TIDMENOG

RNS Number : 9567W

Energean PLC

28 April 2021

Energean plc

("Energean" or the "Company")

Publication of 2020 Annual Report and Accounts and Notice of

Annual General Meeting ( AGM)

London, 28 April 2021 - Energean plc (LSE: ENOG, TASE: ) is

pleased to announce that it has today published its Annual Report

and Accounts for the year ended 31 December 2020, which has also

been distributed to shareholders with a Notice of AGM for the

meeting being held on 24 May 2021 and associated Form of Proxy.

2020 Annual Report and Accounts

The full report is available for download on the Company's

website at www.energean.com

A copy of the report has also been submitted to the FCA's

National Storage Mechanism and will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

In accordance with Disclosure and Transparency Rule 6.3.5(2)(b),

the additional information set out in the following Appendix has

been extracted (unedited) from the 2020 Annual Report and Accounts.

This information consists of principle risks and uncertainties,

related party transactions and the Directors' Responsibility

Statement; and it should be read in conjunction with the Company's

final results for the year ended 31 December 2020, which were

announced on Monday 19 April 2021.

AGM Notice

The Company's 2021 AGM will be held at the registered office of

the Company at Accurist House, London, W1U 7AL on Monday 24 May

2021 at 11:00 a.m. (BST).

Pursuant to Listing Rule 9.6.1, copies of the Notice of AGM and

Form of Proxy have been submitted to the National Storage Mechanism

and will shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism . Electronic

copies of the 2020 Annual Report and Accounts will be available to

view and download from the Company's website: www.energean.com ,

together with the Notice of Annual General Meeting.

Defined terms used in this announcement shall, unless otherwise

specifically defined herein, have the same meanings as in the

Notice of AGM.

As a result of the ongoing COVID-19 global pandemic and the

legal measures that the UK Government has put in place relating to

the pandemic, there are significant restrictions on public

gatherings and non-essential travel that are expected to affect the

arrangements for, and attendance at, the AGM. In light of these

restrictions and the uncertainty as to whether any additional

and/or alternative restrictions or measures may be introduced by

the UK Government, for the safety of our Shareholders, our

employees, our advisers and the general public, attendance at the

AGM in person will not be possible this year and Shareholders or

their appointed proxies (other than the chair of the AGM and one

other shareholder, to ensure a quorum) will not be permitted entry

to the AGM. The Shareholders are encouraged to watch the Company's

website (www.energean.com) and regulatory news services for any

updates in relation to the AGM that may need to be provided.

This year, the AGM will be held purely to conduct the required

formal business and will not include a presentation and questions

to be put to the Board in person, as was the case in previous

years, however, Shareholders are encouraged to send any questions

which they would have, otherwise, raised at the AGM to

IR@energean.com before the date of the AGM; and after the AGM has

concluded the Company will publish responses to those questions on

its website at http://www.energean.com .

The voting results on the resolutions put to the AGM shall be

announced to the market and uploaded onto the Company's website

following the closure of the AGM. The Company will continue to

monitor the restrictions put in place in response to COVID-19 and,

if circumstances change resulting in the lifting of measures

preventing the movement of people ahead of the AGM, it will

consider if it is appropriate to open up the AGM for attendance by

Shareholders. If this is the case, an update will be given on the

Company's website at www.energean.com and by way of announcement to

the London Stock Exchange.

Shareholders are strongly encouraged to ensure that their votes

are counted at the AGM by appointing the chairman of the AGM as

their proxy and submitting their completed proxy forms to the

Company's registrars, Computershare Investor Services plc, The

Pavilions, Bridgwater Road, Bristol BS99 6ZY as soon as possible

and, in any event, no later than 11:00 a.m. on Thursday 20 May

2021. Alternatively, shareholders can also appoint a proxy and

indicate their voting instructions online at

www.investorcentre.co.uk/eproxy or through CREST. Any shareholder

holding shares through a nominee service, should contact the

nominee service provider regarding the process for appointing a

proxy.

Appendix

Strategic risk

#1 Progress key development projects in Israel

Principal risk: Delay to first gas at Karish

Owner: Chief Executive Officer

Link to 2020 KPIs: Delivering our strategy, growing our business

and tackling climate change

Risk appetite Low - Successful delivery of the Karish

project is crucial to achieving the Group's

ambition of becoming the leading independent

E&P company in the Mediterranean and securing

the Group's future revenue stream and its

ability to deliver material free cash flows,

the latter of which underpins the Group's

commitment to deliver material and sustainable

returns to shareholders.

2020 movement This risk increased primarily due to COVID-19

related challenges at the Admiralty yard

in Singapore, where the Energean Power FPSO

is under construction. Energean continues

to work towards first gas from Karish in

1Q 2022. The shipyard in Singapore remains

under limitations imposed by COVID-related

restrictions, including limited access to

workers and yard productivity. Energean

is working with its contractors to firm

up this timetable and will update the market

as the situation evolves

Impact Delayed sailaway of the FPSO could result

in a delay in delivering future cash flows,

and delay Energean's ability to pay a meaningful

and sustainable dividend to its shareholders.

