TIDMFRAN

RNS Number : 0451G

Franchise Brands PLC

22 July 2021

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

22 July 2021

FRANCHISE BRANDS PLC

("Franchise Brands", the "Group" or the "Company")

Interim results for the six months ended 30 June 2021

Strong revenue recovery and record profits give confidence in a

full year performance ahead of expectations

Franchise Brands plc (AIM: FRAN), a multi-brand franchise

business , is pleased to announce its unaudited results for the six

months ended 30 June 2021.

Financial highlights

-- Revenue increased by 18% to GBP28.6m ( H1 2020 : GBP24.2m).

-- Adjusted EBITDA* increased by 50% to GBP4.2m ( H1 2020 : GBP2.8m).

-- Statutory profit before tax increased by 200% to GBP2.6m ( H1 2020 : GBP0.9m).

-- Strong cash conversion of 84% (H1 2020: 38%).

-- Net cash of GBP5.2m at 30 June 2021 (31 December 2020: GBP4.9m).

-- Adjusted EPS** increased by 46% to 2.70p (H1 2020: 1.84p).

-- Basic EPS increased by 143% to 1.63p (H1 2020: 0.67p).

-- An interim dividend of 0.60p per share declared (interim 2020: 0.30p per share).

Operational highlights

-- A strong recovery across the Group, despite the Q1 lockdown.

-- Metro Rod and Metro Plumb system sales increased by 21% to

GBP23.7m, including a record GBP4.3m in June.

-- Metro Rod won significant GBP1m contract with Peel Ports, being delivered directly.

-- Digital transformation continues at pace: launch of new customer portal "Connect".

-- Pump sales by Metro Rod franchisees increased 159% to GBP0.7m, facilitated by Willow Pumps.

-- Willow Pumps sales growth of 11% driven by higher gross

margin service work and the development of the Metro Rod corporate

franchise areas.

-- A strong performance by the B2C division.

-- Robust return of recruitment with 40 new franchisees (H1 2020: 27).

-- Total number of franchisees up to 393 (30 December 2020: 386).

*Adjusted EBITDA is earnings before interest, tax, depreciation,

amortisation and share-based payment expense and non-recurring

items.

**Adjusted profit before tax and Adjusted EPS are earnings per

share before amortisation of acquired intangibles, share-based

payment expense and non-recurring items.

Stephen Hemsley, Executive Chairman, commented:

" The first half of 2021 has been a period of strong recovery

from the COVID-impacted performance in 2020, despite the lockdown

in Q1.

"The strength of our brands, our people and our franchisees have

allowed us to weather the storm and emerge fitter and stronger as

both a team and as a business. We look forward to the second half

of the year and beyond with great optimism. We are confident that

the full year performance will be ahead of current consensus market

expectations."

Consensus market expectations for the financial year ended 31

December 2021 are currently as follows:

-- Revenue GBP56.7m

-- Adjusted EBITDA GBP7.85m

-- Adjusted EPS 5.07p

-- Dividend 1.40p

Enquiries:

Franchise Brands plc + 44 (0) 1625 813231

Stephen Hemsley, Executive Chairman

Chris Dent, Chief Financial Officer

Julia Choudhury, Corporate Development Director

Allenby Capital Limited (Nominated Adviser

and Joint Broker) +44 (0) 20 3328 5656

Jeremy Porter / Liz Kirchner (Corporate

Finance)

Amrit Nahal (Sales)

Dowgate Capital Limited (Joint Broker) +44 (0) 20 3903 7715

James Serjeant / Colin Climie / Nicholas

Chambers

MHP Communications (Financial PR) +44 (0) 20 3128 8100

Katie Hunt +44 (0) 7884 494112

franchisebrands@mhpc.com

CHAIRMAN'S STATEMENT

Introduction

The first half of 2021 has been a period of strong recovery from

the COVID-impacted performance in 2020, despite the lockdown in Q1.

Metro Rod and Willow Pumps provide essential services to a wide

range of sectors which have gradually reopened over the period. As

consumer confidence has returned, our B2C businesses have seen a

recovery in the demand for the services offered by our franchisees

and increased interest in buying a franchise. Some key sectors

which the B2B division serves have still not fully reopened and the

vaccination programme which underpins consumer confidence has not

yet been completed, so we look forward to the second half of the

year (and beyond) with considerable confidence.

Metro Rod Division

The Metro Rod Division comprises the franchise activities of

Metro Rod and Metro Plumb, and the direct labour ("DLO") London

based plumbing business, Kemac, which are all the responsibility of

the divisional MD, Peter Molloy.

System sales at Metro Rod and Metro Plumb grew by 21% in the

first half of the year, accelerating throughout the period to a

record GBP4.3m in June. This strong overall performance masks a

quarterly performance impacted by lockdowns. We had previously

announced that Q1 2020 (pre-COVID) was a record for the business

with 19% growth in system sales year-on-year, whereas Q1 2021 was

substantially impacted by the winter lockdown and, as a result,

systems sales grew by only 2% year-on-year. Q2 2021 saw a complete

reversal of this position as we experienced the first, and most

severe lockdown in Q2 2020, whereas in Q2 2021 the restrictions

were more modest and, as a result, system sales grew by 48%

year-on-year.

