0001992243false00019922432024-08-092024-08-090001992243freyr:OrdinarySharesWithoutNominalValueMember2024-08-092024-08-090001992243freyr:WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member2024-08-092024-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 9, 2024

FREYR Battery, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 333-274434 | | 93-3205861 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

6&8 East Court Square, Suite 300,

Newnan, Georgia 30263

| | | | | | | | |

| | |

| (Address of principal executive offices, including zip code) |

| | | |

Registrant’s telephone number, including area code: (678) 632-3112

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | FREY | | The New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 | | FREY WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 9, 2024, FREYR Battery, Inc., a Delaware corporation, issued a press release announcing its financial results for the second quarter ended June 30, 2024.

The information set forth under Item 9.01 of this Current Report on Form 8-K is incorporated herein by reference.

The information in this Item 2.02, including the Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

FREYR Battery, Inc. is also furnishing a Second Quarter 2024 Earnings Call presentation, dated August 9, 2024 (the “Presentation”), attached as Exhibit 99.2 to this Current Report on Form 8-K, which may be referred to on FREYR Battery, Inc.’s second quarter 2024 conference call to be held on August 9, 2024. The Presentation will also be available on FREYR Battery, Inc.’s website at https://www.freyrbattery.com.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | FREYR BATTERY, INC. |

| | |

Date: August 9, 2024 | By: | /s/ Joseph Evan Calio |

| | Name: | Joseph Evan Calio |

| | Title: | Chief Financial Officer |

News Release

FREYR Battery Reports Second Quarter 2024 Results

New York, Oslo, and Newnan, GA, August 9, 2024, FREYR Battery, Inc. (NYSE: FREY) (“FREYR” or the “Company”), a developer of sustainable, next-generation battery solutions, today reported financial results for the second quarter of 2024.

Key Messages:

•FREYR’s new Board of Directors and leadership team executing plan to achieve first revenues and EBITDA as soon as 2025. The Company’s top priority is to focus resources on financeable projects and inorganic opportunities that accelerate FREYR’s commercialization and pathway to cash flows.

•FREYR is prioritizing conventional technology strategy to achieve commercialization. FREYR is advancing discussions and diligence tied to agreements to develop conventional battery technology solutions in the U.S. and Europe under its previously unveiled FREYR 2.0 growth initiative. Within the commercial and project pipelines, the Company is focusing on less-capital intensive opportunities tied to downstream modules and packs which offer the fastest and most readily financeable paths to first revenues and cash flows.

•Maintaining strict financial discipline and balance sheet strength. The Company remains committed to preserving the strength of its debt-free balance sheet by reducing its cash burn rate. The spending reductions currently underway are expected to extend FREYR’s cash liquidity runway to approximately 36 months. As part of the Company’s commitment to value maximization, FREYR is concurrently evaluating value accretive business models and use cases for Giga Arctic.

•Evaluating inorganic opportunities. FREYR is pursuing potential inorganic opportunities to accelerate its commercialization efforts.

•Maintaining ambition to establish long-term competitive moat based on next-generation intellectual property with the 24M SemiSolidTM platform. As FREYR intensifies its near-term commercialization efforts with its conventional technology strategy, the Company is preserving the option value of its position on 24M’s SemiSolidTM platform. After hitting several production milestones at the Customer Qualification Plant (“CQP”) in 2024, the Company is exploring new funding and commercial pathways for its next-generation IP to augment its long-term competitive position.

“Following the second quarter’s production achievements at the CQP on the 24M platform, FREYR’s reconfigured Board of Directors and management team have unified the organization’s focus on rapid commercialization while we extend our liquidity runway to 36 months,” commented Tom Jensen, FREYR’s Co-founder, Chief Executive Officer and Board Member. “Having demonstrated that our people have unique technical and operational capabilities, during the last 65 days since the new team was appointed, we have been building momentum with our partners and customers to develop projects in high-return adjacencies on the battery value chain. The discussions we are having with a variety of industry leaders are exciting, and we look forward to sharing additional updates on these important strategic initiatives as they continue to develop.”

