AFRICA OIL ANNOUNCES INVESTMENT IN IMPACT OIL AND GAS

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES

OR FOR DISSEMINATION IN THE UNITED STATES

Africa Oil Corp. (TSX: AOI) (OMX: AOI) (“Africa Oil”, “AOC”

or the “Company”) is pleased to announce that it has entered into

agreements that will provide it with an approximately 25.2% equity

interest in Impact Oil and Gas Limited (“Impact”), a private UK

company with exploration assets in South and West Africa.

Investment in Impact Oil and Gas

The Company has entered into a subscription

agreement (the “Subscription Agreement”) with inter alia Impact

providing for the purchase by AOC of 59,681,539 ordinary shares

(the “Shares”) and 29,840,769 ordinary share purchase warrants (the

“Warrants”) for an aggregate subscription price of approximately

US$15 million. The Warrants have an exercise price of £0.25 per

Share and an expiry date of April 27, 2021, subject to early

expiration in the event of a liquidity event in respect of Impact.

The Warrants are subject to customary adjustment provisions in

respect of anti-dilution matters. The Subscription Agreement also

provides that during the nine (9) month period after closing of the

transactions contemplated by the Subscription Agreement, AOC may

acquire, at the election of either AOC or Impact, an additional

9,946,923 Shares and 4,973,461 Warrants for an aggregate

subscription price of approximately US$2,500,000.

The Company has also entered into a share

purchase agreement (the “Helios SPA”) with Helios Natural Resources

2 Ltd. (“Helios”) to acquire 70,118,381 Shares and 15,529,731

warrants currently held by Helios in the capital of Impact (the

“Helios Warrants”) in exchange for 13,946,545 common shares of AOC

(the “AOC Shares”). Upon completion of the transactions

contemplated by the Helios SPA, the Helios Warrants will have an

exercise price of £0.18 per Share for a 12 month period, and if not

exercised during such period, £0.25 thereafter and the same expiry

date as the Warrants. The Helios Warrants are also subject to

customary adjustment provisions in respect of anti-dilution

matters.

Finally, the Company has entered into an

investors agreement (“Investors’ Agreement”) with Impact and

certain other shareholders of Impact. The Investors’ Agreement

provides AOC with the right to nominate up to two members of the

board of directors of Impact (which may consist of a maximum of

nine (9) members) based on certain share ownership thresholds and

consent rights with respect to certain fundamental matters in

respect of Impact, including the future issuance of securities of

Impact. The rights pursuant to the Investors’ Agreement will cease

upon AOC holding less than 10% of the Shares.

Africa Oil CEO Keith Hill commented, “We are

very pleased to acquire a significant interest in Impact which

holds a highly attractive portfolio in West and South Africa that

has the potential for major discoveries in the short and medium

term. Impact has done a great job of acquiring these

properties at modest prices and bringing in major oil companies to

fund upcoming drilling and seismic programs. This investment

is a strong complement to our existing holdings in Africa Energy

and ECO Atlantic and results in Africa Oil having exposure to some

of the most exciting exploration plays in Africa to complement our

Kenya development project. The structure of these investments

allows us to preserve the necessary cash to ensure we can get to

first oil without issuing additional equity.”

The transactions contemplated by the

Subscription Agreement and Helios SPA are subject to certain

customary conditions to closing, including approval of the Toronto

Stock Exchange and shareholder approval of Impact. The Helios SPA

is subject to concurrent closing of the transactions contemplated

by the Subscription Agreement, provided that the transactions

contemplated by the Subscription Agreement are not conditional on

the transactions contemplated by the Helios SPA.

The transactions contemplated by the Helios SPA

constitute a “related party transaction” within the meaning of

Multilateral Instrument 61-101- Protection of Minority Security

Holders in Special Transactions (“MI 61-101”) as Helios is a

“related party” of AOC because it beneficially owns or controls

more than 10% of the outstanding AOC Shares. The Company is relying

on the exemptions from the formal valuation and minority approval

requirements of MI 61-101 contained in subsections 5.5(a)(iv) and

5.7(1)(a), respectively, of MI 61-101, as neither the fair market

value of the subject matter of, nor the fair market value of the

consideration for, the transactions contemplated by the Helios SPA

exceeds 25 percent of AOC’s market capitalization. The AOC Shares

to be issued to Helios will have a hold period in accordance with

applicable Canadian securities law for a period of four (4) months

and one day from their date of issuance.

PillarFour Securities LLP is acting as financial

advisor and Pareto Securities is acting as strategic advisor to

Africa Oil in connection with the transactions described herein.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended, (the “U.S. Securities Act”) or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

About Africa Oil Corp.

