Verizon Communications Inc. (NYSE, NASDAQ: VZ) and Frontier

Communications Parent, Inc. (NASDAQ: FYBR) today announced they

have entered into a definitive agreement for Verizon to acquire

Frontier in an all-cash transaction valued at $20 billion. This

strategic acquisition of the largest pure-play fiber internet

provider in the U.S. will significantly expand Verizon's fiber

footprint across the nation, accelerating the company’s delivery of

premium mobility and broadband services to current and new

customers. It will also expand Verizon's intelligent edge network

for digital innovations like AI and IoT.

The combination will integrate Frontier’s cutting-edge fiber

network into Verizon's leading portfolio of fiber and wireless

assets, including its best-in-class Fios offering. Over

approximately four years, Frontier has invested $4.1 billion

upgrading and expanding its fiber network, and now derives more

than 50% of its revenue from fiber products. Frontier’s 2.2 million

fiber subscribers across 25 states will join Verizon’s

approximately 7.4 million Fios connections1 in 9 states and

Washington, D.C. In addition to Frontier’s 7.2 million fiber

locations, the company is committed to its plan to build out an

additional 2.8 million fiber locations by the end of 2026.

“Connectivity is essential in nearly every part of our lives and

work, and no one delivers better than Verizon,” said Verizon

Chairman and CEO Hans Vestberg. “Verizon offers more choice,

flexibility and value, and we continuously look for ways to provide

the best product and network experience to our customers as we

bolster our position as the provider of choice.”

Vestberg added: “The acquisition of Frontier is a strategic fit.

It will build on Verizon’s two decades of leadership at the

forefront of fiber and is an opportunity to become more competitive

in more markets throughout the United States, enhancing our ability

to deliver premium offerings to millions more customers across a

combined fiber network.”

“Less than four years ago, we set out an ambitious plan to Build

Gigabit America, the digital infrastructure this country needs to

thrive for generations to come,” said Nick Jeffery, President and

CEO of Frontier. “Today’s announcement is recognition of our

progress building a best-in-class fiber network and delivering

reliable, high-speed broadband to millions of customers across the

country. It’s also a vote of confidence for the future of fiber. I

am confident that this delivers a significant and certain cash

premium to Frontier’s shareholders, while creating exciting new

opportunities for our employees and expanding access to reliable

connectivity for more Americans.”

Customer and Strategic Benefits:

- Extends Verizon premium

offerings and

experience to Frontier’s

consumer and small business customers. Frontier customers

and those previously outside Verizon’s fiber footprint are expected

to gain more choice and access to Verizon’s premium mobility, home

internet, streaming and connected home offerings, alongside premium

business products like Verizon Business Complete.

- Creates

market-leading

broadband

network with

superior

scale and

distribution. Frontier’s consumer

fiber network, one of the largest and fastest-growing nationally,

can be immediately and seamlessly integrated upon closing directly

into Verizon’s award-winning Fios network, meeting existing Fios

standards. Today, Verizon and Frontier have approximately 10

million fiber customers across 31 states and Washington D.C. with

fiber networks passing over 25 million premises, and both companies

expect to increase their fiber penetration between now and

closing.

- Unites Frontier’s premium broadband

offering with Verizon’s premium mobile offering. Combined

Mobile and Home Internet customers show increased loyalty and have

an improved rate of churn by approximately 50% for postpaid

mobility, which is expected to improve Verizon’s mobility

economics.

- Increases reach

across more markets. Verizon will gain access to

Frontier’s high-quality customer base in markets highly

complementary to Verizon’s core Northeast and Mid-Atlantic markets.

Frontier’s footprint offers substantial room for increased

penetration in both fiber and mobility services and Verizon is well

positioned with stores throughout Frontier’s territory.

- Aligns with Verizon’s

long-term

strategic

plan. The acquisition of Frontier

is consistent with Verizon’s core strategy of growing and

strengthening customer relationships. This transaction is expected

to expand Verizon’s share of the nationwide broadband market,

building upon Verizon’s two decades of leadership at the forefront

of fiber.

Substantial Financial Benefits:

- Accretive to Verizon’s earnings. The

transaction is expected to be accretive to Verizon's revenue and

Adjusted EBITDA growth rates upon closing.

- Drives significant

cost

synergies. Verizon expects to

realize at least $500 million in run-rate cost synergies by year

three from benefits of increased scale and distribution and network

integration.

