Proxy Statement (definitive) (def 14a)

17 Abril 2023 - 2:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant

to Section 14(a)

of the Securities Exchange

Act of 1934 (Amendment No. )

| Filed by the Registrant x |

Filed by a Party other than the Registrant ¨ |

Check the appropriate box:

| ¨ | Preliminary

Proxy Statement |

| ¨ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive

Proxy Statement |

| ¨ | Definitive

Additional Materials |

| ¨ | Soliciting

Material Pursuant to §240.14a-12 |

Source

Capital, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee

paid previously with preliminary materials. |

| ¨ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and

0-11 |

SOURCE CAPITAL, INC.

April 17, 2023

Dear Shareholder:

We are writing to inform you of a Special Meeting of Shareholders (the "Meeting") of Source Capital, Inc. (the "Company") scheduled to be held at 10:00 a.m. Pacific Time on June 1, 2023, at the offices of First Pacific Advisors, LP, 11601 Wilshire Boulevard, Suite 1200, Los Angeles, California 90025. A Notice of Meeting of Shareholders, Proxy Statement regarding the Meeting, Proxy Card for your vote, and postage-paid envelope in which to return your Proxy Card are enclosed.

As a shareholder of the Company, you are being asked to vote on (1) the election of five (5) Director nominees (the "Nominees"), of which three currently serve as Directors of the Company, (2) the approval and adoption of the Agreement and Plan of Merger (as amended from time to time, the "Merger Agreement") by and between Company and its wholly-owned subsidiary Source Sub, Inc., pursuant to which such subsidiary will merge with and into the Company (the "Merger") and (3) the approval of an adjournment of the Meeting to a later date or dates if necessary or appropriate, including adjournments to solicit additional proxies if there are insufficient votes at the time of the Meeting to adopt the Merger Agreement. The Company's Board of Directors (the "Board") has reviewed the qualifications and backgrounds of each of the Nominees and believes that they are experienced in overseeing an investment company, are familiar with the Company and its investment adviser and that their election is in the Company's best interests. The Company will be the surviving corporation in the Merger, the sole purpose of which is to effect an amendment to the certificate of incorporation of the Company to delete a provision requiring approval of holders of two-thirds of the outstanding shares of Common Stock in order for the Company to take certain actions. The Board unanimously recommends that you vote "FOR" the election of each Nominee to the Board, "FOR" the approval and adoption of the Merger Agreement and "FOR" the approval of the adjournment of the Meeting. The proposals are discussed in more detail in the Proxy Statement, which you should read carefully.

Please exercise your right to vote by completing, dating, and signing the enclosed Proxy Card or voting by telephone or Internet as described herein. A self-addressed, postage-paid envelope has been enclosed for your convenience.

If you have questions, please do not hesitate to email the Company at crm@fpa.com.

Thank you for taking the time to consider these important proposals and for your continuing investment in the Company.

Respectfully,

REBECCA D. GILDING

Secretary

(This page has been left blank intentionally.)

SOURCE CAPITAL, INC.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

June 1, 2023

To the Shareholders of Source Capital, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the "Meeting") of Source Capital, Inc. (the "Company") will be held at 10:00 a.m. Pacific Time on June 1, 2023, at the offices of First Pacific Advisors, LP, 11601 Wilshire Boulevard, Suite 1200, Los Angeles, California 90025 for the following purposes:

1. To elect five (5) Director nominees (the "Nominees") to the Board of Directors of the Company (the "Board");

2. To approve and adopt the Agreement and Plan of Merger (as amended from time to time, the "Merger Agreement") by and between Company and its wholly-owned subsidiary Source Sub, Inc., pursuant to which such subsidiary will merge with and into the Company;

3. To approve an adjournment of the Meeting to a later date or dates if necessary or appropriate, including adjournments to solicit additional proxies if there are insufficient votes at the time of the Meeting to adopt the Merger Agreement; and

4. To transact such other business as may properly come before the Meeting, or any adjournment(s) or postponements(s) thereof.

The Board has fixed the close of business on April 4, 2023 as the record date for the determination of Shareholders entitled to notice of and to vote at the Meeting or any adjournment(s) thereof.

You are cordially invited to attend the Meeting. Shareholders who do not expect to attend the Meeting are requested to vote by telephone, by Internet, or by completing, dating, and signing the enclosed Proxy Card and returning it promptly in the envelope provided for that purpose. You may nevertheless vote at the Meeting if you choose to attend. The enclosed proxy is being solicited by the Board.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING ON JUNE 1, 2023: This Notice, the Proxy Statement and the Proxy Card are available on the Internet free of charge at https://vote.proxyonline.com/fps/docs/sourcecapital2023.pdf.

By order of the Board,

REBECCA D. GILDING

Secretary

(This page has been left blank intentionally.)

SOURCE CAPITAL, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 1, 2023

Introduction

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the "Board," and each member of the Board, a "Director") of Source Capital, Inc. (the "Company") for voting at the Annual Meeting of Shareholders (the "Meeting") of the Company to be held at 10:00 a.m. (Pacific time) on June 1, 2023, at the offices of First Pacific Advisors, LP ("FPA" or the "Adviser"), 11601 Wilshire Boulevard, Suite 1200, Los Angeles, California 90025, and at any and all adjournments thereof. The Meeting will be held for the purposes set forth in the accompanying Notice of Meeting of Shareholders. This Proxy Statement and the accompanying materials are being mailed by the Board on or about April 17, 2023.

At the Meeting, shareholders of the Company will be asked to vote on (1) the proposal to elect five (5) nominees (the "Nominees") to the Board (the "Proposal 1"), (2) the proposal to approve and adopt the Agreement and Plan of Merger (as amended from time to time, the "Merger Agreement") by and between Company and its wholly-owned subsidiary Source Sub, Inc., pursuant to which such subsidiary will merge with and into the Company ("Proposal 2") and (3) the proposal to approve an adjournment of the Meeting to a later date or dates if necessary or appropriate, including adjournments to solicit additional proxies if there are insufficient votes at the time of the Meeting to adopt the Merger Agreement ("Proposal 3" and, collectively, the "Proposals"). The Board knows of no business, other than that specifically mentioned in the Notice, which will be presented for consideration at the Meeting. If other business should properly come before the Meeting, the proxy holders will vote thereon in accordance with their best judgment.

Voting Information

Record Date; Shareholders Entitled to Vote; Cumulative Voting Rights of Director Elections

The Board has fixed the close of business on April 4, 2023 as the record date (the "Record Date") for the determination of shareholders of the Company entitled to notice of and to vote at the Meeting and at any adjournment(s) and postponement(s) thereof. Shareholders of the Company are entitled to one vote for each full share held and a proportionate fractional vote for each fractional share held on the Record Date. On the Record Date, there were 8,279,030 shares of Common Stock of the Company outstanding.

With respect to Proposal 1, each shareholder with voting power at the Meeting shall be entitled to cast a number of votes equal to the number of shares owned multiplied by the number of Directors to be elected, and each shareholder may cast the whole number of votes for one Nominee or distribute such votes among Nominees as such shareholder chooses. Unless otherwise instructed, the proxy holders intend to vote proxies received by them for the five Nominees named in this Proxy Statement, reserving the right, however, to cumulate such votes and distribute them among Nominees at the discretion of the proxy holders.

Solicitation of Proxies

This solicitation of proxies is being made by and on behalf of the Board, and the cost of preparing, printing, and mailing this Proxy Statement, the Notice and the accompanying Proxy Card and all other costs incurred in connection with this solicitation of proxies, including any additional solicitation made by mail, telephone, e-mail, virtual means or in person, will be paid by the Company. AST Fund Solutions, LLC has been retained for proxy solicitation services, including print, mail, and tabulation services, as well as the facilitation of mail, telephone, and internet voting, at an anticipated cost of $94,000 which will be borne by the Company. The Company will reimburse banks, brokers, and other persons holding the Company's shares registered in their names or in the names of their nominees for their expenses incurred in sending proxy materials to and obtaining proxies from the beneficial owners of such shares.

