UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the Securities

Exchange Act of 1934

For the month of January 2025

Commission File Number 001-35754

Infosys Limited

(Exact name of Registrant as specified in its charter)

Not Applicable.

(Translation of Registrant's name into English)

Electronics City, Hosur Road, Bengaluru - 560 100,

Karnataka, India. +91-80-2852-0261

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F:

Form 20-F þ

Form 40-F o

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

TABLE OF CONTENTS

DISCLOSURE OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

Infosys Limited (“we” or “the Company”)

hereby furnishes the United States Securities and Exchange Commission with copies of the following information concerning our public

disclosures regarding our results of operations and financial condition for the quarter and nine months ended December 31, 2024.

The following information shall not be deemed

"filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific reference in such a filing.

On January 16, 2025, we announced our results of operations

for the quarter and nine months ended December 31, 2024. A copy of the outcome of the board meeting is attached to this Form 6-K as Exhibit

99.1.

We issued press releases announcing our results under

International Financial Reporting Standards ("IFRS"), copies of which are attached to this Form 6-K as Exhibit 99.2.

We have placed the form of release to stock exchanges

concerning our results of operations for the quarter and nine months ended December 31, 2024 under Indian Accounting Standards (Ind-AS).

A copy of the release to stock exchanges is attached to this Form 6-K as Exhibit 99.3.

Based on the recommendations of the Nomination

and Remuneration Committee, the Board approved annual time-based stock incentives in the form of Restricted Stock Units (RSUs) to

Salil Parekh, CEO & MD having a market value of  3 crore as on the date of grant under

the 2015 Stock Incentive Compensation Plan (2015 Plan) in accordance with the terms of his employment agreement. The RSUs will be

granted w.e.f. February 1, 2025 and the number of RSUs will be calculated based on the market price at the close of trading on a

date immediately preceding the grant date. The exercise price of RSUs will be equal to the par value of the share.

3 crore as on the date of grant under

the 2015 Stock Incentive Compensation Plan (2015 Plan) in accordance with the terms of his employment agreement. The RSUs will be

granted w.e.f. February 1, 2025 and the number of RSUs will be calculated based on the market price at the close of trading on a

date immediately preceding the grant date. The exercise price of RSUs will be equal to the par value of the share.

The Board of Directors of the Company

amongst other matters, approved Allotted 5,552 equity shares of face value of  5 each,

pursuant to exercise of Restricted Stock Units by eligible employees as hereunder :

5 each,

pursuant to exercise of Restricted Stock Units by eligible employees as hereunder :

| · | | 1,982 equity shares

under the 2015 Incentive Compensation Plan; |

| · | | 3,570 equity shares

under the Infosys Expanded Stock Ownership Program 2019. |

Consequently, effective from January

16, 2025, the issued and subscribed share capital of the Company stands increased to  20,76,13,73,730/- divided into 4,15,22,74,746 equity shares of

20,76,13,73,730/- divided into 4,15,22,74,746 equity shares of  5/- each.

5/- each.

Also, the Board of Directors, considered and approved

amendments to the Whistleblower policy. Copy of the policy will be made available on the website of the Company under the following link

: https://www.infosys.com/investors/corporate-governance/policies.html.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Infosys Limited

|

| |

|

|

Date: January 16, 2025 |

Inderpreet Sawhney

General Counsel and Chief Compliance Officer |

INDEX TO EXHIBITS

| Exhibit No. |

Description of Document |

| 99.1 |

Outcome of the Board Meeting |

| 99.2 |

IFRS USD press release |

| 99.3 |

Form of Release to Stock Exchanges |

Exhibit 99.1

Outcome of the Board meeting

Exhibit 99.2

IFRS USD Press Release

Strong growth of 6.1% YoY in CC, 80

bps YoY operating margin expansion

Large deal TCV of $2.5 billion including

63% net new; Headcount increased by 5,591

FY25 revenue guidance revised to 4.5%-5.0%

Bengaluru, India – January 16, 2025: Infosys (NSE, BSE, NYSE: INFY), a global leader in nextgeneration digital services and consulting, delivered

strong and broad-based performance with $4,939 million in Q3 revenues, growth of 1.7% sequentially and 6.1% year on year in constant

currency. Operating margin for Q3 was at 21.3%, increase of 0.2% sequentially. Free cash flow for Q3 was highest ever at $1,263

million, growing 90% year on year. TCV of large deal wins was $2.5 billion, with 63% net new growing at 57% sequentially. Headcount

increased for second consecutive quarter.

Revenues for YTD Dec’24 grew at 3.9% year on year in constant currency and in reported terms. Operating margin was at 21.2%, increase

of 0.3% year on year.

“Our strong revenue growth sequentially

in a seasonally weak quarter and broad-based year on year growth, along with robust operating parameters and margins, is a clear reflection

of the success of our differentiated digital offerings, market positioning, and key strategic initiatives. We continue to strengthen

our enterprise AI capabilities, particularly focusing on generative AI, which is witnessing increasing client traction”, said Salil

Parekh, CEO and MD. “This has led to another quarter of strong large deal wins and improved deal pipeline giving us greater

confidence as we look ahead”, he added.

