Quorum Releases Fiscal Year 2012 Results and Announces Board of Directors Changes Quorum Produces Solid Operational and Finan...

15 Abril 2013 - 8:22AM

Marketwired Canada

Quorum Information Technologies Inc. (TSX VENTURE:QIS) ("Quorum" or the

"Company") today released its Fiscal Year (FY) 2012 results. Quorum delivers its

dealership management system (DMS), XSellerator(TM), and related services to

automotive dealerships throughout North America. The Company is both an

Integrated Dealership Management System (IDMS) strategic partner with General

Motors Corporation (GM) and a strategic partner with Microsoft. Quorum's

XSellerator product is broadly promoted to its target dealerships throughout

North America by these prominent industry partners. Quorum also supplies its

product to Isuzu, Chrysler, Hyundai, Kia, Nissan, Subaru, NAPA and Bumper to

Bumper franchised dealership customers.

Maury Marks, Quorum's President and CEO made the following remarks about the

Company's FY2012 results:

Some of our most significant measurable sales and operational results in FY2012

are as follows:

-- Customer Base - Quorum reached 270 active dealership rooftops at the end

of FY2012 after installing 20 dealership rooftops during the year.

-- Key customer metrics are as follows:

-- Customer Satisfaction Index ("CSI") semi-annual survey in Q2 FY2012

and Q4 FY2012 showed an average of 74% of end users reported

"satisfied" or "very satisfied" and an average of 73% of dealer

principals reported "satisfied" or "very satisfied".

-- Our monthly Support Center CSI survey reported an average of over

95% "very satisfied" with the service received from our support

team.

-- For our Support services, on average, we now close 73% of all

support calls within 30 minutes (up from 60% in 2008, when we first

started measuring this statistic) and 87% of all calls within 24

hours (up from 81% in 2008).

-- Product - during FY2012 we released V4.7.3 and V4.7.4 of XSellerator to

all of our dealership customers. We continued work on two ground

breaking product features:

-- "Communicator" which transforms how dealership staff communicate

with their customers and each other. In Q4 FY2012 we general

released "Communicator" and started the full implementation to our

customer base.

-- "Console" which is a new customizable workspace with a suite of

productivity tools to help dealerships improve customer service,

increase utilization of XSellerator and track key performance

indicators. In Q3 FY2012, the "Console" was setup as a default

workspace for every XSellerator user.

-- Employees - none of the Company's accomplishments are possible without

highly motivated, engaged people. Our sincere thanks to the people that

drive Quorum. Every year we measure our staff engagement and we actively

work towards improving our job satisfaction and engagement throughout

the Company.

Financial Results highlights for FY2012 are as follows:

-- Sales decreased by 2% to $7,567K in FY2012 from $7,728K in FY2011 and

margin after direct costs decreased to $4,113K in FY2012, from $4,447K

in FY2011, a 7% decrease. The change in sales is due to:

-- An increase of $303K in recurring support revenue as a result from

having 270 active dealership rooftops at the end of FY2012 versus

254 at the end of FY2011;

-- A decrease in integration revenue of $386K due to a decrease in the

number of GM integration projects during FY2012;

-- A decrease of $78K in net new and transition revenue which was a

result of completing 20 rooftop installations in FY2012 as compared

to 22 roof top installations in FY2011.

-- Earnings before interest, taxes, depreciation and amortization (EBITDA)

decreased to $848K in FY2012 from $1,307K in FY2011. Income before

deferred income tax expense decreased to $189K for FY2012 compared to

$611K in FY2011. The decreases in both EBITDA and income before deferred

income tax expense are largely due to:

-- $333K decrease in margin after direct costs in FY2012 compared to

FY2011;

-- An increase in staffing levels which increased salaries and benefits

(direct and indirect) expense by $418K; and

-- Expiration of the wage subsidy and NL loan which resulted in an

increase of $115K in net salaries and benefits.

-- Net income (loss) decreased to negative $65K for FY2012 compared with

$332K in FY2011. This change is consistent with our change in Income

before deferred income taxes expense.

-- Comprehensive income (loss) decreased to negative $118K in FY2012

compared with $372K in FY2011 due to a foreign exchange loss in FY2012

of $53K versus a foreign exchange gain in FY2011 of $40K.

-- Working capital decreased to $1,004K at the end of December 2012

compared with $1,065K at the end of December 2011. Cash increased to

$425K at the end of December 2012 compared with $224K at the end of

December 2011.

During FY2012 we grew our customer base and support revenues; however, this

growth was offset by a 66% decrease in integration revenues from $583K FY2011 to

$197K in FY2012. We expect a further decline in integration revenues in FY2013.

The decrease in integration revenues directly impacted our EBITDA and Net

Income; however, we started to recover in Q3 and Q4 of FY2012 where we posted

$239K in EBITDA and $34K in Net Income and $257K in EBITDA and $33K in EBITDA in

each of the respective quarters. My sincere appreciation is extended to Quorum's

Board of Directors and to our employees and consultants who have been diligent

and dedicated in their support of the Corporation's goals and objectives. My

thanks also extend to our investors for their long-term and continued support of

Quorum.