Revocation of Proxies

Any shareholder giving a proxy has the power to revoke it by executing a superseding proxy by phone, Internet or mail following the process described on the Proxy Card or by submitting a notice of revocation to the Company before the Meeting or by voting in person at the Meeting. A proxy purporting to be executed by or on behalf of a shareholder shall be deemed valid unless challenged at or prior to its exercise, with the burden of proving invalidity resting on the challenger.

1

Quorum; Required Vote on Proposals 1 and 2

A quorum of shareholders is required to take action at this Meeting of Shareholders. A quorum is present to transact business if the holders of a majority of the outstanding shares of the Company entitled to vote on the Proposals are present in person or by proxy. The shares represented by a proxy that is properly executed and returned will be considered to be present at the Meeting.

For Proposal 1, the election of each Nominee to the Board requires the affirmative vote of the holders of a majority of the votes represented by the Company's shares present in person or represented by proxy at the Meeting and entitled to vote on Proposal 1. Unless otherwise instructed, the proxy holders intend to vote the proxies received by them for the Nominees and reserve the right to cumulate such votes and distribute them among Nominees at the discretion of the proxy holders.

For Proposal 2, the approval and adoption of the Merger Agreement requires the affirmative vote of the holders of a majority of the Company's outstanding shares entitled to vote at the Meeting. Unless otherwise instructed, the proxy holders intend to vote the proxies received by them for the approval and adoption of the Merger Agreement. Any failure to return a proxy will have the same effect as a vote against Proposal 2.

All properly executed proxies received in time for the Meeting will be treated as present for quorum purposes and will be voted as specified in the proxy or, if no specification is made, for the Proposals as described in this Proxy Statement.

In determining whether shareholders, present in person or represented by proxy at the Meeting, have approved the Proposals, abstentions, and broker non-votes, if any, will be treated as shares present at the Meeting for establishing a quorum. Based on the Company's interpretation of Delaware law, abstentions on a proposal will have the same effect as a vote against the Proposals. Under the rules of the New York Stock Exchange ("NYSE"), brokers who hold shares in street name for customers have the authority to vote on Proposal 1 only if they have not received instructions from beneficial owners. Broker non-votes, if any, will have no effect on Proposal 1. Broker non-votes will count as a vote "against" Proposal 2 because approval requires an absolute percentage of affirmative votes.

Adjournment

If a quorum is not present at the Meeting or if a quorum is present at the Meeting but sufficient votes in favor of the Proposals are not received, the Meeting may be adjourned to permit further solicitation of proxies. The affirmative vote of a majority of the outstanding shares of the Company represented in person or by proxy at the Meeting and entitled to vote thereon will be sufficient for an adjournment without notice other than announcement at the Meeting, until a quorum shall be present or represented. An abstention will have the same effect as a vote against Proposal 3; a broker non-vote will have no effect on Proposal 3. An adjournment may be held within 30 days after the date set for the Meeting without the necessity of further notice other than announcement at the Meeting of the date, time, and place of the reconvened Meeting. Any business that might have been transacted at the Meeting may be transacted at any such adjourned session(s) at which a quorum is present.

IMPORTANT INFORMATION

The Proxy Statement discusses important matters affecting the Company. Please take the time to read the Proxy Statement, and then cast your vote.

You may obtain additional copies of the Notice of Meeting, Proxy Statement and Proxy Card by accessing https://vote.proxyonline.com/fps/docs/sourcecapital2023.pdf. There are multiple ways to vote. Choose the method that is most convenient for you. To vote by telephone or Internet, follow the instructions provided on the proxy card. To vote by mail, simply fill out the Proxy Card and return it in the enclosed postage-paid reply envelope. You do not need to return your Proxy Card if you vote by telephone or Internet. To vote at the Meeting, attend the Meeting and cast your vote. The Meeting will be held at the offices of First Pacific Advisors, LP, 11601 Wilshire Boulevard, Suite 1200, Los Angeles, California 90025.

The following documents containing additional information about the Company, each having been filed with the Securities and Exchange Commission (the "SEC"), are incorporated by reference into (legally form a part of) this Proxy Statement:

• The Annual Report to shareholders for the fiscal year ended December 31, 2022, as filed with the SEC on March 10, 2023 (Accession No. 0001104659-23-030702); and

• The Semi-Annual Report to shareholders for the period ended June 30, 2022, as filed with the SEC on September 7, 2022 (Accession No. 0001104659-22-098169).

The Company will furnish, without charge, copies of its most recent Annual Report and Semi-Annual Report succeeding such annual report, if any, to any shareholder requesting such a report. Requests for an Annual or Semi-Annual Report should be made in writing to First Pacific Advisors, LP, 11601 Wilshire Boulevard, Suite 1200, Los Angeles, California 90025, by accessing the Company's website at www.fpa.com or by calling (800) 982-4372 ext. 5419. To avoid sending duplicate copies of materials to households, please note that only one Annual or Semi-Annual report or Proxy Statement, as applicable, may be delivered to two or more shareholders of the Company who share an address, unless the Company has received instructions to the contrary.

2

PROPOSAL 1 — ELECTION OF THE BOARD

Background

Currently, the Board of the Company is comprised of the following individuals: Sandra Brown, Robert F. Goldrich, Mark L. Lipson, Alfred E. Osborne, and J. Richard Atwood. Each of the existing Directors, with the exception of J. Richard Atwood, are not "interested person(s)" as that term is defined in the 1940 Act (the "Independent Directors"). At a duly constituted meeting of the Board held on March 29, 2023 (the "March Meeting"), the Board determined to nominate the following Directors of the Company for election by shareholders at the Meeting: Sandra Brown, Robert F. Goldrich, and J. Richard Atwood. Mr. Lipson and Mr. Osborne have indicated their intention to retire from the Board in 2023. Each current Director will hold office until his or her successor is duly elected and qualified, and each Nominee, if elected, will hold office until his or her successor are duly elected and qualified. In light of these departures, and at the suggestion of the Adviser, at the March Meeting the Board's Nominating and Governance Committee recommended the nomination of John P. Zader as an Independent Director and the nomination of Maureen Quill as an Interested Director of the Company and recommended that shareholders elect Mr. Zader and Ms. Quill as Directors of the Company at the Meeting. Mr. Zader and Ms. Quill do not currently serve as a Director of the Company. All of the Nominees have consented to serving as Directors of the Company if elected. If any Nominee is unable to serve due to an event not now anticipated, the persons named as proxies will vote for such other nominee as may be proposed by the Nominating and Governance Committee of the Board. Each Nominee, if elected, will hold office until their successors are duly elected and qualified. Sandra Brown, Robert F. Goldrich, J. Richard Atwood, John Zader and Maureen Quill are each referred to herein as a "Nominee" and collectively, as the "Nominees."

Nominee Information

The Company's Board is comprised of individuals with considerable and varied business experiences, backgrounds, skills, and qualifications who collectively have a strong knowledge of business and financial matters and are committed to helping the Company achieve its investment objective while acting in the best interests of the Company's shareholders. As noted in the table below, the Nominees bring a variety of experiences and qualifications through their business backgrounds in the fields of consulting and strategic planning, corporate management, education, and investment management. The Board believes that each particular Nominee's financial and business experience give him or her the qualifications and skills to serve as a Director.

Information about the Directors and Nominees, including their business addresses, year of birth and principal occupations during the past five years, and other current directorships, are set forth in the table below. A Nominee is deemed to be "independent" to the extent the individual is not an "interested person" of the Company, as that term is defined in Section 2(a)(19) of the 1940 Act.

