Goodfellow Reports Its Results for the Third Quarter Ended August 31, 2020

15 Octubre 2020 - 4:40PM

Goodfellow Inc. (TSX: GDL) announced today its financial results

for the third quarter ended August 31, 2020. The Company reported a

net income of $6.7 million or $0.78 per share compared to a net

income of $2.5 million or $0.29 per share a year ago. Consolidated

sales were $138.8 million compared to $130.6 million last year.

Sales in Canada increased 9% compared to the same period a year

ago, while sales in the United States decreased 6% (on a Canadian

dollar basis) and export sales decreased 23% compared to the same

period a year ago. On the operating side, selling, administrative

and general expenses decreased overall by $1.6 million.

For the nine months ended August 31, 2020, the

Company reported a net income of $8.0 million or $0.94 per share

compared to a net income of $2.8 million or $0.33 per share a year

ago. Consolidated sales were $331.5 million compared to $342.5

million last year. Sales in Canada decreased 1% compared to the

same period a year ago, while sales in the United States decreased

9% (on a Canadian dollar basis) and export sales decreased 25%

compared to the same period a year ago. On the operating side,

selling, administrative and general expenses decreased overall by

$6.7 million.

The Company was able to take advantage of the

travel restrictions imposed by Canadian and provincial governments

in the third quarter. Since many customers were unable to travel

during the summer, they decided to invest in their properties and

had a strong impact on the demand for the Company's products. The

Company also took advantage in the third quarter of measures taken

in the second quarter to reduce costs and improve operational

efficiency. Furthermore, export sales are still affected by the

COVID-19 pandemic and have also been affected by the strike at the

Port of Montreal.

“Third quarter of fiscal 2020 was characterized

by the realities of the pandemic having set in and its drastic

effects on supply and demand. The Company performed very well and

was able to capitalize on surging demand in commodities and

seasonal products.’’

Goodfellow Inc. is a distributor of lumber

products, building materials and floor coverings. Goodfellow shares

trade on the Toronto Stock Exchange under the symbol GDL.

