Courts, Congress Likely to Stand in Way of J&J’s Third Texas Two-Step Plan

26 Julio 2024 - 8:38AM

Business Wire

U.S. Court of Appeals for 3rd Circuit latest to

reject unprecedented bankruptcy strategy

Lawyers on behalf of tens of thousands of ovarian cancer victims

are calling on Johnson & Johnson (NYSE: JNJ) to end its “war of

attrition against cancer victims.”

“The third time will not be the charm for J&J,” says Andy

Birchfield, head of the Mass Torts Litigation Section at the

Beasley Allen Law Firm, who has been instrumental in helping to

foil the first two attempts at bankruptcy by the

half-trillion-dollar company. “Recent developments in the courts

and in Congress should convince J&J to abandon its strategy and

act as a responsible corporation by providing truly fair and

reasonable compensation in a non-coercive resolution.”

On Thursday, the U.S. Court of Appeals for the 3rd Circuit

reinforced an earlier ruling that J&J could not stash its talc

liabilities in a shell subsidiary and then plunge it into

bankruptcy to stymie thousands of lawsuits alleging that its talc

products caused ovarian cancer and mesothelioma. The court found

the bankruptcy was filed in bad faith because the subsidiary, LTL

Management, LLC, was not in financial distress.

Earlier this week, a bipartisan group of congressional lawmakers

led by Sen. Josh Hawley (R-MO) and Sen. Sheldon Whitehouse (D-RI)

introduced legislation to ban the Texas Two-Step. The Ending

Corporate Bankruptcy Abuse Act (ECBA) of 2024 would deter the Texas

Two-Step and ensure injury victims have a chance to be heard in

court. The ECBA would instruct courts to presume a bankruptcy has

been filed in bad faith if it is a Texas Two-Step bankruptcy.

“Johnson & Johnson has brought this legislative action upon

itself by flouting the law and arrogantly pushing a failed

strategy,” says Leigh O’Dell, co-lead counsel for consolidated

multidistrict litigation. “The courts and Congress are saying that

J&J is not entitled to use the powerful tools of bankruptcy to

strip away the rights of cancer victims.”

Friday July 26 is the deadline for talc claimants to approve or

reject a third J&J bankruptcy attempt. A settlement plan aimed

at ending the litigation must receive 75% of all votes before the

company can proceed with another Texas Two-Step maneuver and

bankruptcy filing, this time in Texas. Opponents of the plan say

that proposed compensation unfairly shortchanges victims and their

families, many who have died or suffered for a decade or more.

“For J&J to lose this vote would be akin to Vladimir Putin

losing a Russian election,” says Mr. Birchfield. “J&J controls

the ballot. J&J determines who can vote and all the rules for

voting. J&J controls the agent that counts the ballots and

determines which votes will be counted and which ones will be

discarded. And this is all done without court supervision.

“However, there is a vast difference between winning the vote

through ballot stuffing and succeeding with a bankruptcy plan. This

will be J&J’s third attempt to use bankruptcy to shirk its

responsibility for its asbestos-laden talc-based baby powder. The

egregiousness of J&J’s scheme to use bankruptcy to evade

accountability and cap its liability has prompted bipartisan

congressional action with a bill that would curb the abuse of

J&J’s Texas Two Step.”

Beasley Allen is one of the country’s leading civil litigation

firms, holding several national records for verdicts and

settlements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240726363190/en/

Mike Androvett mike@androvett.com 214-507-5456

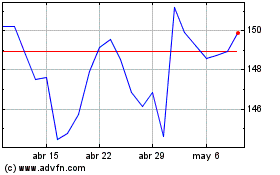

Johnson and Johnson (NYSE:JNJ)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

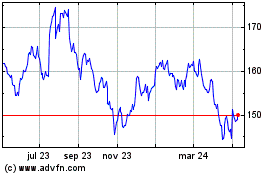

Johnson and Johnson (NYSE:JNJ)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024