Nova Leap Health Corp. Posts Record Revenues for First Quarter 2021

06 Mayo 2021 - 3:45PM

NOVA LEAP HEALTH CORP. (TSXV: NLH) (“Nova Leap” or “the Company”),

a home health care organization ranked #2 on the 2020 Report on

Business ranking of Canada’s Top Growing Companies, is pleased to

announce the release of financial results for the first quarter

ended March 31, 2021.

All amounts are in United States

dollars unless otherwise specified.

Nova Leap First Quarter of

2021

Highlights for the first quarter ended March 31,

2021 included the following:

-

First quarter revenues were the highest in the Company’s

history;

-

Q1 2021 revenues of $5,020,139 increased by 11.97% relative to Q4

2020 revenues of $4,483,539 and were 8.87% higher than Q1 2020

revenues of $4,611,140; Revenue in USD $ is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/409fe3bc-6a3d-4de8-8e7c-b8a77f6f9e01

-

The Canadian operating segment generated record revenues, record

gross margin, record EBITDA and record EBITDA as a percentage of

revenue (14.4%) during Q1 2021;

-

The Company had a cash balance of $2,351,134 as of March 31, 2021

as well as full access to the unutilized revolving credit facility

of $696,000;

- Nova Leap’s U.S. operating segment

qualified for the Employee Retention Credit (“ERC”) in the first

quarter of 2021 and has recognized $1,555,431 in Other Income with

a corresponding receivable. The U.S. operating segment

automatically qualifies for the ERC in Q2 2021, based on its

qualification in Q1 2021, and expects to receive a further $1.6

million for Q2 for a total estimated benefit of $3.1 million in

2021. Timing of collection of the ERC is unknown.

-

In the first quarter of 2021, the Company received confirmation

that $1,403,900 of the PPP loans previously recognized in income

during the latter part of 2020 were forgiven. One forgiveness

application remains in process for an additional $571,700.

Management now expects the full amount of the PPP loans received to

be forgiven and an additional $63,446 was recognized in Other

income in Q1 2021.

-

Q1 2021 EBITDA of ($38,692), which excludes government assistance

programs, was consistent with Q4 2020 EBITDA of ($36,515) and lower

than Q1 2020 EBITDA of $220,051. EBITDA in USD $ is available

at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f73d02fb-ee56-4711-b6d0-e9abada0b08e

-

The Company reported an adjusted net loss of ($196,132) for Q1 2021

as compared to an adjusted net loss of ($71,019) for Q1 2020 and an

adjusted net income of $719,088 for Q4 2020 (see reconciliation of

adjusted net (loss) income to net (loss) income in “Summary of

Quarterly Results” section in the MD&A).

President & CEO’s

Comments

“I’ll share a few comments that I believe are

relevant as I reflect on our Q1 results”, said Chris Dobbin,

President & CEO of Nova Leap. “I am very pleased that the

Company was able to attract such high caliber directors in Marie

Mullally and Anne Whelan. It is a testament to our team, the

industry in which we operate and those we serve that they are

willing to make such a commitment to Nova Leap’s success moving

forward.

During Q1, Nova Leap forced conversion of a

substantial portion of outstanding convertible debt which improved

the Company’s balance sheet, integrated two new acquired businesses

from Q4 2020, received analyst coverage for the first time and saw

insider buying in the market. Insider ownership of the Company sits

just below 40%. I view these as positives for all stakeholders.

I believe there are two financial items of

importance that warrant special attention. First, our U.S.

operations qualified for the ERC in Q1. As a result, we anticipate

that the Company will receive approximately $3.1 million over the

course of the next several months. We intend to put these funds to

use in support of our U.S. operations with continued hiring and

expansion in the U.S.

