WATERS CORP /DE/ NYSE false 0001000697 0001000697 2025-01-13 2025-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 13, 2025

Waters Corporation

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

01-14010 |

|

13-3668640 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

34 Maple Street

Milford, Massachusetts 01757

(Address of Principal Executive Offices) (Zip Code)

(508) 478-2000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

WAT |

|

New York Stock Exchange, Inc. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

Waters Corporation (the “Company”) is furnishing as Exhibit 99.1 to this Current Report on Form 8-K an investor presentation (the “Presentation”) that it will present at the J.P. Morgan Healthcare Conference (the “Conference”) on January 13, 2025, which, along with the subsequent Q&A session, will include high-level commentary on the Company’s business performance. A transcript of the Presentation will be available on the Waters Corporation website, www.waters.com, in the Investors section under the heading “Events & Presentations.”

The information contained in this Current Report on Form 8-K (including Exhibit 99.1) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly provided by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| WATERS CORPORATION |

|

|

| By: |

|

/s/ Amol Chaubal |

| Name: |

|

Amol Chaubal |

| Title: |

|

Senior Vice President and Chief Financial Officer |

|

|

(Principal Financial Officer and Principal Accounting Officer) |

Dated: January 13, 2025

3

Exhibit 99.1 J.P. Morgan 43rd Annual Healthcare Conference Udit Batra,

Ph.D. President & CEO January 13, 2025

Forward-Looking Statements & Non-GAAP Financial Measures This

presentation contains forward-looking statements regarding future results and events, including financial and operational guidance and projected estimates. For this purpose, any statements that are not statements of historical fact may be deemed

forward-looking statements. Words such as “may,” “will,” “expect,” “plan,” “anticipate,” “estimate,” “intend,” “outlook,” and similar expressions (as

well as other words or expressions referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These forward-looking statements may include statements regarding future operating and financial

performance, market growth, success of our products, customer trends, and the acquisition of Wyatt Technology and the realization of the benefits thereof. Forward-looking statements in this presentation are based on Waters’ expectations and

assumptions as of the date of this presentation and are neither predictions nor guarantees of future events or performance. You should not place undue reliance on forward-looking statements, which speak only as of the date hereof and should not be

relied upon as representing the Company’s estimates or views as of any date subsequent to the date of this presentation. Each of these forward-looking statements involves risks and uncertainties, including risks and uncertainties associated

with the Wyatt acquisition, as well as the Company’s ability to realize the expected benefits related to its various cost-saving initiatives, and actual results may differ materially from such forward-looking statements. We discuss various

factors that may cause Waters actual results to differ from those expressed or implied in the forward-looking statements in this presentation, including, but not limited to, those factors relating to the impact on Waters’ operating results

throughout the Company’s various market sectors or geographies from economic, environmental, regulatory, sovereign and political uncertainties, in the sections entitled “Forward-Looking Statements,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations”, and “Risk Factors” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 as filed with the Securities and Exchange

Commission (“SEC”) on February 27, 2024, as updated by the Company’s subsequent filings with the SEC, including the Company’s Quarterly Reports on Form 10-Q. Except as required by law, Waters does not assume any obligation to

update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. To supplement the Company’s financial statements presented on a GAAP basis, the Company has provided certain non-GAAP

financial measures, such as organic constant currency revenue, adjusted operating margin, free cash flow, and non-GAAP diluted earnings per share. Management uses these non-GAAP financial measures to evaluate the Company’s operating

performance in a manner that allows for meaningful period-to-period comparison and analysis of trends in its business. Management believes that such measures are important in comparing current results with prior period results and are useful to

investors and financial analysts in assessing the Company’s operating performance. The non-GAAP financial information presented herein should be considered in conjunction with, and not as a substitute for, the financial information presented

in accordance with GAAP. Management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. The Company’s definition of these non-GAAP financial measures may

differ from similarly titled measures used by others. The non-GAAP financial measures used in this presentation adjust for specified items that can be highly variable or difficult to predict. Investors are encouraged to review the reconciliation of

these non-GAAP measures to their most directly comparable GAAP financial measures using a reconciliation of these measures included in the Appendix to this presentation and which can also be found on the company’s website at:

https://ir.waters.com/. ©2025 Waters Corporation 1

Key Messages Strong Business Model in Attractive Markets Disciplined

Execution of our Growth Strategy Entering Next Phase of Waters Growth ©2025 Waters Corporation 2