1 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

Recent news

•Successful production trials at Customer Qualification Plant (“CQP”). Following several prior interim milestones at the CQP earlier this year, in June, FREYR announced that it had become the first company to complete automated production trials on the second-generation 24M SemiSolidTM manufacturing platform. While simultaneously running the anode casting, cathode casting, and merge units in automatic mode, FREYR produced more than 50 individual unit cells. FREYR is now exploring funding pathways for the long-term development of its next-generation technology stack.

•Leadership changes to support FREYR’s commitment to accelerate path to profitability. In June 2024, FREYR announced the return of Co-founder and previous CEO and Executive Chairman Tom Jensen to the CEO role, and the appointments of Evan Calio as FREYR’s CFO, and of Daniel Barcelo as the Chairman of FREYR’s Board of Directors. FREYR’s Board and management team are focused on key initiatives, including: pursuing organic and inorganic opportunities in the U.S. and Europe to accelerate FREYR’s timelines to revenues and EBITDA and maintaining strict financial discipline to preserve the strength of the Company’s clean balance sheet and extend FREYR’s cash liquidity runway to 36 months.

Results Overview, Financing, and Liquidity

•FREYR reported a net loss attributable to stockholders for the second quarter of 2024 of $(27.0) million, or $(0.19) per diluted share compared to net loss for the second quarter 2023 of $(25.3) million or $(0.18) per diluted share. The increase in net loss in the second quarter of 2024 was primarily due to a $0.1 million net foreign currency transaction loss for the three months ended June 30, 2024, compared to a $7.7 million gain for the three months ended June 30, 2023, partially offset by lower operating expenses mainly from decreases in personnel costs and legal and professional fees.

•As of June 30, 2024, FREYR had cash, cash equivalents, and restricted cash of $221.5 million, and no debt.

Presentation of Second Quarter 2024 Results

A presentation will be held today, August 9, 2024, at 8:30 am Eastern Daylight Time (2:30 pm Central European Time) to discuss financial results for the second quarter 2024. The results and presentation material will be available for download at https://ir.freyrbattery.com.

To access the conference call, listeners should contact the conference call operator at the appropriate number listed below approximately 10 minutes prior to the start of the call.

Participant conference call dial-in numbers:

USA / International Toll +1 (646) 307-1963

USA - Toll-Free (800) 715-9871

UK - London +44.20.3433.3846

UK - Toll-Free +44.800.358.0970

Denmark - National +45.70.71.00.47

Denmark - Toll-Free +45.80.711369

Norway - Forde +47.57.98.92.37

Sweden - Stockholm +46.8.535.243.45

Sweden - Toll-Free +46.20.0123579

Greece - Athens +30.21.1199.4415

Spain - Madrid +34.917.874.190

Spain - Toll-Free +34.800.906144

Germany - Berlin +49.30.22403073

Germany - Toll-Free +49.800.0000105

2 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

The participant passcode for the call is: 4087726

A webcast of the conference call will be broadcast simultaneously at https://events.q4inc.com/attendee/250372491 on a listen-only basis. Please log in at least 10 minutes in advance to register and download any necessary software.

A replay of the webcast will be available at https://ir.freyrbattery.com/events-and-presentations/Events-Calendar/default.aspx.

***

3 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

About FREYR Battery

FREYR Battery is a developer of sustainable, next-generation battery solutions. The Company’s mission is to accelerate the decarbonization of global energy and transportation systems by producing sustainable, cost-competitive batteries. FREYR seeks to serve the primary markets of energy storage systems (“ESS”) and commercial mobility, and the Company maintains an ambition to serve the passenger electric vehicles market (“EV”). FREYR is operating its Customer Qualification Plant (“CQP”) for technology development in Mo i Rana, Norway, and the Company is continuing development of the Giga America battery manufacturing project in Coweta County, Georgia, in the U.S. To learn more about FREYR, please visit www.freyrbattery.com.