- Maintains Verizon’s

financial

strength,

flexibility and

consistent

capital

allocation

approach. Following the closing

of the transaction, Verizon will continue to have a strong balance

sheet and liquidity profile. The company will maintain its capital

allocation priorities, characterized by prudent investment in the

business, a commitment to maintaining an industry-leading dividend

and continued debt reduction.

Additional Transaction Details:

Under the terms of the agreement, Verizon will acquire Frontier

for $38.50 per share in cash, representing a premium of 43.7% to

Frontier’s 90-Day volume-weighted average share price (VWAP) on

September 3, 2024, the last trading day prior to media reports

regarding a potential acquisition of Frontier. The transaction is

valued at approximately $20 billion of enterprise value.

The transaction has been unanimously approved by the Verizon and

Frontier Boards of Directors. The transaction is expected to close

in approximately 18 months, subject to approval by Frontier

shareholders, receipt of certain regulatory approvals and other

customary closing conditions.

Verizon Reaffirms Full-Year 2024 Guidance:

- Total wireless service revenue growth2 of 2.0 percent to 3.5

percent.

- Adjusted EBITDA growth3 of 1.0 percent to 3.0 percent.

- Adjusted EPS3 of $4.50 to $4.70.

- Capital expenditures between $17.0 billion and $17.5

billion.

- Adjusted effective income tax rate3 in the range of 22.5

percent to 24.0 percent.

Advisors:Centerview Partners LLC and Morgan

Stanley & Co. LLC acted as financial advisors to Verizon and

Debevoise & Plimpton LLP acted as legal counsel. PJT Partners

served as financial advisor to the Strategic Review Committee of

the Board of Directors of Frontier, and Barclays served as

financial advisor to Frontier. Cravath, Swaine & Moore LLP

served as legal advisor to Frontier, and Paul, Weiss, Rifkind,

Wharton & Garrison LLP served as legal advisor to the Strategic

Review Committee of the Board of Directors of Frontier.

Conference Call Information:Verizon management

will conduct a conference call today, September 5, 2024, at 8:00 AM

Eastern Time to discuss this announcement. Access to a live audio

webcast and slide presentation will be available on its Investor

Relations website, https://www.verizon.com/about/investors. An

archive of the webcast will be available on the website.

1 Metrics reflect an aggregation of Consumer and Business

segments. 2 Total wireless service revenue represents the sum of

Consumer and Business segments.3 Non-GAAP financial measure. See

www.verizon.com/about/investors for additional information about

non-GAAP financial measures cited in this document. The company

does not provide a reconciliation for any of these adjusted

(non-GAAP) forecasts because it cannot, without unreasonable

effort, predict the special items that could arise, and the company

is unable to address the probable significance of the unavailable

information.

About Verizon Verizon Communications Inc.

(NYSE, Nasdaq: VZ) powers and empowers how its millions of

customers live, work and play, delivering on their demand for

mobility, reliable network connectivity and security. Headquartered

in New York City, serving countries worldwide and nearly all of the

Fortune 500, Verizon generated revenues of $134.0 billion in 2023.

Verizon’s world-class team never stops innovating to meet customers

where they are today and equip them for the needs of tomorrow. For

more, visit verizon.com or find a retail location at

verizon.com/stores.

VERIZON’S ONLINE MEDIA CENTER: News releases, stories, media

contacts and other resources are available atverizon.com/news. News

releases are also available through an RSS feed. To subscribe,

visit www.verizon.com/about/rss-feeds/.

About Frontier Frontier (NASDAQ: FYBR) is the

largest pure-play fiber provider in the U.S. Driven by our purpose,

Building Gigabit America®, we deliver blazing-fast broadband

connectivity that unlocks the potential of millions of consumers

and businesses. For more information, visit www.frontier.com.

Verizon Contacts

Investor RelationsBrady

Connorgeorge.connor@verizon.com

Media Katie

Magnottakatie.magnotta@verizon.com

Frontier Contacts

Investor RelationsSpencer

Kurnspencer.kurn@ftr.com

MediaChrissy Murraychrissy.murray@ftr.com

Forward-Looking Statements

In this communication, we have made forward-looking statements.

