Exceeded 40,000 metric tons of REO production

for the third consecutive year

Commenced production of separated rare earth

products

Produced 200 metric tons of NdPr oxide in

2023

Generated $253.4 million of revenue in 2023

Produced $24.3 million of net income and

Adjusted EBITDA of $102.5 million in 2023

MP Materials Corp. (NYSE: MP) (“MP Materials” or the “Company”)

today announced its financial results for the fourth quarter and

full year ended December 31, 2023.

Full Year 2023

Highlights

- Produced 41,557 metric tons of rare earth oxides (“REO”) in

concentrate

- Produced 200 metric tons of NdPr oxide

- Sold 36,837 metric tons of REO, generating revenue of $253.4

million

- Produced net income of $24.3 million and Adjusted EBITDA of

$102.5 million

- Ended 2023 with $997.8 million of cash, cash equivalents and

short-term investments and $307.8 million of net cash on the

balance sheet

- Secured significant NdPr oxide-to-metal tolling capacity to

expand midstream sales opportunities

- Began installation of metal and alloy production equipment in

Fort Worth, Texas, magnetics facility

- Started trial production of NdPr metal

Fourth Quarter 2023

Highlights

- Production of 9,257 metric tons of REO in concentrate

- Sales volumes of 7,174 metric tons of REO in concentrate

- Production of 150 metric tons of NdPr oxide

- Sales of 10 metric tons of NdPr oxide

“MP executed diligently throughout 2023 despite formidable

market headwinds. We exceeded 40,000 tons of REO production for the

third consecutive year, achieved first production and sales of

NdPr, and added substantial depth to our team and capability set,”

said MP Materials Chairman and CEO, James Litinsky. “Our magnetics

division completed construction in Fort Worth and began trial

production of rare earth metal. Given the challenging pricing

environment, MP remains steadfast in our conservative approach to

capital deployment while we seek to create significant shareholder

value through the cycle.”

Fourth Quarter 2023 Financial and Operational

Highlights

For the three months ended

December 31,

2023 vs. 2022

(unaudited)

2023

2022

Amount Change

% Change

Financial Measures:

(in thousands, except per share

data)

Revenue(1)

$

41,205

$

93,245

$

(52,040

)

(56

)%

Net income (loss)

$

(16,259

)

$

67,007

$

(83,266

)

N/M

Adjusted EBITDA(2)

$

1,300

$

55,050

$

(53,750

)

(98

)%

Adjusted Net Income (Loss)(2)

$

(3,998

)

$

78,786

$

(82,784

)

N/M

Diluted EPS

$

(0.09

)

$

0.36

$

(0.45

)

N/M

Adjusted Diluted EPS(2)

$

(0.02

)

$

0.42

$

(0.44

)

N/M

Key Performance Indicators

(“KPIs”)(3):

(in whole units or dollars)

Rare earth concentrate

REO Production Volume (MTs)

9,257

10,485

(1,228

)

(12

)%

REO Sales Volume (MTs)

7,174

10,816

(3,642

)

(34

)%

Realized Price per REO MT

$

5,622

$

8,515

$

(2,893

)

(34

)%

Production Cost per REO MT(2)

$

2,393

$

1,928

$

465

24

%

Separated NdPr products

NdPr Production Volume (MTs)

150

N/A

N/A

N/A

NdPr Sales Volume (MTs)

10

N/A

N/A

N/A

NdPr Realized Price per KG

$

70

N/A

N/A

N/A

N/M = Not meaningful.

N/A = Not applicable as there was neither

NdPr production nor sales volume in the three months ended December

31, 2022.

(1)

The vast majority of the Company’s revenue pertains to sales of its

rare earth concentrate product.

(2)

See “Use of Non-GAAP Financial Measures” below for the definitions

of Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Diluted

EPS and Production Costs, which is used in the calculation of

Production Cost per REO MT. Beginning with the first quarter of

2024, the Company will no longer present Production Cost per REO

MT, which is a metric focused solely on concentrate production, and

accordingly, Production Costs. See tables below for reconciliations

of non-GAAP financial measures to their most directly comparable

GAAP financial measures.

(3)

During 2023, upon production of separated products, management

identified three new KPIs of the Company’s business. See “Key

Performance Indicators” below for definitions and further

information.

Revenue declined 56% year-over-year, due to a 34% decrease in

sales volumes as well as a 34% decline in realized sales prices of

REO in concentrate. The 34% decrease in metric tons (“MTs”) sold

was mainly due to the transition to midstream production of NdPr

oxide as well as slightly lower upstream production volumes. The

34% decline in realized prices was mainly due to the significantly

softer pricing environment for rare earth products as compared to

the prior year period. The softer pricing was mostly driven by

lower growth in magnetic products demand. The 12% decrease in

production volumes compared to the fourth quarter of 2022 was due

to a higher unplanned downtime in the current quarter.