Investor contact:

Jeffrey Spittel

Senior Vice President, Investor Relations and Corporate Development

jeffrey.spittel@freyrbattery.com

Tel: (+1) 409-599-5706

Media contact:

Amy Jaick

Global Head of Communications

amy.jaick@freyrbattery.com

Tel: (+1) 973 713-5585

Cautionary Statement Concerning Forward-Looking Statements

All statements, other than statements of present or historical facts included in this press release, including, without limitation, FREYR Battery, Inc.’s (“FREYR”) ability to establish a profitable business; FREYR’s plan to extend its cash liquidity runway to 36 months and first revenue and EBITDA in 2025; the financial benefits of FREYR’s subject matter expertise; FREYR’s plan to expand on the battery value chain into high value adjacencies; FREYR’s efforts to accelerate the path to commercialization; the pursuit of project opportunities in accordance with the FREYR 2.0 initiative; potential inorganic growth opportunities and the ability to generate revenue in the near-term through possible acquisitions; the development, financing, construction, timeline, capacity, and other usefulness of FREYR’s CQP, Giga Arctic, Giga America, and other planned or future production facilities; any potential benefits of the U.S. Inflation Reduction Act; FREYR’s ability to reduce spending; and the implementation and effectiveness of FREYR’s overall business, technology, capital-raising, and liquidity strategies are forward-looking statements.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside FREYR’s control and are difficult to predict. Additional information about factors that could materially affect FREYR is set forth under the “Risk Factors” section in (i) FREYR’s Registration Statement on Form S-3 filed with the Securities and Exchange Commission (the “SEC”) on September 1, 2022 and subsequent post-effective amendment thereto filed on January 5, 2024, (ii) FREYR Battery, Inc.’s Registration Statement on Form S-4 filed with the SEC on September 8, 2023 and subsequent amendments thereto filed on October 13, 2023, October 19, 2023, and October 31, 2023, (iii) FREYR’s annual report on Form 10-K filed with the SEC on February 29, 2024; and (iv) FREYR’s Quarterly Reports on Form 10-Q filed with the SEC on May 8, 2024 and available on the SEC’s website at www.sec.gov. Except as otherwise required by applicable law, FREYR disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward-looking statements.

FREYR intends to use its website as a channel of distribution to disclose information which may be of interest or material to investors and to communicate with investors and the public. Such disclosures will be included on FREYR’s website in the ‘Investor Relations’ sections. FREYR also intends to use certain social media channels, including, but not limited to, Twitter and LinkedIn, as means of communicating with the public and investors about FREYR, its progress, products, and other matters. While not all the information that FREYR posts to its digital

4 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

platforms may be deemed to be of a material nature, some information may be. As a result, FREYR encourages investors and others interested to review the information that it posts and to monitor such portions of FREYR’s website and social media channels on a regular basis, in addition to following FREYR’s press releases, SEC filings, and public conference calls and webcasts. The contents of FREYR’s website and other social media channels shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

5 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| | |

| ASSETS |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 219,560 | | | $ | 253,339 | |

| Restricted cash | | 1,977 | | | 22,403 | |

| Prepaid assets | | 868 | | | 2,168 | |

| Other current assets | | 12,016 | | | 34,044 | |

| Total current assets | | 234,421 | | | 311,954 | |

| | | | |

| Property and equipment, net | | 362,641 | | | 366,357 | |

| Intangible assets, net | | 2,738 | | | 2,813 | |

| Long-term investments | | 21,969 | | | 22,303 | |

| | | | |

| Right-of-use asset under operating leases | | 22,603 | | | 24,476 | |

| Other long-term assets | | 9 | | | 4,282 | |

| Total assets | | $ | 644,381 | | | $ | 732,185 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | | |

| Accounts payable | | $ | 14,688 | | | $ | 18,113 | |

| Accrued liabilities and other | | 20,495 | | | 30,790 | |

| | | | |

| | | | |

| Share-based compensation liability | | 168 | | | 281 | |

| Total current liabilities | | 35,351 | | | 49,184 | |

| | | | |

| Warrant liability | | 1,817 | | | 2,025 | |

| Operating lease liability | | 16,921 | | | 18,816 | |

| Other long-term liabilities | | 27,443 | | | 27,444 | |

| | | | |

| Total liabilities | | 81,532 | | | 97,469 | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| Stockholders’ equity: | | | | |

