TIDMINDV

RNS Number : 5938Q

Indivior PLC

28 October 2021

October 28, 2021

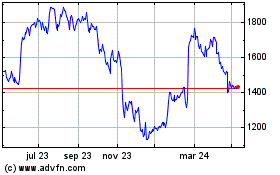

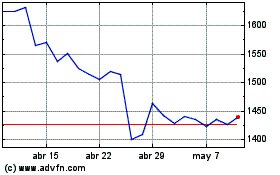

Indivior Announces Q3 and Nine Months 2021 Results;

Raises FY 2021 Guidance

Period to September Q3 Q3 % Change YTD YTD % Change

30th

2021 2020 2021 2020

$m $m $m $m

------------------------- ------ ------ --------- --- ------ ------ ---------

Net Revenue 187 159 18 568 462 23

------------------------- ------ ------ --------- --- ------ ------ ---------

Operating Profit/(Loss) 38 18 111 168 (147) NM

------------------------- ------ ------ --------- --- ------ ------ ---------

Net Income/(Loss) 27 10 170 169 (135) NM

------------------------- ------ ------ --------- --- ------ ------ ---------

EPS/(LPS) (cents

per share) 4 1 NM 23 (18) NM

------------------------- ------ ------ --------- --- ------ ------ ---------

Adj. Operating

Profit* 38 30 27 155 56 177

------------------------- ------ ------ --------- --- ------ ------ ---------

Adj. Net Income* 27 19 42 114 33 NM

------------------------- ------ ------ --------- --- ------ ------ ---------

Adj. EPS* 4 3 33 16 5 NM

========================= ====== ====== ========= === ====== ====== =========

(*) Adjusted (Adj.) basis excludes the impact of exceptional

items as referenced and reconciled in Note 4, 5 and 6. NM - Not

meaningful.

Comment by Mark Crossley, CEO of Indivior PLC

"We are pleased to report another quarter of good growth and

further strengthening of our leadership in addiction treatment.

Based on the strong commercial execution behind SUBLOCADE (R)

(buprenorphine extended-release) injection and the resilience of

our legacy US film business, we have again raised our 2021 net

revenue expectations for the overall Group and for SUBLOCADE. Our

strategy to focus on the large and growing opportunity in organized

health systems (OHS) has seen us deliver five consecutive quarters

of double-digit(1) underlying net revenue growth for SUBLOCADE,

providing us strong momentum as we look forward to 2022."

YTD / Q3 2021 Financial Highlights

-- YTD 2021 total net revenue (NR) of $568m increased 23% (YTD

2020: $462m); Q3 2021 total NR of $187m increased 18% (Q3 2020:

$159m). The strong increase in both periods was primarily driven by

higher NR from SUBLOCADE (+86% vs. YTD 2020, +97% vs. Q3 2020),

continued growth in the buprenorphine medication-assisted treatment

(BMAT) market, and by market share stability for SUBOXONE (R)

(buprenorphine and naloxone) Film in the US.

-- YTD 2021 reported operating profit was $168m (YTD 2020

operating loss: $147m); Q3 2021 reported operating profit of $38m

increased 111% (Q3 2020: $18m). On an adjusted basis, YTD 2021

operating profit was $155m (Adj. YTD 2020: $56m). Adj. Q3 2021

operating profit of $38m increased 27% (Adj. Q3 2020: $30m). The

substantial improvement in adjusted operating profit in both

periods was primarily driven by strong net revenue growth.

-- YTD 2021 reported net income was $169m (YTD 2020 net loss:

$135m); Q3 2021 reported net income was $27m (Q3 2020 net income:

$10m). On an adjusted basis, YTD 2021 net income was $114m (Adj.

YTD 2020 net income: $33m). Adj. Q3 2021 net income was $27m (Adj.

Q3 2020: $19m). The significant increases in adjusted net income in

both periods were primarily driven by higher operating profit,

partially offset by increased net finance expense.

-- YTD 2021 ending cash balance was $1,005m (FY 2020: $858m);

net cash was $756m (FY 2020: $623m). Higher operating profit,

relatively stable government rebate payables and proceeds from the

sale of the legacy TEMGESIC(R)/ BUPREX(R) / BUPREXX(R)

(buprenorphine) analgesic franchise outside of North America was

offset by cash used to repurchase ordinary shares as part of the

Group's $100m share repurchase program.

(1) Assumes net revenue of $54m in Q2 2021, which excludes a

large order of $7m from a criminal justice customer

YTD / Q3 2021 Operating Highlights

-- YTD 2021 SUBLOCADE NR of $169m (+86% vs. YTD 2020); Q3

SUBLOCADE NR of $65m (+97% vs. Q3 2020 and +7% vs. Q2 2021)

reflects strong growth in the OHS channel and increased new US

patient enrolments. Q3 2021 US dispenses were approx. 48,400 units

(+66% vs. Q3 2020 and +13% vs. Q2 2021).

-- YTD 2021 PERSERIS(R) (risperidone) extended-release injection

NR of $12m (+20% vs. YTD 2020); Q3 2021 PERSERIS NR of $5m (+67%

vs. Q3 2020 and +25% vs. Q2 2021) reflects improved commercial

access to US healthcare practitioners (HCPs) from the continued

reopening of the US healthcare system. The Group is currently

investing to expand the PERSERIS sales force to achieve US national

coverage in 2022.

-- YTD 2021 SUBOXONE Film share averaged 20% (YTD 2020: 21%) and

exited the quarter at 20% (Q3 2020: 21%). Share erosion since the

"at-risk" launch of generic buprenorphine/naloxone film products in

February 2019 has thus far been lower than historical industry

analogues(1) would suggest.

-- Outside the US: SUBLOCADE / SUBUTEX(R) prolonged release

solution for injection is available in Australia, Canada, and

Israel; approved in Sweden, Finland, New Zealand, Denmark, Germany,

Italy and Norway. SUBOXONE Film now available in Canada, Israel,

Germany, UK, Italy, Finland, Denmark, Sweden, and Norway.

Share Repurchase Program

On July 30, 2021, the Group announced an irrevocable share

repurchase program of up to $100m. Through September 30, 2021, the

Group has repurchased and cancelled 11,730,087 of the Group's

ordinary shares at a daily weighted average purchase price of

189.87p at a cost of approximately $31m. See Note 13 for further

discussion.

FY 2021 Guidance Raised

The Group is raising its FY 2021 guidance for NR and pre-tax

income as follows:

-- Total FY 2021 NR range expected to be $750m to $770m

(previously $705m to $740m), reflecting strong SUBLOCADE

performance and continued market share stability for SUBOXONE

Film.

-- SUBLOCADE FY 2021 NR range expected to be $235m to $245m

(previously $210m to $230m), based on stronger demand and progress

in the US criminal justice system (OHS sub-channel).

-- Positive adjusted pre-tax income at a higher level than previous management expectations.

FY 2021 guidance for the below items remains unchanged :

-- PERSERIS(R) (risperidone) extended-release injection FY 2021 NR range of $17m to $20m.

-- Adjusted gross margin in the low-80% range.

-- Adjusted operating expense (SG&A+R&D) range of $470m

to $480m, primarily reflecting commercial investments to grow the

Group's long-acting injectable (LAI) technologies, principally in

the US.

U.S. Opioid Use Disorder (OUD) Market Update

YTD 2021, the U.S. BMAT market grew in low single-digits.

Moderation in the growth rate versus 2020 reflects the high base

period for comparison in the year-ago quarter, when the BMAT market

grew in the low- to mid-teens as a result of COVID-19-related

demand and the implementation of new federal and state government

actions to facilitate access to medication-assisted treatment (MAT)

for OUD patients. Over the approximate two year period since the

beginning of 2020, BMAT market growth has averaged in the mid- to

high-single digits, which is in-line with the historical industry

growth rate and the Group's long-term expectations.

The Group continues to expect long-term U.S. market growth to be

sustained in the mid- to high-single digit percentage range due to

increased severity and overall public awareness of the opioid

epidemic and approved treatments, together with regulatory and

legislative actions that have expanded OUD treatment funding and

treatment capacity. The number of physicians, nurse practitioners

and physician assistants who have received a waiver to administer

MAT and those able to treat up to the permitted level of 275

patients continued to grow in Q3 2021.

