Martinrea International Inc. (TSX : MRE), a diversified and global

automotive supplier engaged in the design, development and

manufacturing of highly engineered, value-added Lightweight

Structures and Propulsion Systems, today announced the release of

its financial results for the third quarter ended September 30,

2024, and declared a quarterly cash dividend of $0.05 per share.

HIGHLIGHTS

- Third quarter total sales of

$1,237.5 million, production sales of $1,167.3 million.

- Third quarter Adjusted EBITDA(1) of

$154.1 million, 12.5% of total sales.

- Third quarter Operating Income

Margin of 5.3%; Adjusted Operating Income Margin(1) was 5.9% for

the nine months ended September 30, 2024.

- Third quarter Free Cash Flow(1)

(excluding principal payments of IFRS-16 lease liabilities) was

$57.0 million; Free Cash Flow(1) was $107.4 million for the nine

months ended September 30, 2024, a notable improvement over $75.5

million generated in the nine months ended September 30, 2023.

- Third quarter diluted net earnings

per share of $0.19 or $0.44 per share at a normalized effective tax

rate after adjusting for unusual foreign exchange movements between

the Mexican Peso against the U.S. dollar. These foreign exchange

movements are non-cash in nature, do not impact cash taxes and tend

to balance out over time (refer to “Overall Results” section for

further details).

- Net Debt-to-Adjusted EBITDA(1)

ratio, excluding the impact of IFRS 16, ended the third quarter at

1.46x.

- New business awards of

approximately $35 million in annualized sales at mature

volumes.

- Quarterly cash dividend of $0.05

per share declared.

OVERVIEW

Pat D’Eramo, Chief Executive Officer, stated:

“Our third quarter financial results were solid, and met our

internal expectations based on the lower level of industry

production volumes in the quarter. Our Free Cash Flow(1) was

strong, and our Adjusted EBITDA(1) was solid, with Adjusted EBITDA

Margin(1) up year over year. Operationally, we are executing well.

We continue to drive efficiency gains and cost savings through our

Martinrea Operating System. In addition, we continue to make good

progress in commercial negotiations with our customers, obtaining

compensation for volume shortfalls on electric vehicle programs and

lingering inflationary costs. We are experiencing some further

production volume shortfalls in the fourth quarter as OEMs adjust

inventories on a number of platforms, some of which are big

programs for us. We have been impacted by OEM production shutdowns,

often with little to no advance warning, which makes it challenging

to properly flex costs. The impact is being felt across all

powertrain types, not just electric vehicles. While this will

impact our financial performance in the fourth quarter, we expect

production volumes to improve beginning in the first quarter of

2025, as inventories adjust. Interest rates, which are coming down

in both the U.S. and Canada, with further cuts expected, should

help to improve vehicle affordability, which in turn, should lead

to higher sales for suppliers.”

He continued: “I am pleased to announce that we

have been awarded new business representing $35 million in

annualized sales at mature volumes, consisting of $30 million in

Lightweight Structures with multiple customers including

International Motors (formerly Navistar), BMW, and Nissan, and $5

million in Propulsion Systems, with Audi.”

Peter Cirulis, Chief Financial Officer, stated:

“We are pleased with our financial performance in the third

quarter. We are driving a healthy level of Free Cash Flow(1) from

the business, and our balance sheet is in great shape. Sales for

the third quarter, excluding tooling sales of $70.2 million, were

$1,167.3 million. Third quarter Adjusted EBITDA was $154.1 million,

and Adjusted EBITDA Margin of 12.5% was up 60 basis points year

over year. Free Cash Flow(1) (excluding principal payments of

IFRS-16 lease liabilities) was $57.0 million in the third quarter,

and $107.4 million on a year-to-date basis, a big improvement over

the $75.5 million generated in the comparable 2023 period, driven

in part by lower capex. On a full year basis, we project that we

will come in at the high end of our 2024 Free Cash Flow(1) outlook

range of $100 million to $150 million, excluding lease payments,

and potentially even better.”

He continued: “Net Debt(1) (excluding IFRS-16

lease liabilities) declined by approximately $32 million quarter

over quarter, to $820.1 million, reflecting the Free Cash Flow(1)

profile for the quarter. Approximately $9.5 million was spent

during the quarter, repurchasing approximately 826,000 shares

through our normal course issuer bid. Our-Net-Debt-to-Adjusted

EBITDA(1) ratio (excluding the impact of IFRS 16) ended the quarter

at 1.46x, in line with our target leverage ratio of 1.5x or

better.”

Rob Wildeboer, Executive Chairman, stated: “We

are executing well operationally and financially, and allocating

capital with a view to maximizing returns for our stakeholders. We

have previously mentioned that capital allocation would be balanced

between share buybacks and debt reduction. Both are important

priorities for us, and we have demonstrated disciplined execution

on both fronts, including during the third quarter. In the past

year and a half, since our net debt hit an all-time high of $956

million, we have paid down $136 million in debt, repurchased 6.5

million common shares, equal to 8% of shares outstanding, and

reduced our Net-Debt-to-Adjusted EBITDA(1) ratio from 1.90x to

1.46x. We believe consistent Free Cash Flow(1) generation is the

path to a higher valuation. On behalf of the executive management

team, we would like to thank our people for their hard work in

delivering a solid quarterly performance, as well as our

shareholders and other stakeholders for their continued

support.”

RESULTS OF OPERATIONS

All amounts in this press release are in

Canadian dollars, unless otherwise stated; and all tabular amounts

are in thousands of Canadian dollars, except earnings per share and

number of shares.

Additional information about the Company,

including the Company’s Management Discussion and Analysis of

Operating Results and Financial Position for the three and nine

months ended September 30, 2024 (“MD&A”), the Company’s interim

condensed consolidated financial statements for the three and nine

months ended September 30, 2024 (the “interim financial

statements”) and the Company’s Annual Information Form for the year

ended December 31, 2023 can be found at www.sedarplus.ca.

OVERALL RESULTS

Results of operations may include certain items

which have been separately disclosed, where appropriate, in order

to provide a clear assessment of the underlying Company results. In

addition to IFRS measures, management uses non-IFRS measures in the

Company’s disclosures that it believes provide the most appropriate

basis on which to evaluate the Company’s results.

The following tables set out certain highlights

of the Company’s performance for the three and nine months ended

September 30, 2024 and 2023. Refer to the Company’s interim

financial statements for the three and nine months ended September

30, 2024 for a detailed account of the Company’s performance for

the periods presented in the tables below.

