TIDMCLON

RNS Number : 7697L

Clontarf Energy PLC

15 September 2021

15(th) September 2021

Clontarf Energy plc

("Clontarf" or the "Company")

Interim Statement for the period ended 30 June 2021

Clontarf Energy (AIM: CLON), the energy company focused on

Africa and Bolivia, announces its unaudited financial results for

the six months ended 30 June 2021:

The principal activities during this period were ongoing

contacts with the Ghanaian authorities to resuscitate the

ratification of our signed Petroleum Agreement on Tano 2A Block,

discussions with the Chad authorities on prime sedimentary basin

close to pipeline infrastructure, leading to a signed Memorandum of

Understanding, and negotiating a exploration and development

agreement with the Bolivian authorities for lithium

evaporation.

Oil & Gas markets are cyclical, and exploration even more

so. Explorers do best when they acquire choice acreage at a modest

cost in bad times, add value prudently, and then fund or attract

partners on carried terms. This is an approach our group has used

successfully over 30 years, with circa 20 partnerships. The "junior

company" profits from agility, low cost base and a rising market.

The "major" 'farming in' later on gains time by short-circuiting

the often - for them - difficult environmental permitting and

community relations - at which Clontarf's experienced team

excels.

Where does the market stand in this cycle as of 3rd quarter

2021? Oil demand peaked at 101 million barrels of oil daily during

the 4th quarter of 2019. It crashed by 10% in mid 2020 - half of

which was due to de-stocking. But - helped by pump-priming and C-19

vaccines - a sharp recovery occurred in 2021.

Demand is generally expected to be fully restored by 2022 -

Chinese consumption is already at record levels of 14.3mmbod,

though Beijing wishes to control commodity imports by means of

import taxes and closing loopholes. Assuming continued vaccine

success, continued relaxing of lock-downs and no major breakthrough

C-19 variants, we expect strong demand growth in 2022.

What of supply? The fracking revolution was halted by the 2014

oil price fall, and has gone into reverse - though we should never

write US entrepreneurs off. They added more barrels than the entire

demand growth between 2005 and 2015.

OPEC plans to open the spigots in a controlled fashion: already

there is some relaxation of Emirates' exports. But there is no

production surge: on the contrary, sanctions-hit Venezuelan output

collapsed to 0.55mmbod, Iran's is down to 2.5mmbod, while Iraq

languishes at 4mmbod and Nigeria at 1.44mmbod. Only Libya has

recovered, and only partially to 1.17mmbod (only 70% of the

pre-2011 level).

Given recovering demand and supply constraints, one would expect

oil companies to explore for and develop new sources of competitive

oil and gas for the future. Instead, the combination of C-19,

market hostility, low prices and lower 2020 demand was a perfect

storm storing up future supply problems, as demand surges. But,

over the medium-term, China, other Asian countries, and India are

expected to grow strongly.

A supply crunch - maybe triggered by a political crisis in some

exporting country - is likely within 2 years - subject to effective

C-19 vaccines and no new pandemic.

Yet, though oil demand rebounded strongly during 2021, following

the record demand fall caused by the C-19 pandemic, exploration and

development expenditure remain depressed. At least $5 trillion of

necessary investment has been deferred. Despite much debate about

modernising tax rates and contract conditions, governments have

been slow to update contractual arrangements so as to deliver

development.

Despite a cyclical freezing of the farm-out market, and reduced

investor interest, some governments remain stuck in the contract

and fiscal terms expectations of the pre-2014 boom years. Most

frustrating for innovative juniors are the frequent requests for

bonds and bonuses. These may suit incumbent politicians and

slow-moving majors with large balance sheets, but they are not well

suited to advancing development in challenging times. Partly

balancing the revenue fall is the collapse in service costs,

especially seismic and rig rates. Partners and investors can be

persuaded to fund operating and capex costs at currently low rates

- on the cyclical argument - but they are reluctant to pay money to

host governments.

If we can resolve the outstanding issues (especially the request

for an up-front sign-on bonus, technology and training grants,

etc.,), we hope to proceed quickly with our work programmes. It

makes no sense to pay money up-front for a contract in which we

would be paying 100% of the cost and taking 100% of the risk. The

anomalous nature of such bonuses is confirmed by the fact that they

are generally not included in the "cost oil".

