Overall

PerformanceFor the three-month period ended June

30, 2020, PHX Energy realized adjusted EBITDA of $5.3 million (11

percent of revenue) as compared to $11 million (13 percent of

revenue) in the corresponding 2019-quarter. Adjusted EBITDA in the

2020-quarter includes $1.1 million in government grants earned as

part of the Canada Emergency Wage Subsidy (“CEWS”) program.

Positive adjusted EBITDA was achieved despite the negative impact

of COVID-19 on consolidated revenue and operating activity in all

regions. For the three-month period ended June 30, 2020, the

Corporation generated consolidated revenue of $46.8 million, a

decline of 44 percent relative to the $83 million recognized in the

second quarter of 2019. There were 2,990 consolidated operating

days recorded in the 2020-quarter, which is 46 percent lower than

the 5,567 days in the 2019-quarter. In contrast, consolidated

revenue per day, excluding the motor rental division in the US,

increased by 5 percent to $14,932, compared to revenue per day of

$14,181 in the 2019-quarter.

For the three-month period ended June 30, 2020,

the US division’s revenue, which represented 82 percent of

consolidated revenue, fell to the lowest quarterly revenue since

the fourth quarter of 2018. US revenue in the 2020-quarter was

$38.4 million compared to $67.1 million in the corresponding

2019-quarter, a decrease of 43 percent. The lower revenue in the

quarter was mainly due to the declining rig count in the US. The

Corporation’s US operating days in the 2020-quarter decreased by 44

percent to 2,172 days as compared to 3,903 days in the same

2019-quarter. The decrease in the Corporation’s drilling activity

was not as steep as what was experienced in the US industry which

declined by 60 percent from 939 average rigs running per day in the

second quarter of 2019 to 378 rigs in the 2020-quarter (Source:

Baker Hughes). US revenue per day rose slightly by 2 percent to

$16,774 from revenue per day of $16,409 in the corresponding

2019-quarter.

For the three-month period ended June 30, 2020,

the Canadian segment’s revenue decreased to $4.6 million from $10.7

million in the 2019-quarter. The Corporation’s Canadian operating

days in the 2020-quarter were 63 percent lower than in the

2019-quarter, whereas the industry experienced a 74 percent

decrease in horizontal and directional drilling days. The

negative impact of this decline in activity to revenue was

partially offset by an increase in revenue per day, which rose by

23 percent to $10,873 in the second quarter of 2020 compared to

$8,860 in the 2019-quarter.

Throughout the first half of 2020, the

Corporation maintained a strong balance sheet position and as at

June 30, 2020 had a cash balance of $14.6 million with no bank

loans and borrowings outstanding. As a result of lower earnings,

for the three-month period ended June 30, 2020, the Corporation’s

free cash flow decreased to $0.6 million as compared to $4.8

million realized in the corresponding 2019-quarter (see “Non-GAAP

Measures”).

Responding to

COVID-19On March 11, 2020, the World Health

Organization declared the novel coronavirus or COVID-19 a global

pandemic and the Corporation adopted heightened safety protocols as

a result of COVID-19. At present, the Corporation’s business is

considered essential in Canada and the US given the important role

that PHX Energy’s activities play in delivering oil and natural gas

to North American markets. The Corporation anticipates that changes

to work practices and other restrictions put in place by

governments and health authorities in response to COVID-19 will

continue to have an impact on business activities going

forward.

COVID-19 has had a significant impact on the

global economy and has resulted in a substantial weakening of

global oil prices and global oil demand. The Corporation

experienced reduced drilling activity in the second quarter of 2020

and the deterioration of the economic and industry conditions has

materially impacted the second quarter financial results. For the

three-month period ended June 30, 2020, the Corporation recognized

a $0.5 million impairment expense related to international EDR

assets, and received $1.1 million in government grants under the

CEWS program. The status of the bad debt provision of $4 million

made in the first quarter of 2020 remains substantially unchanged.

There are many variables and uncertainties regarding COVID-19,

including the duration and magnitude of the disruption in the oil

and natural gas industry. As such, it is not possible to precisely

estimate the potential impact of the COVID-19 pandemic on the

Corporation’s financial condition and operations. Management has

been proactive in mitigating these risks by aligning costs with

projected revenues and protecting profit margins. The Corporation

has restructured its business costs in line with decreasing

drilling activity in North America. This includes the unfortunate

necessity to decrease the size of its workforce as well as actions

to lower labour rates, reduce rental costs, and maximize discounts

and efficiencies within the supply chain. The Corporation will also

continue to take advantage of various government assistance

programs available for businesses in North America.

The Corporation has remained diligent in

protecting its balance sheet and retains financial flexibility with

significant liquidity on its credit facilities and no bank loans

and borrowings outstanding at the end of the 2020-quarter. As at

June 30, 2020, the Corporation has working capital of $56.9 million

and has approximately CAD $65 million and USD $15 million available

to be drawn from its credit facilities. The Corporation has

suspended new capital expenditures and as at June 30, 2020 has

commitments to purchase drilling and other equipment for $4.5

million, with delivery expected to occur by the end of the third

quarter. The Corporation has also currently suspended all share

repurchases under its Normal Course Issuer Bid (“NCIB”). Additional

information regarding the risks, uncertainties and impact on the

Corporation’s business can be found throughout this press release,

including under the headings “Capital Spending”, “Operating Costs

and Expenses”, and “Outlook”.

Severance

PayoutBeginning in March 2020 as a result of the

negative impacts of COVID-19 to drilling activity, Management

started to reduce the size of its workforce to align the

Corporation’s cost structure with lower activity levels. In the

three and six-month periods ended June 30, 2020, this resulted in

severance payouts of $1.3 million and $1.9 million, respectively,

included in direct costs and selling, general & administrative

(“SG&A”) costs (2019 – nil).

Capital

SpendingFor the three-month period ended June 30,

2020, the Corporation spent $1.4 million in capital expenditures,

which is lower when compared to the $9.1 million spent in the same

2019-quarter. Due to COVID-19’s impact on rig counts in North

America, the Corporation suspended any new capital expenditures in

the second quarter of 2020. Capital expenditures in the

2020-quarter were primarily directed towards Velocity Real Time

Systems (“Velocity”) and other machine and equipment. For the

six-month period ended June 30, 2020, the Corporation spent $20.4

million in capital expenditures, which were primarily directed

towards Atlas Higher Performance (“Atlas”) Motors, PowerDrive Orbit

Rotary Steerable Systems (“RSS”), and Velocity (2019 - $20.4

million). Of the total capital expenditures in the 2020-period,

$16.6 million was spent growing the Corporation’s fleet of drilling

equipment and the remaining $3.8 million was spent on maintenance

of the current fleet of drilling and other equipment.

As at June 30, 2020, the Corporation has capital

commitments to purchase drilling and other equipment for $4.5

million, majority of which is maintenance capital, and which

includes $4 million for Velocity systems, $0.3 million for

performance drilling motors, and $0.2 million for vehicles and

other equipment.

In 2020, the Corporation expects to spend $27.5

million in capital expenditures as compared to the previously

forecasted $30 million.