|

|

Three months ended September 30,

2024 |

|

Three months ended September 30,

2023 |

|

$ Change |

|

% Change |

|

Sales |

$ |

1,237,493 |

|

|

$ |

1,378,938 |

|

|

(141,445 |

) |

|

(10.3 |

%) |

| Gross Margin |

|

163,350 |

|

|

|

181,194 |

|

|

(17,844 |

) |

|

(9.8 |

%) |

| Operating Income |

|

65,879 |

|

|

|

83,015 |

|

|

(17,136 |

) |

|

(20.6 |

%) |

| Net

Income for the period |

|

14,157 |

|

|

|

53,744 |

|

|

(39,587 |

) |

|

(73.7 |

%) |

|

Net Earnings per Share - Basic and Diluted |

$ |

0.19 |

|

|

$ |

0.68 |

|

|

(0.49 |

) |

|

(72.1 |

%) |

|

Non-IFRS Measures** |

|

|

|

|

|

|

|

| Adjusted Operating Income |

$ |

65,879 |

|

|

$ |

83,015 |

|

|

(17,136 |

) |

|

(20.6 |

%) |

| % of Sales |

|

5.3 |

% |

|

|

6.0 |

% |

|

|

|

|

| Adjusted EBITDA |

|

154,129 |

|

|

|

163,482 |

|

|

(9,353 |

) |

|

(5.7 |

%) |

| % of Sales |

|

12.5 |

% |

|

|

11.9 |

% |

|

|

|

|

|

Adjusted Net Income* |

|

14,157 |

|

|

|

53,744 |

|

|

(39,587 |

) |

|

(73.7 |

%) |

|

Adjusted Net Earnings per Share - Basic and Diluted* |

$ |

0.19 |

|

|

$ |

0.68 |

|

|

(0.49 |

) |

|

(72.1 |

%) |

|

|

Nine months ended September 30, 2024 |

|

Nine months ended September 30, 2023 |

|

$ Change |

|

% Change |

|

Sales |

$ |

3,863,199 |

|

|

$ |

4,043,882 |

|

|

(180,683 |

) |

|

(4.5 |

%) |

| Gross Margin |

|

519,517 |

|

|

|

522,169 |

|

|

(2,652 |

) |

|

(0.5 |

%) |

| Operating Income |

|

215,019 |

|

|

|

240,628 |

|

|

(25,609 |

) |

|

(10.6 |

%) |

| Net

Income for the period |

|

98,786 |

|

|

|

151,815 |

|

|

(53,029 |

) |

|

(34.9 |

%) |

|

Net Earnings per Share - Basic and Diluted |

$ |

1.30 |

|

|

$ |

1.90 |

|

|

(0.60 |

) |

|

(31.6 |

%) |

|

Non-IFRS Measures** |

|

|

|

|

|

|

|

| Adjusted Operating Income |

$ |

226,629 |

|

|

$ |

240,628 |

|

|

(13,999 |

) |

|

(5.8 |

%) |

| % of Sales |

|

5.9 |

% |

|

|

6.0 |

% |

|

|

|

|

| Adjusted EBITDA |

|

483,098 |

|

|

|

476,598 |

|

|

6,500 |

|

|

1.4 |

% |

| % of Sales |

|

12.5 |

% |

|

|

11.8 |

% |

|

|

|

|

| Adjusted Net Income* |

|

106,637 |

|

|

|

147,241 |

|

|

(40,604 |

) |

|

(27.6 |

%) |

|

Adjusted Net Earnings per Share - Basic and Diluted* |

$ |

1.40 |

|

|

$ |

1.84 |

|

|

(0.44 |

) |

|

(23.9 |

%) |

*Adjusted Net Income and Adjusted Net Earnings

per Share for the three and nine months ended September 30, 2024

were negatively impacted by an unusually high effective tax rate.

This was driven primarily by the magnitude and pace of the

depreciation of the Mexican Peso against the U.S. dollar, which is

the functional currency of the Company’s Mexican operations. In

situations where the local and functional currencies differ, IFRS,

contrary to US GAAP, requires the tax value of assets and

liabilities denominated in local currency to be revalued to the

operations' functional currency at the reporting date, with the

related foreign exchange movements impacting the tax expense for

the period. These foreign exchange movements are non-cash in

nature, do not impact cash taxes and tend to balance out over time.

Including this, and other foreign exchange related items, the

effective tax rate for the nine months ended September 30, 2024 was

38.8%. Excluding these foreign exchange items, the effective tax

rate would have been 31.0%, which is more reflective of a typical

tax rate for the Company. Using a tax rate of 31.0%, Adjusted Net

Earnings per Share would have been $0.44 for the three months ended

September 30, 2024, and $1.47 for the nine months ended September

30, 2024.

**Non-IFRS Measures

The Company prepares its interim financial

statements in accordance with IFRS. However, the Company considers

certain non-IFRS financial measures as useful additional

information in measuring the financial performance and condition of

the Company. These measures, which the Company believes are widely

used by investors, securities analysts and other interested parties

in evaluating the Company’s performance, do not have a standardized

meaning prescribed by IFRS and therefore may not be comparable to

similarly titled measures presented by other publicly traded

companies, nor should they be construed as an alternative to

financial measures determined in accordance with IFRS. Non-IFRS

measures include “Adjusted Net Income”, “Adjusted Net Earnings per

Share (on a basic and diluted basis)”, “Adjusted Operating Income”,

"Adjusted EBITDA”, “Free Cash Flow”, "Free Cash Flow (after IFRS 16

lease payments)", and “Net Debt”.

The following tables provide a reconciliation of

IFRS “Net Income” to Non-IFRS “Adjusted Net Income”, “Adjusted

Operating Income” and “Adjusted EBITDA”:

|

|

Three months endedSeptember 30,

2024 |

|

Three months endedSeptember 30,

2023 |

|

Net Income |

$ |

14,157 |

|

$ |

53,744 |

|

Adjustments, after tax* |

|

- |

|

|

- |

|

Adjusted Net Income |

$ |

14,157 |

|

$ |

53,744 |

|

|

Nine months ended September 30, 2024 |

|

Nine months ended September 30, 2023 |

|

Net Income |

$ |

98,786 |

|

$ |

151,815 |

|

|

Adjustments, after tax* |

|

7,851 |

|

|

(4,574 |

) |

|

Adjusted Net Income |

$ |

106,637 |

|

$ |

147,241 |

|

*Adjustments are explained in the "Adjustments

to Net Income" section of this Press Release

|

|

Three months endedSeptember 30,

2024 |

|

Three months endedSeptember 30,

2023 |

|

Net Income |

$ |

14,157 |

|

|

$ |

53,744 |

|

| Income tax expense |

|

33,276 |

|

|

|

14,713 |

|

| Other finance income |

|

(1,084 |

) |

|

|

(7,418 |

) |

| Share of loss of equity

investments |

|

690 |

|

|

|

600 |

|

| Finance expense |

|

18,840 |

|

|

|

21,376 |

|

|

Adjustments, before tax* |

|

- |

|

|

|

- |

|

|

Adjusted Operating Income |

$ |

65,879 |

|

|

$ |

83,015 |

|

|

Depreciation of property, plant and equipment and right-of-use

assets |

|

84,904 |

|

|

|

77,837 |

|

| Amortization of development

costs |

|

3,084 |

|

|

|

2,488 |

|

| Loss on

disposal of property, plant and equipment |

|

262 |

|

|

|

142 |

|

|

Adjusted EBITDA |

$ |

154,129 |

|

|

$ |

163,482 |

|

|

|

Nine months ended September 30, 2024 |

|

Nine months ended September 30, 2023 |

|

Net Income |

$ |

98,786 |

|

|

$ |

151,815 |

|

| Income tax expense |

|

63,725 |

|

|

|

38,422 |

|

| Other finance income |

|

(8,140 |

) |

|

|

(7,074 |

) |

| Share of loss of equity

investments |

|

2,147 |

|

|

|

2,630 |

|

| Finance expense |

|

58,501 |

|

|

|

60,108 |

|

|

Adjustments, before tax* |

|

11,610 |

|

|

|

(5,273 |

) |

|

Adjusted Operating Income |

$ |

226,629 |

|

|

$ |

240,628 |

|

|

Depreciation of property, plant and equipment and right-of-use

assets |

|

246,808 |

|

|

|

228,041 |

|

| Amortization of development

costs |

|

8,172 |

|

|

|

7,771 |

|

| Loss on

disposal of property, plant and equipment |

|

1,489 |

|

|

|

158 |

|

|

Adjusted EBITDA |

$ |

483,098 |

|

|

$ |

476,598 |

|

*Adjustments are explained in the "Adjustments

to Net Income" section of this Press Release

SALES

Three months ended September 30, 2024 to

three months ended September 30, 2023 comparison

|

|

Three months endedSeptember 30,

2024 |

|

Three months endedSeptember 30,

2023 |

|

$ Change |

|

% Change |

|

North America |

$ |

960,256 |

|

|

$ |

1,042,218 |

|

|

(81,962 |

) |

|

(7.9 |

%) |

| Europe |

|

250,499 |

|

|

|

302,145 |

|

|

(51,646 |

) |

|

(17.1 |

%) |

| Rest of the World |

|

33,638 |

|

|

|

42,644 |

|

|

(9,006 |

) |

|

(21.1 |

%) |

|

Eliminations |

|

(6,900 |

) |

|

|

(8,069 |

) |

|

1,169 |

|

|

14.5 |

% |

|

Total Sales |

$ |

1,237,493 |

|

|

$ |

1,378,938 |

|

|

(141,445 |

) |

|

(10.3 |

%) |

The Company’s consolidated sales for the third

quarter of 2024 decreased by $141.4 million or 10.3% to $1,237.5

million as compared to $1,378.9 million for the third quarter of

2023. The total decrease in sales was driven by year-over-year

decreases across all operating segments.

