TIDMCEPS

RNS Number : 0591M

CEPS PLC

16 September 2021

16 September 2021

CEPS PLC

("CEPS", "CEPS Group" "Group" or "Company")

HALF-YEARLY REPORT

The Board is pleased to announce its unaudited half-yearly

report for the six months ended 30 June 2021.

CHAIRMAN'S STATEMENT

Review of the period

I am pleased to say these interim accounts, unlike the accounts

for the past few years, are relatively simple with no goodwill

write-offs, no extraordinary expenses, no corporate reconstructions

and no subsidiaries being placed into administration.

However, whilst profitable, these results continue to show the

impact of the pandemic and the various lockdowns. The whole

six-month accounting period being reported on fell into a time of a

national lockdown which ended on 19 July 2021. In reality, because

of business seasonality, it might well be that in some of the CEPS

companies there may be little or no recovery in the current year.

We must, therefore, look to the future, and by that, I mean the

results for the year ending 31 December 2022, which will be

reported in May 2023, for a true representation of the real

potential of the CEPS Group.

As a Board we are confident of better returns for the CEPS Group

in the future as the UK economy continues to recover back to, and

in time, exceed its pre-pandemic level. Whilst the Company as a

stand-alone legal entity does have a high level of debt of some

GBP5.85m, this debt has been lent, firstly, by me personally,

secondly, from a corporate entity that my family controls and,

thirdly, from an individual for whom the sum advanced is guaranteed

by me. This debt will, in time, be repaid as the subsidiaries make

increasing profits, generate cash and repay loans advanced from

CEPS.

Aford Awards Limited ("Aford Awards") reported sales that

remained well down on the comparable period in pre-pandemic 2019,

but demonstrated a continuing recovery throughout the period,

reflecting the gradual opening of society and of more sporting

events taking place. Shareholders will have seen the recent,

complicated announcement about the acquisition of three small

business entities which will be incorporated into the current

operational unit in Maidstone from September 2021 onwards. As was

flagged in the 2020 Annual Report, this consolidation process is

being driven by the new management team introduced in the second

half of last year. Subject to prudent integration, it is the

intention to make a series of these types of acquisitions in the

future.

Friedman's Limited ("Friedman's"), including Milano

International Limited ("Milano International"), has reported a

decline in sales and profitability in the period as compared to

2020 because the first three months of 2021 were locked down and

the comparable three months in 2020 were not. As we know, the

majority of the six-month period to June 2021 was impacted by the

ongoing restrictions resulting from the third lockdown. Whilst in

H1 of 2021 sales in Friedman's started to gradually recover, the

sales in Milano International, a supplier of leotards and gymnastic

clothing, did not. The management team is not expecting any

improvement in Milano International's sales until gymnastics clubs

and schools are fully open and operational from September 2021

onwards.

The enlarged Hickton group has included Cook Brown Building

Control Limited and Cook Brown Energy Limited for a full six months

in H1 2021 as compared to only three months in H1 2020, and now

also includes the recent acquisition of Millington Lord, which

became part of the CEPS Group from 15 March 2021. The purchase of

Millington Lord Limited ("Millington Lord") was initially financed

by Hickton Group Limited ("Hickton Group") and subsequently

partially refinanced by the shareholders, with CEPS borrowing a

further GBP150,000 from Chelverton Asset Management Limited to

enable it to make a further investment in Hickton Group. The

shareholding of CEPS in Hickton Group, notwithstanding this further

investment, declined from 54.7% to 52.4% at the time of this

investment. The Board of Hickton Group is pleased with the

performance in the period but is concerned with the issue of

recruiting the necessary quality of staff needed to continue to

grow the business. This is a problem common to many industry

sectors and much reported on in the UK economy.

The new associate company, being the merger of the previously

85% subsidiary Davies Odell Limited ("Davies Odell") with Vale

Brothers Limited ("Vale Brothers") by the setting up of a new

holding company called Vale Brothers Group Limited, produced a

small profit contribution of GBP25,000. Whilst this is the first

positive contribution connected with Davies Odell for seven years,

it is still disappointing as this was effectively achieved from the

cost-cutting in Davies Odell, made possible by the merger with Vale

Brothers. We look forward to an improved performance from Vale

Brothers Group Limited in 2022.