The growth in system sales was spread through almost the entire

network, with 44 of the 47 Metro Rod and Metro Plumb franchisees

growing their business during the first half of the year (H1 2020:

21). Of the 44 in growth, 70% or 31 franchisees grew by more than

20% year-on-year (H1 2020: 8). We also achieved good progress on

existing initiatives to widen and deepen the services offered by

the franchise network, particularly in the area of pump service and

maintenance.

Demonstrating Metro Rod's ability to take on large scale

projects for customers directly, we were pleased to secure a GBP1m

contract with Peel Ports Group to deliver a comprehensive drainage

mapping and maintenance plan for its Liverpool site. We invested in

additional equipment and employed 20 new operatives to satisfy the

requirements of the project.

Metro Plumb has continued to trade well throughout the period

due to the resilient nature of its principal activity of emergency

plumbing services. We now have five independent Metro Plumb

franchisees compared with two in the first half of 2020. Plumbing

remains a clear growth opportunity for the Group and we continue to

focus on

recruiting more independent franchisees and broadening the customer base.

Kemac, which operates 6 Metro Plumb territories in the London

area, and provides specialist services to several water utilities,

traded well in the period following the management changes made in

2020. It is currently working on broadening its customer base to

improve resilience and increase the range of services offered.

The digital transformation taking place within Metro Rod

continues at pace. The completion of the roll-out of the new works

management system "Vision" at the end of 2020 and the subsequent

introduction of the customer portal "Connect" are contributing to

improved customer service and efficiency savings. Following

customer and franchisee feedback, these platforms are now being

optimised, with a series of upgrades that will further enhance

functionality. This integrated platform now allows us to progress

with further automation of the job acquisition, deployment,

reporting and invoicing process using robotics and AI technologies.

The digitisation of the business is having a positive impact on our

overhead costs as manual, repetitive, tasks are automated which

will improve our operational gearing, and hence profitability, as

we grow.

Willow Pumps Division

This division comprises the core Willow Pumps DLO pump business

acquired in 2019 and the Metro Rod corporate franchises in Kent

& Sussex and Exeter which are all the responsibility of the

divisional MD, Ian Lawrence.

The core Willow Pumps business was significantly impacted by the

winter lockdown with Q1 sales down 31% year-on-year. However, these

recovered strongly in Q2 as the restrictions lifted, with sales

growth of 43% year-on-year in the quarter, resulting in overall

sales growth of 9% in the first half of the year. As we saw in the

first half of 2020, the main driver of growth in the period was the

higher gross margin service and emergency work rather than the

lower gross margin supply and installation work ("S&I").

Service work now represents 77% of total sales (H1 2020: 64%).

Following the successful transfer of two Metro Rod corporate

franchise areas to Willow Pumps in the first half of 2020, their

sales have grown by 19% year-on-year and this previously

loss-making activity has been returned to profitability.

Overall, the division saw an 11% increase in revenue. Although

the core business continues to be more impacted by the partial

closure of the hospitality sector, and particularly hotel and

holiday venues, we are confident that sales growth will accelerate

in the second half of the year as these venues fully reopen.

In addition, Willow Pumps continues to facilitate the growth of

pump-related work within Metro Rod, where system sales by our

franchisees have increased 159% to GBP0.7m (H1 2020: GBP0.3m), more

than that achieved in the whole of 2019 and 2020 combined.

B2C Division

The B2C division comprises the ChipsAway, Ovenclean and Barking

Mad franchise businesses, which are the responsibility of the

divisional MD, Tim Harris.

The division recovered strongly in the first half of 2021,

despite the Q1 lockdown, as most of the franchisees continued to

trade and, therefore, paid full Management Service Fees ("MSF"). By

comparison, in Q2 2020 all these businesses were shut down and fees

were reduced to nominal levels.

Franchise recruitment was also strong with 40 new franchisees in

the period (H1 2020: 27). ChipsAway continues to be the strongest

brand with 27 new recruits in the period (H1 2020: 23), however,

Ovenclean recruitment accelerated strongly with 9 new recruits (H1

2020: 2). Barking Mad also contributed with 4 new recruits (H1

2020: 2). The total number of franchisees in the B2C division grew

to 393 (30 June 2020: 389).

Despite the strong overall performance during the period, t he

B2C brands continue to recover at different speeds. ChipsAway

continues to be our largest network, generating 86% of divisional

EBITDA, a year-on-year increase of 51%. The improved franchise

recruitment income at Ovenclean allowed it to contribute 13% of

divisional EBITDA and more than double its contribution in the

period. Barking Mad, our smallest network, returned to

profitability as a result of franchise recruitment and significant

cost-savings as a result of the integration of its activities into

the main Kidderminster facility. Barking Mad's MSF income will not

recover until the foreign holiday market returns, which we

anticipate will occur in the second half of the year.