Preferred stock, $0.01 par value, 10,000 shares authorized, none issued and outstanding as of both June 30, 2024 and December 31, 2023 | | — | | | — | |

Common stock, $0.01 par value, 355,000 shares authorized as of both June 30, 2024 and December 31, 2023; 140,490 issued and outstanding as of June 30, 2024; and 139,705 issued and outstanding as of December 31, 2023 | | 1,405 | | | 1,397 | |

| | | | |

| Additional paid-in capital | | 930,781 | | | 925,623 | |

| | | | |

| Accumulated other comprehensive loss | | (40,008) | | | (18,826) | |

| Accumulated deficit | | (330,529) | | | (274,999) | |

| Total stockholders' equity | | 561,649 | | | 633,195 | |

| | | | |

| Non-controlling interests | | 1,200 | | | 1,521 | |

| Total equity | | 562,849 | | | 634,716 | |

| | | | |

| Total liabilities and equity | | $ | 644,381 | | | $ | 732,185 | |

6 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

June 30, | | Six months ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Operating expenses: | | | | | | | | |

| General and administrative | | $ | 20,107 | | | $ | 27,631 | | | $ | 43,008 | | | $ | 57,633 | |

| Research and development | | 10,493 | | | 6,365 | | | 22,238 | | | 11,209 | |

| Share of net loss of equity method investee | | 178 | | | 30 | | | 334 | | | 55 | |

| Total operating expenses | | 30,778 | | | 34,026 | | | 65,580 | | | 68,897 | |

| Loss from operations | | (30,778) | | | (34,026) | | | (65,580) | | | (68,897) | |

| | | | | | | | |

| Other income (expense): | | | | | | | | |

| Warrant liability fair value adjustment | | 52 | | | (2,556) | | | 198 | | | (1,151) | |

| | | | | | | | |

| | | | | | | | |

| Interest income, net | | 1,148 | | | 1,755 | | | 2,553 | | | 4,758 | |

| | | | | | | | |

| Foreign currency transaction (loss) gain | | (122) | | | 7,711 | | | 1,355 | | | 23,759 | |

| Other income, net | | 2,550 | | | 1,851 | | | 5,634 | | | 3,566 | |

| Total other income | | 3,628 | | | 8,761 | | | 9,740 | | | 30,932 | |

| Loss before income taxes | | (27,150) | | | (25,265) | | | (55,840) | | | (37,965) | |

| Income tax expense | | (11) | | | (138) | | | (11) | | | (341) | |

| Net loss | | (27,161) | | | (25,403) | | | (55,851) | | | (38,306) | |

| Net loss attributable to non-controlling interests | | 174 | | | 121 | | | 321 | | | 298 | |

| Net loss attributable to stockholders | | $ | (26,987) | | | $ | (25,282) | | | $ | (55,530) | | | $ | (38,008) | |

| | | | | | | | |

| | | | | | | | |

| Weighted average shares outstanding - basic and diluted | | 140,107 | | | 139,705 | | | 139,905 | | | 139,705 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net loss per share attributable to stockholders - basic and diluted | | $ | (0.19) | | | $ | (0.18) | | | $ | (0.40) | | | $ | (0.27) | |

| | | | | | | | |

| | | | | | | | |

| Other comprehensive (loss) income: | | | | | | | | |

| Net loss | | $ | (27,161) | | | $ | (25,403) | | | $ | (55,851) | | | $ | (38,306) | |

| Foreign currency translation adjustments | | 4,862 | | | (20,425) | | | (21,182) | | | (54,143) | |