Sales for the third quarter of 2024 in the

Company’s North America operating segment decreased by $82.0

million or 7.9% to $960.3 million from $1,042.2 million for the

third quarter of 2023. The decrease was due to a decrease in

tooling sales of $47.5 million, which are typically dependent on

the timing of tooling construction and final acceptance by the

customer; programs that ended production during or subsequent to

the third quarter of 2023, specifically the Ford Edge, Dodge

Charger/Challenger, and Chevrolet Bolt; and lower year-over-year

OEM production volumes on certain platforms, including the Jeep

Grand Cherokee and Wagoneer, an engine block for Stellantis, and

the Ford Mustang Mach E. These negative factors were partially

offset by the launch and ramp up of new programs during or

subsequent to the third quarter of 2023, including General Motors'

new electric vehicle platforms (BEV3/BET), and the Toyota Tacoma;

higher year-over-year OEM production volumes on certain other light

vehicle platforms, including General Motors' large pick-up truck

and SUV platform, and the Ford Maverick; and the impact of foreign

exchange on the translation of U.S. denominated production sales,

which had a positive impact on overall sales for the third quarter

of 2024 of $21.1 million. Overall third quarter industry-wide OEM

light vehicle production volumes in North America decreased by

approximately 5% year-over-year.

Sales for the third quarter of 2024 in the

Company’s Europe operating segment decreased by $51.6 million or

17.1% to $250.5 million from $302.1 million for the third quarter

of 2023. The decrease was due to lower year-over-year OEM

production volumes on certain platforms, including aluminum engine

blocks for Ford and Mercedes, and the Mercedes' new electric

vehicle platform (EVA2); programs that ended production during or

subsequent to the third quarter of 2023, specifically the BMW Mini;

and a decrease in tooling sales of $8.8 million, which are

typically dependent of the timing of tooling construction and final

acceptance by the customer. These negative factors were partially

offset by higher year-over-year OEM production volumes on certain

platforms, including the Lucid Air, and an aluminum engine block

for Jaguar Land Rover; and the impact of foreign exchange on the

translation of Euro denominated production sales, which had a

positive impact on overall sales for the third quarter of 2024 of

$4.8 million. Overall third quarter industry-wide OEM light vehicle

production volumes in Europe decreased by approximately 6%

year-over-year.

Sales for the third quarter of 2024 in the

Company’s Rest of the World operating segment decreased by $9.0

million or 21.1% to $33.6 million from $42.6 million in the third

quarter of 2023. The decrease was largely driven by programs that

came with the operations acquired from Metalsa in China that ended

production during or subsequent to the third quarter of 2023, lower

year-over-year production volumes on the Cadillac CT6 vehicle

platform in China, and a decrease in tooling sales of $2.0 million;

partially offset by the launch and ramp up of new programs,

specifically the BMW 5-series in China.

Overall tooling sales decreased by $58.3 million

(including outside segment sales eliminations) to $70.2 million for

the third quarter of 2024 from $128.6 million for the third quarter

of 2023.

Nine months ended September 30, 2024 to

nine months ended September 30, 2023 comparison

|

|

Nine months ended September 30, 2024 |

|

Nine months ended September 30, 2023 |

|

$ Change |

|

% Change |

|

North America |

$ |

2,908,778 |

|

|

$ |

3,063,277 |

|

|

(154,499 |

) |

|

(5.0 |

%) |

| Europe |

|

871,469 |

|

|

|

893,638 |

|

|

(22,169 |

) |

|

(2.5 |

%) |

| Rest of the World |

|

102,600 |

|

|

|

113,092 |

|

|

(10,492 |

) |

|

(9.3 |

%) |

|

Eliminations |

|

(19,648 |

) |

|

|

(26,125 |

) |

|

6,477 |

|

|

24.8 |

% |

|

Total Sales |

$ |

3,863,199 |

|

|

$ |

4,043,882 |

|

|

(180,683 |

) |

|

(4.5 |

%) |

The Company’s consolidated sales for the nine

months ended September 30, 2024 decreased by $180.7 million or 4.5%

to $3,863.2 million as compared to $4,043.9 million for the nine

months ended September 30, 2023. The total decrease in sales was

driven by year-over-year decreases across all operating

segments.

Sales for the nine months ended September 30,

2024 in the Company’s North America operating segment decreased by

$154.5 million or 5.0% to $2,908.8 million from $3,063.3 million

for the nine months ended September 30, 2023. The decrease was due

generally to a decrease in tooling sales of $154.2 million which

are typically dependent on the timing of tooling construction and

final acceptance by the customer; programs that ended production

during or subsequent to the corresponding period of 2023,

specifically the Dodge Charger/Challenger, the Ford Edge, and

Chevrolet Bolt; and lower year-over-year OEM production volumes on

certain platforms, including an engine block for Stellantis, the

Jeep Grand Cherokee and Wagoneer, the Ford Mustang Mach E, and

Mercedes' new electric vehicle platform (EVA2). These negative

factors were partially offset by the launch and ramp up of new

programs, including General Motors' new electric vehicle platforms

(BEV3/BET), and the Toyota Tacoma; higher year-over-year production

volumes of certain light vehicle platforms including the Ford

Escape and Maverick, and General Motors' large pick-up truck and

SUV platform; and the impact of foreign exchange on the translation

of U.S. denominated production sales, which had a positive impact

on overall sales for the nine months ended September 30, 2024 of

$26.1 million.

Sales for the nine months ended September 30,

2024 in the Company’s Europe operating segment decreased by $22.2

million or 2.5% to $871.5 million from $893.6 million for the nine

months ended September 30, 2023. The decrease was due to programs

that ended production during or subsequent to the corresponding

period of 2023, specifically the BMW Mini; and lower year-over-year

production volumes of certain other light vehicle platforms,

including the Mercedes' new electric vehicle platform (EVA2) and

aluminum engine blocks for Ford and Mercedes. These negative

factors were partially offset by higher year-over-year OEM

production volumes on certain platforms, including an aluminum

engine block for Jaguar Land Rover; an increase in tooling sales of

$21.0 million, which are typically dependent on the timing of

tooling construction and final acceptance by the customer; and the

impact of foreign exchange on the translation of Euro denominated

production sales, which had a positive impact on overall sales for

the nine months ended September 30, 2024 of $9.9 million.

Sales for the nine months ended September 30,

2024 in the Company’s Rest of the World operating segment decreased

by $10.5 million or 9.3% to $102.6 million from $113.1 million for

the nine months ended September 30, 2023. The decrease was largely

driven by programs that came with the operations acquired from

Metalsa in China that ended production during or subsequent to the

nine months ended September 30, 2023, and lower year-over-year

production volumes on the Cadillac CT6 vehicle platform in China;

partially offset by the launch and ramp up of new programs,

specifically the BMW 5-series in China, and an increase in tooling

sales of $4.0 million.

Overall tooling sales decreased by $128.1

million (including outside segment sales eliminations) to $174.7

million for the nine months ended September 30, 2024 from $302.8

million for the nine months ended September 30, 2023.