As a result, there is increasing patient access to BMAT.

Indivior supports efforts to encourage more eligible healthcare

practitioners (HCPs) to provide BMAT, and the Group continues to

resource its compliance capabilities for the growing number of BMAT

prescribers and patients.

The Group's focus is to continue to expand access to SUBLOCADE

amongst OHS and core HCPs to ensure availability of this

potentially important treatment option to the estimated 1 million+

patients per month who are prescribed BMAT by HCPs.

(1) IMS Institute Report, January 2016, "Price Declines after

Branded Medicines Lose Exclusivity in the U.S."

Financial Performance 9 Mos. YTD and Q3 2021

Total YTD 2021 net revenue increased 23% to $568m at actual

exchange rates (YTD 2020: $462m; +21% at constant exchange rates).

In Q3 2021, total net revenue increased 18% at actual exchange

rates to $187m (Q3 2020: $159m; +18% at constant exchange

rates).

YTD 2021 U.S. net revenue increased 33% to $428m (YTD 2020:

$323m) and by 29% in Q3 2021 to $143m (Q3 2020: $111m). Strong

year-over-year SUBLOCADE net revenue growth, SUBOXONE Film share

resilience along with underlying BMAT market growth were the

principal drivers of the net revenue increase in both periods.

YTD 2021 Rest of World (ROW) net revenue increased 1% at actual

exchange rates to $140m (YTD 2020: $139m; -7% at constant exchange

rates). YTD 2021 and 2020 ROW SUBLOCADE net revenue were $11m and

$2m (at actual exchange rates), respectively. Foreign currency

translation benefits and SUBLOCADE net revenue contribution were

the principal drivers of the YTD net revenue increase. These

benefits were partially offset by ongoing competitive pressure in

the legacy tablet business in Western Europe.

In Q3 2021, ROW net revenue decreased 8% at actual exchange

rates to $44m (Q3 2020: $48m; -9% at constant exchange rates). Q3

2021 and 2020 ROW SUBLOCADE net revenue were $4m and $2m (at actual

exchange rates), respectively. The NR decline in Q3 was mainly

attributable to ongoing competitive pressure in the legacy tablet

business in Western Europe and the sale of the legacy TEMGESIC(R)/

BUPREX(R) / BUPREXX(R) analgesic franchise.

Gross margin as reported YTD 2021 was 85% (YTD 2020: 84%; Adj.

YTD 2020: 86%) and 86% in Q3 2021 (Q3 2020: 79%; Adj. Q3 2020:

82%). There were no exceptional costs recorded in gross margin for

the current periods. Adj. YTD 2020 and Q3 2020 excludes $11m and

$5m, respectively, of net exceptional costs of sales related to

inventory provisions due to the adverse impact of COVID-19. The

adjusted gross margin improvement in Q3 reflects a more favorable

product mix from the continued strong growth of SUBLOCADE while the

modest decline in YTD 2021 gross margin reflects the continued

relative strength of SUBOXONE Film.

YTD SG&A expenses as reported were $279m (YTD 2020: $509m).

YTD 2021 included $13m of net exceptional benefits primarily due to

other operating income recorded from the net proceeds received from

the sale of the legacy TEMGESIC(R)/ BUPREX(R) / BUPREXX(R)

(buprenorphine) analgesic franchise outside of North America

(+$19m), and non-cash adjustments to provisions related to

DOJ-related matters (+$18m) and ANDA litigation matter (-$24m). YTD

2020 reported SG&A included exceptional costs of $192m, which

were related to the DOJ matter (-$183m), the Group's strategic

alignment actions (-$7m) and lease impairments (-$2m).

Q3 SG&A expenses as reported were $112m in Q3 2021 (Q3 2020:

$100m). Q3 2021 exceptional items netted to $nil. Net proceeds

received from the sale of the legacy TEMGESIC(R)/ BUPREX(R) /

BUPREXX(R) (buprenorphine) analgesic franchise outside of North

America (+$19m) were fully offset by non-cash adjustments to

provisions related to the ANDA litigation matter (-$24m) and DOJ

related matters (+$5m). Q3 2020 reported SG&A included

exceptional costs (-$7m) related to the Group's strategic alignment

actions.

On an adjusted basis, YTD 2021 SG&A expenses decreased 8% to

$292m (Adj. YTD 2020: $317m); Q3 2021 adjusted SG&A expense

increased 20% to $112m (Adj. Q3 2020: $93m). The YTD 2021 decline

largely reflects incremental costs in the prior period related to

the US direct-to-consumer (DTC) advertising campaign for SUBLOCADE

that did not repeat in 2021, as well as lower legal fees and

expenses related to the DOJ matter (settled in Q3 2020). Higher Q3

2021 SG&A expense largely reflects planned commercial activity

investments, including increased sales and marketing investments

for SUBLOCADE and recruiting for the PERSERIS sales force

expansion.

YTD 2021 and Q3 2021 R&D expenses were $33m and $11m,

respectively (YTD 2020: $26m; Q3 2020: $8m). The increases over the

year-ago periods reflect planned higher R&D activity, as

certain projects and post-market studies were suspended in 2020 due

to the pandemic.

YTD 2021 operating profit as reported was $168m (YTD 2020 op.

loss: $147m). Exceptional benefits of $13m are included in the

current period while exceptional costs of $203m are included in the

year-ago period. On an adjusted basis, YTD 2021 operating profit

was $155m (Adj. YTD 2020: $56m). The increase on an adjusted basis

primarily reflects higher net revenue along with a decline in

SG&A expenses as detailed above.

Q3 2021 operating profit as reported was $38m (Q3 2020: $18m).

Net exceptional items of $nil are included in the current period

while exceptional costs of $12m are included in the Q3 2020

reported results. Q3 2021 operating profit of $38m versus adj. Q3

2020: $30m primarily reflects higher net revenue.

YTD 2021 net finance expense as reported was $18m (YTD 2020:

$12m expense). The additional net expense primarily reflects lower

interest income on the Group's cash balance due to lower short-term

interest rates versus the year-ago period and higher expense

primarily related to interest on the Group's outstanding DOJ

settlement amount. An exceptional expense of $1m is included in the

current period due to the write-off of deferred financing costs on

the previous term loan. On an adjusted basis, YTD 2021 net finance

expense was $17m. There was no adjustment in the prior period.

YTD 2021 reported tax benefit was $19m, or a rate of -13% (YTD

2020 tax benefit: $24m, 15%). Excluding the YTD 2021 $43m tax

benefit on exceptional items, the effective tax rate was 17% (YTD

2020 adj. tax charge: $11m; 25% rate). Q3 2021 reported total tax

expense was $4m, or a rate of 13% (Q3 2020: $3m, 23%). There were

no tax exceptional items recorded in Q3 2021. Excluding the QTD tax

benefit on exceptional items in Q3 2020, the effective tax rate was

24%.

YTD 2021 reported net income was $169m (YTD 2020 net loss:

$135m). On an adjusted basis, YTD 2021 net income was $114m and

excludes the $55m after-tax impact from exceptional items (Adj. YTD

2020: $33m, excl. $168m of exceptional items). The increase in net

income on an adjusted basis primarily reflects higher net revenue

and lower operating expenses mainly due to the SUBLOCADE DTC

campaign in Q1 2020.

Q3 2021 net income on a reported basis was $27m (Q3 2020: $10m).

There were no exceptional items recorded in Q3 2021 (Adj. Q3 2020:

$19m, excl. $9m of exceptional items). On an adjusted basis, higher

Q3 2021 net income was primarily due to increased net revenue.

YTD diluted earnings per share was 22 cents and 15 cents on an

adjusted diluted basis (YTD 2020: 18 cents loss per share on a

diluted basis and 4 cents earnings per share adjusted diluted

basis). In Q3 2021, earnings per share on a diluted and adjusted

diluted basis was 3 cents (Q3 2021: 1 cent earnings per share on a

diluted and 2 cents on an adjusted diluted basis). Higher YTD 2021

and Q3 2021 EPS on an adjusted diluted basis is primarily due to

higher net revenue and the impact of the share repurchase

program.