| Total comprehensive loss | | $ | (22,299) | | | $ | (45,828) | | | $ | (77,033) | | | $ | (92,449) | |

| Comprehensive loss attributable to non-controlling interests | | 174 | | | 121 | | | 321 | | | 298 | |

| Comprehensive loss attributable to stockholders | | $ | (22,125) | | | $ | (45,707) | | | $ | (76,712) | | | $ | (92,151) | |

| | | | | | | | |

7 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | Six months ended

June 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (55,851) | | | $ | (38,306) | |

| Adjustments to reconcile net loss to cash used in operating activities: | | | | |

| Share-based compensation expense | | 5,044 | | | 5,201 | |

| Depreciation and amortization | | 4,578 | | | 732 | |

| | | | |

| Reduction in the carrying amount of right-of-use assets | | 732 | | | 491 | |

| Warrant liability fair value adjustment | | (198) | | | 1,151 | |

| | | | |

| | | | |

| Share of net loss of equity method investee | | 334 | | | 55 | |

| | | | |

| Foreign currency transaction net unrealized gain | | (1,188) | | | (23,247) | |

| Other | | — | | | (929) | |

| Changes in assets and liabilities: | | | | |

| Prepaid assets and other current assets | | 2,038 | | | 2,834 | |

| | | | |

| Accounts payable, accrued liabilities and other | | 1,242 | | | 19,967 | |

| | | | |

| | | | |

| | | | |

| Operating lease liability | | (932) | | | (2,669) | |

| Net cash used in operating activities | | (44,201) | | | (34,720) | |

| | | | |

| Cash flows from investing activities: | | | | |

| Proceeds from the return of property and equipment deposits | | 22,735 | | | — | |

| | | | |

| Purchases of property and equipment | | (29,099) | | | (128,361) | |

| Investments in equity method investee | | — | | | (1,655) | |

| Purchases of other long-term assets | | — | | | (1,000) | |

| Net cash used in investing activities | | (6,364) | | | (131,016) | |

| | | | |

| Cash flows from financing activities: | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Net cash provided by financing activities | | — | | | — | |

| | | | |

| Effect of changes in foreign exchange rates on cash, cash equivalents, and restricted cash | | (3,640) | | | (13,520) | |

| Net decrease in cash, cash equivalents, and restricted cash | | (54,205) | | | (179,256) | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 275,742 | | | 563,045 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 221,537 | | | $ | 383,789 | |

| | | | |

| Supplementary disclosure for non-cash activities: | | | | |

| Accrued purchases of property and equipment | | $ | 8,908 | | | $ | 23,085 | |

| | | | |

| | | | |

| Reconciliation to condensed consolidated balance sheets: | | | | |

| Cash and cash equivalents | | $ | 219,560 | | | $ | 334,364 | |

| Restricted cash | | 1,977 | | | 49,425 | |

| Cash, cash equivalents, and restricted cash | | $ | 221,537 | | | $ | 383,789 | |