Key Messages Strong Business Model in Attractive Markets Disciplined

Execution of our Growth Strategy Entering Next Phase of Waters Growth ©2025 Waters Corporation 3

Waters Serves Regulated Markets with Large Unmet Needs Food &

Academic & Clinical Pharma Environment Materials Government HSD HSD MSD MSD LSD - MSD Multiplex diagnostics High-quality medicines Pure food and water Safe renewable energy Research Endocrinology, Oncology, NBS Biologics, Novel Modalities PFAS,

Nitrosamines Batteries, Electric Vehicles Enabling Scientific Discovery $12B TAM* with 4-6% Long-Term Market Growth Rate * TAM = Total Addressable Market, where $12B of a broader $80B TAM for Analytical Instruments is serviceable by Waters core

business. Growth rates here reflect our internal analysis of historical, long-term market trend data, which are subject to future changes. TAMs and growth rates are estimates based on internal projections and represent forward-looking statements and

are subject to inherent uncertainties that could cause actual results to differ and such differences could be material. Source: Waters data and estimates, consulting data, industry reports, and market research. ©2025 Waters Corporation

4

With a Simple & Repeatable Business Model 170K+ 4 installed base 1

Growth from #1 Liquid Mass new applications & 2 Chromatography Spectrometry Chromatography Data System instrument replacement ~80% of novel drugs Simple, submitted to FDA, EMA, China Compliant, 3 NMPA using Empower Efficient DE ED Peep UNDE

under RS stT andi A NDI ng of NG O F For High Volume CUSTOMER UNMET NEEDS Applications customer unmet needs Dedicated 4 Uniquely design & manufacture chemistry service team 3 in-house >50% of I-Base has plan attached R&D = ~10% of

Innovation leader in 1 product revenues Ranked #1 large-molecule separations 2 by Customers Note: 1. Total R&D spending as a percentage of non-service total company revenue based on trailing twelve-month (TTM) as reported, GAAP data for the

period ended September 28, 2024. 2. According to SDi 2024 Analytical & Life Science Instrumentation Service Market, Waters has the highest service satisfaction score among all instrument vendors, while according to TSIA, 2024 tNPS score over 20

points higher than benchmark average. 3. According to internal analysis, ~80% of the drugs filed with the FDA, EMA, and China National Medical Products Administration (NMPA) in 2023 were done so using our Empower software. Source: Waters data and

estimates. 4. Installed base data are estimates based on internal analysis and include Wyatt. ©2025 Waters Corporation 5

Resulting in Attractive Growth & Industry-Leading Profitability

Leads to Sales Recurrence Downstream Presence NYSE:WAT & Best-in-Class Financials 5 $2.9B Adj. Operating Margin ( T T M) 6% 2 Total Revenue (TTM) 1 Average WAT 30.7% 2009-2019 Peer 1 26.4% 59.7% 2 Gross Margin (TTM) Peer 2 15.9% Peer 3 15.3%

30.7% 3 Adj. Operating Margin (TTM) Peer 4 28.4% Peer 5 30.0% 23% Serving High Volume, WAT Historical 4 Peer 6 22.5% 5-yr Avg FCF as % of Sales Long-Term Growth Regulated Applications Note: 1. Approximate average growth rates of year-over-year,

total constant currency growth from 2009 to 2019; 2. Based on trailing twelve-month (TTM) as reported, GAAP data for the period ended September 28, 2024; 3. Operating margin results are in adjusted, non-GAAP operating margin percentage terms based

on trailing twelve-month non-GAAP data for the period ended September 28, 2024. 4. FCF = Free Cash Flow where data presented is a 5-year average of annual free cash flow as a % of as-reported, GAAP revenues from 2019-2023. 5. Compares Waters

trailing twelve-month adjusted operating margin performance as of 3Q24 to that of the prior year equivalent period to total company performance of other U.S. companies in the life science tools peer group, for whom complete public data is available

throughout the relevant time periods required to effect the analysis. See reconciliations of the non-GAAP measures to the most directly comparable GAAP measures included in the Appendix of this presentation and available on the Company’s

website at: https://ir.waters.com/. Source: Waters Corporation data, publicly available data. $7B Total Accessible Market ©2025 Waters Corporation 6