Outlook

As we emerge from COVID-related disruption, the Group is very

well placed to continue investing in organic growth and

earnings-enhancing acquisitions. In March, we set out for the first

time new strategic financial targets for the Group of run-rate

revenues of GBP100m and adjusted EBITDA of GBP15m by the end of

2023. With all our main businesses growing again and with a

positive outlook, we are confident that the Group's organic growth

priorities are well supported and on track to deliver. We are,

therefore, increasing our focus on growth by acquisition and are

actively reviewing acquisition opportunities that would be

significantly earnings-enhancing.

The second half of the year has started encouragingly with

continuing growth in both Metro Rod and Willow Pumps as a result of

the opening up of the hospitality and leisure sectors. In the B2C

division, franchise recruitment remains buoyant as people continue

to reassess their work/life balance following the impact of the

COVID crisis. If they decide that self-employment is the right

course for them, there is no safer way to achieve this than through

franchising. We are therefore confident that the full year

performance will be ahead of current consensus market

expectations.

Conclusion

As ever, I would like to thank my colleagues, our franchisees

and particularly our engineers, for their continued hard work and

commitment in what continues to be a challenging and disrupted

working environment. The adaptability and resilience everyone has

shown in dealing with this disruption, whilst continuing to grow

the business, has been remarkable and I am very grateful to them

all.

In conclusion, we have weathered the storm and emerged fitter

and stronger as a team and as a business, and have heightened

ambitions. We therefore look forward to the second half of the year

and beyond with great optimism.

Stephen Hemsley

Executive Chairman

FINANCIAL REVIEW

Summary statement of income (unaudited)

H1 2021 H1 2020 Change Change

GBP'000 GBP'000 GBP'000 %

-------------------------------------- ---------------- ---------------- ----------------- -------

Revenue 28,631 24,209 4,422 18%

Cost of sales (16,921) (14,634) (2,287) 16%

-------------------------------------- ---------------- ---------------- ----------------- -------

Gross profit 11,710 9,576 2,134 22%

Administrative expenses (7,542) (6,793) (749) 11%

---------------- ---------------- -----------------

Adjusted EBITDA 4,168 2,782 1,386 50%

-------------------------------------- ---------------- ---------------- ----------------- -------

Depreciation & amortisation

of software (819) (666) (153) 23%

Finance expense (157) (262) 105 -40%

---------------- ---------------- -----------------

Adjusted profit before tax 3,192 1,854 1,338 72%

-------------------------------------- ---------------- ---------------- ----------------- -------

Tax expense (606) (286) (321) 112%

---------------- ---------------- -----------------

Adjusted profit after tax 2,586 1,568 1,017 65%

-------------------------------------- ---------------- ---------------- ----------------- -------

Amortisation of acquired intangibles (196) (196) 0

Share-based payment expense (175) (102) (73)

Non-recurring costs - (620) 620

Other gains and losses (174) (53) (121)

Tax on adjusting items (478) (26) (452)

---------------- ----------------

Statutory profit 1,562 570 992 174%

-------------------------------------- ---------------- ---------------- ----------------- -------

Overall, consolidated Group revenue has increased by 18% to

GBP28.6m in the period (H1 2020: GBP24.2m). This has been driven by

the increase in demand for the Group's services following the

continued lifting of COVID-19 lockdown restrictions. Gross profit

has increased 22% to GBP11.7m (H1 2020: GBP9.6m), reflecting a

slight increase in the gross margin from 40% to 41% as revenues

have returned more strongly in the higher-margin franchise

operations of the Group. Overheads increased by only 11%, resulting

in a 50% increase in Group EBITDA to a record GBP4.2m (H1 2020:

GBP2.8m).

Divisional trading results

The adjusted EBITDA of the operational business divisions of the

Group may be analysed as follows:

Metro Willow Metro Willow

Rod Pumps B2C H1 2021 Rod Pumps B2C H1 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- -------- -------- --------- --------- -------- -------- ---------

Statutory revenue 17,459 7,805 3,367 28,631 14,636 7,031 2,542 24,209

Cost of sales (12,394) (3,756) (771) (16,921) (10,496) (3,571) (567) (14,634)

-------------------- --------- -------- -------- --------- --------- -------- -------- ---------

Gross profit 5,065 4,049 2,596 11,710 4,141 3,460 1,975 9,576

-------------------- --------- -------- -------- --------- --------- -------- -------- ---------

GM% 29% 52% 77% 41% 28% 49% 78% 40%

Admin expenses (2,717) (3,120) (1,140) (6,978) (2,620) (2,640) (1,082) (6,343)

-------------------- --------- -------- -------- --------- --------- -------- -------- ---------

Divisional

EBITDA 2,347 929 1,456 4,732 1,520 820 893 3,233

Group overheads (564) (451)

Adjusted EBITDA 4,168 2,782

-------------------- --------- -------- -------- --------- --------- -------- -------- ---------

Metro Rod

Metro Rod comprises the franchise and direct labour activities

of Metro Rod and Metro Plumb, and the direct labour DLO London

based plumbing business, Kemac. The results of the division may be

summarised as follows:

H1 2021 H1 2020 Change Change

GBP'000 GBP'000 GBP'000 %

----------------- --------- --------- -------- -------

Revenue 17,459 14,636 2,823 19%

------------------ --------- --------- -------- -------

Cost of sales (12,394) (10,496) (1,898) (18)%

------------------ --------- --------- -------- -------

Gross profit 5,065 4,141 924 22%

------------------ --------- --------- -------- -------

GM% 29% 28% 1%

Admin expenses (2,717) (2,620) (97) (4)%

------------------ --------- --------- -------- -------

Adjusted EBITDA 2,347 1,520 827 54%

------------------ --------- --------- -------- -------

The statutory revenue of Metro Rod does not reflect the

underlying system sales generated by the franchisees as national

sales are accounted for on a gross basis, as are the sales of Kemac

and the direct labour activities, whereas in respect of the local

sales generated by franchisees, only the MSF revenue is reflected.

Therefore, it is re-analysed below to reconcile system sales to

gross profit.

H1 2021 H1 2020 Change Change

GBP'000 GBP'000 GBP'000 %

-------------------- --------- -------- -------- -------

System sales 23,699 19,600 4,099 21%

--------------------- --------- -------- -------- -------

MSF income 4,400 3,747 653 17%

Effective MSF

% 18.6% 19.1%

Other gross profit 665 394 271 69%

--------------------- --------- -------- -------- -------

Gross profit 5,065 4,141 924 22%

--------------------- --------- -------- -------- -------

Overall, system sales at Metro Rod and Metro Plumb, increased by

21% to a record GBP23.7m in the period (H1 2020: GBP19.6m). Our net

MSF income at Metro Rod increased by 17% to GBP4.4m (H1 2020:

GBP3.7m), which represented an effective MSF of 18.6% (H1 2020:

19.1%). We continue to incentivise Metro Rod's franchisees to grow

their businesses through a series of MSF discount schemes designed

to encourage sales growth and investment in a broader range of

equipment and people. In line with this strategy, as system sales

have grown, especially in tanker and pump work, the effective MSF

percentage rate has fallen.

Other gross profit represents the gross profit from Metro Rod's

DLOs. This profit increased 69% to GBP0.7m (H1 2020: GBP0.4m) due

to a good performance by Kemac and the contribution from Metro

Rod's new, centrally managed, contract with Peel Ports.

The 54% increase in the adjusted EBITDA to GBP2.3m (H1 2020:

GBP1.5m; H1 2019: GBP1.4m) has been driven by the increase in

system sales and the strong performance by direct labour

operations. In addition, the division continues to benefit from

some permanent cost savings through the efficiencies developed

during lockdowns and the continuing benefits resulting from the

investment in IT systems.

Willow Pumps

Willow Pumps comprises the core DLO pump business and the Metro

Rod corporate franchises in Kent & Sussex and Exeter. The

results of the division may be summarised as follows:

H1 2021 H1 2020 Change Change

GBP'000 GBP'000 GBP'000 %

----------------- -------- -------- -------- -------

Revenue 7,805 7,031 775 11%

------------------ -------- -------- -------- -------

Cost of sales (3,756) (3,571) (185) (5)%

------------------ -------- -------- -------- -------

Gross profit 4,049 3,460 589 17%

------------------ -------- -------- -------- -------

GM% 52% 49% 3%

Admin expenses (3,120) (2,640) (481) (18)%

------------------ -------- -------- -------- -------

Adjusted EBITDA 929 820 109 13%

------------------ -------- -------- -------- -------

The Willow Pumps core business has two distinct types of

revenue: Service revenue and Supply and Install revenue

("S&I"). Service revenue is generated from the routine service

and maintenance of pumps and drains. S&I revenue is generated

from the design, supply and installation of pump stations, which

are typically projects that are performed in discrete phases over a

number of accounting periods, with revenue recognised over time

based on the proportion of the contract which has been completed.

The gross profit generated on S&I projects is lower than

service work due to the significant proportion of the total cost

being the supply of the pumps.

Whilst core revenue increased by only 9%, overall divisional

revenue increased by 11% as a result of the 19% growth in sales at

the Metro Rod DLOs. This increase in volume and more effective

management of overhead costs resulted in these activities

generating a positive return.

Core sales growth has been weighted towards higher gross margin

service revenue, rather than lower gross margin S&I revenue and

therefore, gross margin increased from 52% to 54%, leading to an

increase in core gross profit of 22% to GBP3.7m (H1 2020:

GBP3.3m).

By their nature direct labour operations have less operational

gearing than franchise businesses, as the increase in income needs

to be matched by increased labour costs, all of which are included

in administration expenses. As a result, there was an 18% increase

in administrative expenses when compared with the prior period.

Overall, the 11% increase in revenue has resulted in a 13%

increase in adjusted EBITDA to GBP0.9m (H1 2020: GBP0.8m).