GROSS MARGIN

Three months ended September 30, 2024 to

three months ended September 30, 2023 comparison

|

|

Three months endedSeptember 30,

2024 |

|

Three months endedSeptember 30,

2023 |

|

$ Change |

|

% Change |

|

Gross margin |

$ |

163,350 |

|

|

$ |

181,194 |

|

|

(17,844 |

) |

|

(9.8 |

%) |

| % of

Sales |

|

13.2 |

% |

|

|

13.1 |

% |

|

|

|

|

The gross margin percentage for the third

quarter of 2024 of 13.2% increased slightly as a percentage of

sales as compared to the gross margin percentage for the third

quarter of 2023 of 13.1% due to:

- productivity and

efficiency improvements at certain operating facilities and other

improvements; and

- a decrease in tooling sales which

typically earn low margin for the Company.

These factors were essentially offset by:

- overall lower

production sales volume and corresponding contribution;

- operational

inefficiencies at certain operating facilities; and

- a negative sales mix, including

additional depreciation expense from recent new program

investments.

Overall market related inflationary pressures on

labour, material and energy costs, along with offsetting commercial

settlements, were generally stable for the quarter on a

year-over-year basis.

Nine months ended September 30, 2024 to

nine months ended September 30, 2023 comparison

|

|

Nine months ended September 30, 2024 |

|

Nine months ended September 30, 2023 |

|

$ Change |

|

% Change |

|

Gross margin |

$ |

519,517 |

|

|

$ |

522,169 |

|

|

(2,652 |

) |

|

(0.5 |

%) |

| % of

Sales |

|

13.4 |

% |

|

|

12.9 |

% |

|

|

|

|

The gross margin percentage for the nine months

ended September 30, 2024 of 13.4% increased as a percentage of

sales by 0.5% as compared to the gross margin percentage for the

nine months ended September 30, 2023 of 12.9%. The increase in

gross margin as a percentage of sales was generally due to:

- productivity and

efficiency improvements at certain operating facilities and other

improvements; and

- a decrease in tooling sales which

typically earn low margin for the Company.

These factors were partially offset by:

- operational

inefficiencies at certain other operating facilities;

- overall lower

production sales volume and corresponding contribution;

- an unfavourable

impact from a year-over-year change in foreign exchange rates in

Mexico; and

- a negative sales mix, including

additional depreciation expense from recent new program

investments.

Overall market related inflationary pressures on

labour, material and energy costs, along with offsetting commercial

settlements, were generally stable year-over-year.

ADJUSTMENTS TO NET INCOME

Adjusted Net Income excludes certain items as

set out in the following tables and described in the notes thereto.

Management uses Adjusted Net Income as a measurement of operating

performance of the Company and believes that, in conjunction with

IFRS measures, it provides useful information about the financial

performance and condition of the Company.

TABLE A

Three months ended September 30, 2024 to

three months ended September 30, 2023 comparison

No adjustments were noted during the three

months ended September 30, 2024 and 2023.

TABLE B

Nine months ended September 30, 2024 to

nine months ended September 30, 2023 comparison

|

|

Nine months ended September 30, 2024 |

|

Nine months ended September 30, 2023 |

|

$ Change |

|

NET INCOME |

$ |

98,786 |

|

|

$ |

151,815 |

|

|

$ |

(53,029 |

) |

| |

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

| Restructuring costs (1) |

|

11,610 |

|

|

|

- |

|

|

|

11,610 |

|

| Net gain on disposal of equity

investments (2) |

|

- |

|

|

|

(5,273 |

) |

|

|

5,273 |

|

|

ADJUSTMENTS, BEFORE TAX |

$ |

11,610 |

|

|

$ |

(5,273 |

) |

|

$ |

16,883 |

|

| |

|

|

|

|

|

| Tax impact of adjustments |

|

(3,759 |

) |

|

|

699 |

|

|

|

(4,458 |

) |

|

ADJUSTMENTS, AFTER TAX |

$ |

7,851 |

|

|

$ |

(4,574 |

) |

|

$ |

12,425 |

|

|

|

|

|

|

|

|

|

ADJUSTED NET INCOME |

$ |

106,637 |

|

|

$ |

147,241 |

|

|

$ |

(40,604 |

) |

|

|

|

|

|

|

|

| Number of Shares Outstanding –

Basic (‘000) |

|

76,191 |

|

|

|

79,933 |

|

|

|

| Adjusted Basic Net Earnings

Per Share |

$ |

1.40 |

|

|

$ |

1.84 |

|

|

|

| Number of Shares Outstanding –

Diluted (‘000) |

|

76,194 |

|

|

|

79,989 |

|

|

|

|

Adjusted Diluted Net Earnings Per Share |

$ |

1.40 |

|

|

$ |

1.84 |

|

|

|

(1) Restructuring

costs

Additions to the restructuring provision during

the nine months ended September 30, 2024 totaled $11.6 million and

represent employee-related severance resulting from the rightsizing

of certain operations in Germany, Mexico, Canada, and the United

States.

(2) Net gain on

disposal of equity investments

On March 24, 2023, Martinrea sold its equity

interest in VoltaXplore Inc. ("VoltaXplore) to NanoXplore Inc.

("NanoXplore") for 3,420,406 common shares of NanoXplore at $2.92

per share representing an aggregate consideration of $10.0 million.

The sale transaction resulted in a gain on disposal of equity

investments during the first quarter of 2023 as follows:

|

Gross gain (Total consideration of $10.0 million less book value of

investment) |

$ |

6,821 |

|

| Less:

gain attributable to indirect retained interest |

|

(1,548 |

) |

|

Net gain on disposal of equity investments |

$ |

5,273 |

|

Subsequent to this transaction, the Company no

longer holds a direct equity interest in VoltaXplore while its

equity ownership interest in NanoXplore increased from 21.1% to

22.7%.

NET INCOME

Three months ended September 30, 2024 to

three months ended September 30, 2023 comparison

|

|

Three months ended September 30,

2024 |

|

Three months ended September 30,

2023 |

|

$ Change |

|

% Change |

|

Net Income |

$ |

14,157 |

|

$ |

53,744 |

|

(39,587 |

) |

|

(73.7 |

%) |

| Net Earnings per Share |

|

|

|

|

|

|

|

|

Basic and Diluted |

$ |

0.19 |

|

$ |

0.68 |

|

|

|

|

Net Income for the third quarter of 2024

decreased by $39.6 million to $14.2 million or $0.19 per share, on

a basic and diluted basis, from Net Income of $53.7 million or

$0.68 per share, on a basic and diluted basis, for the third

quarter of 2023.

Net Income for the third quarter of 2024, as

compared to the third quarter of 2023, was negatively impacted by

the following:

- lower gross

margin from lower year-over-year sales volume;

- a net foreign

exchange gain of $1.3 million for the third quarter of 2024

compared to a gain of $7.1 million for the third quarter of 2023;

and

- a higher effective tax rate (70.2%

for the third quarter of 2024 compared to 21.5% for the third

quarter of 2023) driven primarily by the IFRS accounting treatment

of the rapid depreciation of the Mexican Peso against the U.S.

dollar that does not impact cash.

These factors were partially offset by the

following:

- a year-over-year

decrease in SG&A expense, as previously explained; and

- a $2.5 million year-over-year

decrease in finance expense as a result of lower borrowing rates on

the Company's revolving bank debt.