Delays could also result in increased capital

expenditure and incremental G&A costs, which

could result in a reduction to said cash

flows.

A failure to achieve certain milestones,

such as targeted sailaway date and / or

first gas delivery could result in reputational

damage within the wider market, including

with Energean's investors, banks, gas buyers

and wider stakeholders.

Under its gas sale agreements (GSPAs), the

Group may be subject to various contractual

consequences in case of a delayed start

up in supplying gas in accordance with specific

deadlines detailed in the relevant GSPAs.

Such contractual consequences may include

early termination rights that certain buyers

potentially have after applicable long-stop

dates, and in the majority of the GSPAs,

monetary contractual payments or early shortfall

after the long-stop dates.

Mitigation Energean has actively engaged with its contractors

early to ensure highly effective working

relationships and to discuss incentivising

contractors to accelerate completion of

the works.

Energean's contract with TechnipFMC is a

lump-sum, turnkey EPCIC, which minimises

development risk and the potential for significant

cost overruns. Energean's 2021 budget has

been updated to reflect increased cost of

interest and potential liquidated damages

arising from a delay to first gas.

Energean benefits from strong support from

Government and continued engagement with

customers in Israel. Energean's GSPAs are

priced amongst the lowest in Israel, suggesting

that buyers (who have signed GSPAs that

contain termination rights) will have limited

incentive to terminate them due to delay

in first gas.

Ongoing monitoring of the exercise or threat

of liquidated damages, which might at a

certain point be diminished by Force Majeure

relief due to COVID-19. Force Majeure notices

have been served on all gas buyers.

Access to funding: during the year, the

Karish project finance facility was upsized

from $1.275 billion to $1.45 billion. Post-period

end, the maturity date was extended to September

2022 providing additional flexibility on

refinancing timing, in the event of ongoing

delays. In addition, the Company undertook

a $2.5 billion Bond Issue to refinance the

Karish project finance facility and raised

a $700 million Term Loan.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Deliver first gas at Karish in 1Q 2022.

Continued quantitative assessment of the

impact of delay to the Karish Project to

the revenue stream secured by the GSPAs

and of potential mitigating actions.

================ ====================================================

#2 Market risk in Israel

Principal risk: The potential for Israeli gas market oversupply

may result in offtake being at the take-or-pay level of existing

GSPAs and could result in the failure to secure new GSPAs

Owner: Commercial Director

Link to 2020 KPIs: Delivering our strategy, growing our business

and tackling climate change

Risk appetite Low - Strong commercial terms and contract

security are a core component of Energean's

business model and investment case. The

Group utilises its strong regional ties

and the experience of Energean's commercial

teams to mitigate this risk.

2020 movement This risk increased in 2020 after the Leviathan

field came onstream in December 2019, significantly

increasing the supply of gas into Israel.

COVID-19 also negatively impacted upon regional

gas demand, further contributing to potential

regional market oversupply.

Impact Increased market competition may drive Israeli

domestic gas prices down. Lower pricing

may incentivise gas buyers to make nominations

that are restricted to the take-or-pay levels

within the GSPAs, rather than the full annual

contracted quantities. This could reduce

Energean's future net revenues and cash

flows, potentially impacting upon its ambition

to pay a meaningful and sustainable dividend.

An oversupplied gas market may impact upon

Energean's ability to commercialise future

gas discoveries.

Mitigation Energean's GSPAs contain provisions for

floor pricing, take-or-pay and/or exclusivity.

Energean is investigating all options for

the commercialisation of future exploration

success, including further domestic supply

as well as supply to key regional gas markets.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Energean will continue to maintain good

relationships with its gas buyers, whilst

also evaluating potential export routes

and other options for monetisation.

================ =====================================================

#3 Progress key development projects

Principal risk: Delayed delivery of future development projects

(including NEA / NI in Egypt, Cassiopea in Italy and Karish North

in Israel)

Owner: Chief Executive Officer

Link to 2020 KPIs: Delivering our strategy and growing our

business

Risk appetite Low - The three key new development projects

are viewed as essential for the relevant

country portfolios, substantially benefitting

the long-term production profiles of the

Company, whilst bringing cost and investment

efficiencies and strategic benefits.

2020 movement This risk increased during 2020 as Energean's

development portfolio increased with (i)

the maturation of the Karish North development,

which was sanctioned in early 2021; and

(ii) the acquisition of Edison E&P resulting

in the addition of the Cassiopea (Italy)

and NEA/NI (Egypt) projects to the portfolio.