On behalf of all shareholders, I would like to thank all my

colleagues in the CEPS Group for what was achieved in the first six

months of this year. Each company has had to adapt its business to

face a whole series of different challenges and it is only through

the phenomenal collective effort across the CEPS Group at all

levels that this progress has been made.

Financial review

As a result of the CEPS Group restructuring that has taken place

over the last three years, the results for H1 2021 reflect the

performance of the continuing operations, namely Aford Awards,

Friedman's, including Milano International, and Hickton Group.

Revenue from continuing operations for the six months ended 30 June

2021 was GBP8,970,000 an increase on the very depressed level of

GBP6,299,000 in 2020, which included GBP5,414,000 of revenue from

continuing operations.

Aford Awards generated revenue of GBP515,000 for the first six

months of 2021 compared to GBP390,000 for the same period in 2020.

The segmental result presented as EBITDA before exceptional items

was GBP164,000, an improvement on H1 2020 (GBP57,000). However,

when compared to H1 2019, when revenue was GBP1,094,000 and EBITDA

was GBP285,000, the impact of the pandemic on the company's

performance becomes clear.

As already mentioned, sales of Milano International's products

continue to be diminished by the restrictions resulting from the

pandemic Revenue from Friedman's and Milano International was

GBP1,857,000 in H1 2021 compared to GBP2,149,000 in H1 2020 and

EBITDA before exceptional items was GBP82,000 compared to

GBP304,000 in the respective periods. Given that the latest

restrictions were only lifted on July 19, after the period end,

this was a creditable result in the circumstances.

A meaningful comparison between the results for Hickton Group in

H1 2021 and 2020 is more difficult as we are not comparing

like-with-like in terms of the group's component parts, as

described above. Suffice to say that the construction sector has

recovered more quickly than the leisure sector. Revenue was

GBP6,598,000 in the first half of 2021 compared to GBP2,875,000 in

H1 2020 and EBITDA before exceptional items was GBP1,026,000 for

the six-month period to 30 June 2021 compared to GBP515,000 for the

six months to 30 June 2020.

The operating profit before exceptional items for CEPS for H1

2021 was GBP855,000 and for H1 2020 was GBP213,000, split between

an operating profit before exceptional items from continuing

operations of GBP357,000 and an operating loss before exceptional

items of GBP144,000 from discontinued operations. Whilst

acknowledging that the profit improvement is largely due to the

growth of the Hickton group of companies and the recovery of the

construction sector, the Board is hopeful that this profit

improvement is an early indication that the CEPS Group

restructuring is proving to be successful.

Included within operating profit before exceptional items is

other operating income of GBP240,000 for the period to June 2021

and GBP563,000 for the six months to 30 June 2020, split between

continuing operations of GBP447,000 and discontinued operations of

GBP116,000. This income was derived from the Coronavirus Job

Retention Scheme grant and other similar government grants and the

fact that it has reduced so much when comparing the periods

reflects, not only the gradual withdrawal of this support, but also

the gradual return to work of the CEPS Group's employees.

Also included within operating profit before exceptional items

are CEPS Group costs. These have reduced from GBP254,000 for H1

2020 to GBP164,000 for H1 2021 primarily due to the reduction in

fees for the Dinkie Heel Defined Benefit Pension Scheme which are

being paid by the Scheme from its surplus for the time being.

Exceptional items represent expenses relating to the Millington

Lord acquisition in the six months to 30 June 2021 of GBP46,000 and

profit on disposal of subsidiaries arising in discontinued

operations in H1 2020. There was a restatement of the profit on

disposal of subsidiaries downwards from GBP2,555,000 to GBP825,000

which is explained in more detail in note 2 to the financial

information.

Net finance costs have remained roughly the same between the two

periods (H1 2021: GBP357,000; H1 2020: GBP375,000) and the

corporation tax charge of GBP137,000 (H1 2020: GBP1,000) is

primarily a provisional charge on the profits generated by Hickton

Group.

The profit after taxation for the first six months of 2021 was

GBP340,000 which compares to a profit of GBP664,000 for the same

period last year, split between a loss from continuing operations

of GBP17,000 and a profit from discontinued operations of

GBP681,000.