Nine months ended September 30, 2024 to

nine months ended September 30, 2023 comparison

|

|

Nine months ended September 30, 2024 |

|

Nine months ended September 30, 2023 |

|

$ Change |

|

% Change |

|

Net Income |

$ |

98,786 |

|

$ |

151,815 |

|

(53,029 |

) |

|

(34.9 |

%) |

| Adjusted Net Income |

|

106,637 |

|

|

147,241 |

|

(40,604 |

) |

|

(27.6 |

%) |

| Net Earnings per Share |

|

|

|

|

|

|

|

|

Basic and Diluted |

$ |

1.30 |

|

$ |

1.90 |

|

|

|

|

| Adjusted Net Earnings per

Share |

|

|

|

|

|

|

|

|

Basic and Diluted |

$ |

1.40 |

|

$ |

1.84 |

|

|

|

|

Net Income, before adjustments, for the nine

months ended September 30, 2024 decreased by $53.0 million to $98.8

million or $1.30 per share, on a basic and diluted basis, from Net

Income of $151.8 million or $1.90 per share, on a basic and diluted

basis, for the nine months ended September 30, 2023. Excluding the

adjustments explained in Table B under “Adjustments to Net Income”,

Adjusted Net Income for the nine months ended September 30, 2024

decreased by $40.6 million to $106.6 million or $1.40 per share on

a basic and diluted basis, from $147.2 million or $1.84 per share

on a basic and diluted basis, for the nine months ended September

30, 2023.

Adjusted Net Income for the nine months ended

September 30, 2024, as compared to the nine months ended September

30, 2023, was negatively impacted by the following:

- a year-over-year

increase in SG&A expense, as previously explained;

- a $3.8 million

year-over-year increase in research and development costs driven

generally by increased new product and process development

activity;

- lower gross

margin on lower year-over-year sales volume;

- a $1.5 million

loss on the disposal of property, plant and equipment for the nine

months ended September 30, 2024; and

- a higher effective tax rate (38.8%

for the nine months ended September 30, 2024 compared to 20.4% for

the nine months ended September 30, 2023) driven primarily by the

IFRS accounting treatment of the rapid depreciation of the Mexican

Peso against the U.S. dollar that does not impact cash.

These factors were partially offset by the

following:

- a net foreign

exchange gain of $8.1 million for the nine months ended September

30, 2024 compared to a gain of $6.5 million for the nine months

ended September 30, 2023; and

- a $1.6 million year-over-year

decrease in finance expense as a result of lower borrowing rates on

the Company's revolving bank debt.

Adjusted Net Income and Adjusted Net Earnings

per Share for the three and nine months ended September 30, 2024

were negatively impacted by an unusually high effective tax rate.

This was driven primarily by the magnitude and pace of the

depreciation of the Mexican Peso against the U.S. dollar, which is

the functional currency of the Company’s Mexican operations. In

situations where the local and functional currencies differ, IFRS,

contrary to US GAAP, requires the tax value of assets and

liabilities denominated in local currency to be revalued to the

operations' functional currency at the reporting date, with the

related foreign exchange movements impacting the tax expense for

the period. These foreign exchange movements are non-cash in

nature, do not impact cash taxes and tend to balance out over time.

Including this, and other foreign exchange related items, the

effective tax rate for the nine months ended September 30, 2024 was

38.8%. Excluding these foreign exchange items, the effective tax

rate would have been 31.0%, which is more reflective of a typical

tax rate for the Company. Using a tax rate of 31.0%, Adjusted Net

Earnings per Share would have been $0.44 for the three months ended

September 30, 2024, and $1.47 for the nine months ended September

30, 2024.

DIVIDEND

A cash dividend of $0.05 per share has been

declared by the Board of Directors payable to shareholders of

record on December 31, 2024, on or about January 15, 2025.

ABOUT MARTINREA

Martinrea International Inc. is a leader in the

development and production of quality metal parts, assemblies and

modules, fluid management systems, and complex aluminum products

focused primarily on the automotive sector. Martinrea currently

operates in 56 locations in Canada, the United States, Mexico,

Brazil, Germany, Slovakia, Spain, China, South Africa, and Japan.

Martinrea’s vision is making lives better by being the best

supplier we can be in the products we make and the services we

provide. For more information on Martinrea, please visit

www.martinrea.com. Follow Martinrea on X and Facebook.

CONFERENCE CALL DETAILS

A conference call to discuss the financial

results will be held on Tuesday, November 12, 2024 at 5:30 p.m.

Eastern Time. To participate, please dial 416-641-6104 (Toronto

area) or 800-952-5114 (toll free Canada and US) and enter

participant code 1624622#. Please call 10 minutes prior to the

start of the conference call.

The conference call will also be webcast live in

listen‐only mode and archived for twelve months. The webcast and

accompanying presentation can be accessed at:

https://www.martinrea.com/investor-relations/events-presentations/.

There will also be a rebroadcast of the call

available by dialing 905-694-9451 or toll free 800-408-3053

(Conference ID – 9076430#). The rebroadcast will be available until

December 14, 2024 at 5:00 p.m.

If you have any teleconferencing questions,

please call Ganesh Iyer at 416-749-0314.

FORWARD-LOOKING INFORMATION

Special Note Regarding Forward-Looking

Statements

This Press Release and the documents

incorporated by reference therein contains forward-looking

statements within the meaning of applicable Canadian securities

laws including those related to the Company’s expectations as to,

or its views or beliefs in or on, the impact of, or duration of, or

factors affecting, or expected response to or growth of,

improvements in, expansion of and/or guidance or outlook (including

for 2024) as to future results, revenue, sales, margin, gross

margin, earnings, and earnings per share, adjusted earnings per

share, free cash flow, volumes, adjusted net earnings per share,

operating income margins, operating margins, adjusted operating

income margins, leverage ratios, net debt to adjusted EBITDA(1),

debt repayment, Adjusted EBITDA(1), improvements in interest rates,

tax rates, supply constraints, inflation and labour, the growth of

the Company and pursuit of, and belief in, its strategies, the

strength, recovery and growth of the automotive industry and

continuing challenges, capital allocation strategies, contemplated

purchases under the NCIB, as well as other forward-looking

statements. The words “continue”, “expect”, “anticipate”,

“estimate”, “may”, “will”, “should”, “views”, “intend”, “believe”,

“plan” and similar expressions are intended to identify

forward-looking statements. Forward-looking statements are based on

estimates and assumptions made by the Company in light of its

experience and its perception of historical trends, current

conditions and expected future developments, as well as other

factors that the Company believes are appropriate in the

circumstances, such as expected sales and industry production

estimates, current foreign exchange rates, timing of product

launches and operational improvement during the period, and current

Board approved budgets. Many factors could cause the Company’s

actual results, performance or achievements to differ materially

from those expressed or implied by the forward-looking statements,

including, without limitation, the following factors, some of which

are discussed in detail in the Company’s AIF and MD&A for the

year ended December 31, 2023, and other public filings which can be

found at www.sedarplus.ca:

- North American and Global Economic

and Political Conditions (including war) and Consumer

Confidence

- Automotive Industry Risks

- Pandemics and Epidemics, Force

Majeure Events, Natural Disasters, Terrorist Activities, Political

and Civil Unrest or War, and Other Outbreaks

- Russia and Ukraine War and

Hamas-Israel War

- Semiconductor Chip Shortages and

Price Increases

- Inflationary Pressures

- Regional Energy Shortages

- Dependence Upon Key Customers

- Customer Consolidation and

Cooperation

- Emergence of Potentially Disruptive

EV OEMs

- Outsourcing and Insourcing

Trends

- Financial Viability of Suppliers

and Key Suppliers and Supply Disruptions

- Competition

- Customer Pricing Pressures,

Contractual Arrangements, Cost and Risk Absorption and Purchase

Orders

- Material and Commodity Prices and

Volatility

- Scrap Steel/Aluminum Price

Volatility

- Quote/Pricing Assumptions

- Launch and Operational Costs and

Cost Structure

- Fluctuations in Operating

Results

- Product Warranty,

Repair/Replacement Costs, Recall, Product Liability and Liability

Risk

- Product Development and

Technological Change

- A Shift Away from Technologies in

Which the Company is Investing

- Dependence Upon Key Personnel

- Limited Financial

Resources/Uncertainty of Future Financing/Banking

- Cybersecurity Threats

- Acquisitions

- Joint Ventures

- Private or Public Equity

Investments in Technology Companies

- Potential Tax Exposures

- Potential Rationalization Costs,

Turnaround Costs and Impairment Charges

- Labour Relations Matters

- Trade Restrictions or Disputes

- Changes in Laws and Governmental

Regulations

- Environmental Regulation and

Climate Change

- Litigation and Regulatory

Compliance and Investigations

- Risks of Conducting Business in

Foreign Countries, Including China, Brazil and Other Growing

Markets

- Currency Risk

- Internal Controls Over Financial

Reporting and Disclosure Controls and Procedures

- Loss of Use of Key Manufacturing

Facilities

- Intellectual Property

- Availability of Consumer Credit or

Cost of Borrowing

- Evolving Business Risk Profile

- Competition with Low Cost

Countries

- The Company’s Ability to Shift its

Manufacturing Footprint to Take Advantage of Opportunities in

Growing Markets

- Change in the Company’s Mix of

Earnings Between Jurisdictions with Lower Tax Rates and Those with

Higher Tax Rates

- Pension Plans and Other

Post-Employment Benefits

- Potential Volatility of Share

Prices

- Dividends

- Lease Obligations

These factors should be considered carefully,

and readers should not place undue reliance on the Company’s

forward-looking statements. The Company has no intention and

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

The common shares of Martinrea trade on The

Toronto Stock Exchange under the symbol “MRE”.

For further information, please contact:

Peter CirulisChief Financial OfficerMartinrea

International Inc.3210 Langstaff RoadVaughan, Ontario L4K

5B2Tel: 416-749-0314Fax:

289-982-3001

1 The Company prepares its financial statements

in accordance with IFRS Accounting Standards (“IFRS”). However, the

Company considers certain non-IFRS financial measures as useful

additional information in measuring the financial performance and

condition of the Company. These measures, which the Company

believes are widely used by investors, securities analysts and

other interested parties in evaluating the Company’s performance,

do not have a standardized meaning prescribed by IFRS and therefore

may not be comparable to similarly titled measures presented by

other publicly traded companies, nor should they be construed as an

alternative to financial measures determined in accordance with

IFRS. Non-IFRS measures, included anywhere in this press release,

include “Adjusted Net Income”, “Adjusted Net Earnings per Share (on

a basic and diluted basis)”, “Adjusted Operating Income”, “Adjusted

EBITDA”, “Free Cash Flow”, “Free Cash-Flow (after IFRS 16 lease

payments)” and “Net Debt”. The relevant IFRS financial measure, as

applicable, and a reconciliation of certain non-IFRS financial

measures to measures determined in accordance with IFRS are

contained in the Company’s Management Discussion and Analysis for

the three and nine months ended September 30, 2024 and in this

press release.

Martinrea International Inc.Interim Condensed

Consolidated Balance Sheets(in thousands of Canadian dollars)

(unaudited)

|

|

Note |

September 30, 2024 |

December 31, 2023 |

|

ASSETS |

|

|

|

|

Cash and cash equivalents |

|

$ |

177,267 |

$ |

186,804 |

| Trade and other

receivables |

2 |

|

801,012 |

|

695,819 |

| Inventories |

3 |

|

564,558 |

|

568,274 |

| Prepaid expenses and

deposits |

|

|

35,611 |

|

33,904 |

| Income

taxes recoverable |

|

|

35,644 |

|

11,089 |

|

TOTAL CURRENT ASSETS |

|

|

1,614,092 |

|

1,495,890 |

|

Property, plant and equipment |

4 |

|

1,945,783 |

|

1,943,771 |

| Right-of-use assets |

5 |

|

224,230 |

|

238,552 |

| Deferred tax assets |

|

|

193,175 |

|

192,301 |

| Intangible assets |

|

|

40,193 |

|

42,743 |

| Investments |

6 |

|

66,124 |

|

60,170 |

| Pension

assets |

|

|

17,046 |

|

16,303 |

|

TOTAL NON-CURRENT ASSETS |

|

|

2,486,551 |

|

2,493,840 |

|

TOTAL ASSETS |

|

$ |

4,100,643 |

$ |

3,989,730 |

|

|

|

|

|

|

LIABILITIES |

|

|

|

| Trade and other payables |

|

$ |

1,185,482 |

$ |

1,176,579 |

| Provisions |

7 |

|

8,843 |

|

29,892 |

| Income taxes payable |

|

|

52,364 |

|

25,017 |

| Current portion of long-term

debt |

8 |

|

11,290 |

|

12,778 |

| Current

portion of lease liabilities |

9 |

|

52,177 |

|

48,507 |

|

TOTAL CURRENT LIABILITIES |

|

|

1,310,156 |

|

1,292,773 |

|

Long-term debt |

8 |

|

986,063 |

|

956,458 |

| Lease liabilities |

9 |

|

192,233 |

|

210,469 |

| Pension and other

post-retirement benefits |

|

|

40,055 |

|

37,261 |

|

Deferred tax liabilities |

|

|

26,059 |

|

27,588 |

|

TOTAL NON-CURRENT LIABILITIES |

|

|

1,244,410 |

|

1,231,776 |

|

TOTAL LIABILITIES |

|

|

2,554,566 |

|

2,524,549 |

|

|

|

|

|

| EQUITY |

|

|

|

| Capital stock |

11 |

|

611,101 |

|

645,256 |

| Contributed surplus |

|

|

45,950 |

|

45,903 |

| Accumulated other

comprehensive income |

|

|

139,934 |

|

95,753 |

|

Retained earnings |

|

|

749,092 |

|

678,269 |

|

TOTAL EQUITY |

|

|

1,546,077 |

|

1,465,181 |

|

TOTAL LIABILITIES AND EQUITY |

|

$ |

4,100,643 |

$ |

3,989,730 |

Contingencies (note 16)Subsequent event

(note 18)

See accompanying notes to the interim condensed consolidated

financial statements.

On behalf of the Board:

|

“Robert Wildeboer” |

Director |

| “Terry

Lyons” |

Director |

Martinrea International Inc.Interim Condensed

Consolidated Statements of Operations(in thousands of Canadian

dollars, except per share amounts) (unaudited)

