Green Shift Commodities Ltd. (

TSXV:

GCOM and

OTCQB: GRCMF),

(“

Green Shift”, “

GCOM” or the

“

Company”) is pleased to announce that initial

exploration work on its Armstrong Lithium Project (the

“

Armstrong Project” or the

“

Project”) is now complete. The sampling program

consisted of reconnaissance prospecting and geological mapping

along the 90 contiguous claims totaling ~1,800 ha, located in the

Seymour-Crescent-Falcon lithium belt, ~55 km northeast of the town

of Armstrong and ~245 km from Thunder Bay in Ontario, Canada.

Highlights

- Given the potential of the region,

the purpose of the program was to identify lithium bearing

structures resembling the adjacent properties held by Green

Technology Metals Limited (“GT1”) and Antler Gold

Inc. (“Antler”).

- Mapping and sampling done which

indicate several positive mineral occurrences leading to further

planned exploration.

- 2023 prospecting program yielded

several highly anomalous results in both lithium (Li) and tantalum

(Ta), with notable samples including:

| |

|

223 ppm

Li |

| |

|

175 ppm Li |

| |

|

98 ppm Ta |

| |

|

greater than 100 ppm Ta |

All results of the samples are listed

in Table 1 below.

- The results of the samples were

above the crustal average for all four elements tested, supporting

GCOM’s thesis that the Project’s pegmatites are sourced from a

peraluminous granite melt and, in a region, prospective for Li

bearing pegmatites.

- The results are currently being

used to plan further exploration work in 2024.

Peter Mullens, Executive Chairman of GCOM

commented, “We are excited to advance the Armstrong Project with

initial exploration. Sampling has shown the presence of potential

lithium bearing pegmatites with a peraluminous granite source,

which resembles closely the highly prospective neighbouring

properties held by GT1 and Antler. With these findings, we can now

start planning our 2024 work program. Ontario is an exciting place

to be, in particular for lithium, with the province seeing ~$25B in

government subsidies for EV battery plants in 2023 alone, and this

being a very low-cost entry into the most prospective lithium

exploration belt in the province.”

Figure 1 – 2023 Sampling Program at the

Armstrong Project in Northern Ontario

2023 Sampling Program

The 2023 sampling program consisted of

reconnaissance prospecting and geological mapping conducted by

Fladgate Exploration Consulting Corporation, a full-service mineral

exploration consulting group.

A total of 287 mapped features and 89 samples

were collected on the Project with results from rock chip sampling

and prospecting showing above average crustal levels for 17 out of

89 samples for the following four elements: Li (20 ppm), Cs (4

ppm), Rb (112 ppm) and Ta (2 ppm). In addition, the mean for all of

the samples is above the crustal averages for all four elements

supporting the model that the Armstrong Project pegmatites are

sourced from a peraluminous granite melt and, in a region,

prospective for Li bearing pegmatites. While the overall grade of

these samples is low, it is indicative of the potential presence of

spodumene bearing pegmatites, related to a peraluminous granite

melt. Relevant analytical results of the samples are listed in

Table 1 and include lithium, cesium (Cs), rubidium (Rb) and

tantalum.

The primary focus of the 2023 exploration

program was to define and better understand the lithium bearing

pegmatite placement on the Project in order to develop targets for

future exploration programs. Samples were chosen based on visual

observations of pegmatites with favourable Li-bearing

mineralization, beryl, muscovite, tourmaline. The collection sites

of the prospecting samples and lithology mapping are illustrated in

Figure 1.

Additionally, geochemical analysis of the

samples shows a positive A/CNK ratio. The A/CNK molecular ratio

[Al2O3/(CaO + Na2O + K2O)] which is commonly used to indicate

whether a sample or a stock/pluton is mildly peraluminous (A/CNK =

1.0 to 1.1) or strongly peraluminous (A/CNK > 1.2). The A/CNK

ratio, the higher the aluminum content and the greater the

abundance of aluminum-rich minerals, such as garnet and muscovite

which are the more common minerals in a fertile pluton. In short,

barren granites will have a low A/CNK ratio, fertile granites will

have a moderate A/CNK ratio and rare-element pegmatites will have a

high A/CNK (F. W. Breaks, 2006). In this case, a 1.71 average A/CNK

for all the samples is considered in the vicinity of a strongly

peraluminous fertile pluton.

