false

0000076267

0000076267

2024-07-16

2024-07-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 16, 2024

PARK AEROSPACE CORP.

| |

(Exact Name of Registrant as

Specified in Charter)

|

|

| |

|

|

| |

|

|

|

New York

|

1-4415

|

11-1734643

|

|

(State or Other Jurisdiction

|

(Commission File

|

(IRS Employer

|

|

of Incorporation)

|

Number)

|

Identification No.)

|

| |

|

|

| |

|

|

|

1400 Old Country Road, Westbury

|

New York

|

11590

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant's telephone number, including area code (631) 465-3600)

|

Not Applicable

|

|

Former Name or Former Address, if Changed Since Last Report

|

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $.10 per share

|

PKE

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has selected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Park Aerospace Corp. (the "Company") issued a news release on July 16, 2024 reporting its results of operations for its 2025 fiscal year first quarter ended June 2, 2024.

The Company is furnishing the news release to the Securities and Exchange Commission pursuant to Item 2.02 of Form 8-K as Exhibit 99.1 hereto, and it is incorporated herein by reference. The information in this Item 2.02 and the attached Exhibit shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as shall be expressly stated by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

| |

|

|

| |

(d) |

Exhibits. |

| |

|

|

|

| |

|

99.1 |

News Release dated July 16, 2024 |

| |

|

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PARK AEROSPACE CORP.

|

|

| |

|

|

|

| |

|

|

|

|

Date: July 16, 2024

|

By:

|

/s/ P. Matthew Farabaugh

|

|

| |

Name:

|

P. Matthew Farabaugh

|

|

| |

Title:

|

Senior Vice President and Chief

|

|

| |

|

Financial Officer

|

|

| |

Exhibit 99.1 |

| |

NEWS RELEASE |

| Contact: Donna D’Amico-Annitto |

486 North Oliver Road, Bldg. Z |

| |

Newton, Kansas 67114 |

| |

(316) 283-6500 |

PARK AEROSPACE CORP. REPORTS FIRST QUARTER RESULTS

Newton, Kansas, Tuesday, July 16, 2024…..Park Aerospace Corp. (NYSE-PKE) reported results for the 2025 fiscal year first quarter ended June 2 2024. The Company will conduct a conference call to discuss its financial results and other matters at 5:00 p.m. EDT today. A live audio webcast of the event, along with presentation materials, will be available at https://edge.media-server.com/mmc/p/f7gkgg8i at 5:00 p.m. EDT today. The presentation materials will also be available at approximately 4:15 p.m. EDT today at https://parkaerospace.com/shareholders/investor-conference-calls/ and on the Company’s website at www.parkaerospace.com under “Investor Conference Calls” on the “Shareholders” page.

Park reported net sales of $13,970,000 for the 2025 fiscal year first quarter ended June 2 2024 compared to $15,551,000 for the 2024 fiscal year first quarter ended May 28, 2023 and $16,333,000 for the 2024 fiscal year fourth quarter ended March 3, 2024. Net earnings for the 2025 fiscal year first quarter were $993,000 compared to $1,854,000 for the 2024 fiscal year first quarter and $2,670,000 for the 2024 fiscal year fourth quarter.

Net earnings before special items for the 2025 fiscal year first quarter were $1,781,000 compared to $2,407,000 for the 2024 fiscal year first quarter and $2,308,000 for the 2024 fiscal year fourth quarter.

Adjusted EBITDA for the 2025 fiscal year first quarter was $2,610,000 compared to $3,311,000 for the 2024 fiscal year first quarter and $3,201,000 for the 2024 fiscal year fourth quarter.

During the 2025 fiscal year, the Company recorded a $1,052,000 pre-tax charge related to storm damage to the Company’s facilities in Newton Kansas. During the 2024 fiscal year first quarter, the Company recorded $570,000 of pre-tax activist shareholder defense costs, $65,000 of pre-tax losses on sales of investments to fund the $1.00 per share special cash dividend paid on April 6, 2023 to shareholders of record on March 9, 2023 and a $109,000 pre-tax charge for the modification of previously granted stock options in connection with the special cash dividend in the 2024 fiscal year first quarter. During the 2024 fiscal year fourth quarter, the Company recorded $70,000 of pre-tax costs to settle an insurance claim as the result of the bankruptcy of an insurer and $38,000 of pre-tax recruiting fees. The Company recognized a tax benefit of $657,000 in the 2024 fiscal year fourth quarter primarily from the reductions of uncertain tax positions related to expiring statutes of limitations on tax positions taken in prior years regarding the taxability of funds repatriated from the Company’s subsidiary in Singapore, and the Company recorded $224,000 of additional tax expense for tax deductions becoming unavailable related to stock options expiring unexercised in the 2024 fiscal year fourth quarter.