Earnings per share attributable to the owners of the parent on a

basic and diluted basis was 0.73p for H1 2021 and 3.63p for H1

2020, split between a loss per share of 0.38p for continuing

operations and an earnings per share from discontinued operations

of 4.01p.

In terms of the Consolidated Statement of Financial Position,

the figures relating to the acquisition of Millington Lord are

provisional at this stage and will be confirmed at the financial

year end, but are not expected to differ materially.

The cash generation from operations in H1 2021 was GBP515,000

which compares to GBP696,000 for the same period last year. Net

debt, excluding acquisition loan notes, increased between the

periods from GBP5,597,000 at 30 June 2020 to GBP6,158,000 at 30

June 2021. The additional cash was primarily used to finance the

new acquisitions and the restructuring over the year.

On 21 January 2021 I loaned the Company a further GBP100,000

interest free and with no fixed repayment date for general working

capital for the Company during the pandemic, taking the Company's

total indebtedness owed to me to GBP750,000. On 15 April 2021,

Hickton Group Limited drew down on a four year GBP500,000, secured

Coronavirus Business Interruption Loan with Santander UK plc

available for general corporate purposes. In May 2021, the Company

entered into a loan agreement with a third party for GBP2,000,000.

The loan was used to repay an existing GBP2,000,000 loan from

another third party which fell due for repayment on 30 June 2021.

Finally, as already mentioned, in June 2021 CEPS borrowed a further

GBP150,000 from Chelverton Asset Management Limited to enable it to

make a further investment in Hickton Group, taking the total amount

loaned by Chelverton Asset Management limited to GBP3,100,000.

2021 outlook

We have been encouraged by the determination of the people at

the subsidiary companies to get on and ensure that their businesses

continued to develop and provide product and services to their

customers.

It remains very difficult to predict the outlook and the exact

performance of the businesses. We recognise the possibility of

further regional lockdowns in the winter season. However, another

national lockdown would be disastrous. The consistent message we

have given is that we do not expect normalisation of trading until

perhaps 2022. After prior economic shocks, it has taken about 18 to

24 months for confidence to fully return.

The CEPS Group is now better positioned than it was three years

ago, and each company has a clear strategy as to how it will grow

its businesses over time. This will be by a combination of

acquisition of related companies to both broaden and deepen

activities with the intention of capturing a greater market share

by more efficient processes and marketing. In addition, where

possible and appropriate, CEPS will look to increase its

shareholdings in the underlying subsidiaries.

David Horner

Chairman

16 September 2021

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (which forms part of

domestic UK law pursuant to the European Union (Withdrawal) Act

2018).

The directors of the Company accept responsibility for the

content of this announcement.

Enquiries

CEPS PLC

David Horner, Chairman +44 1225 483030

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

/ Ludovico Lazzaretti +44 20 7213 0880

Caution Regarding Forward Looking Statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the directors' current beliefs

and assumptions and are based on information currently available to

the directors .

CEPS PLC

Consolidated Statement of Comprehensive Income

Six months ended 30 June 2021

Note Continuing Continuing Discontinued

Operations Operations Operations Audited

Unaudited Unaudited Unaudited Unaudited 12 months

6 months 6 months 6 months

to 30 to 30 6 months to 30 to 31

June June to 30 June June December

2021 2020 2020 2020 2020

restated restated restated

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 5 8,970 5,414 885 6,299 13,952

Cost of sales (5,255) (3,018) (698) (3,716) (9,328)

------------ ------------ ------------- ---------- ----------

Gross profit 3,715 2,396 187 2,583 4,624

Administration expenses (3,100) (2,486) (447) (2,933) (5,473)

Other operating income 240 447 116 563 861

------------ ------------ ------------- ---------- ----------

Operating profit/(loss) 855 357 (144) 213 12

Exceptional items (46) - 825 825 (191)

Impairment of intangible

assets - - - - (354)

Adjusted operating profit/(loss) 809 357 681 1,038 (533)

Analysis of adjusted

operating profit/(loss)

------------ ------------ ------------- ---------- ----------

Trading 779 164 (260) (96) 442

Exceptional items 4 (46) - 825 825 (191)

Impairment of intangible

assets - - - - (354)

Other operating income 240 447 116 563 -

Group costs 5 (164) (254) - (254) (430)

