Azimut Exploration Inc. (“Azimut” or the

“Company”) (

TSXV: AZM) is pleased to report

excellent preliminary metallurgical test results for three (3)

representative samples of spodumene-bearing pegmatite from the

Galinée Property (the “Property”) in the Eeyou

Istchee James Bay region of Quebec, Canada. The Property is a joint

venture project between Azimut and

SOQUEM Inc.,

with Azimut acting as the operator.

The test program conducted by SGS Canada Inc.

included chemical and mineralogical characterization and

metallurgical testing. The objective was to obtain baseline

recovery data for a Dense Media Separation

(DMS) and magnetic separation flowsheet.

HIGHLIGHTS

- The test program demonstrates

excellent lithium recovery through combined

DMS and magnetic separation for the three

composites (Comp 1 to 3). Lithium recoveries for the three

samples are 68%, 79% and 86%,

respectively, with spodumene concentrates

grading 6.93% Li2O for

Comp 1 and 7.10%

Li2O for Comp 2

and 3.

- The production of

high-grade spodumene concentrates (over 6.90%

Li2O) in the 2.95 sink fraction

by Heavy Liquid Separation for all samples significantly exceeds

the chemical-grade quality required for hydrometallurgical

processing.

Testwork SummarySGS Canada Inc.

conducted the tests in their Quebec City laboratory using three

representative composite drill core samples of spodumene-bearing

pegmatite. The Li2O composition in the material is 1.16%, 2.07%,

and 4.52% for Comp 1, Comp 2, and Comp 3, respectively.

Each composite was stage-crushed to P100 passing

9.5 mm, blended, and submitted for chemical and mineralogical

analysis. The remaining material from each composite was screened

to 850 µm and riffled into charges for metallurgical testwork.

Head CharacterizationThe

program's primary objective was to characterize the composite

samples, with a particular emphasis on lithium mineral

characterization. This included (see Table 1

below):

- Head analysis;

- Mineralogical analysis;

- Identification of key impurities;

and

- Mineralogical analysis on Comp 2

using Tescan Integrated Mineral Analyzer (TIMA-X).

These steps are crucial for developing the

metallurgical process, as they significantly influence the

operating conditions and approach.

Head Analysis: Representative 75-micron

pulverized samples were submitted for an ICP scan analysis. The

three samples (Comp 1, Comp 2 and Comp 3) were found to contain

silica (69.2% to 80.8%), Al2O3 (12.7% to 21.7%), Fe2O3 (0.86% to

1.93%) and Li2O (1.16% to

4.52%).

Mineralogical Analysis: Quartz, spodumene,

albite/plagioclase and elbaite are the main mineralogical phases.

XRD analysis revealed that Comp 3 had the highest spodumene content

at 56.2%. Hornblende was low in Comp 1 (2.8%) and absent in both

Comp 2 and Comp 3.

Detailed Mineralogical Analyses (TIMA-X)

performed on Comp 2 indicate excellent spodumene liberation

reaching 97.8%. Impurities such as quartz and feldspar also showed

high levels of liberation, exceeding 95%.

Table 1: Head Analysis

Summary

|

Method/Elements |

Comp 1 |

Comp 2 |

Comp 3 |

|

ICP-OES by Na2O2 Fusion |

|

|

|

|

Li2O % |

1.16 |

2.07 |

4.52 |

|

XRF by Borate Fusion |

|

|

|

|

SiO2 % Al2O3 %Fe2O3 % MgO % CaO % Na2O % K2O % |

72.1161.930.550.95.210.25 |

80.812.70.860.030.112.620.16 |

69.221.70.780.030.172.640.18 |

|

Mineralogical analysis % |

Comp 1 |

Comp 2 |

Comp 3 |

|

Quartz |

32.4 |

47.0 |

17.3 |

|

Spodumene |

13.9 |

26.4 |

56.2 |

|

Albite/Plagioclase |

42.9 |

22.9 |

22.7 |

|

Elbaite |

2.9 |

2.24 |

1.1 |

|

Hornblende |

2.8 |

- |

- |

|

Spodumene liberation* |

- |

97.8 |

- |

|

*Pure, free, and liberated |

|

|

|

Metallurgical Testing

Bulk Density Tests: Average density measurements

were conducted on five core samples for each composite. The results

showed average densities of 2.78, 2.79, and 2.82 g/cm3 for

composites 1, 2, and 3, respectively.

