reacquisition price is excluded from management's

assessment of our operating performance because management believes

that these non-cash gains are not indicative of ongoing operating

performance. Chegg believes that the exclusion of the gain on early

extinguishment of debt provides investors with a better comparison

of period-over-period operating results.

Loss contingency.

We record a contingent liability for a loss contingency related

to legal matters when a loss is both probable and reasonably

estimable. The loss contingency is excluded from non-GAAP financial

measures because they are the result of discrete events that are

not considered core-operating activities. Chegg believes that it is

appropriate to exclude the loss contingency from non-GAAP financial

measures because it enables the comparison of period-over-period

operating results.

Transitional logistics charges.

The transitional logistics charges represent incremental

expenses incurred as we transition our print textbooks to a third

party. Chegg believes that it is appropriate to exclude them from

non-GAAP financial measures because it is the result of an event

that is not considered a core-operating activity and we believe its

exclusion provides investors with a better comparison of

period-over-period operating results.

Effect of shares for stock plan activity.

The effect of shares for stock plan activity represents the

dilutive impact of outstanding stock options, RSUs, and PSUs

calculated under the treasury stock method.

Effect of shares related to convertible senior notes.

The effect of shares related to convertible senior notes

represents the dilutive impact of our convertible senior notes, to

the extent such shares are not already included in our weighted

average shares outstanding as they were antidilutive on a GAAP

basis.

Free cash flow.

Free cash flow represents net cash provided by operating

activities adjusted for purchases of property and equipment. Chegg

considers free cash flow to be a liquidity measure that provides

useful information to management and investors about the amount of

cash generated by the business after the purchases of property and

equipment, which can then be used to, among other things, invest in

Chegg's business and make strategic acquisitions. A limitation of

the utility of free cash flow as a measure of financial performance

is that it does not represent the total increase or decrease in

Chegg's cash balance for the period.

Forward-Looking

Statements

This press release contains forward-looking statements made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, which include, without limitation,

that there continues to be a large market of students looking for

the high-quality, proven, and differentiated learning expertise and

experience that Chegg provides, that we will continue to

enthusiastically serve this audience, our ability to extend our

brand, individualize our product and weather current and future

business challenges, that our brand and product experience will

endure, our intention to implement a program to purchase up to $300

million of our common stock and/or convertible notes, the expected

timing, volume and nature of such securities repurchase program,

the expiration of the program, our belief that the prevalence of

AIO will continue to increase, that Google is shifting from being a

search origination point to the destination, the disintermediation

of content sites like Chegg, the impact of generative AI for

academic support on the education ecosystem at large, including

universities and education technology companies broadly, students'

view that generative AI products like Chat GPT is a strong

alternative to Chegg, our expectation that we will not meet our

2025 goals of 30% adjusted EBITDA margin and $100 million in free

cash flow, the speed and scale of Google's AIO rollout, the student

adoption of generative AI products, statements regarding Chegg's

restructuring plan, reduction in force, the number of employees

impacted, the amount of the charges in connection with the actions,

the timing that such charges will be incurred, the impact of the

actions on our non-GAAP financial measures, the amount of the cost

savings and the timing of those savings, that there is an audience

for Chegg, what differentiates Chegg from other generative I tools,

why millions of learners depend on Chegg, why students come

directly to Chegg, even as the competitive environment evolves, our

commitment to developing a verticalized and individualized

experience for education, supporting students throughout their

entire learning journey, starting with academic support and

eventually functional support, our expectation that our efforts on

Discord and Chrome to reach students where they are will engage

them with our product, create new pathways for product-driven

growth, and reduce our reliance on SEO, that our new vendor-based

commerce platform will reduce our costs, provide flexibility and

allow us to move faster as we continue to evolve our pricing and

packaging programs, our ability to diversify our customer

acquisition and revenue streams while strengthening Chegg's role in

improving student learning outcomes, our commitment to building and

generating momentum with our brand, traffic, and product

capabilities, our ability to raise brand awareness with a new

spring brand campaign and that this campaign will bring new users

in, create strong consideration and connection, and ultimately

drive conversion, that we will bring both audience expansion and

acquisition efficiency based on what we learned from prior brand

marketing campaigns, that our product will continue to deliver

individualized learning solutions, that our brand and product

experiences are resilient, our ability to strengthen our student

experience and increase efficiency across the business and to

manage our expenses prudently as the competitive landscape evolves,

the amount of the insurance proceeds that we expect to receive in

the Leventhal class action securities lawsuit, our Q4 guidance,

including total revenue, Subscription Services revenue, gross

margin, and adjusted EBITDA, the time it will take to adjust to

Chegg's new opportunity and see the benefits in our business

results, as well as those included in the investor presentation

referenced above, those included in the “Prepared Remarks” sections

above, and all statements about Chegg’s outlook under “Business

Outlook.” The words “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “project,” “endeavor,” “will,” “should,” “future,”