Park reported basic and diluted earnings per share of $0.05 for the 2025 fiscal year first quarter compared to $0.09 for the 2024 fiscal year first quarter and $0.13 for the 2024 fiscal year fourth quarter. Basic and diluted earnings per share before special items were $0.09 for the 2025 fiscal year first quarter compared to $0.12 for the 2024 fiscal year first quarter and $0.11 for the 2024 fiscal year fourth quarter.

The Company will conduct a conference call to discuss its financial results at 5:00 p.m. EDT today. Forward-looking and other material information may be discussed in this conference call. The conference call dial-in number is (877) 407-3982 in the United States and Canada, and (201) 493-6780 in other countries. The required conference ID for attendance by phone is 13747817.

For those unable to listen to the call live, a conference call replay will be available from approximately 8:00 p.m. EDT today through 11:59 p.m. EDT on Tuesday, July 23, 2024. The conference call replay will be available at https://edge.media-server.com/mmc/p/f7gkgg8i and on the Company’s website at www.parkaerospace.com under “Investor Conference Calls” on the “Shareholders” page. It can also be accessed by dialing (844) 512-2921 in the United States and Canada, and (412) 317-6671 in other countries. The required passcode for accessing the replay by phone is 13747817.

Any additional material financial or statistical data disclosed in the conference call, including the investor presentation, will also be available at the time of the conference call on the Company's web site at

https://parkaerospace.com/shareholders/investor-conference-calls/.

Park believes that an evaluation of its ongoing operations would be difficult if the disclosure of its operating results were limited to accounting principles generally accepted in the United States of America (“GAAP”) financial measures, which include special items, such as a charge related to storm damage, activist shareholder defense costs, losses on sales of investments, charges for modification of previously granted stock options, reductions in uncertain tax positions, tax deductions becoming unavailable, costs to settle an insurance claim and recruiting fees. Accordingly, in addition to disclosing its operating results determined in accordance with GAAP, Park discloses non-GAAP measures, including Adjusted EBITDA, and operating results that exclude special items in order to assist its shareholders and other readers in assessing the Company’s operating performance, since the Company’s on-going, normal business operations do not include such special items. The detailed operating information presented below includes a reconciliation of the non-GAAP operating results before special items to earnings determined in accordance with GAAP and a reconciliation of GAAP pre-tax earnings to Adjusted EBITDA. Such non-GAAP financial measures are provided to supplement the results provided in accordance with GAAP.

Park Aerospace Corp. develops and manufactures solution and hot-melt advanced composite materials used to produce composite structures for the global aerospace markets. Park’s advanced composite materials include film adhesives (Aeroadhere®) and lightning strike protection materials (Electroglide®). Park offers an array of composite materials specifically designed for hand lay-up or automated fiber placement (AFP) manufacturing applications. Park’s advanced composite materials are used to produce primary and secondary structures for jet engines, large and regional transport aircraft, military aircraft, Unmanned Aerial Vehicles (UAVs commonly referred to as “drones”), business jets, general aviation aircraft and rotary wing aircraft. Park also offers specialty ablative materials for rocket motors and nozzles and specially designed materials for radome applications. As a complement to Park’s advanced composite materials offering, Park designs and fabricates composite parts, structures and assemblies and low volume tooling for the aerospace industry. Target markets for Park’s composite parts and structures (which include Park’s proprietary composite SigmaStrut™ and AlphaStrut™ product lines) are, among others, prototype and development aircraft, special mission aircraft, spares for legacy military and civilian aircraft and exotic spacecraft. Park’s objective is to do what others are either unwilling or unable to do. When nobody else wants to do it because it is too difficult, too small or too annoying, sign us up.

Additional corporate information is available on the Company’s website at www.parkaerospace.com

Performance table, including non-GAAP information (in thousands, except per share amounts –unaudited):

| |

|

13 Weeks Ended

|

|

|

13 Weeks Ended

|

|

|

14 Weeks Ended

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

June 2,

2024

|

|

|

May 28,

2023

|

|

|

March 3,

2024

|

|

|

Sales

|

|

$ |

13,970 |

|

|

$ |

15,551 |

|

|

$ |

16,333 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings before Special Items1

|

|

$ |

1,781 |

|

|

$ |

2,407 |

|

|

$ |

2,308 |

|

|

Special Items, Net of Tax:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Activist Shareholder Defense Costs