High Pharma Exposure with Balanced Geographic Footprint 1 Waters $2.9B

Revenue (TTM) % of Total 11% 29% 33% 38% 43% End Products & 1 Geography 1 1 31% Markets Services 58% 38% 19% Academic & Pharma Industrial Asia Americas Europe Instruments Consumables Service Government Note: 1. Revenue data is based on total

trailing twelve-month (TTM) as reported, GAAP revenues for the period ended September 28, 2024 (100% = $2.9B). ©2025 Waters Corporation 7

With ~75% of Revenue Tied to Resilient Growth Drivers Pharma Discovery

Academic Pharma Academic & Govt. & Govt. Development 11% Materials & Pharmaceuticals Chemicals Waters $2.9B of which >50% is 58% Revenue (TTM) 3 Manufacturing QA/QC Batteries & 1 % of Total Electronics 31% Industrial & Applied

Pharma QA/QC of which ~50% is Food & Environmental Food & Environmental Clinical 2 REVENUE TIED TO RESILIENT GROWTH DRIVERS Note: 1. Overall and reported end market segment revenue data is based on total trailing twelve-month (TTM) as

reported, GAAP revenues for the period ended September 28, 2024 (100% = $2.9B). 2. Depicted weighting to identified resilient growth drivers within each reported end market segment is based on waters internal estimates, analysis and approximations.

3. Refers to non-clinical pharma end market segment revenue. Not to scale. ©2025 Waters Corporation 8

Our Volume Scales with the Molecule Pharma growth is correlated to

production volume of late-stage or commercial drugs Spec'd into testing Defining critical quality Volume scales with ongoing attributes & process with increased regulatory data control parameters manufacturing submission Discovery &

Early-Stage Pre-Clinical Late-Stage Development Manufacturing Development Generics & Biosimilars ©2025 Waters Corporation 9

Key Messages Strong Business Model in Attractive Markets Disciplined

Execution of our Growth Strategy Entering Next Phase of Waters Growth ©2025 Waters Corporation 10

Transformation Plan Launched in 2020 Regain Revitalize Enter Faster

Commercial Innovation Growth Momentum Adjacencies ©2025 Waters Corporation 11

That we Stuck to Throughout a Volatile Market Environment 2020 2021

2022 2023 2024 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 45% Instrument Recurring 40% Org. CC Rev. Growth Org. CC Rev. Growth 26% 21% 12% 12% 10% 10% 4% 1% -1% -2% -3% -13% -17% -19% -20% -23% -25% COVID-19 New Growth Initiatives

Supply Challenges Economic Slowdown Return to Growth 1 Instrument Replacement 2 Service Attachment 3 Contract Organizations 4 eCommerce Adoption 5 Launch Excellence Note: Org. CC Rev. Growth = Organic Constant Currency Revenue Growth; growth rates

are versus prior year Note: Growth rates here reflect the analysis of Waters historical, quarterly non-GAAP sales data which is all publicly available, including the relevant GAAP to Non-GAAP reconciliations for each quarter, available on the

Company’s website at: https://ir.waters.com/ ©2025 Waters Corporation 12

1) Executed Commercial Initiatives with Clear Results Now 2019 Strong

progress with ~15% of lagged Instrument Replacement 2015-19 replacement opps remaining 43% >50% Service Plan Attachment of Active I-Base of Active I-Base 20% >40% eCommerce Adoption of Chemistry Rev of Chemistry Rev 15% >25% Contract

Organizations of Pharma Rev of Pharma Rev Podium position in LC, MS, Chemistry Innovation Launches w/ new products augmenting growth ©2025 Waters Corporation 13

2) Innovation Setting New Standards Back to rich history of new

category creation with product launches Chemistry Liquid Chromatography Mass Spectrometry Bioseparations Next-Gen Flagship Enhanced Detection Sharper Peaks World’s & Minimal Most Sensitive Smartest HPLC Statistical Noise Tandem Quad

Eliminates common user Up to 15x better sensitivity 17x faster, 12x more sensitive errors by up to 40% while 45% more compact large molecule separation Note: Estimates on this slide are comprised of internal analysis, consulting data, industry

reports and internal market research which are subject to change. ©2025 Waters Corporation 14