These statements are based on our estimates and assumptions and are

subject to risks and uncertainties. Forward-looking statements

include the information concerning our possible or assumed future

results of operations. Forward-looking statements also include

those preceded or followed by the words “anticipates,” “assumes,”

“believes,” “estimates,” “expects,” “forecasts,” “hopes,”

“intends,” “plans,” “targets” or similar expressions. For those

statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. We undertake no obligation to revise

or publicly release the results of any revision to these

forward-looking statements, except as required by law. Given these

risks and uncertainties, readers are cautioned not to place undue

reliance on such forward-looking statements. For a discussion of

some of the risks and important factors thatcould affect such

forward-looking statements, see our and Frontier’s most recent

annual and quarterly reports and other filings filed with the

SEC.

Factors which could have an adverse effect on our operations and

future prospects include, but are not limited to, the following:

risks relating to the proposed transactions, including in respect

of the ability to obtain required regulatory approvals and approval

by Frontier’s stockholders, and the satisfaction of other closing

conditions on a timely basis or at all; unanticipated difficulties

and/or expenditures relating to the proposed transactions and any

related financing; uncertainties as to the timing of the completion

of the proposed transactions; litigation relating to the proposed

transactions; the impact of the proposed transactions on each

company’s business operations (including the threatened or actual

loss of subscribers, employees or suppliers); the inability to

obtain, or delays in obtaining cost savings and synergies from the

proposed transactions; incurrence of unexpected costs and expenses

in connection with the proposed transactions; risks related to

changes in the financial, equity and debt markets; and risks

related to political, economic and market conditions. In addition,

the risks to which Frontier’s business is subject, including those

risks set forth in Part I, Item 1A of Frontier’s most recent Annual

Report on Form 10-K and its periodic reports filed with the SEC,

could adversely affect the proposed transactions and, following the

completion of the proposed transactions, our operations and future

prospects.

Important Additional Information and Where to Find

It

This press release may be deemed to be in solicitation material

in respect of the proposed acquisition of Frontier by Verizon. In

connection with the proposed transactions, Frontier intends to file

with the SEC a proxy statement on Schedule 14A (the “Proxy

Statement”), in preliminary and definitive form, the definitive

version of which will be sent or provided to Frontier stockholders.

Verizon or Frontier may also file other documents with the SEC

regarding the proposed transactions.

This document is not a substitute for the Proxy Statement or any

other relevant document which Frontier may file with the SEC.

Promptly after filing its definitive Proxy Statement with the SEC,

Frontier will mail or provide the definitive Proxy Statement and a

proxy card to each Frontier stockholder entitled to vote at the

meeting relating to the proposed transactions. INVESTORS AND

SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY

OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE

SEC (WHEN THEY ARE AVAILABLE), AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY

BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE

TRANSACTIONS BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE TRANSACTIONS AND RELATED MATTERS. Investors

and security holders may obtain free copies of the Proxy Statement

and other documents that are filed or will be filed with the SEC by

Frontier or Verizon (when they are available) through the website

maintained by the SEC at www.sec.gov, Frontier’s investor relations

website at investor.frontier.com or Verizon’s investor relations

website at verizon.com/about/investors.

Participants in the Solicitation

Verizon, Frontier and Frontier’s directors, executive officers

and other members of management and employees, under SEC rules, may

be deemed to be participants in the solicitation of proxies from

the stockholders of Frontier in connection with the proposed

transactions. Information about Frontier’s directors and executive

officers is set forth in the Frontier Proxy Statement on Schedule

14A for its 2024 Annual Meeting of Shareholders, which was filed

with the SEC on April 3, 2024. To the extent holdings of Frontier’s

securities by its directors or executives officers have changed

since the amounts set forth in such 2024 proxy statement, such

changes have been or will be reflected on Initial Statements of

Beneficial Ownership on Form 3 or Statements of Change in Ownership

on Form 4 filed with the SEC. Additional information regarding the

identity of potential participants, and their direct or indirect

interests, by security holdings or otherwise, will be included in

Frontier’s definitive Proxy Statement relating to the proposed

transactions when it is filed by Frontier with the SEC. These

documents (when available) may be obtained free of charge from the

SEC’s website at www.sec.gov or Frontier’s website at

investor.frontier.com.

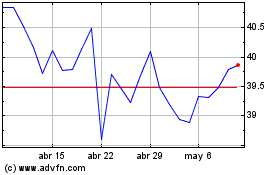

Verizon Communications (NYSE:VZ)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Verizon Communications (NYSE:VZ)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024