Impact A delay to any of these projects could result

in a delay to, or reduction of, future cash

flows, which could impact upon Energean's

goal of paying a meaningful and sustainable

dividend to its shareholders.

Mitigation Energean is actively engaged with its partners,

contractors and all other relevant stakeholders

on all development projects to ensure effective

working relationships.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Developments to progress in line with expectations,

targeting first gas from NEA/NI in 2H 2022,

Karish North in 2H 2023 and Cassiopea in

1H 2024.

Continue to monitor project progress.

================ ====================================================

#4 Deliver exploration success and reserves addition

Principal risk: Lack of new commercial discoveries and reserves

replacement

Owner: Chief Growth Officer

Link to 2020 KPIs: Delivering our strategy and growing our

business

Risk appetite Medium - Exposure to exploration and appraisal

failure is inherent in accessing the significant

upside potential of exploration projects,

and this remains a core value driver for

Energean. The Group invests in data and

exploits the strong experience of Energean's

technical teams to mitigate this risk.

2020 movement This risk remained static in 2020 following

the decision of the Group to postpone its

exploration plans offshore Israel due to

the low commodity price environment. The

Group is preparing for its next four-well

exploration and appraisal campaign offshore

Israel in 2022.

Impact Failure to make new significant gas discoveries

and replenish the exploration portfolio

will reduce the Group's ability to grow

the business and deliver its strategy.

Mitigation Energean focuses on high-grading of its

exploration and appraisal programme and

maintains a focus on low-risk, high-reward

prospects with clear and short-term routes

to commercialisation.

Planning for the Group's next major exploration

and appraisal campaign, offshore Israel,

are underway. Drilling is expected to commence

in early 2022 for up to four exploration

and appraisal wells.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Maturation of planning for the four-well

exploration and appraisal campaign offshore

Israel.

================ ==================================================

#5 Portfolio Integration

Principal risk: Failure to successfully integrate Edison E&P

into Energean's day-to-day business activities resulting in limited

financial, social and environmental benefits

Owner: Chief Executive Officer

Link to 2020 KPIs: Growing our business

Risk appetite Low - Edison E&P integration is a top priority

for the Board and Executive Management.

Successful integration of Edison E&P with

Energean's existing business will depend

on our ability to combine the two businesses,

including bringing together the cultures

and capabilities of both organisations in

an effective manner, which will require

the co-operation of Edison E&P's existing

workforce.

2020 movement This risk remained static in 2020. The

acquisition of Edison E&P closed successfully

in December 2020 and constitutes the largest

acquisition the Group has undertaken to

date.

Impact The potential impacts of inadequate portfolio

integration are multi-fold and include:

* Disruption to ongoing operations and development

projects

* Diversion of Executive Management's attention; and

* A lack of ability to realise anticipated financial

benefits and cost synergies.

The challenges and/or costs associated with

integration may be higher than expected

and the benefits expected from the acquisition

of Edison E&P may not be fully achieved.

Mitigation Energean developed a detailed integration

and strategic plan with activities and milestones,

for example, providing strategic access

to the Edison E&P SAP system from day one

to provide immediate and full control over

the acquired business.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Continued implementation of the integration

roadmap, including further definition of

the one-year ahead plan and mapping of identified

synergies, resulting in finalisation and

implementation of the end-state operating

model.

================ ===============================================================

Operational risk

#1 Production performance

Principal risk: Underperformance at core producing assets in

Egypt and Italy

Owner: Chief Growth Officer

Link to 2020 KPIs: Growing our business

Risk appetite Low - Delivering operational excellence

in all of Energean's activities is a strategic

objective and we work closely with all partners

to mitigate the risk and impact of any operational

delay or underperformance. As such, the

Company has a low appetite for risks which

may impact on operating cash flow.

2020 movement This risk increased during 2020 following

the acquisition of Edison E&P, which has

seen increased scrutiny on the performance

of the acquired assets. Pro forma Working

Interest production averaged 48.3 kboepd,

around the mid-point of guidance of 44.5

- 51.5 kboepd. The risk around operational

readiness e.g. the availability of highly

trained technical staff to operate assets

and man vessels, also increased in 2020

largely due to the COVID-19 pandemic.

Impact Delay to, or reduction of, operating cash

flows.

Increased unit operating costs.

Mitigation Executive Management works closely with

technical leads, the HSE Director and Country

Managers to deliver risk mitigation plans

and project solutions.

Positive regular engagement with the Technical

team and partners to share knowledge, offer

support and exert influence.

Strong work ethic and culture, with good

policies, procedures and practices in place.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Ongoing management of risks surrounding

production.

================ ====================================================

#2 JV Misalignment

Principal risk(s): Misalignment with JV operators

Owner: Chief Growth Officer

Link to 2020 KPIs: Growing our business

Risk appetite Medium - The Group seeks to operate assets

which align with the Group's core areas

of expertise, but recognises that a balanced

portfolio will also include non-operated

ventures. The Group accepts that there are

risks associated with a non-operator role

and will seek to mitigate these risks by

working with partners of high integrity

and experience and maintaining close working

relationships with all JV partners.