3) Expanded into Faster Growing Segments $12B TAM +$7B TAM Strong Core

Position Faster-Growing Adjacencies Pharma QA/QC Bio-separations Late-Stage Drug Development Bioanalytical Characterization Food and Environmental Safety LC-MS in Diagnostics Clinical Diagnostics Battery Testing Materials Testing MSD – HSD

Markets HSD – DD Markets Note: $12B Core TAM + $7B Higher Growth Adjacencies TAM = $19B TAM with MSD-HSD growth. MSD = Mid single-digit., HSD = High single-digit., DD = Double-digit. Market growth rates are Waters internal estimates based on

long-term historical data for more mature markets as well as current and recent historical growth rate data for more nascent, high-growth markets. These estimates are comprised of consulting data, industry reports and market research which are

subject to change. Please refer to the Forward-Looking Statements & Non-GAAP Financial Measures on page 1. ©2025 Waters Corporation 15

Bioseparations: Deliberate Focus is Yielding Results % Chemistry

Revenue STRONG CHEMISTRY LAUNCH SUCCESS 1 from Large Mol 40% +45% YTD-24 1 Y/Y SALES GROWTH EXPANDING INNOVATION TO NOVEL MODALITIES 20% RECENT CHEMISTRY LAUNCH EXAMPLES AUG 2023 OCT 2023 APR 2024 OCT 2024 xBridge Premier OligoWorks SPE GTxResolve

Launched first in- SEC columns for Workflow & Kits Premier SEC house developed AAV-based for LC-MS based columns for enzymes & Gene Therapy bioanalysis of cell & gene, reagents for novel Applications oligonucleotides mRNA & LNPs

modalities 2019 Now ~70% of our Chemistry R&D is Now Spent on Large Mol Note: 1. Approximation based on pharma segment revenue for the first nine months of 2024. 2. Waters MaxPeak chemistry sales grew 45% in organic constant currency for the

first nine months of 2024 compared with the first nine months of 2023. ©2025 Waters Corporation 16

Building Compliant Informatics for BioAnalysis F D A / E M A / N M P A

SM Small mol data SM LM LM LM LM LM LM Large mol data … Mass Capillary Mass Light UV LC Others Detection Electrophoresis Spectrometry Scattering Developing Bioanalytical Characterization w/ Mix of Innovation, Partnerships, M&A ©2025

Waters Corporation 17

Clinical & Batteries: High Volume Business Model Developing 1

Double-Digit Growth with End-to-End LC-MS for CDx RE CE NT L A UNCHE S : 1. Instruments: Xevo TQ Absolute IVD System for trace-level analytes 2. Informatics: QUAN Review on waters_connect 3. Consumables: IVD Reagents for Endocrinology &

Immunosuppressant Drugs Supporting Analytical Workflows with New Launches RE CE NT L A UNCHE S : 1. Instruments: TA Battery Cycler Microcalorimeter & Rheo-IS Accessory 2. Informatics: TAM Assistant integrated software platform 3. Consumables:

TGA Smart Seal Pan novel consumable Note: 1. According to internal analysis, Waters average clinical revenue grew low-double-digits on average, based on FY-21, FY-22, FY-23 organic, constant currency growth rates. ©2025 Waters Corporation 18

Batteries Clinical Dx

All While Delivering Strong Operational Performance W ATERS RESPONSE

GROSS MARGIN Volume Headwinds +210bps 1 TTM (as of 3Q24) vs TTM (as of 3Q22) 2023 - 24 FX CHA L L E NG I N G M A RKE T Headwinds EN VI R O N M EN T 2 ADJ. OPERATING MARGIN Inflationary +80bps Pressures Productivity Proactive Cost 1 Pricing TTM (as

of 3Q24) vs TTM (as of 3Q22) Alignment Delivering on margin expansion promise through challenging market conditions… Note: 1. Compares trailing twelve-tonth (TTM) margin percentage levels as of 3Q24 to levels for the equivalent 12-month

preceding time-period as of 3Q22; 2. Operating margin results and percentage growth are in adjusted non-GAAP operating margin percentage terms. See reconciliations of the non-GAAP measures to the most directly comparable GAAP measures included in

the Appendix of this presentation and available on the Company’s website at: https://ir.waters.com/. ©2025 Waters Corporation 19