B2C Division

The B2C division comprises the ChipsAway, Ovenclean and Barking

Mad franchise businesses. The results of the division may be

summarised as follows:

H1 2021 H1 2020 Change Change

GBP'000 GBP'000 GBP'000 %

----------------- -------- -------- -------- -------

Revenue 3,367 2,542 824 32%

------------------ -------- -------- -------- -------

Cost of sales (771) (567) (204) (36)%

------------------ -------- -------- -------- -------

Gross profit 2,596 1,975 620 31%

------------------ -------- -------- -------- -------

GM% 77% 78% (1)%

Admin expenses (1,140) (1,082) (58) (5)%

------------------ -------- -------- -------- -------

Adjusted EBITDA 1,456 893 563 63%

------------------ -------- -------- -------- -------

The key revenue streams are MSF and Area Sales income. MSF

income is mostly made up of fixed monthly fees as this remains the

most effective method of generating income given the large number

of franchisees and the lower level of individual sales. Area Sales

are the fees generated from the sale (or resale) of franchise

territories.

Our B2C division, was the most impacted by the 2020 Spring

lockdown as the franchisees where unable to trade. To help ensure

their survival the majority of fees charged to the networks were

suspended or greatly reduced during this period. During the current

period almost all franchisees were back to paying full monthly fees

and as a result revenue increased by 32%. Franchise recruitment

also recovered strongly during the period with 40 new franchisees

joining the three brands (H1 2020: 27).

The cost base of this business was very strictly controlled

particularly when compared with a significant reduction in salary

costs in H1 2020 resulting from the furlough scheme. In the current

period we have seen the benefit of our decision to close the

Barking Mad head office and consolidate all B2C operations in

Kidderminster.

Overall, the 31% increase in gross profit, tied to a stable cost

base, resulted in an impressive 63% increase in adjusted EBITDA to

GBP1.5m (H1 2020: GBP0.9m; H1 2019: GBP1.2m).

Adjusted & statutory profit

H1 2021 H1 2020 Change Change

GBP'000 GBP'000 GBP'000 %

-------------------------------------- ---------------- ---------------- ----------------- -------

Adjusted EBITDA 4,168 2,782 1,386 50%

-------------------------------------- ---------------- ---------------- ----------------- -------

Depreciation & amortisation

of software (819) (666) (153) 23%

Finance expense (157) (262) 105 -40%

---------------- ---------------- -----------------

Adjusted profit before tax 3,192 1,854 1,338 72%

-------------------------------------- ---------------- ---------------- ----------------- -------

Tax expense (606) (286) (321) 112%

---------------- ---------------- -----------------

Adjusted profit after tax 2,586 1,568 1,017 65%

-------------------------------------- ---------------- ---------------- ----------------- -------

Amortisation of acquired intangibles (196) (196) 0

Share-based payment expense (175) (102) (73)

Non-recurring costs - (620) 620

Other gains and losses (174) (53) (121)

Tax on adjusting items (478) (26) (452)

---------------- ----------------

Statutory profit 1,562 570 992 174%

-------------------------------------- ---------------- ---------------- ----------------- -------

Depreciation and amortisation of software increased 23% to

GBP0.8m (H1 2020: GBP0.7m) as a result of the increase in the

amortisation charge in respect of software development, and the

purchase of GBP0.8m of tangible assets to support the Peel Ports

contract at Metro Rod.

The finance charge has reduced by 40% due to the lower net debt

position following the April 2020 Placing which raised GBP13.6m

(net of expenses) and was partially used to pay down bank

facilities. The finance charge does not solely reflect bank

interest, but also includes interest on capitalised leases.

During H1 2020 we took a GBP0.6m charge in respect of events

related to the COVID-19 crisis. We believed it was prudent to

anticipate that a number of customers would fail as the various

Government support schemes begin to unwind, and as a result we

increased our bad debt provision by GBP0.5m. During the period the

level of actual credit losses were GBP0.1m which were expensed,

resulting in us continuing to hold a total bad debt provision of

GBP0.8m provision (31 December 2020: GBP0.8m).

The other loss of GBP0.2m (H1 2020: GBP0.1m) represents the

movement in the fair value of the deferred consideration in

relation to the acquisition of Willow Pumps which is provided in

accordance with IFRS 9.

The tax charge for the period at 40% (H1 2020: 35%) was higher

than the statutory rate of 19% due to the revaluation of the

deferred tax liability on acquired intangibles resulting from the

increase in the future corporation tax rate to 25%. This added

GBP0.6m to the H1 tax charge. Excluding this one-off charge (which

will not recur at the year-end), the underlying tax rate would have

been 19%.

As a result, the statutory profit after tax increased by 174% to

GBP1.6m (H1 2020: GBP0.6m).

Earnings per share

No new shares have been issued during the period, meaning that

the total number of Ordinary Shares in issue throughout the period

was 95,758,470 (31 December 2020: 95,758,470). On 30 April 2020 the

Group completed a Placing of 15,555,556 new Ordinary Shares.

Although this represented a 20% dilution, the basic weighted

average number of Ordinary Shares in issue and not in Treasury in

H1 2020 was 85,067,691 (H1 2021: 95,758,470) resulting in 12.5%

dilution in the current period. As a result, whilst adjusted profit

after tax grew by 65% to GBP2.6m (H1 2020: GBP1.6m), adjusted

earnings per share increased by only 46% to 2.7p (H1 2020:

1.84p).

