Reunion Closes $30.7 Million Bought Deal Private Placement Financing and Concurrent Non-Brokered Private Placement of $6.1 Million

08 Julio 2022 - 11:17AM

Reunion Gold Corporation (TSXV: RGD) (the

“

Company”) is pleased to announce that it has

closed its previously announced “bought deal” private placement

(the “

Bought Deal”) of units of the Company (the

“

Units”) underwritten by Sprott Capital Partners

LP (“

Sprott”), as lead underwriter and sole

bookrunner, together with Paradigm Capital Inc., as co-lead

underwriter (together with Sprott, the “

Co-Lead

Underwriters”) on behalf of a syndicate of underwriters

comprised of Cormark Securities Inc., iA Private Wealth Inc. and

Dundee Goodman Merchant Partners, a division of Goodman &

Company, Investment Counsel Inc. (collectively with the Co-Lead

Underwriters, the “

Underwriters”). Concurrently

with the Bought Deal, the Company also closed its previously

announced non-brokered private placement of Units on the same terms

as the Units issued and sold under the Bought Deal (the

“

Concurrent Financing” and collectively with the

Bought Deal, the “

Offering”). Pursuant to the

Offering, the Company issued 141,648,349 Units at a price of $0.26

per Unit, including 2,648,349 Units issued pursuant to the exercise

of the Underwriters’ over-allotment option and 23,500,000 Units

issued pursuant to the Concurrent Financing, for aggregate gross

proceeds to the Company of $36,828,570.

Each Unit consists of one common share in the

capital of the Company (each, a “Common Share”)

and one-half of one Common Share purchase warrant of the Company

(each whole warrant, a “Warrant”). Each Warrant

entitles the holder thereof to purchase one Common Share at an

exercise price of $0.39 until July 8, 2024, provided that if the

volume weighted average closing price of the Common Shares of the

Company on the TSX Venture Exchange or such other stock exchange on

which the Common Shares are traded is equal to or greater than

$0.55 for a period of 10 consecutive trading days, the Company may

elect to accelerate the expiry of the Warrants at its option.

As compensation for the Underwriters’ services

rendered in connection with the Bought Deal, the Company paid to

the Underwriters a cash fee of $1,835,314 and issued to the

Underwriters an aggregate of 7,058,900 non-transferable broker

warrants. Each broker warrant entitles the holder thereof to

purchase one Common Share at an exercise price of $0.26 until July

8, 2024.

The net proceeds derived from the Offering will

be used for exploration expenditures, primarily on the Company’s

Oko West project in Guyana, as well as for general corporate and

working capital purposes. All securities issued pursuant to the

Offering are subject to a statutory four-month hold period, which

expires on November 9, 2022.

The securities issued pursuant to the Offering

have not been, and will not be, registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”), or

any U.S. state security laws, and may not be offered or sold in the

United States without registration under the U.S. Securities Act

and all applicable state securities laws or compliance with

requirements of an applicable exemption therefrom. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy securities in the United States, nor shall there

be any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

About Reunion Gold

Corporation

Reunion Gold Corporation is a leading gold

explorer in the Guiana Shield, South America, with a portfolio of

projects in Guyana, Suriname and French Guiana. In 2021 the Company

made an exciting new gold discovery at its Oko West project in

Guyana, where to date it has outlined continuous gold

mineralization at the Kairuni zone over 2,500 meters of strike and

to a depth of 575 meters. The Company’s Common Shares are listed on

the TSX Venture Exchange under the symbol ‘RGD’ and trade on the

OTCQB under the symbol ‘RGDFF’. Additional information about the

Company is available on SEDAR (www.sedar.com) and the Company’s

website (www.reuniongold.com).

Forward Looking Statements

This news release contains “forward-looking

information” which may include, but is not limited to, statements

with respect to the use of proceeds of the Offering.

Forward-looking statements are based on the opinions and estimates

of management as of the date such statements are made and are based

on various assumptions. We do not intend and do not assume any

obligation to update these forward- looking statements and

shareholders are cautioned not to put undue reliance on such

statements.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For further information, please contact:

REUNION GOLD CORPORATION

Carlos H. Bertoni, Interim CEO, orDoug Flegg, Business

Development Advisor Telephone: +1 450.677.2585Email:

info@reuniongold.comWebsite: www.reuniongold.com

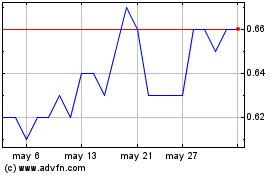

Reunion Gold (TSXV:RGD)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Reunion Gold (TSXV:RGD)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025