Cameco (TSX: CCO; NYSE: CCJ) today reported its consolidated

financial and operating results for the fourth quarter and year

ended December 31, 2018 in accordance with International Financial

Reporting Standards (IFRS).

“As we expected, we had a strong finish to 2018,” said Tim

Gitzel, Cameco’s president and CEO. “There were some significant

developments in 2018 that contributed to the strong finish, and

that have strengthened our foundation, setting the course for our

future success.

“In 2018, the temporary suspension of production at McArthur

River/Key Lake, and the subsequent extension for an indeterminate

duration, allowed us to preserve the value of our tier-one assets,

drawdown our excess inventory under the protection of our contract

portfolio, and build a significant cash balance, positioning the

company to self-manage risk. And, of course one of those risks has

been substantially diminished with the unequivocal win in our CRA

tax case for the tax years 2003, 2005, and 2006.

“In addition, we saw a significant improvement in the spot

market driven by substantial production cuts, cuts to some

secondary supplies, a reduction in producer inventories, and an

increase in demand for uranium in the spot market from producers

and financial players. However, the term market remains tentative

driven largely by market access and trade policy issues.

“Our outlook for 2019 is also as we expected, and reflects the

deliberate decisions we have made. Our decisions come with some

near-term costs, but they are the right decisions to make in order

to build long-term value. Although we currently expect our gross

margin could be weaker, our balance sheet will remain strong. We

will continue to maintain a significant cash balance, and generate

cash from operations, allowing us to self-manage risk. And, there

is significant potential upside to our outlook. Remember, there are

a number of moving pieces both internally and externally that could

have a significant impact on the market and on our results for the

year.

“These items include the result of the investigation under

Section 232 of the Trade Expansion Act in the US, a potential cost

award from the Tax Court based on the unequivocal win in our tax

case, and a potential award for damages in our TEPCO dispute.

“We are a commercially motivated supplier, with a diversified

portfolio of assets, including a tier-one production portfolio that

is among the best in the world. We will continue to be disciplined

and make the decisions necessary to keep the company strong and

viable for the long term.”

Summary of 2018 results and developments:

- 2018 performance in line with outlook provided; net

earnings of $166 million; adjusted net earnings of $211

million: As expected, production was lower than 2017 due

to the suspension of production at McArthur River/Key Lake and the

change in reporting for Inkai. In 2018, we undertook a number of

deliberate and disciplined actions, which resulted in lower direct

administration and exploration costs, lower capital expenditures

and $1.1 billion in cash on our balance sheet largely as a result

of our inventory drawdown.

- McArthur River/Key Lake suspended for indeterminate

duration: On July 25, 2018, we, along with our partner

Orano, announced the extended shutdown of McArthur River/Key Lake

for an indeterminate duration removing 18 million pounds (100%

basis) annually from the market. The action resulted in the

permanent layoff of approximately 520 site employees. A reduced

workforce of approximately 200 employees remain at the sites to

keep the facilities in a state of safe care and maintenance. We

incurred approximately $29 million in severance costs as a result

of the permanent layoffs. Our share of the cash and non-cash costs

to maintain both operations during the suspension is expected to

range between $7 million and $9 million per month. In addition, to

further decrease costs, the workforce at our corporate office was

reduced by approximately 150 positions, resulting in severance

costs of approximately $14 million.

- Unequivocal win in Canada Revenue Agency (CRA) case,

awaiting cost award: On September 26, 2018, the Tax Court

of Canada ruled unequivocally in our favour in our case for the

2003, 2005 and 2006 tax years. On October 25, 2018, CRA filed an

appeal with the Federal Court of Appeal seeking to overturn the

decision. We believe there is nothing in the decision that would

warrant a materially different outcome on appeal, or for subsequent

tax years. In accordance with the ruling, we have made an

application to the Tax Court to recover costs in the amount of $38

million, which were incurred over the course of this case. In its

response to the Tax Court regarding our cost submission, CRA is

claiming $9.6 million would be an appropriate award in this

case. The actual cost award will be at the discretion of the

Tax Court. For more information, see Transfer Pricing Dispute in

our annual and fourth quarter MD&A.