As of September 2021, testing, quarantine, and documentation

requirements remain onerous. Nonetheless, Clontarf Energy plc

directors and contractors were able to conduct business travel to

Africa, and America.

Ghana - developments delayed

Clontarf Energy plc, and its partners, are ready to advance the

Ghana Tano 2A work programme, subject to securing the necessary

funding in an environment complicated by prevailing circumstances,

as soon as the signed Petroleum Agreement is ratified.

Despite volatile oil prices, the carefully calibrated Ghanaian

fiscal terms help make the Tano Basin oil play feasible, given the

demonstrated source rock and Cretaceous sands which remain an

industry favourite. Indeed, the industry's exploration contraction

may assist Clontarf's focused strategy on the bigger potential

stratigraphic traps.

Ghana achieved much after 2007, ramping oil production up to 215

kbod by 2020.

Unfortunately, a slow ratification process, exacerbated by

conflicting policies, stymied efficient development: progress

stagnated after 2018, and output slipped below 200kbod.

Tano 2A Block, Tano Basin, Ghana

The Joint Venture (JV) group, which consists of Clontarf (60%),

Petrel Resources plc (30%), and local partner Abbey Oil & Gas

(10%) negotiated a Memorandum of Understanding (MoU) with GNPC in

2008, and signed (subject to ratification) a Petroleum Agreement in

2010.

The work programme was aggressive (by the standards of the

time), including 2D seismic and a well commitment, but it was not

bonded (other than by corporate guarantees).

Part of the Petroleum Agreement is a one-off "technology" grant

(of US$0.5mm) and "training" (of US$0.2mm yearly) payments,

together with land rentals, and standard fees.

Under previous administrations, the authorities raised periodic

objections, usually concerning bonding (though this had been agreed

to be unnecessary in the signed Petroleum Agreement) and the market

capitalisation of the original vehicle (Pan Andean Resources plc).

They have encouraged us to admit additional Ghanaian partners -

though to date these have proven to be ultimately Nigerian or other

companies lacking financial backing.

We have had initial partnership discussions with potential

partners but could not advance these without full ratification of

title. About 60% of Ghanaian Tano wells have been successful.

Fiscal terms, in spite of upward creep, and lower oil prices, are

competitive - so long as there are no bonding or bonus requirements

beyond those envisaged in the Petroleum Agreement.

Chad:

One of the great exploration stories of the 21st century will be

the unexplored interior basins of

Africa. Our group has long been interested in Chad, despite

logistical and security issues, provided we have access to export

pipeline capacity, and sedimentary basin close-by.

Despite ongoing conflict with rebels in remote areas, Clontarf

Energy plc signed, in December 2020, a Memorandum of Understanding

on available acreage close to existing pipeline infrastructure.

The subsequent death of the former president fighting jihadis in

the north, does not change this prospectivity. However, neither

should we ignore ongoing security costs and uncertainties. This

reinforces our determination to avoid onerous bonuses - at least

prior to discoveries. This is a buyers' market, and fiscal terms

should reflect current realities.

International majors continue to operate in Chad, though some

independents have relinquished ground recently.

The retrenchment of companies under restructuring opens

opportunity for juniors: super-majors such as Exxon seek to

rationalise their properties, influenced by decreasing production

from operated fields (having earlier been obliged to drop

exploration acreage), so as to concentrate on mega discoveries

elsewhere. National Oil Companies, like Petronas, concentrate their

focus on specific geographic areas.

Provided we can avoid or defer sign-on bonuses, Chad's

exploration potential is a fit with Clontarf

Energy plc. But the location of exploration blocks is crucial,

as are the terms.

Despite political and logistical challenges, Chad offers

considerable potential.

Lithium in Bolivia

Much of the world's economic lithium resource is in

south-western Bolivia and neighbouring countries. Clontarf plans to

participate in the coming lithium boom.

Clontarf and its processor companies operated in Bolivia since

1988. No other lithium player equals this record. The group's

interest in evaporites dates from 1994.

