RPT Realty (NYSE:RPT) (“RPT” or the “Company”)

announced today the release of its third annual Corporate

Sustainability Report. The report details RPT’s strategy and

performance in the areas of environmental, social and governance

(ESG) and demonstrates the Company’s commitment to be a disciplined

steward of ESG principles through transparent, consistent and

reliable reporting of our plans and ongoing progress. The report

can be found on the Corporate Responsibility page of the RPT

website.

“RPT’s investments in our people, properties and

processes have resulted in tangible progress towards our ESG goals,

as reflected in our third annual Corporate Sustainability report,”

said Brian Harper, President and CEO. “As the Company works towards

the successful closing of the proposed merger with Kimco Realty, we

are proud to pass on a solid ESG foundation to build upon, ensuring

a sustainable and prosperous future for the combined company’s

stakeholders.”

Environmental Highlights

- Reduced electricity consumption in

landlord-controlled areas by 19% in 2022, compared to 2018

- Diverted 24% of landlord-controlled

shopping center waste from landfills, compared to 2018

- Saved almost 19 million gallons of

water in 2022, compared to 2019, a reduction of nearly 25%

Social Highlights

- 99% of respondents to an employee

engagement survey care about the success of RPT and 95% are proud

of the work that they do

- 41% of new hires in 2022 were

racially diverse, increasing RPT’s racially diverse workforce by 5%

in 2022 to 24% of employees

- RPT employees contributed 832 hours

of hands-on volunteer time to 54 different organizations spanning

12 states, all within communities where we live and work

Governance

Highlights

- Directly linked the achievement of

specific ESG goals, such as the implementation of LED lighting,

smart irrigation, and waste management projects, to the bonus

portion of executive compensation

- Implemented an enhanced Crisis

Management Plan, Crisis Communication Plan and Emergency Response

Plan

- Conducted quarterly risk

assessments in connection with the Enterprise Risk Management

program with the goal of giving RPT a greater ability to manage and

prioritize risks

- Established the Data Governance

Council that aligns business strategy with data analytics and

establishes data management and quality control standards

Recognition Highlights

- 50/50 Women on Board Gender

Balanced Board Recognition

- GlobeSt. Real Estate Forum Best

Places to Work

- GlobeSt. Net Lease Influencer

- Green Star by GRESB for ESG

excellence

- Best & Brightest in

Wellness

- Top Workplaces Detroit Free

Press

- EV Charging Hero by Connect the

Watts

About RPT Realty

RPT Realty owns and operates a national

portfolio of open-air shopping destinations principally located in

top U.S. markets. The Company's shopping centers offer diverse,

locally-curated consumer experiences that reflect the lifestyles of

their surrounding communities and meet the modern expectations of

the Company's retail partners. The Company is a fully integrated

and self-administered REIT publicly traded on the New York Stock

Exchange (the “NYSE”). The common shares of the Company, par value

$0.01 per share are listed and traded on the NYSE under the ticker

symbol “RPT”. As of June 30, 2023, the Company's property

portfolio (the "aggregate portfolio") consisted of 43 wholly-owned

shopping centers, 13 shopping centers owned through its

grocery-anchored joint venture, and 49 retail properties owned

through its net lease joint venture, which together represent 14.9

million square feet of gross leasable area. As of June 30,

2023, the Company’s pro-rata share of the aggregate portfolio was

93.2% leased. For additional information about the Company please

visit rptrealty.com.

Company Contact:

Vin Chao, Managing Director - Finance19 W 44th

St. 10th Floor, Ste 1002New York, New York

10036vchao@rptrealty.com(212) 221-1752

Forward Looking Statements

This communication contains certain

“forward-looking” statements within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended. RPT

Realty (“RPT”) intends such forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995 and includes this statement for purposes of complying

with the safe harbor provisions. Forward-looking statements, which

are based on certain assumptions and describe RPT’s future plans,

strategies and expectations, are generally identifiable by use of

the words “believe,” “expect,” “intend,” “commit,” “anticipate,”

“estimate,” “project,” “will,” “target,” “plan”, “forecast” or

similar expressions. Forward-looking statements regarding Kimco

Realty Corporation (“Kimco”) and RPT, include, but are not limited

to, statements related to the anticipated acquisition of RPT by

Kimco and the anticipated timing and benefits thereof and other

statements that are not historical facts. These forward-looking

statements are based on each of the companies’ current plans,

objectives, estimates, expectations and intentions and inherently

involve significant risks and uncertainties. You should not rely on

forward-looking statements since they involve known and unknown

risks, uncertainties and other factors which, in some cases, are

beyond RPT’s and Kimco’s control and could materially affect actual

results, performances or achievements. Factors which may cause

actual results to differ materially from current expectations

include, but are not limited to, risks and uncertainties associated

with: RPT’s and Kimco’s ability to complete the proposed

transaction on the proposed terms or on the anticipated timeline,

or at all, including risks and uncertainties related to securing

the necessary RPT shareholder approval and satisfaction of other

closing conditions to consummate the proposed transaction; the

occurrence of any event, change or other circumstance that could

give rise to the termination of the definitive transaction

agreement relating to the proposed transaction; risks related to

diverting the attention of RPT and Kimco management from ongoing

business operations; failure to realize the expected benefits of

the proposed transaction; significant transaction costs and/or

unknown or inestimable liabilities; the risk of shareholder

litigation in connection with the proposed transaction, including

resulting expense or delay; the ability to successfully integrate

the operations of RPT and Kimco following the closing of the

transaction and the risk that such integration may be more

difficult, time-consuming or costly than expected; risks related to

future opportunities and plans for the combined company, including

the uncertainty of expected future financial performance and

results of the combined company following completion of the

proposed transaction; effects relating to the announcement of the

proposed transaction or any further announcements or the

consummation of the proposed transaction on the market price of

RPT’s common shares or Kimco’s common stock or on each company’s

respective relationships with tenants, employees and third-parties;