H1 2021 EPS H1 2020 EPS

GBP'000 p GBP'000 p

-------------------------------------- -------------------------- ------------ ----------------- -------------

Adjusted profit after tax 2,586 2.70 1,568 1.84

-------------------------------------- -------------------------- ------------ ----------------- -------------

Amortisation of acquired intangibles (196) (0.20) (196) (0.23)

Share-based payment expense (175) (0.18) (102) (0.12)

Non-recurring costs - - (620) (0.73)

Other gains and losses (174) (0.18) (53) (0.06)

Tax on adjusting items (478) (0.50) (26) (0.03)

--------------------------------------

Statutory profit after tax 1,562 1.63 570 0.67

-------------------------------------- -------------------------- ------------ ----------------- -------------

Basic earnings per share increased by 143% to 1.63p (H1 2020:

0.67p).

Financing and cash flow

At 30 June 2021, the Group had cash of GBP12.2m, and undrawn

bank facilities of GBP7.0m (comprised of the GBP5m Revolving Credit

Facility ("RCF") and GBP2m overdraft), giving the Group GBP19.2m of

cash and available facilities.

30 June 2021 31 Dec 2020 Change Change

GBP'000 GBP'000 GBP'000 %

-------------------- ------------- ------------ ----------------- ------------

Cash 12,182 13,203 (1,021) (8)%

Term loan (4,218) (5,225) 1,007 19%

RCF - - - 0%

Loan fee 84 116 (32) (28)%

Hire purchase debt (1,339) (1,408) 69 5%

Adjusted net cash 6,709 6,686 23 0%

-------------------- ------------- ------------ ----------------- ------------

Other lease debt (1,528) (1,729) 201 12%

Net cash 5,181 4,957 224 5%

-------------------- ------------- ------------ ----------------- ------------

Overall, the Group continue to be substantially ungeared, being

in a net cash position of GBP5.2m (31 December 2020: GBP4.9m). The

Group continues to hold cash on its balance sheet to allow

flexibility in terms of corporate activity.

The Group generated cash from operating activities of GBP3.5m

(H1 2020: GBP1.1m) resulting in a cash conversion rate from

adjusted EBITDA of 84% (H1 2020: 38%). During H1 2020 the Group

continued to make payments to all suppliers, providers of finance

and HMRC, however, we took a pragmatic stance with some of our

commercial customers who were unable to trade during lockdowns. As

our trading partners have been able to re-establish more normal

trading terms in H1 2021, our cash conversion has improved

significantly.

The cash generated in the period has been partially absorbed in

additional working capital as turnover has grown and by the

investment required in plant and machinery needed for the Peel

Ports contract. We have also continued to invest in our IT

infrastructure.

Dividend

Given the strong balance sheet position, the significant

increase in profits and the optimism the Board has for the full

year, the Board has declared an interim dividend of 0.60p per share

(H1 2020: 0.30p). This also reflects a reweighting between the

interim and final dividend and the unwinding of the cautious

approach we took in 2020 . The interim dividend will be paid on 17

September 2021 to shareholders on the register on 3 September

2021.

Chris Dent

Chief Financial Officer

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2021

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------------------------------------------------------- ----------- ----------- -------------

Revenue 28,631 24,209 49,287

Cost of sales (16,921) (14,634) (28,362)

--------------------------------------------------------------------------- ----------- ----------- -------------

Gross profit 11,710 9,576 20,925

Adjusted earnings before interest, tax, depreciation, amortisation,

share-based payments & non-recurring items ("Adjusted EBITDA") 4,168 2,782 6,640

Depreciation (660) (577) (1,149)

Amortisation of software (159) (89) (209)

Amortisation of acquired intangibles (196) (196) (393)

Share-based payment expense (175) (102) (205)

Non-recurring items - (620) (707)

-----------

Total administrative expenses (8,733) (8,378) (16,948)

--------------------------------------------------------------------------- ----------- ----------- -------------

Operating profit 2,977 1,198 3,977

Other gains and losses (174) (53) 151

Finance expense (157) (262) (446)

--------------------------------------------------------------------------- ----------- ----------- -------------

Profit before tax 2,647 882 3,682

Tax expense (1,084) (312) (889)

--------------------------------------------------------------------------- ----------- ----------- -------------

Profit for the period and total comprehensive income attributable to equity

holders of the

Parent Company 1,562 570 2,793

--------------------------------------------------------------------------- ----------- ----------- -------------

All amounts relate to continuing operations.