All While Delivering Strong Operational Performance W ATERS RESPONSE

Gross Margin Adj. Operating Margin (TTM-3Q24 vs TTM-3Q22) (TTM-3Q24 vs TTM-3Q22) 2.1 Volume 0.8 WAT Headwinds -0.4 -0.7 Peer 1 2023 - 24 -3.7 Peer 2 -1.1 FX CHA L L E NG I N G M A RKE T Headwinds -0.9 -4.7 Peer 3 EN VI R O N M EN T -1.2 -4.0 Peer 4

Inflationary 0.4 Peer 5 0.9 Pressures Productivity Proactive Cost Pricing Alignment -4.0 -3.7 Peer 6 …resulting in differentiated margin results versus peers Note: Analysis compares Waters trailing twelve-month (TTM) GAAP gross margin and

adjusted non-GAAP operating margin percentage levels to levels for the equivalent 12-month preceding time-period as of 3Q22 to total company performance of other U.S. companies in the life science tools peer group, for whom complete public data is

available throughout the relevant time periods required to effect the analysis. Source: publicly available data, Waters internal company analysis. ©2025 Waters Corporation 20

1 Transformation Delivered Top TSR Regain Commercial Revitalize Enter

Faster Growth Momentum Innovation Adjacencies Executed key commercial Back to rich history of Organic & inorganic growth initiatives new category creation investment yielding results Leader in Downstream, High-Volume = Life Science Applications

Note: 1. When comparing total return of WAT shares versus life science tools peers between 09/01/20 and 12/31/24; Source: FactSet ©2025 Waters Corporation 21

Key Messages Strong Business Model in Attractive Markets Disciplined

Execution of our Growth Strategy Entering Next Phase of Waters Growth ©2025 Waters Corporation 22

At Inflection Point as End-Mkts have Returned to Positive Growth Total

3Q24 Y/Y Sales Growth in Constant Currency Ex. China Inc. China Pharma +5% +3% Non-Pharma +5% +5% 3Q24 Total +5% +4% + Instruments have Returned to Growth after 7 consecutive quarters of LC decline Note: A reconciliation of these non-GAAP financial

measures to the most directly comparable GAAP financial measures is included in the Appendix to this presentation and is also available on the Company’s website at: https://ir.waters.com/. ©2025 Waters Corporation 23

Growth Catch-Up Opportunity Ahead in Near-Term New Replacement Cycle is

Developing Pre-Covid Historical Growth is MSD Instruments; HSD Recurring due to Aged Installed Base 15% 6% 2 Org. CC 5-Yr CAGR (vs. 19) Total 1 Average Total Instruments 1% 5% 2009-2019 5% LC 0% Avg MS 2% -5% Meanwhile, our Recurring Revenue has

Remained Highly Resilient 15% 10% 3 Recurring Revenue Growth: 2020-2024 10% 7% Avg 0% 5% Historical Long-Term 0% FY-20 FY-21 FY-22 FY-23 YTD-24 Growth 2 Waters % Revenue Growth (Y/Y Constant Currency 2010-19) Note: MSD = Mid-single-digit., HSD =

High single-digit. 1. Approximate average growth rate of year-over-year, total constant currency growth between 2009 and 2019. 2. Approximate compound average growth rate of year-over-year organic constant currency total instrument sales growth from

2019 to 2024 as of 3Q24, where 2024 growth reflect the expected instrument growth implied in the Company’s full-year guidance as disclosed in the Company’s press release dated November 1, 2024, available on the Company’s website

at: https://ir.waters.com/, which is subject to change. 3. Table shows historical year-over-year organic constant currency growth for Total Recurring sales for full-year 2020, 2021, 2022, 2023 and year-to-date growth for the first nine months of

2024. Growth rates here reflect our internal analysis of Waters historical, annual non-GAAP sales data which is publicly available, including the relevant GAAP to Non-GAAP reconciliations for each year. Certain content on this slide may represent

forward-looking statements which are subject to inherent uncertainties that could cause actual results to differ and such differences could be material. Please refer to the Forward-Looking Statements & Non-GAAP Financial Measures on Page 1.

