JPEL Private Equity Limited Completion of Ninth Mandatory Redemption (3713I)

12 Agosto 2021 - 1:00AM

UK Regulatory

TIDMJPEL

RNS Number : 3713I

JPEL Private Equity Limited

12 August 2021

JPEL Private Equity Limited

Ground Floor

Cambridge House

Le Truchot, St Peter Port

Guernsey, GY1 1WD

www.jpelonline.com

COMPLETION OF NINTH MANDATORY REDEMPTION

* * *

GUERNSEY, 12 AUGUST 2021

The Board of Directors of JPEL Private Equity Limited ("JPEL" or

the "Company") is pleased to announce that the partial mandatory

redemption of the Company's US$ Equity Share class announced on 5

August 2021 has been completed with the redemption of 42,499,886

US$ Equity Shares ("Mandatory Redemption").

On 12 August 2021, JPEL redeemed 42,499,886 US$ Equity Shares,

on a pro rata basis, at the prevailing NAV per US$ Equity Share of

$2.00 as at 30 June 2021. Such shares were cancelled automatically

following their redemption.

Fractions of shares produced by the applicable redemption ratios

have not been redeemed and so the number of shares redeemed in

respect of each shareholder has been rounded down to the nearest

whole number of shares.

Payments of redemption proceeds are expected to be effected

either through CREST (in the case of shares held in uncertificated

form) or by cheque (in the case of shares held in certificated

form) on or around 19 August 2021. Any share certificates for the

balance of holdings of shares will also be despatched to

shareholders on or around 20 August 2021.

The US$ Equity Shares were disabled in CREST on the record date

(11 August 2021) and the existing ISIN number GG00BNDVXN48 (the

"Old ISIN") has expired. The new ISIN number GG00BM8B8T38 (the "New

ISIN") in respect of the remaining 40,017,883 US$ Equity Shares

which have not been redeemed will be enabled and will be available

for transactions on 12 August 2021.

Inclusive of this Mandatory Redemption, JPEL will have returned

$499.2 million to US$ Equity Shareholders, or approximately 104.2%

and 131.3% of the Company's 31 October 2016 NAV and market

capitalization. Please note that the prevailing NAV at the time of

the Company's first mandatory redemption was 31 October 2016.

DIRECTORS' INTERESTS

As a result of the Mandatory Redemption described above, Sean

Hurst, Christopher Spencer and Tony Dalwood are expected,

immediately following the redemption date, to hold approximately

2,953, 3,563 and 15,133 US$ Equity Shares, respectively.

* * *

About JPEL Private Equity Limited

JPEL Private Equity Limited is a Guernsey registered and

incorporated, London Stock Exchange-listed, closed-ended investment

company (LSE: JPEL) designed primarily to invest in the global

private equity market. The investment objective of the Company is

to achieve both short and long-term capital appreciation by

investing in a well-diversified portfolio of private equity fund

interests and by capitalising on the inefficiencies of the

secondary private equity market.

ENQUIRIES:

FCF JPEL Management LLC

JPELClientService@fortress.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CASEANPFFEAFEFA

(END) Dow Jones Newswires

August 12, 2021 02:00 ET (06:00 GMT)

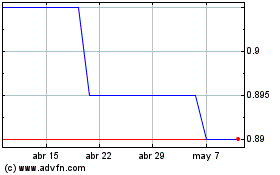

Jpel Private Equity (LSE:JPEL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

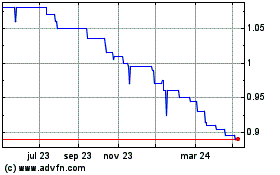

Jpel Private Equity (LSE:JPEL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024