Normal Course Issuer

BidDuring the third quarter of 2019, the Toronto

Stock Exchange (“TSX”) approved the renewal of PHX Energy’s NCIB to

purchase for cancellation, from time-to-time, up to a maximum of

3,280,889 common shares, representing 10 percent of the

Corporation’s public float of Common Shares as at July 31, 2019.

The NCIB commenced on August 9, 2019 and will terminate on August

8, 2020. Purchases of common shares are to be made on the open

market through the facilities of the TSX and through alternative

trading systems. The price which PHX Energy is to pay for any

common shares purchased is to be at the prevailing market price on

the TSX or alternate trading systems at the time of such purchase.

Pursuant to the current NCIB, subsequent to August 9, 2019,

2,524,500 common shares were purchased by the Corporation and

cancelled as at December 31, 2019.

For the six-month period ended June 30, 2020,

the Corporation made no common share repurchases (2019 –

1,625,000).

The Corporation intends to make an application

to the TSX for renewal of its NCIB for a further one year

term. The anticipated renewal of the NCIB remains subject to

the review and approval of the TSX.

Financial Highlights

(Stated in thousands of dollars except per share

amounts, percentages and shares outstanding)

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

2020 |

|

2019 |

|

% Change |

|

|

2020 |

|

2019 |

|

% Change |

|

|

Operating Results |

(unaudited) |

|

(unaudited) |

|

|

|

|

(unaudited) |

|

(unaudited) |

|

|

|

|

Revenue |

46,769 |

|

82,984 |

|

(44 |

) |

|

149,788 |

|

175,104 |

|

(14 |

) |

|

Net loss |

(4,899 |

) |

(2,020 |

) |

143 |

|

|

(8,220 |

) |

(3,087 |

) |

166 |

|

|

Loss per share – diluted |

(0.09 |

) |

(0.04 |

) |

125 |

|

|

(0.15 |

) |

(0.05 |

) |

200 |

|

|

Adjusted EBITDA (1) |

5,308 |

|

10,995 |

|

(52 |

) |

|

23,994 |

|

22,426 |

|

7 |

|

|

Adjusted EBITDA per share – diluted (1) |

0.10 |

|

0.19 |

|

(47 |

) |

|

0.45 |

|

0.38 |

|

18 |

|

|

Adjusted EBITDA as a percentage of revenue (1) |

11 |

% |

13 |

% |

|

|

16 |

% |

13 |

% |

|

|

Cash Flow |

|

|

|

|

|

|

|

|

Cash flows from operating activities |

37,251 |

|

21,244 |

|

75 |

|

|

48,381 |

|

30,944 |

|

56 |

|

|

Funds from operations (1) |

3,157 |

|

9,785 |

|

(68 |

) |

|

23,948 |

|

19,884 |

|

20 |

|

|

Funds from operations per share – diluted (1) |

0.06 |

|

0.17 |

|

(65 |

) |

|

0.45 |

|

0.34 |

|

32 |

|

|

Capital expenditures |

1,438 |

|

9,090 |

|

(84 |

) |

|

20,430 |

|

20,397 |

|

- |

|

|

Free cash flow (1) |

573 |

|

4,806 |

|

(88 |

) |

|

17,338 |

|

10,756 |

|

61 |

|

|

|

|

|

|

|

|

|

|

|

Financial Position (unaudited) |

|

|

|

|

Jun 30, ‘20 |

|

Dec 31, ‘19 |

|

|

|

Working capital |

|

|

|

|

56,869 |

|

68,393 |

|

(17 |

) |

|

Net debt (1) (2) |

|

|

|

|

(14,628 |

) |

14,710 |

|

n.m. |

|

|

Shareholders’ equity |

|

|

|

|

144,018 |

|

148,944 |

|

(3 |

) |

|

Common shares outstanding |

|

|

|

|

53,251,420 |

|

53,246,420 |

|

- |

|

n.m. – not meaningful(1) Non-GAAP measure that

does not have any standardized meaning under IFRS and therefore may

not be comparable to similar measures presented by other entities.

Refer to non-GAAP measures section that follows the Outlook section

of this press release.(2) As at June 30, 2020, the Corporation had

no bank loans and borrowing outstanding and was in a cash positive

position.

Non-GAAP

MeasuresPHX Energy uses throughout this press

release certain measures to analyze operational and financial

performance that do not have standardized meanings prescribed under

Canadian generally accepted accounting principles (“GAAP”). These

non-GAAP measures include adjusted EBITDA, adjusted EBITDA per

share, debt to covenant EBITDA, funds from operations, funds from

operations per share, free cash flow, net debt and working capital.

Management believes that these measures provide supplemental

financial information that is useful in the evaluation of the

Corporation’s operations and are commonly used by other oil and

natural gas service companies. Investors should be cautioned,

however, that these measures should not be construed as

alternatives to measures determined in accordance with GAAP as an

indicator of PHX Energy’s performance. The Corporation’s method of

calculating these measures may differ from that of other

organizations, and accordingly, such measures may not be

comparable. Please refer to the “Non-GAAP Measures” section

following the Outlook section of this press release for applicable

definitions and reconciliations.

Cautionary Statement Regarding

Forward-Looking Information and Statements

This document contains certain forward-looking

information and statements within the meaning of applicable

securities laws. The use of "expect", "anticipate", "continue",

"estimate", "objective", "ongoing", "may", "will", "project",

"could", "should", "can", "believe", "plans", "intends", "strategy"

and similar expressions are intended to identify forward-looking

information or statements.

The forward-looking information and statements

included in this document are not guarantees of future performance

and should not be unduly relied upon. These statements and

information involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements and information. The Corporation believes the

expectations reflected in such forward-looking statements and

information are reasonable, but no assurance can be given that

these expectations will prove to be correct. Such forward-looking

statements and information included in this document should not be

unduly relied upon. These forward-looking statements and

information speak only as of the date of this document.

In particular, forward-looking information and

statements contained in this document include, without limitation,

the timeline for delivery of equipment on order, the projected

capital expenditures budget for the 2020-year and how this budget

will be allocated and funded, the Corporation’s intention to renew

its NCIB, and the anticipated impact of COVID-19 on the

Corporation’s operations, results and the Corporation’s planned

responses thereto.

The above are stated under the headings:

“Capital Spending”, “Normal Corse Issuer Bid”, “Responding to

COVID-19” and “Cash Requirements for Capital Expenditures”. In

addition, all information contained under the headings “Responding

to COVID-19” and “Outlook” in this document contains

forward-looking statements.