Adjusted EBITDA declined 98% year-over-year, driven by lower

per-unit profitability, as well as higher personnel and other

general and administrative costs. The per-unit profitability

decline was driven primarily by the lower realized prices discussed

above, as well as higher production costs per MT. Production cost

of $2,393 per MT of REO increased 24% year-over-year mainly due to

the descaling impact of lower REO sales, a longer and more detailed

plant turnaround and higher payroll costs year-over-year from the

implementation of our Stage II strategy. Also impacting the

comparison was a write-down of $2.3 million on certain inventories

attributable to elevated carrying costs of initial production of

separated products. Higher general and administrative costs were

driven by higher corporate personnel and infrastructure costs

required to further build out our corporate infrastructure in

support of our downstream expansion.

In the quarter, the Company recorded an Adjusted Net Loss of

$4.0 million compared to Adjusted Net Income of $78.8 million in

the prior year period. The change was primarily driven by the lower

Adjusted EBITDA as well as higher depreciation expense and a lower

income tax benefit in the current quarter. Higher depreciation

expense resulted from an increase in capital assets placed into

service over the last year, mostly related to Stage II refining

upgrades. The change in income tax benefit was primarily due to a

tax benefit derived from the timing of capital assets placed into

service and the related impact on certain other deductions in the

prior year period. Also impacting the comparison was higher

interest and investment income earned in the current quarter.

Net loss was $16.3 million compared to net income of $67.0

million in the prior year period. The change was driven by the

trends discussed above impacting Adjusted Net Income/(Loss) in

addition to higher start-up and transaction costs in the current

quarter compared to last year.

Diluted EPS was $(0.09) and Adjusted Diluted EPS was $(0.02) in

the current quarter mainly due to the change from net income to a

net loss and Adjusted Net Income to Adjusted Net Loss,

respectively, as discussed above.

Full Year 2023 Financial and Operational Highlights

For the year ended

December 31,

2023 vs. 2022

(unaudited)

2023

2022

Amount Change

% Change

Financial Measures:

(in thousands, except per share

data)

Revenue(1)

$

253,445

$

527,510

$

(274,065

)

(52

)%

Net income

$

24,307

$

289,004

$

(264,697

)

(92

)%

Adjusted EBITDA(2)

$

102,502

$

388,631

$

(286,129

)

(74

)%

Adjusted Net Income(2)

$

71,378

$

320,557

$

(249,179

)

(78

)%

Diluted EPS

$

0.14

$

1.52

$

(1.38

)

(91

)%

Adjusted Diluted EPS(2)

$

0.39

$

1.68

$

(1.29

)

(77

)%

Key Performance Indicators:(3)

(in whole units or dollars)

Rare earth concentrate

REO Production Volume (MTs)

41,557

42,499

(942

)

(2

)%

REO Sales Volume (MTs)

36,837

43,198

(6,361

)

(15

)%

Realized Price per REO MT

$

6,854

$

11,974

$

(5,120

)

(43

)%

Production Cost per REO MT(2)

$

2,058

$

1,728

$

330

19

%

Separated NdPr products

NdPr Production Volume (MTs)

200

N/A

N/A

N/A

NdPr Sales Volume (MTs)

10

N/A

N/A

N/A

NdPr Realized Price per KG

$

70

N/A

N/A

N/A

N/M = Not meaningful.

N/A = Not applicable as there was neither

NdPr production nor sales volume in the year ended December 31,

2022.

(1)

The vast majority of the Company’s revenue pertains to sales of its

rare earth concentrate product.

(2)

See “Use of Non-GAAP Financial Measures” below for the definitions

of Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS and

Production Costs, which is used in the calculation of Production

Cost per REO MT. Beginning with the first quarter of 2024, the

Company will no longer present Production Cost per REO MT, which is

a metric focused solely on concentrate production, and accordingly,

Production Costs. See tables below for reconciliations of non-GAAP

financial measures to their most directly comparable GAAP financial

measures.

(3)

During 2023, upon production of separated products, management

identified three new KPIs of the Company’s business. See “Key

Performance Indicators” below for definitions and further

information.

Revenue declined 52% year-over-year, driven by a decrease in the

realized sales prices of REO in concentrate as well as lower

volumes sold. The 43% decrease in realized sales price was

primarily due to lower growth in magnetic products demand, which

negatively impacted the price of REO. The 15% decrease in MTs sold

was mainly due to the start-up of Stage II operations as a

significant portion of REO produced during the year was used to

charge the Stage II circuits, establish separations work-in-process

inventory, or produce packaged and finished separated rare earth

products, instead of being sold as REO in concentrate. Production

volumes were down slightly in 2023 mainly due to higher unplanned

downtime in the fourth quarter.