2020 movement - This is an increased risk in 2020 that

follows the acquisition of Edison E&P. Commodity

price volatility continues to have a financial

impact across the sector and the risk remains

that the Group's JV partners may not be

able to fund work programme expenditures

and/or reprioritise projects. A large component

of the Italian portfolio and the entire

UK portfolio are operated by joint venture

partners.

Impact Cost/schedule overruns.

Poor operational performance of assets.

Poor HSE performance.

Delay in first production from new projects.

Negative impact on asset value.

Ability to effect change towards lowering

carbon footprint.

Mitigation Actively engage with all JV partners early

to establish good working relationships.

Actively participate in operational and

technical meetings to challenge, apply influence

and/or support partners to establish a cohesive

JV view.

Active engagement with supply chain providers

to monitor performance and delivery.

Application of the Group risk management

processes and non-operated ventures procedure.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Continue to engage with JV partners and

monitor project progress.

================ ==================================================

Financial risk

#1 Maintaining liquidity and solvency

Principal risk: Insufficient liquidity and funding capacity

Owner: Chief Financial Officer

Link to 2020 KPIs: Growing our business

Risk appetite Low - Energean seeks to maintain liquidity

and to develop and implement a funding strategy

that allows a value generative plan to be

executed and ensures minimum headroom from

existing sources of funding is maintained.

2020 movement This risk remained static in 2020.

Impact The Company has secured loan agreements

and is subject to restrictive debt covenants

and security arrangements that may limit

its ability to finance its future operations

and capital needs and to pursue business

opportunities and activities. Breach of

financial covenants may lead to default

and/or liquidity risk.

The Company is exposed to commodity prices

in relation to its sales and revenues under

its crude oil and gas sales contracts, which

are subject to variable market factors.

The full impact of COVID-19 to a lower price

environment could impact the Group's cash

flows and results.

Interest and foreign exchange rate movements

could negatively affect profitability, cash

flow and balance sheets (see Note ___ to

the consolidated financial statements).

Funding and liquidity risks could impact

viability and ability to continue as a going

concern, including a downturn in business

operations for unexpected factors, e.g.

COVID-19.

Erosion of balance sheet through impairments

of financial assets may further impact the

Group's financial position.

Mitigation Regular monitoring of financial covenants

on an actual and forecast basis as part

of the monthly reporting to management and

the Board.

The Karish project finance facility, Egypt

RBL and Greek RBL have covenants and metrics

to monitor the ability to refinance via

capital markets or by conversion of existing

commitments to a term loan. The Company

ensures that these covenants are met on

a quarterly basis. During the period, the

Karish project finance facility was upsized

from $1.275 billion to $1.45 billion and,

post-period end, maturity was extended to

September 2022. Post-period end, a new 18-month,

$700 million term loan was arranged in January

2021, and both facilities will be refinanced

under a $2.5 billion Bond Issue in March

2021.

The Group's debt facilities have been sized

and structured on conservative oil and gas

price assumptions versus the prevailing

market prices.

The Group actively monitors oil price movements

and may hedge part of its production to

protect the downside while maintaining access

to upside and to ensure availability of

cashflows for re-investment and debt-service.

All Karish gas contracts are based on pricing

formulas which include floor prices; that

ensures a minimum price for gas sales whatever

the market conditions or pricing formulas

outcome.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Refinance the Israeli project finance facility

and $700 million term loan.

Continuous stress testing of short-term

cash forecasts.

================ ==================================================

#2 Egypt receivables

Principal risk: Recoverability of revenues and receivables in

Egypt

Owner: Chief Financial Officer

Link to 2020 KPIs: Growing our business

Risk appetite Low - Edison E&P has receivables due from

its operations in Egypt which have historically

been paid irregularly and after significant

delay. Energean management believes that

this risk is not specific to Edison E&P

and affects all operators in the country.

The Group utilises its strong regional ties

and the experience of its commercial teams

to mitigate this risk.

2020 movement N - This is a new risk for 2020 that arises

due to the acquisition of producing assets

in Egypt through the acquisition of Edison

E&P. At 31 December 2020, net receivables

(after provision for bad and doubtful debts)

in Egypt were $153.5 million.

Impact Loss of value.

Work programme restricted by reduced financial

capability.

Inability to fund key development projects,

including NEA/NI.

Reduced ability to meet debt covenants and

service outstanding debt.

Mitigation Energean has a number of contractual solutions

with EGPC to ensure an effective collection

policy, including condensate proceeds, lump-sum

payments, Abu Qir payables offsetting and

local currency collection.