Balance Sheet & Cash Flow

September 30, 2021 cash and cash equivalents were $1,005m, an

increase of $147m versus the $858m position at year-end 2020. This

primarily reflects higher operating profit and relatively stable

government rebate payables. Gross borrowings, before issuance

costs, were $249m at the end of Q3 2021 (FY 2020: $235m). As a

result, net cash (as defined in Note 8) stood at $756m at the end

of Q3 2021 (FY 2020: $623m), a $133m increase over the YTD 2021

period.

Net working capital (inventory plus trade receivables, less

trade and other payables) was negative $278m at the end of Q3 2021

versus negative $252m at the end of FY 2020. The change in the

period was primarily a result of timing of payments made on

government rebate and trade payables. Separately, the current

portion of provisions and other liabilities increased by $66m in Q3

2021 for the remaining unfunded portion of the Group's share

repurchase program.

Cash generated by operating activities in YTD 2021 was $200m

(YTD 2020 cash used: $94m), representing a change of $294m

primarily due to strong YTD 2021 operating profit, timing of

government rebates payable and the surety bond refunded in Q1 2021.

Net cash inflow from operating activities was $186m in YTD 2021

(YTD 2020 net cash outflow: $122m) reflecting higher cash from

operations and an exceptional tax refund from the IRS which were

offset by taxes paid, interest paid, and transaction costs paid

related to the Group's debt refinancing.

YTD 2021 cash outflow from investing activities was $12m (YTD

2020: $2m) which reflects a payment made to Aelis Farma for an

exclusive option and license agreement to develop its leading

compound (AEF0117) targeting cannabis use disorders which was

partially offset by the proceeds received from the sale of the

legacy TEMGESIC(R)/ BUPREX(R) / BUPREXX(R) (buprenorphine)

analgesic franchise outside of North America.

YTD 2021 cash outflow from financing activities was $26m (YTD

2020: $7m) which reflects payments made for the Group's share

repurchase program and principal lease payments which were

partially offset by the gross proceeds received upon refinancing of

the Group's term loan facility. See Note 8 for further discussion

related to the debt refinancing.

R&D / Pipeline Update

Indivior's quarterly R&D and pipeline update may be found by

clicking here .

Principal Risk Factors

The Group utilizes a formal process to identify, evaluate and

manage significant risks. The Directors have reviewed the principal

risks and uncertainties for the remainder of the 2021 financial

year. In addition to the principal risks and uncertainties

affecting the Group's business activities, detailed on pages 39 to

45 of the Indivior PLC Annual Report 2020:

-- Business Operations

-- Product Pipeline, Regulatory & Safety

-- Commercialization

-- Economic & Financial

-- Supply

-- Legal & Intellectual Property

-- Compliance

During 2021, the COVID-19 pandemic has continued to impact the

Group's principal risks. Governments worldwide have started

deploying vaccination programs and other health measures to lower

virus infection and mortality rates and enable people and companies

to start resuming normality. However, infections caused by the

virus (including its variants) have resurged to various degrees in

some countries the Group has operations in or is targeting for

growth. In June 2021, the Group started to partially reopen its

offices worldwide following local guidelines and regulations while

also continuing to ensure the welfare of its employees. A full

reopening is planned for the fourth quarter, which assumes the

virus or its variants remain relatively contained and that local

guidelines and regulations permit reopening. Reopenings have eased

the challenging business environment in which the Group and

companies across industries have been operating for over a year,

and the Group has experienced some improvements (e.g., increased

number of in-person engagements with healthcare professionals and

members of Organized

Health Systems and easing of certain travel restrictions).

However, some new challenges associated with the reopening of the

economy also have emerged (e.g., high demand with limited supply

for several goods and services resulting in price increases and

project delays). As a result, pre-pandemic business conditions have

not yet been observed or experienced. Therefore, the overall risks

related to the Group's business and operations have only marginally

decreased for the following principal risks: business operations;

product pipeline and regulatory; commercialization; supply; and

economic and financial.

Given the dynamic nature of the current environment, the Group

is closely monitoring health, business, and economic conditions

(including a virus resurgence or new government containment

measures) and their related impact on our employees, as well as on

the workforce of our key third parties, which ultimately may impact

our operations. Given the still mostly remote working environment,

the Group is also continuing to closely monitor the cross-industry

increase in cybersecurity threats and the overall operating

effectiveness of its monitoring and control activities. Despite the

risk mitigation measures the Group has taken, and its on-going

efforts to ensure that contingency actions are appropriate and

effective, if health and business conditions deteriorate, they may

adversely affect Indivior's operations and/or performance, and have

a heightened effect on certain principal risks, including as

related to business operations, product pipeline and regulatory,

commercialization, supply, and economic and financial

Other than in respect to the above, the Directors consider the

principal risks and uncertainties which could have a material

impact on the Group's performance for the rest of the year to

remain the same as described on pages 39 to 45 of the Annual Report

2020.

Exchange Rates

The average and period end exchange rates used for the

translation of currencies into U.S. dollars that have most

significant impact on the Group's results were:

9 Months to September 9 Months to September

30, 30,

2021 2020

GB GBP period end 1.3530 1.2852

---------------------- ----------------------

GB GBP average rate 1.3853 1.2716

---------------------- ----------------------

EUR Euro period end 1.1682 1.1656

---------------------- ----------------------

EUR Euro average 1.1971 1.1237

---------------------- ----------------------

Webcast Details

There will be a live webcast presentation at 13:00 BST (8:00 am

EDT) hosted by Mark Crossley, CEO. The details are below. All

materials will be available on the Group's website prior to the

event at www.indivior.com .

Webcast link: https://edge.media-server.com/mmc/p/oy28w6i3

Confirmation Code: 6677702

Participants, Local - London, United Kingdom: +44 (0) 2071 928338

Participants, Local - New York, United

States of America: +1 646 7413167

For Further Information

Investor Enquiries Jason Thompson VP Investor Relations, +1 804 402 7123

Indivior PLC jason.thompson@indivior.com

Media Enquiries Jonathan Sibun Tulchan Communications +44 (0) 2073 534200

US Media Inquiries +1 804 594 0836

Indiviormediacontacts@indivior.com

Corporate Website www.indivior.com

This announcement does not constitute an offer to sell, or the

solicitation of an offer to subscribe for or otherwise acquire or

dispose of shares in the Group to any person in any jurisdiction to

whom it is unlawful to make such offer or solicitation.

About Indivior

Indivior is a global pharmaceutical company working to help

change patients' lives by developing medicines to treat addiction

and serious mental illnesses. Our vision is that all patients

around the world will have access to evidence-based treatment for

the chronic conditions and co-occurring disorders of addiction.

Indivior is dedicated to transforming addiction from a global human

crisis to a recognized and treated chronic disease. Building on its

global portfolio of opioid dependence treatments, Indivior has a

pipeline of product candidates designed to both expand on its

heritage in this category and potentially address other chronic

conditions and cooccurring disorders of addiction, including

alcohol use disorder. Headquartered in the United States in

Richmond, VA, Indivior employs more than 800 individuals globally

and its portfolio of products is available in over 40 countries

worldwide. Visit www.indivior.com to learn more. Connect with

Indivior on LinkedIn by visiting www.linkedin.com/company/indivior

.

Forward-Looking Statements

This announcement contains certain statements that are

forward-looking. By their nature, forward-looking statements

involve risks and uncertainties as they relate to events or

circumstances that may or may not occur in the future. Actual

results may differ materially from those expressed or implied in

such statements because they relate to future events.

Forward-looking statements include, among other things, statements

regarding the Indivior Group's financial guidance for 2021 and its

medium- and long-term growth outlook, its operational goals, its

product development pipeline and statements regarding ongoing

litigation and other statements containing the words "subject to",

"believe", "anticipate", "plan", "expect", "intend", "estimate",

"project", "may", "will", "should", "would", "could", "can", the

negatives thereof, variations thereon and similar expressions.

