Top 4 Penny Stocks to Watch This Week

16 Septiembre 2019 - 11:35AM

InvestorsHub NewsWire

Penny stocks are some of the most active and

volatile types of stocks in the stock market today. But what

everyone knows about these is that they can break out in a big way.

That’s why so many continue to look for the best penny stocks to

buy. In this regard, several economic and sector events have

sparked interest in a number of small-cap and micro-cap stocks this week.

Here is a list of 4 penny stocks that may be worth watching this

week:

Penny Stocks To Watch #1:

PharmaCyte Biotech (PMCB)

There has been no lack of

attention on biotech penny stocks this year. At the beginning

of August, one small biotech stock broke to highs of over $10 from

a starting price below $2 a share after releasing news. PharmaCyte Biotech (PMCB) focuses on ways to

effectively deliver treatments to patients with diseases ranging

from cancer to diabetes.

The company’s proprietary

cellulose-based live-cell encapsulation technology known as

“Cell-in-a-Box® is the platform that

the company uses to develop its therapy delivery methods. For

most of the quarter, shares of PMCB stock have traded between

$0.033 and $0.04 with volume recently surging.

On September 12, PharmaCyte saw

more than 4 million shares trade; well above its daily

average. Most of the attention surrounding the company has been on

two things. First, its progress with Cell-In-A-Box and the

application for Pancreatic cancer has continued to progress. The

company brought on Dr. Manuel Hidalgo has confirmed that he will be

Principal Investigator (PI) for PharmaCyte’s planned clinical trial

in locally advanced, inoperable pancreatic cancer (LAPC) now that

he is at Weill Cornell Medical Center.

Second, the company has been

ramping up for a much-anticipated shareholder update call on

September 20. The call will cover PharmaCyte’s preparations for

submission of its Investigational New Drug application (IND) to the

U.S. Food and Drug Administration (FDA) to treat locally advanced,

inoperable pancreatic cancer and developments related to

PharmaCyte’s product pipeline on which PharmaCyte has been working

and that have not yet been reported in a press

release.

Penny Stocks To Watch #2:

Discovery Gold (DCGD)

One of the more volatile penny

stocks to watch this month has been Discovery Gold (DCGD). Though the stock is not mining, it is

participating in another industry that has seen its own “rush:”

cannabis. For the better part of the last quarter, shares of

Discovery Gold have climbed from $0.01 to as high as $2.22. Over

the last few days, however, the marijuana stock took an aggressive

tumble to lows of $0.43.

The company had previously

announced that it would be pursuing a name change to GRN Holdings

Corporation. Over the past few months, GRN has been adding new

management and advisory members. Most of them have some background

in the cannabis industry.

On Monday, DCGD shares saw a

dramatic trend reversal compared to its previous two trading

sessions. Shares opened the week at $0.64 and have seen highs of

$0.81 heading into the lunch hour on Monday. The company hosted web

conferences on the 13th, throughout the

afternoon.

Penny Stocks To Watch #3:

Fannie Mae (FNMA)

One of the more popular housing

penny stocks to watch this month has been Fannie Mae (FNMA). Thanks to the government’s focus on

overhauling the company, the market has been monitoring progress

closely. The mortgage giant, along with Freddie Mac, has seen a

rise in price from lows this month of $2.51 to highs of $3.98

during the early lunch hour on Monday. Since the beginning of the

year, FNMA stock has risen by as much as 272%.

The firm announced the results of

its thirteenth reperforming loan sale transaction. The deal, which

was announced on August 13, 2019, included the sale of

approximately 29,400 loans totaling $5.1 billion in

unpaid principal balance (UPB), divided into six pools. The winning

bidders of the six pools for the transaction were Goldman Sachs

Mortgage Company (Goldman Sachs) for Pool 1, Towd Point Master

Funding LLC (Cerberus) for Pools 2, 3, 4, NRZ Mortgage Holdings,

LLC (Fortress) for Pool 5, and DLJ Mortgage Capital, Inc. (Credit

Suisse) for Pool 6. The transaction is expected to close

on October 25, 2019.

Penny Stocks To Watch #4:

Cardiff Lexington Corporation (CDIX)

The last penny stock to watch on

this list is Cardiff Lexington Corporation (CDIX). Shares of the sub-penny stock have

climbed from lows of $0.0014 on September 10 to highs of $0.0059 as

of the 12 o’clock hour on Monday. This move of more than 320% came

as the company is in the midst of several key

developments.

First, Cardiff announced in late

August that, along with Acela BioMedical, LLC, the two have signed

a Letter of Intent whereby Acela BioMedical would become a

subsidiary of Cardiff Lexington. Acela Biomedical is an existing

Hemp grower, distributor, processor, extractor, and retailor

specializing in CBD Oil Production with over two million plants in

the ground in Kentucky. Its processing facility is currently in

operation.

In addition to this, Cardiff

announced this month that the Company has received $410,000.00 in

new funding from the Private Equity Group, Leonite Capital, LLC. As

a result, Cardiff was able to pay off three significant convertible

notes totaling $379,902 and further, plans to retire all commercial

notes by year-end 2019 in concert with acquisition-related equity

funding.

What Is Stock Price

(StockPrice.com)?

Stock Price is defined as the

price of a single share of a number of saleable stocks of a public

company. A stock price is the highest amount an investor or trader

is willing to pay for the stock, or the lowest amount that it can

be bought for.

StockPrice.com was created for

everyone that wants the latest stock quotes, stock charts, company

news, and the best financial content.

At Stock Price (StockPrice.com), you get free stock quotes, up-to-date

news, international market data, social interaction and the best

financial content that will help you manage your financial

life.

Legal

Disclaimer

Except for the historical

information presented herein, matters discussed in this article

contain forward-looking statements that are subject to certain

risks and uncertainties that could cause actual results to differ

materially from any future results, performance or achievements

expressed or implied by such statements. Midam Ventures LLC which

owns www.StockPrice.com is not registered with any financial or

securities regulatory authority and does not provide nor claims to

provide investment advice or recommendations to readers of this

release.

Midam Ventures LLC, which owns

www.StockPrice.com, may from time to time have a position in the

securities mentioned herein and may increase or decrease such

positions without notice. For making specific investment decisions,

readers should seek their own advice Midam Ventures LLC, which owns

www.StockPrice.com, may be compensated for its services in the form

of cash-based compensation or equity securities in the companies it

writes about, or a combination of the two. Disclaimer: Pursuant to

an agreement between MIDAM VENTURES, LLC and Complete Investment

And Management LLC, a Non-affiliate Third Party, Midam was hired

for a period from 07/09/2019 – 8/09/2019 to publicly disseminate

information about PharmaCyte Biotech including on the Website and

other media including Facebook and Twitter. We were paid $150,000

(CASH) for & were paid “0” shares of restricted common shares.

We were paid an additional $150,000 (CASH) BY Complete Investment

And Management LLC, a Non-affiliate Third Party, AND HAVE EXTENDED

coverage for a period from 8/12/2019 – 9/12/2019. We may buy or

sell additional shares of PharmaCyte Biotech in the open market at

any time, including before, during or after the Website and

Information, provide public dissemination of favorable

Information. Click Here For Full

Disclaimer

Contact

Information:

news@stockprice.com

SOURCE: StockPrice.com

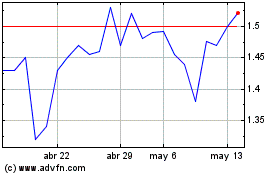

Fannie Mae (QB) (USOTC:FNMA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Fannie Mae (QB) (USOTC:FNMA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024