Guidance

for FY25:

| · | | Revenue growth of 4.5%-5.0% in constant currency |

| · | | Operating margin

of 20%-22% |

|

For quarter ended December 31, 2024

|

For the nine months ended December 31, 2024

|

·

Revenues in CC terms grew by 6.1% YoY and 1.7% QoQ

·

Reported revenues at $4,939 million, growth of 5.9% YoY

·

Operating margin at 21.3%, increase of 0.8% YoY and 0.2% QoQ

·

Basic EPS at $0.19, growth of 9.6% YoY

·

FCF at $1,263 million, growth of 89.9% YoY; FCF conversion at 156.6% of net profit

|

·

Revenues in CC terms grew by 3.9% YoY

·

Reported revenues at $14,547 million, growth of 3.9% YoY

·

Operating margin at 21.2%, growth of 0.3% YoY

·

Basic EPS at $0.57, growth of 6.1% YoY

·

FCF at $3,196 million, growth of 57.1% YoY; FCF conversion at 136.1% of net profit

|

“We had another quarter

of strong performance with revenue growth across segments and operating margin expansion, leading to 11.4% EPS growth year on year in

rupee terms. Our structured approach to operating margin expansion yielded more results in Q3, particularly due to benefits from improving

realization and scale benefits” said Jayesh Sanghrajka, CFO. “Our sharp focus on cash flow is reflected in Free cash

conversion to net profits of 157% in Q3 with free cash generation for 9 months of FY25 surpassing that of entire FY24”, he added.

1. Client wins &

Testimonials

| · | Infosys Compaz and Temasek, announced a strategic collaboration with StarHub to accelerate their

operations and drive technology-led innovations. Tan Kit Yong, Head of Enterprise Business Group, StarHub, said, “At StarHub,

we have always prided ourselves on being at the forefront of innovation. By collaborating with iCompaz, we are expanding our horizons

to offer an even wider range of offerings and technologies that are co-created to address the unique needs of our customers. Aligned with

our DARE+ strategy, this powerful synergy will better position us as the go-to full-service supplier for businesses that need connectivity,

cloud, cybersecurity, and other ICT services to accelerate their digital journeys.” |

| · | Infosys announced the extension of its existing collaboration with Old National Bank to accelerate its

operational and technological transformation. Jim Ryan, Chairman & CEO, Old National Bank, said, “At Old National,

we are committed to creating exceptional client and team member experiences. Infosys is expertly guiding us through business process enhancements,

with a strong emphasis on efficiency and value generation. We greatly appreciate Infosys’ commitment to our growth and success.” |

| · | Infosys announced its collaboration with RheinEnergie to help enterprises drive their energy

transition and sustainability agenda forward. Stephan Segbers, Chief Sales Officer and member of the board, RheinEnergie, said, “RheinEnergie

firmly believes that innovative technological and digital solutions are intrinsic to achieving the ‘Energiewende’ and the

‘Wärmewende’, Germany’s planned transition to a low-carbon, nuclear-free economy. The powerful combination of Infosys’

global expertise in energy transition and cutting-edge technologies such as cloud and AI, and RheinEnergie’s extensive experience

in providing energy services allows us to offer enterprises a comprehensive suite of solutions to help manage their energy costs and navigate

their energy transition journey. We are excited about joining forces with Infosys and extend this innovative approach to businesses across

various sectors. Together, we can accelerate the transition to a clean energy future for a healthier planet.” |

| · | Infosys announced the extension of its existing collaboration with Microsoft to help accelerate customer

adoption of generative AI and Microsoft Azure, globally. Nicole Dezen, Chief Partner Officer at Microsoft, said, “Our

expanded collaboration with Infosys will transform industries, enhance business operations, elevate employee experiences, and deliver

new value for customers. Together, we will harness the power of generative AI to deliver innovative solutions, drive AI Adoption and enable

unprecedented innovation for customers.” |

| · | Infosys announced the launch of its small language models – Infosys Topaz BankingSLM and Infosys

Topaz ITOpsSLM – built using the powerful NVIDIA AI Stack. Jay Puri, Executive Vice President, Worldwide Field Operations,

NVIDIA, said, “Generative AI and the recent advancements in agentic and physical AI are ushering in a new era of innovation

and productivity for enterprises worldwide. NVIDIA's full-stack AI platform combined with Infosys Topaz empowers businesses to build and

deploy custom AI applications that will transform industries, helping businesses unlock their full potential.” |

| · | Infosys announced the launch of Google Cloud center of excellence, powered by Infosys Topaz, to foster

enterprise AI innovation. Victor Morales, Vice President of GSI and Consulting Partnerships, Google Cloud, said, “Infosys

and Google Cloud are committed to providing customers with the industry expertise and technology needed to accelerate digital transformation.

The center of excellence is a testament to our strong collaboration and dedication to helping businesses innovate with breakthrough solutions

powered by generative AI.” |

| · | Infosys announced its strategic collaboration with zooplus to enhance its service capability and scalability.