In addition to other material factors,

expectations and assumptions which may be identified in this press

release and other continuous disclosure documents of the

Corporation referenced herein, assumptions have been made in

respect of such forward-looking statements and information

regarding, among other things: the Corporation will continue to

conduct its operations in a manner consistent with past operations;

the general continuance of current industry conditions; anticipated

financial performance, business prospects, impact of competition,

strategies, the general stability of the economic and political

environment in which the Corporation operates; the continuing

impact of COVID-19 on the global economy, specifically trade,

manufacturing, supply chain and energy consumption, among other

things and the resulting impact on the Corporation’s operations and

future results which remain uncertain; exchange and interest rates;

the continuance of existing (and in certain circumstances, the

implementation of proposed) tax, royalty and regulatory regimes;

the sufficiency of budgeted capital expenditures in carrying out

planned activities; the availability and cost of labour and

services and the adequacy of cash flow; debt and ability to obtain

and maintain financing on acceptable terms to fund its ongoing

operations and planned expenditures, which are subject to change

based on commodity prices; market conditions and future oil and

natural gas prices; and potential timing delays. Although

Management considers these material factors, expectations, and

assumptions to be reasonable based on information currently

available to it, no assurance can be given that they will prove to

be correct.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. Additional information on these and

other factors that could affect the Corporation's operations and

financial results are included in reports on file with the Canadian

Securities Regulatory Authorities and may be accessed through the

SEDAR website (www.sedar.com) or at the Corporation's website. The

forward-looking statements and information contained in this press

release are expressly qualified by this cautionary statement. The

Corporation does not undertake any obligation to publicly update or

revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise, except as

may be required by applicable securities laws.

Revenue

(Stated in thousands of dollars)

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

2020 |

2019 |

% Change |

|

|

2020 |

2019 |

% Change |

|

|

Revenue |

46,769 |

82,984 |

(44 |

) |

|

149,788 |

175,104 |

(14 |

) |

In the second quarter of 2020, PHX Energy

recorded the lowest quarterly revenue since the fourth quarter of

2016. For the three-month period ended June 30, 2020, consolidated

revenue decreased by 44 percent to $46.8 million as compared to $83

million in the second quarter of 2019. Due to COVID-19,

drilling activity was significantly lower in the quarter and

consolidated operating days decreased 46 percent from 5,567 days in

the 2019-quarter to 2,990 days in the 2020-quarter. During the

second quarter of 2020, the Western Texas Intermediate (“WTI”)

crude oil price was 35 percent lower than in the 2019-quarter

averaging USD $37/bbl (2019-quarter – USD $57/bbl) and the Western

Canadian Select (“WCS”) oil prices decreased 54 percent

averaging USD $21/bbl (2019-quarter – USD $46/bbl). Both the US and

Canadian industry’s activity slowed quarter-over-quarter with the

Canadian rig count declining 70 percent and the US rig count

declining 60 percent. The US market remained significantly larger

than the Canadian market, with an average of 378 active rigs

operating per day in the US and an average of 25 active rigs

operating per day in Canada. Throughout North America the vast

majority of wells continued to be horizontal and directional

representing approximately 95 percent of all activity (Source:

Daily Oil Bulletin and Baker Hughes). PHX Energy’s average revenue

per day, excluding the motor rental division in the US, increased

from $14,181 in the 2019-quarter to $14,932 in the relative

2020-quarter.

For the six-month period ended June 30, 2020,

the Corporation’s consolidated revenue decreased by 14 percent to

$149.8 million compared to $175.1 million in the 2019-quarter. For

the first half of the year, the industry rig counts declined 41

percent in the US and 17 percent in Canada. Consolidated operating

days for PHX Energy decreased from 12,592 days in the 2019-period

to 10,231 days in the corresponding 2020-period, a decline of 19

percent. For the six-month period ended June 30, 2020, the average

consolidated revenue per day, excluding the motor rental division

in the US, was $14,000 as compared to $13,214 in the 2019-period,

an increase of 6 percent.

Operating Costs and

Expenses

(Stated in thousands of dollars except

percentages)

|

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

2020 |

|

2019 |

|

% Change |

|

|

2020 |

|

2019 |

|

% Change |

|

|

Direct costs |

|

44,876 |

|

72,261 |

|

(38 |

) |

|

128,230 |

|

151,051 |

|

(15 |

) |

|

Gross profit as a percentage of revenue |

|

4 |

% |

13 |

% |

|

|

14 |

% |

14 |

% |

|

|

Depreciation & amortization drilling and other equipment

(included in direct costs) |

|

7,912 |

|

10,118 |

|

(22 |

) |

|

15,817 |

|

20,284 |

|

(22 |

) |

|

Depreciation & amortization right-of-use asset (included in

direct costs) |

|

932 |

|

878 |

|

6 |

|

|

1,862 |

|

1,746 |

|

7 |

|

|

Gross profit as percentage of revenue excluding depreciation &

amortization |

|

23 |

% |

26 |

% |

|

|

26 |

% |

26 |

% |

|

Direct costs are comprised of field and shop

expenses, and include depreciation and amortization on the

Corporation’s equipment and right-of-use assets. For the three and

six-month periods ended June 30, 2020, direct costs decreased to

$44.9 million and $128.2 million, respectively, from $72.3 million

and $151.1 million in the corresponding 2019-periods. Lower costs

in the respective periods was mainly the result of lower drilling

activity in the second quarter.

For the three-month period ended June 30,

2020, gross profit as a percent of revenue, excluding depreciation

and amortization, decreased to 23 percent from 26 percent in the

2019-quarter. Lower profitability in the period was primarily due

to the lower revenues that resulted from the reduced activity in

all operating divisions of the Corporation. For the six-month

period ended June 30, 2020, gross profit as a percent of revenue,

excluding depreciation and amortization, was flat

period-over-period at 26 percent.

For the three and six-month periods ended June

30, 2020, the Corporation’s depreciation and amortization on

drilling and other equipment was $7.9 million and $15.8 million,

respectively, which is less than the $10.1 million and $20.3

million recorded in the corresponding 2019-periods. The

decrease in depreciation and amortization of drilling and other

equipment in the respective periods is mainly due to a large number

of drilling and other equipment being fully depreciated in the

fourth quarter of 2019.

(Stated in thousands of dollars except

percentages)

| |

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

2020 |

|

2019 |

|

% Change |

|

|

2020 |

|

2019 |

|

% Change |

|

|

SG&A costs |

|

7,332 |

|

11,394 |

|

(36 |

) |

|

14,334 |

|

24,596 |

|

(42 |

) |

|

Cash-settled share-based payments (included in SG&A costs) |

|

1,410 |

|

1,095 |

|

29 |

|

|

(2,037 |

) |

4,030 |

|

n.m. |

|

|

Equity-settled share-based payments (included in SG&A

costs) |

|

85 |

|

215 |

|

(60 |

) |

|

148 |

|

399 |

|

(63 |

) |

|

SG&A costs excluding equity and cash-settled share-based

payments and provision for onerous contracts as a percentage of

revenue |

|

12 |

% |

12 |

% |

|

|

11 |

% |

12 |

% |

|

n.m. – not meaningful

For the three and six-month period ended June

30, 2020, SG&A costs were $7.3 million and $14.3 million,

respectively, as compared to $11.4 million and $24.6 million in the

corresponding 2019-periods. Reduced SG&A costs in both periods

is attributable to lower personnel costs due to the decline in

drilling activity. For the six-month period ended June 30, 2020,

the recovery in cash-settled share-based payments also reduced

SG&A.

Cash-settled share-based payments relate to the

Corporation’s Retention Award Plan and are measured at fair value.

For the three-month period ended June 30, 2020, the Corporation

recognized $1.4 million in cash-settled share-based payments, a 29

percent increase compared to $1.1 million in the corresponding

2019-quarter. For the six-month period ended June 30, 2020, the

Corporation recognized a recovery of $2 million relating to

cash-settled share-based payments compared to an expense of $4

million in the same 2019-period. Fluctuations in the cash-settled

share-based payments in the respective 2020-periods are primarily

due to movements in the Corporation’s share price in those periods,

relative to share price movements in the same 2019-periods.

