Renasant Corporation (NYSE: RNST) (“Renasant”) and The First

Bancshares, Inc. (“The First”) (NYSE: FBMS) jointly announced today

that they have entered into a definitive agreement and plan of

merger, pursuant to which The First will merge with and into

Renasant (the “Merger”) in an all-stock transaction valued at

approximately $1.2 billion, based on Renasant’s closing stock price

as of July 26, 2024. The Merger has been approved unanimously by

each company’s board of directors and is expected to close in the

first half of 2025. Completion of the transaction is subject to

customary closing conditions, including the receipt of required

regulatory approvals and the approval of Renasant and The First

shareholders.

Headquartered in Hattiesburg, Mississippi, The

First operates 111 branches across Mississippi, Louisiana, Alabama,

Florida and Georgia. As of June 30, 2024, The First had

approximately $8.0 billion in total assets, $5.3 billion in total

loans and $6.6 billion in total deposits. The Merger will create a

six-state Southeastern banking franchise with approximately $25

billion in total assets, $18 billion in total loans and $21 billion

in total deposits, based on financial data as of June 30, 2024.

“As two of the largest banks headquartered in

Mississippi, each with a footprint across the Southeast, both

Renasant and The First have grown to know and respect each other’s

operating philosophy, dedication to providing best-in-class

customer service and commitment to the communities in which we

operate,” said Renasant CEO, Mitch Waycaster. “As with Renasant,

The First has expanded into some of the most dynamic, fastest

growing markets in the Southeast. Together, we create a more

valuable company with the meaningful scale needed to compete in

today’s operating environment.”

Kevin Chapman, Renasant’s President, further

commenting on the transaction, added, “This merger will greatly

benefit our current and future customers by expanding our

locations, services and products. The First is a strong community

bank with employees who are deeply invested in the markets they

serve. We look forward to enhancing our ability to serve the needs

of our customers and communities through this merger.”

M. Ray “Hoppy” Cole, President and CEO of The

First, will become a Senior Executive Vice President and join both

the Renasant and Renasant Bank boards of directors. Three

additional independent directors of The First will be appointed to

both the Renasant and Renasant Bank boards of directors, and two

additional independent directors of The First will be appointed to

the Renasant Bank board of directors.

“At The First, we are proud of the team we have

assembled and the company we have built together. The First has

always operated with a community-first mindset, building strong,

trust-based relationships with our clients and the markets we

serve. Going forward, we are excited for our customers, bankers and

shareholders to experience our next chapter as we join Renasant and

form a leading Southeast regional bank with the scale and

capabilities of a larger bank while maintaining the community bank

touch our customers have come to expect. Because of our great

respect for the culture Renasant has established and the

like-minded manner in which they operate, we believe this merger

will create significant benefits for all stakeholders,” said

Cole.

According to the terms of the merger agreement,

shareholders of The First will receive 1.00 share of Renasant

common stock for each share of The First common stock.

Additionally, all options of The First will be cashed out at their

in-the-money value at closing. Based on Renasant’s closing stock

price of $37.09 per share as of July 26, 2024, the implied

transaction value is approximately $37.09 per The First share, or

$1.2 billion, in the aggregate. Excluding one-time transaction

costs, the merger is expected to be immediately accretive to

Renasant’s estimated earnings per share and to have a positive

long-term impact on Renasant’s key profitability and operating

ratios.

Stephens Inc. is serving as Renasant’s exclusive

financial advisor and rendered a fairness opinion to Renasant’s

board of directors, and Covington & Burling LLP is serving as

its legal advisor. Keefe, Bruyette & Woods, A Stifel Company,

is serving as exclusive financial advisor and rendered a fairness

opinion to The First’s board of directors, and Alston & Bird

LLP is serving as its legal advisor.

Community Benefit Plan

In connection with the announcement of the

Merger, Renasant announced its adoption of a Community Benefit

Plan. Under this plan, which is effective upon completion of the

Merger, Renasant is committed to an $10.3 billion, five-year plan

to foster economic growth, access to financial services and

inclusion in Renasant’s and The First’s combined footprint. More

information about Renasant’s Community Benefit Plan can be found at

www.renasant.com under the News & Market Data tab.

Information to Access Joint Conference

Call About the Merger:A live audio webcast and conference

call with analysts will be available beginning at 10:00 AM Eastern

Time (9:00 AM Central Time) on Tuesday, July 30, 2024.

