Cameco Reports Document Filings

29 Marzo 2019 - 12:07PM

currency: Cdn (unless

noted)

Cameco (TSX: CCO; NYSE: CCJ) reported today that

it filed its annual report on Form 40-F with the US Securities and

Exchange Commission. The document includes Cameco’s audited annual

financial statements for the year ended December 31, 2018, its

management’s discussion and analysis (MD&A), and its Canadian

annual information form (AIF).

In addition, Cameco filed with Canadian

securities regulatory authorities its AIF. Its audited annual

financial statements for the year ended December 31, 2018, and its

MD&A were filed with Canadian securities regulatory authorities

in February 2019.

Cameco also filed a technical report for the

McArthur River operation under Canadian Securities Administrators’

National Instrument 43-101. Production at the operation has been

suspended for an indeterminate duration and no production restart

decision has been made.

“The McArthur River operation is one of the best

uranium mines in the world, and we are pleased with the significant

improvement in the economics of the McArthur River operation since

the last report in 2012, which clearly highlights how much value

this asset will create when it comes back into production. However,

we want to be very clear, the market conditions necessary for a

restart decision have not been achieved, and therefore the

production suspension will continue for an indeterminate duration,”

said Tim Gitzel, Cameco’s president and CEO.

Key highlights of the technical report

include:

- Cameco has updated the mineral reserve and mineral resource

estimates for McArthur River. As of December 31, 2018, the mineral

reserve estimates increased 9.1% compared to December 31,

2017.

- The McArthur River production schedule has been modified to

incorporate the additional mineral reserves and to maintain a

production rate of 18.0 million pounds U3O8 per year upon a

production restart. Based on the current assumed production

schedule, Cameco estimates that McArthur River will have a mine

life of 23 years.

- Cameco’s share of the total estimated life of mine capital

costs for the McArthur River and Key Lake operations is $658

million compared to $2.5 billion in the 2012 technical report.

- Operating costs are estimated to average $14.97 per pound U3O8

over the mine life. This is a significant decrease from the

estimate of $19.23 per pound U3O8 in the 2012 technical

report.

- Cameco’s share of cash operating and capital costs to maintain

both operations during the production suspension shutdown is

expected to range between $6 million and $7 million per month.

Please see the full technical report for more

information. All of these documents are posted on our website.

Shareholders may obtain hard copies of these documents, including

the financial statements, free of charge by contacting:

Cameco Investor Relations2121 11th Street

WestSaskatoon, SK S7M 1J3Phone: 306-956-6340

Profile

Cameco is one of the world’s largest providers

of uranium fuel. Our competitive position is based on our

controlling ownership of the world’s largest high-grade reserves

and low-cost operations. Our uranium products are used to generate

clean electricity in nuclear power plants around the world. Our

shares trade on the Toronto and New York stock exchanges. Our head

office is in Saskatoon, Saskatchewan.

The McArthur River operation is an underground

uranium mine located in northern Saskatchewan. It contains the

largest known high-grade uranium deposit and has extracted 327.5

million pounds U3O8 since the start of production in 1999. Cameco

is the operator. The McArthur River joint venture consisting of

Cameco (69.805%) and Orano Canada Inc. (30.195%) owns the

operation.

All uranium mined at McArthur River is processed

and packaged at the Key Lake mill located in northern

Saskatchewan. Cameco is the operator. The Key Lake joint

venture consisting of Cameco (83.333%) and Orano (16.667%) owns the

mill.

Caution Regarding Forward-Looking

Information and Statements

This news release includes statements and

information about our expectations for the future, which we refer

to as forward-looking information. Forward-looking information is

based on our current views, which can change significantly, and

actual results and events may be significantly different from what

we currently expect. Examples of forward-looking information in

this news release include: the duration of the suspension of

McArthur River operations, the expected value created when McArthur

River comes back into production, mineral reserve estimates,

production rate estimate, estimated mine life of 23 years, Cameco’s

share of total estimated life of mine capital and operating costs,

and Cameco’s expected monthly share of cash operating and capital

costs to maintain both operations during the production

suspension. Material risks that could lead to different

results include the risk that Cameco’s expectations relating to

these estimates, including value creation, mineral reserves,

production rate, mine life, life of mine capital and operating

costs, and care and maintenance costs during the production

suspension, prove to be inaccurate, and the other material risks

referred to in the technical report for the McArthur River

operation, including in sections 24.4 and 24.5, and in our AIF and

MD&A. In presenting the forward-looking information, we have

made material assumptions which may prove incorrect including that

these estimates will be as expected, along with the underlying

assumptions associated with them, in addition to the other material

assumptions related to them referred to in the technical report for

the McArthur River operation, and in our MD&A and AIF. Forward

looking information is designed to help you understand management’s

current views of our near term and longer-term prospects, and it

may not be appropriate for other purposes. We will not necessarily

update this information unless we are required to by securities

laws.

Qualified Persons

The technical and scientific information

discussed in this news release was approved by the following

individuals who are qualified persons for the purposes of NI

43-101:

- Linda Bray, P.Eng., Principal Metallurgist, Technical Services,

Cameco Corporation

- Gregory M. Murdock, P.Eng., General Manager, McArthur River/Key

Lake, Cameco Corporation

- Alain D. Renaud, P.Geo., Lead Geologist, Technical Services,

Cameco Corporation

|

Investor inquiries: |

Rachelle Girard |

306-956-6403 |

|

|

| |

|

|

|

|

| Media inquiries: |

Carey Hyndman |

306-956-6317 |

|

|

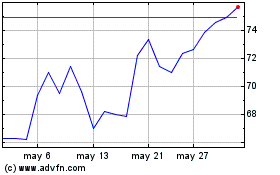

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025