|

|

Note |

Three

monthsendedSeptember 30,2024 |

|

Three

monthsendedSeptember 30,2023 |

|

Nine monthsendedSeptember 30,2024 |

|

Nine monthsendedSeptember 30,2023 |

|

|

|

|

|

|

|

|

|

SALES |

|

$ |

1,237,493 |

|

$ |

1,378,938 |

|

$ |

3,863,199 |

|

$ |

4,043,882 |

|

|

|

|

|

|

|

|

|

Cost of sales (excluding depreciation of property, plant and

equipment and right-of-use assets) |

|

|

(993,212 |

) |

|

(1,124,326 |

) |

|

(3,109,104 |

) |

|

(3,306,836 |

) |

|

Depreciation of property, plant and equipment and right-of-use

assets (production) |

|

|

(80,931 |

) |

|

(73,418 |

) |

|

(234,578 |

) |

|

(214,877 |

) |

|

Total cost of sales |

|

|

(1,074,143 |

) |

|

(1,197,744 |

) |

|

(3,343,682 |

) |

|

(3,521,713 |

) |

|

GROSS MARGIN |

|

|

163,350 |

|

|

181,194 |

|

|

519,517 |

|

|

522,169 |

|

|

|

|

|

|

|

|

|

Research and development costs |

|

|

(10,852 |

) |

|

(9,628 |

) |

|

(32,037 |

) |

|

(28,257 |

) |

|

Selling, general and administrative |

|

|

(82,384 |

) |

|

(83,990 |

) |

|

(247,132 |

) |

|

(239,962 |

) |

|

Depreciation of property, plant and equipment and right-of-use

assets (non-production) |

|

|

(3,973 |

) |

|

(4,419 |

) |

|

(12,230 |

) |

|

(13,164 |

) |

|

Loss on disposal of property, plant and equipment |

|

|

(262 |

) |

|

(142 |

) |

|

(1,489 |

) |

|

(158 |

) |

|

Restructuring costs |

7 |

|

- |

|

|

- |

|

|

(11,610 |

) |

|

- |

|

|

OPERATING INCOME |

|

|

65,879 |

|

|

83,015 |

|

|

215,019 |

|

|

240,628 |

|

|

|

|

|

|

|

|

|

Share of loss of equity investments |

6 |

|

(690 |

) |

|

(600 |

) |

|

(2,147 |

) |

|

(2,630 |

) |

|

Net gain on disposal of equity investments |

|

|

- |

|

|

- |

|

|

- |

|

|

5,273 |

|

|

Finance expense |

13 |

|

(18,840 |

) |

|

(21,376 |

) |

|

(58,501 |

) |

|

(60,108 |

) |

|

Other finance income |

13 |

|

1,084 |

|

|

7,418 |

|

|

8,140 |

|

|

7,074 |

|

|

INCOME BEFORE INCOME TAXES |

|

|

47,433 |

|

|

68,457 |

|

|

162,511 |

|

|

190,237 |

|

|

|

|

|

|

|

|

|

Income tax expense |

10 |

|

(33,276 |

) |

|

(14,713 |

) |

|

(63,725 |

) |

|

(38,422 |

) |

|

NET INCOME FOR THE

PERIOD |

|

$ |

14,157 |

|

$ |

53,744 |

|

$ |

98,786 |

|

$ |

151,815 |

|

|

|

|

|

|

|

|

|

Basic earnings per share |

12 |

$ |

0.19 |

|

$ |

0.68 |

|

$ |

1.30 |

|

$ |

1.90 |

|

|

Diluted earnings per share |

12 |

$ |

0.19 |

|

$ |

0.68 |

|

$ |

1.30 |

|

$ |

1.90 |

|

See accompanying notes to the interim condensed consolidated

financial statements.

Martinrea International Inc.Interim Condensed

Consolidated Statements of Comprehensive Income(in thousands of

Canadian dollars) (unaudited)

|

|

Three

monthsendedSeptember 30,2024 |

|

Three

monthsendedSeptember 30,2023 |

Nine monthsendedSeptember 30,2024 |

|

Nine monthsendedSeptember 30,2023 |

|

|

|

|

|

|

|

|

NET INCOME FOR THE

PERIOD |

$ |

14,157 |

|

$ |

53,744 |

$ |

98,786 |

|

$ |

151,815 |

|

| Other

comprehensive income (loss), net

of tax: |

|

|

|

|

|

Items that may be reclassified to net

income |

|

|

|

|

|

Foreign currency translation differences for foreign

operations |

|

(1,472 |

) |

|

28,682 |

|

44,206 |

|

|

(2,345 |

) |

|

Items that will not be reclassified to net

income |

|

|

|

|

|

Share of other comprehensive income (loss) of equity investments

(note 6) |

|

14 |

|

|

14 |

|

(25 |

) |

|

(4 |

) |

|

Remeasurement of defined benefit plans |

|

322 |

|

|

3,184 |

|

(814 |

) |

|

5,630 |

|

|

Other comprehensive income

(loss), net of tax |

|

(1,136 |

) |

|

31,880 |

|

43,367 |

|

|

3,281 |

|

|

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD |

$ |

13,021 |

|

$ |

85,624 |

$ |

142,153 |

|

$ |

155,096 |

|

See accompanying notes to the interim condensed consolidated

financial statements.

Martinrea International Inc.Interim Condensed

Consolidated Statements of Changes in Equity(in thousands of

Canadian dollars) (unaudited)

|

|

Capitalstock |

|

Contributedsurplus |

|

Accumulatedothercomprehensiveincome |

|

Retainedearnings |

|

Total equity |

|

|

BALANCE AT DECEMBER 31,

2022 |

$ |

663,646 |

|

$ |

45,558 |

|

$ |

124,065 |

|

$ |

543,636 |

|

$ |

1,376,905 |

|

|

Net income for the period |

|

- |

|

|

- |

|

|

- |

|

|

151,815 |

|

|

151,815 |

|

|

Compensation expense related to stock options |

|

- |

|

|

331 |

|

|

- |

|

|

- |

|

|

331 |

|

|

Dividends ($0.15 per share) |

|

- |

|

|

- |

|

|

- |

|

|

(11,939 |

) |

|

(11,939 |

) |

|

Exercise of employee stock options |

|

358 |

|

|

(97 |

) |

|

- |

|

|

- |

|

|

261 |

|

|

Repurchase of common shares (note 11) |

|

(13,370 |

) |

|

- |

|

|

- |

|

|

(7,474 |

) |

|

(20,844 |

) |

|

Other comprehensive income (loss) net of tax |

|

|

|

|

|

|

Remeasurement of defined benefit plans |

|

- |

|

|

- |

|

|

- |

|

|

5,630 |

|

|

5,630 |

|

|

Foreign currency translation differences |

|

- |

|

|

- |

|

|

(2,345 |

) |

|

- |

|

|

(2,345 |

) |

|

Share of other comprehensive loss of equity investments |

|

- |

|

|

- |

|

|

(4 |

) |

|

- |

|

|

(4 |

) |

|

BALANCE AT SEPTEMBER 30,

2023 |

|

650,634 |

|

|

45,792 |

|

|

121,716 |

|

|

681,668 |

|

|

1,499,810 |

|

|

Net income for the period |

|

- |

|

|

- |

|

|

- |

|

|

1,850 |

|

|

1,850 |

|

|

Compensation expense related to stock options |

|

- |

|

|

111 |

|

|

- |

|

|

- |

|

|

111 |

|

|

Dividends ($0.05 per share) |

|

- |

|

|

- |

|

|

- |

|

|

(3,907 |

) |

|

(3,907 |

) |

|

Repurchase of common shares (note 11) |

|

(5,378 |

) |

|

- |

|

|

- |

|

|

(2,847 |

) |

|

(8,225 |

) |

|

Other comprehensive income (loss) net of tax |

|

|

|

|

|

|

Remeasurement of defined benefit plans |

|

- |

|

|

- |

|

|

- |

|

|

1,505 |

|

|

1,505 |

|

|

Foreign currency translation differences |

|

- |

|

|

- |

|

|

(25,949 |

) |

|

- |

|

|

(25,949 |

) |

|

Share of other comprehensive loss of equity investments |

|

- |

|

|

- |

|

|

(14 |

) |

|

- |

|

|

(14 |

) |

|

BALANCE AT DECEMBER 31,

2023 |

|

645,256 |

|

|

45,903 |

|

|

95,753 |

|

|

678,269 |

|

|

1,465,181 |

|

|

Net income for the period |

|

- |

|

|

- |

|

|

- |

|

|

98,786 |

|

|

98,786 |

|

|

Compensation expense related to stock options |

|

- |

|

|

127 |

|

|

- |

|

|

- |

|

|

127 |

|

|

Dividends ($0.15 per share) |

|

- |

|

|

- |

|

|

- |

|

|

(11,281 |

) |

|

(11,281 |

) |

|

Exercise of employee stock options |

|

350 |

|

|

(80 |

) |

|

- |

|

|

- |

|

|

270 |

|

|

Repurchase of common shares (note 11) |

|

(34,505 |

) |

|

- |

|

|

- |

|

|

(15,868 |

) |

|

(50,373 |

) |

|

Other comprehensive income (loss) net of tax |

|

|

|

|

|

|

Remeasurement of defined benefit plans |

|

- |

|

|

- |

|

|

- |

|

|

(814 |

) |

|

(814 |

) |

|

Foreign currency translation differences |

|

- |

|

|

- |

|

|

44,206 |

|

|

- |

|

|

44,206 |

|

|

Share of other comprehensive loss of equity investments |

|

- |

|

|

- |

|

|

(25 |

) |

|

- |

|

|

(25 |

) |

|

BALANCE AT SEPTEMBER 30,

2024 |

$ |

611,101 |

|

$ |

45,950 |

|

$ |

139,934 |

|

$ |

749,092 |

|

$ |

1,546,077 |

|

See accompanying notes to the interim condensed consolidated

financial statements.