Equity-settled share-based payments relate to

the amortization of the fair values of issued options by the

Corporation using the Black-Scholes model. For both the three and

six-month periods ended June 30, 2020, equity-settled share-based

payments were $0.1 million, as compared to $0.2 million and $0.4

million in the respective 2019-periods. Lower equity-settled

share-based payments in both 2020-periods is due to stock option

grants from prior years fully vesting in 2019 and 2020-years.

(Stated in thousands of dollars)

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

2020 |

2019 |

% Change |

|

|

2020 |

2019 |

% Change |

|

|

Research & development expense |

308 |

880 |

(65 |

) |

|

1,580 |

1,780 |

(11 |

) |

Research and development (“R&D”)

expenditures for the three and six-month periods ended June 30,

2020 were $0.3 million (2019 - $0.9 million) and $1.6 million (2019

- $1.8 million), respectively. Decreased R&D costs primarily

relate to lower personnel costs resulting from the cost reduction

measures taken by Management in response to the decline in

activity.

(Stated in thousands of dollars)

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

2020 |

2019 |

% Change |

|

|

2020 |

2019 |

% Change |

|

|

Finance expense |

176 |

400 |

(56 |

) |

|

529 |

784 |

(33 |

) |

|

Finance expense lease liability |

683 |

629 |

9 |

|

|

1,226 |

1,275 |

(4 |

) |

Finance expenses relate to interest charges on

the Corporation’s long-term and short-term bank facilities. For the

three and six-month periods ended June 30, 2020, finance charges

decreased to $0.2 million (2019 - $0.4 million) and $0.5 million

(2019 - $0.8 million), respectively. In the second quarter of 2020,

the Corporation paid down all bank loans and borrowings

outstanding, resulting in lower interest charges in the respective

periods.

Finance expense lease liability relates to

interest expenses incurred on lease liabilities. For the

three-month period ended June 30, 2020, finance expense lease

liability increased by 9 percent to $0.7 million.

(Stated in thousands of dollars)

|

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

|

Net gain on disposition of drilling equipment |

|

(470 |

) |

(1,596 |

) |

|

(2,409 |

) |

(2,876 |

) |

|

Foreign exchange (gains) losses |

|

(357 |

) |

246 |

|

|

(230 |

) |

512 |

|

|

Provision for (Recovery of) bad debts |

|

(51 |

) |

280 |

|

|

3,952 |

|

326 |

|

|

Other expenses (income) |

|

(878 |

) |

(1,070 |

) |

|

1,313 |

|

(2,038 |

) |

Net gain on disposition of drilling equipment is

comprised of gains on disposition of drilling equipment that

typically result from insurance programs undertaken whereby

proceeds for the lost equipment are at current replacement values,

which are higher than the respective equipment’s book value. The

recognized gain is net of losses, which typically result from asset

retirements that were made before the end of the equipment’s useful

life and self-insured downhole equipment losses. For the three and

six-month periods ended June 30, 2020, the Corporation recognized

gain on dispositions of $0.5 million and $2.4 million,

respectively, which are lower compared to the $1.6 million and $2.9

million gain on dispositions realized in the respective

2019-periods. The Corporation had fewer occurrences of downhole

equipment losses in the second quarter of 2020 resulting in a lower

net gain on disposition of drilling equipment.

Foreign exchange gains and losses relate to

unrealized and realized exchange fluctuations in the period. For

the three and six-month periods ended June 30, 2020, the

Corporation recognized foreign exchange gains of $0.4 million and

$0.2 million, respectively, relative to foreign exchange losses of

$0.2 million and $0.5 million in the corresponding 2019-periods.

Gains in the 2020-periods primarily relate to settlement of

CAD-denominated intercompany payable in the US segment.

Provision for bad debts for the six-month period

ended June 30, 2020 were higher because of provisions recognized in

the first quarter of 2020. Greater provisions in 2020 reflect

increased credit risks of the Corporation’s customers as a result

of the unparalleled decline in energy demand and the resulting

supply imbalance stemming from global impacts of COVID-19.

(Stated in thousands of dollars)

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

2020 |

2019 |

% Change |

|

|

2020 |

2019 |

% Change |

|

|

Impairment loss |

481 |

- |

n.m. |

|

|

10,730 |

- |

n.m. |

|

n.m. – not meaningful

For the three and six-month periods ended June

30, 2020, the Corporation recognized $0.5 million and $10.7 million

in impairment losses, respectively (2019 – nil). In the first

quarter of 2020, due to COVID-19 and the decline in global oil and

natural gas prices, the Corporation determined that indicators of

impairment existed in its Canadian, US, and International

segments. Goodwill that was allocated to PHX Energy’s

Canadian segment was tested for impairment, and as a result, the

Corporation recognized an impairment expense of $8.9 million

equivalent to the full amount of goodwill. The Corporation also

determined no further economic benefits are expected from the

future use or future disposal of Stream’s EDR equipment. The

Corporation has substantially closed all of its operations in

Stream. As a result, EDR equipment with a carrying amount of $1.2

million was derecognized, as well as working capital of $0.1

million. In the second quarter of 2020, additional

international EDR equipment and inventory of $0.5 million were

identified as impaired and derecognized.

(Stated in thousands of dollars, except

percentages)

|

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

2020 |

|

2019 |

|

|

2020 |

2019 |

|

|

Provision for (Recovery of) income taxes |

|

(1,309 |

) |

510 |

|

|

67 |

744 |

|

|

Effective tax rates |

|

n.m. |

|

n.m. |

|

|

n.m. |

n.m. |

|

n.m. – not meaningful

For the three and six-month periods ended June

30, 2020, the Corporation recognized a recovery of income taxes of

$1.3 million (2019 - $0.5 million provision) and provision for

income taxes of $0.1 million (2019 - $0.7 million), respectively.

Deferred taxes in the 2020 and 2019-periods were impacted by

unrecognized deferred tax assets with respect to deductible

temporary differences in the Canadian jurisdictions.

Segmented

Information

The Corporation reports three operating segments

on a geographical basis throughout the Canadian provinces of

Alberta, Saskatchewan, British Columbia, and Manitoba; throughout

the Gulf Coast, Northeast and Rocky Mountain regions of the US; and

internationally, in Russia and Albania.