8 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

Q2 2024 Earnings Call August 9, 2024

2 Forward Looking Statements Important Notices All statements, other than statements of present or historical facts included in this presentation, including, without limitation, FREYR Battery, Inc.’s (“FREYR”) ability to establish a profitable business; FREYR’s plan to extend its cash liquidity runway to 36 months and first revenue and EBITDA in 2025; the financial benefits of FREYR’s subject matter expertise; FREYR’s plan to expand on the battery value chain into high value adjacencies; FREYR’s efforts to accelerate the path to commercialization; the pursuit of project opportunities in accordance with the FREYR 2.0 initiative; potential inorganic growth opportunities and the ability to generate revenue in the near-term through possible acquisitions; the development, financing, construction, timeline, capacity, and other usefulness of FREYR’s CQP, Giga Arctic, Giga America, and other planned or future production facilities; any potential benefits of the U.S. Inflation Reduction Act; FREYR’s ability to reduce spending; and the implementation and effectiveness of FREYR’s overall business, technology, capital-raising, and liquidity strategies are forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside FREYR’s control and are difficult to predict. Additional information about factors that could materially affect FREYR is set forth under the “Risk Factors” section in (i) FREYR’s Registration Statement on Form S-3 filed with the Securities and Exchange Commission (the “SEC”) on September 1, 2022 and subsequent post-effective amendment thereto filed on January 5, 2024, (ii) FREYR Battery, Inc.’s Registration Statement on Form S-4 filed with the SEC on September 8, 2023 and subsequent amendments thereto filed on October 13, 2023, October 19, 2023, and October 31, 2023, (iii) FREYR’s annual report on Form 10-K filed with the SEC on February 29, 2024; and (iv) FREYR’s Quarterly Reports on Form 10-Q filed with the SEC on May 8, 2024 and available on the SEC’s website at www.sec.gov. Except as otherwise required by applicable law, FREYR disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward-looking statements. FREYR intends to use its website as a channel of distribution to disclose information which may be of interest or material to investors and to communicate with investors and the public. Such disclosures will be included on FREYR’s website in the ‘Investor Relations’ sections. FREYR also intends to use certain social media channels, including, but not limited to, X (Twitter) and LinkedIn, as means of communicating with the public and investors about FREYR, its progress, products, and other matters. While not all the information that FREYR posts to its digital platforms may be deemed to be of a material nature, some information may be. As a result, FREYR encourages investors and others interested to review the information that it posts and to monitor such portions of FREYR’s website and social media channels on a regular basis, in addition to following FREYR’s press releases, SEC filings, and public conference calls and webcasts. The contents of FREYR’s website and other social media channels shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

Today’s Speakers and Topics 3 • Message from FREYR’s Board of Directors • Summary of leadership appointments and AGM results • Alignment with FREYR’s investors as fellow shareholders committed to shareholder value • The opportunities and challenges in today’s dynamic environment • FREYR’s plan to generate shareholder value • Summary of FREYR’s key priorities • FREYR’s commitment to financial discipline and a strong balance sheet • Approach to capital formation • Financial summary Tom Einar Jensen, Co-founder and CEO Evan Calio, CFO Daniel Barcelo, Board Chair

FREYR’s Value Proposition to Investors 4 Untapped asset and real option value • Current equity discount to cash on balance sheet reflective of FREYR’s pre-commercial state and challenging financing climate • Focused on unlocking value by developing projects with real assets (Giga America, Giga Arctic, CQP, Finland, Tech licenses) • FREYR's leadership team is executing its revised business plan targeting first revenue and EBITDA in 2025 Strong balance sheet and liquidity position • Debt free balance sheet and cash of $222 million at June 30th • FREYR is extending its cash liquidity runway to 36 months with spending rationalization Installed talent base of FREYR’s organization • Developed subject matter expertise across the battery value chain creates optionality across adjacent technology spectrum • Demonstrated ability to produce cells on the 24M next-generation production platform at CQP • Technical execution-oriented team is a differentiator in the battery industry Thematic exposure to secular growth trends across expanding partner network • FREYR’s equity story is tied to long-term supply and demand investment themes in the global battery and power markets • Accelerating electricity demand growth driven by data centers introducing new opportunities for FREYR

FREYR 2.0 5 Accelerating pathway to Revenue and EBITDA generation in 2025 in a highly dynamic environment Accelerate Conventional Technology Strategy Establish Long-Term Competitive Moat Based on next- generation SemiSolidTM IP Prioritize Financial Discipline and Balance Sheet Strength Pursue Opportunities Under FREYR 2.0 Commercial Initiative Accelerate FREYR’s Commercialization to Create Shareholder Value • Surplus cell capacity from established global producers will be embedded in modules/packs with next-generation electronics • Pursue downstream business focused on modules and packs at Giga America and/or Giga Arctic • Preserve option value of FREYR’s SemiSolidTM position and develop new funding pathways and business cases for the CQP • Working with partners to design safe, improved and competitive battery solutions tied to next- generation IP • Leverage AI and digital simulation engines to develop improved solutions • Protect and fortify FREYR’s clean balance sheet • Reduce costs and extend cash liquidity runway to 36 months • Pursue options that are value accretive and strategic for Giga Arctic • Evaluating potential inorganic growth opportunities • Maturing multiple strategic and project-driven conventional technology opportunities • Exploring commercial avenues for FREYR’s digital assets at the CQP

