Wilmington Announces Proposed Reduction in Stated Capital and Return of Capital

01 Abril 2024 - 3:36PM

Wilmington Capital Management Inc. (“Wilmington” or the

“Corporation”) today announces that it will seek shareholder

approval to reduce the stated capital associated with its Class A

and Class B shares at its upcoming May 6, 2024 annual general and

special meeting of shareholders (the “

Meeting”).

At the Meeting, the Corporation will seek approval to reduce the

stated capital associated with: (i) the Class A shares by

approximately $14,160,226 (the “

Class A

Reduction"); and (ii) the Class B shares by approximately

$1,117,370 (the “

Class B Reduction”). The Class A

Reduction, together with the Class B Reduction (collectively, the

“

Reduction in Stated Capital”), will result in an

aggregate reduction in stated capital of approximately $15,277,596.

If approved, the Class A Reduction will be

distributed to Class A shareholders as a return of capital in an

amount equal to $1.25 per Class A share (the “Class A

Return”), and the Class B Reduction will be distributed to

Class B shareholders as a return of capital in an amount equal to

$1.12 per Class B share (the “Class B Return”,

collectively with the Class A Return, the “Return of

Capital”). The Corporation has determined that it is

necessary and desirable to effect the Return of Capital as partial

payment for the Corporation’s previously announced special dividend

of $2.75 per share (the “Special Dividend”). The

portion of the Special Dividend not paid by way of the Return of

Capital will be paid in cash in an amount of $1.50 and $1.63 per

Class A share and Class B share, respectively. Regardless of

whether the Reduction in Stated Capital is approved, shareholders

will receive $2.75 per share; however, approval of the Reduction in

Stated Capital and the corresponding payment of the Class A Return

and the Class B Return as a return of capital is expected to be

preferred by shareholders.

The Corporation’s Board of Directors has

unanimously determined that the Return of Capital is in the best

interests of the Corporation. All directors, either directly or

through their holding company, representing approximately 64% of

the issued and outstanding Class A shares and 77% of the Class B

shares, have entered into voting support agreements with the

Corporation in support of the Return of Capital and will be voting

IN FAVOUR of the Return of Capital at the Meeting.

The payment of the Special Dividend is not

conditional on any event, including the shareholder approval

described above.

About

Wilmington

Wilmington is a Canadian asset management

company whose principal objective is to seek out investment

opportunities in the alternative asset classes that provide

shareholders with capital appreciation over the longer term as

opposed to current income returns. Wilmington invests its own

capital, alongside partners and co-investors, in hard assets and

manages these assets through operating entities.

WILMINGTON

CAPITAL MANAGEMENT

INC.

For further information, please contact:Executive Officers(403)

705-8038

STATEMENT

REGARDING FORWARD-LOOKING

STATEMENTS

This news release contains forward-looking

statements. Forward-looking statements that are predictive in

nature, depend upon or refer to future events or conditions,

include statements regarding the operations, business, financial

conditions, expected financial results, performance, opportunities,

priorities, ongoing objectives, strategies and outlook of the

Corporation and its investee entities and contain words such as

“anticipate”, “believe”, “expect”, “plan”, “intend”, “estimate”,

“seek”, or similar expressions and statements relating to matters

that are not historical facts constitute “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Forward-looking statements contained in this news

release include statements regarding the anticipated partial

payment of the Special Dividend by way of Return of Capital and

matters to be considered at the Meeting.

Forward-looking statements are subject to a

variety of risks and uncertainties that could cause actual events

or results to materially differ from those reflected in the

forward-looking statements. These risks and uncertainties include

but are not limited to: regulatory issues that may arise in

connection with the proposed dividend payment timing and failure to

obtain the requisite level of shareholder support for the proposed

Reduction in Stated Capital. There can be no assurance that

forward-looking statement will prove to be accurate, and actual

results and future events could differ materially from those

anticipated in such statements. The Corporation undertakes no

obligation to update forward-looking statements if circumstances or

management’s estimates or opinions should change except as required

by applicable Canadian securities laws. The reader is cautioned not

to place undue reliance on forward-looking statements.

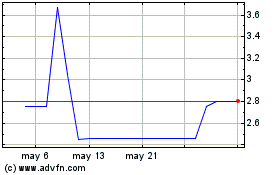

Wilmington Capital Manag... (TSX:WCM.A)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

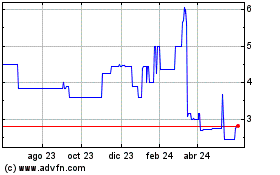

Wilmington Capital Manag... (TSX:WCM.A)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024