Second, Nova Leap achieved record quarterly

revenues. With the vaccine rollout across the U.S., we began to see

a positive trend through Q1 with Nova Leap’s March revenues the

highest monthly revenues in the Company’s history. It was a good

way to end the quarter as we entered Q2. Much like we saw a direct

correlation between a decrease in client service hours during the

early days of the pandemic in 2020, it appears that there is a

direct correlation between the positive impacts of the vaccine

rollout with an increase in demand for services. In fact, there has

been such an increase in demand for services that our agencies are

struggling to meet the demand. The biggest challenge across the

industry remains achieving increased staffing levels. I have no

doubt that home care is viewed with increased importance as a

result of the pandemic.”

This news release should be read in conjunction

with the unaudited condensed interim consolidated financial

statements for the three and nine months ended September 30, 2020,

notes to the financial statements, and management's discussion and

analysis, which have been filed on SEDAR.

About Nova Leap

Nova Leap is an acquisitive home health care

services company operating in one of the fastest-growing industries

in the U.S. & Canada. The Company performs a vital

role within the continuum of care with an individual and family

centered focus, particularly those requiring dementia care. Nova

Leap achieved the #2 ranking on the 2020 Report on Business ranking

of Canada’s Top Growing Companies and the #10 Ranking in the 2019

TSX Venture 50™ in the Clean Technology & Life Sciences sector.

The Company is geographically diversified with operations in 7

different U.S. states within the New England, South- Central and

Midwest regions as well as Nova Scotia, Canada.

NON-GAAP MEASURES:

Earnings before interest, taxes, depreciation

and amortization (“EBITDA”), is calculated as income (loss) from

operating activities plus amortization and depreciation and

stock-based compensation.

Adjusted net income is net income adjusted for

stock-based compensation expense, acquisition expenses, foreign

exchange gains/losses, restructure charges, and severance and other

costs.

FORWARD LOOKING

INFORMATION:

Certain information in this press release may

contain forward-looking statements, such as statements regarding

future expansions and cost savings, expected forgiveness of PPP

loans, timing of receipt of ERC, qualification for and amount of

ERC for Q2 2021, and plans regarding future acquisitions and

business growth. This information is based on current expectations

and assumptions, including assumptions concerning general economic

and market conditions, availability of working capital necessary

for conducting Nova Leap’s operations, availability of desirable

acquisition targets and financing to fund such acquisitions, and

Nova Leap’s ability to integrate its acquired businesses and

maintain previously achieved service hour and revenue levels, that

are subject to significant risks and uncertainties that are

difficult to predict. Actual results might differ materially from

results suggested in any forward-looking statements. Risks that

could cause results to differ from those stated in the

forward-looking statements in this release include the impact of

the COVID-19 pandemic or any recurrence, including government

regulations or voluntary measures limiting the Company’s ability to

provide care to clients (such as shelter-in-place orders, isolation

or quarantine orders, distancing requirements, or closures or

restricted access procedures at facilities where clients reside),

increased costs associated with personal protective equipment and

sanitization supplies, staff and supply shortages, regulatory

changes affecting the home care industry, other unexpected

increases in operating costs and competition from other service

providers. All forward-looking statements, including any financial

outlook or future-oriented financial information, contained in this

press release are made as of the date of this release and included

for the purpose of providing information about management's current

expectations and plans relating to the future. The Company assumes

no obligation to update the forward-looking statements, or to

update the reasons why actual results could differ from those

reflected in the forward-looking statements unless and until

required by securities laws applicable to the Company. Additional

information identifying risks and uncertainties is contained in the

Company's filings with the Canadian securities regulators, which

filings are available at www.sedar.com.

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For further information:

Chris Dobbin, CPA, CA, Director, President and CEO Nova Leap Health Corp.,

T: 902 401 9480 F: 902 482 5177

E:cdobbin@novaleaphealth.com

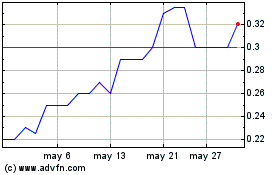

Nova Leap Health (TSXV:NLH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

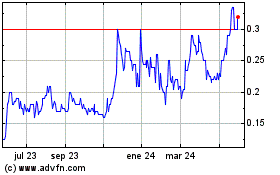

Nova Leap Health (TSXV:NLH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024