KKR Real Estate Finance Trust Inc. Tax Treatment of 2022 Dividends

31 Enero 2023 - 3:30PM

Business Wire

KKR Real Estate Finance Trust Inc. (the “Company” or “KREF”)

(NYSE: KREF) today announced the tax treatment of its 2022 common

stock and 6.50% Series A Cumulative Redeemable Preferred Stock (the

“Series A Preferred Stock”) dividends. The following table

summarizes KKR Real Estate Finance Trust Inc.’s common stock and

Series A Preferred Stock dividend payments for the tax year ended

December 31, 2022:

Tax Treatment of 2022 Common Stock Dividends Record Date

Payment Date Cash Distribution Adjustment Dividend(1) Ordinary

Dividends(2) Qualified Dividends Capital Gain Dividends December

31, 2021 January 14, 2022

$0.43

($0.23)

$0.20

$0.20000

$0.00000

$0.00000

March 31, 2022 April 15, 2022

$0.43

$0.00

$0.43

$0.43000

$0.00000

$0.00000

June 30, 2022 July 15, 2022

$0.43

$0.00

$0.43

$0.43000

$0.00000

$0.00000

September 30, 2022 October 14, 2022

$0.43

$0.00

$0.43

$0.43000

$0.00000

$0.00000

December 30, 2022 January 13, 2023

$0.43

($0.18)

$0.25

$0.25000

$0.00000

$0.00000

$2.15

($0.41)

$1.74

$1.74000

$0.00000

$0.00000

(1)

Pursuant to IRC Section 857(b)(9), cash distributions made on

January 13, 2023 with a record date of December 30, 2022 are

treated as received by shareholders on December 31, 2022 to the

extent of 2022 earnings and profits.

(2)

Ordinary dividends may be eligible for the 20% deduction

applicable to “qualified REIT dividends” under IRC Section

199A(b)(1)(B). Stockholders are encouraged to consult with their

own tax advisors as to their specific tax treatment of the

Company's distributions.

Tax Treatment of 2022 Series A Preferred Stock Dividends

Record Date Payment Date Cash Distribution Adjustment Dividend

Ordinary Dividends(1) Qualified Dividends Capital Gain Dividends

February 28, 2022 March 15, 2022

$0.41

$0.00

$0.41

$0.40625

$0.00000

$0.00000

May 31, 2022 June 15, 2022

$0.41

$0.00

$0.41

$0.40625

$0.00000

$0.00000

August 31, 2022 September 15, 2022

$0.41

$0.00

$0.41

$0.40625

$0.00000

$0.00000

November 30, 2022 December 15, 2022

$0.41

$0.00

$0.41

$0.40625

$0.00000

$0.00000

$1.63

$0.00

$1.63

$1.62500

$0.00000

$0.00000

(1)

Ordinary dividends may be eligible for the 20% deduction

applicable to “qualified REIT dividends” under IRC Section

199A(b)(1)(B). Stockholders are encouraged to consult with their

own tax advisors as to their specific tax treatment of the

Company's distributions.

About KKR Real Estate Finance Trust

Inc.

KREF is a real estate finance company that focuses primarily on

originating and acquiring senior loans secured by commercial real

estate properties. KREF is externally managed and advised by an

affiliate of KKR & Co. Inc. For additional information about

KREF, please visit its website at www.kkrreit.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230131006063/en/

MEDIA CONTACT: Miles Radcliffe-Trenner (212) 750-8300

media@kkr.com

INVESTOR RELATIONS CONTACT: Jack Switala (212) 763-9048

kref-ir@kkr.com

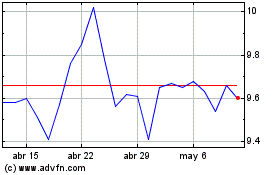

KKR Real Estate Finance (NYSE:KREF)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

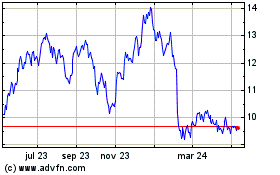

KKR Real Estate Finance (NYSE:KREF)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024