Name, Address,

Year of Birth and

Position(s) Held With

Company |

|

Year First

Elected/

Appointed as

Director

of the

Company |

|

Principal Occupation During the

Past Five Years and Other Affiliations(3) |

|

Number of

FPA Funds(4)

Boards on

Which

Director or

Nominee

Serves |

|

Other

Directorships

Held by

Director or

Nominee |

|

|

Independent Director Nominees: |

|

Mark L. Lipson*, 1949

Director & Chairperson |

|

|

2015 |

|

|

Managing Member, ML2 Advisors, LLC (since 2014). Formerly Managing Director, Bessemer Trust (2007-2014) and US Trust (2003-2006); Chairman and CEO of the Northstar Mutual Funds (1993-2001); and President and CEO of the National Mutual Funds (1988-1993).

Director/Trustee of each FPA Fund (Bragg Capital Trust since 2020). |

|

|

7 |

|

|

None |

|

Alfred E. Osborne*, Jr., 1944

Director |

|

|

2013 |

|

|

Formerly UCLA professor, retired effective July 2022. Dr. Osborne served at UCLA's John E. Anderson School of Management in several capacities for 50 years. He was formerly Senior Associate Dean, (July 2003-June 2022), Interim Dean (July 2018-June 2019), Professor (July 1972-June 2022) and Faculty Director, Price Center for Entrepreneurship and Innovation (July 1984-June 2022).

Director/Trustee of each FPA Fund (Bragg Capital Trust since 2020). |

|

|

7 |

|

|

Kaiser Aluminum, Wedbush Capital and Waverley Capital Acquisition Corporation |

|

3

Name, Address,

Year of Birth and

Position(s) Held With

Company |

|

Year First

Elected/

Appointed as

Director

of the

Company |

|

Principal Occupation During the

Past Five Years and Other Affiliations(3) |

|

Number of

FPA Funds(4)

Boards on

Which

Director or

Nominee

Serves |

|

Other

Directorships

Held by

Director or

Nominee |

|

|

Independent Director Nominees: |

|

Sandra Brown(1) 1955

Director |

|

|

2016 |

|

|

Consultant (since 2009). Formerly, CEO and President of Transamerica Financial Advisers, Inc. (1999-2009); President, Transamerica Securities Sales Corp. (1998-2009); Vice President, Bank of America Mutual Fund Administration (1990-1998);

Director/Trustee of each FPA Fund (Bragg Capital Trust since 2020). |

|

|

7 |

|

|

None |

|

Robert F. Goldrich(1) 1962

Director |

|

|

2022 |

|

|

Senior Vice President for Strategic Initiatives of CMW Strategies LLC (since 2022). Former President/CFO of the Leon Levy Foundation (2015-2022).

Director/Trustee of each FPA Fund (since 2022). |

|

|

7 |

|

|

Uluru, Inc (2015-2017) |

|

John P. Zader(2) 1961

Director |

|

|

2023 |

|

|

Retired (June 2014-present); formerly, CEO, UMB Fund Services, Inc., a mutual fund and hedge fund service provider, and the transfer agent, fund accountant, and co-administrator for the Fund(s) (December 2006-June 2014); President, Investment Managers Series Trust (December 2007-June 2014). |

|

|

7(7) |

|

|

Investment Managers Series Trust II (since 2013) and Investment Managers Series Trust (2007-2022) |

|

|

Interested Director Nominees: |

|

J. Richard Atwood(1,5) 1960

Director |

|

|

2016 |

|

|

Director and President of FPA GP, Inc., the General Partner of the Adviser (since 2018); Director/Trustee of each FPA Fund (Bragg Capital Trust since 2020); President of each FPA Fund (Bragg Capital Trust since 2020); formerly, Managing Partner of FPA (2006-2018). |

|

|

7 |

|

|

None |

|

Maureen Quill(2,6) 1963

Director |

|

|

2023 |

|

|

President, Investment Managers Series Trust (since June 2014); EVP/Executive Director Registered Funds (January 2018-present), Chief Operating Officer (June 2014-January 2018), and Executive Vice President (January 2007-June 2014), UMB Fund Services, Inc.; President, UMB Distribution Services (March 2013-December 2020); Vice President, Investment Managers Series Trust (December 2013-June 2014). |

|

|

7(7) |

|

|

Investment Managers Series Trust (since 2019) |

|

* Mr. Lipson and Mr. Osborne will retire immediately after the Meeting.

(1) The address for each Director, other than Mr. Zader and Ms. Quill, is 11601 Wilshire Boulevard, Suite 1200, Los Angeles, California 90025.

(2) The address for Mr. Zader and Ms. Quill is 235 West Galena Street, Milwaukee, Wisconsin 53212.

(3) "Principal Occupation" includes all positions held with affiliates of the Company during the past five years.

(4) FPA New Income, Inc., FPA U.S. Core Equity Fund, Inc., FPA Funds Trust, on behalf of its series FPA Crescent Fund and FPA Flexible Fixed Income Fund, Bragg Capital Trust on behalf of its series FPA Queens Road Value Fund and FPA Queens Road Small Cap Value Fund, and the Company (each, an "FPA Fund").

(5) Mr. Atwood is an "interested person" within the meaning of the 1940 Act by virtue of his affiliation with FPA.

(6) Ms. Quill is an "interested person" within the meaning of the 1940 Act by virtue of her affiliation with UMB Fund Services, Inc.

(7) Mr. Zader and Ms. Quill have also been selected to serve as Directors/Trustees of FPA Funds Trust, Bragg Capital Trust, FPA New Income, Inc. and FPA U.S. Core Equity Fund, Inc. following the approval by shareholders of each respective fund.

The Board and Its Leadership Structure. The Board has general oversight responsibility with respect to the Company's business and affairs. Although the Board has delegated day-to-day management to the Adviser, all Company operations are overseen by the Company's Board, which meets at least quarterly. The Board is currently composed of five directors, four of whom are Independent Directors: Sandra Brown, Robert F. Goldrich, Mark L. Lipson, Alfred E. Osborne, and J. Richard Atwood (Interested Director). If the Nominees in Proposal 1 are elected, the number of Independent Directors will change from four to three out of five Directors. The Board holds executive sessions (with and without partners and/or employees of the Adviser) in connection with its regularly scheduled Board meetings. The Audit Committee and the Nominating and Governance Committee of the Board meets quarterly at regularly scheduled meetings. The Independent Directors have retained "independent legal counsel," as that term is defined in the rules under the 1940 Act.

4

The Board has appointed Mark L. Lipson to serve in the role of Chairman. The Chairman presides at all meetings of the Board and works with the President to set the agenda for meetings. The Chairman's responsibilities include presiding at all meetings of the Board, working with the President to set the agenda for meetings and serving as liaison among the other Directors and with Company officers and management personnel.

The Board periodically reviews its leadership structure, including the role of the Chairman. The Board also conducts an annual self-assessment during which it reviews its leadership and Committee structure and considers whether its structure remains appropriate in light of the Company's current operations, among other matters. The Board believes that its leadership structure, including the current percentage of the Board who are Independent Directors, is appropriate given its specific characteristics. Once the Nominees are elected by shareholders, the Board will elect a new Chairman.

The Company's Board is comprised of individuals with considerable and varied business experiences, backgrounds, skills, and qualifications who collectively have a strong knowledge of business and financial matters and are committed to helping the Company achieve its investment objective while acting in the best interests of the Company's shareholders. Several members of the Board have had a long and continued service with the Company. As noted in the Nominee Information Table above, the Nominees bring a variety of experiences and qualifications through their business backgrounds in the fields of consulting and strategic planning, education, corporate management, and investment management. The Board believes that each particular Nominee's financial and business experience gives him or her the qualifications and skills to serve as a Director.

The Board has also appointed a chief compliance officer ("CCO") for the Company. The CCO reports directly to the Board and participates in the meetings of the Board. The Independent Directors meet quarterly in executive session with the CCO, and the CCO prepares and presents periodic written compliance reports which update compliance activities to date and results thereon. Additionally, the CCO presents an annual written report to the Board evaluating the Company's compliance policies and procedures. The Board expects the CCO to report any material compliance risk, should it arise, to the Board.