The webcast is accessible at

https://event.choruscall.com/mediaframe/webcast.html?webcastid=trsUDhdF.

To access the conference call, dial 1-877-871-3172

in the United States and enter access code:

9874245 for the Renasant Corporation 2024 Investor

Conference Call. International participants should dial

1-412-902-6603 and enter the access code 9874245 to access the

conference call.

The webcast will be archived on www.renasant.com

after the call. A replay can be accessed via telephone by dialing

1-877-344-7529 in the United States and entering conference number

5191560 or by dialing 1-412-317-0088 internationally and entering

the same conference number.

ABOUT RENASANT CORPORATION:

Renasant Corporation is the parent of Renasant

Bank, a 120-year-old financial services institution. Renasant has

assets of approximately $17.5 billion and operates 185 banking,

lending, mortgage and wealth management offices in Mississippi,

Tennessee, Alabama, Florida, Georgia, North Carolina and South

Carolina. Additional information is available on Renasant’s

website: www.renasant.com.

ABOUT THE FIRST BANCSHARES, INC:

The First Bancshares, Inc., headquartered in

Hattiesburg, Mississippi, is the parent company of The First Bank.

Founded in 1996, the First has operations in Mississippi,

Louisiana, Alabama, Florida and Georgia. Additional information is

available on The First’s website: www.thefirstbank.com.

IMPORTANT ADDITIONAL

INFORMATION

In connection with the proposed transaction,

Renasant will file with the U.S. Securities and Exchange Commission

(the “SEC”) a registration statement on Form S-4 (the “registration

statement”), which will contain a joint proxy statement of Renasant

and The First and a prospectus of Renasant (the “joint proxy

statement/prospectus”), and each of Renasant and The First may file

with the SEC other relevant documents regarding the proposed

transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS

CAREFULLY AND IN THEIR ENTIRETY AND ANY OTHER RELEVANT DOCUMENTS

FILED WITH THE SEC BY RENASANT AND THE FIRST, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

RENASANT, THE FIRST AND THE PROPOSED TRANSACTION. When final, a

definitive copy of the joint proxy statement/prospectus will be

mailed to Renasant and The First shareholders. Investors and

security holders will be able to obtain the registration statement

and the joint proxy statement/prospectus, as well as other filings

containing information about Renasant and The First, free of charge

from Renasant or The First or from the SEC’s website when they are

filed. The documents filed by Renasant with the SEC may be obtained

free of charge at Renasant’s website, at www.renasant.com, by

requesting them by mail at Renasant Corporation, 209 Troy Street,

Tupelo, Mississippi 38804, Attention: Corporate Secretary. The

documents filed by The First with the SEC may be obtained free of

charge at The First’s website, at www.thefirstbank.com, or by

requesting them by mail at The First Bancshares, Inc., 6480 U.S.

Highway 98 West, Suite A, Hattiesburg, Mississippi 39402,

Attention: Corporate Secretary.

PARTICIPANTS IN THE

SOLICITATION

Renasant and The First and certain of their

respective directors and executive officers may be deemed to be

participants in the solicitation of proxies from the shareholders

of Renasant or The First in respect of the proposed transaction.

Information about Renasant’s directors and executive officers is

available in Renasant’s proxy statement dated March 13, 2024, for

its 2024 Annual Meeting of Shareholders, and other documents filed

by Renasant with the SEC. Information about The First’s directors

and executive officers is available in The First’s proxy statement

dated April 10, 2024, for its 2024 Annual Meeting of Shareholders,

and other documents filed by The First with the SEC. Other

information regarding the persons who may, under the rules of the

SEC, be deemed participants in the proxy solicitation and a

description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the joint proxy

statement/prospectus and other relevant materials to be filed with

the SEC regarding the proposed transaction when they become

available. Investors should read the joint proxy

statement/prospectus carefully when it becomes available before

making any voting or investment decisions. You may obtain free

copies of these documents from Renasant or The First as indicated

above.