the ability to attract, retain and motivate key personnel; the

possibility that, if Kimco does not achieve the perceived benefits

of the proposed transaction as rapidly or to the extent anticipated

by financial analysts or investors, the market price of Kimco’s

common stock could decline; general adverse economic and local real

estate conditions; the impact of competition, including the

availability of suitable acquisition, disposition, development and

redevelopment opportunities; adverse changes in the financial

condition of joint venture partner(s) or major tenants, including

as a result of bankruptcy, insolvency or a general downturn in

their business; the potential impact of e-commerce and other

changes in consumer buying practices, and changing trends in the

retail industry and perceptions by retailers or shoppers, including

safety and convenience; disruptions and increases in operating

costs due to inflation and supply chain issues; risks associated

with the development of properties; changes in governmental laws

and regulations, including, but not limited to changes in data

privacy, environmental (including climate change), safety and

health laws; impairment charges; criminal cybersecurity attacks

disruption, data loss or other security incidents and breaches;

impact of natural disasters and weather and climate-related events;

pandemics or other health crises, such as COVID-19; financing

risks, such as the inability to obtain equity, debt or other

sources of financing or refinancing on favorable terms or at all;

the level and volatility of interest rates; changes in dividend

rates or the ability to pay dividends at current levels; RPT’s and

Kimco’s ability to continue to maintain their respective status as

a REIT for United States federal income tax purposes and potential

risks and uncertainties in connection with their respective UPREIT

structure; and the other risks and uncertainties affecting RPT and

Kimco, including those described from time to time under the

caption “Risk Factors” and elsewhere in RPT’s and Kimco’s

Securities and Exchange Commission (“SEC”) filings and reports,

including RPT’s Annual Report on Form 10-K for the year ended

December 31, 2022, Kimco’s Annual Report on Form 10-K for the year

ended December 31, 2022, and future filings and reports by either

company. Moreover, other risks and uncertainties of which RPT or

Kimco are not currently aware may also affect each of the

companies’ forward-looking statements and may cause actual results

and the timing of events to differ materially from those

anticipated. The forward-looking statements made in this

communication are made only as of the date hereof or as of the

dates indicated in the forward-looking statements, even if they are

subsequently made available by RPT or Kimco on their respective

websites or otherwise. Neither RPT nor Kimco undertakes any

obligation to update or supplement any forward-looking statements

to reflect actual results, new information, future events, changes

in its expectations or other circumstances that exist after the

date as of which the forward-looking statements were made.

Important Additional Information and

Where to Find It

In connection with the proposed transaction,

Kimco will file with the SEC a registration statement on Form S-4

to register the shares of Kimco common stock to be issued in

connection with the proposed transaction. The registration

statement will include a proxy statement/prospectus which will be

sent to the shareholders of RPT seeking their approval of their

respective transaction-related proposals. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4

AND THE RELATED PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT

DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED

MERGER, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT RPT, KIMCO AND THE PROPOSED

TRANSACTION.

Investors and security holders may obtain copies

of these documents free of charge through the website maintained by

the SEC at www.sec.gov or from RPT at its website,

www.rptrealty.com or from Kimco at its website,

www.kimcorealty.com. Documents filed with the SEC by RPT will be

available free of charge by accessing RPT’s website at

www.rptrealty.com under the heading Investors or, alternatively, by

directing a request to RPT at invest@rptrealty.com or 19 West 44th

Street, Suite 1002, New York, NY 10036, telephone: (212) 221-7139,

and documents filed with the SEC by Kimco will be available free of

charge by accessing Kimco’s website at kimcorealty.com under the

heading Investors or, alternatively, by directing a request to

Kimco at ir@kimcorealty.com or 500 North Broadway, Suite 201,

Jericho, NY 11753, telephone: (516) 869-9000.

Participants in the

Solicitation

RPT and Kimco and certain of their respective

trustees, directors and executive officers and other members of

management and employees may be deemed to be participants in the

solicitation of proxies from the shareholders of RPT in respect of

the proposed transaction under the rules of the SEC. Information

about RPT’s trustees and executive officers is available in RPT’s

proxy statement dated March 16, 2023 for its 2023 Annual Meeting of

Shareholders. Information about Kimco’s directors and executive

officers is available in Kimco’s proxy statement dated March 15,

2023 for its 2023 Annual Meeting of Stockholders. Other information

regarding the participants in the proxy solicitation and a

description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the proxy

statement/prospectus and other relevant materials to be filed with

the SEC regarding the proposed transaction when they become

available. Investors should read the proxy statement/prospectus

carefully when it becomes available before making any voting or

investment decisions. You may obtain free copies of these documents

from RPT or Kimco using the sources indicated above.

No Offer or Solicitation

This communication shall not constitute an offer

to sell or the solicitation of an offer to buy any securities, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act.

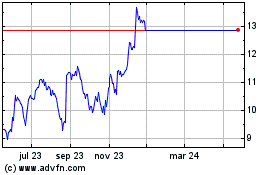

Rithm Property (NYSE:RPT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Rithm Property (NYSE:RPT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024