Shareholders wishing to communicate with the Board may do so by sending a written communication to J. Richard Atwood, President of the Company, 11601 Wilshire Boulevard, Suite 1200, Los Angeles, California 90025.

During the fiscal year ended December 31, 2022, the Board held five meetings. Each of the existing Directors attended more than 75% of the aggregate of (1) the total number of meetings of the Board and (2) the total number of meetings held by all Committees of the Board on which they served. All of the existing Directors attended the Company's prior year's annual meeting.

Risk Oversight. Day-to-day management of the Company including risk management is the responsibility of the Adviser, which is responsible for managing all Company operations and the Company's risk management processes. The Board oversees the processes implemented by the Adviser or other service providers to manage relevant risks and considers risk management issues as part of its responsibilities throughout the year at regular meetings. The Audit Committee also considers risk management issues affecting the Company's financial reporting and controls at its regular meetings throughout the year. The Adviser and other service providers prepare regular reports for Board and Audit Committee meetings that address a variety of risk-related matters, and the Board as a whole or the Audit Committee may also receive special written reports or presentations on a variety of risk issues at their request. For example, the portfolio managers of the Company meet regularly with the Board to discuss portfolio performance, including investment risk, trading, and the impact on the Company of investments in particular securities. The Adviser also prepares reports for the Board regarding various issues, including valuation and liquidity.

Not all risks that may affect the Company can be identified or processes and controls developed to eliminate or mitigate their effect. Moreover, it is necessary to bear certain risks (such as investment-related risks) to achieve the Company's objectives. As a result of the foregoing and other factors, the ability of the Company's service providers, including the Adviser, to eliminate or mitigate risks is subject to limitations.

Standing Committees of the Board. The Board has an Audit Committee and a Nominating and Governance Committee. The responsibilities of each committee are described below.

The Board has designated Ms. Brown and Messrs. Lipson, Osborne, and Goldrich as the current members of the Audit Committee of the Board. If elected by shareholders of the Company to serve as an Independent Director, Mr. Zader will become a member of the Board's Audit Committee. All members of the Audit Committee are "independent," as that term is defined in the applicable listing standards of the NYSE. No member of the Audit Committee is considered an "interested person" of the Company within the meaning of the 1940 Act. The Audit Committee makes recommendations to the Board concerning the selection of the Company's independent registered public accounting firm and reviews with such firm the results of the annual audit, including the scope of auditing procedures, the adequacy of internal controls and compliance by the Company with the accounting, recording, and financial reporting requirements of the 1940 Act. In each instance, before an accountant has been engaged by the Company, the engagement has been approved by the Audit Committee. The Audit Committee met four times during the last fiscal year. The responsibilities of the Audit Committee are set forth in the Audit Committee Charter, which is available on the Company's website, https://fpa.com/funds/overview/source-capital (see Related Documents/Fund Literature), and is available without charge, upon request, by calling (800) 982-4372 ext. 5419. The Audit Committee Report relating to the audit of the Company's financial statements for the fiscal year ended December 31, 2022, is attached hereto as Appendix A.

5

The Board has designated Ms. Brown and Messrs. Lipson, Osborne, and Goldrich as the current members of the Nominating and Governance Committee. If elected by shareholders of the Company to serve as an Independent Director, Mr. Zader will become a member of the Board's Nominating and Governance Committee. All members of the Nominating and Governance Committee are "independent," as that term is defined in the applicable listing standards of the NYSE. No member is considered an "interested person" of the Company within the meaning of the 1940 Act. The Nominating and Governance Committee recommends to the full Board nominees for election as Directors of the Company to fill vacancies on the Board, when and as they occur. In addition, the Nominating and Governance Committee periodically reviews issues such as the Board's composition and compensation as well as other relevant issues, and recommends appropriate action, as needed, to the full Board. While the Nominating and Governance Committee expects to be able to identify from its own resources an ample number of qualified candidates, it will review recommendations from shareholders of persons to be considered as nominees to fill future vacancies. The determination of nominees recommended by the Nominating and Governance Committee is within the sole discretion of the Nominating and Governance Committee, and the final selection of nominees is within the sole discretion of the Board. Therefore, no assurance can be given that persons recommended by shareholders will be nominated as Directors. The Nominating and Governance Committee met four times during the last fiscal year. The responsibilities of the Nominating and Governance Committee are set forth in the Nominating and Governance Committee Charter, which is available on the Company's website, https://fpa.com/funds/overview/source-capital (see Related Documents/Fund Literature), and is available without charge, upon request, by calling (800) 982-4372 ext. 5419.

The Nominating and Governance Committee is responsible for searching for Director candidates that meet the evolving needs of the Board. Director candidates must have the highest personal and professional ethics and integrity. Additional criteria weighed by the Nominating and Governance Committee in the Director identification and selection process include the relevance of a candidate's experience in investment company and/or public company businesses, enterprise or business leadership and managerial experience, broad economic and policy knowledge, the candidate's independence from conflict or direct economic relationship with the Company, financial literacy and knowledge, and the candidate's ability and willingness to devote the proper time to prepare for, attend and participate in discussions in meetings. The Nominating and Governance Committee also takes into account whether a candidate satisfies the criteria for independence under the rules and regulations of the 1940 Act and of the NYSE, and if a nominee is sought for service on the Audit Committee, the financial and accounting expertise of a candidate, including whether the candidate would qualify as an Audit Committee financial expert. While the Nominating and Governance Committee does not have a formal policy respecting diversity on the Board, consideration is given to nominating persons with different perspectives and experience to enhance the deliberation and decision-making processes of the Board.

Corporate Governance

As noted above, the Company has adopted a charter for both its Audit Committee and Nominating and Governance Committee. The Board has also adopted a Code of Ethics, which applies to, among others, the Company's officers, and directors, as well as a Code of Ethics for Senior Executive and Financial Officers that applies to the Principal Executive Officer and Principal Financial Officer of the Company. A copy of the Code of Ethics for Senior Executive and Financial Officers is available as an exhibit to Form N-CSR on the website of the SEC, www.sec.gov, or without charge, upon request, by calling (800) 982-4372 ext. 5419.

Section 16(a) Beneficial Ownership Compliance

The Company's Directors and officers are required to file reports with the SEC and the NYSE concerning their ownership and changes in ownership of the Company's Common Stock. Based on its review of such reports, the Company believes that all filing requirements were met by its Directors and officers during the fiscal year ended December 31, 2022.

Compensation of Nominees

No compensation is paid by the Company to any officer or Director who is a Director, officer or employee of the Adviser or its affiliates. The following information relates to compensation paid to the Directors and Nominees for the fiscal year ended December 31, 2022. The Company typically pays each Independent Director an annual retainer, as well as fees for attending meetings of the Board and its Committees. Board and Committee chairs receive additional fees for their services. No pension or retirement benefits are accrued as part of Company expenses. Each such Independent Director is also reimbursed for out-of-pocket expenses incurred as a Director.

|

Name |

|

Aggregate Compensation

From the Company(1) |

|

Total Compensation

From All FPA Funds,(1,2)

Including the Company |

|

|

Independent Directors |

|

|

Mark L. Lipson* |

|

$ |

29,600 |

|

|

$ |

261,500 |

|

|

|

Alfred E. Osborne, Jr.* |

|

|

27,200 |

|

|

|

237,500 |

|

|

|

Sandra Brown |

|

|

27,690 |

|

|

|

242,403 |

|

|

|

Robert F. Goldrich |

|

|

21,838 |

|

|

|

189,875 |

|

|

|

John P. Zader |

|

|

0 |

|

|

|

0 |

|

|

6

|

Name |

|

Aggregate Compensation

From the Company(1) |

|

Total Compensation

From All FPA Funds,(1,2)

Including the Company |

|

|

Interested Director |

|

|

J. Richard Atwood |

|

$ |

0 |

|

|

$ |

0 |

|

|

|

Maureen Quill |

|

|

0 |

|

|

|

0 |

|

|

* Mr. Lipson and Mr. Osborne will retire immediately after the Meeting.

