Altius Reports Royalty Revenue of $17.5M & $66.9M for the Quarter & Year Ended December 31, 2018 & Provides Revenue Guidance ...

17 Enero 2019 - 6:00AM

Business Wire

Altius Minerals Corporation (TSX: ALS; OTCQX:

ATUSF) (“Altius” or the “Corporation”) reports that it

will release audited financial results for its three month and

twelve month period ended December 31, 2018 on March 12, 2019 after

the close of market, with a conference call to follow March 13,

2019 at 9:00 am ET.

Altius expects to report attributable royalty revenue1 of

approximately $17.5 million ($0.41 per share) for the fourth

quarter of 2018, compared to $17.1 million ($0.40 per share) in Q3

2018 and to $13.7 million ($0.32 per share) in the two month period

ended December 31, 2017, when Altius was transitioning to a

December year end. Full year attributable royalty revenue is

expected to be approximately $66.9 million ($1.56 per share) which

compares to $46.7 million ($1.08 per share) during the abbreviated

previous year comparable period.

Summary of attributable royalty revenue

Three months ended

December 31,

12 months ended

December 31,

8 months ended

December 31,

(in thousands of Canadian dollars) 2018

2018 2017 Base metals 7,388 29,209 20,808

Potash 3,695 14,023 7,365 Thermal (electrical) coal 3,064 13,119

9,465 Iron ore (1) 2,097 5,911 6,116 Metallurgical coal 859 3,227

1,466 Other royalties and interest 388

1,434 1,527

Attributable royalty revenue

17,491 66,923

46,747 See non-IFRS measures section of this MD&A

for definition and reconciliation of attributable revenue (1) LIF

dividends received

The results, which are consistent with the mid range of

guidance, were positively impacted by higher potash prices and

production volumes and higher metallurgical coal volumes. These

factors were negatively offset by the election of Labrador Iron Ore

Royalty Corporation (LIORC) to withhold an unusual amount of its

free cash flows from shareholder dividends during the second half

of the year, and by lower base metal prices.

Altius anticipates $67-72 million in attributable royalty

revenue in 2019, which assumes current commodity prices and

incorporates information received from mine operators with regards

to expected production volumes where provided and assumptions based

upon historical production rates and other publicly available

information in other cases.

At year end, the Corporation had approximately $28 million in

cash, $115 million in debt, and $139 million in investments, which

are primarily the position in LIORC and the junior equity portfolio

as detailed in the press release dated January 10, 2019.

More detail on royalty revenue, costs and outlook will be

provided in the upcoming year end disclosure.

Year End Financials Conference Call and Webcast

Information:

A conference call will be held on Wednesday, March 13, 2019,

starting at 9:00 a.m. EST to further discuss the quarter and year

end results and guidance for 2019. To participate in the conference

call, use the following dial-in numbers or join the webcast on-line

as detailed below.

Time: 9.00 a.m. EST on Wednesday, March 13,

2019Dial-In Numbers: +1 647-427-2311 (Direct), or

1-866-521-4909(US/Canada)Pass code: None required, but

provide title of callConference Title: Altius December 31,

2018 Q4 and year end resultsWebcast URL: Altius Q4 and

Year End 2018 webcast

The call will be webcast and archived on the Corporation’s

website for a limited time.

1 Attributable royalty revenue is a non‐IFRS measure and does

not have any standardized meaning prescribed under IFRS. For a

detailed description and examples of the reconciliation of

this measure, please see the Corporation’s MD&A disclosures for

prior quarterly and annual reporting periods, which are available

at http://altiusminerals.com/financial-statements

About AltiusAltius’ directly and indirectly held

diversified royalties and streams generate revenue from 15

operating mines. These are located in Canada and Brazil and produce

copper, zinc, nickel, cobalt, iron ore, potash and thermal

(electrical) and metallurgical coal. The portfolio also includes

numerous pre-development stage royalties covering a wide spectrum

of mineral commodities and jurisdictions. It also holds a large

portfolio of exploration stage projects which it has generated for

deal making with industry partners that results in newly created

royalties and equity and minority interests.

Altius has 42,851,726 common shares issued and outstanding that

are listed on Canada’s Toronto Stock Exchange. It is a member of

both the S&P/TSX Small Cap and S&P/TSX Global Mining

Indices.

Forward-Looking Information

This news release contains forward‐looking information. The

statements are based on reasonable assumptions and expectations of

management and Altius provides no assurance that actual events will

meet management's expectations. In certain cases, forward‐looking

information may be identified by such terms as "anticipates",

"believes", "could", "estimates", "expects", "may", "shall",

"will", or "would". Although Altius believes the expectations

expressed in such forward‐looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected. Mining exploration and development

is an inherently risky business. In addition, factors that could

cause actual events to differ materially from the forward-looking

information stated herein include any factors which affect

decisions to pursue mineral exploration on the relevant property

and the ultimate exercise of option rights, which may include

changes in market conditions, changes in metal prices, general

economic and political conditions, environmental risks, and

community and non-governmental actions. Such factors will also

affect whether Altius will ultimately receive the benefits

anticipated pursuant to relevant agreements. This list is not

exhaustive of the factors that may affect any of the

forward‐looking statements. These and other factors should be

considered carefully and readers should not place undue reliance on

forward-looking information. Altius does not undertake to update

any forward-looking information contained herein except in

accordance with securities regulation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190117005320/en/

Altius Minerals CorporationFlora

WoodorBen

Lewis1.877.576.2209flora@altiusminerals.com

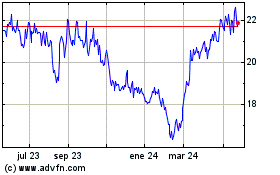

Altius Minerals (TSX:ALS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

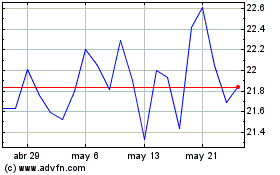

Altius Minerals (TSX:ALS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024