6 FREYR is commercially focused on storage applications that are fundamental to power grid reliability Batteries – The Core Enabler of the Energy Transition Batteries are a renewable energy catalyst Batteries enable intermittent energy sources that are growing exponentially to be viable, dispatchable, affordable sources of power generation. Wind and solar power growth are just part of the story Wind and solar dispatchability varies with weather, as does power demand. Batteries fortify the electric grid and improve cost and reliability regardless of the source of power generation. Batteries are an interface for electrified energy assets Batteries provide an AC/DC interface and energy storage that enables integration of heat pumps, EVs, distributed solar generation, etc. to be cheaper, more valuable, and more efficient. Source: Rocky Mountain Institute

Optimizing our Balance Sheet 7 • 2024 YTD total cash uses of $54 million • Controlling costs to extend cash liquidity runway to 36 months or longer Minimizing cash spending to preserve liquidity FREYR H1 2024 Cash Bridge ($ in millions) Note: Cash includes cash, cash equivalents and restricted cash: amounts may not reconcile due to rounding. FREYR Q2 2024 Balance Sheet Summary ($ in millions) As of June 30, As of December 31, 2024 2023 Cash, equivalents, and restricted cash 222$ 276$ Other current assets 13 36 Net property, plant & equipment 363 366 Other assets 46 54 Total assets 644$ 732$ Current liabilities 35 49 Other liabilities 47 48 Shareholders' equity 563 635 Total liabilities and equity 644$ 732$

Summary of Key Messages 8 Accelerating path to market with conventional technology strategy • Executing plan to achieve first revenues and EBITDA as soon as 2025 • Pursuing multiple opportunities with emphasis on downstream Module and Pack production • Potential downstream projects tied to Giga America and Giga Arctic • Continuing to progress cell production opportunities in parallel Prioritizing financial discipline and balance sheet strength • Optimizing spending to extend cash liquidity runway to 36 months or longer • Evaluating strategic and value accretive options for Giga Arctic Continuing to advance new business opportunities under FREYR 2.0 commercial initiative • Evaluating potential inorganic deals • New use cases for FREYR's existing facilities emerging Establish long-term competitive moat around the 24M next-generation IP technology stack • Preserve option value of FREYR’s SemiSolidTM position • Evaluating commercial pathways to leverage FREYR’s growing digital asset portfolio at CQP and Giga Arctic Committed to building on FREYR’s strong competitive position to create sustainable shareholder value

v3.24.2.u1

Cover

|

Aug. 09, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 09, 2024

|

| Entity Registrant Name |

FREYR Battery, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

333-274434

|

| Entity Address, Address Line One |

6&8 East Court Square, Suite 300

|

| Entity Address, Postal Zip Code |

30263

|

| Entity Address, City or Town |

Newnan

|

| City Area Code |

678

|

| Local Phone Number |

632-3112

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

93-3205861

|

| Entity Central Index Key |

0001992243

|

| Amendment Flag |

false

|

| Entity Address, State or Province |

GA

|

| OrdinarySharesWithoutNominalValueMember |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

FREY

|

| Security Exchange Name |

NYSE

|

| WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50

|

| Trading Symbol |

FREY WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=freyr_OrdinarySharesWithoutNominalValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=freyr_WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

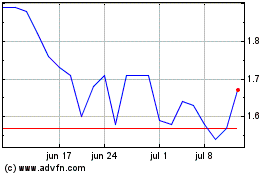

FREYR Battery (NYSE:FREY)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

FREYR Battery (NYSE:FREY)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024