|

GOODFELLOW

INC. |

|

Consolidated Statements of Comprehensive

Income |

|

For the three and nine months ended August 31, 2020 and

2019 |

|

(in thousands of dollars, except per share

amounts) |

|

Unaudited |

| |

|

|

|

|

|

|

|

|

|

For the three months ended |

For the nine months ended |

|

|

August 31 2020 |

|

August 31 2019 |

August 31 2020 |

|

August 31 2019 |

|

|

$ |

|

$ |

$ |

|

$ |

| |

|

|

|

|

|

Sales |

138,843 |

|

130,594 |

331,462 |

|

342,460 |

|

Expenses |

|

|

|

|

|

Cost of goods sold |

111,030 |

|

106,840 |

266,748 |

|

278,088 |

|

Selling, administrative and general expenses |

17,835 |

|

19,426 |

51,413 |

|

58,053 |

|

(Gain) loss on disposal of property, plant and equipment |

(1 |

) |

- |

(11 |

) |

7 |

|

Net financial costs |

679 |

|

895 |

2,152 |

|

2,449 |

|

|

129,543 |

|

127,161 |

320,302 |

|

338,597 |

|

|

|

|

|

|

| Earnings

before income taxes |

9,300 |

|

3,433 |

11,160 |

|

3,863 |

| |

|

|

|

|

| Income

taxes |

2,604 |

|

961 |

3,125 |

|

1,086 |

|

|

|

|

|

|

|

Total comprehensive income |

6,696 |

|

2,472 |

8,035 |

|

2,777 |

|

|

|

|

|

|

| |

|

|

|

|

|

Net earnings per share – Basic |

0.78 |

|

0.29 |

0.94 |

|

0.33 |

|

Net earnings per share – Diluted |

0.78 |

|

0.29 |

0.94 |

|

0.32 |

|

GOODFELLOW INC. |

|

Consolidated Statements of Financial

Position |

|

(in thousands of dollars) |

|

Unaudited |

|

|

|

|

|

|

|

As at |

As at |

As at |

|

|

August 31 2020 |

November 30 2019 |

August 31 2019 |

|

|

$ |

$ |

$ |

|

Assets |

|

|

|

|

Current Assets |

|

|

|

|

Cash |

1,884 |

2,364 |

1,546 |

|

Trade and other receivables |

64,511 |

48,498 |

65,216 |

|

Inventories |

82,498 |

87,339 |

99,761 |

|

Prepaid expenses |

2,077 |

2,563 |

2,552 |

|

Total Current Assets |

150,970 |

140,764 |

169,075 |

| |

|

|

|

|

Non-Current Assets |

|

|

|

|

Property, plant and equipment |

31,536 |

32,838 |

32,754 |

|

Intangible assets |

3,420 |

3,927 |

3,990 |

|

Right-of-use assets |

15,113 |

- |

- |

|

Defined benefit plan asset |

2,188 |

2,222 |

2,700 |

|

Investment in a joint venture |

25 |

25 |

25 |

|

Other assets |

753 |

805 |

849 |

|

Total Non-Current Assets |

53,035 |

39,817 |

40,318 |

|

Total Assets |

204,005 |

180,581 |

209,393 |

|

|

|

|

|

|

Liabilities |

|

|

|

|

Current liabilities |

|

|

|

|

Bank indebtedness |

23,872 |

31,204 |

56,579 |

|

Trade and other payables |

35,818 |

29,048 |

32,216 |

|

Income taxes payable |

3,246 |

734 |

667 |

|

Provision |

1,514 |

1,470 |

316 |

|

Dividend payable |

- |

856 |

- |

|

Current portion of lease liabilities |

4,338 |

15 |

15 |

|

Total Current Liabilities |

68,788 |

63,327 |

89,793 |

| |

|

|

|

|

Non-Current Liabilities |

|

|

|

|

Provision |

- |

- |

1,319 |

|

Lease liabilities |

14,194 |

28 |

32 |

|

Deferred income taxes |

2,269 |

3,209 |

3,652 |

|

Defined benefit plan obligation |

734 |

609 |

159 |

|

Total Non-Current Liabilities |

17,197 |

3,846 |

5,162 |

|

Total Liabilities |

85,985 |

67,173 |

94,955 |

|

|

|

|

|

|

Shareholders’ Equity |

|

|

|

|

Share capital |

9,424 |

9,424 |

9,152 |

|

Retained earnings |

108,596 |

103,984 |

105,286 |

|

|

118,020 |

113,408 |

114,438 |

|

Total Liabilities and Shareholders’ Equity |

204,005 |

180,581 |

209,393 |

|

GOODFELLOW

INC. |

|

Consolidated Statements of Cash

Flows |

|

For the three and nine months ended August 31, 2020 and

2019 (in thousands of dollars)