- TEPCO dispute: In accordance with the

provisions in the supply agreement, an arbitration hearing to

resolve the dispute took place during January of 2019. There are a

number of post hearing steps and we expect they will be completed

by mid-May, 2019. The timing of the final decision will be

dependent on how long the arbitrators deliberate following receipt

of post-hearing submissions. The arbitration proceedings are

subject to a confidentiality order which limits the information we

are able to disclose. For more information, see TEPCO contract

dispute in our annual and fourth quarter MD&A.

| |

THREE

MONTHS ENDED |

|

YEAR

ENDED |

|

|

HIGHLIGHTS |

DECEMBER 31 |

|

DECEMBER 31 |

|

| ($ MILLIONS EXCEPT WHERE INDICATED) |

2018 |

2017 |

|

2018 |

2017 |

|

| Revenue |

831 |

809 |

|

2,092 |

2,157 |

|

| Gross profit |

207 |

237 |

|

296 |

436 |

|

| Net earnings (loss) attributable to equity holders |

160 |

(62 |

) |

166 |

(205 |

) |

| $ per common share (diluted) |

0.40 |

(0.16 |

) |

0.42 |

(0.52 |

) |

| Adjusted net earnings (non-IFRS, see below) |

202 |

181 |

|

211 |

59 |

|

| $ per common share (adjusted and diluted) |

0.51 |

0.46 |

|

0.53 |

0.15 |

|

| Cash provided by operations (after working capital

changes) |

57 |

320 |

|

668 |

596 |

|

The 2018 annual financial statements have been audited; however,

the 2017 fourth quarter and 2018 fourth quarter financial

information presented is unaudited. You can find a copy of our 2018

annual MD&A and our 2018 audited financial statements on our

website at cameco.com.

| |

|

|

| CHANGES IN

EARNINGS |

|

|

| ($ MILLIONS) |

IFRS |

|

ADJUSTED |

|

| Net earnings (losses) - 2017 |

(205 |

) |

59 |

|

| Change in

gross profit by segment |

|

|

| (we calculate gross profit by deducting from revenue

the cost of products and services sold, and depreciation and

amortization (D&A), net of hedging benefits) |

|

Uranium |

Higher sales

volume |

18 |

|

18 |

|

|

|

|

Higher realized prices

($US) |

40 |

|

40 |

|

|

|

|

Foreign exchange impact

on realized prices |

1 |

|

1 |

|

|

|

|

Higher costs |

(186 |

) |

(186 |

) |

|

|

|

change – uranium |

(127 |

) |

(127 |

) |

|

Fuel services |

Higher sales

volume |

1 |

|

1 |

|

|

|

|

Lower realized prices

($Cdn) |

(5 |

) |

(5 |

) |

|

|

|

Higher costs |

(1 |

) |

(1 |

) |

|

|

|

change – fuel services |

(5 |

) |

(5 |

) |

|

Other changes |

|

|

| Lower

administration expenditures |

21 |

|

21 |

|

| Lower

impairment charges |

358 |

|

- |

|

| Lower

exploration expenditures |

10 |

|

10 |

|

| Change in

reclamation provisions |

(60 |

) |

- |

|

| Lower loss

on disposal of assets |

5 |

|

5 |

|

| Change in

gains or losses on derivatives |

(137 |

) |

36 |

|

| Change in

foreign exchange gains or losses |

49 |

|

49 |

|

| Change in

earnings from equity-accounted investments |

32 |

|

32 |

|

| Gain on

sale of interest in Wheeler River Joint Venture in 2018 |

17 |

|

17 |

|

| Gain on

restructuring of JV Inkai in 2018 |

49 |

|

- |

|

| Gain on

customer contract restructuring in 2018 |

6 |

|

6 |

|

| Sale of

exploration properties in 2018 |

7 |

|

7 |

|

| Reversal of

tax provision related to CRA dispute |

61 |

|

61 |

|

| Change in

income tax recovery or expense |

62 |

|

17 |

|

| Other |

23 |

|

23 |

|

| Net earnings - 2018 |

166 |

|

211 |

|

| |

|

|

|

|

Non-IFRS measures

ADJUSTED NET EARNINGS

Adjusted net earnings is a measure that does not have a

standardized meaning or a consistent basis of calculation under

IFRS (non-IFRS measure). We use this measure as a more meaningful

way to compare our financial performance from period to period. We

believe that, in addition to conventional measures prepared in

accordance with IFRS, certain investors use this information to

evaluate our performance. Adjusted net earnings is our net earnings

attributable to equity holders, adjusted to better reflect the

underlying financial performance for the reporting period. The

adjusted earnings measure reflects the matching of the net benefits

of our hedging program with the inflows of foreign currencies in

the applicable reporting period, and is adjusted for impairment

charges, reclamation provisions for our Rabbit Lake and US

operations, which have been impaired, the gain on restructuring of

JV Inkai, and income taxes on adjustments.