When the new State lithium company YLB, established in 2017,

opened to foreign investment in 2018, Clontarf seized the

opportunity to lever its country and industry expertise.

Though the current legal framework is not ideal, Clontarf

submitted proposals on select salt-lakes within the existing law.

We expect the legal framework to evolve to meet market needs.

A technology supply bid round is being conducted by the State

lithium company, YLB, to determine which, if any of the new Direct

Lithium Extraction (DLE) may achieve satisfactory recoveries and

impurity levels. So far, there has been no recorded breakthrough

based on pilot plant work.

Meanwhile Clontarf Energy Plc proposes exploration and

development of salt lakes in three phases: exploration, pilot plant

processing and industrialisation. Direct Lithium Extraction

technologies will be added to the process if and when they become

commercial.

A secondary objective of the sampling was to establish the

brines' chemical composition.

Results are encouraging though not yet conclusive. We propose to

conduct a 3D evaluation of several salt lakes.

To confirm how Lithium salts can be concentrated and recovered,

we are working with research laboratories, expert in bench testing

through pilot plant work. It is unlikely that there will be a

single, 'magical' membrane solution sufficient to deliver the

purities and volumes required by the high-tech battery

industry.

Since lithium extraction depends on the specific brine

composition, we analyse brines throughout the production process -

which includes traditional evaporation, as well as alternative

techniques.

Among the processes of potential are:

-- Li recovery evaporation to produce lithium carbonate (LiCO3).

-- Li recovery through ion exchange.

-- Li recovery through solvent extraction.

-- Li recovery through membrane technology.

-- Direct production of lithium hydroxide (LiOH).

The construction period for most salt lake commercial Li

production is two to three years.

The rapid growth in battery-powered electric vehicles (EVs) to

over 6.8 million vehicles worldwide by end 2020, albeit from a

small base, is generating high demand growth for scarce minerals

with which Clontarf is familiar - especially battery-grade lithium

and cobalt - as well as vanadium, zinc, and copper.

Power storage remains the key problem: existing battery

technologies are inefficient, heavy, and expensive. But faster and

more efficient charging technologies are being developed.

For the fast growth electric vehicles and electronic devices

market, 'Lithium ion technology' is the best economically feasible

solution developed so far, though it has 'only' quadrupled its

performance since 1992.

The appeal of electric vehicles is that they are emission-free

at the point of use - though the electricity must be generated and

transmitted. Any plausible demand forecast anticipates market needs

greatly in excess of current supplies. Very aggressive forecasts

may be hindered by lower oil prices after 2020 but official

support, especially in Europe, remains strong.

Lithium from salt pan deposits will be in high demand - though

processing issues remain.

Subject to likely legal framework improvements, Clontarf plans

to complete an exploration and laboratory work programme on a

select group of salares, if required by law produce an initial

precipitate product as an Engineering, Procurement and Construction

(EPC) contractor, and then produce additional, enhanced high

performance precipitated and processed salts as a joint venture

partner. This formula fits with the spirit and letter of current

Bolivian legislation, and offers a sustainable route to participate

in the coming lithium ion battery boom.

There is no quick and easy way to process brine to produce Li.

Each brine is unique, and the differences matter, as tests (such as

the new German, and American technologies) show. Additional work is

necessary to streamline evaporation, reduce costs and boost

yields.

Bolivia needs effective exploration before attracting existing

lithium producers, and battery manufacturers, in order to achieve

the stated national ambition of moving from exploration to domestic

production and value added.

Clontarf's preference is to identify potential for improvement

on the model used in similar Chilean and Argentine deposits to

define resources and reserves with a pilot plant mainly designed

for LiCO3 output. The Group has, as yet, limited expertise in

battery production, but are close to the leading Lithium metal and

battery producers. They target involvement after successful

completion of the first phase of exploration.

Clontarf plans to finalise a strategic alliance with leading

Lithium metal / Lithium-ion battery producers for the advanced

stage development, and may include a global car manufacturer to

off-take and finance Lithium-ion battery production in Bolivia. The

anticipated global demand surge is greatly in excess of current

quality, purity and volume capacity. These manufacturers are

anxious to secure a reliable supply of adequate high purity LiCO3.