Adjusted EBITDA decreased 74% year-over-year, driven by lower

per-unit profitability, decreased sales volumes, as well as higher

personnel and other general and administrative costs. Per-unit

profitability was impacted by the lower realized prices discussed

above, as well as higher production costs per MT of REO. Production

cost of $2,058 per MT of REO increased 19% year-over-year, mainly

driven by higher payroll costs, including the increase in employee

headcount to support the expansion of operations, and to a lesser

extent, higher materials and supplies costs as well as higher

property and other taxes. Also impacting the comparison was a

write-down of $2.3 million on certain inventories attributable to

elevated carrying costs of initial production of separated

products. Higher general and administrative costs were driven by

higher corporate personnel and infrastructure costs required to

further build out corporate infrastructure in support of our

downstream expansion.

Adjusted Net Income was $71.4 million compared to $320.6 million

in the prior year. The change was mainly due to the lower Adjusted

EBITDA discussed above, as well as higher depreciation expense

resulting from an increase in capital assets placed into service

over the last year, mostly related to Stage II refining upgrades.

Also impacting the comparison was higher interest and investment

income earned, and lower income tax expense mostly related to the

lower pre-tax income.

Net income was $24.3 million compared to $289.0 million in the

prior year, driven primarily by the change in Adjusted Net Income

discussed above, as well as higher start-up, transaction and

demolition costs in 2023. Net income in 2023 was also impacted by

lower stock-based compensation expense. Diluted EPS declined 91%

year-over-year to $0.14 and Adjusted Diluted EPS decreased 77% to

$0.39, both mainly due to the decrease in net income and Adjusted

Net Income discussed above.

MP MATERIALS CORP. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

December 31,

(in thousands, except share and per

share data, unaudited)

2023

2022

Assets

Current assets

Cash and cash equivalents

$

263,351

$

136,627

Short-term investments

734,493

1,045,718

Total cash, cash equivalents and

short-term investments

997,844

1,182,345

Accounts receivable

10,029

32,856

Inventories

95,182

57,554

Government grant receivable

19,302

—

Prepaid expenses and other current

assets

8,820

21,073

Total current assets

1,131,177

1,293,828

Non-current assets

Property, plant and equipment, net

1,158,054

935,743

Operating lease right-of-use assets

10,065

99

Inventories

13,350

5,744

Equity method investment

9,673

—

Intangible assets, net

8,881

89

Other non-current assets

5,252

2,284

Total non-current assets

1,205,275

943,959

Total assets

$

2,336,452

$

2,237,787

Liabilities and stockholders’

equity

Current liabilities

Accounts and construction payable

$

27,995

$

15,326

Accrued liabilities

73,939

56,939

Income taxes payable

—

21,163

Other current liabilities

6,616

4,053

Total current liabilities

108,550

97,481

Non-current liabilities

Asset retirement obligations

5,518

5,295

Environmental obligations

16,545

16,580

Long-term debt, net

681,980

678,444

Operating lease liabilities

6,829

15

Deferred government grant

17,433

—

Deferred income taxes

130,793

122,353

Other non-current liabilities

3,025

4,985

Total non-current liabilities

862,123

827,672

Total liabilities

970,673

925,153

Commitments and contingencies

Stockholders’ equity:

Preferred stock ($0.0001 par value,

50,000,000 shares authorized, none issued and outstanding in either

year)

—

—

Common stock ($0.0001 par value,

450,000,000 shares authorized, 178,082,383 and 177,706,608 shares

issued and outstanding, as of December 31, 2023 and December 31,

2022, respectively)

17

18

Additional paid-in capital

979,891

951,008

Retained earnings

385,726

361,419

Accumulated other comprehensive income

145

189

Total stockholders’ equity

1,365,779

1,312,634

Total liabilities and stockholders’

equity

$

2,336,452

$

2,237,787

MP MATERIALS CORP. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

For the three months ended

December 31,

For the year ended December

31,

(in thousands, except share and per

share data, unaudited)

2023

2022

2023

2022

Revenue:

Rare earth concentrate

$

40,329

$

92,098

$

252,468

$

517,267

NdPr oxide and metal

695

—

695

—

Other rare earth products

181

1,147

282

10,243

Total revenue

41,205

93,245

253,445

527,510

Operating costs and expenses:

Cost of sales (excluding depreciation,

depletion and amortization)

23,577

24,536

92,714

92,218

Selling, general and administrative

21,416

19,707

79,245

75,857

Depreciation, depletion and

amortization

18,633

5,593

55,709

18,356

Start-up costs

5,205

3,782

21,330

7,551

Advanced projects and development

5,346

1,806

14,932

4,249

Other operating costs and expenses

656

355

7,234

1,868

Total operating costs and expenses

74,833

55,779

271,164

200,099

Operating income (loss)

(33,628

)

37,466

(17,719

)

327,411

Interest expense, net

(1,107

)

(1,331

)

(5,254

)

(5,786

)

Other income, net

14,078

10,953

56,048

19,527

Income (loss) before income

taxes

(20,657

)

47,088

33,075

341,152

Income tax benefit (expense)

4,398

19,919

(8,768

)

(52,148

)

Net income (loss)