Geoffroy Lefebvre, Chief Executive Officer, zooplus SE, said, “At zooplus our growth strategy has always been focused

on leveraging data-driven insights to meet our customers’ demands. Our collaboration with Infosys to establish our new technology

hub is a strategic decision driven by their AI-first strategies combined with expertise in delivering AI-powered solutions, with Infosys

Topaz. We are confident that through this collaboration we will unlock greater operational efficiencies, enhance customer experience,

and stay ahead in the competitive e-commerce landscape.” |

| · | Infosys announced a strategic collaboration with Kardex to transform its business operations

using SAP S/4HANA. Thomas Reist, Chief Financial Officer of Kardex, said, “Our mission is to empower our customers to

optimize their intralogistics operations, enhancing efficiency, agility, and overall success. By continually evolving our solutions and

adapting to changing market demands, we aim to be the trusted partner of choice for companies seeking to boost their productivity. We

are confident that our partnership with Infosys will propel us forward. With their extensive expertise in process transformation, supported

by SAP solutions, and a proven track record of successful implementations, Infosys is the ideal partner to help us achieve our strategic

objectives. We look forward to this collaboration as a means to advance our growth and further strengthen our position as a market leader.” |

| · | Infosys announced its collaboration with Southwark Council to launch its digital learning platform - Springboard in

the borough. Dionne Lowndes, Chief Digital & Technology Officer, Southwark Council, said, “Partnering with Infosys

to bring the Springboard platform to Southwark is a significant step towards realising our ambitious three-year digital strategy. The

initiative will not only empower our residents, but local businesses too, with vital digital skills and resources. By enhancing this kind

of accessibility and fostering innovation, we are working to enable our community to thrive in an ever-advancing technological world.” |

2. Recognitions & Awards

Brand

| · | Awarded Silver in the India Workplace Equality Index (IWEI) 2024 |

| · | Received the 2024 UN Women’s WEP India Award in the Gender-inclusive Workplace category |

| · | Received multiple recognitions at The Asset ESG Corporate Awards 2024 - Platinum Award for Excellence,

Best Investor Relations Team, Best Initiative in Environmental Responsibility, and Best Initiative in Diversity and Inclusion categories |

| · | Received the Shorty Impact Awards in the Gender Equality category for the #SpotItToStopIt campaign |

AI and Cloud Services

| · | Received Binding Corporate Rules Certification from EU Data Protection Authorities |

| · | Positioned as a leader in Gartner Magic Quadrant for Cloud ERP Services |

| · | Rated as a leader in The Forrester Wave™: Automation Fabric Services, Q4 2024 |

| · | Positioned as a leader in Microsoft Azure Services PEAK Matrix® Assessment 2024 by Everest Group |

| · | Recognized as a leader in IDC MarketScape: Asia/Pacific Managed Cloud Services 2024–2025 Vendor

Assessment |

| · | Recognized as a leader in IDC MarketScape: Worldwide Adobe Experience Cloud Professional Services 2024–2025

Vendor Assessment |

| · | Positioned as a leader in HFS Horizons: AADA Quadfecta of Analytics, AI, Data Platforms, and Automation

Services for Generative Enterprise 2024 |

| · | Positioned as a leader in HFS Horizons: Azure Ecosystem Services Providers, 2024 |

Key Digital Services

| · | Rated as a leader in The Forrester Wave™: Infrastructure Outsourcing Services, Q4 2024 |

| · | Recognized as a leader in IDC MarketScape: Asia/Pacific Salesforce Implementation Services 2024–2025

Vendor Assessment |

| · | Recognized as a leader in IDC MarketScape: Worldwide Digital Workplace Services 2024 Vendor Assessment |

| · | Recognized as a leader in IDC MarketScape: European SAP Modernization Services 2024 Vendor Assessment |

| · | Positioned as a leader in HFS Horizons: IoT Service Providers, 2024 |

| · | Positioned as a leader in HFS Horizons: Sustainability Services, 2024 |

| · | Rated as a leader in Quality Engineering NEAT 2024 by NelsonHall |

| · | Recognized as a Market Maker in CapioIT Salesforce SI and Solutions Providers Ecosystem Capture Share

Report, 2024 |

| · | Infosys BPM won the ‘Outsourcing Impact Champion’ award at the Outsourcing Impact Review (OIR)

2024 for ‘Project Genesis’ |

| · | Infosys BPM ranked as a Leader in ISG Provider Lens™ Quadrant Study on Procurement Services 2024 |

| · | Infosys BPM recognized as a Leader in the IDC MarketScape: Worldwide Enterprise Analytics and AI Business

Process Services for Finance and Accounting 2024 Vendor Assessment |

Industry & Solutions

| · | Recognized as a leader in IDC MarketScape Worldwide Life Science R&D ITO Services 2024 |

| · | Recognized as a leader in IDC MarketScape: Worldwide Smart Insurance Producer Management Applications |

| · | Recognized as a leader in IDC MarketScape: Worldwide Service Providers for Utilities Customer Operations

2024 Vendor Assessment |

| · | Positioned as a leader in HFS Horizons: Healthcare Payer Services 2024 |

| · | Positioned as a leader in HFS Horizons: The Best Service Providers for Commercial Banks, 2025 |

| · | Infosys Finacle has been positioned as a Leader by Everest Group in the Wealth Management Products PEAK Matrix®

Assessment 2024 Report |

| · | Infosys Finacle has been positioned as a Leader by Everest Group in the Consumer Loan Origination Systems

(LOS) – Products PEAK Matrix® Assessment 2024 Report |

| · | MEA Finance Banking Technology Awards 2024: Best Composable Banking Transformation - Emirates NBD and Infosys

Finacle |

Read more about our Awards & Recognitions

here.