Various factors may cause differences between Indivior's

expectations and actual results, including, among others (including

those described in the risk factors described in the most recent

Indivior PLC Annual Report and in subsequent releases): factors

affecting sales of Indivior Group's products and financial

position; the outcome of research and development activities;

decisions by regulatory authorities regarding the Indivior Group's

drug applications or authorizations; the speed with which

regulatory authorizations, pricing approvals and product launches

may be achieved, if at all; the outcome of post-approval clinical

trials; competitive developments; difficulties or delays in

manufacturing and in the supply chain; disruptions in or failure of

information technology systems; the impact of existing and future

legislation and regulatory provisions on product exclusivity;

trends toward managed care and healthcare cost containment;

legislation or regulatory action affecting pharmaceutical product

pricing, reimbursement or access; challenges in the commercial

execution; claims and concerns that may arise regarding the safety

or efficacy of the Indivior Group's products and product

candidates; risks related to legal proceedings, including

compliance with the Group's agreements with the U.S. Department of

Justice and with the Office of Inspector General of the Department

of Health and Human Services, noncompliance with which could result

in potential exclusion from U.S. Federal health care programs; the

ongoing investigative and antitrust litigation matters; the opioid

multi-district litigation; the Indivior Group's ability to protect

its patents and other intellectual property; the outcome of patent

infringement litigation relating to Indivior Group's products,

including the ongoing ANDA lawsuits; changes in governmental laws

and regulations; issues related to the outsourcing of certain

operational and staff functions to third parties; risks related to

the evolving COVID-19 pandemic and the potential impact of COVID-19

on the Indivior Group's operations and financial condition, which

cannot be predicted with confidence; uncertainties related to

general economic, political, business, industry, regulatory and

market conditions; and the impact of acquisitions, divestitures,

restructurings, internal reorganizations, product recalls and

withdrawals and other unusual items.

Consequently, forward-looking statements speak only as of the

date that they are made and should be regarded solely as our

current plans, estimates and beliefs. You should not place undue

reliance on forward-looking statements. We cannot guarantee future

results, events, levels of activity, performance, or achievements.

Except as required by law, we do not undertake and specifically

decline any obligation to update, republish or revise

forward-looking statements to reflect future events or

circumstances or to reflect the occurrences of unanticipated

events.

About SUBOXONE(R)

SUBOXONE (buprenorphine and naloxone) Sublingual Film (CIII)

INDICATION AND USAGE

SUBOXONE(R) (buprenorphine and naloxone) Sublingual Film (CIII)

is indicated for treatment of opioid dependence. SUBOXONE Film

should be used as part of a complete treatment plan that includes

counseling and psychosocial support.

HIGHLIGHTED SAFETY INFORMATION

Prescription use of this product is limited under the Drug

Addiction Treatment Act.

CONTRAINDICATIONS

SUBOXONE Film is contraindicated in patients with a history of

hypersensitivity to buprenorphine or naloxone.

WARNINGS AND PRECAUTIONS

Addiction, Abuse, and Misuse : Buprenorphine can be abused in a

manner similar to other opioids and is subject to criminal

diversion. Monitor patients for conditions indicative of diversion

or progression of opioid dependence and addictive behaviors.

Multiple refills should not be prescribed early in treatment or

without appropriate patient follow-up visits.

Respiratory Depression : Life--threatening respiratory

depression and death have occurred in association with

buprenorphine use. Warn patients of the potential danger of

self--administration of benzodiazepines or other CNS depressants

while under treatment with SUBOXONE Film.

Strongly consider prescribing naloxone at the time SUBOXONE Film

is initiated or renewed because patients being treated for opioid

use disorder have the potential for relapse, putting them at risk

for opioid overdose. Educate patients and caregivers on how to

recognize respiratory depression and, if naloxone is prescribed,

how to treat with naloxone.

Unintentional Pediatric Exposure: Store SUBOXONE Film safely out

of the sight and reach of children. Buprenorphine can cause severe,

possibly fatal, respiratory depression in children.

Neonatal Opioid Withdrawal Syndrome: Neonatal opioid withdrawal

syndrome (NOWS) is an expected and treatable outcome of prolonged

use of opioids during pregnancy.

Adrenal Insufficiency : If diagnosed, treat with physiologic

replacement of corticosteroids, and wean patient off the

opioid.

Risk of Opioid Withdrawal with Abrupt discontinuation : If

treatment is temporarily interrupted or discontinued, monitor

patients for withdrawal and treat appropriately.

Risk of Hepatitis, Hepatic Events: Monitor liver function tests

prior to initiation and during treatment and evaluate suspected

hepatic events.

Precipitation of Opioid Withdrawal Sign and Symptoms: An opioid

withdrawal syndrome is likely to occur with parenteral misuse of

SUBOXONE Film by individuals physically dependent on full opioid

agonists, or by sublingual or buccal administration before the

agonist effects of other opioids have subsided.

Risk of Overdose in Opioid Naïve Patients: SUBOXONE Film is not

appropriate as an analgesic. There have been reported deaths of

opioid naïve individuals who received a 2 mg sublingual dose.

ADVERSE REACTIONS

Adverse events commonly observed with the sublingual/buccal

administration of the SUBOXONE Film are oral hypoesthesia,

glossodynia, oral mucosal erythema, headache, nausea, vomiting,

hyperhidrosis, constipation, signs and symptoms of withdrawal,

insomnia, pain, and peripheral edema.

DRUG INTERACTIONS

Benzodiazepines: Use caution in prescribing SUBOXONE Film for

patients receiving benzodiazepines or other CNS depressants and

warn patients against concomitant self--administration/misuse.

CYP3A4 Inhibitors and Inducers : Monitor patients starting or

ending CYP3A4 inhibitors or inducers for potential over-- or

under-- dosing.

Antiretrovirals: Patients who are on chronic buprenorphine

treatment should have their dose monitored if NNRTIs are added to

their treatment regimen. Monitor patients taking buprenorphine and

atazanavir with and without ritonavir. Dose reduction of

buprenorphine may be warranted.

Serotonergic Drugs: Concomitant use may result in serotonin

syndrome. Discontinue SUBOXONE Film if serotonin syndrome is

suspected.

USE IN SPECIFIC POPULATIONS

Lactation: Buprenorphine passes into the mother's milk.

Geriatric Patients: Monitor geriatric patients receiving

SUBOXONE Film for sedation or respiratory depression.

Moderate or Severe Hepatic Impairment: Buprenorphine/naloxone

products are not recommended in patients with severe hepatic

impairment and may not be appropriate for patients with moderate

hepatic impairment.

To report pregnancy or side effects associated with taking

SUBOXONE Film, please call 1-877-782-6966.

For more information about SUBOXONE Film, the full Prescribing

Information, and Medication Guide visit www.suboxone.com . For REMS

information visit www.suboxoneREMS.com .

About SUBLOCADE(R) (7)

SUBLOCADE (buprenorphine extended-release) injection, for

subcutaneous use (CIII)

INDICATION AND HIGHLIGHTED SAFETY INFORMATION

INDICATION

SUBLOCADE is indicated for the treatment of moderate to severe

opioid use disorder in patients who have initiated treatment with a

transmucosal buprenorphine-containing product, followed by dose

adjustment for a minimum of 7 days.

SUBLOCADE should be used as part of a complete treatment plan

that includes counseling and psychosocial support.

HIGHLIGHTED SAFETY INFORMATION

WARNING: RISK OF SERIOUS HARM OR DEATH WITH INTRAVENOUS

ADMINISTRATION; SUBLOCADE RISK EVALUATION AND MITIGATION

STRATEGY

-- Serious harm or death could result if administered intravenously. SUBLOCADE

forms a solid mass upon contact with body fluids and may cause

occlusion,

local tissue damage, and thrombo-embolic events, including life

threatening

pulmonary emboli, if administered intravenously.

-- Because of the risk of serious harm or death that could result from intravenous

self-administration, SUBLOCADE is only available through a

restricted program called

the SUBLOCADE REMS Program. Healthcare settings and pharmacies

that order and

dispense SUBLOCADE must be certified in this program and comply

with the REMS

requirements.

Prescription use of this product is limited under the Drug

Addiction Treatment Act.

CONTRAINDICATIONS

SUBLOCADE should not be administered to patients who have been

shown to be hypersensitive to buprenorphine or any component of the

ATRIGEL(R) delivery system

WARNINGS AND PRECAUTIONS

Addiction, Abuse, and Misuse: SUBLOCADE contains buprenorphine,

a Schedule III controlled substance that can be abused in a manner

similar to other opioids. Monitor patients for conditions

indicative of diversion or progression of opioid dependence and

addictive behaviors.

