General Mills Announces Agreements to Sell Its North American Yogurt Business to Lactalis and Sodiaal

12 Septiembre 2024 - 6:00AM

Business Wire

General Mills, Inc. (NYSE: GIS) today announced that it has

entered into definitive agreements to sell its North American

Yogurt business to Lactalis and Sodiaal, two leading French dairy

companies, in cash transactions valued at an aggregate $2.1 billion

USD. Following the completion of the transactions, the U.S. and

Canadian businesses will operate independently, with Lactalis

acquiring the U.S. business and Sodiaal acquiring the Canadian

business. The proposed transactions are expected to close in

calendar 2025, subject to receipt of requisite regulatory approvals

and other customary closing conditions.

The divestitures encompass the U.S. and Canada operations of

several yogurt brands including Yoplait, Liberté, Go-Gurt, Oui,

Mountain High, and :ratio, as well as manufacturing facilities in

Murfreesboro, Tenn., Reed City, Mich., and Saint-Hyacinthe, Québec.

Collectively, the North American Yogurt business contributed

approximately $1.5 billion USD to General Mills’ fiscal 2024 net

sales.

“Today’s announcement represents another significant step

forward for General Mills in advancing our Accelerate strategy and

our portfolio reshaping ambitions,” said General Mills Chairman and

Chief Executive Officer Jeff Harmening. “Upon completion of these

divestitures, we will have turned over nearly 30 percent of our net

sales base since fiscal 2018. By efficiently managing our portfolio

and sharpening our focus on our global platforms and local gem

brands that have stronger growth prospects and more attractive

margins, we will be in a better position to drive top-tier

shareholder returns over the long term.”

“We would also like to take this time to thank our North

American Yogurt team members for their significant contributions,”

Harmening continued. “In Lactalis and Sodiaal, we believe we’ve

found the right homes for these businesses, with dairy-focused

owners who are well equipped to drive success for our people and

growth for these brands into the future.”

General Mills anticipates the combined transactions will be

approximately 3 percent dilutive to adjusted earnings per share in

the first 12 months after the close, excluding transaction costs

and other one-time impacts. The company expects to use the net

proceeds from the transactions for share repurchases.

General Mills will provide additional details about the

potential financial impact of the transactions when it reports

first-quarter results on September 18, 2024.

J.P. Morgan served as the exclusive financial adviser to General

Mills for the transactions and Cleary Gottlieb Steen & Hamilton

LLP served as legal adviser.

About General Mills

General Mills makes food the world loves. The company is guided

by its Accelerate strategy to boldly build its brands, relentlessly

innovate, unleash its scale and stand for good. Its portfolio of

beloved brands includes household names like Cheerios, Nature

Valley, Blue Buffalo, Häagen-Dazs, Old El Paso, Pillsbury, Betty

Crocker, Yoplait, Totino’s, Annie’s, Wanchai Ferry, Yoki and more.

General Mills generated fiscal 2024 net sales of U.S. $20 billion.

In addition, the company’s share of non-consolidated joint venture

net sales totaled U.S. $1 billion. For more information, visit

www.generalmills.com.

Cautionary Statement Concerning Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

that are based on our current expectations and assumptions. These

forward-looking statements, including the statements regarding the

proposed transactions and the timing and impact of such

transactions, are subject to certain risks and uncertainties that

could cause actual results to differ materially from the potential

results discussed in the forward-looking statements. In particular,

our predictions about future results could be affected by a variety

of factors, including: disruptions or inefficiencies in the supply

chain; competitive dynamics in the consumer foods industry and the

markets for our products, including new product introductions,

advertising activities, pricing actions, and promotional activities

of our competitors; economic conditions, including changes in

inflation rates, interest rates, tax rates, or the availability of

capital; product development and innovation; consumer acceptance of

new products and product improvements; consumer reaction to pricing

actions and changes in promotion levels; acquisitions or

dispositions of businesses or assets; changes in capital structure;

changes in the legal and regulatory environment, including tax

legislation, labeling and advertising regulations, and litigation;

impairments in the carrying value of goodwill, other intangible

assets, or other long-lived assets, or changes in the useful lives

of other intangible assets; changes in accounting standards and the

impact of critical accounting estimates; product quality and safety

issues, including recalls and product liability; changes in

consumer demand for our products; effectiveness of advertising,

marketing, and promotional programs; changes in consumer behavior,

trends, and preferences, including weight loss trends; consumer

perception of health-related issues, including obesity;

consolidation in the retail environment; changes in purchasing and

inventory levels of significant customers; fluctuations in the cost

and availability of supply chain resources, including raw

materials, packaging, energy, and transportation; effectiveness of

restructuring and cost saving initiatives; volatility in the market

value of derivatives used to manage price risk for certain

commodities; benefit plan expenses due to changes in plan asset

values and discount rates used to determine plan liabilities;

failure or breach of our information technology systems; foreign

economic conditions, including currency rate fluctuations; and

political unrest in foreign markets and economic uncertainty due to

terrorism or war. The company undertakes no obligation to publicly

revise any forward-looking statement to reflect any future events

or circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240912977759/en/

(Investors) Jeff Siemon: +1-763-764-2301 (Media) Chelcy Walker:

+1-763-764-6364

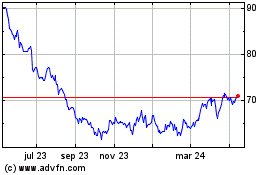

General Mills (NYSE:GIS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

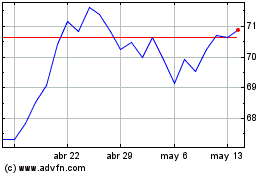

General Mills (NYSE:GIS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025