------------ ------------ ------------- ---------- ----------

809 357 681 1,038 (533)

------------ ------------ ------------- ---------- ----------

Profit on disposal of

discontinued operations - - - - 626

Share of associate profit 25 - - - -

Net finance costs 5 (357) (375) - (375) (738)

Profit/(loss) before

tax 477 (18) 681 663 (645)

Taxation 5 (137) 1 - 1 (20)

------------ ------------ ------------- ---------- ----------

Profit/(loss) for the

period 340 (17) 681 664 (665)

------------ ------------ ------------- ---------- ----------

Other comprehensive

loss

Items that will not

be reclassified to profit

or loss

------------ ---------- ----------

Actuarial loss on defined

benefit pension plans - - - - (13)

------------ ------------ ------------- ---------- ----------

Other comprehensive

loss for the period,

net of tax - - - - (13)

Total comprehensive

income/(loss) for the

period 340 (17) 681 664 (678)

------------ ------------ ------------- ---------- ----------

Income/(loss) attributable

to:

Owners of the parent 124 (64) 681 617 (624)

Non-controlling interest 216 47 - 47 (41)

------------ ------------ ------------- ---------- ----------

340 (17) 681 664 (665)

------------ ------------ ------------- ---------- ----------

Total comprehensive

income/(loss) attributable

to:

Owners of the parent 124 (64) 681 617 (637)

Non-controlling interest 216 47 - 47 (41)

------------ ------------ ------------- ---------- ----------

340 (17) 681 664 (678)

------------ ------------ ------------- ---------- ----------

Earnings per share attributable

to owners of the parent

during the period

basic and diluted 6 0.73p (0.38p) 4.01p 3.63p (3.67p)

------------ ------------ ------------- ---------- ----------

CEPS PLC

Consolidated Statement of Financial Position

As at 30 June 2021

Note Unaudited Unaudited Audited

as at as at as at

30 June 30 June 31 December

2021 2020 2020

restated

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 651 860 633

Right-of-use assets 948 1,150 976

Intangible assets 10,364 10,033 9,208

Investment in associate 25 - -

11,988 12,043 10,817

---------- ---------- ------------

Current assets

Inventories 1,284 2,386 1,441

Trade and other receivables 3,150 2,423 1,883

Cash and cash equivalents

(excluding bank overdrafts) 2,114 2,048 2,332

6,548 6,857 5,656

---------- ---------- ------------

Total assets 5 18,536 18,900 16,473

========== ========== ============

Equity

Capital and reserves attributable

to owners of the parent

Called up share capital 8 1,700 1,700 1,700

Share premium 5,841 5,841 5,841

Retained earnings (8,299) (6,548) (8,402)

---------- ---------- ------------

(758) 993 (861)

Non-controlling interest in equity 2,199 2,209 1,954

Total equity 1,441 3,202 1,093

---------- ---------- ------------

Liabilities

Non-current liabilities

Borrowings 6,948 8,827 6,415

IFRS lease liability 882 1,040 887

Deferred tax liability 150 216 51

7,980 10,083 7,353

---------- ---------- ------------

Current liabilities

Borrowings 4,119 1,260 3,861

IFRS lease liability 191 235 248

Trade and other payables 3,357 3,142 2,909

Current tax liabilities 1,448 978 1,009

9,115 5,615 8,027

---------- ---------- ------------

Total liabilities 5 17,095 15,698 15,380

---------- ---------- ------------

Total equity and liabilities 18,536 18,900 16,473

========== ========== ============

CEPS PLC

Consolidated Statement of Cash Flows

Six months ended 30 June 2021

Unaudited Unaudited Audited

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2021 2020 2020

restated

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit/(loss) for the financial

period 340 664 (665)

Adjustments for:

Depreciation and amortisation 253 312 601

Loss on disposal of fixed assets 1 - -

Profit on disposal of subsidiaries - (825) (626)

Share of associate profit (25) - -

Impairment of intangible assets - - 354

Pension contributions less than

administrative charge - - 9

Net finance costs 357 375 738

Taxation charge 137 (1) 20

Changes in working capital

Movement in inventories 157 (142) 375

Movement in trade and other receivables (341) (190) 325

Movement in trade and other payables (305) 476 377

---------- ---------- ------------

Cash generated from operations 574 669 1,508

Corporation tax (paid)/received (59) 27 (241)