About

Infosys

|

Infosys is a global leader in next-generation digital services and consulting. Over 300,000 of our people work to amplify human potential

and create the next opportunity for people, businesses and communities. We enable clients in more than 56 countries to navigate their

digital transformation. With over four decades of experience in managing the systems and workings of global enterprises, we expertly steer

clients, as they navigate their digital transformation powered by the cloud. We enable them with an AIpowered core, empower the business

with agile digital at scale and drive continuous improvement with always-on learning through the transfer of digital skills, expertise,

and ideas from our innovation ecosystem. We are deeply committed to being a well-governed, environmentally sustainable organization where

diverse talent thrives in an inclusive workplace.

Visit

www.infosys.com

to see how Infosys (NSE, BSE, NYSE: INFY) can help your enterprise navigate your next.

|

|

Safe

Harbor

Certain

statements in this release concerning our future growth prospects, our future financial or operating performance, the McCamish cybersecurity

incident and the related review and notification process are forwardlooking statements intended to qualify for the 'safe harbor' under

the Private Securities Litigation Reform Act of 1995, which involve a number of risks and uncertainties that could cause actual results

or outcomes to differ materially from those in such forward-looking statements. The risks and uncertainties relating to these statements

include, but are not limited to, risks and uncertainties regarding the execution of our business strategy, increased competition for

talent, our ability to attract and retain personnel, increase in wages, investments to reskill our employees, our ability to effectively

implement a hybrid working model, economic uncertainties and geo-political situations, technological disruptions and innovations such

as Generative AI, the complex and evolving regulatory landscape including immigration regulation changes, our ESG vision, our capital

allocation policy and expectations concerning our market position, future operations, margins, profitability, liquidity, capital resources,

our corporate actions including acquisitions, the amount of any additional costs, including indemnities or damages or claims, resulting

directly or indirectly from the McCamish cybersecurity incident and the outcome and effect of pending litigation. Important factors that

may cause actual results or outcomes to differ from those implied by the forward-looking statements are discussed in more detail in our

US Securities and Exchange Commission filings including our Annual Report on Form 20-F for the fiscal year ended March 31, 2024. These

filings are available at https://www.sec.gov/. Infosys may, from time to time, make additional

written and oral forward-looking statements, including statements contained in the Company's filings with the Securities and Exchange

Commission and our reports to shareholders. The Company does not undertake to update any forward-looking statements that may be made

from time to time by or on behalf of the Company unless it is required by law.

Contact

|

Investor

Relations

|

Sandeep

Mahindroo

+91

80 3980 1018

Sandeep_Mahindroo@infosys.com

|

|

|

Media

Relations

|

Rishi

Basu

+91

80 4156 3998

Rajarshi.Basu@infosys.com

|

Harini

Babu

+1

469 996 3516

Harini_Babu@infosys.com

|

Infosys

Limited and subsidiaries

Extracted

from the Condensed Consolidated Balance Sheet under IFRS as at:

(Dollars

in millions)

| |

December 31, 2024 |

March 31, 2024 |

| ASSETS |

|

|

| Current assets |

|

|

| Cash and cash equivalents |

2,663 |

1,773 |

| Current investments |

933 |

1,548 |

| Trade receivables |

3,896 |

3,620 |

| Unbilled revenue |

1,318 |

1,531 |

| Other current assets |

1,428 |

2,250 |

| Total current assets |

10,238 |

10,722 |

| Non-current assets |

|

|

| Property, plant and equipment and Right-of-use assets |

2,183 |

2,323 |

| Goodwill and other Intangible assets |

1,508 |

1,042 |

| Non-current investments |

1,105 |

1,404 |

| Unbilled revenue |

301 |

213 |

| Other non-current assets |

956 |

819 |

| Total non-current assets |

6,053 |

5,801 |

| Total assets |

16,291 |

16,523 |

| LIABILITIES AND EQUITY |

|

|

| Current liabilities |

|

|

| Trade payables |

429 |

474 |

| Unearned revenue |

988 |

880 |

| Employee benefit obligations |

336 |

314 |

| Other current liabilities and provisions |

3,050 |

2,983 |

| Total current liabilities |

4,803 |

4,651 |

| Non-current liabilities |

|

|

| Lease liabilities |

667 |

767 |

| Other non-current liabilities |

465 |

500 |

| Total non-current liabilities |

1,132 |

1,267 |

| Total liabilities |

5,935 |

5,918 |

| Total equity attributable to equity holders of the company |

10,307 |

10,559 |

| Non-controlling interests |

49 |

46 |

| Total equity |

10,356 |

10,605 |

| Total liabilities and equity |

16,291 |

16,523 |

Extracted

from the Condensed Consolidated statement of Comprehensive Income under IFRS for:

(Dollars

in millions except per equity share data)

| |

3 months ended December 31, 2024 |

3 months ended December 31, 2023 |

9 months ended December 31, 2024 |

9 months ended December 31, 2023 |

| Revenues |

4,939 |

4,663 |

14,547 |

13,997 |

| Cost of sales |

3,444 |

3,274 |

10,103 |

9,755 |

| Gross profit |

1,495 |

1,389 |

4,444 |

4,242 |

| Operating expenses: |

|

|

|

|

| Selling and marketing expenses |

218 |

204 |

671 |

633 |

| Administrative expenses |

224 |

229 |

693 |

692 |

| Total operating expenses |

442 |

433 |

1,364 |

1,325 |

| Operating profit |

1,053 |

956 |

3,080 |

2,917 |

| Other income, net (3) |

90 |

79 |

249 |

196 |

| Profit before income taxes |

1,143 |

1,035 |

3,329 |

3,113 |

| Income tax expense |

337 |

301 |

981 |

904 |

| Net profit (before minority interest) |

806 |

734 |

2,348 |

2,209 |

| Net profit (after minority interest) |

804 |

733 |

2,345 |

2,208 |

| Basic EPS ($) |

0.19 |

0.18 |

0.57 |

0.53 |

| Diluted EPS ($) |

0.19 |

0.18 |

0.56 |

0.53 |

NOTES:

|

1.

|

|

The above information is extracted from the audited condensed consolidated Balance sheet and Statement of Comprehensive Income for the

quarter and nine months ended December 31, 2024, which have been taken on record at the Board meeting held on January 16, 2025.

|

|

2.

|

|

A

Fact Sheet providing the operating metrics of the Company can be downloaded from

www.infosys.com

.

|

|

3.

|

|

Other

income is net of Finance Cost

|

|

4.

|

|

As the quarter and nine months ended figures are taken from the source and rounded to the nearest digits, the quarter figures in this statement

added up to the figures reported for the previous quarter might not always add up to the nine months ended figures reported in this statement.

|

Exhibit 99.3

Form of Release to Stock Exchanges

|

Infosys Limited

Regd. office: Electronics City, Hosur Road,

Bengaluru 560 100, India |

CIN : L85110KA1981PLC013115

Website: www.infosys.com

email: investors@infosys.com

T: 91 80 2852 0261, F: 91 80 2852 0362 |

Statement of Consolidated Audited Results of Infosys

Limited and its subsidiaries for the quarter and nine months ended December 31, 2024 prepared in compliance with the Indian Accounting

Standards (Ind-AS)

(in  crore, except per equity share data)

crore, except per equity share data)