Canada

(Stated in thousands of dollars)

|

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

2020 |

|

2019 |

|

% Change |

|

|

2020 |

2019 |

|

% Change |

|

|

Revenue |

|

4,562 |

|

10,664 |

|

(57 |

) |

|

29,166 |

35,528 |

|

(18 |

) |

|

Reportable segment profit (loss) before tax |

|

(2,869 |

) |

(3,856 |

) |

(26 |

) |

|

424 |

(4,251 |

) |

(110 |

) |

For the three and six-month periods ended June

30, 2020, Canadian revenue was $4.6 million and $29.2 million,

respectively, compared to revenue of $10.7 million and $35.5

million in the same 2019-periods. The decrease in revenue in both

2020-periods was primarily due to lower Canadian activity

levels. For the three-month period ended June 30, 2020,

operating days declined 63 percent to 408 days, compared to 1,097

days in the relative 2019-quarter. The decline in the Canadian

segment’s activity was less than that of the industry, which can be

attributed to the Corporation’s positive reputation in the Canadian

market and strong operational performance. The industry’s

horizontal and directional drilling activity contracted 74 percent

as measured by drilling days shrinking from 7,348 days in the

2019-quarter to 1,947 days in the 2020-quarter (Source: Daily Oil

Bulletin). The Canadian segment’s average revenue per

day in the second quarter of 2020 was $10,873 compared to $8,860 in

the 2019-quarter.

During the second quarter of 2020, the

Corporation remained active in the Montney and Duvernay in addition

to also having a Potash project.

For the six-month period ended June 30, 2020,

operating days declined 20 percent to 3,053 days, compared to 3,834

days in the same 2019-period. The Canadian industry activity

decreased 14 percent to 18,737 horizontal and directional drilling

days reported in the first half of 2020 as compared to 21,846

horizontal and directional drilling days in 2019 (Sources: Daily

Oil Bulletin).

Despite the decline in activity, the Canadian

segment’s reportable segment loss before tax decreased for the

three and six-month periods ended June 30, 2020. Improved

profitability is mainly attributed to higher average revenue per

day, lower depreciation expense, and reduced repair costs for

drilling and other equipment.

United

States

(Stated in thousands of dollars)

|

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

2020 |

|

2019 |

|

% Change |

|

|

2020 |

|

2019 |

|

% Change |

|

|

Revenue |

|

38,423 |

|

67,137 |

|

(43 |

) |

|

112,737 |

|

130,133 |

|

(13 |

) |

|

Reportable segment income (loss) before tax |

|

(1,239 |

) |

5,079 |

|

(124 |

) |

|

9,156 |

|

9,123 |

|

- |

|

For the three-month period ended June 30, 2020,

US segment revenue declined by 43 percent to $38.4 million as

compared to $67.1 million in the corresponding 2019-quarter. The US

division’s revenue represented 82 percent of consolidated revenue

in the second quarter of 2020 (2019 - 81 percent). PHX

Energy’s US drilling activity decreased by 44 percent in the

quarter to 2,172 days compared to 3,903 days in the same

2019-quarter. The US industry rig count dropped far more sharply,

with 60 percent fewer rigs operating per day. There was an

average of 378 active horizontal and directional rigs per day in

the 2020-quarter compared to an average of 939 active horizontal

and directional rigs per day in the 2019-quarter (Source:

Baker Hughes). PHX Energy’s US division gained market share in the

challenging downturn environment which is a testament to the

superior operational performance of personnel and the Corporation’s

high performance fleet. Phoenix USA continued to be active in the

Permian, Granite Wash, SCOOP/STACK, Marcellus, Bakken and Niobrara

basins. For the three-month period ended June 30, 2020, average

revenue per day, excluding the Corporation’s US motor rental

division, rose slightly by 2 percent to $16,774 relative to $16,409

in the corresponding 2019-quarter. Reportable segment income

decreased from $5.1 million in the 2019-quarter to a loss of $1.2

million in the second quarter of 2020. This reduced profitability

primarily resulted from the drop in activity in the US.

In the first half of 2020, Phoenix USA’s revenue

was $112.7 million, a decrease of 13 percent compared to the $130.1

million in the same 2019-period. Drilling activity for the

six-month period ended June 30, 2020 declined by 19 percent to

6,200 days as compared to 7,652 days in the same 2019-period. In

comparison, US industry activity, as measured by the average number

of horizontal and directional rigs running on a daily basis, fell

by twice as much from 960 rigs in the first half of 2019 to an

average of 564 rigs in the comparable 2020-period (Source: Baker

Hughes). For the six-month period ended June 30, 2020,

Phoenix USA’s average revenue per day, excluding the Corporation’s

motor rental division, was $17,292, which is 7 percent higher than

the $16,181 in the 2019-period. The increase in average

revenue per day was mainly realized in the first quarter of 2020

and was primarily a result of increased utilization of the fleet of

high performance technologies. For the six-month period ended

June 30, 2020, despite lower revenues, PHX Energy’s US division

realized reportable segment income of $9.2 million, the same level

of reportable segment income realized in the corresponding

2019-period. The strong volume of activity and profitability

in the first quarter of 2020 greatly contributed to this

result.

International

(Stated in thousands of dollars)

|

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

2020 |

|

2019 |

|

% Change |

|

|

2020 |

|

2019 |

|

% Change |

|

|

Revenue |

|

3,784 |

|

5,183 |

|

(27 |

) |

|

7,885 |

|

9,443 |

|

(16 |

) |

|

Reportable segment income (loss) before tax |

|

(207 |

) |

170 |

|

n.m. |

|

|

18 |

|

65 |

|

(72 |

) |

n.m. – not

meaningful

For the three-month period ended June 30, 2020, the International

segment’s revenue was $3.8 million, a 27 percent decrease over the

$5.2 million in the 2019-quarter. PHX Energy generated 8

percent of its consolidated revenue from its International

operations in the 2020-quarter versus 6 percent in the second

quarter of 2019. For the six-month period ended June 30,

2020, the International segment’s revenue was $7.9 million, a 16

percent decrease compared to $9.4 million in the same 2019-period.

The decrease in revenue in both 2020-periods is mainly a result of

Albania operations being temporarily suspended since the first

quarter of 2020.

For the three-month period ended June 30, 2020,

the Russia division’s revenue grew by 24 percent to $3.8 million as

compared to $3.1 million in the 2019-quarter. The division’s

operating days rose to 410 days in the 2020-quarter compared to 312

days in the corresponding 2019-quarter, a 31 percent

increase.

For the three and six-month periods ended June

30, 2020, the International segment recognized reportable segment

loss of $0.2 million (2019 - $0.2 income) and reportable segment

income of $18,000 (2019 - $0.1 million), respectively. Lower

margins in both 2020-periods were mainly due to suspended

operations in Albania.

Investing

Activities

For the three-month period ended June 30, 2020,

PHX Energy used $5.6 million net cash in investing activities as

compared to $7.5 million in the same 2019-quarter, and received

proceeds of $1.2 million relating to the involuntary disposal of

drilling equipment in well bores as compared to $3.5 million in the

corresponding 2019-quarter. In the second quarter of 2020, the

Corporation spent $1.4 million on capital expenditures compared to

$9.1 million in the 2019-quarter. The expenditures in the

2020-quarter were comprised of:

- $1 million in MWD systems and spare components; and

- $0.4 million in machinery and equipment and other assets.

The capital expenditure program undertaken in

the period was financed generally from cash flow from operating

activities. Of the total capital expenditures in the 2020-quarter

$0.2 million was used to grow the Corporation’s fleet of drilling

equipment and the remaining $1.2 million was used to maintain the

current fleet of drilling and other equipment.

The change in non-cash working capital balance

of $5.3 million (use of cash) for the three-month period ended June

30, 2020, relates to the net change in the Corporation’s trade

payables that are associated with the acquisition of capital

assets. This compares to $2 million (use of cash) for the

three-month period ended June 30, 2019.