Continued engagement with the Egyptian government

and Ministry of Petroleum.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Improve receivables position and agreements

in place to accelerate recovery of overdue

receivables.

Maintain an active investment programme.

================ ===================================================

#3 Decommissioning liability

Principal risk: Higher than expected decommissioning costs and

acceleration of abandonment schedules

Owner: Chief Financial Officer

Link to 2020 KPIs: Growing our business

Risk appetite Low - Energean is committed to optimising

its decommissioning activities and spend.

2020 movement N - This is a new, but material risk for

2020 onwards following the closing of the

acquisition of Edison E&P. Decommissioning

estimates and timing of abandonment schedules

are subject to uncertainty but are expected

to be material for the Group, particularly

in the UK and Italy. The estimates for decommissioning

obligations vary depending on the sources

provided during the due diligence undertaken

as part of the competitive sale process

for Edison E&P but are estimated to be in

excess of $500 million.

Impact Reduction in cash flow.

Work programme restricted by reduced financial

capability.

Negative impact on asset value.

Mitigation Utilisation of the strong experience of

Energean's technical teams and commercial

partnerships

Proactive interaction with local government

and regulation bodies to jointly design/review

decommissioning regulation.

Scale achievement through grouping of assets

in adjacent areas also promoting increased

negotiation leverage in contracting activities.

Potential creation of partnerships for decommissioning

activities, further increasing scale potential

and promoting transfer of decommissioning

solutions.

Adoption of new technologies promoting innovative

solutions to further optimise costs and

maximise operational excellence.

Continued effort in identifying potential

alternative uses for existing platforms

prioritising assets with higher cost base.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Continue to develop and refine strategy

for optimising decommissioning spend.

================ ========================================================

Organisational, compliance and regulatory risk

#1 Cyber

Principal risk: Major cyber-attack or information security

incident

Owner: Information Technology Manager

Link to 2020 KPIs: Growing our business and 'Best in Class' on

safety

Risk appetite Low - Energean is committed to maintaining

the security and integrity of its data and

IT systems.

2020 movement This risk increased in 2020. Energean continues

to grow its operational presence in the

Mediterranean and is in the process of integrating

the recently acquired Edison E&P company

into its day-to-day business activities,

putting the Group at further risk of cyber-attacks

or IT system failure.

Impact Loss of value.

Reputational damage.

Loss of data and theft of confidential information,

and personal data.

Regulatory implications and financial penalties.

Mitigation Digital transformation of email and collaboration

services to the Cloud.

Constant implementation and monitoring of

the Company's IT Security Policy.

Control of disclosures and protection of

any disclosed confidential information in

third party contracts.

Advanced network security detection and

data encryption. Vulnerability Assessment

and Penetration Testing.

Annual mandatory security and GDPR awareness

training. Staff susceptibility to phishing

regularly tested.

Insurance policies in place.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Complete digital transformation and integration

project as part of Edison E&P acquisition.

================ =====================================================

#2 Ethics, culture and compliance

Principal risk: Major breach of values, business principles and

'Ethos'

Owner: Compliance Officer

Link to 2020 KPIs: Growing our business and 'Best in Class' on

safety

Risk appetite Low - Energean is committed to maintain integrity

and high ethical standards in all of the Group's

business dealings. The Group has a zero-tolerance

approach to conduct that may compromise its reputation,

safety procedures or integrity.

2020 movement This risk remained static in 2020. There were

no reportable instances of fraud, bribery or

corruption.

Impact Reputational damage.

Financial penalties or civil claim.

Criminal prosecution.

Breach of safety procedures resulting in a HSE

incident.

Mitigation Business Code of Ethics and bribery and corruption

policies and procedures. Audit reviews, use of

data analytics and continuous monitoring of policies.

Financial procedures in place to mitigate fraud.

Annual training programme in place for all employees.

Enhanced due diligence of business partners and

suppliers and compliance auditing of contractors.

Enhancement of our whistleblowing process through

creation of a confidential reporting channel.

Ongoing monitoring of KPIs by Executive Management.

2021 Objectives Continued focus on enhanced due diligence and

monitoring, as well as the review of higher risk

areas.

Implementing compliance programmes and employee

awareness communication and training to all different

countries of operations, translated to local

languages where appropriate, to enhance corporate

compliance and governance and ensure the organisational

culture is 'fit for purpose' everywhere that

the Company operates.

================ =========================================================

#3 HSE

Principal risk: Lack of adherence to health, safety, environment

and security policies

Owner: HSE Director

Link to 2020 KPIs: 'Best in Class' on safety

Risk appetite Low - Energean continuously strives to

reduce risks that could lead to an HSE incident

to as low as reasonably practicable

2020 movement This risk remained static in 2020. The

Group's pro forma LTIF [1] for operated

activity in 2020 was 0.63 per million hours

worked. Our pro forma TRIR [2] for 2020

was 1.05 per million hours worked. There

were no spills to the environment.