Unaudited |

|

|

|

|

|

|

|

|

For the three months ended |

For the nine months ended |

|

|

August 31 2020 |

August 31 2019 |

August 31 2020 |

August 31 2019 |

|

|

$ |

$ |

$ |

$ |

|

Operating Activities |

|

|

|

|

|

Net earnings |

6,696 |

2,472 |

8,035 |

2,777 |

|

Adjustments for: |

|

|

|

|

|

Depreciation and amortization of: |

|

|

|

|

|

Property, plant and equipment |

678 |

696 |

2,002 |

2,076 |

|

Right-of-use assets |

1,084 |

- |

3,265 |

- |

|

Intangible assets |

183 |

173 |

546 |

516 |

|

Accretion expense on provision |

18 |

3 |

54 |

10 |

|

Decrease in provision |

- |

(28) |

(10) |

(28) |

|

Income taxes |

2,604 |

961 |

3,125 |

1,086 |

|

(Gain) loss on disposal of property, plant and equipment |

(1) |

- |

(11) |

7 |

|

Interest expense |

187 |

603 |

825 |

1,708 |

|

Interest on lease liabilities |

167 |

- |

520 |

- |

|

Funding in deficit of pension plan expense |

52 |

35 |

158 |

106 |

|

Other assets |

- |

- |

- |

67 |

|

Other |

(13) |

- |

28 |

- |

|

|

11,655 |

4,915 |

18,537 |

8,325 |

|

|

|

|

|

|

|

Changes in non-cash working capital items |

9,239 |

6,126 |

(3,915) |

(19,079) |

|

Interest paid |

(114) |

(580) |

(733) |

(1,791) |

|

Income taxes recovered (paid) |

478 |

(152) |

(613) |

(828) |

|

|

9,603 |

5,394 |

(5,261) |

(21,698) |

|

Net Cash Flows from Operating Activities |

21,258 |

10,309 |

13,276 |

(13,373) |

| |

|

|

|

|

|

Financing Activities |

|

|

|

|

|

Net decrease in bank loans |

- |

(3,000) |

(5,000) |

(1,000) |

|

Net (decrease) increase in banker’s acceptances |

(21,000) |

(12,000) |

(5,000) |

13,000 |

|

Payment of lease liabilities |

(1,312) |

(4) |

(3,954) |

(10) |

|

Dividend Paid |

- |

- |

(1,712) |

(851) |

|

|

(22,312) |

(15,004) |

(15,666) |

11,139 |

| |

|

|

|

|

|

Investing Activities |

|

|

|

|

|

Acquisition of property, plant and equipment |

(222) |

(263) |

(732) |

(488) |

|

Increase in intangible assets |

(3) |

(17) |

(39) |

(62) |

|

Proceeds on disposal of property, plant and equipment |

(1) |

- |

13 |

8 |

|

|

(226) |

(280) |

(758) |

(542) |

| |

|

|

|

|

| Net cash

outflow |

(1,280) |

(4,975) |

(3,148) |

(2,776) |

|

Cash position, beginning of period |

(708) |

2,942 |

1,160 |

743 |

|

Cash position, end of period |

(1,988) |

(2,033) |

(1,988) |

(2,033) |

|

|

|

|

|

|

| Cash

position is comprised of: |

|

|

|

|

|

Cash |

1,884 |

1,546 |

1,884 |

1,546 |

|

Bank overdraft |

(3,872) |

(3,579) |

(3,872) |

(3,579) |

|

|

(1,988) |

(2,033) |

(1,988) |

(2,033) |

| GOODFELLOW

INC. |

|

Consolidated Statements of Change in Shareholders’

Equity |

| For the

nine months ended August 31, 2020 and 2019 |

| (in thousands of

dollars) |

|

Unaudited |

|

|

|

|

|

|

|

Share |

Retained |

Total |

|

Capital |

Earnings |

| |

$ |

$ |

$ |

| |

|

|

|

| Balance

as at November 30, 2018 |

9,152 |

103,711 |

112,863 |

| |

|

|

|

|

Net earnings |

- |

2,777 |

2,777 |

|

|

|

|

|

|

Total comprehensive income |

- |

2,777 |

2,777 |

| |

|

|

|

| Transactions with

owners of the Company |

| |

|

|

|

|

Dividend |

- |

(851) |

(851) |

|

Modification of share-based payment |

- |

(351) |

(351) |

| |

|

|

|

|

Balance as at August 31, 2019 |

9,152 |

105,286 |

114,438 |

| |

|

|

|

|

|

|

|

|

|

Balance as at November 30, 2019 |

9,424 |

103,984 |

113,408 |

| |

|

|

|

|

IFRS 16 adoption adjustment, net of taxes of

$940 |

- |

(2,567) |

(2,567) |

| |

|

|

|

|

Balance as at December 1, 2019 |

9,424 |

101,417 |

110,841 |

| |

|

|

|

|

Net earnings |

- |

8,035 |

8,035 |

|

|

|

|

|

|

Total comprehensive income |

- |

8,035 |

8,035 |

| |

|

|

|

| Transactions with

owners of the Company |

|

|

|

| |

|

|

|

|

Dividend |

- |

(856) |

(856) |

|

|

|

|

|

|

Balance as at August 31, 2020 |

9,424 |

108,596 |

118,020 |

| From: |

Goodfellow Inc. Patrick

Goodfellow President and CEO Tel:

450 635-6511 Fax: 450 635-3730

Internet:

info@goodfellowinc.com |

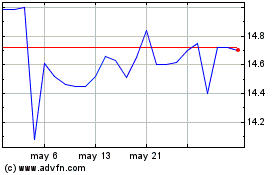

Goodfellow (TSX:GDL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Goodfellow (TSX:GDL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024