Financing

Activities

The Corporation reported cash flows used in

financing activities of $24.2 million in the three-month period

ended June 30, 2020 as compared to $10.3 million in the

2019-period. In the 2020-quarter the Corporation:

- made net payments of $23.5 million to its syndicated

facilities; and

- made payments of $0.7 million towards lease liability.

Capital

Resources

As of June 30, 2020, the Corporation had nothing

drawn on its syndicated and operating facilities, and a cash

balance of $14.6 million. As at June 30, 2020, the Corporation had

approximately CAD $65 million and USD $15 million available to be

drawn from its credit facilities. The credit facilities are secured

by substantially all of the Corporation’s assets.

As at June 30, 2020, the Corporation was in compliance with

all its financial covenants.

Cash Requirements for Capital

ExpendituresHistorically, the Corporation has

financed its capital expenditures and acquisitions through cash

flows from operating activities, debt and equity. The 2020 capital

expenditures are expected to be $27.5 million, subject to quarterly

review of the Board.

These planned expenditures are expected to be

financed from a combination of one or more of the following: cash

flow from operations, the Corporation’s unused credit facilities or

equity, if necessary. However, if a sustained period of market

uncertainty and financial market volatility persists in 2020, the

Corporation's activity levels, cash flows and access to credit may

be negatively impacted, and the expenditure level would be reduced

accordingly. Conversely, if future growth opportunities present

themselves, the Corporation would look at expanding this planned

capital expenditure amount.

As at June 30, 2020, the Corporation has

commitments to purchase drilling and other equipment for $4.5

million, with delivery expected to occur by the end of the third

quarter.

Outlook

The challenges of this unprecedented time in our

history intensified during the second quarter of 2020 and the

COVID-19 pandemic and severe industry downturn impacted our

financial and operational results. However, diligent cost

management strategies and entering this period with a healthy

balance sheet allowed us to end the quarter with net cash and no

bank debt.

Our top priority remains the health and safety

of our stakeholders and as the pandemic has evolved, we have

remained diligent in following guidance provided by government and

health authorities. We have remained operational, although at lower

activity levels, while the policies and procedures we implemented

ensure we are operating in the safest manner possible. We continue

to monitor the situation, adapt our contingency planning and act

when additional precautionary measures can be taken.

As rig counts slid to historically low levels in

North America, our competitive advantages helped lessen the decline

in our activity as compared to the industry. This

demonstrates the resiliency of our operations which is created by

our unwavering focus on strong marketing relationships, unmatched

drilling performance and industry leading technologies. That

said this is the harshest downturn we have ever experienced, and it

is anticipated to persist through 2020 and possibly into 2021 with

only a very gradual recovery. In Canada, although we are now

starting to come out of spring break up with a slight uptick in

active rigs, we don’t foresee a meaningful industry recovery in the

near future as there are many challenges that persist in this

market. Similarly, although the US industry is at historical

lows, it seems unlikely that rig counts will begin to climb upward

in the foreseeable future given the current economic and industry

conditions.

For the remainder of 2020, we foresee our

operations generating greatly reduced activity

quarter-over-quarter. In the US we anticipate that our

operations will be slower for the third and fourth quarter when

compared to the second quarter. Whereas in Canada, the third and

fourth quarters will show an increase in relation to the second

quarter only as a result of the industry exiting spring break

up. That said, this is a very volatile time surrounded with

uncertainty and the industry and economic conditions can change

rapidly. We will continue to diligently work to maintain a

cost structure aligned with our operations activity and protect our

healthy financial position. With the strength of our fleet of

technology and operational performance, we believe we will continue

to be market leaders in our sector, and this will be reflected in

our market share in both Canada and the US.

Knowing the cyclical nature of this industry,

one of our ongoing strategies has been to position ourselves for

the next downturn. This meant protecting and building balance sheet

strength, maintaining low or no bank debt and focusing on being a

vital provider in Operators’ drive for drilling efficiency.

We believe we are positioned operationally and financially to

outlast and survive this downturn and to grow when the market does

recover, without significant capital commitments. What we have also

learned from past downturns is that with each recovery wells are

drilled much quicker and more efficiently than before. The

directional drilling market still remains saturated with

competitors, and the brutal nature of this downturn is likely to

shrink the competitive landscape as the opportunity for those

without high performance technologies has significantly

shrunk. We are in the enviable position to outlast this

unprecedented time with a strong team of personnel, a fleet

comprised of some of the top technologies in our sector and a

healthy financial position.

Michael Buker, President

August 5, 2020

Non-GAAP

Measures

Adjusted

EBITDAAdjusted EBITDA, defined as earnings before

finance expense, finance expense lease liability, income taxes,

depreciation and amortization, impairment losses on drilling and

other equipment and goodwill, equity share-based payments,

severance payouts relating to the Corporation’s restructuring cost,

and unrealized foreign exchange gains or losses, does not have a

standardized meaning and is not a financial measure that is

recognized under GAAP. However, Management believes that adjusted

EBITDA provides supplemental information to net earnings that is

useful in evaluating the results of the Corporation’s principal

business activities before considering certain charges, how it was

financed and how it was taxed in various countries. Starting in the

first quarter of 2020, due to the impact of COVID-19 and the

downturn in the oil and natural gas industry, the Corporation

included impairment expenses and severance costs, which were not

present in the relative 2019-quarter. Severance costs related to

restructuring were not present, and therefore were not included in

the 2019 Annual Report. Investors should be cautioned,

however, that adjusted EBITDA should not be construed as an

alternative measure to net earnings determined in accordance with

GAAP. PHX Energy’s method of calculating adjusted EBITDA may

differ from that of other organizations and, accordingly, its

adjusted EBITDA may not be comparable to that of other

companies.

The following is a reconciliation of net

earnings to adjusted EBITDA:

(Stated in thousands of dollars)

|

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

|

Net loss |

|

(4,899 |

) |

(2,020 |

) |

|

(8,220 |

) |

(3,087 |

) |

|

Add (deduct): |

|

|

|

|

|

|

|

Depreciation and amortization drilling and

other equipment |

|

7,912 |

|

10,118 |

|

|

15,817 |

|

20,284 |

|

|

Depreciation and amortization right-of-use asset |

|

932 |

|

878 |

|

|

1,862 |

|

1,746 |

|

|

Impairment loss |

|

481 |

|

- |

|

|

10,730 |

|

- |

|

|

Severance expense |

|

1,348 |

|

- |

|

|

1,931 |

|

- |

|

|

Provision for (Recovery of) income taxes |

|

(1,309 |

) |

510 |

|

|

67 |

|

744 |

|

|

Finance expense |

|

176 |

|

400 |

|

|

529 |

|

784 |

|

|

Finance expense lease liability |

|

683 |

|

629 |

|

|

1,226 |

|

1,275 |

|

|

Equity-settled share-based payments |

|

85 |

|

215 |

|

|

148 |

|

399 |

|

|

Unrealized foreign exchange (gain) loss |

|

(101 |

) |

265 |

|

|

(96 |

) |

281 |

|

|

Adjusted EBITDA as reported |

|

5,308 |

|

10,995 |

|

|

23,994 |

|

22,426 |

|

Adjusted EBITDA per share - diluted is

calculated using the treasury stock method whereby deemed proceeds

on the exercise of the share options are used to reacquire common

shares at an average share price. The calculation of adjusted

EBITDA per share on a dilutive basis does not include anti-dilutive

options.