Respiratory Depression: Life threatening respiratory depression

and death have occurred in association with buprenorphine. Warn

patients of the potential danger of self-administration of

benzodiazepines or other CNS depressants while under treatment with

SUBLOCADE.

Opioids can cause sleep-related breathing disorders e.g.,

central sleep apnea (CSA), sleep-related hypoxemia. Opioid use

increases the risk of CSA in a dose-dependent fashion. Consider

decreasing the opioid using best practices for opioid taper if CSA

occurs.

Strongly consider prescribing naloxone at SUBLOCADE initiation

or renewal because patients being treated for opioid use disorder

have the potential for relapse, putting them at risk for opioid

overdose. Educate patients and caregivers on how to recognize

respiratory depression and how to treat with naloxone if

prescribed.

Risk of Serious Injection Site Reactions: The most common

injection site reactions are pain, erythema and pruritis with some

involving abscess, ulceration, and necrosis. The likelihood of

serious injection site reactions may increase with inadvertent

intramuscular or intradermal administration.

Neonatal Opioid Withdrawal Syndrome: Neonatal opioid withdrawal

syndrome is an expected and treatable outcome of prolonged use of

opioids during pregnancy.

Adrenal Insufficiency: If diagnosed, treat with physiologic

replacement of corticosteroids, and wean patient off the

opioid.

Risk of Opioid Withdrawal With Abrupt Discontinuation: If

treatment with SUBLOCADE is discontinued, monitor patients for

several months for withdrawal and treat appropriately.

Risk of Hepatitis, Hepatic Events: Monitor liver function tests

prior to and during treatment.

Risk of Withdrawal in Patients Dependent on Full Agonist

Opioids: Verify that patient is clinically stable on transmucosal

buprenorphine before injecting SUBLOCADE.

Treatment of Emergent Acute Pain: Treat pain with a non-opioid

analgesic whenever possible. If opioid therapy is required, monitor

patients closely because higher doses may be required for analgesic

effect.

ADVERSE REACTIONS

Adverse reactions commonly associated with SUBLOCADE (in >=5%

of subjects) were constipation, headache, nausea, injection site

pruritus, vomiting, increased hepatic enzymes, fatigue, and

injection site pain.

For more information about SUBLOCADE, the full Prescribing

Information including BOXED WARNING, and Medication Guide, visit

www.sublocade.com .

PERSERIS(TM) (risperidone) for extended-release injectable

suspension

INDICATION AND HIGHLIGHTED SAFETY INFORMATION

PERSERIS(TM) (risperidone) is indicated for the treatment of

schizophrenia in adults.

WARNING: INCREASED MORTALITY IN ELDERLY PATIENTS WITH

DEMENTIA-RELATED PSYCHOSIS

See full prescribing information for complete boxed warning.

-- Elderly patients with dementia-related psychosis treated with

antipsychotic drugs are at an increased risk of death.

-- PERSERIS is not approved for use in patients with dementia-related psychosis.

CONTRAINDICATIONS

PERSERIS should not be administered to patients with known

hypersensitivity to risperidone, paliperidone, or other components

of PERSERIS.

WARNINGS AND PRECAUTIONS

Cerebrovascular Adverse Reactions, Including Stroke in Elderly

Patients with Dementia-Related Psychosis: Increased risk of

cerebrovascular adverse reactions (e.g., stroke, transient ischemic

attack), including fatalities. PERSERIS is not approved for use in

patients with dementia-related psychosis.

Neuroleptic Malignant Syndrome (NMS): Manage with immediate

discontinuation and close monitoring.

Tardive Dyskinesia: Discontinue treatment if clinically

appropriate.

Metabolic Changes: Monitor for hyperglycemia, dyslipidemia and

weight gain.

Hyperprolactinemia: Prolactin elevations occur and persist

during chronic administration. Long-standing hyperprolactinemia,

when associated with hypogonadism, may lead to decreased bone

density in females and males.

Orthostatic Hypotension: Monitor heart rate and blood pressure

and warn patients with known cardiovascular disease or

cerebrovascular disease, and risk of dehydration or syncope.

Leukopenia, Neutropenia, and Agranulocytosis: Perform complete

blood counts (CBC) in patients with a history of a clinically

significant low white blood cell count (WBC) or history of

leukopenia or neutropenia. Consider discontinuing PERSERIS if a

clinically significant decline in WBC occurs in absence of other

causative factors.

Potential for Cognitive and Motor Impairment: Use caution when

operating machinery.

Seizures: Use caution in patients with a history of seizures or

with conditions that lower the seizure threshold.

ADVERSE REACTIONS

The most common adverse reactions in clinical trials (>= 5%

and greater than twice placebo) were increased weight,

sedation/somnolence and musculoskeletal pain. The most common

injection site reactions (>= 5%) were injection site pain and

erythema (reddening of the skin).

For more information about PERSERIS, the full Prescribing

Information including BOXED WARNING, and Medication Guide visit

www.perseris.com .

Condensed consolidated interim income statement

Unaudited Unaudited Unaudited Unaudited

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months

ended September 30 Notes $m $m $m $m

Net Revenue 2 187 159 568 462

Cost of sales (26) (33) (88) (74)

Gross Profit 161 126 480 388

------------------------------------- ------ ---------- ---------- ---------- ----------

Gross profit before exceptional

items 4 161 131 480 399

Exceptional items 4 - (5) - (11)

------------------------------------- ------ ---------- ---------- ---------- ----------

Selling, general and administrative

expenses 3 (112) (100) (279) (509)

Research and development

expenses 3 (11) (8) (33) (26)

------------------------------------- ------ ---------- ---------- ---------- ----------

Operating Profit/(Loss) 38 18 168 (147)

------------------------------------- ------ ---------- ---------- ---------- ----------

Operating profit before exceptional

items 4 38 30 155 56

Exceptional items 4 - (12) 13 (203)

------------------------------------- ------ ---------- ---------- ---------- ----------

Finance income - 1 3 6

Finance expense (7) (6) (21) (18)

------------------------------------- ------ ---------- ---------- ---------- ----------

Net Finance Expense (7) (5) (18) (12)

------------------------------------- ------ ---------- ---------- ---------- ----------

Net finance expense before

exceptional items (7) (5) (17) (12)

Exceptional items within

finance expense 4 - - (1) -

------------------------------------- ------ ---------- ---------- ---------- ----------

Profit/(Loss) Before Taxation 31 13 150 (159)

------------------------------------- ------ ---------- ---------- ---------- ----------

Income tax (expense)/benefit (4) (3) 19 24

------------------------------------- ------ ---------- ---------- ---------- ----------

Taxation before exceptional

items 5 (4) (6) (24) (11)

Exceptional items within

taxation 4,5 - 3 43 35

------------------------------------- ------ ---------- ---------- ---------- ----------

Net Income/(Loss) 27 10 169 (135)

------------------------------------- ------ ---------- ---------- ---------- ----------

Earnings/(loss) per ordinary

share (cents)

Basic earnings/(loss) per

share 6 4 1 23 (18)

Diluted earnings/(loss) per

share 6 3 1 22 (18)

Condensed consolidated interim statement of comprehensive

(loss)/income

Unaudited Unaudited Unaudited Unaudited

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months

ended September 30 $m $m $m $m

----------------------------------- ---------- ---------- ---------- ----------

Net income/(loss) 27 10 169 (135)

Other comprehensive (loss)/income

Items that may be reclassified

to profit or loss in subsequent

years:

Net exchange adjustments on

foreign currency translation (8) 8 (6) (5)

Other comprehensive (loss)/income (8) 8 (6) (5)

Total comprehensive income/(loss) 19 18 163 (140)

----------------------------------- ---------- ---------- ---------- ----------

The notes are an integral part of these condensed consolidated

interim financial statements.