$

(16,259

)

$

67,007

$

24,307

$

289,004

Earnings (loss) per share:

Basic

$

(0.09

)

$

0.38

$

0.14

$

1.64

Diluted

$

(0.09

)

$

0.36

$

0.14

$

1.52

Weighted-average shares

outstanding:

Basic

177,619,628

176,646,587

177,181,661

176,519,203

Diluted

177,619,628

193,494,131

178,152,212

193,453,087

MP MATERIALS CORP. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

For the year ended December

31,

(in thousands, unaudited)

2023

2022

Operating activities:

Net income

$

24,307

$

289,004

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, depletion and

amortization

55,709

18,356

Accretion of asset retirement and

environmental obligations

908

1,477

Accretion of discount on short-term

investments

(26,316

)

(9,958

)

Loss on disposals of long-lived assets,

net

808

391

Stock-based compensation expense

25,236

31,780

Accretion of debt discount and

amortization of debt issuance costs

3,536

4,034

Write-down of inventories

2,285

—

Revenue recognized in exchange for debt

principal reduction

—

(13,566

)

Deferred income taxes

8,455

17,789

Decrease (increase) in operating

assets:

Accounts receivable

22,827

18,153

Inventories

(47,099

)

(24,314

)

Government grant receivable

(19,302

)

—

Prepaid expenses, other current and

non-current assets

2,377

(8,223

)

Increase (decrease) in operating

liabilities:

Accounts payable and accrued

liabilities

11,305

1,962

Income taxes payable

(21,163

)

17,700

Deferred government grant

19,120

—

Other current and non-current

liabilities

(294

)

(1,071

)

Net cash provided by operating

activities

62,699

343,514

Investing activities:

Additions to property, plant and

equipment

(261,897

)

(326,595

)

Purchases of short-term investments

(1,185,477

)

(2,779,666

)

Proceeds from sales of short-term

investments

507,736

1,463,160

Proceeds from maturities of short-term

investments

1,015,190

281,000

Investment in equity method investee

(9,673

)

—

Proceeds from sale of property, plant and

equipment

18

—

Proceeds from government awards used for

construction

2,800

5,130

Net cash provided by (used in) investing

activities

68,697

(1,356,971

)

Financing activities:

Principal payments on debt obligations and

finance leases

(2,732

)

(5,834

)

Tax withholding on stock-based awards

(7,185

)

(18,357

)

Net cash used in financing activities

(9,917

)

(24,191

)

Net change in cash, cash equivalents and

restricted cash

121,479

(1,037,648

)

Cash, cash equivalents and restricted cash

beginning balance

143,509

1,181,157

Cash, cash equivalents and restricted

cash ending balance

$

264,988

$

143,509

Reconciliation of cash, cash

equivalents and restricted cash:

Cash and cash equivalents

$

263,351

$

136,627

Restricted cash, current

1,290

6,287

Restricted cash, non-current

347

595

Total cash, cash equivalents and

restricted cash

$

264,988

$

143,509

Reconciliation of GAAP Net

Income (Loss) to Non-GAAP Adjusted EBITDA

For the three months ended

December 31,

For the year ended December

31,

(in thousands, unaudited)

2023

2022

2023

2022

Net income (loss)

$

(16,259

)

$

67,007

$

24,307

$

289,004

Adjusted for:

Depreciation, depletion and

amortization

18,633

5,593

55,709

18,356

Interest expense, net

1,107

1,331

5,254

5,786

Income tax expense (benefit)

(4,398

)

(19,919

)

8,768

52,148

Stock-based compensation expense(1)

6,195

6,761

25,236

31,780

Initial start-up costs(2)

5,133

3,729

20,607

7,432

Transaction-related and other costs(3)

4,311

1,146

11,435

1,784

Accretion of asset retirement and

environmental obligations(4)

227

222

908

1,477

Loss on disposals of long-lived assets,

net(4)(5)

429

133

6,326

391

Other income, net(6)

(14,078

)

(10,953

)

(56,048

)

(19,527

)

Adjusted EBITDA

$

1,300

$

55,050

$

102,502

$

388,631

(1)

Principally included in “Selling, general and administrative”

within our unaudited Condensed Consolidated Statements of

Operations.

(2)

Included in “Start-up costs” within our unaudited Condensed

Consolidated Statements of Operations and excludes any applicable

stock-based compensation, which is included in the “Stock-based

compensation expense” line above. Relates to certain costs incurred

in connection with the commissioning and starting up of our initial

separations capability at Mountain Pass and our initial

magnet-making capabilities at Fort Worth prior to the achievement

of commercial production. These costs include labor of incremental

employees hired in advance to work directly on such commissioning

activities, training costs, costs of testing and commissioning the

new circuits and processes, and other related costs. Given the

nature and scale of the related costs and activities, management

does not view these as normal, recurring operating expenses, but

rather as non-recurring investments to initially develop our

separations and magnet-making capabilities. Therefore, we believe

it is useful and necessary for investors to understand our core

operating performance in current and future periods by excluding

the impact of these start-up costs. To the extent additional

start-up costs are incurred in the future to expand our separations

and magnet-making capabilities after initial achievement of

commercial production (e.g., significantly expanding production

capacity at an existing facility or building a new separations or

magnet manufacturing facility), such costs would not be considered

an adjustment for this non-GAAP financial measure.