(1) No pension or retirement benefits are provided to directors by the Company or the FPA Funds.

(2) Includes compensation from the currently active funds including the Company, FPA New Income, Inc., FPA U.S. Core Equity Fund, Inc., FPA Funds Trust, on behalf of its series FPA Crescent Fund and FPA Flexible Fixed Income Fund, and Bragg Capital Trust on behalf of its series FPA Queens Road Value Fund and FPA Queens Road Small Cap Value Fund.

Share Ownership

Company Shares Owned by Directors and Nominees as of December 31, 2022

|

Name |

|

Dollar Range of Company

Shares Owned |

|

Aggregate Dollar Ranges of Shares

Owned in All FPA Funds

Overseen by Director |

|

|

Independent Directors |

|

|

Mark L. Lipson* |

|

Over $100,000 |

|

Over $100,000 |

|

|

Alfred E. Osborne, Jr.* |

|

$50,000-$100,000 |

|

Over $100,000 |

|

|

Sandra Brown |

|

$10,000-$50,000 |

|

Over $100,000 |

|

|

Robert F. Goldrich |

|

None |

|

None |

|

|

John P. Zader |

|

None |

|

None |

|

|

Interested Director |

|

|

J. Richard Atwood |

|

Over $100,000 |

|

Over $100,000 |

|

|

Maureen Quill |

|

None |

|

None |

|

* Mr. Lipson and Mr. Osborne will retire immediately after the Meeting.

As of December 31, 2022, all officers and Directors of the Company as a group owned beneficially approximately 1% of the outstanding shares of Common Stock of the Company.

Executive Officers of the Company

The following information relates to the executive officers of the Company who are not Directors of the Company. Each officer except the Secretary also serves as an officer of FPA.

Name, Address(1) and

Year of Birth |

|

Position with

Company |

|

Year First

Appointed as

Officer

of the

Company |

|

Principal Occupation(s) During the Past Five Years(2) |

|

|

Steven T. Romick 1963 |

|

Vice President and Portfolio Manager |

|

|

2015 |

|

|

Director and President of FPA GP, Inc., the General Partner of the Adviser (since 2018). Vice President and Portfolio Manager of FPA Crescent Fund, a series of FPA Funds Trust. Formerly, Managing Partner of FPA (2010-2018). |

|

|

Mark Landecker 1977 |

|

Vice President and Portfolio Manager |

|

|

2015 |

|

|

Partner of FPA. Vice President and Portfolio Manager of the FPA Crescent Fund, a series of the FPA Funds Trust. |

|

|

Brian A. Selmo 1979 |

|

Vice President and Portfolio Manager |

|

|

2015 |

|

|

Partner of FPA. Vice President and Portfolio Manager of the FPA Crescent Fund, a series of the FPA Funds Trust. |

|

|

Abhijeet Patwardhan 1979 |

|

Vice President and Portfolio Manager |

|

|

2015 |

|

|

Partner and a Director of Research of FPA. Vice President and Portfolio Manager of FPA New Income, Inc. and FPA Flexible Fixed Income Fund (since 2018). |

|

7

Name, Address(1) and

Year of Birth |

|

Position with

Company |

|

Year First

Appointed as

Officer

of the

Company |

|

Principal Occupation(s) During the Past Five Years(2) |

|

|

Ryan Leggio 1980 |

|

Vice President, Strategy |

|

|

2021 |

|

|

Partner of FPA (since 2018). Formerly, Senior Vice President of FPA. |

|

|

J. Richard Atwood 1960 |

|

President |

|

|

1997 |

|

|

Director and President of FPA GP, Inc., the General Partner of FPA (since 2018). Director/Trustee of each FPA Fund (Bragg Capital Trust since 2020). Formerly, Managing Partner of FPA. |

|

|

Karen E. Richards 1969 |

|

Chief Compliance Officer |

|

|

2019 |

|

|

Chief Compliance Officer of FPA (since 2018); and Chief Compliance Officer of each FPA Fund (since 2019, except Bragg Capital Trust since 2020). Formerly, Deputy Chief Compliance Officer of First Republic Investment Management, LLC (2016 to 2018), and Vice President, Senior Compliance Officer of Pacific Investment Management Company (2010 to 2016). |

|

|

E. Lake Setzler III 1967 |

|

Treasurer |

|

|

2006 |

|

|

Managing Director and CFO (since 2020) of FPA. Treasurer of each FPA Fund (Bragg Capital Trust since 2020). Formerly Senior Vice President and Controller of FPA. |

|

|

Rebecca D. Gilding 1979 |

|

Secretary |

|

|

2019 |

|

|

Vice President and Senior Counsel, State Street Bank and Trust Company; and Secretary of each FPA Fund (since 2019, except Bragg Capital Trust since 2020). Formerly, Assistant Vice President and Associate Counsel, Brown Brothers Harriman & Co. (2013 to 2016). |

|

(1) The address for each Officer (except Ms. Gilding) is 11601 Wilshire Blvd, Ste. 1200, Los Angeles, California 90025. Ms. Gilding's address is State Street Bank and Trust Company, One Lincoln Street, Boston, MA 02111.

(2) "Principal Occupation" includes all positions held with affiliates of the Company during the past five years.

PROPOSAL 2 — APPROVAL AND ADOPTION OF MERGER AGREEMENT

Introduction

The Company's certificate of incorporation (the "Charter") contains a provision requiring approval of the holders of two-thirds of the outstanding shares of each class of stock of the Company (with the Common Stock being the only currently outstanding class) to take certain actions. More specifically, Section E.(iv) of Article IV of the Company's Charter (the "Supermajority Provision") reads in its entirety as follows:

(iv) The vote of two-thirds of the outstanding shares of each class of stock entitled to be cast shall be necessary to authorize any of the following actions: (a) a merger or consolidation of the corporation (in which the corporation is not the surviving company) either with an open-end investment company or with a closed-end investment company unless such closed-end investment company's Certificate of Incorporation requires a two-thirds or greater vote of each class of such company's stock entitled to be cast to approve the types of transactions described in this paragraph; (b) the dissolution of the corporation; (c) the sale of all or substantially all of the assets of the corporation to any person (as such term is defined in the Investment Company Act of 1940); or (d) any amendment to this Certificate of Incorporation which makes any class of the corporation's stock a redeemable security (as such term is defined in the Investment Company Act of 1940) or reduces the two-thirds vote required to authorize the actions listed in this paragraph.

In order to delete this provision of the Charter and provide the Company flexibility to potentially pursue transactions of the type to which the Supermajority Provision would currently apply, the Board has approved the merger of a wholly-owned subsidiary of the Company into the Company. The sole purpose and effect of such merger will be to delete the Supermajority Provision. In all other respects, the Company and its Charter will continue on in its present form and under its present capital structure. In order to consummate such merger (and thus the deletion of the Supermajority Provision), the Board is seeking approval and adoption of the Merger Agreement as described below.

Amendments to charters, such as the one contemplated in Proposal 2, are subject to litigation risk. For example, stockholders of the Company could bring an action to reverse or delay the implementation of Proposal 2. The Registrant does not presently have any reason to believe that such an action will be brought in connection with Proposal 2.