Adjusted net earnings is non-standard supplemental information

and should not be considered in isolation or as a substitute for

financial information prepared according to accounting standards.

Other companies may calculate this measure differently, so you may

not be able to make a direct comparison to similar measures

presented by other companies.

To facilitate a better understanding of these measures, the

table below reconciles adjusted net earnings with our net earnings

for the three months and years ended December 31, 2018 and

2017.

| |

THREE MONTHS ENDED |

|

YEAR ENDED |

|

|

|

DECEMBER 31 |

|

DECEMBER 31 |

|

| ($

MILLIONS) |

2018 |

|

2017 |

|

2018 |

|

2017 |

|

| Net earnings (loss) attributable to equity

holders |

160 |

|

(62 |

) |

166 |

|

(205 |

) |

|

Adjustments |

|

|

|

|

| Adjustments on derivatives |

47 |

|

(2 |

) |

65 |

|

(108 |

) |

|

Impairment charges |

- |

|

247 |

|

- |

|

358 |

|

|

Reclamation provision adjustments |

10 |

|

15 |

|

60 |

|

- |

|

| Gain on

restructuring of JV Inkai |

- |

|

- |

|

(49 |

) |

- |

|

|

Income taxes on adjustments |

(15 |

) |

(17 |

) |

(31 |

) |

14 |

|

| Adjusted net earnings |

202 |

|

181 |

|

211 |

|

59 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Selected segmented highlights

| |

|

|

THREE MONTHS ENDED |

|

YEAR ENDED |

|

|

|

|

|

DECEMBER 31 |

|

DECEMBER 31 |

|

| HIGHLIGHTS |

2018 |

2017 |

CHANGE |

2018 |

2017 |

CHANGE |

|

Uranium |

Production volume

(million lbs) |

|

2.4 |

6.9 |

(65 |

)% |

9.2 |

23.8 |

(61 |

)% |

| |

Sales

volume (million lbs) |

|

12.6 |

12.6 |

- |

|

35.1 |

33.6 |

4 |

% |

| |

Average realized

price |

($US/lb) |

40.50 |

39.44 |

3 |

% |

37.01 |

36.13 |

2 |

% |

| |

|

($Cdn/lb) |

53.11 |

50.04 |

6 |

% |

47.96 |

46.80 |

2 |

% |

| |

Revenue

($ millions) |

|

670 |

631 |

6 |

% |

1,684 |

1,574 |

7 |

% |

|

|

Gross

profit ($ millions) |

|

179 |

216 |

(17 |

)% |

268 |

395 |

(32 |

)% |

| Fuel

services |

Production volume (million kgU) |

|

3.5 |

2.5 |

40 |

% |

10.5 |

7.9 |

33 |

% |

| |

Sales

volume (million kgU) |

|

5.1 |

4.6 |

11 |

% |

11.7 |

11.5 |

2 |

% |

| |

Average

realized price |

($Cdn/kgU) |

23.56 |

23.13 |

2 |

% |

26.78 |

27.20 |

(2 |

)% |

| |

Revenue

($ millions) |

|

120 |

107 |

12 |

% |

314 |

313 |

- |

|

|

|

Gross

profit ($ millions) |

|

25 |

22 |

14 |

% |

59 |

64 |

(8 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

Management's discussion and analysis and financial

statements

The 2018 annual MD&A and consolidated financial statements

provide a detailed explanation of our operating results for the

three and twelve months ended December 31, 2018, as compared to the

same periods last year, and our outlook for 2018. This news release

should be read in conjunction with these documents, as well as our

most recent annual information form, all of which are available on

our website at cameco.com, on SEDAR at sedar.com, and on EDGAR at

sec.gov/edgar.shtml.

Caution about forward-looking information

This news release includes statements and information about our

expectations for the future, which we refer to as forward-looking

information. Forward-looking information is based on our current

views, which can change significantly, and actual results and

events may be significantly different from what we currently

expect. Examples of forward-looking information in this news

release include: our 2019 outlook information (including our

expectations regarding future upside potential, gross margins,

balance sheet position, cash generation and cash balances),

statements about our ability to manage risk, the factors

potentially affecting the uranium market and our future results,

our long term prospects, our expected costs to maintain McArthur

River and Key Lake operations during suspension, our views

regarding the Tax Court of Canada decision and its implications,

the remaining steps in the TEPCO arbitration and the timing for

their completion and the expected dates for announcement of our

2019 quarterly results.

