Weak Earnings: China to Blame? - Analyst Blog

24 Octubre 2012 - 4:24AM

Zacks

A lot of the weakness in the ongoing third quarter earnings

season is attributable to problems in the Chinese economy. Europe

obviously is also an issue, but it’s the loss of growth momentum in

China that is showing up in a range of industries this earnings

season.

We have heard the China growth issue mentioned on earnings calls

from companies as diverse as FedEx (FDX) and

General Electric (GE) to

Caterpillar (CAT), Yum! Brands

(YUM) and Coach (COH). The domestic economic

picture is not that pretty either, but it is in far better shape

compared to what is going on beyond the U.S. shores.

Given this China fixation, it would make sense for the market to

feel some ease on the sign that the country’s manufacturing sector

may be improving. This morning’s preliminary October PMI by the

HSBC Bank (HBC) shows the measure improving to a

three-month high, though it still remains below the ‘50’ level.

This comes after other key measures of economic activity,

particularly export growth and industrial production, also showed

signs that the economy may have bottomed already and will start

stabilizing in the coming quarters. Conclusive evidence on that

front should offset the earnings deterioration trend currently in

play. But we will likely have to wait a bit longer for that

evidence to emerge.

On the earnings front, the positive looking numbers from

Boeing (BA) and Facebook (FB) are

not enough to change the overall weak tone of this reporting

season. In terms of a running scorecard, we have third quarter

results from 179 companies in the S&P 500 as of this morning

(Wednesday, October 24th).

Total earnings for these 179 companies are down 2.9% from the same

period last year, with only 57% of the companies beating earnings

expectations. On the revenue side, the growth rate is a bit better,

though only 33% of the 179 companies have come ahead of revenue

expectations.

This is a materially weaker performance than what these same

companies did in recent quarters. Importantly, the tone and

substance of guidance has been on the weaker side, which means that

we will likely see an acceleration in negative estimate revisions

over the coming days and weeks.

BOEING CO (BA): Free Stock Analysis Report

CATERPILLAR INC (CAT): Free Stock Analysis Report

COACH INC (COH): Free Stock Analysis Report

FACEBOOK INC-A (FB): Free Stock Analysis Report

FEDEX CORP (FDX): Free Stock Analysis Report

GENL ELECTRIC (GE): Free Stock Analysis Report

HSBC HOLDINGS (HBC): Free Stock Analysis Report

YUM! BRANDS INC (YUM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

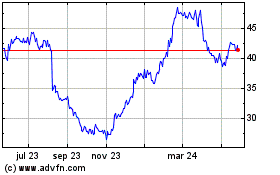

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

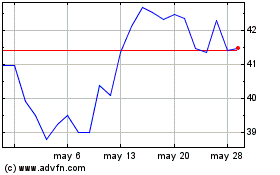

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024