Heavy Liquid Separation (HLS)

and Magnetic Separation: DMS concentration tests coupled with

magnetic separation of the DMS concentrate produced excellent

results for all three composite samples.

- A single step of magnetic separation performed at 10,000 Gauss

effectively removed the amphibole present in the DMS concentrate

for the three composites tested, particularly for Comp 1.

- At a particle size of 9.50 mm, HLS produced high-grade

spodumene concentrates (over 6.90%

Li2O) in the 2.95 sink fraction

for all samples, meeting the chemical grade quality required for

hydrometallurgical processing. Lithium recoveries were

excellent, at 68%, 79% and 86% for Comp 1, Comp 2 and Comp 3,

respectively.

- The concentrates are notably distinguished by their very low

impurity levels, with Fe2O3 contents below 1.2% and Cr2O3 contents

below 0.01%.

- For Comp 1, magnetic separation was necessary due to the

presence of hornblende. Two tests were conducted using the 2.70 and

2.95 sink fractions. In the test performed with the 2.70 sink

fraction, the Li₂O concentrate reached a grade of 5.51%, with a

lithium recovery of 82.1%. For the 2.95 sink fraction, the Li₂O

concentrate reached a grade of 6.93% but with a lower lithium

recovery of 68%.

- For Comp 2 and Comp 3, which contain very little amphibole, a

simple DMS separation at a density of 2.70, even without a magnetic

separation step, could yield Li2O concentrates with purities of

5.99% and 6.76%, with recoveries of 89% and 91%, respectively. This

is exceptional and demonstrates the excellent liberation and purity

of the lithium-bearing phases of the Galinée mineralized zone.

Description of the Composites

The three drill core composites sent to SGS for metallurgical

testing are described as follows:

- Comp 1: 22.1

metres of half-core spodumene pegmatite (from 339.9 m to 362.0 m)

from hole GAL24-025, including a 1.0 m amphibolite interval (from

347.0 m to 348.0 m). Weight: 37.76 kg.

- Comp 2: 17.1

metres of half-core spodumene pegmatite (from 171.6 m to 188.7 m)

from hole GAL24-018. Weight: 27.04 kg.

- Comp 3: 16.5

metres of half-core spodumene pegmatite (from 109.5 m to 126.0 m)

from hole GAL24-020. Weight: 25.59 kg.

About the Galinée Property

Galinée (649 claims, 335 km2) is a 50/50 joint

venture project between Azimut and SOQUEM. The 36-kilometre-long

property lies about 50 kilometres north-northwest of the Renard

diamond mine (Stornoway Diamonds (Canada) Inc.) and 60 kilometres

south of the Trans-Taiga Road, an all-season regional highway. The

region is widely considered an emerging lithium district.

The winter 2023 and spring 2024 drilling program

yielded wide intervals of high-grade mineralization in the

northernmost part of the Property, notably including (see press

release of June 19, 2024):

| |

1.62% Li2O over 158.0

m |

|

Hole GAL24-025 |

| |

2.48%

Li2O over 72.7 m |

|

Hole GAL23-001 |

| |

2.68%

Li2O over

54.6 m |

|

Hole GAL24-020 |

| |

2.13%

Li2O over 44.1 m |

|

Hole GAL23-009 |

| |

1.66%

Li2O over 40.4 m |

|

Hole GAL24-018 |

| |

2.53%

Li2O over 25.0 m |

|

Hole GAL24-022 |

| |

2.02%

Li2O over 32.2 m |

|

Hole GAL24-023 |

| |

1.71%

Li2O over 37.0 m |

|

Hole GAL23-011 |

In addition, the summer 2024 program further underscored the

project’s strong exploration potential. Extensive lithium

targets with a cumulative length of about 18

kilometres have been identified based on systematic till

sampling and prospecting. One of the most promising areas,

returning up to 2.85%

Li₂O in boulders, lies

within a 10-kilometre zone in the northwestern

part of the Property (see press release of October 10, 2024).