|

|

|

- |

|

|

|

(570 |

) |

|

|

- |

|

|

Stock Option Modification

|

|

|

- |

|

|

|

(109 |

) |

|

|

- |

|

|

Loss on Sale of Marketable Securities

|

|

|

- |

|

|

|

(65 |

) |

|

|

- |

|

|

Insurer Bankruptcy Cost

|

|

|

- |

|

|

|

- |

|

|

|

(70 |

) |

|

Recruiting Fees

|

|

|

- |

|

|

|

- |

|

|

|

(38 |

) |

|

Storm Damage Charge

|

|

|

(1,052 |

) |

|

|

- |

|

|

|

- |

|

|

Income Tax Effect on Pretax Special Items

|

|

|

264 |

|

|

|

191 |

|

|

|

37 |

|

|

Tax Impact of Cancelled Stock Options

|

|

|

- |

|

|

|

- |

|

|

|

(224 |

) |

|

Reduction in Uncertain Tax Positions

|

|

|

- |

|

|

|

- |

|

|

|

657 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings

|

|

$ |

993 |

|

|

$ |

1,854 |

|

|

$ |

2,670 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings per Share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings before Special Items1

|

|

$ |

0.09 |

|

|

$ |

0.12 |

|

|

$ |

0.11 |

|

|

Special Items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Activist Shareholder Defense Costs

|

|

|

- |

|

|

|

(0.03 |

) |

|

|

- |

|

|

Stock Option Modification

|

|

|

- |

|

|

|

(0.01 |

) |

|

|

- |

|

|

Loss on Sale of Marketable Securities

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Insurer Bankruptcy Cost

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Recruiting Fees

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Storm Damage Charge

|

|

|

(0.05 |

) |

|

|

- |

|

|

|

- |

|

|

Income Tax Effect on Pretax Special Items

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

- |

|

|

Tax Impact of Cancelled Stock Options

|

|

|

- |

|

|

|

- |

|

|

|

(0.01 |

) |

|

Reduction in Uncertain Tax Positions

|

|

|

- |

|

|

|

- |

|

|

|

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings per Share

|

|

$ |

0.05 |

|

|

$ |

0.09 |

|

|

$ |

0.13 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings before Special Items1

|

|

$ |

0.09 |

|

|

$ |

0.12 |

|

|

$ |

0.11 |

|

|

Special Items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Activist Shareholder Defense Costs

|

|

|

- |

|

|

|

(0.03 |

) |

|

|

- |

|

|

Stock Option Modification

|

|

|

- |

|

|

|

(0.01 |

) |

|

|

- |

|

|

Loss on Sale of Marketable Securities

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Insurer Bankruptcy Cost

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Recruiting Fees

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Storm Damage Charge

|

|

|

(0.05 |

) |

|

|

- |

|

|

|

- |

|

|

Income Tax Effect on Pretax Special Items

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

- |

|

|

Tax Impact of Cancelled Stock Options

|

|

|

- |

|

|

|

- |

|

|

|

(0.01 |

) |

|

Reduction in Uncertain Tax Positions

|

|

|

- |

|

|

|

- |

|

|

|

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per Share

|

|

$ |

0.05 |

|

|

$ |

0.09 |

|

|

$ |

0.13 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

20,253 |

|

|

|

20,461 |

|

|

|

20,253 |

|

|

Diluted

|

|

|

20,371 |

|

|

|

20,526 |

|

|

|

20,357 |

|

1 Refer to "Reconciliation of non-GAAP financial measures" below for information regarding Special Items.

Comparative balance sheets (in thousands):

| |

|

June 2,

2024

|

|

|

March 3,

2024

|

|

|

|

|

(unaudited)

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and Marketable Securities

|

|

$ |

74,418 |

|

|

$ |

77,211 |

|

|

Accounts Receivable, Net

|

|

|

11,386 |

|

|

|

12,381 |

|

|

Inventories

|

|

|

8,312 |

|

|

|

6,404 |

|

|

Prepaid Expenses and Other Current Assets

|

|

|

3,180 |

|

|

|

2,849 |

|

|

Total Current Assets

|

|

|

97,296 |

|

|

|

98,845 |

|

| |

|

|

|

|

|

|

|

|

|

Fixed Assets, Net

|

|

|

22,185 |

|

|

|

23,499 |

|

|

Operating Right-of-use Assets

|

|

|

81 |

|

|

|

95 |

|

|

Other Assets

|

|

|

9,866 |

|

|

|

9,870 |

|

|

Total Assets

|

|

$ |

129,428 |

|

|

$ |

132,309 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts Payable

|

|

$ |

2,201 |

|

|

$ |

3,514 |

|

|

Accrued Liabilities

|

|

|

1,513 |

|

|

|

1,986 |

|

|

Operating Lease Liability

|

|

|

17 |

|

|

|

53 |

|

|

Income Taxes Payable

|

|

|

4,206 |

|

|

|

4,105 |

|

|

Total Current Liabilities

|

|

|

7,937 |

|

|

|

9,658 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term Operating Lease Liability