Net cash generated from operating

activities 515 696 1,267

---------- ---------- ------------

Cash flows from investing activities

Interest received 6 - 2

Acquisition of subsidiaries, net

of cash acquired (740) (1,870) (866)

Acquisition of minority shareholdings

in subsidiaries - (1,313) (1,366)

Disposal of subsidiaries, net of

cash - (4) (4)

Purchase of property, plant and

equipment (41) (142) (95)

Proceeds from sale of assets 35 - 1

Purchase of intangible fixed assets (3) (229) (24)

Net cash from investing activities (743) (3,558) (2,352)

---------- ---------- ------------

Cash flows from financing activities

Proceeds from borrowings 2,978 3,485 3,174

Repayment of borrowings (2,485) - (904)

Loan issue costs paid - - (86)

Proceeds from subsidiary share

issue 5 - 26

Interest paid (315) (319) (432)

Lease liability payments (173) (277) (319)

Net cash flow generated from financing

activities 10 2,889 1,459

---------- ---------- ------------

Net (decrease)/increase in cash

and cash equivalents (218) 27 374

Cash and cash equivalents at the

beginning of the period 2,332 1,958 1,958

Cash and cash equivalents at the

end of the period 2,114 1,985 2,332

========== ========== ============

Cash and cash equivalents

Cash at bank and in hand 2,114 2,048 2,332

Bank overdrafts repayable on demand - (63) -

2,114 1,985 2,332

========== ========== ============

CEPS PLC

Consolidated Statement of Changes in Equity

Six months ended 30 June 2021

Share Share Retained Attributable Non-controlling Total

capital premium earnings to owners interest equity

of the

parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- ---------- ------------- ---------------- --------

At 1 January 2020 1,700 5,841 (6,808) 733 2,018 2,751

(audited)

--------- --------- ---------- ------------- ---------------- --------

Profit and total comprehensive

income for the period

(restated) - - 617 617 47 664

--------- --------- ---------- ------------- ---------------- --------

Changes in ownership

interest in a subsidiary

(restated) - - (357) (357) (882) (1,239)

--------- --------- ---------- ------------- ---------------- --------

Disposal of subsidiaries - - - - 1,026 1,026

--------- --------- ---------- ------------- ---------------- --------

At 30 June 2020 (unaudited) 1,700 5,841 (6,548) 993 2,209 3,202

--------- --------- ---------- ------------- ---------------- --------

Actuarial loss - - (13) (13) - (13)

--------- --------- ---------- ------------- ---------------- --------

Loss for the period - - (1,241) (1,241) (88) (1,329)

--------- --------- ---------- ------------- ---------------- --------

Total comprehensive

loss for the financial

period - - (1,254) (1,254) - (1,342)

--------- --------- ---------- ------------- ---------------- --------

Changes in ownership

interest

in subsidiaries - - (600) (600) (167) (767)

--------- --------- ---------- ------------- ---------------- --------

At 31 December 2020

(audited) 1,700 5,841 (8,402) (861) 1,954 1,093

--------- --------- ---------- ------------- ---------------- --------

Profit and total comprehensive

income for the financial

period - - 124 124 216 340

--------- --------- ---------- ------------- ---------------- --------

Changes in ownership

interest

in a subsidiary - - (21) (21) 29 8

--------- --------- ---------- ------------- ---------------- --------

At 30 June 2021 (unaudited) 1,700 5,841 (8,299) (758) 2,199 1,441

--------- --------- ---------- ------------- ---------------- --------

Notes to the financial information

1. General information

The Company is a limited liability company incorporated and

domiciled in the UK. The address of its registered office is 11

Laura Place, Bath BA2 4BL and the registered number of the company

is 00507461.

The Company is quoted on AIM.

This condensed consolidated half-yearly financial information

was approved by the directors for issue on 16 September 2021.

This condensed consolidated half-yearly financial information

does not comprise statutory accounts within the meaning of section

434 of the Companies Act 2006. Statutory accounts for the year

ended 31 December 2020 were approved by the Board of directors on

24 May 2021 and delivered to the Registrar of Companies. The report

of the auditor on those accounts was unqualified, did not contain

an emphasis of matter paragraph and did not contain any statement

under section 498 of the Companies Act 2006.