(3)

Principally included in “Advanced projects and development” within

our unaudited Condensed Consolidated Statements of Operations, and

pertains to legal, consulting, and advisory services, and other

costs associated with specific transactions, including potential

acquisitions, mergers, or other investments.

(4)

Included in “Other operating costs and expenses” within our

unaudited Condensed Consolidated Statements of Operations.

(5)

The year ended December 31, 2023, includes $5.5 million in

demolition costs associated with demolishing and removing certain

out-of-use older facilities and infrastructure from the Mountain

Pass site to accommodate future expansion in rare earth processing.

(6)

Principally comprised of interest and investment income.

Reconciliation of GAAP Net

Income (Loss) to

Non-GAAP Adjusted Net Income

(Loss)

For the three months ended

December 31,

For the year ended December

31,

(in thousands, unaudited)

2023

2022

2023

2022

Net income (loss)

$

(16,259

)

$

67,007

$

24,307

$

289,004

Adjusted for:

Stock-based compensation expense(1)

6,195

6,761

25,236

31,780

Initial start-up costs(2)

5,133

3,729

20,607

7,432

Transaction-related and other costs(3)

4,311

1,146

11,435

1,784

Loss on disposals of long-lived assets,

net(4)(5)

429

133

6,326

391

Other

(9

)

(26

)

(51

)

(273

)

Tax impact of adjustments above(6)

(3,798

)

454

(16,482

)

(6,716

)

Release of valuation allowance

—

(418

)

—

(2,845

)

Adjusted Net Income (Loss)

$

(3,998

)

$

78,786

$

71,378

$

320,557

(1)

Principally included in “Selling, general and administrative”

within our unaudited Condensed Consolidated Statements of

Operations.

(2)

Included in “Start-up costs” within our unaudited Condensed

Consolidated Statements of Operations and excludes any applicable

stock-based compensation, which is included in the “Stock-based

compensation expense” line above. Relates to certain costs incurred

in connection with the commissioning and starting up of our initial

separations capability at Mountain Pass and our initial

magnet-making capabilities at Fort Worth prior to the achievement

of commercial production. These costs include labor of incremental

employees hired in advance to work directly on such commissioning

activities, training costs, costs of testing and commissioning the

new circuits and processes, and other related costs. Given the

nature and scale of the related costs and activities, management

does not view these as normal, recurring operating expenses, but

rather as non-recurring investments to initially develop our

separations and magnet-making capabilities. Therefore, we believe

it is useful and necessary for investors to understand our core

operating performance in current and future periods by excluding

the impact of these start-up costs. To the extent additional

start-up costs are incurred in the future to expand our separations

and magnet-making capabilities after initial achievement of

commercial production (e.g., significantly expanding production

capacity at an existing facility or building a new separations or

magnet manufacturing facility), such costs would not be considered

an adjustment for this non-GAAP financial measure.

(3)

Principally included in “Advanced projects and development” within

our unaudited Condensed Consolidated Statements of Operations, and

pertains to legal, consulting, and advisory services, and other

costs associated with specific transactions, including potential

acquisitions, mergers, or other investments.

(4)

Included in “Other operating costs and expenses” within our

unaudited Condensed Consolidated Statements of Operations.

(5)

The year ended December 31, 2023, includes $5.5 million in

demolition costs associated with demolishing and removing certain

out-of-use older facilities and infrastructure from the Mountain

Pass site to accommodate future expansion in rare earth processing.

(6)

Tax impact of adjustments is calculated using an adjusted effective

tax rate, which excludes the impact of discrete tax costs and

benefits, to each adjustment. The adjusted effective tax rates were

23.7%, 25.9%, (3.9)% and 16.3%, for the three months and years

ended December 31, 2023 and 2022, respectively.

Reconciliation of GAAP Diluted

Earnings (Loss) per Share to

Non-GAAP Adjusted Diluted

EPS

For the three months ended

December 31,

For the year ended December

31,

(unaudited)

2023

2022

2023

2022

Diluted earnings (loss) per

share

$

(0.09

)

$

0.36

$

0.14

$

1.52

Adjusted for:

Stock-based compensation expense

0.03

0.03

0.13

0.16

Initial start-up costs

0.03

0.02

0.11

0.04

Transaction-related and other costs

0.02

0.01

0.06

0.01

Loss on disposals of long-lived assets,

net

—

—

0.03

—

Tax impact of adjustments above(1)

(0.01

)

—

(0.08

)

(0.04

)

Release of valuation allowance

—

—

—

(0.01

)

Adjusted Diluted EPS

$

(0.02

)

$

0.42

$

0.39

$

1.68

Diluted weighted-average shares

outstanding

177,619,628

193,494,131

178,152,212

193,453,087

Assumed conversion of Convertible

Notes(2)

—

—

15,584,409

—

Adjusted diluted weighted-average

shares outstanding(2)

177,619,628

193,494,131

193,736,621

193,453,087

(1)

Tax impact of adjustments is calculated using an adjusted effective

tax rate, which excludes the impact of discrete tax costs and

benefits, to each adjustment. The adjusted effective tax rates were

23.7%, 25.9%, (3.9)% and 16.3%, for the three months and years

ended December 31, 2023 and 2022, respectively.