Impact Serious injury or death.

Negative environmental impacts.

Reputational damage.

Regulatory penalties and clean-up costs.

Physical impact of climate change.

Loss or damage to Company's assets and potential

business interruption.

Loss or damage to third parties and potential

claims.

Mitigation Effectively managing health, safety, security

and environmental risk exposure is the first

priority for the Board, Senior Leadership

Team and Management Team

Training for all employees and creation

of a strong HSE culture. Additional HSE

training is included as part of all staff

and contractor inductions.

Crisis and emergency response procedures

and equipment are maintained and regularly

tested to ensure the Group is able to respond

to an emergency quickly, safely and effectively.

Process in place for assessing an operator's

overall operating and HSE capabilities,

including undertaking audits to determine

the level of oversight required.

Comprehensive insurance policies in place.

Ongoing monitoring of KPIs by Executive

Management.

2021 Objectives Achieve a number of specified indicators

in relation to governance, people and society.

================ ==================================================

Climate change risk

#1 Failure to manage the risk of climate change and to adapt to

the energy transition

Principal risk: Climate change policy, technological

development, changing consumer behaviour and reputational

damage

Owner: Chief Executive Officer

Link to 2020 KPIs: Delivering our strategy, growing our business

and tackling climate change

Risk appetite Low - The Group is committed to achieving

its net zero emissions [3] target by 2050

and reducing the near-term carbon intensity

of its operations by over 70% through the

implementation of low carbon solutions and

the acquisition of low carbon intensity

hydrocarbons. Energean is focused on taking

near-term investment decisions that ensure

its assets remain competitive in an environment

where demand for oil and gas may be lower

than today and will continue to stress test

its portfolio against a range of climate

change scenarios, in line with the recommendations

of the TCFD.

2020 movement This risk increased in 2020. There was

continued and increased attention to climate

change from a range of stakeholders in 2020.

This attention has led, and we expect it

to continue to lead, to acceleration of

the energy transition, as well as additional

regulations designed to reduce greenhouse

gas (GHG) emissions.

Impact Providers of capital limit exposure to oil

and gas projects (short-term).

Increasing costs e.g. higher compliance

costs and increased insurance premiums (short

to medium-term).

Early asset retirement (medium to long-term)

Limited access to R&D opportunities (medium

to long-term).

Climate-related policy changes (short to

medium-term).

Reputational damage (medium to long-term).

Retaining and attracting talent (short to

medium-term).

Ability to effect change towards lowering

carbon footprint (medium to long-term).

Mitigation Aligned with the TCFD recommendations across

all TCFD pillars in our year-end reporting.

Established a new climate change and sustainable

development department to manage climate

change projects.

Implemented climate-based scenario analysis

and internal carbon pricing to assist with

investment-decision making.

Enhanced climate disclosure in our Annual

Report and Sustainability Report. Achieved

a B- score on climate change and B score

on supplier engagement in our first CDP.

ESG ratings in top quartile, awarded 'A'

rating by MSCI, 'Gold' by Maala and ranked

16 out of 114 peer companies by Sustainalytics.

Executive compensation tied to ESG performance

targets from 2020. Fully committed to transparency

and adherence to the 17 UN SDGs. First E&P

company globally to commit to net zero emissions

by 2050.

Ongoing monitoring of KPIs by Executive

Management.

Established a dedicated Environment, Safety

and Social Responsibility committee chaired

by Non-Executive Director Robert Peck to

review climate change related risks and

projects.

2021 Objectives Evaluation of Carbon Capture and Storage

(CCS) projects underway, including the maturation

of the conversion of Prinos into the first

CCS project in the East Med.

Small-scale blue hydrogen production facility

at the Sigma plant in Kavala, Greece, also

under evaluation.

Evaluation of use of captured CO2 at Prinos

for enhanced oil recovery (EOR), to unlock

additional upstream value.

Explore the roll out of 'Green Electricity'

across all operated assets.

================ ====================================================

#2 Physical risks related to climate change

Principal risk: Disruption to operations and/or development

projects due to severe weather (both acute and chronic)

Owner: Chief Executive Officer

Link to 2020 KPIs: Delivering our strategy, growing our business

and tackling climate change

Risk appetite Low - Management recognises that Climate

change is expected to lead to rising temperatures

and changes to rainfall patterns in all

the countries where it operates. Energean

is reviewing its response to the increased

risk that changing weather events presents

to both its assets and its people.

2020 movement This risk remained static in 2020. Rising

sea levels coupled with extreme flooding

could cause disruptions to the operational

performance of Energean's assets, especially

those located in higher risk areas, in the

medium-term. This could also result in damage

to infrastructure and an increase in associated

asset integrity and insurance costs. Longer

term atmospheric or sea temperature rises

could result in faster degradation of infrastructure

and necessitate operational changes to the

running of the Group's facilities.