Funds from

OperationsFunds from operations is defined as

cash flows generated from operating activities before changes in

non-cash working capital, interest paid, and income taxes paid.

This non-GAAP measure does not have a standardized meaning and is

not a financial measure recognized under GAAP. Management uses

funds from operations as an indication of the Corporation’s ability

to generate funds from its operations before considering changes in

working capital balances and interest and taxes paid. Investors

should be cautioned, however, that this financial measure should

not be construed as an alternative measure to cash flows from

operating activities determined in accordance with GAAP. PHX

Energy’s method of calculating funds from operations may differ

from that of other organizations and, accordingly, it may not be

comparable to that of other companies.

The following is a reconciliation of cash flows

from operating activities to funds from operations:

(Stated in thousands of dollars)

|

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

|

Cash flows from operating activities |

|

37,251 |

|

21,244 |

|

|

48,381 |

|

30,944 |

|

|

Add (deduct): |

|

|

|

|

|

|

|

Changes in non-cash working capital |

|

(33,644 |

) |

(11,436 |

) |

|

(24,288 |

) |

(11,454 |

) |

|

Interest paid |

|

84 |

|

218 |

|

|

288 |

|

495 |

|

|

Income taxes paid (received) |

|

(534 |

) |

(241 |

) |

|

(433 |

) |

(101 |

) |

|

Funds from (used in) operations |

|

3,157 |

|

9,785 |

|

|

23,948 |

|

19,884 |

|

Funds from operations per share - diluted is

calculated using the treasury stock method whereby deemed proceeds

on the exercise of the share options are used to reacquire common

shares at an average share price. The calculation of funds from

operations per share on a dilutive basis does not include

anti-dilutive options.

Free Cash

FlowFree cash flow is defined as funds from

operations (as defined above) less maintenance capital expenditures

and cash payment on leases. This non-GAAP measure does not have a

standardized meaning and is not a financial measure recognized

under GAAP. Management uses free cash flow as an indication of the

Corporation’s ability to generate funds from its operations to

support operations and maintain the Corporation’s drilling and

other equipment. This performance measure is useful to investors

for assessing the Corporation’s operating and financial

performance, leverage and liquidity. Investors should be cautioned,

however, that this financial measure should not be construed as an

alternative measure to cash flows from operating activities

determined in accordance with GAAP. PHX Energy’s method of

calculating free cash flow may differ from that of other

organizations and, accordingly, it may not be comparable to that of

other companies.

The following is a reconciliation of funds from

operations to free cash flow:

(Stated in thousands of dollars)

|

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

|

Funds from operations (1) |

|

3,157 |

|

9,785 |

|

|

23,948 |

|

19,884 |

|

|

Deduct: |

|

|

|

|

|

|

|

Maintenance capital expenditures |

|

(1,228 |

) |

(3,590 |

) |

|

(3,787 |

) |

(6,298 |

) |

|

Cash payment on leases |

|

(1,356 |

) |

(1,389 |

) |

|

(2,823 |

) |

(2,830 |

) |

|

Free cash flow |

|

573 |

|

4,806 |

|

|

17,338 |

|

10,756 |

|

(1) Non-GAAP measure that does not have any

standardized meaning under IFRS and therefore may not be comparable

to similar measures presented by other entities. Refer to non-GAAP

measures section that follows the Outlook section of this press

release.

Debt to Covenant EBITDA

RatioDebt is represented by loans and borrowings.

Covenant EBITDA, for purposes of the calculation of this covenant

ratio, is represented by net earnings for a rolling four quarter

period, adjusted for finance expense and finance expense lease

liability, provision for income taxes, depreciation and

amortization, equity-settled share-based payments, impairment

losses on drilling and other equipment and goodwill, unrealized

foreign exchange gains or losses, and IFRS 16 adjustment to restate

cash payments to expense, subject to the restrictions provided in

the amended credit agreement.

Working

CapitalWorking capital is defined as the

Corporation’s current assets less its current liabilities and is

used to assess the Corporation’s short-term liquidity. This

non-GAAP measure does not have a standardized meaning and is not a

financial measure recognized under GAAP. Management uses working

capital to provide insight as to the Corporation’s ability to meet

obligations as at the reporting date. PHX Energy’s method of

calculating working capital may differ from that of other

organizations and, accordingly, it may not be comparable to that of

other companies.

Net DebtNet

debt is defined as the Corporation’s syndicate loans and borrowings

and operating facility borrowings less cash and cash equivalents.

This non-GAAP measure does not have a standardized meaning and is

not a financial measure recognized under GAAP. Management uses

working capital to provide insight as to the Corporation’s ability

to meet obligations as at the reporting date. PHX Energy’s method

of calculating working capital may differ from that of other

organizations and, accordingly, it may not be comparable to that of

other companies.

About PHX Energy Services

Corp.

The Corporation, through its directional

drilling subsidiary entities, provides horizontal and directional

drilling technology and services to oil and natural gas producing

companies in Canada, the US, Russia and Albania.

PHX Energy’s Canadian directional drilling

operations are conducted through Phoenix Technology Services LP.

The Corporation maintains its corporate head office, research and

development, Canadian sales, service and operational centres in

Calgary, Alberta. In addition, PHX Energy has a facility in

Estevan, Saskatchewan. PHX Energy’s US operations, conducted

through the Corporation’s wholly-owned subsidiary, Phoenix

Technology Services USA Inc. (“Phoenix USA”), is headquartered in

Houston, Texas. Phoenix USA has sales and service facilities in

Houston, Texas; Denver, Colorado; Casper, Wyoming; Midland, Texas;

Bellaire, Ohio; and Oklahoma City, Oklahoma. Internationally, PHX

Energy has sales offices and service facilities in Albania and

Russia, and administrative offices in Nicosia, Cyprus; Dublin,

Ireland; and Luxembourg City, Luxembourg.

In the first quarter of 2020, the Corporation

closed substantially all of its operations in its Stream Services

(“Stream”) division which marketed electronic drilling recorder

(“EDR”) technology and services.

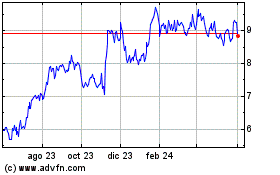

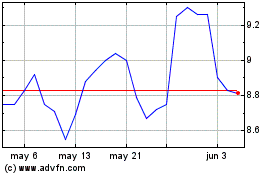

The common shares of PHX Energy trade on the

Toronto Stock Exchange under the symbol PHX.