(2)

The Convertible Notes were antidilutive for GAAP purposes for the

year ended December 31, 2023; however, for purposes of calculating

Adjusted Diluted EPS, we have added back the assumed conversion of

the Convertible Notes since they would not be antidilutive when

using Adjusted Net Income as the numerator in the calculation of

Adjusted Diluted EPS.

Reconciliation of GAAP Cost of

Sales to

Non-GAAP Production

Costs

For the three months ended

December 31,

For the year ended December

31,

(in thousands, unless otherwise stated,

unaudited)

2023

2022

2023

2022

Cost of sales (excluding depreciation,

depletion and amortization)

$

23,577

$

24,536

$

92,714

$

92,218

Adjusted for:

Stock-based compensation expense(1)

(1,173

)

(743

)

(3,932

)

(2,853

)

Shipping and freight(2)

(1,335

)

(2,454

)

(7,485

)

(13,002

)

Write-down of inventories(3)

(2,285

)

—

(2,285

)

—

Other(4)

(1,616

)

(490

)

(3,198

)

(1,715

)

Production Costs(5)

17,168

20,849

75,814

74,648

Divided by:

REO Sales Volume (in MTs)

7,174

10,816

36,837

43,198

Production Cost per REO MT (in

dollars)(5)

$

2,393

$

1,928

$

2,058

$

1,728

(1)

Pertains only to the amount of stock-based compensation expense

included in “Cost of sales (excluding depreciation, depletion and

amortization)” within our unaudited Condensed Consolidated

Statements of Operations.

(2)

Includes $1.3 million for the year ended December 31, 2022, of

shipping and freight costs associated with sales of rare earth

fluoride (“REF”) stockpiles.

(3)

Amount pertains to a write-down of non-concentrate inventories,

which is included in “Cost of sales (excluding depreciation,

depletion and amortization)” within our unaudited Condensed

Consolidated Statements of Operations.

(4)

Amounts for the three months and year ended December 31, 2023,

pertain to costs (excluding shipping and freight) associated with

non-concentrate products. Amount for the year ended December 31,

2022, pertains primarily to costs (excluding shipping and freight)

attributable to sales of REF stockpiles.

(5)

See “Use of Non-GAAP Financial Measures” below for definition and

further information.

Conference Call Details

MP Materials will host a conference call to discuss these

results at 2:00 p.m. Pacific Time, Thursday, February 22, 2024. To

access the conference call, participants should dial 1 833 470 1428

and international participants should dial 1-404-975-4839 and enter

the conference ID number 762562. The live audio webcast along with

the press release and accompanying slide presentation, will be

accessible at investors.mpmaterials.com. A recording of the webcast

will also be available following the conference call.

About MP Materials

MP Materials (NYSE: MP) produces specialty materials that are

vital inputs for electrification and other advanced technologies.

MP’s Mountain Pass facility is America’s only scaled rare earth

production source. The Company is currently expanding its

manufacturing operations downstream to provide a full supply chain

solution from materials to magnetics. More information is available

at https://mpmaterials.com/.

Join the MP Materials community on X, YouTube, Instagram and

LinkedIn.

We routinely post important information on our website,

including corporate and investor presentations and financial

information. We intend to use our website as a means of disclosing

material, non-public information and for complying with our

disclosure obligations under Regulation FD. Such disclosures will

be included in the Investors section of our website. Accordingly,

investors should monitor such portion of our website, in addition

to following our press releases, Securities and Exchange Commission

filings and public conference calls and webcasts.

Forward-Looking Statements

This press release contains certain statements that are not

historical facts and are forward-looking statements for purposes of

the safe harbor provisions under the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of the words such as

“estimate,” “plan,” “shall,” “may,” “project,” “forecast,”

“intend,” “expect,” “anticipate,” “believe,” “seek,” “will,”

“target,” or similar expressions that predict or indicate future

events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to,

statements regarding the price and market for rare earth materials,

the continued demand for rare earth materials and the market for

rare earth materials generally, future demand for electric vehicles

and magnets, estimates and forecasts of the Company’s results of

operations and other financial and performance metrics, including

NdPr oxide production and shipments, expected sales of separated

NdPr oxide in the first quarter of 2024 and throughout all of 2024,

the expected cash flows of the early production of magnetic

precursor products in Stage III and associated expected magnetic

precursor products prepayments, expected capital expenditures in

Stage II and Stage III, expected net cash on the balance sheet at

the end of 2024, the Company’s ability to control costs and

expenses, the Company’s Upstream 60K strategy, including statements

regarding the timing, costs and ability to increase REO production,

and the Company’s Stage II and Stage III projects, including the

Company’s ability to achieve run rate production of separated rare

earth materials and production of magnetic alloy and magnets. Such

statements are all subject to risks, uncertainties and changes in

circumstances that could significantly affect the Company’s future

financial results and business.

