First Foundation Inc. (NYSE: FFWM) ("First Foundation" or the

"Company'') today announced the closing of its individual

investments aggregating to $228 million in the Company from

affiliates of Fortress Investment Group, Canyon Partners, Strategic

Value Bank Partners, North Reef Capital and other investors.

Scott F. Kavanaugh, President and CEO of the Company, stated,

"We want to thank all of our new investor partners for their effort

and significant confidence in First Foundation and our talented

employees. We very much look forward to building a top tier

regional bank and creating long term shareholder value.”

Transaction Details

First Foundation sold and issued (i) 11,308,676 shares of common

stock, par value $0.001 per share at a price per share of $4.10;

(ii) 29,811 shares of a new series of preferred stock, par value

$0.001 per share, designated as Series A Noncumulative Convertible

Preferred Stock; and (iii) 14,490 shares of a new series of

preferred stock, par value $0.001 per share, designated as Series B

Noncumulative Convertible Preferred Stock. In addition, investors

received seven-year warrants to purchase a new series of preferred

stock designated as Series C Non-Voting Common Equivalent

Stock.

Advisors

Jefferies LLC acted as exclusive financial advisor and sole

placement agent to First Foundation. Sheppard, Mullin, Richter

& Hampton LLP served as legal counsel to First Foundation.

Skadden, Arps, Slate, Meagher & Flom LLP served as legal

counsel to Fortress Investment Group. Cleary Gottlieb Steen &

Hamilton LLP served as legal counsel to Canyon Partners. Sullivan

& Cromwell LLP served as legal counsel to Jefferies LLC.

About First Foundation

Inc.

Headquartered in Texas, First Foundation Inc. (NYSE: FFWM), and

its subsidiaries offer personal banking, business banking, and

private wealth management services, including investment, trust,

insurance, and philanthropy services. This comprehensive platform

of financial services is designed to help clients at any stage in

their financial journey. The broad range of financial products and

services offered by First Foundation are more consistent with those

offered by larger financial institutions, while its high level of

personalized service, accessibility, and responsiveness to clients

is more aligned with community banks and boutique wealth management

firms. This combination of an integrated platform of comprehensive

financial products and personalized service differentiates First

Foundation from many of its competitors and has contributed to the

growth of its client base and business. At March 31, 2024, the

Company had $13.6 billion of assets, $10.1 billion of loans,

deposits of $10.6 billion, and total stockholders' equity of $929

million.

About Fortress Investment

Group

Fortress Investment Group LLC is a leading, highly diversified

global investment manager. Founded in 1998, Fortress manages $49.0

billion of assets under management as of March 31, 2024, on behalf

of approximately 2,000 institutional clients and private investors

worldwide across a range of credit and real estate, private equity

and permanent capital investment strategies.

About Canyon Partners

Founded in 1990, Canyon employs a deep value, credit intensive

approach across public and private corporate credit, structured

credit, and direct real estate lending and investing. The firm

seeks to capture excess returns available to those investors with

specialized expertise, rigorous research capabilities, and the

ability to underwrite complexity. Canyon invests on behalf of a

broad range of institutions globally. For more information visit:

www.canyonpartners.com.

About Strategic Value Bank

Partners

Strategic Value Bank Partners is an investment manager focused

on the community banking industry. Founded in 2015, Strategic Value

combines industry operating experience with the rigorous analysis

of an institutional investor. The firm invests across public and

private banks throughout the United States.

Forward-Looking

Statements

This press release may include forward-looking statements by the

Company pertaining to such matters as our goals, intentions, and

expectations regarding, among other things, the convertibility of

the shares of preferred stock and exercisability of the warrants

issued in connection with this capital raise transaction; the

Company’s seeking (and the Company’s ability to obtain) approval of

its stockholders of any necessary amendments of the Company’s

organizational documents or approvals of the issuance of shares of

common stock or preferred stock in connection with this capital

raise transaction; receipt of any required regulatory approvals or

non-objections in connection with this capital raise transaction or

the appointment of directors or senior management; revenues,

earnings, loan production, asset quality, capital levels, and

acquisitions, among other matters; our estimates of future costs

and benefits of the actions we may take; our assessments of

probable losses on loans; our assessments of interest rate and

other market risks; and our ability to achieve our financial and

other strategic goals.

Forward-looking statements are typically identified by such

words as “believe,” “expect,” “anticipate,” “intend,” “outlook,”

“estimate,” “forecast,” “project,” “should,” and other similar

words and expressions, and are subject to numerous assumptions,

risks, and uncertainties, which change over time. Additionally,

forward-looking statements speak only as of the date they are made;

the Company does not assume any duty, and does not undertake, to

update our forward-looking statements. Furthermore, because

forward-looking statements are subject to assumptions and

uncertainties, actual results or future events could differ,

possibly materially, from those anticipated in our statements, and

our future performance could differ materially from our historical

results.