Table 1 – Relevant

analytical results of samples are listed below and include lithium,

cesium, rubidium and tantalum.

|

Sample ID |

Easting NAD83 |

Easting NAD83 |

Cs (ppm) |

Li (ppm) |

Rb (ppm) |

Ta (ppm) |

A/CNK |

|

1290001 |

411164 |

5587355 |

5 |

6 |

283 |

9 |

1.66 |

|

1290002 |

411158 |

5587368 |

14 |

5 |

544 |

28 |

1.41 |

|

1290003 |

411263 |

5588072 |

6 |

5 |

124 |

0 |

1.45 |

|

*1290004* |

411184 |

5588531 |

10 |

25 |

498 |

5 |

1.73 |

|

1290005 |

411624 |

5588578 |

119 |

17 |

690 |

2 |

1.55 |

|

1290006 |

411637 |

5588572 |

54 |

10 |

475 |

4 |

1.49 |

|

*1290007* |

411569 |

5588296 |

21 |

53 |

725 |

2 |

2.40 |

|

1290008 |

411573 |

5588302 |

2 |

50 |

69 |

1 |

1.79 |

|

*1290009* |

411532 |

5588269 |

14 |

37 |

488 |

6 |

1.87 |

|

*1290010* |

411465 |

5588235 |

6 |

27 |

174 |

37 |

1.87 |

|

1290011 |

411871 |

5588878 |

1 |

17 |

13 |

0 |

0.84 |

|

1290012 |

411877 |

5588589 |

1 |

11 |

7 |

40 |

1.52 |

|

1290013 |

411879 |

5588591 |

1 |

4 |

3 |

6 |

1.55 |

|

1290014 |

411862 |

5588601 |

17 |

14 |

200 |

87 |

1.67 |

|

1290015 |

412047 |

5588405 |

3 |

12 |

72 |

0 |

1.93 |

|

1290016 |

411562 |

5588233 |

2 |

43 |

58 |

1 |

1.53 |

|

1290017 |

411373 |

5588147 |

1 |

6 |

63 |

0 |

1.49 |

|

*1290018* |

411355 |

5588099 |

43 |

175 |

771 |

8 |

2.15 |

|

*1290019* |

411340 |

5588109 |

17 |

58 |

537 |

5 |

1.81 |

|

*1290020* |

411346 |

5588104 |

11 |

25 |

254 |

17 |

1.50 |

|

1290021 |

411353 |

5588102 |

10 |

96 |

169 |

2 |

1.44 |

|

*1290022* |

411338 |

5588116 |

26 |

22 |

514 |

3 |

1.50 |

|

1290023 |

411311 |

5588137 |

18 |

9 |

251 |

1 |

1.83 |

|

1290024 |

411249 |

5587981 |

4 |

8 |

63 |

0 |

1.60 |

|

1290025 |

411254 |

5587991 |

3 |

10 |

46 |

0 |

1.57 |

|

1290026 |

411263 |

5587990 |

3 |

23 |

44 |

1 |

1.57 |

|

1290027 |

411334 |

5587968 |

3 |

7 |

70 |

0 |

1.67 |

|

1290028 |

411373 |

5588033 |

1 |

5 |

34 |

4 |

1.59 |

|

1290029 |

411372 |

5588025 |

8 |

2 |

158 |

3 |

1.66 |

|

1290030 |

411381 |

5588045 |

2 |

4 |

49 |

8 |

1.51 |

|

*1290031* |

412012 |

5588075 |

22 |

21 |

297 |

34 |

1.69 |

|

1290032 |

411493 |

5587940 |

1 |

4 |

41 |

6 |

1.67 |

|

1290033 |

411492 |

5587953 |

2 |

3 |

54 |

0 |

1.68 |

|

1290034 |

411447 |

5587983 |

4 |

6 |

100 |

3 |

1.52 |

|

1290035 |

411417 |

5587940 |

1 |

5 |

53 |

0 |

1.44 |

|

1290036 |

411378 |

5587909 |

2 |

6 |

54 |

0 |

1.88 |

|

1290037 |

411260 |

5587934 |

15 |

5 |

269 |

1 |

2.04 |

|

*1290038* |

411219 |

5588090 |

21 |

36 |

371 |

4 |

1.94 |

|

1290039 |

411153 |

5588193 |