This condensed consolidated half-yearly financial information

has not been reviewed or audited.

There is no specific seasonality in relation to the condensed

consolidated half-yearly financial information, although the impact

of COVID-19 has had a profound effect on the subsidiaries and their

performance in H1 2020 and to a lesser overall degree in H2 2020

and into 2021.

Basis of preparation

This condensed consolidated half-yearly financial information

for the six months ended 30 June 2021 has been prepared in

accordance with IAS 34, 'Interim Financial Reporting' as adopted by

the European Union. The condensed consolidated half-yearly

financial information should be read in conjunction with the annual

financial statements for the year ended 31 December 2020, which

have been prepared in accordance with IFRSs as adopted by the

United Kingdom.

Accounting policies

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 31 December 2020, as

described in those annual financial statements.

2. Restatement

The Consolidated Statement of Comprehensive Income for the

period ended 30 June 2020 and the Consolidated Statement of

Financial Position as at that date together with the related

segmental notes have been restated for the error identified in the

preparation of the full year 2020 financial statements and to

reclassify the results of Davies Odell Limited, disposed of in

December 2020, from continuing to discontinued operations. The

profit on disposal of subsidiaries, shown as GBP2,555,000 in the

2020 Half-Yearly Report to Shareholders is now shown as GBP825,000

with the debit to equity on change of ownership interest and

movements in non-controlling interest adjusted by corresponding

amounts. This did not impact cash flows with the cash flow

statement restated only to show the lower profit for the period and

adjustment to this for the reduced profit on disposal.

3. Acquisitions in the current period

Hickton Group Limited, the Company's subsidiary, acquired the

entire issued share capital of Millington Lord Limited ("MLL") on

15 March 2021 from GT Realisations Limited (formerly Gas Tag

Limited). MLL is a holding company, with two wholly owned trading

subsidiaries; Morgan Lambert Limited ("ML") and Qualitas Compliance

Limited ("QC"). The MLL group, which is based out of Selby, North

Yorkshire, is a gas and electrical safety consultancy, providing

auditing, consulting and training services.

The acquisition had the following provisional effect on the

Group's assets and liabilities.

GBP'000

Customer relationship assets 350

Property, plant and equipment 12

Trade and other receivables 926

Cash and cash equivalents 110

Trade and other payables (798)

Borrowings (198)

Taxation balances (135)

--------

Fair value of net identifiable assets

and liabilities acquired 267

Goodwill 833

--------

1,100

--------

Cash consideration transferred 700

Deferred consideration 300

Contingent consideration 100

--------

1,100

--------

The cash outflow, net of cash acquired, at the date of

acquisition was GBP590,000 with GBP150,000 of deferred

consideration paid in June 2021, a further GBP150,000 of deferred

consideration paid in August 2021 and GBP100,000 of contingent

consideration confirmed and being paid post period end.

4. Exceptional items

Non-recurring items disclosed as

exceptional in the results are

as follows: Unaudited Unaudited Audited

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2021 2020 2020

restated

GBP'000 GBP'000 GBP'000

Profit on disposal of subsidiaries - 825 825

Acquisition expenses 46 - 101

Other restructuring costs - - 90

---------- ---------- ------------

5. Segmental analysis

All activities, apart from those relating to CEM Press and

Davies Odell disposed of in 2020, are classed as continuing.

The chief operating decision maker of the Group is its Board.

Each operating segment regularly reports its performance to the

Board which, based on those reports, allocates resources to and

assesses the performance of those operating segments.

Operating segments and their principal activities are as

follows:

- Aford Awards, a sports trophy and engraving company.

- Friedman's, a convertor and distributor of specialist lycra,

including Milano International (trading as Milano Pro-Sport), a

designer and manufacturer of leotards.

- Hickton Group, comprising Hickton Consultants, BRCS, Cook

Brown Building Control, Cook Brown Energy, Morgan Lambert and

Qualitas Compliance, providers of services in the construction

industry.

- Discontinued operations represent the activities of Davies

Odell, a manufacturer and distributor of protection equipment,

matting and footwear components, until disposal in December 2020

and of the CEM Press companies including Travelfast (trading as

Sampling International), a manufacturer of fabric, carpet and

wallpaper pattern books, swatches and shade cards, until these went

into administration in January 2020.