“transition,” “outlook” and similar expressions, as they relate to

Chegg, are intended to identify forward-looking statements. These

statements are not guarantees of future performance, and are based

on management’s expectations as of the date of this press release

and assumptions that are inherently subject to uncertainties, risks

and changes in circumstances that are difficult to predict.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results,

performance or achievements to differ materially from any future

results, performance or achievements. Important factors that could

cause actual results to differ materially from those expressed or

implied by these forward-looking statements include the following:

the effects of AI technology on Chegg’s business and the economy

generally; Chegg’s ability to attract new learners to, and retain

existing learners on, our learning platform; Chegg's innovation and

offering of new products and services in response to technology and

market developments, including AI; Chegg’s brand and reputation;

the uncertainty surrounding the evolving educational landscape;

enrollment and student behavior, including the impact of AI;

Chegg’s ability to expand internationally; the efficacy of Chegg's

efforts to drive user traffic, including search engine

optimization, social media campaigns, and other marketing; the

success of Chegg’s new product offerings, including 360 degrees of

individualized academic and functional support; competition in all

aspects of Chegg’s business, including with respect to AI and

Chegg's expectation that such competition will increase; Chegg’s

ability to maintain its services and systems without interruption,

including as a result of technical issues, cybersecurity threats,

or cyber-attacks; third-party payment processing risks; adoption of

government regulation of education unfavorable to Chegg; the rate

of adoption of Chegg’s offerings; mobile app stores and mobile

operating systems making Chegg’s apps and mobile website available

to students and to grow Chegg’s user base and increase their

engagement; colleges and governments restricting online access or

access to Chegg’s services; Chegg’s ability to strategically take

advantage of new opportunities; competitive developments, including

pricing pressures and other services targeting students; Chegg’s

ability to build and expand its services offerings; Chegg’s ability

to integrate acquired businesses and assets; the impact of

seasonality and student behavior on the business; the outcome of

any current litigation and investigations; misuse of Chegg’s

platform and content; Chegg’s ability to effectively control

operating costs; regulatory changes, in particular concerning

privacy, marketing, and education; changes in the education market,

including as a result of AI technology; and general economic,

political and industry conditions, including inflation, recession

and war. All information provided in this release and in the

conference call is as of the date hereof, and Chegg undertakes no

duty to update this information except as required by law. These

and other important risk factors are described more fully in

documents filed with the Securities and Exchange Commission,

including Chegg's Annual Report on Form 10-K for the year ended

December 31, 2023 filed with the Securities and Exchange Commission

on February 20, 2024 and Chegg's Quarterly Report on Form 10-Q for

the quarterly period ended September 30, 2024 filed with the

Securities and Exchange Commission on November 12, 2024, and could

cause actual results to differ materially from expectations.

CHEGG, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except for

number of shares and par value)

(unaudited)

September 30,

2024

December 31,

2023

Assets

Current assets

Cash and cash equivalents

$

152,073

$

135,757

Short-term investments

209,003

194,257

Accounts receivable, net of allowance of

$208 and $376 at September 30, 2024 and December 31, 2023,

respectively

23,749

31,404

Prepaid expenses

24,706

20,980

Other current assets

86,980

32,437

Total current assets

496,511

414,835

Long-term investments

270,161

249,547

Property and equipment, net

177,882

183,073

Goodwill, net

—

631,995

Intangible assets, net

11,424

52,430

Right of use assets

29,071

25,130

Deferred tax assets, net

2,308

141,843

Other assets

15,315

28,382

Total assets

$

1,002,672

$

1,727,235

Liabilities and stockholders'

equity

Current liabilities

Accounts payable

$

18,124

$

28,184

Deferred revenue

44,355

55,336

Accrued liabilities

125,138

77,863

Current portion of convertible senior

notes, net

358,222

357,079

Total current liabilities

545,839

518,462

Long-term liabilities

Convertible senior notes, net

243,242

242,758

Long-term operating lease liabilities

23,665

18,063

Other long-term liabilities

4,945

3,334

Total long-term liabilities

271,852

264,155

Total liabilities

817,691

782,617

Commitments and contingencies

Stockholders' equity:

Preferred stock, $0.001 par value per

share, 10,000,000 shares authorized, no shares issued and

outstanding

—

—

Common stock, $0.001 par value per share:

400,000,000 shares authorized; 103,967,436 and 102,823,700 shares

issued and outstanding at September 30, 2024 and December 31, 2023,

respectively

104

103

Additional paid-in capital

1,098,242

1,031,627

Accumulated other comprehensive loss

(30,049

)

(34,739

)

Accumulated deficit

(883,316

)

(52,373

)

Total stockholders' equity

184,981

944,618

Total liabilities and stockholders'

equity

$

1,002,672

$

1,727,235

CHEGG, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net revenues

$

136,593

$

157,854

$

474,090

$

528,308

Cost of revenues(1)

43,420

83,575

135,328

180,137

Gross profit

93,173

74,279

338,762

348,171

Operating expenses:

Research and development(1)

41,337

46,202

129,423

145,981

Sales and marketing(1)

26,508

28,872

80,428

96,845

General and administrative(1)

51,910

53,475

161,460

182,757

Impairment expense

195,708

3,600

677,239

3,600

Total operating expenses

315,463

132,149

1,048,550

429,183

Loss from operations

(222,290

)

(57,870

)

(709,788

)

(81,012

)

Interest expense and other income,

net:

Interest expense

(658

)

(733

)

(1,959

)

(3,115

)

Other income, net

7,586

40,492

25,485

116,671

Total interest expense and other income,

net

6,928

39,759

23,526

113,556

(Loss) income before benefit from

(provision for) income taxes

(215,362

)

(18,111

)

(686,262

)

32,544

Benefit from (provision for) income

taxes

2,723

(172

)

(144,681

)

(24,029

)

Net (loss) income

$

(212,639

)

$

(18,283

)

$

(830,943

)

$

8,515

Net (loss) income per share

Basic

$

(2.05

)

$

(0.16

)

$

(8.08

)

$

0.07

Diluted

$

(2.05

)

$

(0.16

)

$

(8.08

)

$

(0.24

)

Weighted average shares used to compute

net (loss) income per share

Basic

103,723

115,407

102,893

119,001

Diluted

103,723

115,407

102,893

121,876

(1) Includes share-based compensation

expense and restructuring charges as follows:

.............................................................................................................

Share-based compensation expense:

Cost of revenues

$

471

$

598

$

1,450

$

1,685

Research and development

7,492

11,027

23,824

33,909

Sales and marketing

2,100

2,435

5,966

7,116

General and administrative

11,868

17,870

38,027

58,886

Total share-based compensation expense

$

21,931

$

31,930

$

69,267

$

101,596

.............................................................................................................

Restructuring charges:

Cost of revenues

$

12

$

—

$

203

$

12

Research and development

827

—

2,909

1,692

Sales and marketing

—

—

906

1,228

General and administrative

1,273

—

4,822

2,772

Total restructuring charges

$

2,112

$

—

$

8,840

$

5,704

CHEGG, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Nine Months Ended

September 30,

2024

2023

Cash flows from operating

activities

Net (loss) income

$

(830,943

)

$

8,515

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Share-based compensation expense

69,267

101,596

Depreciation and amortization expense

58,966

108,945

Deferred income taxes

141,103

20,929

Operating lease expense, net

4,647

4,535

Amortization of debt issuance costs

1,628

2,610

Loss from write-off of property and

equipment

2,024

3,578

Impairment expense

677,239

3,600

Gain on early extinguishment of debt

—

(85,926

)

Loss contingency

5,100

7,000

Impairment on lease related assets

2,189

—

Other non-cash items

222

(389

)

Change in assets and liabilities:

Accounts receivable

8,019

(6,908

)

Prepaid expenses and other current

assets

(55,725

)

558

Other assets

(469

)

8,671

Accounts payable

(8,308

)

4,820

Deferred revenue

(11,763

)

2,539

Accrued liabilities

46,849

(6,149

)

Other liabilities

(2,968

)

(9,810

)

Net cash provided by operating

activities

107,077

168,714

Cash flows from investing

activities

Purchases of property and equipment

(61,659

)

(57,298

)

Proceeds from disposition of textbooks

—

9,787

Purchases of investments

(134,213

)

(585,275

)