4 |

9 |

64 |

1 |

1.59 |

|

1290040 |

411083 |

5588153 |

2 |

7 |

37 |

0 |

1.57 |

|

1290041 |

411116 |

5588132 |

8 |

11 |

108 |

3 |

1.43 |

|

1290042 |

411072 |

5588121 |

3 |

9 |

52 |

1 |

1.41 |

|

1290043 |

410971 |

5588064 |

5 |

11 |

59 |

0 |

1.62 |

|

1290044 |

410533 |

5587911 |

8 |

12 |

50 |

0 |

1.89 |

|

1290045 |

410476 |

5587873 |

6 |

17 |

80 |

4 |

1.98 |

|

*1290046* |

410413 |

5587915 |

14 |

26 |

159 |

12 |

1.71 |

|

1290047 |

410410 |

5587922 |

5 |

22 |

43 |

1 |

2.22 |

|

1290048 |

410477 |

5587945 |

12 |

74 |

74 |

0 |

1.71 |

|

1290049 |

410477 |

5587940 |

12 |

47 |

93 |

0 |

1.65 |

|

1290050 |

410572 |

5588060 |

3 |

23 |

18 |

0 |

1.65 |

|

1290051 |

410589 |

5588082 |

12 |

8 |

197 |

16 |

1.52 |

|

1290052 |

410582 |

5588092 |

4 |

31 |

56 |

0 |

1.71 |

|

1290053 |

410604 |

5588052 |

11 |

4 |

449 |

2 |

1.56 |

|

1290054 |

410604 |

5588058 |

3 |

24 |

55 |

0 |

1.76 |

|

1290055 |

410694 |

5588121 |

6 |

16 |

52 |

0 |

1.75 |

|

1290056 |

410691 |

5588135 |

7 |

9 |

47 |

0 |

2.00 |

|

1290057 |

410985 |

5588325 |

3 |

23 |

27 |

1 |

1.66 |

|

1290058 |

411020 |

5588340 |

6 |

11 |

86 |

1 |

1.77 |

|

*1290059* |

411347 |

5587807 |

32 |

21 |

232 |

2 |

1.77 |

|

1290060 |

411366 |

5587807 |

6 |

21 |

45 |

0 |

1.65 |

|

1290061 |

411386 |

5587847 |

20 |

8 |

49 |

1 |

2.10 |

|

1290062 |

411370 |

5587859 |

12 |

12 |

61 |

1 |

2.17 |

|

1290063 |

411387 |

5587848 |

5 |

8 |

84 |

0 |

2.07 |

|

1290064 |

411251 |

5588502 |

41 |

18 |

1000 |

98 |

1.84 |

|

1290065 |

411259 |

5588501 |

33 |

24 |

943 |

37 |

2.36 |

|

1290066 |

411274 |

5588460 |

39 |

5 |

1640 |

>100 |

1.62 |

|

1290067 |

411261 |

5588195 |

48 |

18 |

424 |

20 |

1.91 |

|

*1290068* |

411238 |

5588169 |

23 |

24 |

435 |

13 |

1.66 |

|

*1290069* |

411237 |

5588170 |

40 |

26 |

517 |

16 |

1.76 |

|

1290070 |

411094 |

5588039 |

3 |

11 |

60 |

1 |

1.68 |

|

1290071 |

411522 |

5587721 |

3 |

6 |

67 |

1 |

1.75 |

|

1290072 |

411505 |

5587581 |

6 |

13 |

68 |

0 |

2.09 |

|

1290073 |

411418 |

5587479 |

2 |

7 |

54 |

0 |

1.92 |

|

1290074 |

411356 |

5587429 |

6 |

11 |

70 |

0 |

1.58 |

|

1290075 |

412481 |

5587212 |

2 |

8 |

62 |

0 |

1.54 |

|

1290076 |

412605 |

5587237 |

4 |

10 |

109 |

1 |

1.26 |

|

1290077 |

412570 |

5587466 |

1 |

6 |

64 |

5 |

1.24 |

|

1290078 |

412946 |

5587194 |

1 |

6 |

45 |

3 |

1.59 |

|

1290079 |

412952 |

5587153 |

2 |

5 |

91 |

4 |

1.67 |

|

1290080 |

412974 |

5587134 |

1 |

4 |

30 |

2 |

1.60 |

|

1290081 |

413001 |

5587105 |

3 |

6 |

97 |