On March 29, 2023, the Board (i) approved and declared advisable the Merger Agreement between the Company and its wholly-owned subsidiary, Source Sub, Inc. (the "Subsidiary"), which provides for the merger of the Subsidiary with and into the Company (the "Merger") and (ii) directed that a proposal to adopt the Merger Agreement be submitted to our stockholders. If implemented, the Merger would be effected pursuant to Section 251 of the Delaware General Corporation Law. Upon the

8

effectiveness of the Merger, the separate corporate existence of the Subsidiary will cease, the Company will continue as the surviving corporation and the Charter will be amended to delete the Supermajority Provision. The Board will retain the right to abandon the Merger Agreement if it is determined by the Board, in its sole discretion, that effecting the Merger is no longer in the best interests of the Company and its stockholders. Assuming the Merger Agreement is adopted by the stockholders, the Merger and the related deletion of the Supermajority Provision will become effective upon the filing of a certificate of merger with the Secretary of State of the State of Delaware. The Merger Agreement is attached to this proxy statement as Appendix B. The Company plans to file the certificate of merger as soon as reasonably practicable following the adoption of the Merger Agreement by the stockholders.

Purpose and Specific Effects of the Merger

The sole purpose of the Merger is to effect the deletion of the Supermajority Provision from the Charter. Approval of Proposal 2, which would result in the removal of the Supermajority Provision, would result in a lower voting threshold of a simple majority for stockholders approving certain stockholder proposals in the future. The Merger will not otherwise affect any rights of the stockholders of the Company and will have no material negative tax, accounting or other consequences to the Company or its stockholders. No consideration is being offered to the stockholders of the Company in connection with the Merger.

Appraisal Rights

The holders of Common Stock are not entitled to appraisal rights in connection with the Merger.

Reasons For Deletion of the Supermajority Provision

The transactions to which the Supermajority Provision applies (certain mergers, sales of all or substantially all the assets of the Company and dissolution) all constitute extraordinary transactions. Supermajority voting requirements were often originally understood to protect all stockholders broadly by only permitting such extraordinary transactions to proceed if such supermajority support was obtained. The Supermajority Provision was also adopted when the Company had two classes of stock outstanding — with each class having different rights — and required the approval of holders of two-thirds of the stock of each such class. Thus, the Supermajority Provision also originally served to provide holders of each class of stock protection against extraordinary transactions unless the requisite two-thirds of holders of the same class of stock (rather than a majority including holders of another class of stock with different interests) approved of the transaction.

The Board has carefully considered the Supermajority Provision, including in light of evolving standards of corporate governance which often support simple majority voting requirements. In particular, supermajority voting requirements permit a minority of stockholders to halt a transaction even if that transaction is supported by holders of a majority of a company's shares. Such a provision can be a helpful mechanism to ensure that a large majority of shareholders agree with a proposed transaction. It can also be helpful in cases where there are multiple shares of stock with competing interests. However, the Company currently only has a single class of stock currently outstanding (Common Stock), rather than the two classes that existed when the Supermajority Provision was adopted. Thus, the protection previously provided by the Supermajority Provision against amendments approved by a majority that included stockholders with different interests is no longer meaningful.

While the Company has no present intent to effect any of the types of transactions to which the Supermajority Provision applies, the Company regularly evaluates strategic alternatives and it is possible the Company may wish to pursue such a transaction in the future. After careful consideration, the Board believes that the two-thirds stockholder approval required by the Supermajority Provision could present a hurdle that could prevent the Company from engaging in a transaction even if the Board determines that such a transaction is in the best interests of the Company and a majority of the Company's stockholders support such a transaction.

After careful consideration, including of the foregoing factors, the Board has determined that it is in the best interests of the Company and its stockholders to delete the Supermajority Provision.

THE BOARD, INCLUDING THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" PROPOSAL 1, PROPOSAL 2 AND PROPOSAL 3.

GENERAL INFORMATION

Investment Adviser

First Pacific Advisors, LP, maintains its principal office at 11601 Wilshire Boulevard, Suite 1200, Los Angeles, California 90025. FPA is a Delaware limited partnership that, together with its predecessor organizations, has been in the investment advisory business since 1954 and has served as the Company's investment adviser since the Company's inception in 1968. No Independent Director owns, beneficially or of record, interests of the Adviser or any entity under common control with the Adviser.

9

Administrator

State Street Bank and Trust Company acts as administrator to the Company pursuant to an Administration Agreement between the Administrator and the Company. The principal business address of the administrator is State Street Financial Center, One Lincoln Street, Boston, Massachusetts 02111.

Independent Registered Public Accounting Firm

The Board, including a majority of the Independent Directors, has selected Ernst & Young LLP ("E&Y") to serve as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2023. E&Y served as the independent registered public accounting firm for the Company for the fiscal year ended December 31, 2018, through the fiscal year ended December 31, 2022. The reports of the financial statements, issued by E&Y for the Company for each of the two most recent fiscal years ended December 31 in which E&Y served as the independent registered public accounting firm of the Company, did not contain any adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. For the past two most recent fiscal years in which E&Y served as the independent registered public accounting firm of the Company and through the date of the auditor change, there were no disagreements between the Company and E&Y on any matters of accounting principles or practices, financial statement disclosures, auditing scope or procedures, or any other matter which, if not resolved to the satisfaction of E&Y, would have caused E&Y to make reference to the subject matter of the disagreements in connection with the issuance of E&Y reports on the financial statements of such periods. The Company has requested that E&Y furnish it with a letter addressed to the SEC stating whether or not it agrees with the above comments.

Representatives of E&Y are expected to be present at the Meeting to be available to respond to any appropriate questions from shareholders.

Pre-Approval Policies and Procedures. The Audit Committee is required to pre-approve all audit and permissible non-audit services provided to the Company in order to assure that they do not impair the Company's independent public accounting firm's (the "Auditor's") independence from the Company. The pre-approval requirement will extend to all non-audit services provided to the Company, the Adviser and any entity controlling, controlled by or under common control with the Adviser that provides ongoing services to the Company, if the engagement relates directly to the operations and financial reporting of the Company; provided, however, that an engagement of the Auditor to perform attest services for the Company, the Adviser or its affiliates required by generally accepted auditing standards to complete the examination of the Company's financial statements (such as an examination conducted in accordance with Statement on Standards for Attestation Engagements Number 16, or a Successor Statement, issued by the American Institute of Certified Public Accountants), will be deemed pre-approved if:

1. The Auditor informs the Audit Committee of the engagement,

2. The Auditor advises the Audit Committee at least annually that the performance of this engagement will not impair E&Y's independence with respect to the Company, and

3. the Audit Committee receives a copy of the Auditor's report prepared in connection with such services.

The Committee may delegate to one or more Committee members the authority to review and pre-approve audit and permissible non-audit services. Actions taken under any such delegation will be reported to the full Committee at its next meeting. Under the pre-approval policies and procedures, the Audit Committee delegates specific pre-approval authority to the Audit Committee Chairman, provided that the estimated fee for any such proposed pre-approved service does not exceed $25,000 and that any pre-approval decisions are reported to the full Audit Committee at its next scheduled meeting.

Audit Fees. The aggregate fees billed for the last two fiscal years ended December 31 for professional services rendered by E&Y to the Company for the audit of the Company's annual financial statements or services normally provided by E&Y in connection with statutory and regulatory filings or engagements for those fiscal years are set forth below.

|

Year Ended December 31, 2022 |

|

$ |

56,175 |

|

|

|

Year Ended December 31, 2021 |

|

$ |

53,500 |

|

|

Audit-Related Fees. There were no fees billed for the last two fiscal years ended December 31 for assurance and related services rendered by E&Y to the Company that are reasonably related to the performance of the audit of the Company's financial statements and are not reported under Audit Fees above.

There were no fees billed for the last two fiscal years for assurance and related services rendered by E&Y to the Adviser that are reasonably related to the performance of the audit of the Company's financial statements that were required to be pre-approved by the Audit Committee.

10

Tax Fees. The aggregate fees billed for the last two fiscal years ended December 31 for professional services rendered by the principal accountant to the registrant for tax return preparation are set forth below.

|

Year Ended December 31, 2022 |

|

$ |

7,035 |

|

|

|

Year Ended December 31, 2021 |

|

$ |

6,700 |

|

|

There were no fees billed for the last two fiscal years for professional services rendered by E&Y to the Adviser for tax compliance, tax advice and tax planning that were required to be pre-approved by the Audit Committee.