Impact Unexpected asset costs arising from operational

incidents (medium to long-term).

Early asset retirement e.g. due to damage

or property being situated in high risk

locations (long-term)

Negative market reaction (medium to long-term).

Loss of investor confidence (medium to long-term).

Serious injury or death (medium to long-term).

Environmental impacts due to spills (medium

to long-term).

Reputational damage (medium to long-term).

Loss or damage to assets and business interruption

(medium to long-term).

Mitigation Monitoring of weather conditions and sea

conditions.

Use of protective barriers to combat flooding.

Comprehensive insurance policies in place

for key assets and infrastructure.

Established a dedicated Environment, Safety

and Social Responsibility committee chaired

by Non-Executive Director Robert Peck to

review climate change related risks and

projects.

2021 Objectives Continue monitoring of environmental conditions

and reporting at both an asset and corporate

level.

Evaluation of climate change projects and

data by Energean Egypt Energy Services (EES).

================ ======================================================

External risk

#1 Geopolitical events

Principal risk: Political and fiscal uncertainties in the

Eastern Mediterranean

Owner: Chief Executive Officer

Link to 2020 KPIs: Delivering our strategy and growing our

business

Risk appetite Medium - Energean faces an uncertain economic

and regulatory environment in some countries

of operation. The Company is willing to

invest in countries where political and/or

fiscal risks may occur provided such risks

can be adequately managed to minimise the

impact where possible.

2020 movement This risk increased in 2020. Energean continues

to source new opportunities in the Eastern

Mediterranean and this can be in jurisdictions

deemed at higher risk of political or fiscal

uncertainty. In addition, Energean entered

into new countries, through the acquisition

of Edison E&P, with an increased risk profile.

The Group will strive for full compliance

with regards to fiscal requirements across

all assets.

Impact Loss of value; increasing costs; uncertain

financial outcomes; HSE incidents; loss

of production.

Mitigation Operate to the highest industry standards

with regulators and monitor compliance with

the Group's licence, Production Sharing

Contracts and taxation requirements.

Maintain positive relationships with governments

and key stakeholders through robust investment

plans and engagement in local projects.

Continuous monitoring of the political and

regulatory environments in which we operate.

2021 Objectives Maintain balance sheet strength, continued

monitoring of geopolitical events and regulatory

changes.

Undertake risk assessment and internal audit

activities in relation to the Karish project

(development project-to-operations transition).

Integration of targets and sustainability

projects (i.e. community investment) within

the strategic plan and management incentive

program.

================ ==================================================

#2 Global pandemic

Principal risk: Operational uncertainties and HSE incidents due

to COVID-19 pandemic

Owner: Executive Management and HSE Director

Link to 2020 KPIs: Delivering our strategy, growing our business

and 'Best in Class' on Safety

Risk appetite Low - COVID-19 and its impact on Energean's

development projects and operations was

identified as an emerging risk to its business

in 2019. Energean has been tracking the

spread of COVID-19 and its impact over the

past year, recognising it as a principal

risk to the business for the first time

in 2020; and is continuing to actively monitor

developments and take precautions to ensure

the health and safety of employees, partners

and contractors.

2020 movement This risk increased in 2020. COVID-19 spread

across the globe in 2020 and government

responses to limit transmission of the virus

significantly weakened global energy demand,

putting huge pressure on the E&P sector.

As a business, and at individual levels,

conditions were extremely challenging.

Impact Project delays; delay in revenue income,

termination of GSPAs, penalties under GSPAs,

supply chain interruption; HSE risk / risk

to employee wellbeing; operational restrictions

e.g. ability to mobilise workforce.

Mitigation Energean is constantly re-assessing our

contingency planning, our emergency/incident

response plan and our business continuity

management plan. Effective communication

plans are in place to respond to the changing

demands of the crisis. As part of the HSE

policies, various measures have been introduced

to protect the health and safety of employees

and contract personnel. Working from home,

revamping office space and a COVID-19 business

continuity plan is in place for all the

company's offices and plant.

2021 Objectives Continued modelling of COVID-19 scenarios

to identify and evaluate financial impacts,

with an assessment of potential mitigating

options.

Continued quantitative assessment of the

impact of delay to the Karish Project to

the revenue stream secured by the Israel

GSPAs and of potential mitigating actions.

Conduct risk assessments for each country

where operations exist to identify potential

strategic, operational, regulatory and people

related-exposures.

================ =================================================

Statement of Directors' Responsibilities

The directors are responsible for preparing the annual report

and the group financial statements in accordance with applicable

United Kingdom law and regulations. Company law requires the

directors to prepare financial statements for each financial

year.