|

|

|

107 |

|

|

|

82 |

|

|

Non-current Income Taxes Payable

|

|

|

5,259 |

|

|

|

5,259 |

|

|

Deferred Income Taxes

|

|

|

3,240 |

|

|

|

3,222 |

|

|

Other Liabilities

|

|

|

1,198 |

|

|

|

1,174 |

|

|

Total Liabilities

|

|

|

17,741 |

|

|

|

19,395 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ Equity

|

|

|

111,687 |

|

|

|

112,914 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders' Equity

|

|

$ |

129,428 |

|

|

$ |

132,309 |

|

| |

|

|

|

|

|

|

|

|

|

Additional information

|

|

|

|

|

|

|

|

|

|

Equity per Share

|

|

$ |

5.51 |

|

|

$ |

5.58 |

|

Comparative statements of operations (in thousands – unaudited):

| |

|

13 Weeks

Ended

|

|

|

13 Weeks

Ended

|

|

|

14 Weeks

Ended

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

June 2,

2024

|

|

|

May 28,

2023

|

|

|

March 3,

2024

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales

|

|

$ |

13,970 |

|

|

$ |

15,551 |

|

|

$ |

16,333 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Sales

|

|

|

9,871 |

|

|

|

10,718 |

|

|

|

11,880 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit

|

|

|

4,099 |

|

|

|

4,833 |

|

|

|

4,453 |

|

|

% of net sales

|

|

|

29.3 |

% |

|

|

31.1 |

% |

|

|

27.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, General & Administrative Expenses

|

|

|

2,017 |

|

|

|

2,615 |

|

|

|

1,882 |

|

|

% of net sales

|

|

|

14.4 |

% |

|

|

16.8 |

% |

|

|

11.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from Operations

|

|

|

2,082 |

|

|

|

2,218 |

|

|

|

2,571 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Storm Damage Charge

|

|

|

(1,052 |

) |

|

|

- |

|

|

|

- |

|

|

Interest and Other Income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Income

|

|

|

339 |

|

|

|

324 |

|

|

|

329 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from Operations before Income Taxes

|

|

|

1,369 |

|

|

|

2,542 |

|

|

|

2,900 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Provision

|

|

|

376 |

|

|

|

688 |

|

|

|

230 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings

|

|

$ |

993 |

|

|

$ |

1,854 |

|

|

$ |

2,670 |

|

|

% of net sales

|

|

|

7.1 |

% |

|

|

11.9 |

% |

|

|

16.3 |

% |

Reconciliation of non-GAAP financial measure (in thousands – unaudited):

Reconciliation of GAAP Net Earnings to Adjusted EBITDA

| |

|

13 Weeks

Ended

|

|

|

13 Weeks

Ended

|

|

|

14 Weeks

Ended

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

June 2, 2024

|

|

|

May 28,

2023

|

|

|

March 3,

2024

|

|

|

GAAP Net Earnings

|

|

$ |

993 |

|

|

$ |

1,854 |

|

|

$ |

2,670 |

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Provision

|

|

|

376 |

|

|

|

688 |

|

|

|

230 |

|

|

Interest Income

|

|

|

(339 |

) |

|

|

(324 |

) |

|

|

(329 |

) |

|

Depreciation

|

|

|

439 |

|

|

|

305 |

|

|

|

418 |

|

|

Stock Option Expense

|

|

|

89 |

|

|

|

109 |

|

|

|

104 |

|

|

Special Items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Activist Shareholder Defense Costs

|

|

|

- |

|

|

|

570 |

|

|

|

- |

|

|

Stock Option Modification Charge (a)

|

|

|

- |

|

|

|

109 |

|

|

|

- |

|

|

Insurer Bankruptcy Cost

|

|

|

- |

|

|

|

- |

|

|

|

70 |

|

|

Recruiting Fees

|

|

|

- |

|

|

|

- |

|

|

|

38 |

|

|

Storm Damage Charge

|

|

|

1,052 |

|

|

|

- |

|

|

|

- |

|

|

Adjusted EBITDA

|

|

$ |

2,610 |

|

|

$ |

3,311 |

|

|

$ |

3,201 |

|

|

(a)

|

pre-tax charge for the modification of previously granted stock options in connection with the special dividend in the 2024 fiscal year first quarter

|

v3.24.2

Document And Entity Information

|

Jul. 16, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

PARK AEROSPACE CORP.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 16, 2024

|

| Entity, Incorporation, State or Country Code |

NY

|

| Entity, File Number |

1-4415

|

| Entity, Tax Identification Number |

11-1734643

|

| Entity, Address, Address Line One |

1400 Old Country Road

|

| Entity, Address, City or Town |

Westbury

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

11590

|

| City Area Code |

631

|

| Local Phone Number |

465-3600

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

PKE

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000076267

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

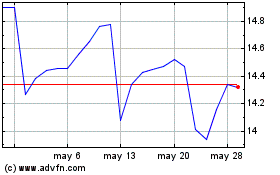

Park Aerospace (NYSE:PKE)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Park Aerospace (NYSE:PKE)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024