All Other Fees. The aggregate fees billed for the last two fiscal years ended December 31 for products and services provided by E&Y to the Company are set forth below:

|

Year Ended December 31, 2022 |

|

$ |

769 |

|

|

|

Year Ended December 31, 2021 |

|

$ |

1,602 |

|

|

These fees paid for the last two fiscal years ended December 31 were for the identification of any PFIC holdings in the Fund.

There were no fees billed for the last two fiscal years for products and services provided by E&Y to the Adviser that were required to be pre-approved by the Audit Committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X.

OTHER MATTERS

The proxy holders have no present intention of bringing before the Meeting for action any matters other than those specifically referred to in the foregoing, and in connection with or for the purpose of effecting the same, nor has the management of the Company any such intention. Neither the proxy holders nor the management of the Company are aware of any matters which may be presented by others. If any other business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

Submission of Shareholder Proposals

Any shareholder proposal to be considered for inclusion in the Company's proxy statement and form of proxy for the 2024 annual meeting of shareholders should be received by the President of the Company no later than December 1, 2023. Under the circumstances described in, and upon compliance with, Rule 14a-4(c) under the Securities Exchange Act of 1934, after February 7, 2024, notice of a shareholder proposal is considered untimely and the Company may solicit proxies in connection with the 2024 annual meeting that confer discretionary authority to vote on such shareholder proposals of which the Secretary of the Company does not receive notice by February 14, 2024.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on June 1, 2023: The Company's proxy statement and annual report for the fiscal year ended December 31, 2022, are available free of charge at https://vote.proxyonline.com/fps/docs/sourcecapital2023.pdf.

11

Security Ownership of Certain Beneficial Owners

Set forth below is information with respect to persons who are registered as beneficial owners of more than 5% of the Company's voting securities as of April 4, 2023.

|

Title of Class |

|

Name and Address |

|

Number of

Shares |

|

Percentage

of Class |

|

|

Common Stock |

|

CEDE & CO

Bowling Green STN

P. O. Box 20

New York, NY 10274-0020 |

|

|

7,061,720 |

|

|

|

85.30 |

% |

|

Legal Proceedings

There are no material pending legal proceedings to which any Nominee, or affiliated person of such Nominee is a party adverse to the Company or any of its affiliated persons or has a material interest adverse to the Company or any of its affiliated persons. In addition, there have been no legal proceedings that are material to an evaluation of the ability or integrity of any Nominee, or executive officer of the Company within the past ten years.

By Order of the Board,

REBECCA D. GILDING

Secretary

April 17, 2023

Please complete, date, and sign the enclosed proxy, and return it promptly in the enclosed reply envelope. No postage is required if mailed in the United States. You may also vote your proxy by telephone or over the Internet.

12

APPENDIX A

AUDIT COMMITTEE REPORT

To the Board of Directors

of Source Capital, Inc.: February 27, 2023

Our Committee has reviewed and discussed with management of the Company and Ernst & Young LLP ("EY"), the independent registered public accounting firm of Source Capital, Inc. (the "Company") during the relevant period, the audited financial statements of the Company as of December 31, 2022, and the financial highlights for the year then ended (the "Audited Financial Statements"). In addition, we have discussed with EY the matters required by Public Company Accounting Oversight Board (United States) Auditing Standards No. 16 regarding communications with audit committees.

The Committee also has received and reviewed the written disclosures and the letter from EY required by Public Company Accounting Oversight Board (United States) Ethics and Independence Rule 3526 (Communication with Audit Committees Concerning Independence), and we have discussed with that firm its independence from the Company and its adviser. We also have discussed with management of the Company and the independent registered public accounting firm such other matters and received such assurances from them as we deemed appropriate.

Management is responsible for the Company's internal controls and the financial reporting process. EY is responsible for performing an independent audit of the Company's financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Committee's responsibility is to monitor and oversee these processes.

Based on the foregoing review and discussions and a review of the report of EY with respect to the Audited Financial Statements, and relying thereon, we have recommended to the Company's Board of Directors the inclusion of the Audited Financial Statements in the Company's Annual Report to Shareholders for the year ended December 31, 2022, for filing with the Securities and Exchange Commission.

Audit Committee:

Sandra Brown, Chair

Mark L. Lipson

Alfred E. Osborne, Jr.

Robert F. Goldrich

A-1

APPENDIX B

AGREEMENT AND PLAN OF MERGER

BY AND BETWEEN

SOURCE CAPITAL, INC. AND SOURCE SUB, INC.

This Agreement and Plan of Merger (this "Agreement") is made and entered into as of ______________ ___, 2023, by and between Source Capital, Inc., a Delaware corporation ("Parent"), and Source Sub, Inc., a Delaware corporation ("Source Sub" and, together with Parent, the "Constituent Corporations").

Whereas, the Board of Directors of each of the Constituent Corporations has deemed it advisable and in the best interests of each of the Constituent Corporations that Source Sub be merged with and into Parent (hereinafter, in such capacity, sometimes referred to as the "Surviving Corporation") as permitted by the Delaware General Corporation Law (the "DGCL") pursuant to the terms hereinafter set forth;

Now, therefore, the parties hereto have agreed as follows:

Section 1. The Merger. Upon the terms and subject to the conditions set forth in this Agreement, at the Effective Time (as defined herein), Source Sub shall be merged with and into Parent (the "Merger"), and the separate existence of Source Sub shall cease. The Surviving Corporation shall be Parent.

Section 2. Filings. The parties hereto shall cause an executed certificate of merger conforming to the requirements of the DGCL to be filed with the Secretary of State of the State of Delaware at such time as they deem advisable (the filing of such certificate to be conclusive evidence of such advisability and such determination). The Merger shall become effective at the time specified in the aforementioned certificate of merger or, if no such time is specified, upon such filing (the "Effective Time").

Section 3. Effects of the Merger. The Merger shall have the effects set forth in this Agreement and the applicable provisions of the DGCL (including without limitation Section 259 of the DGCL).

Section 4. Treatment of Capital Stock. Each share of capital stock of Parent issued and outstanding immediately before the Effective Time shall remain issued and outstanding upon and immediately after the Effective Time. Each share of capital stock of Source Sub issued and outstanding immediately before the Effective Time shall be cancelled upon the Effective Time. There shall be no appraisal rights in connection with the Merger.

Section 5. Certificate of Incorporation of the Surviving Corporation. Subject to the next sentence, the Certificate of Incorporation of Parent shall be unaffected by the Merger and shall be the Certificate of Incorporation of the Surviving Corporation. At the Effective Time, Section E.(iv) of Article IV of Parent's Certificate of Incorporation shall be deleted.

Section 6. Bylaws of the Surviving Corporation. The Bylaws of Parent shall be unaffected by the Merger and shall be the Bylaws of the Surviving Corporation.

Section 7. Directors and Officers of Surviving Corporation. At the Effective Time, the directors of Parent, as in office immediately before the Effective Time, shall be the directors of the Surviving Corporation, until their respective successors are duly elected or appointed and qualified. At the Effective Time, the officers of Parent, as in office immediately before the Effective Time, shall be the officers of the Surviving Corporation, until their respective successors are duly elected or appointed and qualified.

B-1

Section 8. Representations and Warranties of Parent. Parent hereby warrants and represents that (a) it is a corporation duly organized, validly existing and in good standing under Delaware law; (b) it has all requisite power and authority to enter into this Agreement; (c) this Agreement has been duly executed and delivered by Parent and constitutes the valid and binding obligation of Parent enforceable against it in accordance with the terms of this Agreement; and (d) as of the record date for purposes of determining the stockholders of Parent entitled to notice of the meeting at which this Agreement shall be submitted for the approval of such stockholders, the issued and outstanding shares of Common Stock of Parent were listed on a national securities exchange.