Under that law the directors have elected to prepare the group

financial statements in accordance with International Financial

Reporting Standards (IFRSs) in conformity with the Companies Act

2006 and the parent company financial statements in accordance with

United Kingdom Generally Accepted Accounting Practice (United

Kingdom Accounting Standards and applicable law), including

Financial Reporting Standard 101 Reduced Disclosure Framework ("FRS

101").

Under the Financial Conduct Authority's Disclosure Guidance and

Transparency Rules, group financial statements are required to be

prepared in accordance with IFRSs adopted pursuant to Regulation

(EC) No 1606/2002 as it applies in the European Union. Under

company law the directors must not approve the group financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the group and the company and of

the profit or loss of the group and the company for that

period.

In preparing these financial statements the directors are

required to:

-- Select suitable accounting policies in accordance with IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors and

then apply them consistently

-- Make judgements and accounting estimates that are reasonable and prudent

-- Present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information

-- Provide additional disclosures when compliance with the

specific requirements in IFRSs (or in respect of the parent company

financial statements, FRS 101 ) is insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the group's financial position and financial

performance

-- In respect of the group financial statements, state whether

IFRSs in conformity with the Companies Act 2006 and IFRSs adopted

pursuant to Regulation(EC) No 1606/2002 as it applies in the

European Union have been followed, subject to any material

departures disclosed and explained in the financial statements

-- In respect of the parent company financial statements, state

whether applicable UK Accounting standards including FRS 101 have

been followed, subject to any material departures disclosed and

explained in the financial statements

-- Prepare the financial statements on the going concern basis

unless it is appropriate to presume that the company and the group

will not continue in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the company's and

group's transactions and disclose with reasonable accuracy at any

time the financial position of the company and the group and enable

them to ensure that the company and the group financial statements

comply with the Companies Act 2006. They are responsible for such

internal control as they determine is necessary to enable the

preparation of financial statements that are free from material

misstatement, whether due to fraud or error, and have general

responsibility for taking such steps as are reasonably open to them

to safeguard the assets of the group and to prevent and detect

fraud and other irregularities.

Under applicable law and regulations, the directors are also

responsible for preparing a strategic report, directors' report,

directors' remuneration report and corporate governance statement

that complies with that law and those regulations. The directors

are responsible for the maintenance and integrity of the corporate

and financial information included on the company's website.

Legislation in the UK governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

Responsibility statement of the directors in respect of the

annual financial report:

The directors confirm, to the best of their knowledge:

-- That the consolidated financial statements, prepared in

accordance with IFRSs in conformity with the Companies Act 2006 and

IFRSs adopted pursuant to Regulation(EC) No 1606/2002 as it applies

in the European Union, give a true and fair view of the assets,

liabilities, financial position and profit of the parent company

and undertakings included in the consolidation taken as a whole

-- That the annual report, including the strategic report,

includes a fair review of the development and performance of the

business and the position of the company and undertakings included

in the consolidation taken as a whole, together with a description

of the principal risks and uncertainties that they face

-- That they consider the annual report and accounts, taken as a

whole, is fair, balanced and understandable and provides the

information necessary for shareholders to assess the group's

position and performance, business model and strategy.

Mathios Rigas Panos Benos

Director Director

18 April 2021 18 April 2021

Related party transactions

Balances and transactions between the Company and its

subsidiaries, which are related parties, have been eliminated on

consolidation and are not disclosed in this note.

Purchases of goods and services

2020 2019

$'000 $'000

Nature of transactions

Other related party "Seven Vessel leasing

marine" and services 1,473 4,066

Other related party "Prime Construction of

Marine Energy Inc" field support vessel 19,950 -

Other related party "Capital

Earth Ltd" Consulting services 129 129

21,552 4,195

======= =======

Following a competitive tender process, the Group has entered

into an agreement to purchase a Field Support Vessel ("FSV") from

Prime Marine Energy Inc., a company controlled by director and

shareholder at Energean plc, for US$33.3 million. The FSV is being

constructed to meet the Group's specifications and will provide

significant in-country capability to support the Karish project,

including FPSO re-supply, crew changes, holdback operations for

tanker offloading, emergency subsea intervention, drilling support

and emergency response. The purchase of this multi-purpose vessel

will enhance operational efficiencies and economics when compared

to the leasing of multiple different vessels for the various

activities.

Payables

2020 2019

$'000 $'000

Nature of balance

Vessel leasing

Seven marine and services 407 6,105

407 6,105

[1] Lost Time Injury Frequency

[2] Total Recordable Incident Rate

[3] Scope 1 & 2 emissions

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSBSGDSCSDDGBI

(END) Dow Jones Newswires

April 28, 2021 11:03 ET (15:03 GMT)

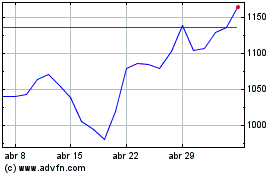

Energean (LSE:ENOG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Energean (LSE:ENOG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024