Earnings per share (p)

Basic 1.63 0.67 3.09

Diluted 1.59 0.66 3.03

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 June 2021

Audited

Unaudited 31 December

30 June 2021 2020

GBP'000 GBP'000

----------------------------------------------------------------- ----------------- ----------------

Assets

Non-current assets

Intangible assets 34,549 34,754

Property, plant and equipment 1,979 1,274

Right-of-use assets 3,409 3,377

Trade and other receivables - 155

------------------------------------------------------------------ ----------------- ----------------

Total non-current assets 39,936 39,560

------------------------------------------------------------------ ----------------- ----------------

Current assets

Inventories 879 712

Trade and other receivables 16,040 15,072

Cash and cash equivalents 12,182 13,203

------------------------------------------------------------------ ----------------- ----------------

Total current assets 29,102 28,987

------------------------------------------------------------------ ----------------- ----------------

Total assets 69,038 68,547

------------------------------------------------------------------ ----------------- ----------------

Liabilities

Current liabilities

Trade and other payables 11,182 10,808

Loans and borrowings 2,134 1,908

Obligations under leases 759 897

Current tax liability 528 445

Contingent consideration - 320

------------------------------------------------------------------ ----------------- ----------------

Total current liabilities 14,604 14,378

------------------------------------------------------------------ ----------------- ----------------

Non-current liabilities

Loans and borrowings 2,000 3,200

Obligations under leases 2,108 2,240

Contingent consideration 3,308 3,136

Deferred tax liability 2,309 1,752

------------------------------------------------------------------ ----------------- ----------------

Total non-current liabilities 9,724 10,328

------------------------------------------------------------------ ----------------- ----------------

Total liabilities 24,328 24,706

------------------------------------------------------------------ ----------------- ----------------

Total net assets 44,710 43,841

------------------------------------------------------------------ ----------------- ----------------

Issued capital and reserves attributable to owners of the Parent

Share capital 479 479

Share premium 36,817 36,817

Share-based payment reserve 599 455

Merger reserve 1,390 1,390

Treasury reserve - -

EBT reserve (186) (149)

Retained earnings 5,611 4,849

------------------------------------------------------------------ ----------------- ----------------

Total equity attributable to equity holders 44,710 43,841

------------------------------------------------------------------ ---------------- ----------------

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 June 2021

Unaudited Unaudited Audited

6 months ended 6 months Year

30 June ended ended

2021 30 June 31 December

2020 2020

GBP'000 GBP'000 GBP'000

---------------------------------------------------------------- --------------- --------- -------------

Cash flows from operating activities

Profit for the period 1,562 570 2,793

Adjustments for:

Depreciation of property, plant and equipment 819 666 1,149

Amortisation of intangible fixed assets 196 196 209

Acquisition-related costs - - 393

Non-recurring charges - 620 707

Share-based payment expense 175 102 205

Other gains and losses 174 53 (151)

Finance expense 157 262 446

Income tax expense 1,084 312 889

---------------------------------------------------------------- --------------- --------- -------------

Operating cash flow before movements in working capital 4,168 2,782 6,640

Decrease/(increase) in trade and other receivables (1,170) 3,493 1,345

(Increase)/decrease in inventories (167) (94) ( 119)

(Decrease)/increase in trade and other payables 668 (5,199) (1,878)

---------------------------------------------------------------- --------------- --------- -------------

Cash generated from operations 3,499 982 5,988

Income taxes (paid)/received (444) (127) (745)

---------------------------------------------------------------- --------------- --------- -------------

Net cash generated from operating activities 3,055 855 5,243

Cash flows from investing activities

Purchases of property, plant and equipment (1,184) (178) (460)

Purchase of software (150) - (319)

Acquisition of subsidiary including costs, net of cash acquired (320) - -

Net cash used in investing activities (1,654) (178) (779)

Cash flows from financing activities

Bank loans- repaid (1,000) (3,300) (4,200)

Other loans- repaid/(made) 49 26 (163)

Capital element of lease obligations repaid (552) (447) (1,100)

Interest paid - bank and other loan (55) (157) (257)

Interest paid - finance leases - (109) (189)

Proceed from issue of shares - 13,677 13,696

Funds supplied to Employee Benefit Trust (98) (214)

Dividends paid (766) (229) (516)

Net cash generated from/used in financing activities (2,422) 9,461 7,057

Net increase/decrease in cash and cash equivalents (1,021) 10,138 11,521

---------------------------------------------------------------- --------------- --------- -------------

Cash and cash equivalents at beginning of period 13,203 1,682 1,682

---------------------------------------------------------------- --------------- --------- -------------

Cash and cash equivalents at end of period 12,182 11,820 13,203

---------------------------------------------------------------- --------------- --------- -------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2021

Share Share-based

Share premium payment Merger Treasury EBT Retained

capital account reserve reserve shares reserve earnings Total

Group GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ---------- --------- ----------- ---------- ---------- -------- ---------- -------

At 1 January

2020 398 22,806 316 1,390 (21) - 2,970 27,859

--------------- ---------- --------- ----------- ---------- ---------- -------- ---------- -------

Profit for the

year and total

comprehensive

income - - - - - - 570 570

Contributions

by and

distributions

to owners -

Shares issued 79 13,622 (51) - 12 - 47 13,709

Dividend paid 2 389 - - - - (620) (229)

Treasury shares - - - - 9 - (9) -

Share-based

payment - - 80 - - - - 80

--------------- ---------- --------- ----------- ---------- ---------- -------- ---------- -------

At 30 June 2020 479 36,817 345 1,390 - - 2,958 41,989

--------------- ---------- --------- ----------- ---------- ---------- -------- ---------- -------