Clontarf has the experience, presence and vision to help bring

these diverse needs together.

The optimal way to exploit smaller salares is to cooperate with

other potential LiCO3 producers in order to achieve world scale

LiCO3 output necessary to sustain a battery factory in the Bolivian

Altiplano.

Clontarf expects the authorities to update legislation to

encourage investment for a mega Lithium-ion battery factory, which

can be expanded with growing LiCO3 production for the benefit of

Clontarf, Bolivia, Lithium producers and battery producers.

While evaporation of LiCO3 is the primary initial goal of the

Group's exploration, Clontarf continues to investigate alternative

or supplementary lithium recovery technologies including membranes,

electrolytic processes, and solvent extraction.

In summary, Clontarf progresses its interests in Bolivia, Chad

and Ghana, maintaining cordial communications with the relevant

authorities, and continues to operate efficiently on minimal

expenditure.

Funding

Clontarf remains fully funded for near to medium term ongoing

activities.

David Horgan

Chairman

14(th) September 2021

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

S

For further information please visit http://clontarfenergy.com or contact:

Clontarf Energy

David Horgan, Executive Chairman

John Teeling, Non-Executive Director +353 (0) 1 833 2833

Nominated & Financial Adviser

Strand Hanson Limited

Rory Murphy

Ritchie Balmer +44 (0) 20 7409 3494

Broker

Novum Securities Limited

Colin Rowbury +44 (0) 207 399 9400

Blytheweigh - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Rachael Brooks +44 (0) 207 138 3206

Said Izagaren +44 (0) 207 138 3206

Naomi Holmes +44 (0) 207 138 3206

Teneo

Luke Hogg

Alan Tyrrell

Ciara Wylie +353 (0) 1 661 4055

CONDENSED CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME

Six Months Ended Year Ended

30 June 21 30 June 20 31 Dec 20

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

Administrative expenses ( 137 ) ( 146 ) ( 361 )

---------------------- ----------------------- ------------------------

LOSS BEFORE TAXATION ( 137 ) ( 146 ) ( 361 )

Income Tax - - -

COMPREHENSIVE INCOME FOR THE PERIOD (137) (146) (361)

====================== ======================= ========================

LOSS PER SHARE - basic and diluted (0.02p) (0.02p) (0.05p)

====================== ======================= ========================

CONDENSED CONSOLIDATED BALANCE SHEET

30 June 21 30 June 20 31 Dec 20

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

ASSETS:

NON-CURRENT ASSETS

Intangible assets 932 869 915

932 869 915

---------------------- ----------------------- ------------------------

CURRENT ASSETS

Other receivables 5 2 2

Cash and cash equivalents 470 190 89

---------------------- ----------------------- ------------------------

475 192 91

TOTAL ASSETS 1,407 1,061 1,006

---------------------- ----------------------- ------------------------

LIABILITIES:

CURRENT LIABILITIES

Trade payables ( 74 ) ( 48 ) ( 66 )

Other payables ( 1,360 ) ( 1,240 ) ( 1,300 )

---------------------- ----------------------- ------------------------

( 1,434 ) ( 1,288 ) ( 1,366 )

---------------------- ----------------------- ------------------------

TOTAL LIABILITIES ( 1,434 ) ( 1,288 ) ( 1,366 )

NET LIABILITES ( 27 ) ( 227 ) ( 360 )

====================== ======================= ========================

EQUITY

Called-up share capital 2,177 1,792 1,792

Share premium 10,985 10,900 10,900

Share based payment reserve 104 22 104

Retained deficit ( 13,293 ) ( 12,941 ) ( 13,156 )

---------------------- ----------------------- ------------------------

TOTAL EQUITY ( 27 ) ( 227 ) ( 360 )

====================== ======================= ========================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Called-up Share based

Share Share Payment Retained

Capital Premium Reserves Deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1

January 2020 1,792 10,900 22 ( 12,795 ) ( 81 )

Total

comprehensive

income - - - ( 146 ) ( 146 )