For further information please contact:John

Hooks, CEO; Michael Buker, President; or Cameron Ritchie, Senior

Vice President Finance and CFO

PHX Energy Services Corp.Suite 1400, 250 2nd

Street SWCalgary, Alberta T2P 0C1Tel:

403-543-4466 Fax:

403-543-4485 www.phxtech.com

Consolidated Statements of

Financial Position(unaudited)

|

|

|

June 30, 2020 |

|

|

December 31, 2019 |

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

14,627,990 |

|

|

$ |

10,582,296 |

|

| |

Trade and other receivables |

|

|

34,990,544 |

|

|

|

93,641,885 |

|

| |

Inventories |

|

|

34,618,956 |

|

|

|

30,826,700 |

|

| |

Prepaid expenses |

|

|

2,828,889 |

|

|

|

2,569,046 |

|

|

|

Current tax assets |

|

|

444,245 |

|

|

|

- |

|

| |

Total current assets |

|

|

87,510,624 |

|

|

|

137,619,927 |

|

|

Non-current assets: |

|

|

|

|

|

|

| |

Drilling and other equipment |

|

|

83,526,554 |

|

|

|

78,416,229 |

|

| |

Right-of-use asset |

|

|

31,016,794 |

|

|

|

32,825,964 |

|

| |

Intangible assets |

|

|

17,555,275 |

|

|

|

18,901,559 |

|

| |

Goodwill |

|

|

- |

|

|

|

8,876,351 |

|

| |

Deferred tax assets |

|

|

927,479 |

|

|

|

613,355 |

|

|

|

Total non-current assets |

|

|

133,026,102 |

|

|

|

139,633,458 |

|

|

Total assets |

|

$ |

220,536,726 |

|

|

$ |

277,253,385 |

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

| |

Operating facility |

|

$ |

- |

|

|

$ |

11,395,835 |

|

| |

Lease liability |

|

|

2,552,968 |

|

|

|

2,765,633 |

|

| |

Trade and other payables |

|

|

28,088,570 |

|

|

|

54,892,277 |

|

|

|

Current tax liability |

|

|

- |

|

|

|

172,766 |

|

| |

Total current liabilities |

|

|

30,641,538 |

|

|

|

69,226,511 |

|

|

Non-current liabilities: |

|

|

|

|

|

|

| |

Lease liability |

|

|

38,568,114 |

|

|

|

39,753,860 |

|

| |

Loans and borrowings |

|

|

- |

|

|

|

13,896,400 |

|

| |

Deferred tax liability |

|

|

7,308,872 |

|

|

|

5,432,527 |

|

|

|

Total non-current liabilities |

|

|

45,876,986 |

|

|

|

59,082,787 |

|

|

Equity: |

|

|

|

|

|

|

| |

Share capital |

|

|

251,219,748 |

|

|

|

251,815,183 |

|

| |

Contributed surplus |

|

|

10,087,914 |

|

|

|

10,854,650 |

|

| |

Retained earnings |

|

|

(136,122,738 |

) |

|

|

(127,902,593 |

) |

|

|

Accumulated other comprehensive income |

|

|

18,833,278 |

|

|

|

14,176,847 |

|

| |

Total equity |

|

|

144,018,202 |

|

|

|

148,944,087 |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

220,536,726 |

|

|

$ |

277,253,385 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Consolidated Statements of

Comprehensive Loss(unaudited)

|

|

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

|

2020 |

|

|

2019 |

|

|

|

2020 |

|

|

2019 |

|

|

Revenue |

|

$ |

46,768,641 |

|

$ |

82,983,644 |

|

|

$ |

149,788,436 |

|

$ |

175,104,348 |

|

|

Direct costs |

|

|

44,876,434 |

|

|

72,260,718 |

|

|

|

128,230,485 |

|

|

151,050,936 |

|

|

Gross profit |

|

|

1,892,207 |

|

|

10,722,926 |

|

|

|

21,557,951 |

|

|

24,053,412 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

7,331,672 |

|

|

11,394,219 |

|

|

|

14,333,809 |

|

|

24,596,157 |

|

|

Research and development expenses |

|

|

307,528 |

|

|

880,017 |

|

|

|

1,579,945 |

|

|

1,779,603 |

|

|

Finance expense |

|

|

175,529 |

|

|

400,025 |

|

|

|

528,599 |

|

|

783,625 |

|

|

Finance expense lease liability |

|

|

683,495 |

|

|

628,522 |

|

|

|

1,226,015 |

|

|

1,274,683 |

|

|

Other income |

|

|

(878,353 |

) |

|

(1,069,532 |

) |

|

|

1,313,166 |

|

|

(2,037,788 |

) |

|

Impairment Loss |

|

|

480,868 |

|

|

- |

|

|

|

10,729,587 |

|

|

- |

|

|

|

|

|

8,100,739 |

|

|

12,233,251 |

|

|

|

29,711,121 |

|

|

26,396,280 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

|

(6,208,532 |

) |

|

(1,510,325 |

) |

|

|

(8,153,170 |

) |

|

(2,342,868 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for (Recovery of) income taxes |

|

|

|

|

|

|

|

|

|

|

|

Current |

|

|

(543,809 |

) |

|

120,312 |

|

|

|

(746,574 |

) |

|

468,784 |

|

|

Deferred |

|

|

(765,264 |

) |

|

389,463 |

|

|

|

813,549 |

|

|

275,413 |

|

|

|

|

|

(1,309,073 |

) |

|

509,775 |

|

|

|

66,975 |

|

|

744,197 |

|

|

Net loss |

|

|

(4,899,459 |

) |

|

(2,020,100 |

) |

|

|

(8,220,145 |

) |

|

(3,087,065 |

) |

|

Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

|

(3,916,078 |

) |

|

(1,803,995 |

) |

|

|

4,656,431 |

|

|

(2,662,069 |

) |

|

Total comprehensive loss for the period |

|

$ |

(8,815,537 |

) |

$ |

(3,824,095 |

) |

|

$ |

(3,563,714 |

) |

$ |

(5,749,134 |

) |

|

Loss per share – basic |

|

$ |

(0.09 |

) |

$ |

(0.04 |

) |

|

$ |

(0.15 |

) |

$ |

(0.05 |

) |

|

Loss per share – diluted |

|

$ |

(0.09 |

) |

$ |

(0.04 |

) |

|

$ |

(0.15 |

) |

$ |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Cash

Flows(unaudited)

| |

|

Three-month periods ended June 30, |

|

|

Six-month periods ended June 30, |

|

|

|

|

|

2020 |

|

|

2019 |

|

|

|

2020 |

|

|

2019 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(4,899,459 |

) |

$ |

(2,020,100 |

) |

|

$ |

(8,220,145 |

) |

$ |

(3,087,065 |

) |

|

Adjustments for: |

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

7,911,639 |

|

|

10,117,493 |

|

|

|

15,816,701 |

|

|

20,284,764 |

|

|

Depreciation and amortization right-of-use asset |

|

|

932,456 |

|

|

878,319 |

|

|

|

1,862,434 |

|

|

1,745,522 |

|

|

Impairment loss |

|

|

480,868 |

|

|

- |

|

|

|

10,729,587 |

|

|

- |

|

|

Provision for (Recovery of) income taxes |

|

|

(1,309,073 |

) |

|

509,775 |

|

|

|

66,975 |

|

|

744,197 |

|

|

Unrealized foreign exchange loss (gain) |

|

|

(100,843 |

) |

|

264,934 |

|

|

|

(96,331 |

) |

|

281,009 |

|

|

Gain on disposition of drilling equipment |

|