Maturities of investments

96,907

561,197

Proceeds from sale of investments

—

238,681

Proceeds from sale of strategic equity

investment

15,500

—

Purchase of strategic equity

investment

—

(11,853

)

Net cash (used in) provided by investing

activities

(83,465

)

155,239

Cash flows from financing

activities

Proceeds from common stock issued under

stock plans, net

2,191

3,108

Payment of taxes related to the net share

settlement of equity awards

(8,648

)

(13,857

)

Repurchase of common stock

—

(186,368

)

Repayment of convertible senior notes

—

(505,986

)

Proceeds from exercise of convertible

senior notes capped call

—

297

Net cash used in financing activities

(6,457

)

(702,806

)

Effect of exchange rate changes

(149

)

(379

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

17,006

(379,232

)

Cash, cash equivalents and restricted

cash, beginning of period

137,976

475,854

Cash, cash equivalents and restricted

cash, end of period

$

154,982

$

96,622

Nine Months Ended

September 30,

2024

2023

Supplemental cash flow data:

Cash paid during the period for:

Interest

$

449

$

741

Income taxes, net of refunds

$

3,531

$

8,368

Cash paid for amounts included in the

measurement of lease liabilities:

Operating cash flows from operating

leases

$

6,329

$

7,037

Right of use assets obtained in exchange

for lease obligations:

Operating leases

$

9,686

$

12,407

Non-cash investing and financing

activities:

Accrued purchases of long-lived assets

$

4,771

$

5,879

September 30,

2024

2023

Reconciliation of cash, cash equivalents

and restricted cash:

Cash and cash equivalents

$

152,073

$

94,419

Restricted cash included in other current

assets

454

60

Restricted cash included in other

assets

2,455

2,143

Total cash, cash equivalents and

restricted cash

$

154,982

$

96,622

CHEGG, INC.

RECONCILIATION OF NET (LOSS)

INCOME TO EBITDA AND ADJUSTED EBITDA

(in thousands)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net (loss) income

$

(212,639

)

$

(18,283

)

$

(830,943

)

$

8,515

Interest expense

658

733

1,959

3,115

Provision for income taxes

(2,723

)

172

144,681

24,029

Depreciation and amortization expense

19,573

56,918

58,966

108,945

EBITDA

(195,131

)

39,540

(625,337

)

144,604

Share-based compensation expense

21,931

31,930

69,267

101,596

Other income, net

(7,586

)

(40,492

)

(25,485

)

(116,671

)

Acquisition-related compensation costs

132

209

560

6,086

Restructuring charges

2,112

—

8,840

5,704

Impairment expense

195,708

3,600

677,239

3,600

Impairment of lease related assets

—

—

2,189

—

Content and related assets charge

—

4,047

729

4,047

Loss contingency

5,100

—

5,100

7,000

Transitional logistics charges

—

—

—

253

Adjusted EBITDA

$

22,266

$

38,834

$

113,102

$

156,219

CHEGG, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(in thousands, except

percentages and per share amounts)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Cost of revenues

$

43,420

$

83,575

$

135,328

$

180,137

Amortization of intangible assets

(1,423

)

(3,138

)

(7,636

)

(9,859

)

Share-based compensation expense

(471

)

(598

)

(1,450

)

(1,685

)

Acquisition-related compensation costs

(5

)

(5

)

(16

)

(17

)

Restructuring charges

(12

)

—

(203

)

(12

)

Content and related assets charge

—

(38,242

)

(729

)

(38,242

)

Transitional logistics charges

—

—

—

(253

)

Non-GAAP cost of revenues

$

41,509

$

41,592

$

125,294

$

130,069

Gross profit

$

93,173

$

74,279

$

338,762

$

348,171

Amortization of intangible assets

1,423

3,138

7,636

9,859

Share-based compensation expense

471

598

1,450

1,685

Acquisition-related compensation costs

5

5

16

17

Restructuring charges

12

—

203

12

Content and related assets charge

—

38,242

729

38,242

Transitional logistics charges

—

—

—

253

Non-GAAP gross profit

$

95,084

$

116,262

$

348,796

$

398,239

Gross margin %

68

%

47

%

71

%

66

%

Non-GAAP gross margin %

70

%

74

%

74

%

75

%

Operating expenses

$

315,463

$

132,149

$

1,048,550

$

429,183

Share-based compensation expense

(21,460

)

(31,332

)

(67,817

)

(99,911

)

Amortization of intangible assets

—

(2,935

)

(1,291

)