-------------------- -------------------- ---------------------- -------------------- ---------------------

As at 30 June

2020 1,792 10,900 22 ( 12,941 ) ( 227 )

Share options

vested - - 82 - 82

Total

comprehensive

income - ( 215 ) ( 215 )

-------------------- -------------------- ---------------------- -------------------- ---------------------

As at 31

December 2020 1,792 10,900 104 ( 13,156 ) ( 360 )

Shares issued 385 115 500

Share issue

expenses - ( 30 ) - - ( 30 )

Total

comprehensive

income - - - ( 137 ) ( 137 )

----------------------

As at 30 June

2021 2,177 10,985 104 ( 13,293 ) ( 27 )

==================== ==================== ====================== ==================== =====================

CONDENSED CONSOLIDATED CASH FLOW Six Months Ended Year Ended

30 June 21 30 June 20 31 Dec 20

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

CASH FLOW USED IN OPERATING ACTIVITIES

Loss for the period ( 137 ) ( 146 ) ( 361 )

Share options vested - - 51

Exchange movements - ( 1 ) -

--------------------- --------------------- ----------------------

( 137 ) ( 147 ) ( 310 )

Movements in Working Capital 49 38 101

--------------------- --------------------- ----------------------

CASH USED BY OPERATIONS ( 88 ) ( 109 ) ( 209 )

NET CASH USED IN OPERATING ACTIVITIES ( 88 ) ( 109 ) ( 209 )

--------------------- --------------------- ----------------------

CASH FLOWS USED IN INVESTING ACTIVITIES

Payments for intangible assets ( 2 ) ( 3 ) ( 3 )

NET CASH USED IN INVESTING ACTIVITIES ( 2 ) ( 3 ) ( 3 )

--------------------- --------------------- ----------------------

CASH FLOW FROM FINANCING ACTIVITIES

Issue of shares 500 - -

Share issue expenses (30) - -

--------------------- --------------------- ----------------------

NET CASH GENERATED FROM FINANCING

ACTIVITIES 470 - -

--------------------- --------------------- ----------------------

NET INCREASE/(DECREASE) IN CASH AND CASH

EQUIVALENTS 380 ( 112 ) ( 212 )

Cash and cash equivalents at beginning of

the period 89 301 301

Effect of exchange rate changes on cash

held 1 1 -

CASH AND CASH EQUIVALENT AT THE OF THE

PERIOD 470 190 89

===================== ===================== ======================

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2021

and the comparative amounts for the six months ended 30 June 2020

are unaudited. The financial information above does not constitute

full statutory accounts within the meaning of section 434 of the

Companies Act 2006.

The Interim Financial Report has been prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the European

Union. The accounting policies and methods of computation used in

the preparation of the Interim Financial Report are consistent with

those used in the Group 2020 Annual Report, which is available at

www.clontarfenergy.com

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. No dividend is proposed in respect of the period.

3. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the year available to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the year. Diluted earnings per share is computed by

dividing the loss after taxation for the year by the weighted

average number of ordinary shares in issue, adjusted for the effect

of all dilutive potential ordinary shares that were outstanding

during the year.

The following table sets out the computation for basic and

diluted earnings per share (EPS):

Six months Ended Year Ended

30 June 30 June 31 Dec 20

21 20

GBP'000 GBP'000 GBP'000

Numerator

For basic and diluted EPS (137) (146) (361)

============== ============== ==============

Denominator

For basic and diluted EPS 763,344,558 716,979,964 716,979,964

============== ============== ==============

Basic EPS (0.02p) (0.02p) (0.05p)

Diluted EPS (0.02p) (0.02p) (0.05p)

============== ============== ==============

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive and is therefore

excluded.