Quorum announces the following changes in the Company's Board of Directors

effective immediately:

-- Michael Podovilnikoff, an existing Board Director, will take over the

role of Chairman of the Board of Directors of Quorum. Mr. Podovilnikoff

has served on the board of directors for TR Labs, on the Conference

Board of Canada Human Resource Committee, and was a member of multiple

national and international committees and forums within the

telecommunications discipline. He worked in the high tech industry for

more than 35 years in various executive positions. Mr. Podovilnikoff

currently consults on various business-related matters.

-- John Carmichael, existing Chairman of the Board of Directors, will be

stepping down as Chairman and will be continuing with the Board as a

Director. Mr. Carmichael is the current Member of Parliament of Don

Valley West. He was previously the Dealer Principal of City Buick

Chevrolet Cadillac GMC Ltd. in Toronto, Ontario, one of Canada's largest

Buick Chevrolet Cadillac dealerships. He has been involved at the most

senior level on many projects with General Motors and is a past Chairman

of the Canadian Automobile Dealers' Association (CADA)

Quorum has filed its 2012 consolidated financial statements and notes thereto as

at and for the period ended December 31, 2012 and accompanying management's

discussion and analysis in accordance with National Instrument 51-102 -

Continuous Disclosure Obligations adopted by the Canadian securities regulatory

authorities. Additional information about Quorum will be available on Quorum's

SEDAR profile at www.sedar.com and Quorum's website at www.QuorumDMS.com.

Financial Highlights

Year ended Year ended Year ended

December 31, 2012 December 31, 2011 December 31, 2010

----------------------------------------------------------------------------

Gross revenue $ 7,566,580 $ 7,727,502 $ 7,695,773

Direct costs 3,453,317 3,280,810 3,303,450

Margin after

direct costs 4,113,263 4,446,692 4,392,323

Earnings before

interest, taxes,

depreciation and

amortization

(EBITDA) 847,906 1,307,465 1,389,639

Income before

deferred income

tax 188,588 611,124 422,511

Net income (loss) (65,237) 331,147 166,555

Comprehensive

income (loss) (118,488) 371,523 3,177

Basic net income

(loss) per share ($0.002) $0.008 $0.004

Fully diluted net

income (loss) per

share ($0.002) $0.008 $0.004

Weighted average

number of common

shares

Basic 39,298,438 39,298,438 39,298,438

Diluted 39,298,438 39,298,438 42,634,919

XSellerator

installations -

in the period 20 22 33

XSellerator active

dealership

rooftops 270 254 240

----------------------------------------------------------------------------

About Quorum

Quorum is a North American company focused on developing, marketing,

implementing and supporting its XSellerator product for GM, Isuzu, Chrysler,

Hyundai, KIA, Nissan, Subaru, NAPA and Bumper to Bumper dealerships. XSellerator

is a dealership and customer management software product that automates,

integrates and streamlines every process across departments in a dealership. One

of the select North American suppliers under General Motors' IDMS program,

Quorum is the second largest DMS provider for GM's Canadian dealerships with 25%

of the market. Quorum is a Microsoft Partner in both Canada and the United

States. Quorum Information Technologies Inc. is traded on the Toronto Venture

Exchange (TSX-V) under the symbol QIS. For additional information please go to

www.QuorumDMS.com.

Forward-Looking Information

This press release contains certain forward-looking statements and

forward-looking information ("forward-looking information") within the meaning

of applicable Canadian securities laws. Forward-looking information is often,

but not always, identified by the use of words such as "anticipate", "believe",

"plan", "intend", "objective", "continuous", "ongoing", "estimate", "expect",

"may", "will", "project", "should" or similar words suggesting future outcomes.

In particular, this press release includes forward-looking information relating

to results of operations, plans and objectives, projected costs and business

strategy. Quorum believes the expectations reflected in such forward-looking

information are reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking information should not be

unduly relied upon.

Forward-looking information is not a guarantee of future performance and

involves a number of risks and uncertainties some of which are described herein.

Such forward-looking information necessarily involves known and unknown risks

and uncertainties, which may cause Quorum's actual performance and financial

results in future periods to differ materially from any projections of future

performance or results expressed or implied by such forward-looking information.

These risks and uncertainties include but are not limited to the risks

identified in Quorum's Management's Discussion and Analysis for the year ended

December 31, 2012. Any forward-looking information is made as of the date hereof

and, except as required by law, Quorum assumes no obligation to publicly update

or revise such information to reflect new information, subsequent or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Quorum Information Technologies Inc.

Maury Marks

403-777-0036 ext 104

MarksM@QuorumDMS.com

www.QuorumDMS.com

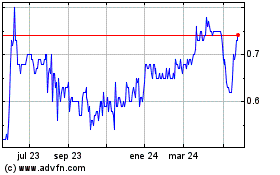

Quorum Information Techn... (TSXV:QIS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

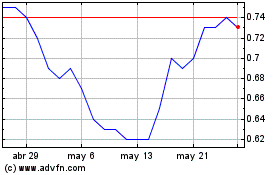

Quorum Information Techn... (TSXV:QIS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024