Profit for the

year and total

comprehensive

income - - - - - - 2,223 2,223

Contributions

by and

distributions

to owners -

Shares issued - - (15) - - 65 19 69

Dividend paid - - - - - - (286) (286)

Treasury shares - - - - - - - -

Contributions

to Employee

Benefit Trust - - - - - (214) (65) (279)

Share-based

payment - - 125 - - - - 125

--------------- ---------- --------- ----------- ---------- ---------- -------- ---------- -------

At 31 December

2020 479 36,817 455 1,390 - (149) 4,849 43,841

--------------- ---------- --------- ----------- ---------- ---------- -------- ---------- -------

Profit for the

year and total

comprehensive

income - - - - - - 1,562 1,562

Contributions

by and

distributions

to owners

Shares issued - - - - - - - -

Dividend paid - - - - - - (766) (766)

Treasury shares - - - - - - - -

Contributions

to Employee

Benefit Trust - - (26) - - (37) (35) (98)

Share-based

payment - - 170 - - - - 170

--------------- ---------- --------- ----------- ---------- ---------- -------- ---------- -------

At 31 December

2020 479 36,817 599 1,390 - (186) 5,611 44,710

--------------- ---------- --------- ----------- ---------- ---------- -------- ---------- -------

1. Accounting policies

Basis of preparation

The consolidated financial statements for the six months ended

30 June 2021 and 2020 are unaudited and were approved by the

Directors on 21 July 2021. They do not constitute statutory

accounts as defined in section 434 of the Companies Act 2006. The

financial statements for the year ended 31 December 2020 were

prepared in accordance with IFRS and have been delivered to the

Registrar of Companies. The report of the auditor on those

financial statements was unqualified and did not draw attention to

any matters by way of emphasis of matter. The Group's financial

statements consolidate the financial statements of Franchise Brands

plc and its subsidiaries.

Applicable standards

These unaudited consolidated interim financial statements have

been prepared in accordance with International Financial Reporting

Standards as adopted by the European Union, under the historical

cost convention. They have not been prepared in accordance with IAS

34, the application of which is not required to the interim

financial statements of AIM companies. The interim financial

statements have been prepared in accordance with the accounting

policies set out in the Group's Annual Report and Accounts for the

year ended 31 December 2020.

Going concern

The condensed financial statements have been prepared on a going

concern basis. The Group has generated profits both during the

period covered by these financial statements and in previous years.

These profits have resulted in operating cash inflows into the

Group, and the Group has sufficient current financial assets to

meet its current liabilities as they fall due.

2. Earnings per share

Basic earnings per share amounts are calculated by dividing

profit for the period attributable to equity holders of the Parent

by the weighted average number of ordinary shares outstanding

during the period. Diluted earnings per share is calculated by

dividing the profit attributable to ordinary equity holders of the

Parent by the weighted average number of ordinary shares

outstanding during the year plus the weighted average number of

Ordinary Shares that would have been issued on the conversion of

all dilutive potential ordinary shares into ordinary shares at the

start of the period or, if later, the date of issue.

During the current and comparative periods, the Group has not

incurred any exceptional costs which the Directors believe should

be separately identified.

Earnings per share

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

GBP'000 GBP'000 GBP'000

----------------------------------- --------------- -------------- -----------------

Profit attributable to owners of

the Parent 1,562 570 2,793

Adjusting items, net of tax 1,023 997 1,144

----------------------------------- --------------- -------------- -----------------

Adjusted profit attributable to

owners of the Parent 2,586 1,568 3,937

----------------------------------- --------------- -------------- -----------------

Number Number Number

----------------------------------- --------------- -------------- -----------------

Basic weighted average number

of shares 95,758,470 85,067,691 90,462,594

Dilutive effect of share options 2,389,068 1,755,549 1,649,029

----------------------------------- --------------- -------------- -----------------

Diluted weighted average number

of shares 98,147,538 86,823,240 92,111,623

----------------------------------- --------------- -------------- -----------------

Pence Pence Pence

----------------------------------- --------------- -------------- -----------------

Basic earnings per share 1.63 0.67 3.09

Diluted earnings per share 1.59 0.66 3.03

Adjusted earnings per share 2.70 1.84 4.35

Adjusted diluted earnings per

share 2.63 1.81 4.27

----------------------------------- --------------- -------------- -------------------

3. Availability of this report

This half year results report will not be sent to shareholders

but is available on the Company's website at

https://www.franchisebrands.co.uk/key-documents/ .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDRSDDDGBB

(END) Dow Jones Newswires

July 22, 2021 02:00 ET (06:00 GMT)

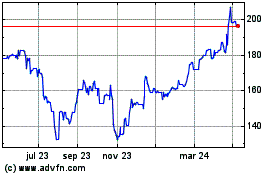

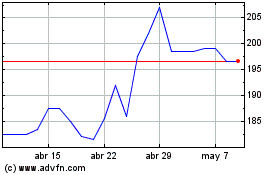

Franchise Brands (LSE:FRAN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Franchise Brands (LSE:FRAN)

Gráfica de Acción Histórica

De May 2023 a May 2024