©2025 Waters Corporation 24 Recurring Instruments 10 11 12 13 14 15 16 17 18 19

Plus, Well-Positioned for Long-Term Growth Pre-Covid Historical Growth

is MSD Instruments; HSD Recurring Incremental Growth Vectors vs. Pre-Covid Trends 15% 6% Higher Volume Growth 1 1 Average § Faster Prescription growth 5% 2009-2019 (GLP-1s, Generics w/ patent cliff) 5% Avg § Regulations (PFAS) New

Applications 2 -5% § Biologics & novel modality high volume testing is new market growth area since 2019 10% Above Historic Pricing 3 § Expected +100bps 7% long-term tailwind Avg 0% Historical Future Long-Term Long-Term Growth Growth

Potential Waters % Revenue Growth (Y/Y Constant Currency 2010-19) Note: MSD = Mid-single-digit., HSD = High single-digit. 1. Approximate average growth rate of year-over-year, total constant currency growth between 2009 and 2019. Growth rates here

reflect our internal analysis of Waters historical, annual non-GAAP sales data which is publicly available, including the relevant GAAP to Non-GAAP reconciliations for each year. This data also represents forward-looking statements and are subject

to inherent uncertainties that could cause actual results to differ and such differences could be material. Please refer to the Forward-Looking Statements & Non-GAAP Financial Measures on Page 1. ©2025 Waters Corporation 25 Recurring

Instruments 10 11 12 13 14 15 16 17 18 19

Sustained Contribution from Idiosyncratic Growth Drivers GLP-1s 1 New

therapeutic areas like GLP-1s expected +30bps / yr to accelerate QA/QC testing Avg annual growth contribution 2024-30 from QA/QC of GLP-1 drugs PFAS PFAS detection expanding into food & materials, 2 +30bps / yr while growth in water testing

continues PFAS testing is a $400M global market, 3 growing ~20% India Strong volume growth dynamics, driven by 4 +70-100bps / yr patent cliff, aging global population Strong market fundamentals support continued +DD avg annual growth Note: 1. Based

on internal analysis and estimates where the QA/QC testing of GLP-1 related drugs is expected to contribute an average 30bps growth tailwind annually for Waters from 2024 to 2030. 2. Based on internal analysis and estimates where the PFAS related

testing is expected to contribute an average 30bps growth tailwind annually in the near-term. 3. Total Addressable Market (TAM) sizing and market growth rates are Waters internal estimates incorporating internal analysis, consulting data, industry

reports and market research, and are based on current and recent historical growth rate data for more nascent, high-growth markets, all of which are subject to change. 4. Based on internal analysis and estimates where total India geographic sales

are expected to contribute an average 70-100bps growth tailwind annually for Waters in the near-term. This data also represents forward-looking statements and are subject to inherent uncertainties that could cause actual results to differ and such

differences could be material. Please refer to the Forward-Looking Statements and Non-GAAP Financial Measures on page 1. ©2025 Waters Corporation 26 Generics PFAS Therapies

Building Exceptional Position for Large Molecule Testing Liquid

Chromatography Linked Detectors UV Mass Spec MALS Solvent Reservoir Solving customer large molecule challenges Degasser § Formulation Chemistry Columns development § Characterization M E A S U R EM EN T M E A S U R EM EN T M E A S U R EM

EN T Pump Filter§ Raw materials testing Titer Sequence Size § Process control Aggregation Charge variants Molecular weight § QA/QC Autosampler Post-translational Aggregation modifications Empty/Full ratio for AAV and LNP +40bps

Expected LT Core Growth Accretion from Wyatt Note: Estimates on this slide are comprised of consulting data, industry reports and internal market research which are subject to change. This data also represents forward-looking statements and are

subject to inherent uncertainties that could cause actual results to differ and such differences could be material. Please refer to the Forward-Looking Statements and Non-GAAP Financial Measures on page 1. ©2025 Waters Corporation 27

Expanding our Growth Initiatives for Recurring Revenue Chemistry

Informatics Service PLAN ATTACHMENT DIGITAL COMMERCE ADOPTION SCALING POSITION & AMBITIONS driving incremental spend Compliant data for large ~40% +750bps Now Goal is 55% molecule workflows expansion since 2019 BI O S E P ARATI O NS NEW VALUE

-ADD FEATURES 43% 55% of chemistry R&D toward Advanced fleet analytics 2019 Goal 70% large molecule separations AI data insights New Goal New Goal Goal Grow Plan Attachment to 50% of pharma chemistry revenue Accelerate growth to HSD 55% of

Active Installed Base from large molecule separations from MSD historical Note: Data referenced on this slide represents a combination of historical analysis based on internal Waters estimates and forward-looking statements which are subject to

inherent uncertainties that could cause actual results to differ and such differences could be material. Historical results are not indicative of future performance. ©2025 Waters Corporation 28