Africa Oil Corp. is a Canadian oil and gas

company with assets in Kenya and Ethiopia, including the South

Lokichar Basin (25% working interest in Blocks 10BB and 13T), where

the Company and its Joint Venture Partners are undertaking

activities aimed at sanctioning development. The Company is listed

on the Toronto Stock Exchange and on Nasdaq Stockholm under the

symbol "AOI".

About Impact Oil and Gas Limited

Impact Oil and Gas acquired its first asset, the

Tugela South Exploration Right, offshore South Africa in 2011 and

has subsequently expanded its asset base across the offshore

margins of South and West Africa. It has since partnered with

ExxonMobil and Statoil (South Africa), CNOOC (AGC – between Senegal

and Guinea Bissau) and Total (Namibia and South Africa). It is

currently seeking a partner in its Gabonese assets. The company’s

current portfolio covers a combined area of over 90,000 km²

(gross).

Impact is a pure exploration company with a

strategic focus on large scale, mid to deep water plays of

sufficient size to be of interest to major companies. Its

management is committed to further expanding this attractive

portfolio of exploration assets and securing these large

independent and major oil companies as partners. The company’s

objective is to build a world class portfolio, in a number of

different geologic and geographic locations to minimise risk and

with a large enough portfolio to ultimately enhance the chance of

drilling success. Management believes that by doing so, and by

having oil industry partners validate its exploration concepts and

ideas, it aims to deliver substantial shareholder value in the

medium to longer term. Impact is currently privately owned.

Additional Information

The information in this release is subject to

the disclosure requirements of the Company under the EU Market

Abuse Regulation and the Swedish Securities Market Act. This

information was publicly communicated on February 7, 2018 at 3:00

a.m. Eastern Time.

Cautionary Language

Certain statements made and information

contained herein constitute "forward-looking information" (within

the meaning of applicable Canadian securities legislation). All

statements in this news release, other than statements of

historical facts, including statements with respect to the planned

completion of the transactions contemplated by the Subscription

Agreement and the Helios SPA are forward-looking statements. Such

statements and information (together, "forward looking statements")

relate to future events or the Company's future performance,

business prospects or opportunities. Forward-looking statements

include, but are not limited to, statements with respect to

estimates of reserves and or resources, future production levels,

future capital expenditures and their allocation to exploration and

development activities, future drilling and other exploration and

development activities, ultimate recovery of reserves or resources

and dates by which certain areas will be explored, developed or

reach expected operating capacity, that are based on forecasts of

future results, estimates of amounts not yet determinable and

assumptions of management.

All statements other than statements of

historical fact may be forward-looking statements. Statements

concerning proven and probable reserves and resource estimates may

also be deemed to constitute forward-looking statements and reflect

conclusions that are based on certain assumptions that the reserves

and resources can be economically exploited. Any statements that

express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words

or phrases such as "seek", "anticipate", "plan", "continue",

"estimate", "expect, "may", "will", "project", "predict",

"potential", "targeting", "intend", "could", "might", "should",

"believe" and similar expressions) are not statements of historical

fact and may be "forward-looking statements". Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. The Company believes that the expectations reflected in

those forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements should not be unduly relied upon.

The Company does not intend, and does not assume any obligation, to

update these forward-looking statements, except as required by

applicable laws. These forward-looking statements involve risks and

uncertainties relating to, among other things, changes in oil

prices, results of exploration and development activities,

uninsured risks, regulatory changes, defects in title, availability

of materials and equipment, timeliness of government or other

regulatory approvals, actual performance of facilities,

availability of financing on reasonable terms, availability of

third party service providers, equipment and processes relative to

specifications and expectations and unanticipated environmental

impacts on operations. Actual results may differ materially from

those expressed or implied by such forward-looking statements.

The Company provides no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The

Company does not assume the obligation to revise or update these

forward-looking statements after the date of this document or to

revise them to reflect the occurrence of future unanticipated

events, except as may be required under applicable securities

laws.

http://prlibrary-eu.nasdaq.com/Resource/Download/cbc6f247-1d22-402c-aff1-5b9cd4b8ab79

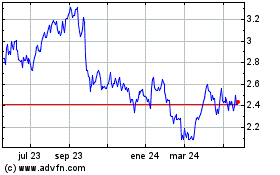

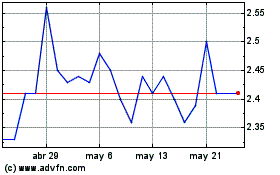

Africa Oil (TSX:AOI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Africa Oil (TSX:AOI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024