Condensed consolidated interim balance sheet

Unaudited Audited

Sep 30, Dec 31,

2021 2020

Notes $m $m

ASSETS

Non-current assets

Intangible assets 84 62

Property, plant and equipment 57 60

Right-of-use assets 38 43

Deferred tax assets 102 75

Other assets 7 105 104

386 344

Current assets

Inventories 97 93

Trade receivables 175 179

Other assets 7 37 50

Current tax receivable - 7

Cash and cash equivalents 8 1,005 858

1,314 1,187

Total assets 1,700 1,531

-------------------------------------- ------ ---------- ---------

LIABILITIES

Current liabilities

Borrowings 8 (3) (4)

Provisions and other liabilities 9 (136) (48)

Trade and other payables 12 (550) (524)

Lease liabilities (8) (8)

Current tax liabilities 5 (15) (15)

-------------------------------------- ------ ---------- ---------

(712) (599)

-------------------------------------- ------ ---------- ---------

Non-current liabilities

Borrowings 8 (239) (230)

Provisions and other liabilities 9 (550) (577)

Lease liabilities (38) (43)

(827) (850)

Total liabilities (1,539) (1,449)

-------------------------------------- ------ ---------- ---------

Net assets 161 82

-------------------------------------- ------ ---------- ---------

EQUITY

Capital and reserves

Share capital 13 72 73

Share premium 7 6

Capital redemption reserve 13 1 -

Other reserves (1,295) (1,295)

Foreign currency translation reserve (19) (13)

Retained earnings 1,395 1,311

-------------------------------------- ------ ---------- ---------

Total equity 161 82

-------------------------------------- ------ ---------- ---------

The notes are an integral part of these condensed consolidated

interim financial statements.

Condensed consolidated interim statement of changes in

equity

Foreign

Capital currency

Share Share redemption Other translation Retained Total

Notes capital premium reserve reserve reserve earnings equity

Unaudited $m $m $m $m $m $m $m

------------------------- ------- --------- --------- ------------ --------- ------------- ---------- --------

Balance at January 1,

2021 73 6 - (1,295) (13) 1,311 82

---------------------------------- --------- --------- ------------ --------- ------------- ---------- --------

Comprehensive income

Net income - - - - - 169 169

Other comprehensive loss - - - - (6) - (6)

Total comprehensive income - - - - (6) 169 163

---------------------------------- --------- --------- ------------ --------- ------------- ---------- --------

Transactions recognised

directly in equity

Shares issued - 1 - - - - 1

Share-based plans - - - - - 7 7

Deferred taxation on share-based

plans - - - - - 8 8

Transfer to share repurchase

liability - - - - - (100) (100)

Transfer to capital redemption

reserve for shares repurchased

and cancelled (1) - 1 - - - -

Balance at September 30,

2021 72 7 1 (1,295) (19) 1,395 161

---------------------------------- --------- --------- ------------ --------- ------------- ---------- --------

Balance at January 1,

2020 73 5 - (1,295) (23) 1,449 209

---------------------------------- --------- --------- ------------ --------- ------------- ---------- --------

Comprehensive loss

Net loss - - - - - (135) (135)

Other comprehensive loss - - - - (5) - (5)

Total comprehensive loss - - - - (5) (135) (140)

---------------------------------- --------- --------- ------------ --------- ------------- ---------- --------

Transactions recognised

directly in equity

Shares issued - 1 - - - - 1

Share-based plans - - - - - 9 9

Deferred taxation on share-based

plans - - - - - 1 1

Balance at September 30,

2020 73 6 - (1,295) (28) 1,324 80

---------------------------------- --------- --------- ------------ --------- ------------- ---------- --------

The notes are an integral part of these condensed consolidated

interim financial statements.

Condensed consolidated interim cash flow statement

Unaudited Unaudited

2021 2020

For the nine months ended September 30 $m $m

----------------------------------------------------------------- ---------- ----------

CASH FLOWS FROM OPERATING ACTIVITIES

Operating Profit/(Loss) 168 (147)

Depreciation, amortization, and impairment 12 14

Gain on disposal of right-of-use assets - (2)

Gain on disposal of intangible assets (20) -

Depreciation and impairment of right-of-use assets 6 6

Share-based payments 7 9

Impact from foreign exchange movements (3) (3)

Decrease in trade receivables 3 31

Decrease/(Increase) in current and non-current other assets 12 (47)

Increase in inventories (5) (11)

Increase/(Decrease) in trade and other payables 30 (132)

(Decrease)/Increase in provisions and other liabilities* (10) 188

Cash generated from/(used in) operations 200 (94)

Interest paid (14) (13)

Interest received 1 8

Exceptional tax refund 31 -

Taxes paid (24) (23)

Transaction costs related to debt refinancing (8) -

Net cash inflow/(outflow) from operating activities 186 (122)

----------------------------------------------------------------- ---------- ----------

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property, plant and equipment (2) (2)

Purchase of intangible asset (30) -

Exceptional net proceeds from disposal of intangible assets 20 -

Net cash outflow from investing activities (12) (2)

----------------------------------------------------------------- ---------- ----------

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from borrowings 250 -

Repayment of borrowings (236) (3)

Payment of lease liabilities (6) (5)

Proceeds from the issuance of ordinary shares - 1

Cash paid for the repurchase and cancellation of shares (34) -

Net cash outflow from financing activities (26) (7)

----------------------------------------------------------------- ---------- ----------

Net increase/(decrease) in cash and cash equivalents 148 (131)

Cash and cash equivalents at beginning of the period 858 1,060

Exchange difference (1) -

Cash and cash equivalents at end of the period 1,005 929

----------------------------------------------------------------- ---------- ----------

* - Changes in provisions and other liabilities line include

exceptional payments of $10m for the RB settlement agreement and

$6m for DOJ related matters.

The notes are an integral part of these condensed consolidated

interim financial statements.

Notes to the condensed consolidated interim financial

statements

1. BASIS OF PREPARATION AND ACCOUNTING POLICIES

Indivior PLC (the 'Company') is a public limited company

incorporated on September 26, 2014 and domiciled in the United

Kingdom. In these Condensed consolidated interim financial

statements ('Condensed Financial Statements'), reference to the

'Group' means the Company and all its subsidiaries.

The Condensed Financial Statements have been prepared in

accordance with UK adopted International Accounting Standard 34,

'Interim Financial Reporting'("IAS 34"). The Condensed Financial

Statements should be read in conjunction with the annual financial

statements for the year ended 31 December 2020 which have been

prepared in accordance with International Financial Reporting

Standards (IFRS) and IFRS Interpretations Committee interpretations

in conformity with the Companies Act 2006 and pursuant to

Regulation (EC) No 1606/2002 as it applies to the European Union.

In respect of accounting standards applicable to the Group in the

current period, there is no difference between IFRS in conformity

with the Companies Act 2006, the UK-adopted IFRS and International

Accounting Standards Board (IASB)-adopted IFRS. In preparing these

Condensed Financial Statements, the significant judgments made by

management in applying the Group's accounting policies and the key

sources of estimation uncertainty were the same as those that

applied to the consolidated financial statements for the year ended

December 31, 2020, with the exception of changes in estimates that

are required in determining the provision for income taxes. The Q3

2020 statement of cash flows has been expanded to present trade

receivables and other assets (current) in separate line items to

improve the transparency and consistency.

The Condensed Financial Statements do not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Group's

annual financial statements at December 31, 2020. These Condensed

Financial Statements have been reviewed and not audited. These

Condensed Financial Statements were approved for issue on October

27, 2021.

As disclosed in Notes 9, 10, and 11, the Group has liabilities

and provisions totaling $539m (FY 2020: $568m) for the Department

of Justice (DOJ) Resolution and related matters and the Reckitt

Benckiser (RB) settlement. The Directors have assessed the Group's

ability to comply with the minimum liquidity covenant in the

Group's debt facility, maintain sufficient liquidity to fund its

operations, fulfill obligations under the DOJ and RB agreements,

and address the reasonably possible financial implications of the

ongoing legal proceedings. The Directors have also modeled the risk

that SUBLOCADE will not meet revenue growth expectations due to the

continued impact from the COVID-19 pandemic or other market driven

factors (considering a 15% decline on forecasts) as part of the

Group's going concern assessment and downside scenario. These risks

were balanced against the Group's current and forecast working

capital position and impact of the cost saving actions taken to

date. As a result of the factors set out above, the Directors of

the Group have a reasonable expectation the Group has adequate

resources to continue in operational existence for at least one

year from the approval of these Condensed Financial Statements and

therefore consider the going concern basis to be appropriate for

the accounting and preparation of these Condensed Financial

Statements.

