Founding Partners of Sculptor Capital File Complaint in Delaware Seeking Injunctive Relief

17 Octubre 2023 - 2:04PM

Business Wire

The Founding Partners of Sculptor Capital Management, Inc.

(“Sculptor” or the “Company”) (NYSE: SCU), which include Daniel S.

Och, Harold Kelly, Richard Lyon, James O’Connor and Zoltan Varga,

today filed a complaint against the Company, its directors

(including the members of the Special Committee) and Rithm Capital

Corp ("Rithm”) in the Delaware Court of Chancery. The lawsuit seeks

to stop the defendants from continuing to breach their fiduciary

duties to the shareholders in connection with a proposed merger

transaction between the Company and Rithm (the “Merger”).

Specifically, to protect the shareholders’ interests, the Founding

Partners have asked the Court to enjoin:

- Rithm and the Company from consummating the

Merger until the Boaz Weinstein Consortium (the “Consortium”) is

able to bid for the Company without restriction from the standstill

obligations imposed on them by the Board and Special Committee;

- The Company, Board and Special Committee

from enforcing the standstill restrictions described above against

the Consortium, including but not limited to provisions that have

limited the Consortium's ability to communicate with stockholders

and/or other potential bidders; and

- Rithm from voting new shares of Sculptor

stock acquired from Delaware Life Insurance in a side deal

facilitated by the Special Committee to influence the vote on the

Merger.

The lawsuit also seeks to reinstate the provision of the Merger

Agreement requiring the approval of a majority of independent

stockholders to effectuate the Merger and to reduce the break-up

fee to the substantially lesser amount to which Rithm and the

Company had previously agreed.

The Founding Partners said:

“The Special Committee’s actions over the past several weeks

remove any doubt that they favor only one result – the preservation

of management’s jobs and compensation, at the expense of

shareholder value. Since the initial announcement of the Rithm

transaction at $11.15 per share, the Company’s stock has been

trading well above $12 per share, reflecting stockholders’

expectations that the Special Committee would act to maximize value

given the higher $13 per share offer from the Consortium. Despite

these fundamental facts, the Special Committee has agreed to an

amended deal with Rithm at only $12 per share. Worse yet, the

Special Committee has imposed a series of extraordinary conditions

designed to tilt the playing field against the Consortium or any

other bidder and undermine stockholders’ ability to vote down the

Rithm deal.

The Sculptor Board continues to prevent the Consortium from

communicating directly with the public stockholders or the

Company’s clients, and from negotiating with the Founders. In

contrast, the Special Committee has readily waived Rithm’s NDA to

permit it to negotiate with the Founders and to purchase 6.5% of

the vote from Delaware Life. Working together, the Special

Committee and Rithm are pushing forward an inferior deal that

protects Sculptor management at the expense of the public

stockholders. In light of what we and others believe to be a

flagrant breach of fiduciary duty, we have brought this action in

an effort to force the Company and its directors to maximize

shareholder value.”

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231017782562/en/

Media: Dan Gagnier dg@gagnierfc.com 646-569-5897

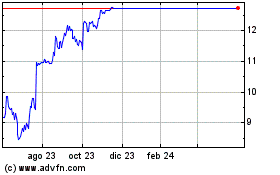

Sculptor Capital Managem... (NYSE:SCU)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Sculptor Capital Managem... (NYSE:SCU)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025