Section 9. Representations and Warranties of Source Sub. Source Sub hereby warrants and represents that (a) it is a corporation duly organized, validly existing and in good standing under Delaware law; (b) it has all requisite power and authority to enter into this Agreement; and (c) this Agreement has been duly executed and delivered by Source Sub and constitutes the valid and binding obligation of Source Sub enforceable against it in accordance with the terms of this Agreement.

Section 10. Conditions to the Obligations of Each Constituent Corporation. The obligations of each Constituent Corporation to consummate the Merger are subject to the satisfaction or waiver of the following conditions as of the Effective Time:

(a) no provision of any applicable law or regulation and no judgment, injunction, order or decree shall prohibit the consummation of the Merger;

(b) all actions by or in respect of or filings with any governmental body, agency, official or authority required to permit the consummation of the Merger shall have been obtained; and

(c) this Agreement shall have been adopted by (i) the affirmative vote of the holders of a majority of the voting power of the outstanding Common Stock of Parent; and (ii) the affirmative vote of the sole stockholder of Source Sub (collectively, the "Required Stockholder Approval").

Section 11. Amendments to this Agreement. This Agreement may be amended at any time prior to the Effective Time by the parties hereto, whether before or after adoption of this Agreement by the Required Stockholder Approval; provided, however, that after any such Required Stockholder Approval no amendment shall be made to this Agreement that by law requires further approval or authorization by the stockholders of Parent or the sole stockholder of Source Sub without such further approval or authorization.

Section 12. Termination. This Agreement may be terminated, and the Merger may be abandoned, by mutual consent of the Boards of Directors of the Constituent Corporations at any time prior to the Effective Time.

Section 13. Governing Law. To the fullest extent permitted by law, this Agreement shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to principles of conflict of laws.

Section 14. Counterparts; Effectiveness. This Agreement may be executed in any number of counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. This Agreement may be executed by facsimile transmission or by portable document format ("pdf"), and signatures transmitted by facsimile or pdf shall be deemed to be original signatures for all purposes. This Agreement shall become effective when each party hereto shall have received the counterpart hereof signed by the other party hereto.

Section 15. No Third Party Rights. Nothing in this Agreement, express or implied, is intended to confer or shall confer upon any person (other than the parties hereto) any right, benefit or remedy of any nature whatsoever under or by reason of this Agreement.

Section 16. Severability. Any term or provision of this Agreement that is invalid or unenforceable in any situation in any jurisdiction shall not affect the validity or enforceability of the remaining terms and provisions hereof or the validity or enforceability of the offending term or provision in any other situation or in any other jurisdiction.

[Signature page(s) follow(s)]

B-2

In Witness Whereof, this Agreement, having first been duly approved by the respective Boards of Directors of each Constituent Corporation, is hereby executed on behalf of each of said corporations by their respective officers thereunto duly authorized as of the date set forth above.

SOURCE CAPITAL, INC.

a Delaware corporation

By:___________________________________________

Name:

Title:

SOURCE SUB, INC.

a Delaware corporation

By:___________________________________________

Name:

Title:

B-3

|

[PROXY ID NUMBER HERE] [BAR CODE HERE] [CUSIP HERE]

SHAREHOLDER’S REGISTRATION PRINTED HERE

***BOXES FOR TYPSETTING PURPOSES ONLY***

THIS BOX AND BOX ABOVE ARE NOT PRINTED ON ACTUAL

PROXY BALLOTS. THEY IDENTIFY LOCATION OF WINDOWS ON

OUTBOUND 9X12 ENVELOPES.

SOURCE CAPITAL, INC.

PROXY FOR AN ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 1, 2023

The undersigned, revoking prior proxies, hereby appoints J. Richard Atwood, Director and President, and E. Lake Setzler, Treasurer

and each of them, as attorneys-in-fact and proxies of the undersigned, granted in connection with the voting of the shares subject

hereto. Each of them, with full power of substitution, to vote shares held in the name of the undersigned on the record date at

the Annual Meeting of Shareholders (the “Meeting”) of Source Capital, Inc. (the “Fund”) to be held at the offices of First Pacific

Advisors, LP, 11601 Wilshire Boulevard, Suite 1200, Los Angeles, California 90025 on June 1, 2023 at 10:00 a.m. Pacific Time, or at

any adjournment thereof, upon the Proposals described in the Notice of Meeting and accompanying Proxy Statement, which have

been received by the undersigned.

Do you have questions?

If you have any questions about how to vote your Proxy or about the Meeting in general, please call toll-free

(800) 283-3192. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS: The Notice of Meeting, Proxy Statement and Proxy Card

are available at: https://vote.proxyonline.com/fpa/docs/sourcecapital2023.pdf

Please sign, date, and mail your Proxy Card in the envelope provided as soon as possible.

1. MAIL your signed and voted Proxy back in

the postage paid envelope provided

2. ONLINE at vote.proxyonline.com using

your Proxy control number found below

3. By PHONE when you dial toll-free

(888) 227-9349 to reach an automated

touchtone voting line

4. By PHONE with a live operator when you

call toll-free (800) 283-3192 Monday through

Friday 9 a.m. to 10 p.m. Eastern time

PROXY VOTING OPTIONS

CONTROL NUMBER 12345678910

SIGN, DATE AND VOTE ON THE REVERSE SIDE

PROXY CARD

YOUR VOTE IS IMPORTANT NO

MATTER HOW MANY SHARES

YOU OWN. PLEASE CAST YOUR

PROXY VOTE TODAY! |

|

[PROXY ID NUMBER HERE] [BAR CODE HERE] [CUSIP HERE]

SOURCE CAPITAL, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE FUND’S BOARD OF DIRECTORS. THE FUND’S BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” ALL PROPOSALS When properly executed, this proxy will be voted as indicated or

“FOR” the proposals if no choice is indicated. The Proxy will be voted in accordance with the Proxy holders’

discretion as to any other matters that may arise at the Meeting.

TO VOTE, MARK CIRCLES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example: ●

PROPOSALS: NOMINEES CUMULATE

1. Election of Directors:

1A Sandra Brown ; FOR ALL NOMINEES ;

1B Robert F. Goldrich ;

1C John P. Zader ; WITHHOLD ALL ;

1D J. Richard Atwood ;

1E Maureen Quill ; FOR ALL EXCEPT ;

INSTRUCTIONS: If you select “FOR ALL NOMINEES” or “WITHHOLD ALL” no further action is needed. To withhold authority to

vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill the circle next to each nominee you wish to withhold, as

shown here: ●

To cumulate your vote for one or more of the above nominee(s), write the manner in which such votes shall be cumulated in the space to the

right of the nominee(s) name(s). If you are cumulating your vote, do not mark any circle. If you wish to cumulate your votes, you must vote

by using the Proxy Card rather than voting by telephone or the internet.

FOR AGAINST ABSTAIN

2. To approve and adopt the Agreement and Plan of Merger by and between the Fund

and Source Sub, Inc.

○ ○ ○

3. To approve an adjournment of the Meeting to a later date or dates. ○ ○ ○

4. In their discretion, the proxies are authorized to vote on such other business as may properly come before the

Meeting or any adjournments or postponements thereof.

YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE

COUNTED. The signer(s) acknowledges receipt of this Proxy Statement of

the Board of Directors. Your signature(s) should be exactly as your name(s)

appear on this Proxy (reverse side). If the shares are held jointly, each holder

should sign this Proxy. Attorneys-in-fact, executors, administrators, trustees

or guardians should indicate the full title and capacity in which they are

signing.

_______________________________________________________________

SIGNATURE (AND TITLE IF APPLICABLE) DATE

_______________________________________________________________

SIGNATURE (IF HELD JOINTLY) DATE |

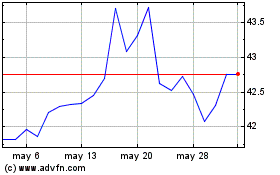

Source Capital (NYSE:SOR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Source Capital (NYSE:SOR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024