2 |

1.69 |

|

1290082 |

412948 |

5587102 |

4 |

9 |

84 |

1 |

1.52 |

|

1290083 |

412909 |

5587092 |

5 |

2 |

94 |

0 |

1.89 |

|

1290084 |

411716 |

5587300 |

4 |

7 |

95 |

0 |

1.45 |

|

1290085 |

411776 |

5587344 |

3 |

6 |

79 |

0 |

1.70 |

|

1290086 |

411809 |

5587227 |

1 |

5 |

76 |

0 |

1.92 |

|

1290087 |

411881 |

5587152 |

4 |

4 |

94 |

0 |

2.07 |

|

1290088 |

411904 |

5587149 |

4 |

7 |

69 |

0 |

1.66 |

|

*1290089* |

411189 |

5588532 |

141 |

223 |

511 |

17 |

1.67 |

|

1290090 |

411163 |

5588545 |

3 |

17 |

32 |

2 |

0.88 |

|

*1290091* |

411186 |

5588530 |

21 |

142 |

1240 |

4 |

2.98 |

Annotated samples indicate samples with above

average crustal levels for Cs, Li, Rb, and Ta.

Note the above samples are selected rock

chip samples. They do necessarily reflect the average grade of the

outcrop. There are no known factors that are expected to materially

affect the accuracy or reliability of the data referred to

above.

Quality Assurance/Quality

Control

All samples were submitted to Activation Laboratories in Thunder

Bay, Ontario, Canada for whole rock geochemical analysis. This lab

is independent of GCOM. The analytical codes used include

Ultratrace 6 (ICP-OES – ICP-MS) and 8-peroxide-all elements (Na2O2

digest/ICP-OES).

Mapping station and UTM coordinates (NAD83 UTM

16N) were recorded using a handheld GPS and data such as lithology,

texture, mineral content, alteration, and a general rock

description for each rock sample taken. Each representative grab

sample was taken from an outcrop using a hammer. From there, the

sample was placed into a poly sample bag along with a sample tag

labeled with a corresponding sample number from a sample tag

booklet. Flagging tape was used to mark the sample location on the

ground as well as on a nearby tree. Access was derived from North

Road along with various historic logging roads.

Filing of Technical Report

The Company has filed an initial technical

report (the “Technical Report”) on the Armstrong

Project in compliance with NI 43-101 – Standards of Disclosure for

Mineral Projects (“NI 43-101”) entitled “National

Instrument 43-301 Independent Technical Report, Armstrong Lithium

Property, Thunder Bay Mining Division, Ontario Canada” dated

December 78, 2023. The Technical Report was completed following the

initial exploration program and accordingly includes particulars

with respect thereto. A copy of the Technical Report is available

under the Company’s profile on SEDAR+ available at

www.sedarplus.ca.

Options Granted

The Company is also announcing that it has

granted a total of 4,250,000 stock options

(“Options”) to various directors, officers,

employees and consultants of the Company.