(8,823

)

Acquisition-related compensation costs

(127

)

(204

)

(544

)

(6,069

)

Restructuring charges

(2,100

)

—

(8,637

)

(5,692

)

Impairment expense

(195,708

)

(3,600

)

(677,239

)

(3,600

)

Impairment of lease related assets

—

—

(2,189

)

—

Loss contingency

(5,100

)

—

(5,100

)

(7,000

)

Non-GAAP operating expenses

$

90,968

$

94,078

$

285,733

$

298,088

Loss from operations

$

(222,290

)

$

(57,870

)

$

(709,788

)

$

(81,012

)

Share-based compensation expense

21,931

31,930

69,267

101,596

Amortization of intangible assets

1,423

6,073

8,927

18,682

Acquisition-related compensation costs

132

209

560

6,086

Restructuring charges

2,112

—

8,840

5,704

Impairment expense

195,708

3,600

677,239

3,600

Impairment of lease related assets

—

—

2,189

—

Content and related assets charge

—

38,242

729

38,242

Transitional logistics charges

—

—

—

253

Loss contingency

5,100

—

5,100

7,000

Non-GAAP income from operations

$

4,116

$

22,184

$

63,063

$

100,151

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net (loss) income

$

(212,639

)

$

(18,283

)

$

(830,943

)

$

8,515

Share-based compensation expense

21,931

31,930

69,267

101,596

Amortization of intangible assets

1,423

6,073

8,927

18,682

Acquisition-related compensation costs

132

209

560

6,086

Amortization of debt issuance costs

547

622

1,628

2,610

Income tax effect of non-GAAP

adjustments

(4,468

)

(7,081

)

126,182

(7,265

)

Restructuring charges

2,112

—

8,840

5,704

Impairment expense

195,708

3,600

677,239

3,600

Impairment of lease related assets

—

—

2,189

—

Content and related assets charge

—

38,242

729

38,242

Gain on sale of strategic equity

investment

—

—

(3,783

)

—

Gain on early extinguishment of debt

—

(32,149

)

—

(85,926

)

Loss contingency

5,100

—

5,100

7,000

Transitional logistics charges

—

—

—

253

Non-GAAP net income

$

9,846

$

23,163

$

65,935

$

99,097

.............................................................................................................

Weighted average shares used to compute

net (loss) income per share, diluted

103,723

115,407

102,893

121,876

Effect of shares for stock plan

activity

67

198

885

424

Effect of shares related to convertible

senior notes

9,234

10,280

9,234

10,378

Non-GAAP weighted average shares used to

compute non-GAAP net income per share, diluted

113,024

125,885

113,012

132,678

Net (loss) income per share, diluted

$

(2.05

)

$

(0.16

)

$

(8.08

)

$

(0.24

)

Adjustments

2.14

0.34

8.66

0.99

Non-GAAP net income per share, diluted

$

0.09

$

0.18

$

0.58

$

0.75

CHEGG, INC.

RECONCILIATION OF NET CASH

PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(in thousands)

(unaudited)

Nine Months Ended

September 30,

2024

2023

Net cash provided by operating

activities

$

107,077

$

168,714

Purchases of property and equipment

(61,659

)

(57,298

)

Proceeds from disposition of textbooks

—

9,787

Free cash flow

$

45,418

$

121,203

CHEGG, INC.

RECONCILIATION OF

FORWARD-LOOKING NET LOSS TO EBITDA AND ADJUSTED EBITDA

(in thousands)

(unaudited)

Three Months Ending December

31, 2024

Net loss

$

(16,600

)

Interest expense, net

500

Provision for income taxes

(1,700

)

Depreciation and amortization expense

19,200

EBITDA

1,400

Share-based compensation expense

15,100

Other income, net

(7,200

)

Acquisition-related compensation costs

200

Restructuring charges

18,100

Impairment of lease related assets

3,800

Content and related assets charge

1,600

Adjusted EBITDA

$

33,000

* Adjusted EBITDA guidance for the three months ending December

31, 2024 represent the midpoint of the range of $32 million to $34

million, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111756755/en/

Media Contact: Candace Sue, press@chegg.com

Investor Contact: Tracey Ford, IR@chegg.com

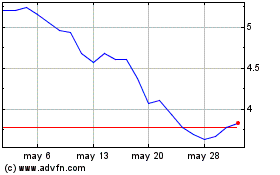

Chegg (NYSE:CHGG)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

Chegg (NYSE:CHGG)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025