| Particulars |

Quarter

ended

December 31, |

Quarter

ended

September 30, |

Quarter

ended

December 31, |

Nine months

ended

December 31, |

Year ended

March 31, |

| |

2024 |

2024 |

2023 |

2024 |

2023 |

2024 |

| |

Audited |

Audited |

Audited |

Audited |

Audited |

Audited |

| Revenue from operations |

41,764 |

40,986 |

38,821 |

122,064 |

115,748 |

153,670 |

| Other income, net |

859 |

712 |

789 |

2,410 |

1,982 |

4,711 |

| Total Income |

42,623 |

41,698 |

39,610 |

124,474 |

117,730 |

158,381 |

| Expenses |

|

|

|

|

|

|

| Employee benefit expenses |

21,436 |

21,564 |

20,651 |

63,934 |

62,228 |

82,620 |

| Cost of technical sub-contractors |

3,302 |

3,190 |

3,066 |

9,661 |

9,264 |

12,232 |

| Travel expenses |

439 |

458 |

387 |

1,375 |

1,288 |

1,759 |

| Cost of software packages and others |

4,607 |

3,949 |

3,722 |

12,012 |

9,828 |

13,515 |

| Communication expenses |

157 |

169 |

169 |

473 |

531 |

677 |

| Consultancy and professional charges |

459 |

451 |

504 |

1,354 |

1,237 |

1,726 |

| Depreciation and amortization expenses |

1,203 |

1,160 |

1,176 |

3,512 |

3,515 |

4,678 |

| Finance cost |

101 |

108 |

131 |

314 |

360 |

470 |

| Other expenses |

1,249 |

1,396 |

1,185 |

3,894 |

3,731 |

4,716 |

| Total expenses |

32,953 |

32,445 |

30,991 |

96,529 |

91,982 |

122,393 |

| Profit before tax |

9,670 |

9,253 |

8,619 |

27,945 |

25,748 |

35,988 |

| Tax expense: |

|

|

|

|

|

|

| Current tax |

3,202 |

3,146 |

2,419 |

9,346 |

7,216 |

8,390 |

| Deferred tax |

(354) |

(409) |

87 |

(1,113) |

258 |

1,350 |

| Profit for the period |

6,822 |

6,516 |

6,113 |

19,712 |

18,274 |

26,248 |

| Other comprehensive income |

|

|

|

|

|

|

| Items that will not be reclassified subsequently to profit or loss |

|

|

|

|

|

|

| Remeasurement of the net defined benefit liability/asset, net |

(45) |

78 |

71 |

53 |

94 |

120 |

| Equity instruments through other comprehensive income, net |

(15) |

(9) |

(9) |

(10) |

31 |

19 |

| Items that will be reclassified subsequently to profit or loss |

|

|

|

|

|

|

| Fair value changes on derivatives designated as cash flow hedges, net |

56 |

(21) |

(46) |

32 |

(17) |

11 |

| Exchange differences on translation of foreign operations |

(483) |

560 |

436 |

(27) |

457 |

226 |

| Fair value changes on investments, net |

10 |

86 |

52 |

136 |

107 |

144 |

| Total other comprehensive income/(loss), net of tax |

(477) |

694 |

504 |

184 |

672 |

520 |

| |

|

|

|

|

|

|

| Total comprehensive income for the period |

6,345 |

7,210 |

6,617 |

19,896 |

18,946 |

26,768 |

| |

|

|

|

|

|

|

| Profit attributable to: |

|

|

|

|

|

|

| Owners of the company |

6,806 |

6,506 |

6,106 |

19,680 |

18,264 |

26,233 |

| Non-controlling interests |

16 |

10 |

7 |

32 |

10 |

15 |

| |

6,822 |

6,516 |

6,113 |

19,712 |

18,274 |

26,248 |

| Total comprehensive income attributable to: |

|

|

|

|

|

|

| Owners of the company |

6,336 |

7,190 |

6,605 |

19,863 |

18,934 |

26,754 |

| Non-controlling interests |

9 |

20 |

12 |

33 |

12 |

14 |

| |

6,345 |

7,210 |

6,617 |

19,896 |

18,946 |

26,768 |

Paid up share capital (par value  5/- each, fully paid) 5/- each, fully paid) |

2,072 |

2,072 |

2,070 |

2,072 |

2,070 |

2,071 |

| Other equity *# |

86,045 |

86,045 |

73,338 |

86,045 |

73,338 |

86,045 |

Earnings per equity share (par value  5/- each)** 5/- each)** |

|

|

|

|

|

|

Basic (in  per share) per share) |

16.43 |

15.71 |

14.76 |

47.52 |

44.13 |

63.39 |

Diluted (in  per share) per share) |

16.39 |

15.68 |

14.74 |

47.40 |

44.08 |

63.29 |

| * | | Balances for the quarter and nine months ended December 31, 2024 and quarter ended September 30,

2024 represent balances as per the audited Balance Sheet as at March 31, 2024 and balances for the quarter and nine months ended

December 31, 2023 represent balances as per the audited Balance Sheet as at March 31, 2023 as required by SEBI (Listing and Other

Disclosure Requirements) Regulations, 2015 |

| ** | | EPS is not annualized for the quarter and nine months ended December 31, 2024, quarter

ended September 30, 2024 and quarter and nine months ended December 31, 2023 |

| # | | Excludes non-controlling interest |

1. Notes pertaining to the current quarter

a) The audited interim condensed consolidated

financial statements for the quarter and nine months ended December 31, 2024 have been taken on record by the Board of Directors at its

meeting held on January 16, 2025. The statutory auditors, Deloitte Haskins & Sells LLP have expressed an unmodified audit opinion.

The information presented above is extracted from the audited interim condensed consolidated financial statements. Those interim condensed

consolidated financial statements are prepared in accordance with the Indian Accounting Standards (Ind-AS) as prescribed under Section

133 of the Companies Act, 2013 read with Rule 3 of the Companies (Indian Accounting Standards) Rules, 2015 and relevant amendment rules

thereafter.

b) Update on stock grants

The Board, on January 16, 2025, based on the recommendations

of the Nomination and Remuneration Committee, approved the annual time-based stock incentives in the form of Restricted Stock Units (RSUs)

to Salil Parekh, CEO & MD having a market value of  3 crore as on the date of grant under the 2015 Stock Incentive Compensation

Plan (2015 Plan) in accordance with the terms of his employment agreement. The RSUs will vest in line with the employment agreement. The

RSUs will be granted w.e.f February 1, 2025 and the number of RSUs will be calculated based on the market price at the close of trading

on a date immediately preceding the grant date. The exercise price of RSUs will be equal to the par value of the share.

3 crore as on the date of grant under the 2015 Stock Incentive Compensation

Plan (2015 Plan) in accordance with the terms of his employment agreement. The RSUs will vest in line with the employment agreement. The

RSUs will be granted w.e.f February 1, 2025 and the number of RSUs will be calculated based on the market price at the close of trading

on a date immediately preceding the grant date. The exercise price of RSUs will be equal to the par value of the share.

2. Information on dividends for the quarter and

nine months ended December 31, 2024

The Board of Directors (in the meeting held on October

17, 2024) declared an interim dividend of  21/- per equity share. The record date for the payment was October 29, 2024 and the same

was paid on November 8, 2024. The interim dividend declared in the previous year was

21/- per equity share. The record date for the payment was October 29, 2024 and the same

was paid on November 8, 2024. The interim dividend declared in the previous year was  18/- per equity share.