Accordingly, the Company cautions that the forward-looking

statements contained herein are qualified by important factors that

could cause actual results to differ materially from those

reflected by such statements. These forward-looking statements are

subject to a number of risks and uncertainties, including

fluctuations and uncertainties related to demand for and pricing of

rare earth products; changes in domestic and foreign business,

market, financial, political and legal conditions; changes in

demand for NdFeB magnets; the effects of competition on the

Company’s future business; risks related to the Company’s Upstream

60K strategy, including delays in completion, unexpected costs and

expenses and timing for obtaining regulatory approvals; risks

related to the rollout of the Company’s business strategy,

including Stage II and Stage III, and the timing of achieving

expected business milestones in Stage II and Stage III; risks

related to the Company’s Stage II operations and the Company’s

ability to achieve run rate production of separated rare earth

materials; risks related to the Company’s long-term agreement with

General Motors, including the Company’s ability to produce and

supply NdFeB magnets; risks related to expected sales of separated

NdPr oxide due to various risks, including demand and pricing for

separated NdPr oxide; risks related to the Company’s ability to

develop magnetic precursor products in Section III, including

production delays; risks related to the Company entering into

agreements with customers for prepayment of magnetic precursor

products, including NdPr metal; the impact of the global COVID-19

pandemic, on any of the foregoing risks; risks related to current

and future governmental and environmental laws, regulations,

licenses or legal requirements; and those risk factors discussed in

the Company’s filings with the Securities and Exchange Commission,

including Annual Reports on Form 10-K, Quarterly Reports on Form

10-Q, Current Reports on Form 8-K and other documents filed by the

Company with the Securities and Exchange Commission.

If any of these risks materialize or the assumptions prove

incorrect, actual results could differ materially from the results

implied by these forward-looking statements. The Company does not

intend to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law. In light of these risks, uncertainties

and assumptions, the forward-looking events discussed in this

earnings release may not occur.

Use of Non-GAAP Financial Measures

This press release references certain non-GAAP financial

measures, including Adjusted EBITDA, Adjusted Net Income (Loss),

Adjusted Diluted EPS, and Production Costs, which have not been

prepared in accordance with GAAP. MP Materials defines Adjusted

EBITDA as GAAP net income or loss before interest expense, net;

income tax expense or benefit; and depreciation, depletion and

amortization; further adjusted to eliminate the impact of

stock-based compensation expense; initial start-up costs;

transaction-related and other costs; accretion of asset retirement

and environmental obligations; gain or loss on disposals of

long-lived assets; and other income or loss. MP Materials defines

Adjusted Net Income (Loss) as GAAP net income or loss excluding the

impact of stock-based compensation expense; initial start-up costs;

transaction-related and other costs; gain or loss on disposals of

long-lived assets; and other items that management does not

consider representative of our underlying operations; adjusted to

give effect to the income tax impact of such adjustments; and the

release of valuation allowance. MP Materials defines Adjusted

Diluted EPS as GAAP diluted earnings or loss per share excluding

the per share impact, using adjusted diluted weighted-average

shares outstanding, of stock-based compensation expense; initial

start-up costs; transaction-related and other costs; gain or loss

on disposals of long-lived assets; and other items that management

does not consider representative of our underlying operations;

adjusted to give effect to the income tax impact of such

adjustments; and the release of valuation allowance. Production

Costs, which we use to calculate our KPI, Production Cost per REO

MT (see “Key Performance Indicators” below), is defined as GAAP

cost of sales (excluding depreciation, depletion and amortization),

less stock-based compensation expense included in cost of sales,

shipping and freight costs, and costs not attributable to

concentrate sales, for a given period.