Industry-Leading Profitability but Far from “Peak Margins”

Long-Term Opportunity for Strong Financial Profile Future Annual Margin Expansion due to downstream presence high-volume, regulated, recurring Volume Leverage 1 59.7% 5% revenue growth = +50bps to Operating Margin Gross Margin (TTM) Pricing &

Mix 2 +25bps expected contribution to annual adj. Operating Margin 30.7% Productivity Initiatives 1 3 Adj. Operating Margin (TTM) +25bps expected contribution to annual adj. Operating Margin +100bps of Annual Adj. Operating Margin Expansion 23% -

Reinvesting 70bps into High Growth Adjacencies 2 FCF as % of Sales = +20-30bps Annual Average Expansion 5-yr Avg (19-23) +300bps OPM Opportunity from Productivity Initiatives over next 8-10 years Note: 1. Operating Margin results are in adjusted,

non-GAAP operating margin percentage terms based on trailing twelve-month non-GAAP data for the period ended September 28, 2024. See reconciliations of the non-GAAP measures to the most directly comparable GAAP measures included in the Appendix of

this presentation and available on the Company’s website at: https://ir.waters.com/. 2. FCF = Free Cash Flow where data presented is a 5-year average of annual free cash flow as a % of as-reported, GAAP revenues from 2019-2023. Source: Waters

Corporation data. Margin expansion estimates are at constant currency. All data are estimates based on internal projections and represent forward-looking statements and are subject to inherent uncertainties that could cause actual results to differ

and such differences could be material. Please refer to the Forward-Looking Statements and Non-GAAP Financial Measures on page 1. ©2025 Waters Corporation 29

Uniquely Positioned for M&A Unlocking additional vector of EPS

accretion w/ new proven capabilities FCF Clear Value Complementary Generation Creation Strong Free Cash Flow Focused on growth Scope of current portfolio Conversion can allow for opportunities with sound may offer advantaged rapid de-levering.

industrial logic and with position to complete deals financial discipline. even more quickly in today’s regulatory environment. Note: This data also represents forward-looking statements and are subject to inherent uncertainties that could

cause actual results to differ and such differences could be material. Please refer to the Forward-Looking Statements and Non-GAAP Financial Measures on page 1. ©2025 Waters Corporation 30

Putting it all Together Raising the bar above ‘6+2+2’ with

new vectors of EPS growth accretion Historic EPS Growth Algorithm Future Potential + Volume + Large Mol + Pricing + Adjacencies Historic L.T. Margin Capital EPS LT EPS Sales Growth Expansion Deployment Growth Growth Potential Note: Growth rates here

reflect our internal analysis of Waters long-term historical sales data which is publicly available. Future long-term growth rate estimates are for organic growth in constant currency with estimates comprised of internal analysis, consulting data,

industry reports, and market research, which are subject to change. Margin expansion estimates are at constant currency. All data are estimates based on internal projections and represent forward-looking statements and are subject to inherent

uncertainties that could cause actual results to differ and such differences could be material. Please refer to the Forward-Looking Statements and Non-GAAP Financial Measures on page 1. ©2025 Waters Corporation 31

Key Messages Strong Business Model in Attractive Markets Disciplined

Execution of our Growth Strategy Entering Next Phase of Waters Growth ©2025 Waters Corporation 32

Register Now for our 2025 Investor Day EVENT REGISTRATION &

SCHEDULE In-Person (Full Event) Quick RSVP for VISIT either option here: ir.waters.com 2025 Investor Day Under ‘Events’ or click here “A New Era of Growth” Virtual (Main Session Only) VISIT Wednesday, March 5, 2025 Please

reach out via ir.waters.com investor_relations@waters.com New York City with any questions Under ‘Events’ or click here ©2025 Waters Corporation 33

Appendix GAAP to Non-GAAP Reconciliations

GAAP to Non-GAAP Reconciliations Operating Income Reconciliation of

GAAP to Adjusted Non-GAAP Reconciliation of Actual GAAP Cashflow to Non-GAAP Free Cash Flow Fiscal Years Trailing Twelve-Months (TTM) Ended September 28, 2024 Ending December 31, 2019 - 2023 Operating Operating Income (in millions USD) 2023 2022