Qualified Person

Dr. Jean-Marc Lulin (P.Geo.) prepared this press

release as the Company’s qualified person within the meaning of

National Instrument 43-101. Rock Lefrançois (P.Geo.), Vice

President of Exploration, also reviewed the contents of this press

release.

About SOQUEM

SOQUEM Inc., a subsidiary of Investissement

Québec, is dedicated to promoting the exploration, discovery and

development of mining properties in Quebec. SOQUEM also contributes

to maintaining strong local economies. A proud partner and

ambassador for developing the province’s mineral wealth, SOQUEM

relies on innovation, research, and strategic minerals to be

well-positioned for the future.

About Azimut

Azimut is a leading mineral exploration company

with a solid reputation for target generation and partnership

development. The Company holds the largest mineral exploration

portfolio in Quebec, controlling strategic land positions for

copper-gold, nickel and lithium. Its wholly owned flagship project,

the Elmer Gold Project, is at the resource stage

(311,200 oz Indicated; 513,900 oz

Inferred*) and has a strong exploration upside. Azimut is

also advancing the Galinée lithium discovery with

SOQUEM.

Azimut uses a pioneering approach to big data

analytics (the proprietary AZtechMine™ expert

system) enhanced by extensive exploration know-how. The Company’s

competitive edge is based on systematic regional-scale data

analysis. Azimut maintains rigorous financial discipline and a

strong balance sheet, with 85.6 million shares issued and

outstanding.

Contact and Information

Jean-Marc Lulin, President and

CEOTel.: (450) 646-3015

Jonathan Rosset, Vice President Corporate

DevelopmentTel: (604)

202-7531info@azimut-exploration.com

www.azimut-exploration.com

* "Technical Report and

Initial Mineral Resource Estimate for the Patwon Deposit, Elmer

Property, Quebec, Canada", prepared by Martin Perron, P.Eng.,

Chafana Hamed Sako, P.Geo., Vincent Nadeau-Benoit, P.Geo. and Simon

Boudreau, P.Eng., of InnovExplo Inc., dated January 4, 2024.

Cautionary note regarding forward-looking

statements

This press release contains forward-looking statements, which

reflect the Company’s current expectations regarding future events

related to the metallurgical testing at the Galinée Property. To

the extent that any statements in this press release contain

information that is not historical, the statements are essentially

forward-looking and are often identified by words such as

“anticipate”, “expect”, “estimate”, “intend”, “project”, “plan”,

“potential”, “suggest” and “believe”. The forward-looking

statements involve risks, uncertainties, and other factors that

could cause actual results to differ materially from those

expressed or implied by such forward-looking statements. There are

many factors that could cause such differences, particularly

volatility and sensitivity to market metal prices, impact of change

in foreign currency exchange rates and interest rates, imprecision

in reserve estimates, recoveries of gold and other metals,

environmental risks, including increased regulatory burdens,

unexpected geological conditions, adverse mining conditions,

community and non-governmental organization actions, changes in

government regulations and policies, including laws and policies,

global outbreaks of infectious diseases, and failure to obtain

necessary permits and approvals from government authorities, as

well as other development and operating risks. Although the Company

believes that the assumptions inherent in the forward-looking

statements are reasonable, undue reliance should not be placed on

these statements, which only apply as of the date of this document.

The Company disclaims any intention or obligation to update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise, other than as required to

do so by applicable securities laws. The reader is directed to

carefully review the detailed risk discussion in our most recent

Annual Report filed on SEDAR for a fuller understanding of the

risks and uncertainties that affect the Company’s business.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

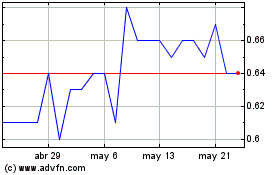

Azimut Exploration (TSXV:AZM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Azimut Exploration (TSXV:AZM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024