Material risks that could lead to different results include:

unexpected changes in uranium supply, demand, long-term

contracting, and prices; unexpected changes in our production,

purchases, sales, costs, and government regulations or policies;

trade restrictions, including the outcome of the investigation

initiated by the US Department of Commerce under Section 232 of the

Trade Expansion Act; taxes and currency exchange rates; our

expectations related to monthly care and maintenance costs at the

McArthur River mine and Key Lake mill prove to be inaccurate; the

risk of litigation or arbitration claims against us that have an

adverse outcome; the risk that we are unsuccessful on an appeal of

the Tax Court of Canada decision for the 2003, 2005 and 2006 tax

years, or are unsuccessful in the outcome for disputes for other

tax years; the risk that our contract counterparties may not

satisfy their commitments; the risk that our strategies may change,

be unsuccessful or have unanticipated consequences; the risk that

our expectations for developments in 2019 prove incorrect; the risk

our estimates and forecasts prove to be incorrect; and the risk

that we may be delayed in announcing our 2019 quarterly

results.

In presenting the forward-looking information, we have made

material assumptions which may prove incorrect about: uranium

demand, supply, consumption, long-term contracting and prices; our

production, purchases, sales and costs; taxes and currency exchange

rates; the market conditions and other factors upon which we have

based our future plans and outlook; the success of our plans and

strategies; monthly care and maintenance costs at the McArthur

River mine and Key Lake mill; the basis upon which the appeal of

the Tax Court of Canada decision for the 2003, 2005 and 2006 tax

years, and the outcome of disputes for other years, will be

determined; the absence of new and adverse government regulations,

policies or decisions; the successful outcome of any litigation or

arbitration claims against us; the timing and outcome of the post

hearing steps in the TEPCO arbitration; and our ability to announce

our 2019 quarterly results when expected.

Please also review the discussion in our 2018 annual MD&A

and most recent annual information form for other material risks

that could cause actual results to differ significantly from our

current expectations, and other material assumptions we have made.

Forward-looking information is designed to help you understand

management’s current views of our near- and longer-term prospects,

and it may not be appropriate for other purposes. We will not

necessarily update this information unless we are required to by

securities laws.

Conference call

We invite you to join our fourth quarter conference call on

Monday, February 11, 2019 at 11:00 a.m. Eastern.

The call will be open to all investors and the media. To join

the call, please dial (800) 319-4610 (Canada and US) or (604)

638-5340. An operator will put your call through. The slides and a

live webcast of the conference call will be available from a link

at cameco.com. See the link on our home page on the day of the

call.

A recorded version of the proceedings will be available:

- on our website, cameco.com, shortly after the call

- on post view until midnight, Eastern, March 11, 2019, by

calling (800) 319-6413 (Canada and US) or (604) 638-9010 (Passcode

2896)

2019 quarterly report release dates

We plan to announce our 2019 quarterly results as follows:

- first quarter consolidated financial and operating results:

before markets open on May 1, 2019

- second quarter consolidated financial and operating results:

before markets open on July 25, 2019

- third quarter consolidated financial and operating results:

before markets open on November 1, 2019

The 2020 date for the announcement of our fourth quarter and

2019 consolidated financial and operating results will be provided

in our 2019 third quarter MD&A. Announcement dates are subject

to change.

Profile

Cameco is one of the world’s largest providers of uranium fuel.

Our competitive position is based on our controlling ownership of

the world’s largest high-grade reserves and low-cost operations.

Our uranium products are used to generate clean electricity in

nuclear power plants around the world. Our shares trade on the

Toronto and New York stock exchanges. Our head office is in

Saskatoon, Saskatchewan.

As used in this news release, the terms we, us, our, the Company

and Cameco mean Cameco Corporation and its subsidiaries unless

otherwise indicated.

Investor inquiries:Rachelle Girard(306)

956-6403

Media inquiries:Carey Hyndman(306) 956-6317

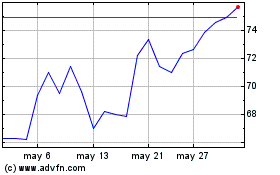

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025