2021 2020 2019 (in thousands USD) Income Percentage Net cash provided by ops - GAAP 602.8 611.7 747.3 790.5 643.1 Trailing Twelve-Months Adjustments: GAAP 798,313 27.5% Additions to property plant, equipment, and Adjustments: (160.6) (175.9) (161.3)

(172.4) (163.8) software capitalization Purchased intangibles amortization (a) 47,485 1.6% Major Facility Renovations 15.6 32.1 49.2 69.8 67.6 Restructuring costs and certain other items (b) 11,716 0.4% Tax Reform Payments 72.1 38.5 38.5 38.5 29.1

Acquisition related costs (c) 649 0.0% Other One-Time Items (1.5) (0.6) 1.8 - - Payment of acquired Wyatt liabilities (f) 25.6 - - - - Litigation provision and settlement (d) 11,568 0.4% Free Cash Flow - Non-GAAP 554.0 505.7 675.5 726.4 576.0

Retention bonus obligation (e) 22,902 0.8% 5-Year Avg as % of Sales 23% Adjusted Non-GAAP * 892,633 30.7% Q3 2024 YTD (a) The purchased intangibles amortization, a non-cash expense, was excluded to be consistent with how GAAP 534,090 25.6%

management evaluates the performance of its core business against historical operating results and the operating Adjustments: results of competitors over periods of time. (b) Restructuring costs and certain other items were excluded as the Company

believes that the cost to consolidate Purchased intangibles amortization (a) 35,337 1.7% operations, reduce overhead, and certain other income or expense items are not normal and do not represent Restructuring costs and certain other items (b)

10,680 0.5% future ongoing business expenses of a specific function or geographic location of the Company. Litigation provision and settlement (d) 11,568 0.6% (c) Acquisition related costs include all incremental expenses incurred, such as advisory,

legal, accounting, tax, valuation, and other professional fees. The Company believes that these costs are not normal and do not Retention bonus obligation (e) 15,268 0.7% represent future ongoing business expenses. Adjusted Non-GAAP 606,943 29.1%

(d) Litigation provisions and settlement gains were excluded as these items are isolated, unpredictable and not Q4 2023 expected to recur regularly. (e) In connection with the Wyatt acquisition, the Company started to recognize a two-year retention

bonus obligation GAAP 264,223 32.2% that is contingent upon the employee’s providing future service and continued employment with Waters. The Adjustments: Company believes that these costs are not normal and do not represent future ongoing

business expenses Purchased intangibles amortization (a) 12,148 1.5% (f) In connection with the Wyatt acquisition, the Company assumed certain obligations of Wyatt and paid those obligations immediately upon closing the transaction. The Company

believes that the assumed obligations do not Restructuring costs and certain other items (b) 1,036 0.1% represent future ongoing business expenses. Acquisition related costs (c) 649 0.1% Retention bonus obligation (e) 7,634 0.9% Adjusted Non-GAAP

285,690 34.9% ©2025 Waters Corporation 35

Q3 2024 Sales – Pharmaceutical & Non-Pharmaceutical End

Markets Reconciliation of GAAP to Adjusted Non-GAAP % Growth Impact of % Growth (in millions USD) 2024 2023 Reported Currency Constant Currency Total Company Pharmaceutical 430.1 421.5 2% (1%) 3% End Markets Non-Pharma 310.2 290.2 7% 2% 5% Total

Company Sales – Q3 QTD 740.3 711.7 4% 0% 4% % Growth Impact of % Growth (in millions USD) 2024 2023 Reported Currency Constant Currency Ex-China Pharmaceutical 384.9 369.3 4% (1%) 5% End Markets Non-Pharma 255.4 240.3 6% 1% 5% Total Sales

Ex-China – Q3 QTD 640.3 609.6 5% 0% 5% The Company believes that referring to comparable constant currency growth rates is a useful way to evaluate the underlying performance of Waters Corporation's net sales. Constant currency growth, a

non-GAAP financial measure, measures the change in net sales between current and prior year periods, excluding the impact of foreign currency exchange rates during the current period. ©2025 Waters Corporation 36

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

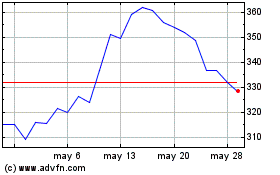

Waters (NYSE:WAT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Waters (NYSE:WAT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025