The financial information contained in this document does not

constitute statutory accounts as defined in section 434 and 435 of

the Companies Act 2006. The Group's statutory financial statements

for the year ended December 31, 2020 were approved by the Board of

Directors on March 18, 2021 and have been filed with Companies

House.

2. SEGMENT INFORMATION

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker

('CODM'). The CODM, who is responsible for allocating resources and

assessing performance of the operating segments, has been

identified as the Chief Executive Officer (CEO). The Group is

predominantly engaged in a single business activity, which is the

development, manufacture, and sale of buprenorphine-based

prescription drugs for treatment of opioid dependence and related

disorders. The CEO reviews disaggregated net revenue on a

geographical and product basis. Financial results are reviewed on a

consolidated basis for evaluating financial performance and

allocating resources. Accordingly, the Group operates in a single

reportable segment.

Net revenues and non-current assets

Revenues are attributed to countries based on the country where

the sale originates. The following tables represent net revenues

from continuing operations and non-current assets, net of

accumulated depreciation and amortization, by country. Non-current

assets for this purpose consist of intangible assets, property,

plant and equipment, right-of-use assets, and other assets. Net

revenues and non-current assets for the three and nine months to

September 30, 2021 and 2020 were as follows:

Net revenue:

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months ended $m $m $m $m

September 30

------------------------------------- ------ ------ ------ ------

United States 143 111 428 323

Rest of World 44 48 140 139

------------------------------------- ------ ------ ------ ------

Total net revenues 187 159 568 462

------------------------------------- ------ ------ ------ ------

On a disaggregated basis, the Group's net revenue by major

product line:

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months ended $m $m $m $m

September 30

------------------------------------- ------ ------ ------ ------

Sublingual/other 117 123 387 361

SUBLOCADE 65 33 169 91

PERSERIS 5 3 12 10

------------------------------------- ------ ------ ------ ------

Total 187 159 568 462

------------------------------------- ------ ------ ------ ------

Non-current assets:

Sep 30, Dec 31,

2021 2020

$m $m

--------------- -------- --------

United States 135 141

Rest of World 149 128

--------------- -------- --------

Total 284 269

--------------- -------- --------

3. OPERATING EXPENSES

The table below sets out selected operating costs and expense

information:

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months ended $m $m $m $m

September 30

----------------------------------------------- ------ ------ ------ ------

Research and development expenses (11) (8) (33) (26)

----------------------------------------------- ------ ------ ------ ------

Selling and general expenses (51) (40) (128) (149)

Administrative expenses(1) (58) (57) (141) (346)

Depreciation, amortization, and impairment(2) (3) (3) (10) (14)

Total (112) (100) (279) (509)

----------------------------------------------- ------ ------ ------ ------

(1) Administrative expenses include exceptional items in the

current and prior period as outlined in Note 4.

(2) Additional YTD 2021 depreciation and amortization of $8m

(YTD 2020: $6m) for intangibles and ROU assets is included within

cost of sales.

4. EXCEPTIONAL ITEMS AND ADJUSTED RESULTS

Exceptional items

Where significant expenses or income occur that do not reflect

the Group's ongoing operations, these items are disclosed as

exceptional items in the income statement. Examples of such items

could include income or restructuring and related expenses for the

reconfiguration of the Group's activities and/or capital structure,

impairment of current and non-current assets, proceeds from the

sale of intangible assets, certain costs arising as a result of

material and non-recurring regulatory and litigation matters,

certain non-recurring benefits, and certain tax related

matters.

The table below sets out exceptional income/(expense) recorded

in each period:

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months ended $m $m $m $m

September 30

-------------------------------------- ------ ------ ------ ------

Exceptional items within cost of

sales

Cost of sales(1) - (5) - (11)

-------------------------------------- ------ ------ ------ ------

Total exceptional items within cost

of sales - (5) - (11)

Exceptional items within SG&A

Restructuring(2) - (7) - (9)

Legal expenses/provision(3) 5 - 18 (183)

ANDA litigation(4) (24) - (24) -

Other operating income(5) 19 - 20 -

Debt refinancing(6) - - (1) -

-------------------------------------- ------ ------ ------ ------

Total exceptional items within SG&A - (7) 13 (192)

Exceptional items within net finance

expense

Finance expense (6) - - (1) -

-------------------------------------- ------ ------ ------ ------

Total exceptional items within net - - (1) -

finance expense

-------------------------------------- ------ ------ ------ ------

Total exceptional items before taxes - (12) 12 (203)

-------------------------------------- ------ ------ ------ ------

Tax benefit on exceptional items(3) - 3 - 35

Exceptional tax item(7) - - 43 -

-------------------------------------- ------ ------ ------ ------

Total exceptional items - (9) 55 (168)

-------------------------------------- ------ ------ ------ ------

1. Exceptional cost of sales relate to inventory provisions due

to the adverse impact of COVID-19 on the business.

2. Restructuring costs incurred in Q3 2020 relate to cost saving

actions taken by the Group to protect the financial and operational

flexibility in response to ongoing challenges posed by COVID-19.

Remaining restructuring costs in YTD 2020 consist primarily of

lease disposals. These costs are included in SG&A.

3. Negotiation with DOJ related plaintiffs in Q3 2021 and YTD

2021 led to a change in the Group's provision for DOJ related

matters which resulted in a provision release of $5m and $18m,

respectively. $183m of legal costs and an exceptional tax benefit

of $35m were recorded YTD 2020 in relation to the DOJ Resolution.

Exceptional legal costs are included within SG&A.

4. In Q3 2021, upon conclusion of expert discovery, the Group

increased the provision for intellectual property related matters -

ANDA Litigation, to $73m, resulting in an exceptional charge for

$24m. See Note 9 and 11 for further discussion. Exceptional legal

costs are included within SG&A.

5. Exceptional other operating income in Q3 2021 relates to the

net proceeds received from the sale of the TEMGESIC / BUPREX /

BUPREXX (buprenorphine) analgesic franchise outside of North

America to Eumedica Pharmaceuticals AG for $19m. Remaining

exceptional income in YTD 2021 relates to the proceeds received

from the out-licensing of nasal naloxone opioid overdose patents

for $1m. Exceptional income items are included within SG&A.

6. Debt refinancing costs in YTD 2021 consist of advisory and

legal fees incurred related to the Group's June 2021 debt

refinancing. These costs are included in SG&A. Additionally, in

YTD 2021 the Group wrote-off $1m of unamortised deferred financing

costs due to extinguishment and settlement of the previous term

loan. These costs are included within finance expense.

7. Exceptional tax benefit recorded YTD 2021 relates to the

approval of tax credits by the Internal Revenue Service in relation

to development credits for SUBLOCADE claimed for years 2014 to

2017, the tax impact of settlement costs incurred with Reckitt

Benckiser (RB) which were recorded in the prior year, reactivation

of prior year interest expense restriction, impact of the ANDA

accrual and a tax expense in relation to exceptional other

operating income. Q3 2021 exceptional tax benefit of $nil includes

the reactivation of prior year interest expense restriction, impact

of the ANDA accrual and a tax expense in relation to exceptional

other operating income.

Adjusted results

The Board and management team use adjusted results and measures

to provide incremental insight to the financial results of the

Group and the way it is managed. The tables below show the list of

adjustments between the reported and adjusted results for both

Q3/YTD 2021 and Q3/YTD 2020.