4. INTANGIBLE ASSETS

30 June 21 30 June 20 31 Dec 20

GBP'000 GBP'000 GBP'000

Exploration and evaluation assets

Cost:

At 1 January 8,625 8,561 8,561

Additions 17 18 64

Closing Balance 8,642 8,579 8,625

=========== =========== ==========

Impairment:

At 1 January 7,710 7,710 7,710

Provision for impairment - - -

Closing Balance 7,710 7,710 7,710

=========== =========== ==========

Carrying value:

At 1 January 915 851 851

=========== =========== ==========

At period end 932 869 915

=========== =========== ==========

Regional Analysis 30 Jun 21 30 Jun 20 31 Dec20

GBP'000 GBP'000 GBP'000

Bolivia 79 16 62

Ghana 853 853 853

---------- ---------- ---------

932 869 915

========== ========== =========

Exploration and evaluation assets relate to expenditure incurred

in prospecting and exploration for lithium, oil and gas in Bolivia

and Ghana. The directors are aware that by its nature there is an

inherent uncertainty in exploration and evaluation assets and

therefore inherent uncertainty in relation to the carrying value of

capitalised exploration and evaluation assets.

During 2018 the Group resolved the outstanding issues with the

Ghana National Petroleum Company (GNPC) regarding a contract for

the development of the Tano 2A Block. The Group has signed a

Petroleum Agreement in relation to the block and this agreement

awaits ratification by the Ghanaian government.

The Company is in negotiations with the Ministry of Electricity

Technologies and the State Lithium Company in Bolivia on

exploration and development of salt-lakes in accordance with law.

Samples have been analysed and process work is underway.

The directors believe that there were no facts or circumstances

indicating that the carrying value of intangible assets may exceed

their recoverable amount and thus no impairment review was deemed

necessary by the directors. The realisation of these intangibles

assets is dependent on the successful discovery and development of

economic deposit resources and the ability of the Group to raise

sufficient finance to develop the projects. It is subject to a

number of potential significant risks, as set out below.

The Group's activities are subject to a number of significant

potential risks including:

-- licence obligations;

-- exchange rate risks;

-- uncertainties over development and operational costs;

-- political and legal risks, including arrangements with

Governments for licences, profit sharing and taxation;

-- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- title to assets;

-- financial risk management;

-- going concern;

-- ability to raise finance; and

-- operational and environmental risks.

Included in the additions for the period are GBP15,000 (2020:

GBP60,849) of directors remuneration. The remaining balance

pertains to the amounts capitalised to the respective licences held

by the entity.

5. TRADE PAYABLES

30 June 21 30 June 20 31 Dec 20

GBP'000 GBP'000 GBP'000

Trade payables 64 38 40

Other accruals 10 10 26

----------- ----------- ----------

74 48 66

=========== =========== ==========

6. OTHER PAYABLES

30 June 21 30 June 20 31 Dec 20

GBP'000 GBP'000 GBP'000

Amounts due to directors 1,360 1,240 1,300

1,360 1,240 1,300

=========== =========== ==========

Other payables relate to amounts due to directors' remuneration

accrued but not paid at period end.

7. SHARE CAPITAL

Allotted, called-up and fully paid:

Number Share Capital Premium

GBP'000 GBP,000

At 1 January 2020 716,979,964 1,792 10,900

Issued during the period - - -

------------ ----------------- ---------

At 30 June 2020 716,979,964 1,792 10,900

Issued during the period - - -

------------ ----------------- ---------

At 31 December 2020 716,979,964 1,792 10,900

Issued during the period 153,846,153 385 115

Share issue expenses - - (30)

At 30 June 2021 870,826,117 2,177 10,985

============ ================= =========

On 6 May 2021 the Company raised GBP500,000 via the placing of

153,846,153 ordinary shares with new and existing investors at a

price of 0.325p per placing share

8. POST BALANCE SHEET EVENTS

There were no material post balance sheet events affecting the

group or company.

9. The Interim Report for the six months to 30 June 2021 was

approved by the Directors on 14(th) September 2021.

10. The Interim Report will be available on the Company's

website at www.clontarfenergy.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCRGBDGBS

(END) Dow Jones Newswires

September 15, 2021 01:59 ET (05:59 GMT)

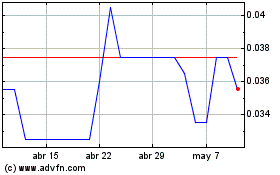

Clontarf Energy (LSE:CLON)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Clontarf Energy (LSE:CLON)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024