The forward-looking statements in this release are based on

current information and on assumptions that we make about future

events and circumstances that are subject to a number of risks and

uncertainties that are often difficult to predict and beyond our

control. As a result of those risks and uncertainties, our actual

financial results in the future could differ, possibly materially,

from those expressed in or implied by the forward-looking

statements contained in this release and could cause us to make

changes to our future plans. Those risks and uncertainties include,

but are not limited to, the risk of incurring credit losses, which

is an inherent risk of the banking business; the quality and

quantity of our deposits; adverse developments in the financial

services industry generally such as bank failures and any related

impact on depositor behavior or investor sentiment; risks related

to the sufficiency of liquidity; risk that we will not be able to

maintain growth at historic rates or at all; the risk that we will

not be able to access the securitization market on favorable terms

or at all; changes in general economic conditions, either

nationally or locally in the areas in which we conduct or will

conduct our business; risks associated with changes in interest

rates, which could adversely affect our interest income, interest

rate margin, and the value of our interest-earning assets, and

therefore, our future operating results; the risk that the

performance of our investment management business or of the equity

and bond markets could lead clients to move their funds from or

close their investment accounts with us, which would reduce our

assets under management and adversely affect our operating results;

negative impacts of news or analyst reports about us or the

financial services industry; the impacts of inflation on us and our

customers; results of examinations by regulatory authorities and

the possibility that such regulatory authorities may, among other

things, limit our business activities or our ability to pay

dividends, or impose fines, penalties or sanctions; the risk that

we may be unable or that our board of directors may determine that

it is inadvisable to pay future dividends at historic levels or at

all; risks associated with changes in income tax laws and

regulations; and risks associated with seeking new client

relationships and maintaining existing client relationships.

Additional information regarding these and other risks and

uncertainties to which our business and future financial

performance are subject is contained in our Annual Report on Form

10-K for the fiscal year ended December 31, 2023, and other

documents we file with the SEC from time to time. We urge readers

of this report to review those reports and other documents we file

with the SEC from time to time. Also, our actual financial results

in the future may differ from those currently expected due to

additional risks and uncertainties of which we are not currently

aware or which we do not currently view as, but in the future may

become, material to our business or operating results. Due to these

and other possible uncertainties and risks, readers are cautioned

not to place undue reliance on the forward-looking statements

contained in this report, which speak only as of today's date, or

to make predictions based solely on historical financial

performance. We also disclaim any obligation to update

forward-looking statements contained in this report or in the

above-referenced reports, whether as a result of new information,

future events or otherwise, except as may be required by law or

NYSE rules.

Important Information and Where You Can

Find It

This press release may be deemed to be solicitation material in

respect of the Requisite Stockholder Approvals. In connection with

the Requisite Stockholder Approval, First Foundation will file with

the SEC a preliminary proxy statement and a definitive proxy

statement, which will be sent to the stockholders of First

Foundation, seeking certain approvals related to the issuances of

shares of common stock issued under each investment agreement and

to be issued upon the conversion of shares of the preferred stock

issued under the investment agreements.

INVESTORS AND SECURITY HOLDERS OF FIRST FOUNDATION AND THEIR

RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE PROXY

STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED

WITH THE SEC IN CONNECTION WITH THE TRANSACTION, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT FIRST FOUNDATION AND THE

TRANSACTION.

Investors and security holders will be able to obtain a free

copy of the proxy statement, as well as other relevant documents

filed with the SEC containing information about First Foundation,

without charge, at the SEC's website (http://www.sec.gov). Copies

of documents filed with the SEC by First Foundation can also be

obtained, without charge, by directing a request to Investor

Relations, First Foundation Inc., 18101 Von Karman Ave., Suite 750,

Irvine, CA. 92612 or by telephone +1 (949) 476-0300.

Participants in the Solicitation of

Proxies in Connection with Proposed Transaction

First Foundation and certain of their respective directors,

executive officers and employees may be deemed to be participants

in the solicitation of proxies in respect of the Requisite

Stockholder Approvals under the rules of the SEC. Information

regarding First Foundation's directors and executive officers is

available in its definitive proxy statement for its 2024 annual

stockholders meeting, which was filed with the SEC on April 18,

2024, and certain of its Current Reports on Form 8-K. Other

information regarding the participants in the solicitation of

proxies in respect of the proposed transaction and a description of

their direct and indirect interests, by security holdings or

otherwise, will be contained in the proxy statement and other

relevant materials to be filed with the SEC. Free copies of these

documents, when available, may be obtained as described in the

preceding paragraph.

Not an Offer of

Securities

The information in this communication is for informational

purposes only and shall not constitute, or form a part of, an offer

to sell or the solicitation of an offer to sell or the solicitation

of an offer to buy any securities. The securities that are the

subject of the private placement have not been registered under the

Securities Act and may not be offered or sold in the United States

absent registration or an applicable exemption from registration

requirements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240709781805/en/

Investor Contact: Jamie Britton, CFO +1 (949)

476-0300

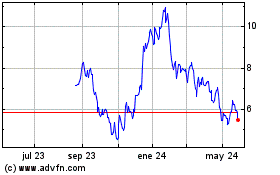

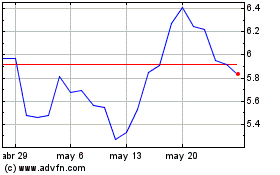

First Foundation (NYSE:FFWM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

First Foundation (NYSE:FFWM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024