Reconciliation of gross profit to adjusted gross profit

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months ended $m $m $m $m

September 30

------------------------------------- ------ ------ ------ ------

Gross profit 161 126 480 388

------------------------------------- ------ ------ ------ ------

Exceptional cost of sales - 5 - 11

Adjusted gross profit 161 131 480 399

------------------------------------- ------ ------ ------ ------

Reconciliation of operating profit/(loss) to adjusted operating

profit

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months ended $m $m $m $m

September 30

------------------------------------------------- ------ ------ ------ ------

Operating profit/(loss) 38 18 168 (147)

------------------------------------------------- ------ ------ ------ ------

Exceptional cost of sales - 5 - 11

Exceptional selling, general and administrative

expenses - 7 (13) 192

Adjusted operating profit 38 30 155 56

------------------------------------------------- ------ ------ ------ ------

Reconciliation of profit/(loss) before taxation to adjusted

profit before taxation

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months ended $m $m $m $m

September 30

------------------------------------------------- ------ ------ ------ ------

Profit/(loss) before taxation 31 13 150 (159)

------------------------------------------------- ------ ------ ------ ------

Exceptional cost of sales - 5 - 11

Exceptional selling, general and administrative

expenses - 7 (13) 192

Exceptional finance expense - - 1 -

------------------------------------------------- ------ ------ ------ ------

Adjusted profit before taxation 31 25 138 44

------------------------------------------------- ------ ------ ------ ------

Reconciliation of net income/(loss) to adjusted net income

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months ended $m $m $m $m

September 30

------------------------------------------------- ------ ------ ------ ------

Net income/(loss) 27 10 169 (135)

------------------------------------------------- ------ ------ ------ ------

Exceptional cost of sales - 5 - 11

Exceptional selling, general and administrative

expenses - 7 (13) 192

Exceptional finance expense - - 1 -

Tax benefit on exceptional items - (3) - (35)

Tax exceptional - - (43) -

------------------------------------------------- ------ ------ ------ ------

Adjusted net income 27 19 114 33

------------------------------------------------- ------ ------ ------ ------

5. TAXATION

The Group calculates tax expense for interim periods using the

expected full year rates, considering the pre-tax income and

statutory rates for each jurisdiction. To the extent practicable, a

separate estimated average annual effective income tax rate is

determined for each taxing jurisdiction and applied individually to

the interim period pre-tax income of each jurisdiction. Similarly,

if different income tax rates apply to different categories of

income (such as capital gains or income earned in particular

industries), to the extent practicable a separate rate is applied

to each individual category of interim period pre-tax income. The

resulting expense is allocated between current and deferred taxes

based upon the forecasted full year ratio. The effective tax rate

was primarily driven by the relative contribution to pre-tax income

by taxing jurisdiction in the period and permanent differences.

In the nine months ended September 30, 2021, the reported total

tax benefit was $19m, or a rate of -13% (YTD 2020 tax benefit:

$24m, 15%). The tax expense on adjusted profits amounted to $24m

(YTD 2020: $11m) and represented a year-to-date effective tax rate

of 17% (YTD 2020: 25%).

The YTD 2021 exceptional benefit recorded in tax of $43m relates

to the approval of tax credits by the Internal Revenue Service in

relation to development credits for SUBLOCADE claimed for years

2014 to 2017 and the tax impact of settlement costs incurred with

Reckitt Benckiser (RB) which were recorded in the prior year, and

reactivation of prior year interest expense restriction, impact of

ANDA accrual and a tax expense in relation to the exceptional

income, as set out in Note 4.

The Group's balance sheet at September 30, 2021 included a

current tax payable of $15m (FY 2020: $15m), and deferred tax asset

of $102m (FY 2020: $75m). The increase in the deferred tax asset is

due to current year activity including the tax impact of the

settlement costs and share awards.

Other tax matters

The European Commission issued a press release on April 2, 2019

announcing its conclusion that the UK Finance Company Partial

Exemption Rules are partly justified. The UK government has made an

annulment application to the General Court against this decision.

The UK government was required to initiate recovery of the alleged

State Aid irrespective of any appeal against the decision and where

they assess a benefit of the potential State Aid has been received.

HMRC has confirmed that there has been no such benefit to the group

and therefore the enquiry in relation to this matter is regarded as

closed.

The enacted United Kingdom Statutory Corporation Tax rate is 19%

for the year ended December 31, 2021. On March 3, 2021 the UK

Chancellor announced an increase in the corporation tax rate from

19% to 25% with effect from April 1, 2023. The increase to the

corporation tax rate was substantively enacted on May 24, 2021. The

effect of the rate change is less than $1m.

As disclosed in Note 9, the Group reached a settlement with

Reckitt Benckiser (RB) on January 25, 2021. Based on the strength

of external advice received, a $7m tax benefit from the settlement

cost has been recognized as of September 30, 2021. Tax authorities

may potentially challenge the Group's position.

6. EARNINGS/(LOSS) PER SHARE

Q3 Q3 YTD YTD

2021 2020 2021 2020

For the three and nine months ended cents cents cents cents

September 30

------------------------------------- ------- ------- ------- -------

Basic earnings/(loss) per share 4 1 23 (18)

Diluted earnings/(loss) per share 3 1 22 (18)

Adjusted basic earnings per share 4 3 16 5

Adjusted diluted earnings per share 3 2 15 4

------------------------------------- ------- ------- ------- -------

Basic

Basic earnings/(loss) per share ("EPS" or "LPS") is calculated

by dividing profit/(loss) for the period attributable to owners of

the Company by the weighted average number of ordinary shares in

issue during the period.

Diluted

Diluted earnings/(loss) per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The Company

has dilutive potential ordinary shares in the form of stock options

and awards. The weighted average number of shares is adjusted for

the number of shares granted assuming the exercise of stock

options.

The weighted average number of ordinary shares outstanding for

2021 includes the favorable impact of the share repurchase program.

Refer to Note 13 for further details.

2021 2020

Weighted average number of shares thousands thousands

---------------------------------------- ----------- -----------

On a basic basis 733,324 732,634

Dilution from share awards and options 43,800 40,001

On a diluted basis 777,124 772,635

----------------------------------------- ----------- -----------

Adjusted Earnings

The Directors believe that diluted earnings per share, adjusted

for the impact of exceptional items after the appropriate tax

amount, provides more meaningful information on underlying trends

to shareholders in respect of earnings per ordinary share. A

reconciliation of net income to adjusted net income is included in

Note 4.

7. CURRENT AND NON-CURRENT OTHER ASSETS

Sep 30 Dec 31

2021 2020

Current and non-current other assets $m $m

-------------------------------------- ---- ------- -------

Short-term prepaid expenses 27 17

Other current assets 10 33

-------------------------------------------- ------- -------

Total other current assets 37 50

-------

Long-term prepaid expenses 23 22

Other non-current assets 82 82

-------

Total other non-current assets 105 104

-------------------------------------------- ------- -------

Total 142 154

-------------------------------------------- ------- -------

Other current and non-current assets as of December 31, 2020

primarily represent the funding of surety bonds in relation to

intellectual property related matters (see Note 11 for further

discussion) . In Q1 2021, one of the surety bond holders returned

$26m causing a decrease in other current assets.

8. FINANCIAL LIABILITIES - BORROWINGS

On June 30, 2021, the Group completed a refinancing of its term

loan, repaying in full the existing $235m term loan and replacing

it with a new term loan with a principal amount of $250m. As a

result of the debt refinancing, in YTD 2021, the Group incurred a

collective charge of $2m related to writing off unamortized

deferred financing costs due to the extinguishment and settlement

of previous term loan ($1m) and advisory fees incurred in

conjunction with the refinancing ($1m). These costs were classified

as exceptional. See Note 4 for further details.

The Group capitalized $8m of deferred financing and original

issue discount costs related to the new term loan, which were

netted against the total amount borrowed and are amortized over the

maturity period. The key terms of the new term loan in effect at

September 30, 2021 are as follows:

Required

Nominal interest annual Minimum

Currency margin Maturity repayments liquidity

---------- --------- ----------------- --------- ------------ ---------------------

Term Loan USD Libor* (0.75%) 2026 1% Larger of $100m or

facility + 5.25% 50% of Loan Balance

---------- --------- ----------------- --------- ------------ ---------------------

*While the new term loan is USD LIBOR based, the new term loan

contains fallback language to convert to a new reference rate when

USD LIBOR is discontinued or becomes non-representative, which is

expected to occur in early 2023.

-- Nominal interest margin is calculated over three-month USD

LIBOR subject to a floor of 0.75%.

-- The minimum liquidity is the larger of $100m or 50% of the

outstanding loan balance.

-- There are no revolving credit commitments under the new Term

Loan.

The table below sets out the current and non-current portion

obligation of the Term Loan:

Sep Dec

30 31

2021 2020

Term loan $m $m

------------------------- ---- ------ ------

Term loan - current (3) (4)

Term loan - non-current (239) (230)