18/- per equity share.

(in  )

)

| Particulars |

Quarter

ended

December 31, |

Quarter

ended

September 30, |

Quarter

ended

December 31, |

Nine months ended December 31, |

Year ended

March 31, |

| |

2024 |

2024 |

2023 |

2024 |

2023 |

2024 |

Dividend per share (par value  5/- each) 5/- each) |

|

|

|

|

|

|

| Interim dividend |

– |

21.00 |

– |

21.00 |

18.00 |

18.00 |

| Final dividend |

– |

– |

– |

– |

– |

20.00 |

| Special dividend |

– |

– |

– |

– |

– |

8.00 |

3. Segment reporting (Consolidated - Audited)

(in  crore)

crore)

| Particulars |

Quarter

ended

December 31, |

Quarter

ended

September 30, |

Quarter

ended

December 31, |

Nine months ended December 31, |

Year ended

March 31, |

| |

2024 |

2024 |

2023 |

2024 |

2023 |

2024 |

| Revenue by business segment |

|

|

|

|

|

|

| Financial Services (1) |

11,589 |

11,156 |

10,783 |

33,561 |

32,149 |

42,158 |

| Retail (2) |

5,746 |

5,446 |

5,649 |

16,619 |

17,075 |

22,504 |

| Communication (3) |

4,688 |

4,879 |

4,421 |

14,311 |

13,325 |

17,991 |

| Energy, Utilities, Resources and Services |

5,635 |

5,546 |

5,121 |

16,402 |

14,966 |

20,035 |

| Manufacturing |

6,479 |

6,424 |

5,786 |

18,680 |

16,710 |

22,298 |

| Hi-Tech |

3,279 |

3,266 |

2,985 |

9,692 |

9,095 |

12,411 |

| Life Sciences (4) |

3,195 |

3,004 |

2,954 |

9,065 |

8,753 |

11,515 |

| All other segments (5) |

1,153 |

1,265 |

1,122 |

3,734 |

3,675 |

4,758 |

| Total |

41,764 |

40,986 |

38,821 |

122,064 |

115,748 |

153,670 |

| Less: Inter-segment revenue |

– |

– |

– |

– |

– |

– |

| Net revenue from operations |

41,764 |

40,986 |

38,821 |

122,064 |

115,748 |

153,670 |

| Segment profit before tax, depreciation and non-controlling interests: |

|

|

|

|

|

|

| Financial Services (1) |

2,679 |

2,860 |

2,260 |

8,150 |

7,384 |

9,324 |

| Retail (2) |

1,975 |

1,768 |

1,715 |

5,493 |

5,018 |

6,882 |

| Communication (3) |

818 |

892 |

860 |

2,506 |

2,879 |

3,688 |

| Energy, Utilities , Resources and Services |

1,528 |

1,435 |

1,450 |

4,520 |

4,091 |

5,523 |

| Manufacturing |

1,357 |

1,297 |

1,110 |

3,661 |

3,116 |

4,197 |

| Hi-Tech |

816 |

794 |

758 |

2,424 |

2,349 |

3,153 |

| Life Sciences (4) |

819 |

614 |

766 |

2,045 |

2,266 |

2,898 |

| All other segments (5) |

123 |

149 |

218 |

562 |

538 |

760 |

| Total |

10,115 |

9,809 |

9,137 |

29,361 |

27,641 |

36,425 |

| Less: Other Unallocable expenditure |

1,203 |

1,160 |

1,176 |

3,512 |

3,515 |

4,678 |

| Add: Unallocable other income |

859 |

712 |

789 |

2,410 |

1,982 |

4,711 |

| Less: Finance cost |

101 |

108 |

131 |

314 |

360 |

470 |

| Profit before tax and non-controlling interests |

9,670 |

9,253 |

8,619 |

27,945 |

25,748 |

35,988 |

| (1) | | Financial Services include enterprises in Financial Services and Insurance |

| (2) | | Retail includes enterprises in Retail, Consumer Packaged Goods and Logistics |

| (3) | | Communication includes enterprises in Communication, Telecom OEM and Media |

| (4) | | Life Sciences includes enterprises in Life sciences and Health care |

| (5) | | All other segments include operating segments of businesses in India, Japan, China, Infosys

Public Services & other enterprises in Public Services |

Notes on segment information

Business segments

Based on the "management approach" as required

by Ind-AS 108 - Operating Segments, the Chief Operating Decision Maker evaluates the Group's performance and allocates resources based

on an analysis of various performance indicators by business segments. Accordingly, information has been presented along these business

segments. The accounting principles used in the preparation of the financial statements are consistently applied to record revenue and

expenditure in individual segments.

Segmental capital employed

Assets and liabilities used in the Group's business

are not identified to any of the reportable segments, as these are used interchangeably between segments. The Management believes that

it is currently not practicable to provide segment disclosures relating to total assets and liabilities since a meaningful segregation

of the available data is onerous.