Each Option is exercisable to acquire one common

share of the Company (a “Common Share”) for a

period of five years at a price of $0.10 per Common Share, with 25%

of the Options vesting immediately and 25% vesting every six months

following the date of grant over an 18 month period.

Technical Disclosure and Qualified

Person

The scientific and technical information

contained in this news release was reviewed and approved by Peter

Mullens (FAusIMM), Executive Chairman of the Company, who is a

“Qualified Person” in accordance with NI 43-101.

Please note that the QP did not review

the samples in the field that were included in this report. The

rock chip samples were collected by contract

prospectors.

About Green Shift Commodities

Ltd.

Green Shift Commodities Ltd. is focused on the

exploration and development of commodities needed to help

decarbonize and meet net-zero goals. The Company is advancing

several projects including the Armstrong project in Ontario.

Armstrong is adjacent to GT1’s Seymour project which holds a

lithium resource. Green Shift is also advancing the Rio Negro

Project in Argentina, a district-scale project in an area known to

contain hard rock lithium pegmatite occurrences that were first

discovered in the 1960s with little exploration since.

For further information, please

contact:

Green Shift Commodities

Ltd.Trumbull FisherDirector and

CEOEmail: tfisher@greenshiftcommodities.comTel: (416)

917-5847

Website: www.greenshiftcommodities.comTwitter: @greenshiftcomLinkedIn: https://www.linkedin.com/company/greenshiftcommodities/

Forward-Looking Statements

This news release includes certain “forward

looking statements”. Forward-looking statements consist of

statements that are not purely historical, including statements

regarding beliefs, plans, expectations or intensions for the

future, and include, but not limited to, statements with respect

to: the completion of future exploration work and the potential

results of such test work; the future direction of the Company’s

strategy; and other activities, events or developments that are

expected, anticipated or may occur in the future. These statements

are based on assumptions, including that: (i) the ability to

achieve positive outcomes from test work; (ii) actual results of

exploration, resource goals, metallurgical testing, economic

studies and development activities will continue to be positive and

proceed as planned, (iii) requisite regulatory and governmental

approvals will be received on a timely basis on terms acceptable to

Green Shift (iv) economic, political and industry market conditions

will be favorable, and (v) financial markets and the market for

uranium, battery commodities and rare earth elements will continue

to strengthen. Such statements are subject to risks and

uncertainties that may cause actual results, performance or

developments to differ materially from those contained in such

statements, including, but not limited to: (1) changes in general

economic and financial market conditions, (2) changes in demand and

prices for minerals, (3) the Company’s ability to source

commercially viable reactivation transactions and / or establish

appropriate joint venture partnerships, (4) litigation, regulatory,

and legislative developments, dependence on regulatory approvals,

and changes in environmental compliance requirements, community

support and the political and economic climate, (5) the inherent

uncertainties and speculative nature associated with exploration

results, resource estimates, potential resource growth, future

metallurgical test results, changes in project parameters as plans

evolve, (6) competitive developments, (7) availability of future

financing, (8) the effects of COVID-19 on the business of the

Company, including, without limitation, effects of COVID-19 on

capital markets, commodity prices, labor regulations, supply chain

disruptions and domestic and international travel restrictions, (9)

exploration risks, and other factors beyond the control of Green

Shift including those factors set out in the “Risk Factors” in our

Management Discussion and Analysis dated May 1, 2023 for the fiscal

year ended December 31, 2022 and other public documents available

under the Company’s profile on SEDAR+

at www.sedarplus.ca. Readers are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

forward-looking statements. Green Shift assumes no obligation to

update such information, except as may be required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

A photo accompanying this announcement is

available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/bf55a56d-0e28-493b-b5bf-d4cbc53d45f9

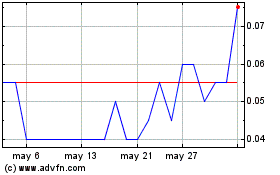

Green Shift Commodities (TSXV:GCOM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Green Shift Commodities (TSXV:GCOM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024