The United Kingdom is the main country of operation from which

the Group derives its revenue and operating profit and is the

principal location of the assets of the Group. The Group

information provided below, therefore, also represents the

geographical segmental analysis. Of the GBP8,970,000

(2020: GBP6,299,000) of revenue, GBP8,463,000 (2020:

GBP5,189,000) is derived from UK customers.

The Board assesses the performance of each operating segment by

a measure of adjusted earnings before interest, tax, depreciation

and amortisation and Group costs. Other information provided to the

Board is measured in a manner consistent with that in the financial

statements.

i) Results by segment

Unaudited 6 months to 30 June 2021

Aford Hickton Total

Awards Friedman's Group Group

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 515 1,857 6,598 8,970

-------- ----------- ---------- --------

Segmental result (EBITDA) before

exceptional items 164 82 1,026 1,272

Exceptional item - - (46) (46)

-------- ----------- ---------- --------

Segmental result (EBITDA) after

exceptional items 164 82 980 1,226

-------- ----------- ----------

Right of use depreciation charge (22) (70) (40) (132)

Depreciation and amortisation

charge (3) (82) (36) (121)

-------- ----------- ----------

Group costs (164)

Share of associate profit 25

Net finance costs (357)

Profit before taxation 477

Taxation (137)

--------

Profit for the period 340

========

Unaudited 6 months to 30 June 2020 (restated)

Aford Hickton Continuing Discontinued Total

Awards Friedman's Group operations operations Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 390 2,149 2,875 5,414 885 6,299

-------- ----------- ---------- ------------ --------------- --------

Segmental result (EBITDA)

before exceptional

items 57 304 515 876 (97) 779

Exceptional item - - - - 825 825

-------- ----------- ---------- ------------ --------------- --------

Segmental result (EBITDA)

after exceptional items 57 304 515 876 728 1,604

-------- ----------- ----------

Right of use depreciation

charge (23) (70) (34) (127) (17) (144)

Depreciation and amortisation

charge (4) (102) (32) (138) (30) (168)

-------- ----------- ----------

Group costs (254) - (254)

Net finance costs (375) - (375)

------------

(Loss)/profit before

taxation (18) 681 663

Taxation 1 - 1

------------ --------------- --------

(Loss)/profit for the

period (17) 681 664

============ =============== ========

Audited 12 months to 31 December 2020

Aford Hickton Continuing Discontinued Total

Awards Friedman's Group operations operations Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 844 3,878 7,139 11,861 2,091 13,952

-------- ----------- ---------- ------------ --------------- --------

Segmental result (EBITDA)

before exceptional

items 111 124 929 1,164 (120) 1,044

Exceptional items - - (481) (481) 562 81

-------- ----------- ---------- ------------ --------------- --------

Segmental result (EBITDA)

after exceptional items 111 124 448 683 442 1,125

-------- ----------- ----------

Right of use depreciation

charge (47) (139) (63) (249) (34) (283)

Depreciation and amortisation

charge (7) (209) (40) (256) (63) (319)

-------- ----------- ----------

Group costs (430) - (430)

Net finance costs (708) (30) (738)

------------

(Loss)/profit before

taxation (960) 315 (645)

Taxation (20) - (20)

------------ --------------- --------

(Loss)/profit for the

year (980) 315 (665)

============ =============== ========

ii) Assets and liabilities by segment

Unaudited as at Segment assets Segment liabilities Segment net assets/(liabilities)

30 June

2021 2020 2021 2020 2021 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Continuing operations:

CEPS 119 141 (6,246) (5,370) (6,127) (5,229)

Aford Awards 1,599 1,717 (511) (524) 1,088 1,193

Friedman's 7,141 7,822 (2,114) (2,414) 5,027 5,408

Hickton Group 9,677 7,960 (8,224) (6,517) 1,453 1,443

Discontinued:

Davies Odell - 1,260 - (873) - 387

Total - Group 18,536 18,900 (17,095) (15,698) 1,441 3,202

======== ======== ========== ========== ================= =================

Segment assets Segment liabilities Segment net assets/(liabilities)

Audited as at 31

December 2020

GBP'000 GBP'000 GBP'000

Continuing operations:

CEPS 57 (5,995) (5,938)

Aford Awards 1,661 (601) 1,060

Friedman's 7,363 (2,227) 5,136

Hickton Group 7,393 (6,558) 835

Total - Group 16,474 (15,381) 1,093

================== ====================== ====================================

6. Earnings per share

Basic earnings per share is calculated on the profit after

taxation for the period attributable to owners of the Company of

GBP124,000 (2020: profit of GBP617,000) and on 17,000,000 (2020:

17,000,000) ordinary shares, being the weighted number in issue

during the period.

