Charles Schwab today released additional findings from its 2024

Modern Wealth Survey. Since 2017, Schwab has collected data

annually on Americans’ perspectives on saving, spending, investing,

and wealth. This year’s study reveals that Americans now think it

takes an average of $2.5 million to be considered wealthy – which

is up slightly from 2023 and 2022 ($2.2 million).

By generation, Boomers have the highest threshold of what it

takes to be considered wealthy, at $2.8 million, while the younger

generations, Millennials and Gen Z, have lower thresholds of what

is considered wealthy. At the same time, Americans say that the

average net worth required to be financially comfortable is

$778,000. The average net worth required for financial comfort

reached a peak last year at $1 million, but this year, Americans’

estimations are more in line with 2022 ($775,000) and show an

upward trend when compared with 2021 ($624,000).

Average net worth it takes to be

“wealthy”

Average net worth it takes to be

“financially comfortable”

All Americans

$2.5 million

$778,000

Boomers

$2.8 million

$780,000

Gen X

$2.7 million

$873,000

Millennials

$2.2 million

$725,000

Gen Z

$1.2 million

$406,000

When it comes to geographic region, Californians have the

highest threshold of what it takes to be wealthy, with San

Franciscans saying it takes $4.4 million and Southern Californians

indicating it takes an average net worth of $3.4 million. Survey

respondents who live in Atlanta, Chicago, Houston, Phoenix, and

Dallas express a lower threshold of what it takes to be wealthy

when compared with the national average.

Average net worth it takes to be

“wealthy”

Average net worth it takes to be

“financially comfortable”

San Francisco

$4.4 million

$1.5 million

Southern California

$3.4 million

$1.2 million

New York

$2.9 million

$994,000

Washington, D.C.

$2.8 million

$968,000

Denver

$2.8 million

$876,000

Seattle

$2.8 million

$789,000

Boston

$2.7 million

$903,000

Atlanta

$2.4 million

$781,000

Chicago

$2.3 million

$813,000

Houston

$2.3 million

$662,000

Phoenix

$2.3 million

$650,000

Dallas

$2.2 million

$724,000

When asked if they think they will be wealthy within their

lifetimes, 21% of Americans say they are on track to be wealthy.

Younger Americans, including Millennials and Gen Z, are the most

optimistic about being wealthy in their lifetimes (29%).

Though they’re optimistic about their future wealth, respondents

acknowledge that there’s more they can do, with fewer than one in

five Americans (18%) saying that they are currently on top of their

finances. Nearly one-third (32%) feel they are on track to being

more on top of their finances and another one-third (34%) feel they

need to make changes to feel more in control.

I’m wealthy now

I’m on track to be wealthy

I’m on top of my finances now

I’m on track to be on top of my

finances

All Americans

10%

21%

18%

32%

Boomers

8%

13%

26%

24%

Gen X

9%

18%

16%

29%

Millennials

12%

28%

14%

40%

Gen Z

10%

29%

17%

36%

Americans generally give themselves passing grades when it comes

to their personal finances, including how much they have saved, how

much they have invested, and how prepared they will be for

retirement. Notably, the grades are higher among those who have a

financial plan in place.

How Americans grade themselves

when it comes to their personal finances

All Americans

Those with a financial plan

A/B/C

D/F

A/B/C

D/F

How much I have saved

63%

37%

86%

14%

How much I have invested

67%

34%

86%

14%

How much I educate myself about

personal finance

78%

22%

92%

8%

How prepared I will be for

retirement

67%

33%

88%

12%

“‘Wealth’ means different things to different people, whether

it’s financial freedom, enriching experiences with friends and

family, or a certain dollar amount,” said Rob Williams, CFP®,

managing director of financial planning at Charles Schwab. “Our

survey reinforces that people with a written financial plan are

more confident about achieving their personal financial goals.

Financial planning helps people understand where they are today and

create a roadmap to get where they want to be, whether someone is

saving for a single goal, like retirement, or needs comprehensive

planning and wealth management.”

About the Modern Wealth Survey

The online survey was conducted by Logica Research from March 4,

2024, to March 18, 2024, among a national sample of 1,000 Americans

aged 21 to 75. An additional 200 Generation Z Americans completed

the study. Quotas were set to balance the national sample on key

demographic variables. Detailed results can be found here.

Disclosures

The information here is for general informational purposes only

and should not be considered an individualized recommendation or

personalized investment advice. The investment strategies mentioned

here may not be suitable for everyone. Each investor needs to

review an investment strategy for his or her own particular

situation before making any investment decision.

All expressions of opinion are subject to change without notice

in reaction to shifting market, economic or geopolitical

conditions.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at https://www.aboutschwab.com.

Follow us on Twitter, Facebook, YouTube and LinkedIn.

Investment and Insurance Products: Not a Deposit • Not FDIC

Insured • Not Insured by any Federal Government Agency • No Bank

Guarantee • May Lose Value

0824-LKA8

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240821310728/en/

Meredith Richard Charles Schwab 646-343-7419

Meredith.Richard@schwab.com

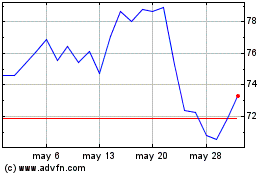

Charles Schwab (NYSE:SCHW)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Charles Schwab (NYSE:SCHW)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024