0001321732FALSE00013217322024-03-172024-03-17

__________________________________________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________________________________________________________________

FORM 8-K

_______________________________________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

August 13, 2024

Date of Report (Date of earliest event reported)

_______________________________________________________________________________________________________________________________

Penumbra, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________________________________________________________

| | | | | | | | |

| Delaware | 001-37557 | 05-0605598 |

| (State or other jurisdiction of incorporation or organization) | (Commission File No.) | (I.R.S. employer identification number) |

One Penumbra Place

Alameda, CA 94502

(Address of principal executive offices, including zip code)

(510) 748-3200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, Par value $0.001 per share | PEN | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

_______________________________________________________________________________________________________________________________

On August 13, 2024, Penumbra, Inc. issued a press release announcing its entry into an accelerated share repurchase agreement. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | Press release of Penumbra, Inc. dated August 13, 2024. |

| 104 | | Cover Page Interactive Data File (formatted as Inline Extensible Business Reporting Language). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Penumbra, Inc. |

| | | |

| Date: August 13, 2024 | By: | /s/ Maggie Yuen |

| | | Maggie Yuen |

| | | Chief Financial Officer |

Penumbra, Inc. Announces $200 Million Share Repurchase Authorization

To Include $100 Million Accelerated Share Repurchase

ALAMEDA, Calif., Aug. 13, 2024 /PRNewswire/ – Penumbra, Inc. (NYSE: PEN), the world’s leading thrombectomy company, today announced that its Board of Directors approved on August 5, 2024 a share repurchase authorization in the amount of up to $200 million, allowing Penumbra to repurchase its common stock from time to time at such prices as it deems appropriate through open market purchases, block transactions, privately negotiated transactions, including accelerated share repurchase transactions, or otherwise. The repurchase authorization expires on July 31, 2025.

Under this authorization, Penumbra entered into an accelerated share repurchase agreement (“ASR”) with JPMorgan Chase Bank, National Association (the “Dealer”) on August 12, 2024 to repurchase $100 million of Penumbra’s common stock.

Under the ASR, Penumbra will make an initial payment of $100 million to the Dealer and will receive an initial delivery of approximately 474,000 shares of Penumbra’s common stock on August 13, 2024. The final number of shares to be repurchased will be based on the average of the daily volume-weighted average prices of Penumbra’s common stock during the term of the ASR, less a discount and subject to adjustments pursuant to the terms of the ASR. The final settlement of the ASR is expected to be completed in the third quarter of 2024. Penumbra is funding the share repurchase under the ASR with cash on hand.

Cautionary Statement Concerning Forward-Looking Statements

Except for historical information, certain statements in this press release are forward-looking in nature and are subject to risks, uncertainties and assumptions. These statements are neither promises nor guarantees but involve a variety of risks and uncertainties and, consequently, actual results may differ materially from those projected by any forward-looking statements. Forward-looking statements in this communication include, but are not limited to, statements about Penumbra’s share repurchase program, the transactions under the ASR, and the expected completion date of the ASR. Factors that could cause actual results to differ from those projected include, but are not limited to: failure to sustain or grow profitability or generate positive cash flows; failure to effectively introduce and market new products; delays in product introductions; significant competition; inability to further penetrate Penumbra’s current customer base, expand Penumbra’s user base and increase the frequency of use of Penumbra’s products by its customers; inability to achieve or maintain satisfactory pricing and margins; manufacturing difficulties; permanent write-downs or write-offs of Penumbra’s inventory or other assets; product defects or failures; unfavorable outcomes in clinical trials; inability to maintain its culture as Penumbra grows; fluctuations in foreign currency exchange rates; potential adverse regulatory actions; and the potential impact of any acquisitions, mergers, dispositions, joint ventures or investments Penumbra may make; and other factors and other risks, including those that Penumbra has described in its filings with the Securities and Exchange Commission, including but not limited to its Annual Reports on Form 10-K, Current Reports on Form 8-K and our Quarterly Reports on Form 10-Q. There may be additional risks of which Penumbra is not presently aware or that it currently believe are immaterial which could have an adverse impact on its business. Any forward-looking statements are based on Penumbra’s current expectations, estimates and assumptions regarding future events and are applicable only as of the dates of such statements. Penumbra makes no commitment to revise or update any forward-looking statements in order to reflect events or circumstances that may change. Penumbra undertakes no obligation to update the information contained in this press release except as required by law.

About Penumbra

Penumbra, Inc., the world’s leading thrombectomy company, is focused on developing the most innovative technologies for challenging medical conditions such as ischemic stroke, venous thromboembolism such as pulmonary embolism, and acute limb ischemia. Our broad portfolio, which includes computer assisted vacuum thrombectomy (CAVT), centers on removing blood clots from head-to-toe with speed, safety and simplicity. By pioneering these innovations, we support healthcare providers, hospitals and clinics in more than 100 countries, working to improve patient outcomes and quality of life. For more information, visit www.penumbrainc.com and connect on Instagram, LinkedIn and X.

Investor Relations

Penumbra, Inc.

investors@penumbrainc.com

Source: Penumbra, Inc.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

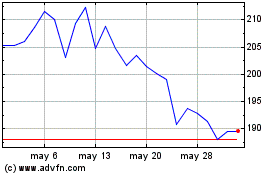

Penumbra (NYSE:PEN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Penumbra (NYSE:PEN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024