NO OFFER OR SOLICITATION

This communication shall not constitute an offer

to sell or the solicitation of an offer to buy any securities or a

solicitation of any vote or approval with respect to the proposed

merger of Renasant and The First, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offering of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the U.S. Securities Act of 1933,

as amended.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

Statements included in this communication which

are not historical in nature or do not relate to current facts are

intended to be, and are hereby identified as, forward-looking

statements for purposes of the safe harbor provided by Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are based on, among other things, Renasant management’s

and The First management’s beliefs, assumptions, current

expectations, estimates and projections about the financial

services industry, the economy and Renasant and The First. Words

and phrases such as “may,” “approximately,” “continue,” “should,”

“expects,” “projects,” “anticipates,” “is likely,” “look ahead,”

“look forward,” “believes,” “will,” “intends,” “estimates,”

“strategy,” “plan,” “could,” “potential,” “possible” and variations

of such words and similar expressions are intended to identify such

forward-looking statements. These forward-looking statements may

include projections of, or guidance on, the Renasant’s or the

combined company’s future financial performance, asset quality,

liquidity, capital levels, expected levels of future expenses,

including future credit losses, anticipated growth strategies,

descriptions of new business initiatives and anticipated trends in

the Renasant’s business or financial results. Renasant and The

First caution readers that forward-looking statements are subject

to certain risks and uncertainties that are difficult to predict

with regard to, among other things, timing, extent, likelihood and

degree of occurrence, which could cause actual results to differ

materially from anticipated results. Such risks and uncertainties

include, among others, the following possibilities: the occurrence

of any event, change or other circumstances that could give rise to

the right of one or both of the parties to terminate the definitive

merger agreement entered into between Renasant and The First; the

outcome of any legal proceedings that may be instituted against

Renasant or The First; the failure to obtain necessary regulatory

approvals (and the risk that such approvals may result in the

imposition of conditions that could adversely affect the combined

company or the expected benefits of the business combination

transaction) and shareholder approvals or to satisfy any of the

other conditions to the business combination transaction on a

timely basis or at all; the possibility that the anticipated

benefits of the business combination transaction are not realized

when expected or at all, including as a result of the impact of, or

problems arising from, the integration of the two companies or as a

result of the strength of the economy and competitive factors in

the areas where Renasant and The First do business; the possibility

that the business combination transaction may be more expensive to

complete than anticipated; diversion of management’s attention from

ongoing business operations and opportunities; potential adverse

reactions or changes to business or employee relationships,

including those resulting from the announcement or completion of

the business combination transaction; changes in Renasant’s share

price before the closing of the business combination transaction;

risks relating to the potential dilutive effect of shares of

Renasant common stock to be issued in the business combination

transaction; and other factors that may affect future results of

Renasant, The First and the combined company. Additional factors

that could cause results to differ materially from those described

above can be found in Renasant’s Annual Report on Form 10-K for the

year ended December 31, 2023, The First’s Annual Report on Form

10-K for the year ended December 31, 2023, and in other documents

Renasant and The First file with the SEC, which are available on

the SEC’s website at www.sec.gov.

All forward-looking statements, expressed or

implied, included in this communication are expressly qualified in

their entirety by the cautionary statements contained or referred

to herein. If one or more events related to these or other risks or

uncertainties materialize, or if Renasant’s or The First’s

underlying assumptions prove to be incorrect, actual results may

differ materially from what Renasant and The First anticipate.

Renasant and The First caution readers not to place undue reliance

on any such forward-looking statements, which speak only as of the

date they are made and are based on information available at that

time. Neither Renasant nor The First assumes any obligation to

update or otherwise revise any forward-looking statements to

reflect circumstances or events that occur after the date the

forward-looking statements were made or to reflect the occurrence

of unanticipated events except as required by federal securities

laws.

|

Contacts: |

For Media: |

For Financials: |

| |

John S. Oxford |

James C. Mabry IV |

| |

Senior Vice President |

Executive Vice President |

| |

Chief

Marketing Officer |

Chief Financial Officer |

| |

(662) 680-1219 |

(662) 680-1281 |

| |

|

|

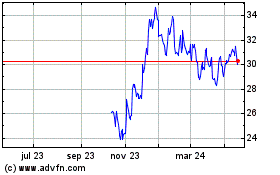

Renasant (NYSE:RNST)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

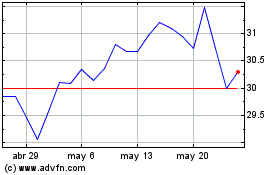

Renasant (NYSE:RNST)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025