4. Audited financial results of Infosys Limited

(Standalone Information)

(in  crore)

crore)

| Particulars |

Quarter

ended

December 31, |

Quarter

ended

September 30, |

Quarter

ended

December 31, |

Nine months ended December 31, |

Year ended

March 31, |

| |

2024 |

2024 |

2023 |

2024 |

2023 |

2024 |

| Revenue from operations |

34,915 |

34,257 |

32,491 |

102,455 |

96,932 |

128,933 |

| Profit before tax |

8,844 |

9,407 |

8,876 |

26,379 |

25,539 |

35,953 |

| Profit for the period |

6,358 |

6,813 |

6,552 |

18,939 |

18,754 |

27,234 |

The audited results of Infosys Limited for the above

mentioned periods are available on our website, www.infosys.com and on the Stock Exchange website www.nseindia.com and www.bseindia.com.

The information above has been extracted from the audited interim standalone financial statements as stated.

| |

By order of the Board

for Infosys Limited

|

|

Bengaluru, India

January 16, 2025 |

Salil Parekh

Chief Executive Officer and Managing Director |

The Board has also taken on record the condensed

consolidated results of Infosys Limited and its subsidiaries for the quarter and nine months ended December 31, 2024, prepared as per

International Financial Reporting Standards (IFRS) and reported in US dollars. A summary of the financial statements is as follows:

(in US$ million, except per equity share data)

| Particulars |

Quarter

ended

December 31, |

Quarter

ended

September 30, |

Quarter

ended

December 31, |

Nine months ended December 31, |

Year ended

March 31, |

| |

2024 |

2024 |

2023 |

2024 |

2023 |

2024 |

| |

Audited |

Audited |

Audited |

Audited |

Audited |

Audited |

| Revenues |

4,939 |

4,894 |

4,663 |

14,547 |

13,997 |

18,562 |

| Cost of sales |

3,444 |

3,400 |

3,274 |

10,103 |

9,755 |

12,975 |

| Gross profit |

1,495 |

1,494 |

1,389 |

4,444 |

4,242 |

5,587 |

| Operating expenses |

442 |

461 |

433 |

1,364 |

1,325 |

1,753 |

| Operating profit |

1,053 |

1,033 |

956 |

3,080 |

2,917 |

3,834 |

| Other income, net |

102 |

85 |

95 |

287 |

239 |

568 |

| Finance cost |

12 |

13 |

16 |

38 |

43 |

56 |

| Profit before income taxes |

1,143 |

1,105 |

1,035 |

3,329 |

3,113 |

4,346 |

| Income tax expense |

337 |

327 |

301 |

981 |

904 |

1,177 |

| Net profit |

806 |

778 |

734 |

2,348 |

2,209 |

3,169 |

| Earnings per equity share * |

|

|

|

|

|

|

| Basic (in $ per share) |

0.19 |

0.19 |

0.18 |

0.57 |

0.53 |

0.77 |

| Diluted (in $ per share) |

0.19 |

0.19 |

0.18 |

0.56 |

0.53 |

0.76 |

| Total assets |

16,291 |

16,928 |

15,606 |

16,291 |

15,606 |

16,523 |

| Cash and cash equivalents and current investments |

3,596 |

3,488 |

2,598 |

3,596 |

2,598 |

3,321 |

| * | | EPS is not annualized for the quarter and nine months ended December 31, 2024, quarter

ended September 30, 2024 and quarter and nine months ended December 31, 2023. |

Certain statements in this release concerning our future

growth prospects, our future financial or operating performance, the McCamish cybersecurity incident and the related review and notification

process are forward-looking statements intended to qualify for the 'safe harbor' under the Private Securities Litigation Reform Act of

1995, which involve a number of risks and uncertainties that could cause actual results or outcomes to differ materially from those in

such forward-looking statements. The risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties

regarding the execution of our business strategy, increased competition for talent, our ability to attract and retain personnel, increase

in wages, investments to reskill our employees, our ability to effectively implement a hybrid working model, economic uncertainties and

geo-political situations, technological disruptions and innovations such as Generative AI, the complex and evolving regulatory landscape

including immigration regulation changes, our ESG vision, our capital allocation policy and expectations concerning our market position,

future operations, margins, profitability, liquidity, capital resources, our corporate actions including acquisitions, the amount of any

additional costs, including indemnities or damages or claims, resulting directly or indirectly from the McCamish cybersecurity incident

and the outcome and effect of pending litigation. Important factors that may cause actual results or outcomes to differ from those implied

by the forward-looking statements are discussed in more detail in our US Securities and Exchange Commission filings including our Annual

Report on Form 20-F for the fiscal year ended March 31, 2024. These filings are available at www.sec.gov. Infosys may, from time to time,

make additional written and oral forward-looking statements, including statements contained in the Company's filings with the Securities

and Exchange Commission and our reports to shareholders. The Company does not undertake to update any forward-looking statements that

may be made from time to time by or on behalf of the Company unless it is required by law.

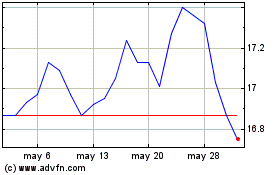

Infosys (NYSE:INFY)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Infosys (NYSE:INFY)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025