Basic earnings per share for continuing operations is calculated

on the profit for the year after taxation attributable to owners of

the Company of GBP124,000 (2020: loss of GBP64,000) and on

17,000,000 ordinary shares, being the weighted number in issue

during the year. Basic earnings per share for discontinued

operations is calculated on the profit for the year after taxation

attributable to owners of the Company of GBPnil (2020: profit of

GBP681,000) and on 17,000,000 (2020: 17,000,000) ordinary shares,

being the weighted number in issue during the period.

7. Net debt and gearing

Gearing ratios at 30 June 2021, 30 June 2020 and 31 December

2020 are as follows:

Group Group Group audited

unaudited unaudited 31 December

30 June 2021 30 June 2020 2020

GBP'000 GBP'000 GBP'000

Total borrowings 8,272 7,645 7,552

Less: cash and cash equivalents (2,114) (2,048) (2,332)

-------------- -------------- --------------

Net debt 6,158 5,597 5,220

-------------- -------------- --------------

Total equity 1,441 3,202 1,093

-------------- -------------- --------------

Gearing ratio 427% 175% 478%

In order to provide a more meaningful gearing ratio, total

borrowings are the sum of bank borrowings and third-party debt,

excluding loan notes used to finance the Group's acquisitions.

8. Share capital and premium

Number Share capital Share premium Total

of shares GBP'000 GBP'000 GBP'000

At 1 January 2021 and 30 June

2021 17,000,000 1,700 5,841 7,541

----------- -------------- -------------- ---------

9. Related-party transactions

During the period the Company entered into the following

transactions with its subsidiaries:

Aford Awards

Group Holdings

Limited Davies Odell Signature Hickton Group

GBP'000 Limited Fabrics Limited Limited

GBP'000 GBP'000 GBP'000

Loan note interest receivable

- 6 months to 30 June

2021 24 - 30 89

- 6 months to 30 June

2020 8 19 30 64

- For the year to 31

December 2020 (audited) 26 35 60 154

Management charge income

receivable

- 6 months to 30 June

2021 10 - 18 6

- 6 months to 30 June

2020 10 8 18 6

- For the year to 31

December 2020 (audited) 20 11 35 13

Amount owed to the Company

- 30 June 2021 685 - 1,105 2,416

- 30 June 2020 210 886 1,044 2,297

- For the year to 31

December 2020 (audited) 735 - 1,075 2,342

Loans and investments

written-off or impaired

- 30 June 2021 - - - -

- 30 June 2020 - 73 - -

- For the year to 31 - 19 - -

December 2020 (audited)

The Company is under the control of its shareholders and not any

one individual party.

Statement of directors' responsibility

The directors confirm that, to the best of their knowledge,

these condensed consolidated half--yearly financial statements have

been prepared in accordance with IAS 34 as adopted by the United

Kingdom. The interim management report includes a fair review of

the information required by DTR 4.2.7R and DTR 4.2.8R, namely:

-- an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed set of financial statements; and

-- material related-party transactions in the first six months

of the financial year and any material changes in the related-party

transactions described in the last Annual Report.

A list of current directors is maintained on the CEPS PLC

website: www.cepsplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFIEAEIRLIL

(END) Dow Jones Newswires

September 16, 2021 11:34 ET (15:34 GMT)

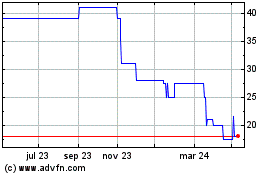

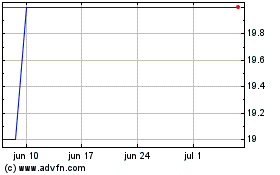

Ceps (LSE:CEPS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ceps (LSE:CEPS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024