NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE

SERVICES OR DISSEMINATION IN THE UNITED STATES

BTB Real Estate Investment Trust (TSX:BTB.UN)

(“

BTB” or the “

REIT”) announces

today that it has reached an agreement with a syndicate of

underwriters led by National Bank Financial Inc. and including TD

Securities Inc., Echelon Wealth Partners Inc., Laurentian Bank

Securities Inc., Raymond James Ltd., Scotiabank, GMP Securities

L.P. and Industrial Alliance Securities Inc. (together, the

“

Underwriters”) to issue to the public, subject to

regulatory approval, on a bought deal basis 5,435,000 trust

units (the “

Units”) at a price of $4.60 per Unit

for gross proceeds of approximately $25 million. The REIT has

granted the Underwriters an over-allotment option exercisable in

whole or in part at any time up to 30 days after closing to

purchase up to an additional 815,250 Units at the same

offering price.

The net proceeds from the offering (after

deducting the Underwriters’ fee and expenses of the offering) will

be used to finance the acquisition of two properties (as defined

below). Should either or both of these acquisitions not

materialize, BTB will use the unallocated net proceeds to repay all

or a portion of the amounts outstanding on its acquisition line of

credit and for general trust purposes.

The REIT will file with the securities

commissions and other similar regulatory authorities in each of the

provinces of Canada a short form preliminary prospectus relating to

the offering of the Units on or about June 5, 2018. Closing of the

offering is expected to take place on or about June 19, 2018.

This press release does not constitute an offer

to sell, or the solicitation of an offer to buy, any securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities being offered have not been and will not

be registered under the U.S. Securities Act of 1933 as amended and

may not be offered or sold in the United States absent registration

or pursuant to applicable exemption from registration.

Acquisition of a Mixed-Use Office and Retail

Property in Montreal

The REIT is finalizing due diligence for the

acquisition of a retail property located at 1325 Saint-Catherine

Street West and an adjacent mixed-use property located at 1411

Crescent Street in Montreal for a total purchase price of $30.2

million excluding transaction fees, at a normalized capitalization

rate of 6.75%. It is expected that approximately

$18.0 million of the net purchase price will be financed by way of

a new mortgage on the property with the balance being funded using

a portion of the proceeds of the offering. The properties comprise

approximately 31,000 sq. ft., with one property being a single

story commercial property and the other being the adjacent 5-story

building strategically situated on the prime commercial artery of

Montreal with retail tenants on the ground floor and office space

on the floors above. BTB would use one and a half story for its

head office premises (having recently sold its current head office)

while a major international retailer occupies part of a floor. The

remaining space would be subject to a head lease with the seller

until December 31st 2018, the value of which is approximately

$567,000. BTB expects to lease the vacant spaces within the next 24

months. The acquisition is expected to close within the next 4

weeks, subject to completing confirmatory due diligence and

customary closing conditions.

Acquisition of a Retail Property in Lévis

The REIT is also finalizing due diligence for

the acquisition of a strip mall located in Lévis, Québec, known as

“Mega Centre Rive-Sud”, comprising approximately 207,000 square

feet for a total purchase price of $43 million. The largest tenant

of this property is Wal-Mart, which occupies approximately 112,000

square feet. The occupancy rate of this property is 99.3%. BTB

expects to finance this acquisition through the assumption of the

current outstanding mortgage on the property in the amount of

approximately $26.1 million and the balance using a portion of the

net proceeds of the offering. The acquisition is expected to close

within 6 weeks, subject to completing confirmatory due diligence

and customary closing conditions.

Acquisition of 25% Remaining Stake in Complexe

Lebourgneuf Phase 2

Concurrent with these two acquisitions, BTB is

also purchasing the remaining 25% equity stake in Complexe

Lebourgneuf Phase 2 in Quebec City (the REIT currently owns 75% of

the property) for $7.5 million, including assumed mortgage, which

represents an implied capitalization rate of 6.75%. The REIT will

satisfy the purchase price of this interest through the issuance of

532,265 limited partnership units to the seller at a price of $4.68

per unit, each unit exchangeable, at the discretion of the vendor,

for a Unit of BTB.

About BTB

BTB is a real estate investment trust listed on

the Toronto Stock Exchange. BTB is an important owner of properties

in eastern Canada. BTB owns 71 retail, office and industrial

properties for a total leasable area of more than 5.4 million

square feet. BTB's asset value is approximately $763M. The

objectives of BTB are: (i) to grow its revenues from its assets to

increase distributable income and therefore fund distributions;

(ii) to maximize the value of its assets through dynamic management

of its properties in order to sustain the long-term value of its

units; and (iii) to generate cash distributions that are fiscally

beneficial to unitholders.

BTB offers a distribution reinvestment plan to

unitholders whereby the participants may elect to have their

monthly cash distribution reinvested in additional units of BTB at

a price based on the weighted average price for BTB's Units on the

Toronto Stock Exchange for the five trading days immediately

preceding the distribution date, discounted by 3%.

Forward-Looking Statements

This press release may contain forward-looking

statements with respect to BTB. These statements generally can be

identified by use of forward looking words such as “may”, “will”,

“expect”, “estimate”, “anticipate”, “intends”, “believe” or

“continue” or the negative thereof or similar variations. The

actual results and performance of BTB could differ materially from

those expressed or implied by such statements. Such statements are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations. Some important factors that could

cause actual results to differ materially from expectations

include, among other things, general economic and market factors,

competition, changes in government regulation and the factors

described from time to time in the documents filed by BTB with the

securities regulators in Canada. Forward looking statements in this

news release include namely that the offering is expected to close

on or about June 19, 2018. The cautionary statements qualify all

forward looking statements attributable to BTB and persons acting

on their behalf. Unless otherwise stated or required by applicable

law, all forward-looking statements speak only as of the date of

this press release.

For more information, please

contact:

BTB REAL ESTATE INVESTMENT TRUSTMr. Michel LéonardPresident and

Chief Executive Officer514-286-0188 ext. 228

Mr. Benoit CyrVice-President and Chief Financial

Officer514-286-0188, ext. 230

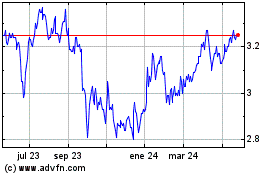

BTB Real Estate Investment (TSX:BTB.UN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

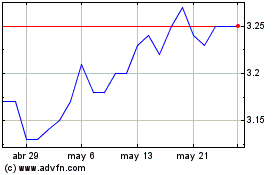

BTB Real Estate Investment (TSX:BTB.UN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024