MP Materials’ management uses Adjusted EBITDA, Adjusted Net

Income (Loss), and Adjusted Diluted EPS to compare MP Materials’

performance to that of prior periods for trend analyses and for

budgeting and planning purposes. MP Materials believes Adjusted

EBITDA, Adjusted Net Income (Loss), and Adjusted Diluted EPS

provide useful information to management and investors regarding

certain financial and business trends relating to MP Materials’

financial condition and results of operations. MP Materials’

management believes that the use of Adjusted EBITDA, Adjusted Net

Income (Loss), and Adjusted Diluted EPS provides an additional tool

for investors to use in evaluating projected operating results and

trends. Furthermore, MP Materials believes Production Cost per REO

MT, which utilizes the non-GAAP financial measure, Production

Costs, is a key indicator of the Company’s concentrate production

efficiency. MP Materials’ method of determining these non-GAAP

measures may be different from other companies’ methods and,

therefore, may not be comparable to those used by other companies

and MP Materials does not recommend the sole use of these non-GAAP

measures to assess its financial performance. Management does not

consider non-GAAP measures in isolation or as an alternative or to

be superior to financial measures determined in accordance with

GAAP. The principal limitation of non-GAAP financial measures is

that they exclude significant expenses and income that are required

by GAAP to be recorded in MP Materials’ financial statements. In

addition, they are subject to inherent limitations as they reflect

the exercise of judgments by management about which expense and

income are excluded or included in determining these non-GAAP

financial measures. In order to compensate for these limitations,

management presents reconciliations of such non-GAAP financial

measures to the most directly comparable GAAP financial

measures.

Key Performance Indicators

REO Production Volume is measured in MTs, the Company’s

principal unit of sale for its concentrate product. This measure

refers to the REO content contained in the rare earth concentrate

we produce and, beginning in the second quarter of 2023, includes

volumes fed into downstream circuits for commissioning and starting

up our separations facilities and for producing separated NdPr

product, the latter of which is also included in our KPI, NdPr

Production Volume. REO Production Volume is a key indicator of the

Company’s mining and concentrate processing capacity and

efficiency.

REO Sales Volume for a given period is calculated in MTs. A

unit, or MT, is considered sold for once we recognize revenue on

its sale as determined in accordance with GAAP. REO Sales Volume is

a key measure of the Company’s ability to convert its concentrate

production into revenue.

Realized Price per REO MT for a given period is calculated as

the quotient of: (i) the Company’s rare earth concentrate sales,

which is determined in accordance with GAAP, for a given period and

(ii) the Company’s REO Sales Volume for the same period. Realized

Price per REO MT is an important measure of the market price of the

Company’s concentrate product.

Production Cost per REO MT is calculated as the quotient of: (i)

the Company’s Production Costs (see “Use of Non-GAAP Financial

Measures” above) for a given period and (ii) the Company’s REO

Sales Volume for the same period. Production Cost per REO MT is a

key indicator of the Company’s concentrate production

efficiency.

As our business continues to evolve and transitions from

production of rare earth concentrate to production of separated

rare earth products, the metrics that management uses to evaluate

the business may continue to change or be revised. For example,

beginning with the first quarter of 2024, we will no longer present

Production Cost per REO MT, which is a metric focused solely on

Stage I concentrate operations, as it will no longer be meaningful

in evaluating and understanding our business or operating results.

Accordingly, we will also no longer present Production Costs.

NdPr Production Volume is measured in MTs, the Company’s

principal unit of sale for its NdPr separated products. NdPr

Production Volume refers to the volume of finished and packaged

NdPr oxide produced at Mountain Pass for a given period. NdPr

Production Volume is a key indicator of the Company’s separating

and finishing capacity and efficiency.

NdPr Sales Volume for a given period is calculated in MTs and on

an NdPr oxide-equivalent basis (see example below). A unit, or MT,

is considered sold once we recognize revenue on its sale, whether

sold as NdPr oxide or NdPr metal, as determined in accordance with

GAAP. For NdPr metal sales, the MTs sold and included in NdPr Sales

Volume are calculated on the basis of the volume of NdPr oxide used

to produce such NdPr metal. For example, assuming a material

conversion ratio of 1.25, a sale of 100 MTs of NdPr metal would be

included in this KPI as 125 MTs of NdPr oxide-equivalent. NdPr

Sales Volume is a key measure of our ability to convert our

production of separated NdPr products into revenue. We expect to

have a mix of contracts with customers where we will sell NdPr as

(i) oxide, (ii) metal, where the amount of oxide required to

produce such metal is variable, and (iii) metal, where we have a

guarantee of the amount produced and sold based on the amount of

oxide consumed. Among other factors, differences between quarterly

NdPr Production Volume and NdPr Sales Volume may be caused by the

time required for the conversion of NdPr oxide to NdPr metal,

including time in-transit.

NdPr Realized Price per kilogram (“KG”) for a given period is

calculated as the quotient of: (i) our NdPr oxide and metal sales,

which is determined in accordance with GAAP, for a given period and

(ii) our NdPr Sales Volume for the same period. NdPr Realized Price

per KG is an important measure of the market price of our NdPr

products.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240222345443/en/

Investors: IR@mpmaterials.com

Media: Matt Sloustcher media@mpmaterials.com

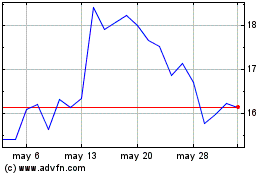

MP Materials (NYSE:MP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

MP Materials (NYSE:MP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024