Martinrea International Inc.Interim Condensed

Consolidated Statements of Cash Flows(in thousands of Canadian

dollars) (unaudited)

|

|

Three

monthsendedSeptember 30,2024 |

|

Three

monthsendedSeptember 30,2023 |

|

Nine monthsendedSeptember 30,2024 |

|

Nine monthsendedSeptember 30,2023 |

|

|

CASH PROVIDED BY (USED IN): |

|

|

|

|

| OPERATING

ACTIVITIES: |

|

|

|

|

|

Net income for the period |

$ |

14,157 |

|

$ |

53,744 |

|

$ |

98,786 |

|

$ |

151,815 |

|

| Adjustments for: |

|

|

|

|

|

Depreciation of property, plant and equipment and right-of-use

assets |

|

84,904 |

|

|

77,837 |

|

|

246,808 |

|

|

228,041 |

|

|

Amortization of development costs |

|

3,084 |

|

|

2,488 |

|

|

8,172 |

|

|

7,771 |

|

|

Unrealized loss (gain) on foreign exchange forward contracts |

|

(4,382 |

) |

|

298 |

|

|

(913 |

) |

|

215 |

|

|

Finance expense |

|

18,840 |

|

|

21,376 |

|

|

58,501 |

|

|

60,108 |

|

|

Income tax expense |

|

33,276 |

|

|

14,713 |

|

|

63,725 |

|

|

38,422 |

|

|

Loss on disposal of property, plant and equipment |

|

262 |

|

|

142 |

|

|

1,489 |

|

|

158 |

|

|

Deferred and restricted share units expense |

|

2,893 |

|

|

2,294 |

|

|

6,261 |

|

|

9,505 |

|

|

Stock options expense |

|

43 |

|

|

110 |

|

|

127 |

|

|

331 |

|

|

Share of loss of equity investments |

|

690 |

|

|

600 |

|

|

2,147 |

|

|

2,630 |

|

|

Net gain on disposal of equity investments |

|

- |

|

|

- |

|

|

- |

|

|

(5,273 |

) |

|

Pension and other post-retirement benefits expense |

|

571 |

|

|

693 |

|

|

1,702 |

|

|

2,087 |

|

|

Contributions made to pension and other post-retirement

benefits |

|

(489 |

) |

|

(666 |

) |

|

(1,657 |

) |

|

(1,886 |

) |

|

|

|

153,849 |

|

|

173,629 |

|

|

485,148 |

|

|

493,924 |

|

| Changes in non-cash working

capital items: |

|

|

|

|

|

Trade and other receivables |

|

(2,739 |

) |

|

(1,108 |

) |

|

(87,575 |

) |

|

(128,104 |

) |

|

Inventories |

|

12,159 |

|

|

25,395 |

|

|

15,897 |

|

|

23,500 |

|

|

Prepaid expenses and deposits |

|

(2,163 |

) |

|

(2,854 |

) |

|

(1,226 |

) |

|

2,595 |

|

|

Trade, other payables and provisions |

|

(5,529 |

) |

|

(5,741 |

) |

|

(17,128 |

) |

|

73,577 |

|

|

|

|

155,577 |

|

|

189,321 |

|

|

395,116 |

|

|

465,492 |

|

|

Interest paid |

|

(21,839 |

) |

|

(25,278 |

) |

|

(65,306 |

) |

|

(73,041 |

) |

|

Income taxes paid |

|

(1,849 |

) |

|

(10,839 |

) |

|

(50,533 |

) |

|

(74,622 |

) |

|

NET CASH PROVIDED BY

OPERATING ACTIVITIES |

$ |

131,889 |

|

$ |

153,204 |

|

$ |

279,277 |

|

$ |

317,829 |

|

|

|

|

|

|

|

| FINANCING

ACTIVITIES: |

|

|

|

|

|

Increase (decrease) in long-term debt (net of deferred financing

fees) |

|

(29,094 |

) |

|

(27,011 |

) |

|

18,847 |

|

|

8,320 |

|

|

Equipment loan repayments |

|

(1,329 |

) |

|

(3,895 |

) |

|

(5,899 |

) |

|

(12,471 |

) |

|

Principal payments of lease liabilities |

|

(13,096 |

) |

|

(11,845 |

) |

|

(38,852 |

) |

|

(34,732 |

) |

|

Dividends paid |

|

(3,743 |

) |

|

(3,981 |

) |

|

(11,489 |

) |

|

(12,019 |

) |

|

Exercise of employee stock options |

|

- |

|

|

- |

|

|

270 |

|

|

261 |

|

|

Repurchase of common shares |

|

(9,471 |

) |

|

(10,804 |

) |

|

(49,393 |

) |

|

(20,844 |

) |

|

NET CASH USED IN

FINANCING ACTIVITIES |

$ |

(56,733 |

) |

$ |

(57,536 |

) |

$ |

(86,516 |

) |

$ |

(71,485 |

) |

|

|

|

|

|

|

| INVESTING

ACTIVITIES: |

|

|

|

|

|

Purchase of property, plant and equipment (excluding capitalized

interest)* |

|

(80,814 |

) |

|

(62,444 |

) |

|

(191,681 |

) |

|

(222,300 |

) |

|

Capitalized development costs |

|

(1,457 |

) |

|

(1,397 |

) |

|

(4,601 |

) |

|

(5,598 |

) |

|

Increase in investments (note 6) |

|

- |

|

|

- |

|

|

(8,130 |

) |

|

(1,000 |

) |

|

Proceeds on disposal of property, plant and equipment |

|

4,122 |

|

|

16 |

|

|

5,311 |

|

|

402 |

|

|

NET CASH USED IN

INVESTING ACTIVITIES |

$ |

(78,149 |

) |

$ |

(63,825 |

) |

$ |

(199,101 |

) |

$ |

(228,496 |

) |

|

|

|

|

|

|

| Effect

of foreign exchange rate changes on cash and cash equivalents |

|

(1,178 |

) |

|

1,127 |

|

|

(3,197 |

) |

|

(778 |

) |

|

|

|

|

|

|

| INCREASE

(DECREASE) IN CASH AND CASH

EQUIVALENTS |

|

(4,171 |

) |

|

32,970 |

|

|

(9,537 |

) |

|

17,070 |

|

|

CASH AND CASH EQUIVALENTS, BEGINNING OF

PERIOD |

|

181,438 |

|

|

145,755 |

|

|

186,804 |

|

|

161,655 |

|

|

CASH AND CASH EQUIVALENTS, END OF PERIOD |

$ |

177,267 |

|

$ |

178,725 |

|

$ |

177,267 |

|

$ |

178,725 |

|

*As at September 30, 2024, $46,104

(December 31, 2023 - $75,800) of purchases of property, plant

and equipment remain unpaid and are recorded in trade and other

payables.

See accompanying notes to the interim condensed

consolidated financial statements.

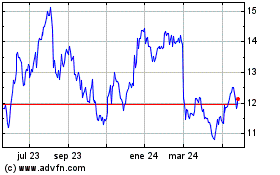

Martinrea (TSX:MRE)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

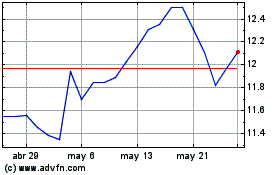

Martinrea (TSX:MRE)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024